Soil Conditioners Market by Type (Surfactants, Gypsum, Super Absorbent Polymers, and Others), Application (Agriculture, Construction & Mining, and Others), Formulation (Liquid and Dry), Crop Type, Soil Type, and Region - Global Forecast to 2025

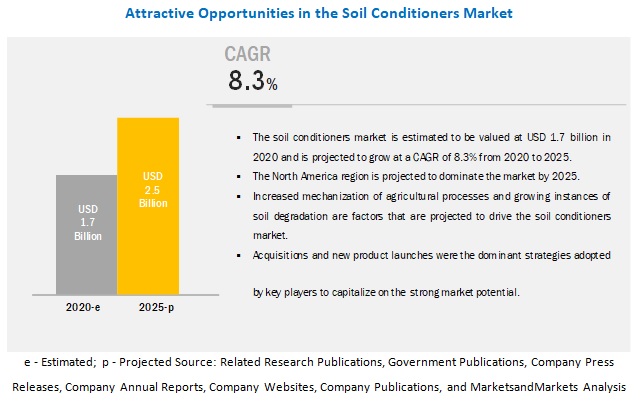

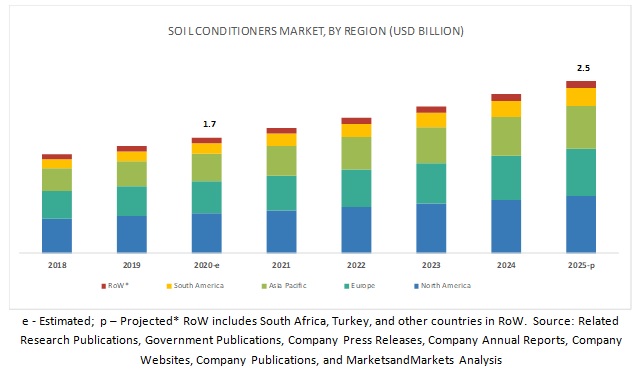

The soil conditioners market is projected to grow at a CAGR of 8.3% from 2020, to reach a value of USD 2.5 billion by 2025. The global market for soil conditioners is projected to witness significant growth due to factors such as rise in demand for agriculture crops, especially from developing countries, decrease in availability of arable land due to industrialization in both developed and developing countries, and shrinkage in productivity of soil due to use of fertilizers and chemicals.

By application, the agriculture segment is projected to be the fastest-growing segment in the soil conditioners market during the forecast period.

The surplus use of chemicals and fertilizers has led to shrinkage in the fertility and productivity of soil. Soil conditioners act as a valuable tool for the agricultural industry with their ability to enhance soil fertility, texture, and quality. Apart from this, shrinkage in the availability of arable land has urged farmers to enhance crop production in existing land, thus creating an opportunity for soil conditioner manufacturers. In developing countries, population growth and urbanization are the key reasons for the shrinkage of arable land. However, this has also increased the demand for crop production in these developing countries, thereby increasing the demand for soil conditioners in these countries.

By formulation, the liquid segment is projected to grow at the highest CAGR in the soil conditioners market during the forecast period.

The liquid forms are applied on a volume basis rather than a weight basis. The liquid form provides various options for crop growers to mix soil conditioners with insecticides, fungicides, or adjuvants. Compared to the dry form, little quantity of liquid soil conditioners is enough to cover larger crop areas, making it a preferable choice among farmers. In South America, the demand for liquid soil conditioners is expected to increase in the years to come, as they are easy to apply, do not require much labor, and increase yield.

By crop type, the cereals & grains segment is projected to dominate the global soil conditioners market during the forecast period.

Cereals & grains are the staple food products in many countries, which include wheat, rice, corn, sorghum, oats, and barley. With the increase in population and food demand, the basic requirement of farmers is to increase the yield of cereals & grains in a sustainable way. Here, the demand for soil conditioners, such as surfactants (soil wetting agents), gypsum, and natural polysaccharide derivatives, is expected to improve the quality and quantity of cereals & grain crops.

The increasing demand for liquid soil conditioners in the South American region is projected to drive the growth of the soil conditioners market.

South American countries have agricultural hubs, such as Brazil, Argentina, and Chile, which contribute to the major farm outputs in the region. Brazil is the largest producer of soybean in the region as well at a global level. It is also the largest producer of other crops such as sugarcane and other key crops at a global level. The farmers in the region have largely adopted the use of liquid soil conditioners and wetting agents, as they are easy to apply, do not require much labor, and increase the yield. The availability of arable land and the expansion of farmlands, especially in Brazil, Argentina, and Chile, promise the growth of this market. Moreover, the need to improve the per hectare crop yield is another opportunity for the growth of the market in South America.

Key Market Players:

Key players in this market include BASF (Germany), Syngenta (Switzerland), Novozymes (Denmark), Solvay (Belgium), UPL (India), Clariant (Switzerland), Evonik Industries (Germany), Eastman Chemical Company (US), Croda International PLC (UK), ADEKA Corporation (Japan), Vantage Specialty Chemicals (US), Aquatrols (US), Rallis India Limited (India), Humintech GmbH (Germany), GreenBest Ltd (UK), Omnia Specialities Australia (Australia), Grow More, Inc. (US), Geoponics Corp. (US), Delbon (France), and FoxFarm Soil & Fertilizer Co. (US). These major players in this market are focusing on increasing their presence through new product launches and acquisitions. These companies have a strong presence in North America, Asia Pacific, South America, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

Scope of the Market Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) & Volume (Tons) |

|

Segments covered |

Type, Soil Type, Crop Type, Formulation, and Application |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and Rest of World (RoW) |

|

Companies covered |

BASF (Germany), Syngenta (Switzerland), Novozymes (Denmark), Solvay (Belgium), UPL (India), Clariant (Switzerland), Evonik Industries (Germany), Eastman Chemical Company (US), Croda International PLC (UK), ADEKA Corporation (Japan), Vantage Specialty Chemicals (US), Aquatrols (US), Rallis India Limited (India), Humintech GmbH (Germany), GreenBest Ltd (UK), Omnia Specialities Australia (Australia), Grow More, Inc. (US), Geoponics Corp. (US), Delbon (France), and FoxFarm Soil & Fertilizer Co. (US). |

This research report categorizes the market for soil conditioners based on type, soil type, crop type, formulation, application, and region.

Based on type, the market for soil conditioners has been segmented into:

- Gypsum

- Surfactants

- Super absorbent polymers

- Others (polysaccharide derivatives, bone meal, blood meal, sphagnum moss, and plant extracts)

Based on formulation, the market for soil conditioners has been segmented into:

- Dry

- Liquid

Based on application, the market for soil conditioners has been segmented into:

- Agriculture

- Construction & mining

- Others (landscape, sports turf, and garden lawns)

Based on soil type, the market for soil conditioners has been segmented into:

- Sand

- Silt

- Clay

- Loam

Based on crop type, the market for soil conditioners has been segmented into:

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Others (plantation and ornamental crops, and forage crops)

Based on the region, the market for soil conditioners has been segmented into:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (South Africa, Turkey, and others in RoW)

Recent Developments

- In February 2019, UPL (India) acquired Arysta Life Sciences from Platform Specialty Products (USD) for USD 4.2 billion. UPL also acquired the company’s soil conditioner portfolio.

- In June 2018, BASF (Germany) launched MasterRoc SLF 50, a soil lubricant that improves performance through the control of soil during tunneling operations and challenging soil conditions. The soil conditioner reduces friction and helps to increase the advance rate of the tunnel boring machine (TBM) under challenging soil conditions.

Key Questions Addressed by the Market Report

- What are the new application areas for the soil conditioners market that companies are exploring?

- Who are some of the key players operating in the market for soil conditioners, and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&As in the soil conditioners market projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders due to the benefits, such as increasing revenue, environmental regulatory compliance, and sustainable profits for the suppliers, offered by the soil conditioners market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 36)

4.2 SOIL CONDITIONERS MARKET, BY LIQUID

4.3 NORTH AMERICA: MARKET, BY COUNTRY AND TYPE

4.4 MARKET, BY APPLICATION AND REGION

4.5 MARKET: MAJOR REGIONAL SUBMARKETS

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MACRO INDICATORS

5.2.1 RISE IN GLOBAL POPULATION

5.2.2 DECREASE IN THE ARABLE LAND

5.2.3 STRONG MARKET DEMAND FROM HIGH-VALUE CROPS

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Increase in awareness about soil management practices

5.3.1.2 Need for food security and enhanced nutrient management in soil

5.3.1.3 Advancements in farming practices

5.3.2 RESTRAINTS

5.3.2.1 Low adoption rate & high cost of inorganic soil conditioners

5.3.2.2 Purchase of low-quality products by farmers

5.3.3 OPPORTUNITIES

5.3.3.1 Strong growth in emerging economies

5.3.3.2 Increasing technological advancements

5.3.3.3 Increase in multiple applications of soil conditioners

5.3.4 CHALLENGES

5.3.4.1 Lack of awareness and high cost for soil management practices

6 COVID-19 IMPACT ON THE SOIL CONDITIONERS MARKET (Page No. - 48)

6.1 INTRODUCTION

6.2 IMPACT ON THE AGROCHEMICALS INDUSTRY

6.3 OPPORTUNITIES DURING THE OUTBREAK

7 SOIL CONDITIONERS MARKET, BY TYPE (Page No. - 50)

7.1 INTRODUCTION

7.2 SURFACTANTS

7.2.1 SURFACTANTS SEGMENT DOMINATES THE NORTH AMERICAN REGION IN THE MARKET

7.3 GYPSUM

7.3.1 SOUTH AMERICA IS PROJECTED TO LEAD THE GYPSUM MARKET DURING THE FORECAST PERIOD

7.4 SUPER ABSORBENT POLYMERS

7.4.1 SOUTH AMERICA AND ASIA PACIFIC PROJECTED TO ATTAIN THE HIGHEST GROWTH IN THE SOIL CONDITIONERS MARKET DURING THE FORECAST PERIOD

7.5 OTHER TYPES

7.5.1 NORTH AMERICA IS ESTIMATED TO LEAD THE OTHER TYPES SEGMENT IN THE MARKET

8 SOIL CONDITIONERS MARKET, BY APPLICATION (Page No. - 56)

8.1 INTRODUCTION

8.2 AGRICULTURE

8.2.1 THE AGRICULTURE SEGMENT IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

8.3 CONSTRUCTION & MINING

8.3.1 SOIL CONDITIONERS HELP IN INCREASING THE ADVANCED RATE OF TUNNELING IN THE CONSTRUCTION & MINING SECTOR

8.4 OTHER APPLICATIONS

9 SOIL CONDITIONERS MARKET, BY FORMULATION (Page No. - 62)

9.1 INTRODUCTION

9.2 LIQUID

9.2.1 HIGH EFFICACY RATE TO DRIVE THE DEMAND FOR LIQUID SOIL CONDITIONERS

9.3 DRY

9.3.1 IMPROVED SHELF LIFE TO PROVIDE BETTER OPPORTUNITIES FOR DRY SOIL CONDITIONERS

10 SOIL CONDITIONERS MARKET, BY CROP TYPE (Page No. - 66)

10.1 INTRODUCTION

10.2 CEREALS & GRAINS

10.2.1 PRODUCTION OF MAJOR FOOD CROPS, SUCH AS WHEAT AND SORGHUM, ENHANCED USING SOIL CONDITIONERS

10.3 FRUITS & VEGETABLES

10.3.1 RISE IN THE USE OF SOIL CONDITIONERS FOR HORTICULTURAL CROPS DUE TO INCREASING FOOD DEMAND GLOBALLY

10.4 OILSEEDS & PULSES

10.4.1 GYPSUM SOIL CONDITIONERS OBSERVING INCREASING DEMAND DUE TO EFFICIENCY ON OILSEEDS AND PULSES CROPS

10.5 OTHER CROP TYPES

10.5.1 RISING PRACTICE OF TURFS AND PLANTATION CROPS DRIVING THE DEMAND FOR SOIL CONDITIONERS

11 SOIL CONDITIONER MARKET, BY SOIL TYPE (Page No. - 73)

11.1 INTRODUCTION

11.2 SAND

11.2.1 COMPOST AND GREEN MANURE ARE HIGHLY PREFERRED FOR APPLICATION IN SANDY SOILS

11.3 CLAY

11.3.1 SURFACTANTS ARE USED ON CLAY SOILS TO LOOSEN THE SOIL TEXTURE AND IMPROVE DRAINAGE

11.4 SILT

11.4.1 APPLICATION OF LIMESTONE HELPS IN BALANCING THE PH OF SILT SOIL

11.5 LOAM

11.5.1 HIGH FERTILITY OF LOAMY SOIL TO INCREASE THE CULTIVATION OF HIGH-VALUE CROPS

12 SOIL CONDITIONER MARKET, BY REGION (Page No. - 78)

12.1 INTRODUCTION

12.2 NORTH AMERICA

12.2.1 US

12.2.1.1 The US market is dominating the North American soil conditioners market during the forecast period

12.2.2 CANADA

12.2.2.1 Degrading soil quality of prairies in Canada is boosting the use of soil conditioners for better yield in field crops

12.2.3 MEXICO

12.2.3.1 Soil degradation due to metal contamination to drive the market for soil conditioners in Mexico

12.3 EUROPE

12.3.1 FRANCE

12.3.1.1 Shift toward adopting organic farming practices drives the market

12.3.2 GERMANY

12.3.2.1 Rise in awareness about soil health management to drive the growth of the market

12.3.3 RUSSIA

12.3.3.1 Increase in the degradation of soil quality to drive the growth of the market

12.3.4 SPAIN

12.3.4.1 Poor structural conditions of soil to encourage the demand for soil conditioners

12.3.5 UK

12.3.5.1 Adoption of intensive farming has led to higher usage of soil conditioners

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 CHINA

12.4.1.1 One of the largest producers of key crops at a global level

12.4.2 INDIA

12.4.2.1 Largest producer of pulses and the second-largest producer of fruits and vegetables at a global level

12.4.3 JAPAN

12.4.3.1 Geographic conditions expected to boost sales of soil conditioner manufacturers

12.4.4 AUSTRALIA

12.4.4.1 High level of soil acidity expected to play a key role in the sale of soil conditioners

12.4.5 REST OF ASIA PACIFIC

12.4.5.1 Expanding population base to create an opportunity for farmers

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.1.1 Tough and unfavorable soil structures drive the growth of the soil conditioners market

12.5.2 ARGENTINA

12.5.2.1 Successful use of organic soil enhancers and amendments determines the scope for the growth of the market

12.5.3 REST OF SOUTH AMERICA

12.5.3.1 Improvement of soil ecology and conditions in the country show scope for the growth of soil conditioners

12.6 REST OF THE WORLD

12.6.1 SOUTH AFRICA

12.6.1.1 Fewer growth opportunities for the soil conditioners market due to economic and environmental factors

12.6.2 TURKEY

12.6.2.1 Better government support and awareness among farmers improving the scope of the soil conditioners market in the country

12.6.3 OTHERS IN ROW

12.6.3.1 Harsh and unfavorable soil conditions showing potential for the soil conditioners market in the future

13 COMPETITIVE LANDSCAPE (Page No. - 119)

13.1 OVERVIEW

13.2 COMPETITIVE LEADERSHIP MAPPING

13.2.1 VISIONARY LEADERS

13.2.2 DYNAMIC DIFFERENTIATORS

13.2.3 INNOVATORS

13.2.4 EMERGING COMPANIES

13.3 MARKET SHARE ANALYSIS

13.4 COMPETITIVE SCENARIO

13.4.1 NEW PRODUCT LAUNCHES

13.4.2 ACQUISITIONS

14 COMPANY PROFILES (Page No. - 124)

(Business overview, Products offered, Recent developments, SWOT analysis & Right to win)*

14.1 BASF

14.2 SYNGENTA

14.3 NOVOZYMES

14.4 SOLVAY

14.5 UPL

14.6 CLARIANT

14.7 EVONIK INDUSTRIES

14.8 EASTMAN CHEMICAL COMPANY

14.9 CRODA INTERNATIONAL PLC

14.10 ADEKA CORPORATION

14.11 VANTAGE SPECIALTY CHEMICALS

14.12 AQUATROLS

14.13 RALLIS INDIA LIMITED

14.14 HUMINTECH GMBH

14.15 GREENBEST LTD

14.16 OMNIA SPECIALITIES AUSTRALIA

14.17 GROW MORE INC.

14.18 GEOPONICS CORP

14.19 DELBON

14.20 FOXFARM SOIL & FERTILIZER CO.

*Details on Business overview, Products offered, Recent developments, SWOT analysis & Right to win might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 154)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (104 Tables)

TABLE 1 USD EXCHANGE RATES, 2015–2018

TABLE 2 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 3 SURFACTANTS: SOIL CONDITIONERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 4 GYPSUM: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 SUPER ABSORBENT POLYMERS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 OTHER TYPES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 8 AGRICULTURE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 CONSTRUCTION & MINING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 12 LIQUID: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 DRY: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

TABLE 15 CEREALS & GRAINS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 FRUITS & VEGETABLES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 OILSEEDS & PULSES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 OTHER CROP TYPES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 MARKET SIZE, BY SOIL TYPE, 2018–2025 (USD MILLION)

TABLE 20 MARKET SIZE FOR SANDY SOIL, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 MARKET SIZE FOR CLAY SOIL, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 MARKET SIZE FOR SLIT SOIL, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 MARKET SIZE FOR LOAMY SOIL, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 NORTH AMERICA: SOIL CONDITIONERS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY FORMULATION, 2018–2025 (TON)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY SOIL TYPE, 2018–2025 (USD MILLION)

TABLE 33 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 34 US: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 35 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 36 CANADA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 37 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 38 MEXICO: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: MARKET SIZE FOR SOIL CONDITIONERS, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 40 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 42 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY FORMULATION, 2018–2025 (TON)

TABLE 45 EUROPE: MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY SOIL TYPE, 2018–2025 (USD MILLION)

TABLE 47 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 FRANCE: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 49 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 50 GERMANY: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 51 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 RUSSIA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 53 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 SPAIN: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 55 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 UK: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 57 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 REST OF EUROPE: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE FOR SOIL CONDITIONERS, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY FORMULATION, 2018–2025 (TON)

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY SOIL TYPE, 2018–2025 (USD MILLION)

TABLE 67 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 CHINA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 69 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 INDIA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 71 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 72 JAPAN: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 73 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 74 AUSTRALIA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 75 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 76 REST OF ASIA PACIFIC: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 77 SOUTH AMERICA: SOIL CONDITIONERS MARKET SIZE, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 78 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 80 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 81 SOUTH AMERICA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 82 SOUTH AMERICA: MARKET SIZE, BY FORMULATION, 2018–2025 (TON)

TABLE 83 SOUTH AMERICA: MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

TABLE 84 SOUTH AMERICA: MARKET SIZE, BY SOIL TYPE, 2018–2025 (USD MILLION)

TABLE 85 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 BRAZIL: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 87 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 ARGENTINA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 89 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 90 REST OF SOUTH AMERICA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 91 ROW: MARKET SIZE FOR SOIL CONDITIONERS, BY COUNTRY/REGION, 2018–2025 (USD MILLION)

TABLE 92 ROW: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 93 ROW: MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 94 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 ROW: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 96 ROW: MARKET SIZE, BY FORMULATION, 2018–2025 (TON)

TABLE 97 ROW: MARKET SIZE, BY CROP TYPE, 2018–2025 (USD MILLION)

TABLE 98 ROW: MARKET SIZE, BY SOIL TYPE, 2018–2025 (USD MILLION)

TABLE 99 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 100 SOUTH AFRICA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 101 TURKEY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 TURKEY: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 103 OTHERS IN ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 104 OTHERS IN ROW: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

LIST OF FIGURES (42 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

FIGURE 3 RESEARCH DESIGN

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 DATA TRIANGULATION METHODOLOGY

FIGURE 7 MARKET SIZE, BY TYPE, 2020 VS. 2025

FIGURE 8 THE AGRICULTURE SEGMENT IS PROJECTED TO GROW AT THE HIGHEST CAGR, BY APPLICATION, IN 2025

FIGURE 9 LIQUID FORMULATION SEGMENT, BY FORMULATION, ESTIMATED TO DOMINATE THE MARKET IN 2020

FIGURE 10 LOAM SOIL TYPE MARKET PROJECTED TO DOMINATE THE SOIL CONDITIONERS MARKET BY 2025

FIGURE 11 THE OILSEEDS & PULSES SEGMENT, BY CROP TYPE, IS PROJECTED TO DOMINATE THE MARKET BY 2025

FIGURE 12 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 13 HIGH DEMAND FOR SURFACTANTS TO DRIVE THE GROWTH OF THE MARKET

FIGURE 14 LIQUID WAS THE MOST PREFERRED SEGMENT IN THE SOIL CONDITIONERS MARKET IN 2019

FIGURE 15 NORTH AMERICA: THE US WAS A MAJOR CONSUMER OF SOIL CONDITIONERS IN 2019

FIGURE 16 NORTH AMERICA ACCOUNTED FOR THE LARGEST MARKET SHARE IN THE CONSTRUCTION & MINING SEGMENT IN 2019

FIGURE 17 THE US ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 18 GLOBAL POPULATION PROJECTED TO REACH ~9.7 BILLION BY 2050

FIGURE 19 ARABLE LAND PER CAPITA, 1960–2050 (HA)

FIGURE 20 CROP PRODUCTION PER REGION, 2015–2018

FIGURE 21 SOIL CONDITIONERS: MARKET DYNAMICS

FIGURE 22 AREA HARVESTED MILLION (HA), 2015-2018

FIGURE 23 SURFACTANTS SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 24 THE AGRICULTURE SEGMENT IS PROJECTED TO GROW AT THE HIGHEST CAGR IN THE SOIL CONDITIONERS MARKET DURING THE FORECAST PERIOD

FIGURE 25 INDIA: HORTICULTURE CROP PRODUCTION, 2013–2018 (MILLION TONNES)

FIGURE 26 MARKET SIZE, BY FORMULATION, 2020 VS. 2025 (USD MILLION)

FIGURE 27 CEREALS & FRUITS SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 28 THE LOAM SEGMENT IS PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 29 SPAIN PROJECTED TO WITNESS HIGH GROWTH RATE IN THE MARKET BETWEEN 2020 AND 2025

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 32 SOIL CONDITIONERS MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 33 SOIL CONDITIONERS MARKET: COMPANY SHARE MARKET IN 2018

FIGURE 34 BASF: COMPANY SNAPSHOT

FIGURE 35 SYNGENTA: COMPANY SNAPSHOT

FIGURE 36 NOVOZYMES: COMPANY SNAPSHOT

FIGURE 37 SOLVAY: COMPANY SNAPSHOT

FIGURE 38 UPL: COMPANY SNAPSHOT

FIGURE 39 CLARIANT: COMPANY SNAPSHOT

FIGURE 40 EVONIK INDUSTRIES: COMPANY SNAPSHOT

FIGURE 41 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 42 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

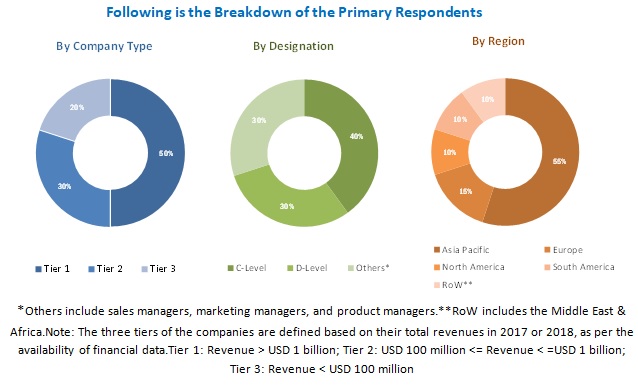

The study involves four major activities to estimate the current soil conditioners market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The soil conditioners market comprises stakeholders such as agrochemicals suppliers and fertilizer manufacturers. The demand-side of this market is characterized by the rising demand for from end-use industries such as agriculture producers, construction & mining industry, and sports & residential turf manufacturers. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Soil Conditioners Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the soil conditioners market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size-using the market size estimation processes, as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, and project the global market size for the soil conditioners market

- To understand the structure of the market for soil conditioners by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, with respect to individual growth trends, prospects, and their contribution to the total soil conditioners market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific soil conditioners market, by country

- Further breakdown of other Rest of Europe soil conditioners market, by country

- Further breakdown of other Rest of the World soil conditioners market, by region

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Soil Conditioners Market