Roofing Chemicals Market by Type (Acrylic Resin, Asphalt/Bituminous, Elastomer, Epoxy Resin, and Styrene), Application (Membrane, Elastomeric, Bituminous, Metal, and Plastic Roofing Materials) - Global Forecast to 2026

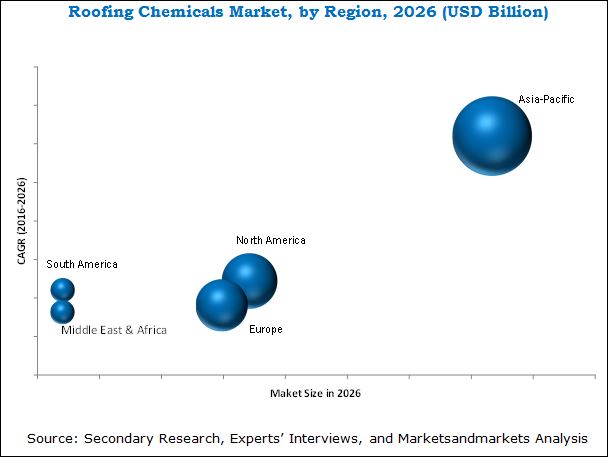

[172 Pages Report] The global roofing chemicals market is projected to be valued at USD 160.25 Billion by 2026, at a CAGR of 7.8% from 2016 to 2026. In this study, 2015 has been considered the base year and 2016 to 2026, the forecast period, to estimate the global market of roofing chemicals. The growing demand in the Asia-Pacific, South American, and Middle-Eastern & African regions, coupled with the growing demand for energy efficient buildings with the help of bio-based roofing chemicals, is expected to drive the global roofing chemicals market during the forecast period.

Objectives of the Study

- To define and segment the global market for roofing chemicals by type, application, and region

- To estimate and forecast the global market for roofing chemicals in terms of value

- To analyze significant region-specific trends of the market in North America, Western Europe, Central & Eastern Europe, the Asia-Pacific region, South America, and the Middle East & Africa

- To estimate and forecast the global market for roofing chemicals by type, application, and region at the country level in each of the regions

- To identify and analyze the key drivers, restraints, and opportunities, and challenges influencing the roofing chemicals market

- To analyze recent market developments and competitive strategies such as alliances, joint ventures, and mergers & acquisitions to draw the competitive landscape in the global market for roofing chemicals

- To strategically identify and profile the key market players and analyze their core competencies in each type, and application of the global roofing chemicals market

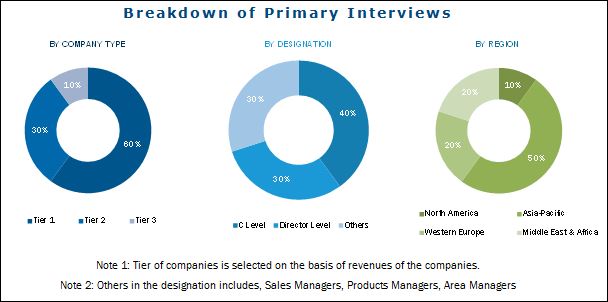

This research study used extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the global roofing chemicals market. The primary sources are mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. The bottom-up approach has been used to estimate the global market size of roofing chemicals on the basis of type, application, and region, in terms of value. The top-down approach has been implemented to validate the market size, in terms of value. With the data triangulation procedure, and validation of data through primary interviews, the exact values of the overall parent market and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The roofing chemical supply chain includes raw material manufacturers such as BASF SE (Germany), The Dow Chemical Company (U.S.) and Du Pont (U.S.) among others, roofing chemicals manufacturers such as Saint-Gobain S.A. (France), 3M Company (U.S), Akzo Nobel N.V (The Netherlands), Sika AG (Switzerland) among others. Further, the products manufactured by these companies are used by residential, commercial, and industrial buildings.

This study answers several questions for the stakeholders, primarily which market segments they need to focus upon during the next two to ten years to prioritize their efforts and investments

Target Audience:

- Roofing chemicals manufacturers

- Roofing chemicals traders, distributors, and suppliers

- End-use market participants of different segments of roofing chemicals

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies

- Investment banks and private equity firms

Scope of the Report:

This research report categorizes the global market for roofing chemicals based on type, application, and region and forecasts the revenue growth and provides an analysis of the trends in each of the submarkets.

On the Basis of Type:

- Asphalt/Bituminous

- Acrylic Resins

- Epoxy Resins

- Elastomers

- Styrene

On the Basis of Application:

- Bituminous Roofing

- Metal Roofing

- Elastomeric Roofing

- Membrane Roofing

- Plastic (PVC) Roofing

On the Basis of Region:

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Others

- North America

- U.S.

- Canada

- Mexico

- Western Europe

- Germany

- France

- U.K.

- Rest of Western Europe

- Central & Eastern Europe

- Russia

- Turkey

- Rest of Central & Eastern Europe

- South America

- Brazil

- Argentina

- Others

- Middle East & Africa

- UAE

- Saudi Arabia

- Nigeria

- Others

These segments are further described in detail with their subsegments in the report, with value forecasts till 2021.

Available Customizations: The following customization options are available for the report:

- Company Information

Analysis and profiles of additional global as well as regional market players (Up to three)

The global roofing chemicals market is projected to reach USD 160.25 Billion by 2026, at a CAGR of 7.8% from 2016 to 2026. Roofing chemicals are experiencing a high demand from the construction sector in the Asia-Pacific region. Expansions and new product development activities undertaken by different companies for more energy efficient solutions are the key factors driving the growth of the global roofing chemicals market. Roofing chemicals helps in maintaining lower temperatures in the interiors of buildings by reflecting the sunlight on roofs. This reduces the energy consumption required to cool buildings. New innovative roofing chemicals have low Volatile Organic Compound (VOC) emissions that comply with standards set by regulatory bodies in the European Union, such as Regulation, Evaluation, Authorization and the Restriction of Chemicals (REACH) and Restriction of Substances Directive (RoHS).

The asphalt/bituminous roofing chemical is projected to be the leading type in the roofing chemicals market from 2016 to 2026. The bituminous roofing chemical is a sticky, black and highly viscous chemical used for coating and for making bituminous shingles. High tensile strength, competitive life cycle cost, and improved surface texture makes bituminous the leading type of roofing chemical among others. The asphalt/bituminous roofing chemical is mainly used in commercial and industrial buildings such as warehouses, factory sheds, which increases its demand in the market. The growth in the commercial sector during the forecast period is expected to drive the asphalt/bituminous market.

The bituminous roofing application is the largest application of roofing chemicals globally. Bituminous roofs are more durable compared to other types of roofing and are hence preferred. The demand for the bituminous roofing application from the Asia-Pacific region is expected to grow at a high rate during the forecast period. This is due to the increasing industrialization, and the growing manufacturing sector.

The Asia-Pacific region was the fastest-growing market for roofing chemicals, in terms of value, in 2015 and this trend is expected to continue till 2026. China, India, South Korea, and Japan are the major consumers in the Asia-Pacific region. The demand for roofing chemicals is primarily driven by the increasing population & urbanization in these countries. The increase in population and urbanization creates a higher demand for buildings, and as a result drives the roofing chemicals market. India is a major growing economy in the world, and the demand for roofing chemicals is expected to increase during the forecast period.

Though the global roofing chemicals market is growing at a fast pace, a few factors are hampering the growth of this market. The higher installation cost is a major restraint in the growth of the global roofing chemicals market.

Companies such as The Dow Chemical Company (U.S.), Sika AG (Switzerland), Johns Manville (U.S.), GAF Materials Corporation (U.S.), and Akzo Nobel N.V (Netherlands) are the leading market participants in the global roofing chemicals market. These companies have been adopting various organic and inorganic growth strategies such as expansions, mergers & acquisitions, and new product developments to expand their market shares of roofing chemicals.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 By Region

1.3.3 Years Considered for the Study

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.3.1 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Roofing Chemicals Market

4.2 Roofing Chemicals Market Growth, By Type

4.3 Roofing Chemicals Market Share, By Region & Application, 2015

4.4 Roofing Chemicals Market Attractiveness

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Application

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Short-Term Drivers

5.4.1.1.1 Increasing Need for Thermal Management in Buildings

5.4.1.2 Mid-Term Drivers

5.4.1.2.1 Regulatory Framework Promotes the Usage of Roofing Chemicals

5.4.1.3 Long-Term Drivers

5.4.1.3.1 Development of Bio-Based Roof Coating Chemicals

5.4.2 Restraints

5.4.2.1 Higher Manufacturing and Installation Costs

5.4.2.2 Fluctuations in Crude Oil Prices and Increasing Competition Among Different Resin Suppliers in Europe

5.4.3 Opportunities

5.4.3.1.1 Emerging Markets are Revenue Pockets for Roofing Chemical Manufacturers

5.4.4 Challenges

5.4.4.1 Lower Market Penetration Due to Higher Manufacturing Costs

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porters Five Forces Analysis

6.3.1 Bargaining Power of Suppliers

6.3.2 Threat of New Entrants

6.3.3 Threat of Substitutes

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Economic Indicators

6.4.1 Trends and Forecast of GDP

6.4.2 Trend of Production of Oil

6.4.3 Trend of Construction Industry

6.5 Patent Analysis

6.5.1 Introduction

6.5.2 Patent Analysis of Roofing Chemicals, By Type

6.5.3 Patent Analysis of Roofing Chemicals, By Application

6.5.4 Patent Analysis of Roofing Chemicals, By Region

7 Roofing Chemicals Market, By Type (Page No. - 55)

7.1 Introduction

7.2 Asphalt/Bituminous

7.3 Acrylic Resin

7.4 Epoxy Resin

7.5 Styrene

7.6 Elastomers

8 Roofing Chemicals Market, By Application (Page No. - 68)

8.1 Introduction

8.2 Revenue Pocket Matrix, By Application

8.3 Membrane Roofing

8.4 Elastomeric Roofing

8.5 Bituminous Roofing

8.6 Metal Roofing

8.7 Plastic (PVC) Roofing

9 Roofing Chemicals Market, By Region (Page No. - 80)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Indonesia

9.2.6 Rest of Asia-Pacific

9.3 North America

9.3.1 U. S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Western Europe

9.4.1.1 Germany

9.4.1.2 U.K.

9.4.1.3 France

9.4.1.4 Rest of Western Europe

9.4.2 Central & Eastern Europe

9.4.2.1 Russia

9.4.2.2 Turkey

9.4.2.3 Rest of Central & Eastern Europe

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East and Africa

9.6.1 Saudi Arabia

9.6.2 UAE

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 124)

10.1 Overview

10.2 New Product Developments: the Most Popular Growth Strategy

10.3 Competitive Situation and Trends

10.3.1 New Product Development

10.3.2 Expansion

10.3.3 Acquisition and Mergers

10.3.4 Joint Ventures and Partnerships

11 Company Profiles (Page No. - 130)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 BASF SE

11.2 The DOW Chemical Company

11.3 Saint-Gobain S.A

11.4 3M Company

11.5 Akzo Nobel N.V.

11.6 Sika AG

11.7 Owens Corning

11.8 Carlisle Companies Incorporated

11.9 Johns Manville Corporation

11.10 GAF Materials Corporation

11.11 Firestone Building Products Company, LLC

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Additional Company Profile (Page No. - 156)

12.1 Alchimica

12.2 Du Pont

12.3 Eastman Chemical Company

12.4 Evonik Industries

12.5 Exxon Mobil Corporation

12.6 H.B Fuller Company

12.7 Maris Polymers

12.8 Mitsubishi Chemical Corporation

12.9 National Coatings Corporation

12.10 Neville Chemical Company

12.11 Paramelt B.V

12.12 Pidilite Industries Limited

12.13 Polygel Industries Private Limited

12.14 Solvay S.A.Year of Establishment: 1863

12.15 Toray Industries

13 Appendix (Page No. - 161)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (105 Tables)

Table 1 Roofing Chemicals Market, By Type

Table 2 Roofing Chemicals Market, By Application

Table 3 Trends and Forecast of GDP, USD Billion (20152021)

Table 4 Trend of Oil Production, Thousand Barrels Per Day (2011-2015)

Table 5 Contribution of Construction to GDP, By Country, USD Billion (20142021)

Table 6 Roofing Chemicals Market Size, By Type, 20142026 (USD Billion)

Table 7 Roofing Chemicals Market Size, By Type, 20142026 (Kiloton)

Table 8 Asphalt/Bituminous Market Size, By Region, 20142026 (USD Billion)

Table 9 Asphalt/Bituminous Market Size, By Region, 20142026 (Kiloton)

Table 10 Acrylic Resin Market Size, By Region, 20142026 (USD Million)

Table 11 Acrylic Resin Market Size, By Region, 20142026 (Kiloton)

Table 12 Epoxy Resin Market Size, By Region, 20142026 (USD Million)

Table 13 Epoxy Resin Market Size, By Region, 20142026 (Kiloton)

Table 14 Styrene Market Size, By Region, 20142026 (USD Million)

Table 15 Styrene Market Size, By Region, 20142026 (Kiloton)

Table 16 Elastomer Market Size, By Region, 20142026 (USD Million)

Table 17 Elastomer Market Size, By Region, 20142026 (Kiloton)

Table 18 Roofing Chemicals Market Size, By Application, 20142026 (USD Billion)

Table 19 Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 20 Roofing Chemicals Market Size in Membrane Roofing, By Region, 20142026 (USD Million)

Table 21 Roofing Chemicals Market Size in Membrane Roofing, By Region, 20142026 (Kiloton)

Table 22 Roofing Chemicals Market Size in Elastomeric Roofing, By Region, 20142026 (USD Million)

Table 23 Roofing Chemicals Market Size in Elastomeric Roofing, By Region, 20142026 (Kiloton)

Table 24 Roofing Chemicals Market Size in Bituminous Roofing, By Region, 20142026 (USD Million)

Table 25 Roofing Chemicals Market Size in Bituminous Roofing, By Region, 20142026 (Kiloton)

Table 26 Roofing Chemicals Market Size in Metal Roofing, By Region, 20142026 (USD Million)

Table 27 Roofing Chemicals Market Size in Metal Roofing, By Region, 20142026 (Kiloton)

Table 28 Roofing Chemicals Market Size in Plastic Roofing, By Region, 20142026 (USD Million)

Table 29 Roofing Chemicals Market Size in Plastic Roofing, By Region, 20142026 (KT)

Table 30 Roofing Chemicals Market Size, By Region, 20142026 (USD Billion)

Table 31 Roofing Chemicals Market Size, By Region, 20142026 (Kiloton)

Table 32 Asia-Pacific: Roofing Chemicals Market Size, By Country, 20142026 (USD Billion)

Table 33 Asia-Pacific: Roofing Chemicals Market Size, By Country, 20142026 (Kiloton)

Table 34 Asia-Pacific: Roofing Chemicals Market Size, By Type, 20142026 (USD Million)

Table 35 Asia-Pacific: Roofing Chemicals Market Size, By Type, 20142026 (Kiloton)

Table 36 Asia-Pacific: Roofing Chemicals Market Size, By Application, 20142026 (USD Billion)

Table 37 Asia-Pacific: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 38 China: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 39 China: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 40 India: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 41 India: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 42 Japan: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 43 Japan: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 44 South Korea: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 45 South Korea: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 46 Indonesia: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 47 Indonesia: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 48 Rest of Asia-Pacific: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 49 Rest of Asia-Pacific: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 50 North America: Roofing Chemicals Market Size, By Country, 20142026 (USD Million)

Table 51 North America: Roofing Chemicals Market Size, By Country, 20142026 (Kiloton)

Table 52 North America: Roofing Chemicals Market Size, By Type, 20142026 (USD Million)

Table 53 North America: Roofing Chemicals Market Size, By Type, 20142026 (Kiloton)

Table 54 North America: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 55 North America: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 56 U.S.: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 57 U.S.: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 58 Canada: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 59 Canada: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 60 Mexico: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 61 Mexico: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 62 Western Europe: Roofing Chemicals Market Size, By Country, 20142026 (USD Billion)

Table 63 Germany: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 64 Germany: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 65 U.K.: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 66 U.K.: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 67 France: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 68 France: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 69 Rest of Western Europe: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 70 Rest of Western Europe: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 71 Central & Eastern Europe: Roofing Chemicals Market Size, By Country, 20142026 (USD Billion)

Table 72 Russia: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 73 Russia: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 74 Turkey: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 75 Turkey: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 76 Rest of Central & Eastern Europe: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 77 Rest of Central & Eastern Europe Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 78 South America: Roofing Chemicals Market Size, By Country, 20142026 (USD Million)

Table 79 South America: Roofing Chemicals Market Size, By Country, 20142026 (Kiloton)

Table 80 South America: Roofing Chemicals Market Size, By Type, 20142026 (USD Million)

Table 81 South America: Roofing Chemicals Market Size, By Type, 20142026 (Kiloton)

Table 82 South America: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 83 South America: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 84 Brazil: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 85 Brazil: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 86 Argentina: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 87 Argentina: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 88 Rest of South America: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 89 Rest of South America: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 90 Middle East & Africa: Roofing Chemicals Market Size, By Country, 20142021 (USD Million)

Table 91 Middle East & Africa: Roofing Chemicals Market Size, By Country, 20142026 (Kiloton)

Table 92 Middle East & Africa: Roofing Chemicals Market Size, By Type, 20142026 (USD Million)

Table 93 Middle East & Africa: Roofing Chemicals Market Size, By Type, 20142026 (Kiloton)

Table 94 Middle East & Africa: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 95 Middle East & Africa: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 96 Saudi Arabia: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 97 Saudi Arabia: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 98 UAE: Roofing Chemicals Market Size, By Application , 20142026 (USD Million)

Table 99 UAE: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 100 Rest of Middle East & Africa: Roofing Chemicals Market Size, By Application, 20142026 (USD Million)

Table 101 Rest of Middle East & Africa: Roofing Chemicals Market Size, By Application, 20142026 (Kiloton)

Table 102 Expansion, 20112016

Table 103 Expansion, 20112016

Table 104 Acquisition and Mergers, 20112016

Table 105 Joint Ventures and Partnerships, 20112016

List of Figures (57 Figures)

Figure 1 Roofing Chemicals: Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Roofing Chemicals Market: Research Design

Figure 4 Key Data From Secondary Sources

Figure 5 Key Data From Primary Sources

Figure 6 Key Industry Insights

Figure 7 Breakdown of Primary Interviews

Figure 8 Market Size Estimation: Bottom-Up Approach

Figure 9 Market Size Estimation: Top-Down Approach

Figure 10 Roofing Chemicals Market: Data Triangulation

Figure 11 Research Assumptions

Figure 12 Asia-Pacific Dominated the Roofing Chemicals Regional Market in 2015

Figure 13 Membrane Roofing Application to Witness Fastest-Growth During Forecast Period

Figure 14 Membrane Roofing Application Dominated the Roofing Chemicals Market in 2015

Figure 15 Roofing Chemicals Market to Witness Moderate Growth Between 2016 & 2021

Figure 16 Styrene to Be the Fastest-Growing Segment Between 2016 & 2021

Figure 17 Bituminous Roofing Accounted for the Largest Share of the Roofing Chemicals Market in 2015

Figure 18 Roofing Chemicals Market to Register High Growth in Asia-Pacific Between 2016 and 2021

Figure 19 Evolution of Roofing Chemicals

Figure 20 Drivers, Restraints, Opportunities, and Challenges for the Roofing Chemicals Market

Figure 21 Supply Chain Analysis of the Roofing Chemicals Market

Figure 22 Porters Five Forces Analysis

Figure 23 Trends of GDP, USD Billion (2015)

Figure 24 U.S. Was the Largest Country in Terms of Oil Production, Thousand Barrels Per Day, 2015

Figure 25 India to Be the Fastest Growing Country in Construction Market, USD Billion (20162021)

Figure 26 Acrylic Resin is the Most Researched Type of Roofing Chemicals, 20112016

Figure 27 Metal Roofing is the Most Researched Application of Roofing Chemicals, 20112016

Figure 28 U.S. Filed the Most Patents for Roofing Chemicals, 20112016

Figure 29 Asphalt to Drive the Roofing Chemicals Market Between 2016 and 2021

Figure 30 North America is Projected to Be the Largest Market for Asphalt/Bituminous Roofing Chemicals Through 2021

Figure 31 Asia-Pacific is Projected to Be the Largest Market for Acrylic Resin Roofing Chemicals Through 2021

Figure 32 Asia-Pacific is Projected to Be the Largest Market for Epoxy Resin Roofing Chemicals Through 2021

Figure 33 Asia-Pacific is Projected to Be the Largest Market for Styrene Roofing Chemicals Through 2021

Figure 34 Asia-Pacific is Projected to Be the Largest Market for Elastomers Roofing Chemicals Through 2021

Figure 35 Membrane Roofing Projected to Drive the Roofing Chemicals Market, 2016 vs 2021

Figure 36 Bituminous Roofing is the Largest Application for Roofing Chemicals

Figure 37 Asia-Pacific is Expected to Be the Largest Market for Membrane Roofing, 20162021

Figure 38 Asia-Pacific is Expected to Be the Largest Market for Elastomeric Roofing, 20162021

Figure 39 North America to Be the Largest Market for Bituminous Roofing, 20162021

Figure 40 Asia-Pacific to Be the Largest Market for Metal Roofing, 20162021

Figure 41 Asia-Pacific to Be the Largest Market for Plastic Roofing, 20162021

Figure 42 Regional Snapshot: India to Emerge as A New Strategic Destination, 20162021

Figure 43 Asia-Pacific Market Snapshot: India is the Fastest-Growing Market, 20162021

Figure 44 North American Market Snapshot: Mexico is Projected to Be the Fastest-Growing Market, 20162021

Figure 45 Western Europe Market Snapshot: Germany to Be the Largest and Fastest-Growing Market

Figure 46 South America Roofing Chemicals Market Snapshot: Brazil is the Largest Market, 20162021

Figure 47 Middle East & Africa Market Snapshot: UAE to Be the Largest and the Fastest-Growing Market, 20162021

Figure 48 Companies Adopted Expansion as the Key Growth Strategy, 20112016

Figure 49 Key Growth Strategies in Roofing Chemicals Market, 20112016

Figure 50 BASF SE : SWOT Analysis

Figure 51 The DOW Chemical Company: SWOT Analysis

Figure 52 Saint Gobain S.A : SWOT Analysis

Figure 53 3M Company : SWOT Analysis

Figure 54 Akzo Nobel N.V : SWOT Analysis

Figure 55 Sika AG: Company Snapshot

Figure 56 Owens Corning: Company Snapshot

Figure 57 Carlisle Companies Incorporated: Company Snapshot

Growth opportunities and latent adjacency in Roofing Chemicals Market

Roofing Market for South Africa

Sanded asphalt roofing felt market and supplier list

Interested in Urethane and acrylate material information

Roof Coating market by chemical, by substrate and by region

Specific interest on roofing market in Middle East & Africa region

Interested Roofing Products related reports covering the Middle East and African regions

Interested to work on marketing the Roofing Products in the entire Middle East Asian Regions and Africa

US silicone elastomeric roof coatings market