The study involved four major activities in estimating the current size of the security screening market. Exhaustive secondary research was conducted to gather information on the market, adjacent markets, and the overall security screening landscape. These findings, along with assumptions and projections, were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the security screening market.

Secondary Research

The secondary research process referred to various secondary sources to identify and collect necessary information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

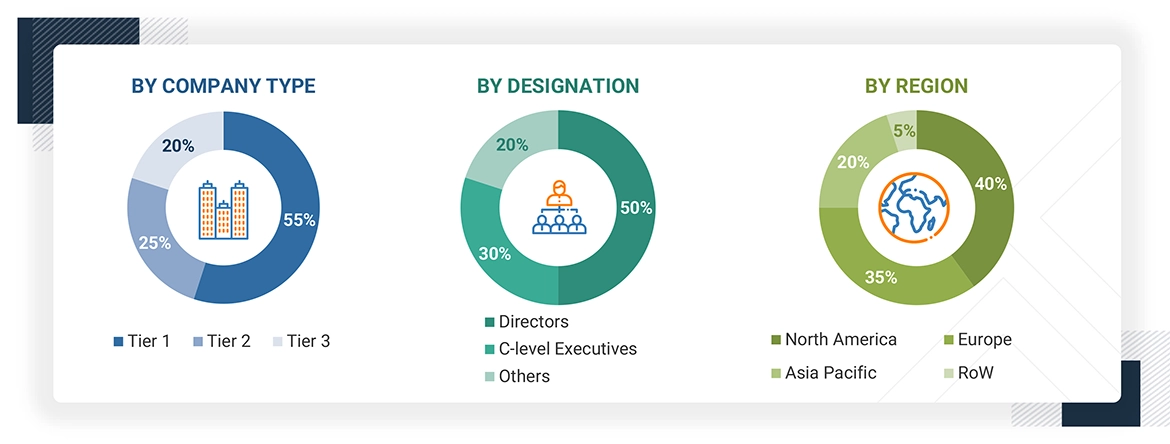

Extensive primary research was conducted after gaining knowledge about the current scenario of the security screening market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of the companies are defined based on their total revenue in 2024: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the security screening market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology was used to estimate the market size:

-

Major players in the industry and markets were identified through extensive secondary research.

-

The industry’s value chain and market size (in terms of value) were determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Security Screening Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the security screening market using the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both top-down and bottom-up approaches.

Market Definition

The security screening market encompasses various technologies and solutions to detect prohibited items, threats, or illicit materials carried by people, baggage, cargo, and vehicles across multiple entry points and high-security environments. It includes X-ray screening, electromagnetic metal detection, biometric verification, spectrometry and spectroscopy, and trace detection technologies. These solutions are widely deployed in transportation hubs, government facilities, commercial buildings, retail spaces, industrial sites, and public venues to ensure safety, prevent unauthorized access, and enhance operational efficiency. Rising global security concerns, regulatory mandates, and the increasing need for advanced, automated, and non-intrusive screening methods drive the market.

Key Stakeholders

-

Raw material and manufacturing equipment suppliers

-

Semiconductor wafer manufacturers and suppliers

-

Original equipment manufacturers (OEMs)

-

Original design manufacturers (ODMs) and OEM solutions providers

-

Government and financial institutions

-

Distributors and retailers

-

Research organizations

-

Technology standards organizations, forums, alliances, and associations

-

Technology investors

-

End users (transportation hubs, government organizations, retail stores and malls, hospitality facilities, commercial and industrial facilities, educational institutes, event venues, and sports clubs)

Report Objectives

-

To define, describe, and forecast the security screening market, in terms of system type, application, vertical, and region, in terms of value

-

To forecast the market, by system type, in terms of volume

-

To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries

-

To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

-

To provide a detailed overview of the security screening value chain

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the security screening market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the security screening market

-

To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

-

To analyze competitive strategies, such as product launches, expansions, and mergers and acquisitions, adopted by key players in the security screening market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Security Screening Market