Smart Card Market Size, Share and Industry Growth Analysis Report by Interface (Contact, Contactless, Dual), Type (Memory, MPU Microprocessor), Functionality (Transaction, Communication, Security and Access Control), Offering, Vertical, and Region - Global Growth Driver and Industry Forecast to 2026

Updated on : Oct 23, 2024

Smart Card Market Size

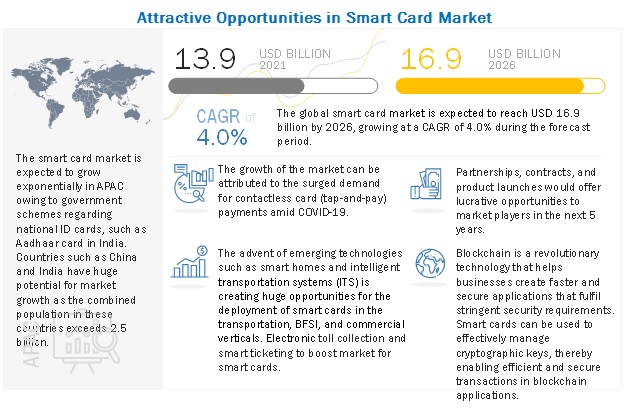

The Smart card market size is projected to reach USD 16.9 billion by 2026, from USD 13.9 billion in 2021; growing at a compound annual growth rate (CAGR) of 4.0% during the forecast period.

Major drivers for the growth of the smart card market are surged demand for contactless card (tap-and-pay) payments amid COVID-19, proliferation of smart cards in healthcare, transportation, and BFSI verticals; increased penetration of smart cards in access control and personal identification applications; and easy access to e-government services and risen demand for online shopping and banking.

To know about the assumptions considered for the study, Request for Free Sample Report

Smart Card Market Analysis

The global smart card market is experiencing significant growth, driven by the increasing adoption of secure digital transactions, the rise of e-government initiatives, and the growing demand for advanced identification and access control solutions. Smart cards, which incorporate integrated circuits to store and process data, are becoming increasingly prevalent in a wide range of applications, including financial services, telecommunications, healthcare, and transportation.

Smart Card Market Overview

The global smart card market is witnessing significant growth, driven by the increasing adoption of secure digital transactions, the rise of e-government initiatives, and the growing demand for advanced identification and access control solutions. Smart cards, which incorporate integrated circuits to store and process data, are becoming increasingly prevalent in a wide range of applications, including financial services, telecommunications, healthcare, and transportation. The market is expected to continue its upward trajectory, with industry analysts projecting a compound annual growth rate (CAGR) of around 8-10% over the next five years. This growth is fueled by the growing need for secure and convenient payment methods, the increasing adoption of smart city initiatives, and the rising demand for biometric identification solutions.

Smart Card Market Segmentation

By Vertical segment, the smart card market share for telecommunications segment held the largest share of the market

A subscriber identity module (SIM) card is a type of microcontroller-based smart card used in mobile phones and other devices. A SIM identifies and authenticates a subscriber to a wireless cell phone network. The telecommunications segment accounted for the maximum share of 42% of the smart card market in 2020. Expanding global mobile network and improvements in its infrastructure are boosting the growth of the market. In addition, COVID-19 led to an increased demand for connectivity. The current crisis provided a push to the trend of digitalization of business and private communication with cellular technology, along with the generalization of digital conferences. Moreover, the penetration of high-end SIM card technologies, such as LTE, 5G, M2M, eSIM, and SWP, is expected to augment the market growth in the coming years.

By Interface, contactless segment of smart card market is projected to account for largest size of the market during the forecast period

A contactless smart card includes an embedded smart card secure microcontroller or equivalent intelligence, internal memory, and a small antenna; it communicates with readers through a contactless radio frequency (RF) interface. Radio-frequency identification (RFID) or near-field communication (NFC) communication technologies are primarily used for contactless smart card applications. COVID-19 is positively impacting the contactless smart card industry growth as the World Health Organization (WHO) and governments across the world are advocating the use of contactless smart cards for various purposes to ensure social distancing to contain the spread of the virus. Contactless smart cards provide ease, speed, and convenience to users. The contactless interface has become highly relevant in the current COVID-19 situation, especially for payment applications, as it facilitates safe and secure transactions without physical contact.

To know about the assumptions considered for the study, download the pdf brochure

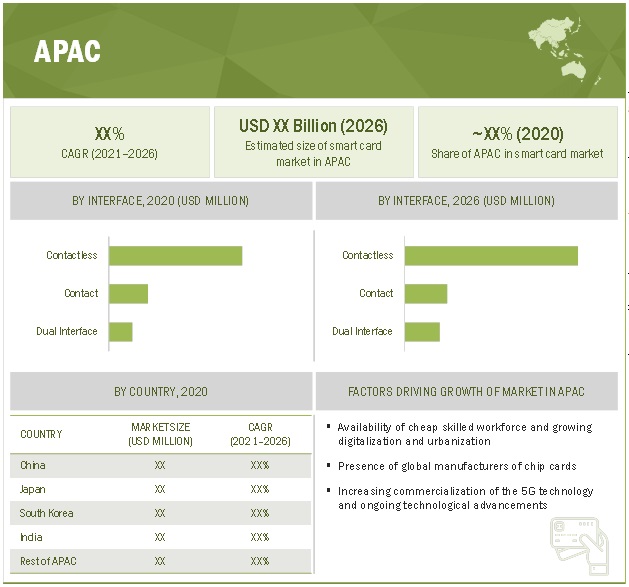

By Region, smart card market in APAC estimated to account for the largest size of the market.

Smart card market statistics in Asia Pacific (APAC) is the largest market during forecast period. The robust financial system that is being increasingly digitized and government agencies incorporating smart chip-based systems for better monitoring of processes are propelling several APAC countries to adopt smart card solutions owing to increasing demand, specifically in the transportation, BFSI, retail, government, and healthcare sectors. Smart cards are used to purchase tickets in metros, buses, and ferries, among others, in several countries in APAC. China is projected to witness the highest demand for smart cards in the region owing to a large consumer base and the presence of a number of smart card manufacturers.

Properly implemented smart cards in all sectors have proven highly effective in combating thefts and fraud. Government projects, such as the Aadhar card in India, drive the demand for smart cards for use in a number of sectors. Moreover, security concerns, particularly within the public sphere, are also expected to fuel the growth of the market in APAC.

Top Smart Card Companies - Key Market Players

Thales Group (France), IDEMIA (France), Giesecke + Devrient GmBH (Germany), CPI Card Group (US), HID Global Corporation (US), Watchdata (China), Eastcompeace (China), Inteligensa (US), ABCorp (US), and CardLogix (US) are a few major smart card companies in the market.

Smart Card Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2021 |

USD 13.9 Billion |

| Revenue Forecast in 2026 | USD 16.9 Billion |

| Growth Rate | 4.0% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Smart Card Companies in North America |

|

| Key Market Driver | Surged demand for contactless (tap-and-play) payments amid COVID-19 |

| Key Market Opportunity | New mode of information security of users enabled by blockchain |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Telecommunications Segment |

| Highest CAGR Segment | Contactless Segment |

| Largest Application Market Share | Access control and personal identification Application |

Market Segmentation:

In this report, the smart card market analysis has been segmented into the following categories:

Smart Card Market Size By Type:

- Memory

- MPU Microprocessor

Smart Card Market Analysis By Interface:

- Contact

- Contactless

- Dual

Smart Card Market By Functionality:

- Transaction

- Communication

- Security & Access Control

Smart Card Market Size By Offering:

- Smart Card

- Smart Card Readers

Smart Card Industries By Vertical:

- BFSI

- Telecommunications

- Government and Healthcare

- Education

- Retail

- Transportation

- Others

Smart Card Market Statistics By Region:

- North America

- Europe

- APAC

- RoW

Smart Card Market Size, Forecast to 2026 With COVID-19 Impact Analysis:

The world is facing an economic crisis caused by COVID-19 pandemic. The pandemic has severely affected various vertical such as education, government, transportation etc. Manufacturing units are hampered due to shutdowns and the availability of labor or raw materials. This has resulted in a huge gap between supply and demand. Further, there is a restriction on foreign trades due to the lockdown of international borders, non-operational distribution channels, and various government laws to take precautionary measures for public health and safety. However, it is expected that there will be an increasing focus on hygiene and sanitation due to the rise in people’s concern for a better and safer lifestyle. An increase in demand from medical and BFSI is also likely to drive the market gradually from 2021 to 2026.

The business for smart card specific to telecommunications, healthcare verticals is less affected compared to other verticals. The expansion in the market size could be seen due to the growing medical sector in the medium to long term. The upsurge of health care data brings up new challenges in providing efficient patient care and privacy. Smart cards solve both challenges by providing secure storage and easy distribution of data. The market witnessed a considerable decline in 2020 as a result of COVID-19, but the market has a huge potential as the region has major manufacturing and assembling plants, which could be an opportunity for players in the market after it recovers from the COVID-19 crisis by 2023. The smart cards market is projected to reach a value of USD 16.9 billion by 2026 due to the demand for increasing contactless payments, government schemes for national ID cards, and rising e-commerce shopping.

Smart Card Market Dynamics:

Driver: Surged demand for contactless (tap-and-play) payments amid COVID-19

The consumer awareness about the benefits of tap-and-pay cards and the use of these cards was already trending upward before the pandemic. However, with the outbreak and the spread of the COVID-19, the use of contactless payments grew quickly. Amid the pandemic, which obligates limited contact and social distancing, people buy groceries, household items, etc., using contactless payment options. Consumers aim to limit their exposure during transactions. According to research carried out by Fiserv (US) in May 2020, people consider contactless (tap-and-pay) cards as the fastest and the safest way to pay.

According to a survey conducted by the Harris Poll in May 2020 on behalf of Fiserv, ~42% of consumers considered tap-and-pay credit cards the safest in preventing the spread of the virus. Consumers considered cash and check the least safe in preventing the spread of the COVID-19 at 6% and 4%, respectively. According to the survey, the general perception of tap-and-pay cards being the most secure, preferred, convenient, and fastest payment method has expanded since 2019.

Restraint:: High infrastructure costs, along with security and data theft concerns

Smart cards have generated a great deal of interest among consumers in recent years owing to the advantages offered by them. However, their cost is one of the factors that restrain the growth of the smart card market. The initial capital investments required for setting up smart cards for access control and other applications are high. Smart cards require readers to read encryptions and obtain the information to provide physical or logical access. The deployment of these readers involves additional purchase costs. The average price of smart card readers varies from USD 50 to USD 300. The costs of smart cards range from USD 2 to USD 10. Costs of these cards increase with the use of chips that have high capacity and offer highly sophisticated capabilities. Thus, equipping employees with multifunctional smart cards is expected to require more initial investments than those required by conventional cards.

Opportunity: New mode of information security of users enabled by blockchain

Blockchain is a revolutionary technology that helps businesses develop fast and secure applications that fulfill stringent security requirements. Smart cards can effectively manage cryptographic keys, thereby enabling efficient and secure transactions in blockchain applications. They act as vaults for storing cryptographic keys. When smart cards are connected to the Internet through POS readers, the keys stored in them can be matched with keys stored in online libraries. If the match is successful, users are authenticated. This is expected to help banks and other ecosystem players secure and authenticate the identity of users in an improved manner, thereby reducing instances of cyber thefts.

Challenge: Risen proliferation of digital identity cards

Digital identity cards are the electronic equivalent of identity cards. Unlike paper-based identity cards such as driving licenses and passports, digital identity cards can be authenticated remotely over digital channels. This results in unlocking their access to banking services, government schemes, educational facilities, etc. It is expected that in the next three to four years, mobile devices will serve as digital identity cards to access enterprise services and data.

The technology required by digital identity cards is not only easily available but is also more affordable than ever, making it possible for emerging economies to skip paper-based approaches for identification. There is a growing demand for digital identity cards across the world as governments of different countries are adopting this technology to identify their population and cater to their requirements.

Recent Developments in Smart Card Industry

- In January 2021, IDEMIA signed a four-year agreement with Jyske Bank, the second-largest Danish-owned bank, to introduce the first recycled plastic payment card in Denmark.

- In June 2020, The Macao government issued contactless prepaid payment cards pre-loaded with credit to mitigate the economic impact of the COVID-19 pandemic and provide financial support to its citizens. The cards were produced by G+D Mobile Security.

- In June 2020, CPI and Visa Inc. launched the Earthwise High Content Card, which is made with up to 98% upcycled plastic. Through an exclusive agreement, the companies will initially provide all Visa-issuing financial institutions worldwide access to the Earthwise High Content Card, which is EMV-compliant and dual interface capable, enabling both contact and contactless payments.

- In January 2020, Confidex, a leading designer and supplier of short-range wireless identification solutions, entered into a partnership with Thales to develop a flexible smart media for Calypso-based systems. Confidex used Gemalto’s software solutions to create a new category of microprocessor-based smart media. These products include durable contactless paper cards embedded with a PET layer that reinforces the structure of the card. This makes the product resistant to harsh environments associated with transportation applications.

- In January 2018, Gemalto expanded its footprint for access management as a service solution across the European Union. This new facility will help the company respond to the rising demand for its cloud-based authentication and smart cards, and help customers maintain privacy and data sovereignty.

Frequently Asked Questions (FAQ):

Who are the winners in the smart card market? How are they strengthening their market presence?

Among the major players in the smart card market are Thales, CPI Card, G+D, HID Global, and IDEMIA. Product launches, expansions, agreements, and acquisitions are major strategies used by these players.

In the next five years, which vertical is expected to drive market growth?

In the coming years, the Government and Healthcare vertical is expected to grow at the highest CAGR. As a result of massive data generation, the healthcare sector faces challenges in maintaining patient privacy and efficiency of care. A smart health card that secures patient information, such as emergency information and benefits status, is being used to overcome these challenges. Several countries have already adopted smart cards as credentials for their health networks and as a way to carry an electronic health record (EHR) that can be accessed immediately. Therefore, smart cards are expected to become more popular in government and healthcare verticals in the coming years due to these benefits.

Which region is expected to be the major potential market for smart card ?

The largest market for smart cards is Asia Pacific (APAC). Many APAC countries are adopting smart card solutions due to increasing demand, specifically for transportation and BFSI services, retail, government, and healthcare. The robust financial systems that are being increasingly digitized and government agencies that are incorporating smart chip-based systems for better process monitoring are driving this trend. In several Asian countries, smart cards are used to purchase tickets for metros, buses, and ferries, among others. It is estimated that China will witness the highest demand for smart cards in the region, thanks to a large consumer base and the presence of a number of smart card manufacturers.

What are the opportunity for new entrants in the smart card market?

Dual interface is currently the most popular smart card interface. Chip cards with dual interfaces are more convenient for processing payments. In the coming years, dual interface smart cards are expected to grow rapidly. Card readers and POS terminals are compatible with both contact and contactless interfaces. The cards are equipped with RFID technology and EMV chips and allow contactless payments. Customers in a queue do not have to wait as long for payment processing with these cards. CPI Card Group Inc. announced the introduction of its patented steel & tungsten cards in January 2020 that feature dual interface EMV technology to enhance the customer experience. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT INTERFACE LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT TYPE LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT FUNCTIONALITY LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT VERTICAL LEVEL

1.3 SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 SMART CARD MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

1.8 STUDY LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 SMART CARD MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Key participants in primary processes across value chain of smart card market

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primaries

2.1.2.5 Key data from primary sources

2.2 SECONDARY AND PRIMARY RESEARCH

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF SMART CARDS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF SMART CARDS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIZE) – BOTTOM-UP APPROACH FOR ESTIMATION OF SIZE OF SMART CARD MARKET, BASED ON VERTICAL

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach used to arrive at market size using bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.2 Approach for obtaining company-specific information on smart card value chain

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach used to arrive at market size using top-down analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS

2.5.1 ASSUMPTIONS

2.6 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

3.1 SMART CARD MARKET: REALISTIC SCENARIO

FIGURE 9 MARKET: OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO ANALYSIS (2017–2026)

3.2 MARKET: OPTIMISTIC SCENARIO

3.3 MARKET: PESSIMISTIC SCENARIO

FIGURE 10 MPU MICROPROCESSOR SEGMENT TO LEAD MARKET FROM 2021 TO 2026

FIGURE 11 CONTACTLESS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2021 TO 2026

FIGURE 12 COMMUNICATION SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET IN 2026

FIGURE 13 TELECOMMUNICATIONS SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

FIGURE 14 APAC ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN SMART CARD MARKET

FIGURE 15 PENETRATION OF SMART CARDS IN ACCESS CONTROL AND PERSONAL IDENTIFICATION APPLICATIONS DRIVING GROWTH OF MARKET

4.2 SMART CARD MARKET, BY TYPE

FIGURE 16 MPU MICROPROCESSOR SEGMENT TO ACCOUNT FOR LARGER SIZE OF MARKET FROM 2021 TO 2026

4.3 MARKET IN APAC, BY VERTICAL AND COUNTRY

FIGURE 17 TELECOMMUNICATIONS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF MARKET IN APAC IN 2020

4.4 MARKET IN NORTH AMERICA, BY INTERFACE

FIGURE 18 CONTACT SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET IN NORTH AMERICA FROM 2021 TO 2026

4.5 MARKET, BY REGION

FIGURE 19 MARKET IN ROW TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 SMART CARD MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Surged demand for contactless (tap-and-play) payments amid COVID-19

FIGURE 21 PREFERENCE FOR DIFFERENT PAYMENT METHODS IN TERMS OF SAFETY TO PREVENT COVID-19 SPREAD

5.2.1.2 Proliferation of smart cards in healthcare, transportation, and BFSI verticals

TABLE 2 COMPARISON OF MULTIFUNCTIONAL SMART CARDS WITH CONVENTIONAL CARDS

TABLE 3 COMPARISON OF TECHNOLOGY FEATURES OF SMART CARDS AND CONVENTIONAL CARDS USED IN HEALTHCARE APPLICATIONS

5.2.1.3 Increased penetration of smart cards in access control and personal identification applications

5.2.1.4 Surged benefits offered by smart cards in form of multifunctionality and flexibility

5.2.1.5 Easy access to e-government services and heightened demand for online shopping and banking

FIGURE 22 IMPACT OF DRIVERS ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 High infrastructure costs, along with security and data theft concerns

5.2.2.2 Emergence of mobile wallets impacting demand for smart cards

FIGURE 23 IMPACT OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 New mode of information security of users enabled by blockchain

5.2.3.2 Adoption of smart cards in populated countries of APAC

5.2.3.3 Advent of smart cities and IoT to open up new latent growth opportunities

FIGURE 24 IMPACT OF OPPORTUNITIES ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Lack of standardization in smart cards and increased security concerns

5.2.4.2 Increased popularity of digital identity cards

FIGURE 25 ADOPTION RATE OF DIGITAL IDENTIFICATION (EKYC) IN DIFFERENT COUNTRIES IN 2019

FIGURE 26 IMPACT OF CHALLENGES ON MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS OF MARKET

5.4 ECOSYSTEM ANALYSIS

TABLE 4 SMART CARD MARKET: ECOSYSTEM

FIGURE 28 KEY PLAYERS IN MARKET ECOSYSTEM

5.5 PRICE TREND ANALYSIS

FIGURE 29 AVERAGE SELLING PRICES OF SMART CARDS USED IN DIFFERENT VERTICALS, 2017–2026

5.6 REGULATORY UPDATES

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 DEGREE OF COMPETITION

FIGURE 31 HIGHLY COMPETITIVE MARKET OWING TO PRESENCE OF SEVERAL WELL-ESTABLISHED PLAYERS

5.7.2 THREAT OF SUBSTITUTES

FIGURE 32 THREAT OF SUBSTITUTES TO CONTINUE HAVING MEDIUM IMPACT ON MARKET OWING TO POOR QUALITY OF SUBSTITUTES

5.7.3 BARGAINING POWER OF BUYERS

FIGURE 33 BARGAINING POWER OF BUYERS TO BE LOW OWING TO INCREASED REQUIREMENT FOR CONTACTLESS PAYMENTS

5.7.4 BARGAINING POWER OF SUPPLIERS

FIGURE 34 BARGAINING POWER OF SUPPLIERS TO BE MODERATE DUE TO LIMITED PRODUCT DIFFERENTIATION

5.7.5 THREAT OF NEW ENTRANTS

FIGURE 35 THREAT OF NEW ENTRANTS TO HAVE LOW IMPACT ON MARKET OWING TO REQUIREMENT OF HIGH CAPITAL INVESTMENTS

5.8 PATENT LANDSCAPE

FIGURE 36 NUMBER OF PATENTS RELATED TO SMART CARDS PUBLISHED FROM 2011 TO 2020

FIGURE 37 SHARE OF TOP 10 COMPANIES IN PATENT APPLICATIONS FROM 2011 TO 2020

TABLE 6 KEY PATENTS FROM 2018 TO 2020

5.9 TRADE ANALYSIS

FIGURE 38 EXPORTS OF PRODUCTS CLASSIFIED UNDER HS CODE 8523, BY KEY COUNTRY, 2015–2019

FIGURE 39 IMPORTS OF PRODUCTS CLASSIFIED UNDER HS CODE 8523, BY KEY COUNTRY, 2015–2019

5.1 TECHNOLOGY ANALYSIS

TABLE 7 COMPARISON OF CONTACT, CONTACTLESS, AND DUAL-INTERFACE CARDS IN TERMS OF TECHNOLOGY

5.11 CASE STUDY ANALYSIS

5.11.1 FARMERS & MERCHANTS BANK IMPLEMENTED [email protected] SOLUTION OF CPI CARD GROUP

5.11.2 RBS DEPLOYED FINGERPRINT BIOMETRIC CARDS FOR PAYMENTS FOR FIRST TIME IN UK

5.11.3 BIG GIANTS TEAM UP TO LAUNCH BIOMETRIC CARDS IN ASIA

6 SMART CARD MARKET, BY INTERFACE (Page No. - 79)

6.1 INTRODUCTION

TABLE 8 MARKET, BY INTERFACE, 2017–2020 (USD MILLION)

TABLE 9 MARKET, BY INTERFACE, 2021–2026 (USD MILLION)

6.2 CONTACT

6.2.1 CONTACT SMART CARDS HAVE TO BE PHYSICALLY CONNECTED TO A READER TO ENSURE THE PROPER TRANSMISSION OF INFORMATION

TABLE 10 CONTACT: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 CONTACT: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 CONTACTLESS

6.3.1 CONTACTLESS SMART CARDS PROVIDE EASE, SPEED, AND CONVENIENCE TO USERS

TABLE 12 CONTACTLESS: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 CONTACTLESS: MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 DUAL INTERFACE

6.4.1 DUAL INTERFACE CHIP CARDS PROVIDE GREATER PAYMENT PROCESSING CONVENIENCE

TABLE 14 DUAL INTERFACE: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 DUAL INTERFACE: MARKET, BY REGION, 2021–2026 (USD MILLION)

7 SMART CARD MARKET, BY TYPE (Page No. - 84)

7.1 INTRODUCTION

TABLE 16 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 17 MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.2 MEMORY

7.2.1 MEMORY-BASED SMART CARDS ARE PRIMARILY USED IN APPLICATIONS WHERE STORAGE, FASTER PROCESSING, AND SECURITY ARE OF LEAST PRIORITY

TABLE 18 MEMORY: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 MEMORY: MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 MPU MICROPROCESSOR

7.3.1 MPU MICROPROCESSOR-BASED SMART CARDS ARE PREDOMINANTLY USED IN BFSI SECTOR

TABLE 20 MPU MICROPROCESSOR: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 MPU MICROPROCESSOR: MARKET, BY REGION, 2021–2026 (USD MILLION)

8 SMART CARD MARKET, BY FUNCTIONALITY (Page No. - 88)

8.1 INTRODUCTION

TABLE 22 MARKET, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 23 MARKET, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

8.2 TRANSACTION

8.2.1 BENEFITS SUCH AS EASE OF USE, CONFIDENTIALITY, AND PORTABILITY TO FUEL ADOPTION OF SMARTS CARDS FOR TRANSACTION PURPOSES

TABLE 24 TRANSACTION: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 TRANSACTION: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 COMMUNICATION

8.3.1 COMMUNICATION TO ACCOUNT FOR LARGE MARKET SHARE DURING FORECAST PERIOD

TABLE 26 COMMUNICATION: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 COMMUNICATION: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 SECURITY & ACCESS CONTROL

8.4.1 SMART CARDS ARE USED FOR SECURITY & ACCESS CONTROL IN ENTERPRISES AND EDUCATION INSTITUTIONS

TABLE 28 SECURITY & ACCESS CONTROL: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 SECURITY & ACCESS CONTROL: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 SMART CARD MARKET, BY OFFERING (Page No. - 93)

9.1 INTRODUCTION

9.2 SMART CARDS

9.2.1 NEED FOR EFFICIENT STORAGE OF PERSONAL DATA IS EXPECTED TO BOOST ADOPTION OF SMART CARDS DURING FORECAST PERIOD

9.3 SMART CARD READERS

9.3.1 INCREASING ADOPTION OF IDENTITY MANAGEMENT TOOLS & SOLUTIONS TO FUEL DEMAND FOR SMART CARD READERS

10 SMART CARD MARKET, BY VERTICAL (Page No. - 94)

10.1 INTRODUCTION

TABLE 30 MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 31 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 32 MARKET, BY VERTICAL, 2017–2020 (MILLION UNITS)

TABLE 33 MARKET, BY VERTICAL, 2021–2026 (MILLION UNITS)

10.2 TELECOMMUNICATIONS

10.2.1 TELECOMMUNICATIONS VERTICAL LED MARKET IN 2020

TABLE 34 TELECOMMUNICATIONS: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 TELECOMMUNICATIONS: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.3 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

10.3.1 IMPLEMENTATION OF EMV STANDARD TO BOOST ADOPTION OF SMART CARDS IN BFSI

TABLE 36 BFSI: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 BFSI: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 GOVERNMENT & HEALTHCARE

10.4.1 GOVERNMENT & HEALTHCARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 38 GOVERNMENT & HEALTHCARE: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 GOVERNMENT & HEALTHCARE: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 TRANSPORTATION

10.5.1 SMART CARDS ARE USED FOR TRANSIT FARE, CAR PARKING, WASHING, SERVICING, AND FUELING PAYMENT IN TRANSPORTATION VERTICAL

TABLE 40 TRANSPORTATION: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 TRANSPORTATION: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.6 EDUCATION

10.6.1 APAC IS EXPECTED TO ACCOUNT FOR LARGEST SHARE OF SMART CARD MARKET FOR EDUCATION VERTICAL DURING FORECAST PERIOD

TABLE 42 EDUCATION: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 EDUCATION: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.7 RETAIL

10.7.1 SMART CARDS HELP RETAILERS ESTABLISH STRONGER CUSTOMER RELATIONSHIPS AND ENSURE CUSTOMER LOYALTY

TABLE 44 RETAIL: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 RETAIL: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHERS

TABLE 46 OTHERS: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 OTHERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

11 SMART CARD MARKET, BY REGION (Page No. - 103)

11.1 INTRODUCTION

FIGURE 40 MARKET IN ROW TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 48 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 41 MARKET SNAPSHOT: NORTH AMERICA

TABLE 50 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 51 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA, BY INTERFACE, 2017–2020 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY INTERFACE, 2021–2026 (USD MILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY TYPE, 2021–2026 (USD MILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 42 PRE- VS. POST-COVID-19 SCENARIO: MARKET IN NORTH AMERICA, 2017–2026 (USD BILLION)

11.2.1 US

11.2.1.1 US accounted for largest market size in North America

TABLE 60 MARKET IN US, BY TYPE, 2017–2020 (USD MILLION)

TABLE 61 MARKET IN US, BY TYPE, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Rising technological awareness about applications and benefits offered by smart cards to drive market growth

TABLE 62 MARKET IN CANADA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 63 MARKET IN CANADA, BY TYPE, 2021–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Government efforts for improving ways to secure identification credentials of citizens to boost growth

TABLE 64 MARKET IN MEXICO, BY TYPE, 2017–2020 (USD MILLION)

TABLE 65 MARKET IN MEXICO, BY TYPE, 2021–2026 (USD MILLION)

11.3 EUROPE

FIGURE 43 MARKET SNAPSHOT: EUROPE

TABLE 66 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 67 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 68 MARKET IN EUROPE, BY INTERFACE, 2017–2020 (USD MILLION)

TABLE 69 MARKET IN EUROPE, BY INTERFACE, 2021–2026 (USD MILLION)

TABLE 70 MRKET IN EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 71 MARKET IN EUROPE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 72 MARKET IN EUROPE, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 73 MARKET IN EUROPE, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 74 MARKET IN EUROPE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 75 MARKET IN EUROPE, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 44 PRE- VS. POST-COVID-19 SCENARIO: MARKET IN EUROPE, 2017–2026 (USD BILLION)

11.3.1 GERMANY

11.3.1.1 Germany to register highest CAGR in European market

TABLE 76 MARKET IN GERMANY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 77 MARKET IN GERMANY, BY TYPE, 2021–2026 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 Early adoption of contactless payment cards to support market growth in France

TABLE 78 MARKET IN FRANCE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 79 MARKET IN FRANCE, BY TYPE, 2021–2026 (USD MILLION)

11.3.3 UK

11.3.3.1 Growing security concerns and rising demand for smart and improved security access controls to boost demand for smart cards

TABLE 80 MARKET IN UK, BY TYPE, 2017–2020 (USD MILLION)

TABLE 81 MARKET IN UK, BY TYPE, 2021–2026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Issue of national e-IDs to boost market growth in Italy

TABLE 82 MARKET IN ITALY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 83 MARKET IN ITALY, BY TYPE, 2021–2026 (USD MILLION)

11.3.5 REST OF EUROPE

TABLE 84 MARKET IN REST OF EUROPE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 85 MARKET IN REST OF EUROPE, BY TYPE, 2021–2026 (USD MILLION)

11.4 APAC

FIGURE 45 MARKET SNAPSHOT: APAC

TABLE 86 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 MARKET IN APAC, BY INTERFACE, 2017–2020 (USD MILLION)

TABLE 89 MARKET IN APAC, BY INTERFACE, 2021–2026 (USD MILLION)

TABLE 90 MARKET IN APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN APAC, BY TYPE, 2021–2026 (USD MILLION)

TABLE 92 MARKET IN APAC, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 93 MARKET IN APAC, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 94 MARKET IN APAC, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 95 MARKET IN APAC, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 46 PRE- VS. POST-COVID-19 SCENARIO: MARKET IN APAC, 2017–2026 (USD BILLION)

11.4.1 CHINA

11.4.1.1 China held largest share of market in APAC in 2020

TABLE 96 MARKET IN CHINA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 97 MARKET IN CHINA, BY TYPE, 2021–2026 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Japan’s top-notch infrastructural setup to boost market growth

TABLE 98 MARKET IN JAPAN, BY TYPE, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN JAPAN, BY TYPE, 2021–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Smart Card India initiative to boost market growth in India

TABLE 100 MARKET IN INDIA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN INDIA, BY TYPE, 2021–2026 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Critical security requirements lead to adoption of smart cards

TABLE 102 MARKET IN SOUTH KOREA, BY TYPE, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN SOUTH KOREA, BY TYPE, 2021–2026 (USD MILLION)

11.4.5 REST OF APAC

TABLE 104 MARKET IN REST OF APAC, BY TYPE, 2017–2020 (USD MILLION)

TABLE 105 MARKET IN REST OF APAC, BY TYPE, 2021–2026 (USD MILLION)

11.5 ROW

TABLE 106 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 107 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 108 MARKET IN ROW, BY INTERFACE, 2017–2020 (USD MILLION)

TABLE 109 MARKET IN ROW, BY INTERFACE, 2021–2026 (USD MILLION)

TABLE 110 MARKET IN ROW, BY TYPE, 2017–2020 (USD MILLION)

TABLE 111 MARKET IN ROW, BY TYPE, 2021–2026 (USD MILLION)

TABLE 112 MARKET IN ROW, BY FUNCTIONALITY, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN ROW, BY FUNCTIONALITY, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN ROW, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN ROW, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 47 PRE- VS. POST-COVID-19 SCENARIO: MARKET IN ROW, 2017–2026 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Contactless segment to gain traction in next 2 to 3 years

11.5.2 MIDDLE EAST

11.5.2.1 Middle East witnessing high adoption of smart cards in medical, commercial, and government applications

11.5.3 AFRICA

11.5.3.1 Africa to grow at highest CAGR in coming years

12 COMPETITIVE LANDSCAPE (Page No. - 133)

12.1 OVERVIEW

FIGURE 48 COMPANIES ADOPTED PRODUCT LAUNCHES/DEVELOPMENTS, CONTRACTS, COLLABORATIONS, AND PARTNERSHIPS AS KEY GROWTH STRATEGIES FROM 2018 TO 2020

12.2 MARKET SHARE ANALYSIS

FIGURE 49 MARKET: MARKET SHARE ANALYSIS

TABLE 116 MARKET: DEGREE OF COMPETITION

FIGURE 50 MARKET: MARKET RANKING ANALYSIS

12.3 KEY STRATEGIES ADOPTED BY SMART CARD PLAYERS

TABLE 117 OVERVIEW OF STRATEGIES DEPLOYED BY KEY SMART CARD PLAYERS

12.3.1 PRODUCT PORTFOLIO

12.3.2 REGIONAL FOCUS

12.3.3 ORGANIC/INORGANIC GROWTH STRATEGIES

12.4 5-YEAR REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 51 5-YEAR REVENUE ANALYSIS FOR KEY COMPANIES

12.5 COMPANY EVALUATION QUADRANT, 2020

FIGURE 52 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

12.5.1 STAR

12.5.2 EMERGING LEADER

12.5.3 PERVASIVE

12.5.4 PARTICIPANT

12.6 COMPETITIVE BENCHMARKING

TABLE 118 COMPANY PRODUCT FOOTPRINT

FIGURE 53 COMPANY INDUSTRY FOOTPRINT

TABLE 119 COMPANY REGION FOOTPRINT

12.7 STARTUP/SME EVALUATION MATRIX, 2020

FIGURE 54 MARKET (GLOBAL) STARTUP/SME EVALUATION MATRIX, 2020

12.7.1 PROGRESSIVE COMPANY

12.7.2 RESPONSIVE COMPANY

12.7.3 DYNAMIC COMPANY

12.7.4 STARTING BLOCK

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 120 SMART CARD MARKET: PRODUCT LAUNCHES, JANUARY 2018–DECEMBER 2020

12.8.2 DEALS

TABLE 121 SMART CARD MARKET: DEALS, JANUARY 2018–DECEMBER 2020

13 COMPANY PROFILES (Page No. - 145)

13.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

13.1.1 THALES GROUP (GEMALTO)

TABLE 122 THALES: BUSINESS OVERVIEW

FIGURE 55 THALES GROUP: COMPANY SNAPSHOT

13.1.2 CPI CARD GROUP

TABLE 123 CPI CARD GROUP: BUSINESS OVERVIEW

FIGURE 56 CPI CARD GROUP: COMPANY SNAPSHOT

13.1.3 GIESECKE & DEVRIENT (G+D)

TABLE 124 GIESECKE & DEVRIENT: BUSINESS OVERVIEW

FIGURE 57 GIESECKE & DEVRIENT: COMPANY SNAPSHOT

13.1.4 IDEMIA

TABLE 125 IDEMIA: BUSINESS OVERVIEW

13.1.5 INTELIGENSA

TABLE 126 INTELIGENSA: BUSINESS OVERVIEW

13.1.6 CARDLOGIX

TABLE 127 CARDLOGIX: BUSINESS OVERVIEW

13.1.7 WATCHDATA

TABLE 128 WATCHDATA: BUSINESS OVERVIEW

13.1.8 EASTCOMPEACE

TABLE 129 EASTCOMPEACE: BUSINESS OVERVIEW

13.1.9 HID GLOBAL

TABLE 130 HID GLOBAL: BUSINESS OVERVIEW

13.1.10 ABCORP

TABLE 131 ABCORP: BUSINESS OVERVIEW

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 CARDCOM TECHNOLOGY

13.2.2 INGENICO

13.2.3 IDENTIV, INC.

13.2.4 KONA I CO., LTD.

13.2.5 VALID

13.2.6 VERIFONE

13.2.7 BRILLIANTTS CO., LTD.

13.2.8 PERFECT PLASTIC PRINTING

13.2.9 INFINEON

13.2.10 BARTRONICS INDIA LIMITED

14 APPENDIX (Page No. - 177)

14.1 OTHER INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

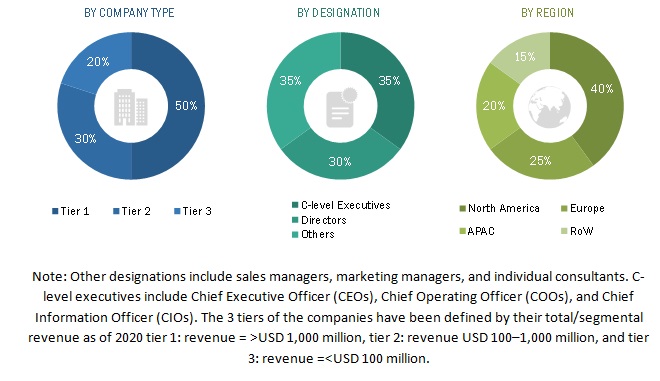

The study involved 4 major activities for estimating the current size of the Smart card market. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, smart card-related journals, The Institute of Environmental Sciences and Technology (IEST) publications; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size estimations, which was further validated through the primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Extensive primary research was conducted after understanding and analyzing the smart card market through secondary research. Several primary interviews were conducted with the key opinion leaders from both demand and supply side across 4 regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). RoW comprises the Middle East and Africa and South America. Approximately 25% of the primary interviews were conducted with the demand side, while approximately 75% with the supply side. This primary data was collected mainly through telephonic interviews, which accounted for approximately 80% of the total primary interviews. Besides, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the smart card market. These methods were also used extensively to estimate the size of the markets based on various segments. The research methodology used to estimate the market size included the following steps:

- The key players in the industry and markets were identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each market segment and subsegment. The data was triangulated by studying various factors and trends from demand and supply sides across different end users.

Study Objectives

- To describe and forecast the size of the overall smart card market, by interface, type, functionality, vertical, in terms of value

- To describe and forecast the size of the overall smart card market, by vertical, in terms of volume

- To describe and forecast the market size across 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the smart card market

- To provide a detailed overview of the smart card value chain

- To analyze each submarket with respect to individual growth trends and contributions to the overall smart card market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the smart card market

- To strategically profile key players in the said market and comprehensively analyze their market ranking in terms of revenue and core competencies1

- To analyze strategies/developments such as product launches, product developments, expansion, acquisition, contract, partnerships, and collaborations in the global smart card market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown of the smart card market for North America, Europe, APAC, and RoW

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Card Market

About Smart IC - Market size and market structure (Application(card, tag, electronic passport)/region etc.) - SCM Structure - Information about the companies involved in market (M/S, main products, sales volume, sales revenue

The study will give a global and regional understanding of the Smart Card Market with Covid-19 Impact in terms of potential, dynamics and opportunities. The country specific information is also included in the report. The market research will give a complete understanding on the current and future market potential and revenues.

We are analyzing the market scenario post COVID and this will help to compare the market scenario pre and post COVID and support the businesses in making decisions.The detailed report will help to address following questions: Which stakeholders in the Smart Card Market ecosystem will gain/ lose? Who will be impacted most adversely? How are the major customers of Smart Card Market players shifting their spending and strategies? What implication will this have on the players short term revenue growth? How are the top 25-30 players in the ecosystem changing their short term strategies in terms of product focus, end-use industry focus, regional focus, technology focus, etc.? What are the most significant changes expected? Post-COVID-19, which would be the most attractive industry for the Smart Card Market OEMs to invest in? How will this pandemic impact the short term and mid-term growth for Smart Card Market?

Need to calculate the TAM of touchless solutions.