Stretch Sleeve & Shrink Sleeve Labels Market by Polymer Film (PVC, PETG, OPS, PE), Sleeve Type (Shrink and Stretch), Ink, Printing Technology, Embellishing Type, Application, and Region - Global Forecast to 2026

Updated on : June 17, 2024

Shrink Sleeve & Stretch Sleeve Labels Market

The stretch sleeve & shrink sleeve labels market is projected to grow from USD 14.4 billion in 2021 to USD 18.9 billion by 2026, at a CAGR of 5.6%. Growth in the stretch sleeve & shrink sleeve labels market can primarily be attributed to the increasing population, developing economies and GDP, increasing awareness, and increasing demand for tamper-evident labels. There is a continual demand from the food and beverage industry. These are the key factors driving the demand for stretch sleeve & shrink sleeve labels during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Global Stretch sleeve & shrink sleeve labels Market

The COVID-19 pandemic has significantly impacted the stretch sleeve & shrink sleeve labels industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. Because of the COVID-19 epidemic, the packaging and labelling industry's supply chain has been interrupted, affecting product demand and supply. Governments all over the world have judged food-related industries vital, therefore demand for shrink and stretch sleeve labels is projected to remain stable over the forecast period. In the first quarter of 2021, a slight demand-supply imbalance arose from end-use industries such as food, drinks, and medicines; nevertheless, manufacturers quickly ramped up output to satisfy the increased demand.

Stretch Sleeve & Shrink Sleeve Labels Market Dynamics

Driver: Anti-counterfeiting and tamper-evident properties

The tamper-evident quality is the most vital aspect of shrink sleeve labels. The tamper-evident shrink sleeve labels are used as safety seals printed with messages such as “If the safety seal is broken, do not use,” “only for adult,” or “discard the product.” The evident products are widely used in the pharmaceutical and food & beverages verticals, as the end product is highly sensitive. This prevents malpractices such as adulteration or reusing containers that are to be discarded.

Restraint: Stand-up pouches replacing bottles

The biggest restraint for shrink sleeve labels is the increasing demand for stand-up pouches and substantially replacing bottles. There are various reasons for the same: stand-up pouches are lightweight, user-friendly, environment friendly, inexpensive, play an important role in the marketing of products, and their transportation is comparatively easy. Therefore, their growth acts as a restraint for the stretch sleeve & shrink sleeve labels industry’s growth, as these cannot be used on pouches.

Opportunity: Reducing overall labeling cost

A simple price comparison proves decisive between orthodox pressure-sensitive and shrink-sleeve labels. Orthodox pressure-sensitive labels are economical in price, but they require two labels to cover both the front and back of a package/container/bottle. But, in terms of shrink-sleeve labels, only one label is required to cover the whole container. Additionally, the orthodox cover only 40% of the total body of the product, whereas shrink-sleeve labels offer 100%, with 360° printing facility.

Challenges: Intricate recycling process

Over the years, the recycling process of sleeves has been the biggest obstacle of the sleeve industry.

The shrink sleeve relies on the following steps:

- Infrared auto-sortation

- Optical color auto-sortation

- Caustic wash

- Float/sink

In the float/sink, PET needs to sink in water and everything else to float in water to remove contamination from the PET.

Shrink sleeve labels most often employ PETG or PVC. Both of these polymers have a density greater than 1; hence, if mixed with PET, it will sink in water with the PET and contaminate the recycling stream. It is better to have a label substrate that floats in water for use with PET. PVC contamination is especially undesirable in PET recycling because of the impact PVC has on the discoloration of PET.

Inks used on sleeve labels can be removed from the label during caustic wash, and these inks can stain the PET. Inks have to be selected and tested to confirm no negative impact on recycling.

Highly colored full sleeve labels make the PET bottle appear to be a colored bottle, and these are rejected in a color sorter. About 25% of clear bottle surface area is required for the color sorter to see the PET bottle underneath as a clear PET container.

Older NIR equipment could not see the PET bottle through the sleeve label.

Some propose the use of “de-label” equipment to remove labels from bottles prior to recycling. They are, however, very undesirable as they add cost and complexity to the recycling process. Also, the ‘de-label’ process is not 100% effective because even after the de-coupling of labels, it contaminates the process.

Finally, a typical wrap-around label might weigh about 2 grams, whereas a shrink label might weigh 4 grams. Shrink labels reduce the yield of PET in a bale of PET bottles and create more landfill waste for recyclers to manage. Recycling and sustainability benefit from smaller, lighter labels.

PVC is the largest polymer film segment of the stretch sleeve & shrink sleeve labels market

On the basis of polymer film, the stretch sleeve & shrink sleeve labels market is segmented PVC, PETG, OPS, PE, and others. The PVC polymer film segment had the largest market share. PVC polymers are the most cost-effective films, and they shrink up to 60% to 65%. PVC films have better dimensional stability, and hence it conforms easily to containers of various sizes. Additionally, PVC films require low heat for shrinking labels. PVC shrink labels are also a big concern for PET recyclers across the globe. The labels have a higher density than water and thus sink during the recycling processes with PET bottles. This contaminates the PET, reducing the per bale yield of PET recycling of bottles. Pre-wash label removers can be used to deal with this issue, but it adds an additional cost for the recyclers and hence, are not very popular.

The shrink sleeve segment is the largest sleeve type segment of the stretch sleeve & shrink sleeve labels market

The stretch sleeve & shrink sleeve labels market is segmented on the basis of sleeve type into the stretch sleeve labels and shrink sleeve labels. The shrink sleeve labels segment led the market in terms of both value and volume. The shrink sleeve labels are printed on a flexible shrink film that reduces in size through the application of heat. Once the film shrinks, it accommodates tightly to the shape of the end product. Shrink sleeves are widely used as they offer 360° printing facilities, tamper-evident features, and conform to any intricate shape of the end product. Additionally, it provides more space for information. Shrink sleeves are also used for sealing. Shrink sleeve labels are segmented into full-body, neck sleeve, and combination packaging.

The other beverages segment is the largest application segment of the stretch sleeve & shrink sleeve labels market

The stretch sleeve & shrink sleeve labels market is segmented on the basis of application into the food, wine & spirit, other beverages, beauty & personal care, healthcare, and others. Stretch & shrink sleeve labels are used as a marketing tool in water bottles, soft drinks, pallets, abrasives, cast steel, empty bottle packing, and boxes with sharp corners. The other beverages application is one of the major users of stretch & shrink sleeve labels. They are used as secondary packaging for many modern-day beverage products, such as carbonated soft drinks. Stretch & shrink sleeve labels are commonly used in other beverages packaging as they easily conform to unique object shapes and provide 360° coverage for maximum branding opportunities. It is being extensively used in specialty drinks, juices & flavored drinks, dairy products, and flavored water & energy drinks.

The water based segment is the largest ink segment of the stretch sleeve & shrink sleeve labels market

The stretch sleeve & shrink sleeve label market is segmented on the basis of ink into water based, UV, and solvent based. Water-based inks use water or other solvents, which do not lead to the production of ozone as the carrier for ink. The availability and use of acceptable water-based inks depend on the substrates that are to be printed and the end-use characteristic to which the product will be subjected. The use of water-based inks on substrates such as films and foils vary and may require special treatment to have the inks or coatings adhere to it.

Water-based inks have been used for flexographic printing on paper & paperboard for a very long time, and it was successful because of the absorbent nature of paper fibers. However, printing a film or foil with water-based ink is very difficult, where water beads up and slides around the surface. Therefore, a lot of modifications are required to facilitate the transfer and adhesion of water inks.

The rotogravure segment is the largest printing technology segment of the stretch sleeve & shrink sleeve labels market

The stretch sleeve & shrink sleeve label market is segmented on the basis of printing technology into the rotogravure, flexography, and digital printing. Rotogravure, or gravure for short, is the most used technology for printing stretch & shrink sleeve labels around the world. In gravure, the image is etched on the surface of a metal plate with ink, creating a recess for the image to be printed. The recesses are then filled with ink, while the non-printing part of the plate is scraped free of ink. The substrate is pressed against the inked plate and the image is transferred. This involves a direct printing process involving sturdy and robust machines with excellent drying, giving a very stable and consistent print. With gravure technology, there is a possibility of fast changeovers and the capability to handle a huge range of substrates for printing.

The hot foil segment is the largest embellishment segment of the stretch sleeve & shrink sleeve labels market

The stretch sleeve & shrink sleeve labels market is segmented on the basis of printing technology into hot foil, cold foil, others. Hot foil stamping is the process of applying a metallic foil finish to labels. In a hot stamping machine, a metal die made in the pattern of the artwork to be foiled presses the foil against the substrate under intense pressure and high heat. Then the excess foil (the portion not intended to highlight anything) is stripped away, leaving only the foil that has been bonded to the selected areas of the printed image. It is popular for creating highlights and premium metallic finishes. It is available in a range of colors, including gold, silver, and bronze. Holographic patterns are also made for specialty finishes.

APAC is the largest market for stretch sleeve & shrink sleeve labels market

The APAC region is projected to be the largest market and is also expected to be the region with the highest CAGR during the forecast period. Countries like China, India and Japan contribute majorly to the stretch sleeve & shrink sleeve labels market. The usage of stretch & shrink sleeve labels in the region has increased due to cost-effectiveness, easy availability of raw materials, and demand for product labeling from highly populated countries such as India and China. The increasing scope of applications of stretch & shrink sleeve labels in the food & beverage, healthcare, and beauty & personal care industries in the region is expected to drive the market in the region. The growing population in these countries presents a huge customer base for FMCG products and food & beverages. Industrialization, growing middle-class population, rising disposable income, changing lifestyles, and rising consumption of packed products are expected to drive the demand for stretch & shrink sleeve labels during the forecast period.

Fuji Seal International (Japan) is key players in stretch sleeve & shrink sleeve labels market.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnections

Stretch Sleeve & Shrink Sleeve Labels Market Players

Berry Global Inc. (US), CCL Industries Inc. (Canada), Huhtamaki Oyj (Finland), Klöckner Pentaplast (England), and Fuji Seal International (Japan) are the key players operating in the stretch sleeve & shrink sleeve labels market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to stretch sleeve & shrink sleeve labels from emerging economies.

Stretch Sleeve & Shrink Sleeve Labels Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Polymer type, Sleevetype, Ink, Printing Technology, Application, Embellishing Type and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies |

Berry Global Inc. (US), CCL Industries Inc. (Canada), Huhtamaki Oyj (Finland), Klöckner Pentaplast (England), and Fuji Seal International (Japan) |

This research report categorizes the stretch sleeve & shrink sleeve labels market based on type, application, technology and region.

Stretch sleeve & shrink sleeve labels market by Polymer film:

- PVC

- PETG

- OPS

- PE

- Others

Stretch sleeve & shrink sleeve labels market by Application:

- Food

- Wine & Spirit

- Other Beverages

- Beauty & Personal care

- Healthcare

- Others

Stretch sleeve & shrink sleeve labels market by Printing technology:

- Gravure

- Flexography

- Digital printing

Stretch sleeve & shrink sleeve labels market by Ink:

- Water based

- Solvent based

- UV

Stretch sleeve & shrink sleeve labels market by Embellishing Type:

- Hot Foil

- Cold Foil

- Others

Stretch sleeve & shrink sleeve labels market by Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In September 2021, Huhtamaki Oyj completed the acquisition of Elif Holding A.ª. Elif Holding A.ª supplies sustainable, flexible packaging to global FMCG brand owners. This acquisition helped Huhtamaki to strengthen its hold as a leading flexible packaging company in emerging markets and further strengthened its existing flexible packaging business catering to attractive consumer product categories.

- In January 2021, Huhtamaki acquired the assets and operations of Mohan Mutha Polytech Private Limited (MMPPL). The debt-free purchase price was approximately USD 10 million. The company has performed this acquisition with the viewpoint to expand its flexible packaging business. Hence, the business will be reported as part of the Flexible Packaging business segment of Huhtamaki Oyj as of January 10, 2020.

- In December 2020, Fuji Seal International is building a new plant in North Carolina to increase its business opportunities. The company undertook this expansion to increase its production capacity. The new plant is situated in an area of 23.66 acres where it is producing shrink labels.

- In July 2020, CCL Industries Inc. acquired InTouch Label and Packaging Co. Inc. InTouch is a specialized short-run digital label converter. This acquisition was done to make InTouch Label and Packaging Co., Inc. (US) a part of the Avery Business segment of CCL Industries Inc.

- In July 2020, CCL Industries Inc. launched a folding carton paperboard brand with up to 30% post-consumer recycled fiber. ReMagine facilitates high-definition print capability and superior converting performance.

- In March 2020, Fuji Seal International acquired Fuji Ace (Thailand). The trade name of Fuji Ace was changed to Fuji Seal Packaging (Thailand) after the acquisition. The company performed this acquisition with the intention to conduct integrated and efficient operations with its bases in the region (Thailand, Vietnam, Indonesia, and India). Meanwhile, the company also planned to implement growth strategies in ASEAN and South Asia, including the development of an ASEAN strategy for the manufacture and sale of flexible packaging materials. This will strengthen the system solutions for shrink labels, pressure-sensitive labels (PSL), and machinery

- In July 2019, Berry Global Group acquired RPC Group. This acquisition helped to create a leading global supplier of value-added protective solutions and one of the world’s largest plastic packaging companies.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the stretch sleeve & shrink sleeve labels market?

Increasing population, developing economies and GDP, increasing awareness, and increasing demand for tamper-evident labels are hot bets for the market.

What are the market dynamics for the different type of stretch sleeve & shrink sleeve labels?

On the basis of sleeve type, the shrink sleeve labels segment accounted for a larger market share. The shrink sleeve labels are printed on a flexible shrink film that reduces in size through the application of heat. Once the film shrinks, it accommodates tightly to the shape of the end product. Shrink sleeves are widely used as they offer 360° printing facilities, tamper-evident features, and conform to any intricate shape of the end product. Additionally, it provides more space for information. Shrink sleeves are also used for sealing. Shrink sleeve labels are segmented into full-body, neck sleeve, and combination packaging.

What are the market dynamics for the different end-uses of stretch sleeve & shrink sleeve labels?

The PVC segment led the market with respect to polymer film in terms of both value and volume. PVC polymers are the most cost-effective films, and they shrink up to 60% to 65%. PVC films have better dimensional stability, and hence it conforms easily to containers of various sizes.

Who are the major manufacturers of the stretch sleeve & shrink sleeve labels market?

Berry Global Inc. (US), CCL Industries Inc. (Canada), Huhtamaki Oyj (Finland), Klöckner Pentaplast (England), and Fuji Seal International (Japan) are the key players operating in the stretch sleeve & shrink sleeve label market.

What are the major factors which will impact market growth during the forecast period?

Stringent government regulations will be a restraint to the growth of the market during the forecast period. Governments worldwide are addressing this issue by imposing strict laws, which results in the stretch sleeve & shrink sleeve labels market being subjected to governance.

What are the effects of COVID-19 on the stretch sleeve & shrink sleeve labels market?

The COVID-19 pandemic has significantly impacted the stretch sleeve & shrink sleeve labels industry worldwide, and it is difficult to ascertain the extent and severity of the impact in the long term. The supply chain in the packaging and labelling business has been interrupted as a result of the COVID-19 epidemic, affecting product demand and supply. Governments all over the world, however, consider food-related industries to be crucial, therefore demand for shrink and stretch sleeve labels is projected to remain stable during the forecast period. In the first quarter of 2021, a moderate demand-supply imbalance arose due to a rush in demand from end-use sectors such as food, drinks, and medicines; nevertheless, manufacturers quickly ramped up output to satisfy the increased demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.4 REGIONS COVERED

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

FIGURE 2 APPROACH 1

FIGURE 3 APPROACH 2: SUPPLY-SIDE APPROACH

FIGURE 4 APPROACH 3: SUPPLY-SIDE - COMPANY REVENUE ESTIMATION

2.3 DATA TRIANGULATION

FIGURE 5 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET: DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Key market insights

2.4 RESEARCH ASSUMPTIONS

2.4.1 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

TABLE 2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 6 SHRINK SLEEVE LABELS SEGMENT TO DOMINATE OVERALL MARKET

FIGURE 7 OTHER BEVERAGES TO BE LARGEST END USER OF STRETCH SLEEVE & SHRINK SLEEVE LABELS

FIGURE 8 HOT FOIL TO BE LARGEST SEGMENT IN OVERALL STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET

FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 HIGHER DEMAND FOR STRETCH SLEEVE & SHRINK SLEEVE LABELS EXPECTED FROM DEVELOPING ECONOMIES

FIGURE 10 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET

4.2 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY APPLICATION AND COUNTRY

FIGURE 11 CHINA WAS LARGEST MARKET FOR STRETCH SLEEVE & SHRINK SLEEVE LABELS IN ASIA PACIFIC

4.3 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY SLEEVE TYPE

FIGURE 12 SHRINK SLEEVE LABELS SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.4 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY POLYMER FILM

FIGURE 13 PVC SEGMENT TO LEAD OVERALL MARKET DURING FORECAST PERIOD

4.5 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY APPLICATION

FIGURE 14 OTHER BEVERAGES PACKAGING PROJECTED TO BE LARGEST APPLICATION

4.6 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY COUNTRY

FIGURE 15 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET IN INDIA PROJECTED TO WITNESS HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET EVOLUTION

FIGURE 16 EVOLUTION OF STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET

5.3 MARKET DYNAMICS

FIGURE 17 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Anti-counterfeiting and tamper-evident properties

5.3.1.2 Conforms to any kind of shape and size

5.3.2 RESTRAINTS

5.3.2.1 Stand-up pouches replacing bottles

5.3.3 OPPORTUNITIES

5.3.3.1 Reducing overall labeling cost

FIGURE 18 OVERALL COST REDUCTION IN LABELING

5.3.4 CHALLENGES

5.3.4.1 Intricate recycling process

5.4 REGULATIONS IN STRETCH SLEEVE & SHRINK SLEEVE LABELS INDUSTRY

6 INDUSTRY TRENDS (Page No. - 52)

6.1 VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: INTENSITY OF RIVALRY IS HIGH IN THE STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF RIVALRY

6.3 PRICE ANALYSIS

6.3.1 BY POLYMER FILM

6.3.2 BY SLEEVE TYPE

6.3.3 BY APPLICATION

6.3.4 BY REGION

7 IMPACT OF COVID-19 ON STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET (Page No. - 59)

7.1 INTRODUCTION

7.2 COVID-19 IMPACT ON STRETCH SLEEVE & SHRINK SLEEVE LABELS MATERIAL SUPPLY

7.3 COVID-19 IMPACT ON STRETCH SLEEVE & SHRINK SLEEVE LABELS APPLICATIONS

TABLE 3 UPDATE ON OPERATIONS BY MANUFACTURERS IN RESPONSE TO COVID-19

8 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY POLYMER FILM (Page No. - 62)

8.1 INTRODUCTION

FIGURE 21 PETG IS PROJECTED TO GROW AT HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 4 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 5 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

8.2 PVC

TABLE 6 PVC IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 7 PVC IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

8.3 PETG

TABLE 8 PETG IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 9 PETG IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

8.4 OPS

TABLE 10 OPS IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 11 OPS IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

8.5 PE

TABLE 12 PE IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 13 PE IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

8.6 OTHERS

TABLE 14 OTHER POLYMERS IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 15 OTHER POLYMERS IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

9 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY SLEEVE TYPE (Page No. - 70)

9.1 INTRODUCTION

FIGURE 22 SHRINK SLEEVE TO DOMINATE MARKET THROUGHOUT THE FORECAST PERIOD

TABLE 16 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 17 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

9.2 STRETCH SLEEVE LABELS

TABLE 18 STRETCH SLEEVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 19 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY TYPE, 2019–2026 (MILLION M2)

TABLE 20 STRETCH SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 21 STRETCH SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

9.3 SHRINK SLEEVE LABELS

TABLE 22 SHRINK SLEEVE LABELS MARKET SIZE, BY SHRINK TYPE, 2019–2026 (USD MILLION)

TABLE 23 SHRINK SLEEVE LABELS MARKET SIZE, BY SHRINK TYPE, 2019–2026 (MILLION M2)

TABLE 24 SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 25 SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

10 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY INK (Page No. - 75)

10.1 INTRODUCTION

FIGURE 23 UV INKS SEGMENT IS PROJECTED TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 26 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY INK, 2019–2026 (USD MILLION)

TABLE 27 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY INK, 2019–2026 (MILLION M2)

10.2 WATER-BASED INKS

10.3 UV INKS

10.4 SOLVENT-BASED INKS

11 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY PRINTING TECHNOLOGY (Page No. - 79)

11.1 INTRODUCTION

FIGURE 24 ROTOGRAVURE SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 28 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 29 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION M2)

11.2 ROTOGRAVURE

11.3 FLEXOGRAPHY

11.4 DIGITAL PRINTING

12 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY EMBELLISHING TYPE (Page No. - 82)

12.1 INTRODUCTION

FIGURE 25 HOT FOIL TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

TABLE 30 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (USD MILLION)

TABLE 31 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY EMBELLISHING TYPE, 2019–2026 (MILLION M2)

12.2 COLD FOIL

12.3 HOT FOIL

12.4 OTHERS

13 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY APPLICATION (Page No. - 85)

13.1 INTRODUCTION

TABLE 32 APPLICATIONS OF STRETCH SLEEVE & SHRINK SLEEVE LABELS

FIGURE 26 OTHER BEVERAGES TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 33 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

13.2 FOOD

13.3 OTHER BEVERAGES

13.4 WINE & SPIRIT

13.5 BEAUTY & PERSONAL CARE

13.6 HEALTHCARE

13.7 OTHERS

14 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, BY REGION (Page No. - 90)

14.1 INTRODUCTION

FIGURE 27 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET

TABLE 35 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY REGION, 2019–2026 (MILLION M2)

14.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET REGIONAL SNAPSHOT

TABLE 37 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 38 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION M2)

TABLE 39 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 40 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 41 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 42 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 43 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 44 ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.2.1 CHINA

14.2.1.1 China is major producer of stretch sleeve & shrink sleeve labels

TABLE 45 CHINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 46 CHINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 47 CHINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 48 CHINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 49 CHINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 50 CHINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.2.2 INDIA

14.2.2.1 Increasing urban population leading to growth of the market

TABLE 51 INDIA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 52 INDIA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 53 INDIA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 54 INDIA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 55 INDIA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 56 INDIA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.2.3 JAPAN

14.2.3.1 Changing trends in food industry leading to higher labeling requirements

TABLE 57 JAPAN: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 58 JAPAN: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 59 JAPAN: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 60 JAPAN: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 61 JAPAN: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 62 JAPAN: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.2.4 REST OF ASIA PACIFIC

TABLE 63 REST OF ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 64 REST OF ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 65 REST OF ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 66 REST OF ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 67 REST OF ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 REST OF ASIA PACIFIC: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.3 EUROPE

FIGURE 29 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET REGIONAL SNAPSHOT

TABLE 69 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 70 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION M2)

TABLE 71 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 72 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 73 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 74 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 75 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.3.1 GERMANY

14.3.1.1 Growing export of food & beverage products expected to drive the demand

TABLE 77 GERMANY: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 78 GERMANY: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 79 GERMANY: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 80 GERMANY: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 81 GERMANY: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 82 GERMANY: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.3.2 UK

14.3.2.1 Increase in demand for convenience foods

TABLE 83 UK: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 84 UK: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 85 UK: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 86 UK: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 87 UK: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 UK: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.3.3 FRANCE

14.3.3.1 Increasing consumption of packaged foods driving the market

TABLE 89 FRANCE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 90 FRANCE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 91 FRANCE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 92 FRANCE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 93 FRANCE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 FRANCE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.3.4 REST OF EUROPE

TABLE 95 REST OF EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 96 REST OF EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 97 REST OF EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 98 REST OF EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 99 REST OF EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 100 REST OF EUROPE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.4 NORTH AMERICA

FIGURE 30 NORTH AMERICA STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SNAPSHOT

TABLE 101 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION M2)

TABLE 103 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 105 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 107 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.4.1 US

14.4.1.1 Rise in demand for FMCG products expected to drive the market

TABLE 109 US: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 110 US: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 111 US: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 112 US: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 113 US: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 114 US: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.4.2 CANADA

14.4.2.1 Increasing disposable income and growth in food industry to drive demand for sleeve labels

TABLE 115 CANADA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 116 CANADA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 117 CANADA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 118 CANADA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 119 CANADA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 120 CANADA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.4.3 MEXICO

14.4.3.1 Demand for convenience/ready-to-go products to drive the market

TABLE 121 MEXICO: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 122 MEXICO: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 123 MEXICO: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 124 MEXICO: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 125 MEXICO: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 MEXICO: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.5 MIDDLE EAST & AFRICA

TABLE 127 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION M2)

TABLE 129 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 130 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 131 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 133 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.5.1 UAE

14.5.1.1 Rising beverage and food sectors to fuel demand for stretch sleeve & shrink sleeve labels

TABLE 135 UAE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 136 UAE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 137 UAE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 138 UAE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 139 UAE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 140 UAE: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.5.2 SOUTH AFRICA

14.5.2.1 High growth potential for packaging industry due to increasing disposable income and rising population

TABLE 141 SOUTH AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 142 SOUTH AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 143 SOUTH AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 144 SOUTH AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 145 SOUTH AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 146 SOUTH AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.5.3 REST OF MIDDLE EAST & AFRICA

14.5.3.1 High growth potential of packaging industry due to increasing disposable income and rising population

TABLE 147 REST OF MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 148 REST OF MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 149 REST OF MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 150 REST OF MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 151 REST OF MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 152 REST OF MIDDLE EAST & AFRICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.6 SOUTH AMERICA

TABLE 153 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 154 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION M2)

TABLE 155 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 156 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 157 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 158 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 159 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 160 SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.6.1 BRAZIL

14.6.1.1 Rise in awareness regarding healthcare issues and robust investment in healthcare industry to drive the market

TABLE 161 BRAZIL: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 162 BRAZIL: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 163 BRAZIL: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 164 BRAZIL: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 165 BRAZIL: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 166 BRAZIL: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.6.2 ARGENTINA

14.6.2.1 Government initiatives for ease of doing business and growing economy supporting market growth

TABLE 167 ARGENTINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 168 ARGENTINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 169 ARGENTINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 170 ARGENTINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 171 ARGENTINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 172 ARGENTINA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

14.6.3 REST OF SOUTH AMERICA

TABLE 173 REST OF SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (USD MILLION)

TABLE 174 REST OF SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY POLYMER FILM, 2019–2026 (MILLION M2)

TABLE 175 REST OF SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (USD MILLION)

TABLE 176 REST OF SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY SLEEVE TYPE, 2019–2026 (MILLION M2)

TABLE 177 REST OF SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 178 REST OF SOUTH AMERICA: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET SIZE, BY APPLICATION, 2019–2026 (MILLION M2)

15 COMPETITIVE LANDSCAPE (Page No. - 148)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 31 COMPANIES ADOPTED ACQUISITION AS THE KEY GROWTH STRATEGY DURING 2017–2021

15.3 MARKET RANKING

FIGURE 32 MARKET RANKING OF KEY PLAYERS, 2020

15.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 33 REVENUE ANALYSIS FOR KEY COMPANIES IN STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET

15.5 MARKET SHARE ANALYSIS

TABLE 179 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET: SHARES OF KEY PLAYERS

FIGURE 34 SHARE OF LEADING COMPANIES IN THE STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET

15.6 COMPANY EVALUATION QUADRANT

15.6.1 STAR

15.6.2 PERVASIVE

15.6.3 EMERGING LEADER

15.6.4 PARTICIPANT

FIGURE 35 COMPETITIVE LEADERSHIP MAPPING: STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET, 2020

15.7 COMPETITIVE BENCHMARKING

15.7.1 STRENGTH OF PRODUCT PORTFOLIO

15.7.2 BUSINESS STRATEGY EXCELLENCE

TABLE 180 COMPANY POLYMER FILM FOOTPRINT

TABLE 181 COMPANY SLEEVE TYPE FOOTPRINT

TABLE 182 COMPANY INK TYPE FOOTPRINT

TABLE 183 COMPANY PRINTING TECHNOLOGY FOOTPRINT

TABLE 184 COMPANY APPLICATION FOOTPRINT

TABLE 185 COMPANY EMBELLISHING TYPE FOOTPRINT

TABLE 186 COMPANY REGION FOOTPRINT

15.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

15.8.1 PROGRESSIVE COMPANIES

15.8.2 RESPONSIVE COMPANIES

15.8.3 STARTING BLOCKS

15.8.4 DYNAMIC COMPANIES

FIGURE 36 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

15.9 COMPETITIVE SCENARIO AND TRENDS

15.9.1 DEALS

TABLE 187 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET: DEALS, JANUARY 2017–NOVEMBER 2020

15.9.2 OTHERS

TABLE 188 STRETCH SLEEVE & SHRINK SLEEVE LABELS MARKET: OTHERS, JANUARY 2017–AUGUST 2021

16 COMPANY PROFILES (Page No. - 165)

16.1 MAJOR PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

16.1.1 BERRY GLOBAL INC.

TABLE 189 BERRY GLOBAL INC.: BUSINESS OVERVIEW

FIGURE 37 BERRY GLOBAL INC.: COMPANY SNAPSHOT

16.1.2 AMCOR PLC

TABLE 190 AMCOR PLC: BUSINESS OVERVIEW

FIGURE 38 AMCOR PLC: COMPANY SNAPSHOT

16.1.3 HUHTAMAKI OYJ

TABLE 191 HUHTAMAKI OYJ: BUSINESS OVERVIEW

FIGURE 39 HUHTAMAKI OYJ: COMPANY SNAPSHOT

16.1.4 WESTROCK COMPANY

TABLE 192 WESTROCK COMPANY: BUSINESS OVERVIEW

FIGURE 40 WESTROCK COMPANY: COMPANY SNAPSHOT

16.1.5 THE DOW CHEMICAL COMPANY

TABLE 193 THE DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 41 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

16.1.6 CCL INDUSTRIES INC.

TABLE 194 CCL INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 42 CCL INDUSTRIES INC.: COMPANY SNAPSHOT

16.1.7 FUJI SEAL INTERNATIONAL

TABLE 195 FUJI SEAL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 43 FUJI SEAL INTERNATIONAL: COMPANY SNAPSHOT

16.1.8 KLÖCKNER PENTAPLAST

TABLE 196 KLÖCKNER PENTAPLAST: BUSINESS OVERVIEW

FIGURE 44 KLÖCKNER PENTAPLAST: COMPANY SNAPSHOT

16.1.9 MACFARLANE GROUP PLC

TABLE 197 MACFARLANE GROUP PLC: BUSINESS OVERVIEW

FIGURE 45 MACFARLANE GROUP PLC: COMPANY SNAPSHOT

16.1.10 FORT DEARBORN COMPANY

TABLE 198 FORT DEARBORN COMPANY: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

16.2 ADDITIONAL PLAYERS

16.2.1 TAGHLEEF INDUSTRIES GROUP

16.2.2 SCHUR FLEXIBLES

16.2.3 COVERIS

16.2.4 CLONDALKIN GROUP

16.2.5 AVERY DENNISON CORPORATION

16.2.6 ANCHOR PRINTING COMPANY

16.2.7 OTK GROUP A.S.

16.2.8 ALUPOL PACKAGING SA

16.2.9 FORTIS SOLUTIONS GROUP LLC

16.2.10 POLYSACK FLEXIBLE PACKAGING LTD.

16.2.11 BONSET AMERICA CORPORATION

16.2.12 EDWARDS LABEL, INC.

16.2.13 D&L PACKAGING

16.2.14 MULTI-COLOR CORPORATION

16.2.15 CONSOLIDATED LABEL CO

17 APPENDIX (Page No. - 207)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the stretch sleeve & shrink sleeve labels market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as automobile, industrial, building & construction companies, and other companies of the customer/end users who are using aluminum cast products were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of stretch sleeve & shrink sleeve labels and outlook of their business, which will affect the overall market.

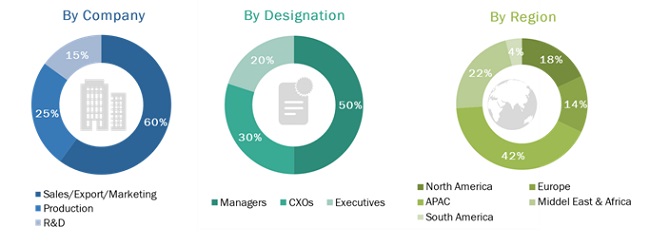

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the stretch sleeve & shrink sleeve labels market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global stretch sleeve & shrink sleeve labels market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth<./

- To analyze and forecast the stretch sleeve & shrink sleeve labels market based on process and end-use

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Stretch Sleeve & Shrink Sleeve Labels Market