Spray Adhesives Market by Chemistry (Epoxy, Polyurethane, Synthetic Rubber, Vinyl Acetate Ethylene), Type (Solvent-Based, Water-Based, Hot Melt), End-Use Industry (Transportation, Construction, Furniture), and Region - Global Forecast to 2022

Spray Adhesives Market Size And Forecast

[154 Pages Report] The overall spray adhesives market is expected to grow from USD 2.61 billion in 2016 to USD 3.41 billion by 2022, at a CAGR of 4.6% from 2017 to 2022. Spray adhesives, also known as sprayable adhesives, are adherents provided in the aerosol form. These adhesives provide good adhesion with fast and aggressive tack. Spraying increases the speed of application with minimum wastage due to controlled spray mechanism.

Market Dynamics

Drivers

- Increasing penetration of spray adhesives in end-use industries

- The rapid growth of key end-use industries in APAC

Restraints

- The volatility of raw material prices

Opportunities

- Growing demand for low-VOC and eco-friendly adhesives

Challenges

- Meeting environmental standards while maintaining performance

Growing furniture industry to drive the spray adhesives market

The spray adhesives market in the furniture industry is estimated to witness the fastest growth during the forecast period. The growth of the furniture industry is attributed to the growing construction industry and improving standards of living. New constructions will increase the demand for housing and/or office furniture. This is expected to be observed mainly in developing economies such as China, India, Brazil, and South Africa.

The following are the major objectives of the study.

- To define, describe, and forecast the spray adhesives market on the basis of type, chemistry, end-use industry, and region

- To identify the factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the spray adhesives market during the forecast period

- To forecast the size of the spray adhesives market, in terms of volume and value

- To analyze the detailed segmentation of the spray adhesives market and forecast the market size, in terms of volume and value, for the five key regions, namely, North America, Europe, Asia-Pacific, the Middle East & Africa, and South America

- To analyze the competitive developments, such as expansions, new product developments, joint ventures, and mergers & acquisitions, in the spray adhesives market

- To profile the leading players operating in the spray adhesives market and identify their core competencies

Both, top-down and bottom-up approaches were used to estimate and validate the sizes of the spray adhesives market and various other dependent submarkets. The research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for this technical, market-oriented, and commercial study of the spray adhesives market.

To know about the assumptions considered for the study, download the pdf brochure

The spray adhesives market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale. Key players considered in the analysis of the spray adhesives market are Bostik SA (US), H.B. Fuller (US), Henkel (Germany), Kissel+Wolf GmbH (Germany), Quin Global (US), SIKA AG (Switzerland), and 3M (US).

Target Audience

- Manufacturers, Dealers, and Suppliers of spray adhesives

- Spray adhesives Manufacturing Plant Developers and Related Service Providers

- Adhesive service providers

- Investors

Report Scope

By Type:

- Solvent-based

- Water-based

- Hot Melt

By Chemistry:

- Epoxy

- Polyurethane

- Synthetic Rubber

- Vinyl Acetate-Ethylene

By End-use industry:

- Transportation

- Construction

- Furniture

- Others

By Geography

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

Critical questions which the report answers

- What are new trends in application areas of spray adhesives?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Spray adhesives market analysis for additional countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall spray adhesives market is expected to grow from USD 2.72 billion in 2017 to USD 3.41 billion by 2022 at a CAGR of 4.6%. Spray adhesives are used in transportation, construction, and furniture industries. In the transportation industry, they are used in the interior development and upholstery applications in vehicles, aircraft, and ships. In the construction industry, spray adhesives are majorly used in flooring and roofing applications. Spray adhesives are also used in packaging, textile, and arts & crafts.

The spray adhesives market is categorized on the basis of their chemical composition as epoxy, polyurethane, synthetic rubber, and vinyl acetate-ethylene. Among these, synthetic rubber spray adhesives are most widely used, while the demand for polyurethane and vinyl acetate-ethylene is increasing.

On the basis of type, the spray adhesives market has been segmented into the solvent-based, water-based, and hot melt. The hot melt spray adhesives segment is estimated to be the fastest-growing type of the spray adhesives market during the forecast period. This high growth is attributed to the tightening environmental norms regarding VOC content of spray adhesives. Hot melt spray adhesives do not use water or solvent as a carrier and, hence, their VOC content is very less, making them more eco-friendly.

In terms of volume, the styrenic block copolymers (SBC) type segment led the thermoplastic elastomers market in 2016. The styrenic block copolymers (SBC) are also called third-generation synthetic rubbers. They are mostly used in the form of a mixture with other polymers, oils, and fillers. They can be processed repeatedly and molded easily. Styrenic block copolymers (SBC) are the most inexpensive type of thermoplastic elastomers available in the market.

Among the various end-use industries of spray adhesives, the transportation segment is estimated to remain the largest consumer during the forecast period. Spray adhesives are used to bond leather, foam, fabric, fiberglass, and other materials such as plastic and rubber to the metal body of vehicle, aircraft, or ship. These adhesives are used in the interior trim application of vehicles and aircraft. The increasing demand for vehicles from emerging countries such as China, India, and Brazil is projected to fuel the demand for spray adhesives during the forecast period. Increasing popularity of electric cars and rising disposable incomes of the middle-class population in many countries are expected to boost the demand for vehicles.

Increasing the use of spray adhesives in transportation, construction, and furniture industries to drive the growth of the market

Transportation

The transportation sector includes automotive, aerospace, and marine. The use of adhesives help manufacturers to reduce the weight of vehicles, and the use of spray adhesives helps in reducing the cost and wastage of adhesive materials. Spray adhesives can generate a smooth coating, covering the complete target area with reduced adhesive usage in a short period of time.

Construction

The applications of spray adhesives in the construction industry include roofing, flooring, and insulation. Spray adhesives can bond a variety of roof construction materials to many roof substrates in new and re-roof applications. They can also be used to bond board stocks with each other. In flooring applications, spray adhesives are used to bond carpets, rubber floor tiles, and carpet tiles to the floor. In insulation application, spray adhesives are used to bond insulation materials such as fiberglass, expanded polystyrene foam, and extruded polystyrene foam.

Furniture

Furniture or woodworking is another major application of spray adhesives. Almost two-thirds of wood products today are totally or partially bonded together using a variety of adhesives. This is because adhesive bonding offers several advantages over other joining methods for wood components. Companies are investing in R&D to synthesize environmentally-friendly and skin-friendly wood adhesives.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for spray adhesives?

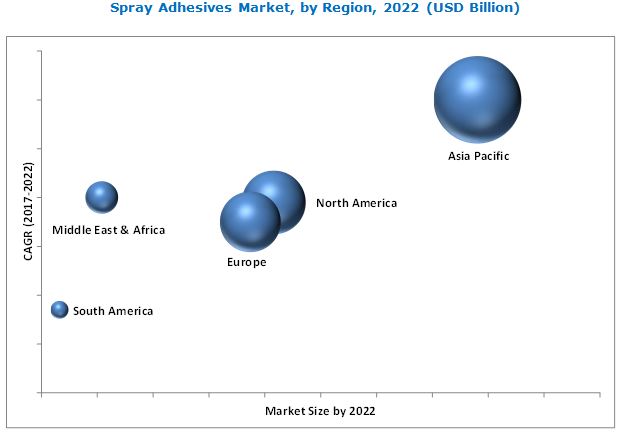

The rising demand for spray adhesives from transportation, construction, furniture, and packaging industries is driving the spray adhesives market, globally. Asia-Pacific is projected to be the fastest-growing market for spray adhesives during the forecast period, followed by the Middle East & Africa and North America. The markets in developing economies such as China and India are experiencing high growth due to increasing purchasing power of the middle class and growing urbanization. The spray adhesives market in India is projected to witness the highest CAGR during the forecast period.

Key players in the market include Bostik SA (US), H.B. Fuller (US), Henkel (Germany), Illinois Tool Works (US), Kissel+Wolf GmbH (Germany), Quin Global (US), Sika AG (Switzerland), and 3M (US). These players are increasingly undertaking expansions, mergers, and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

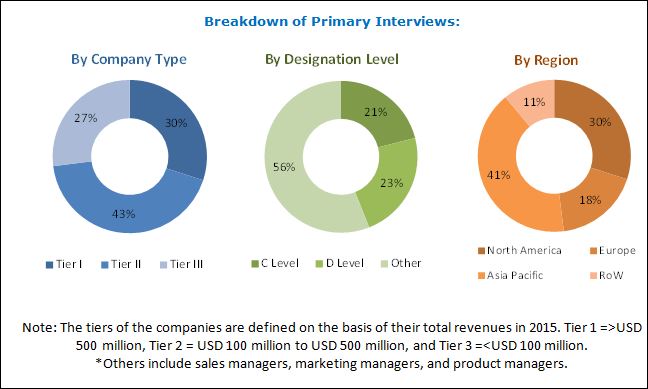

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in Spray Adhesives Market

4.2 APAC Market of Spray Adhesives, By Type and Country

4.3 Market of Spray Adhesives, By Region

4.4 Market of Spray Adhesives, By End-Use Industry and Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Penetration of Spray Adhesives in End-Use Industries

5.2.1.2 Rapid Growth of Key End-Use Industries in APAC

5.2.2 Restraints

5.2.2.1 Volatility of Raw Material Prices

5.2.3 Opportunities

5.2.3.1 Growing Demand for Low-Voc and Eco-Friendly Adhesives

5.2.4 Challenges

5.2.4.1 Meeting Environment Standards While Maintaining Performance

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Growth Rate Forecast of Major Economies

5.4.2 Automotive Industry Trends

6 Spray Adhesives Market, By Chemistry (Page No. - 43)

6.1 Introduction

6.2 Epoxy

6.3 Polyurethane

6.4 Synthetic Rubber

6.5 Vinyl Acetate Ethylene

7 Spray Adhesives Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Solvent-Based

7.3 Water-Based

7.4 Hot Melt

8 Spray Adhesives Market, By End-Use Industry (Page No. - 58)

8.1 Introduction

8.2 Transportation

8.3 Construction

8.4 Furniture

8.5 Other

9 Spray Adhesives Market, By Region (Page No. - 68)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 APAC

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 South Korea

9.3.5 Rest of APAC

9.4 Europe

9.4.1 Germany

9.4.2 France

9.4.3 Italy

9.4.4 UK

9.4.5 Russia

9.4.6 Turkey

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 South Africa

9.5.3 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 125)

10.1 Overview

10.2 Market Ranking of Key Players

10.3 Competitive Scenario

10.3.1 Merger & Acquisitions

10.3.2 Expansions

10.3.3 New Product Development

11 Company Profiles (Page No. - 129)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Henkel

11.2 3M

11.3 H.B. Fuller

11.4 Avery Dennison Corporation

11.5 Bostik

11.6 ND Industries

11.7 Sika AG

11.8 Illinois Tool Works

11.9 Quin Global

11.10 Kissel+Wolf GmbH

11.11 Other Players

11.11.1 Gemini Adhesives

11.11.2 AFT Aerosols

11.11.3 Spray-Lock Inc.

11.11.4 Philips Manufacturing Co.

11.11.5 Westech Aerosol Corporation

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 149)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (160 Tables)

Table 1 Trends and Forecast of GDP Growth Rates Between 2016 and 2021

Table 2 Cars and Commercial Vehicle Production, By Country, 2015–2016

Table 3 Market Size, By Chemistry, 2015–2022 (Kiloton)

Table 4 Market Size, By Chemistry, 2015–2022 (USD Million)

Table 5 Epoxy Market Size, By Region, 2015–2022 (Kiloton)

Table 6 Epoxy Market Size, By Region 2015–2022 (USD Million)

Table 7 Polyurethane Market Size, By Region, 2015–2022 (Kiloton)

Table 8 Polyurethane Market Size, By Region 2015–2022 (USD Million)

Table 9 Synthetic Rubber Market Size, By Region, 2015–2022 (Kiloton)

Table 10 Synthetic Rubber Market Size, By Region 2015–2022 (USD Million)

Table 11 Vinyl Acetate Ethylene Market Size, By Region, 2015–2022 (Kiloton)

Table 12 Vinyl Acetate Ethylene Market Size, By Region 2015–2022 (USD Million)

Table 13 Market Size, By Type, 2015–2022 (Kiloton)

Table 14 Market Size, By Type, 2015–2022 (USD Million)

Table 15 Solvent-Based Spray Adhesives Market, By Region , 2015–2022 (Ton)

Table 16 Solvent-Based Spray Adhesives Market, By Region 2015–2022 (USD Million)

Table 17 Water-Based Spray Adhesives Market, By Region , 2015–2022 (Kiloton)

Table 18 Water-Based Spray Adhesives Market, By Region 2015–2022 (USD Million)

Table 19 Hot Melt Spray Adhesives Market, By Region, 2015–2022 (Kiloton)

Table 20 Hot Melt Spray Adhesives Market, By Region 2015–2022 (USD Million)

Table 21 Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 22 Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 23 Market Size in Transportation Industry, By Region, 2015–2022 (Kiloton)

Table 24 Market Size in Transportation Industry, By Region, 2015–2022 (USD Million)

Table 25 Market Size in Construction Industry, By Region, 2015–2022 (Kiloton)

Table 26 Market Size in Construction Industry, By Region, 2015–2022 (USD Million)

Table 27 Market Size in Furniture Industry, By Region, 2015–2022 (Kiloton)

Table 28 Market Size in Furniture Industry, By Region, 2015–2022 (USD Million)

Table 29 Market Size in Other Industries, By Region, 2015–2022 (Kiloton)

Table 30 Market Size in Other Industries, By Region, 2015–2022 (USD Million)

Table 31 Market Size, By Region, 2015–2022 (Kiloton)

Table 32 Market Size, By Region, 2015–2022 (USD Million)

Table 33 North America: Market Size, By Country, 2015–2022 (Kiloton)

Table 34 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 35 North America: Market Size, By Chemistry, 2015–2022 (Kiloton)

Table 36 North America: Market Size, By Chemistry, 2015–2022 (USD Million)

Table 37 North America: Market Size, By Type, 2015–2022 (Kiloton)

Table 38 North America: Market Size, By Type, 2015–2022 (USD Million)

Table 39 North America: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 40 North America: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 41 US: Market Size, By Type, 2015–2022 (Kiloton)

Table 42 US: Market Size, By Type, 2015–2022 (USD Million)

Table 43 US: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 44 US: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 45 Canada: Market Size, By Type, 2015–2022 (Kiloton)

Table 46 Canada: Market Size, By Type, 2015–2022 (USD Million)

Table 47 Canada: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 48 Canada: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 49 Mexico: Market Size, By Type, 2015–2022 (Kiloton)

Table 50 Mexico: Market Size, By Type, 2015–2022 (USD Million)

Table 51 Mexico: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 52 Mexico: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 53 APAC: Market Size, By Country, 2015–2022 (Kiloton)

Table 54 APAC: Market Size, By Country, 2015–2022 (USD Million)

Table 55 APAC: Market Size, By Chemistry, 2015–2022 (Kiloton)

Table 56 APAC: Market Size, By Chemistry, 2015–2022 (USD Million)

Table 57 APAC: Market Size, By Type, 2015–2022 (Kiloton)

Table 58 APAC: Market Size, By Type, 2015–2022 (USD Million)

Table 59 APAC: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 60 APAC: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 61 China: Market Size, By Type, 2015–2022 (Kiloton)

Table 62 China: Market Size, By Type, 2015–2022 (USD Million)

Table 63 China: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 64 China: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 65 Japan: Market Size, By Type, 2015–2022 (Kiloton)

Table 66 Japan: Market Size, By Type, 2015–2022 (USD Million)

Table 67 Japan: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 68 Japan: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 69 India: Market Size, By Type, 2015–2022 (Kiloton)

Table 70 India: Spray Adhesives Market Size, By Type, 2015–2022 (USD Million)

Table 71 India: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 72 India: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 73 South Korea: Market Size, By Type, 2015–2022 (Kiloton)

Table 74 South Korea: Market Size, By Type, 2015–2022 (USD Million)

Table 75 South Korea: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 76 South Korea: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 77 Rest of APAC: Market Size, By Type, 2015–2022 (Kiloton)

Table 78 Rest of APAC: Market Size, By Type, 2015–2022 (USD Million)

Table 79 Rest of APAC: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 80 Rest of APAC: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 81 Europe: Market Size, By Country, 2015–2022 (Kiloton)

Table 82 Europe: Market Size, By Country, 2015–2022 (USD Million)

Table 83 Europe: Market Size, By Chemistry, 2015–2022 (Kiloton)

Table 84 Europe: Market Size, By Chemistry, 2015–2022 (USD Million)

Table 85 Europe: Market Size, By Type, 2015–2022 (Kiloton)

Table 86 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 87 Europe: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 88 Europe: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 89 Germany: Market Size, By Type, 2015–2022 (Kiloton)

Table 90 Germany: Market Size, By Type, 2015–2022 (USD Million)

Table 91 Germany: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 92 Germany: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 93 France: Market Size, By Type, 2015–2022 (Kiloton)

Table 94 France: Market Size, By Type, 2015–2022 (USD Million)

Table 95 France: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 96 France: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 97 Italy: Market Size, By Type, 2015–2022 (Kiloton)

Table 98 Italy: Market Size, By Type, 2015–2022 (USD Million)

Table 99 Italy: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 100 Italy: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 101 UK: Market Size, By Type, 2015–2022 (Kiloton)

Table 102 UK: Market Size, By Type, 2015–2022 (USD Million)

Table 103 UK: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 104 UK: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 105 Russia: Market Size, By Type, 2015–2022 (Kiloton)

Table 106 Russia: Market Size, By Type, 2015–2022 (USD Million)

Table 107 Russia: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 108 Russia: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 109 Turkey: Market Size, By Type, 2015–2022 (Kiloton)

Table 110 Turkey: Market Size, By Type, 2015–2022 (USD Million)

Table 111 Turkey: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 112 Turkey: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 113 Rest of Europe: Market Size, By Type, 2015–2022 (Kiloton)

Table 114 Rest of Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 115 Rest of Europe: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 116 Rest of Europe: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 117 Middle East & Africa: Market Size, By Country, 2015–2022 (Kiloton)

Table 118 Middle East & Africa: Market Size, By Country, 2015–2022 (USD Million)

Table 119 Middle East & Africa: Market Size, By Chemistry, 2015–2022 (USD Million)

Table 120 Middle East & Africa: Market Size, By Chemistry, 2015–2022 (Kiloton)

Table 121 Middle East & Africa: Market Size, By Type, 2015–2022 (Kiloton)

Table 122 Middle East & Africa: Market Size, By Type, 2015–2022 (USD Million)

Table 123 Middle East & Africa: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 124 Middle East & Africa: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 125 Saudi Arabia: Market Size, By Type, 2015–2022 (Kiloton)

Table 126 Saudi Arabia: Market Size, By Type, 2015–2022 (USD Million)

Table 127 Saudi Arabia: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 128 Saudi Arabia: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 129 South Africa: Market Size, By Type, 2015–2022 (Kiloton)

Table 130 South Africa: Market Size, By Type, 2015–2022 (USD Million)

Table 131 South Africa: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 132 South Africa: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 133 South America: Market Size, By Type, 2015–2022 (Kiloton)

Table 134 Rest of Middle East & Africa: Market Size, By Type, 2015–2022 (USD Million)

Table 135 Rest of Middle East & Africa: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 136 Rest of Middle East & Africa: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 137 South America: Market Size, By Country, 2015–2022 (Kiloton)

Table 138 South America: Market Size, By Country, 2015–2022 (USD Million)

Table 139 South America: Market Size, By Type, 2015–2022 (Kiloton)

Table 140 South America: Market Size, By Type, 2015–2022 (USD Million)

Table 141 South America: Market Size, By Type, 2015–2022 (Kiloton)

Table 142 South America: Market Size, By Type, 2015–2022 (USD Million)

Table 143 South America: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 144 South America: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 145 Brazil: Market Size, By Type, 2015–2022 (Kiloton)

Table 146 Brazil: Market Size, By Type, 2015–2022 (USD Million)

Table 147 Brazil: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 148 Brazil: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 149 Argentina: Market Size, By Type, 2015–2022 (Kiloton)

Table 150 Argentina: Market Size, By Type, 2015–2022 (USD Million)

Table 151 Argentina: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 152 Argentina: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 153 Rest of South America: Market Size, By Type, 2015–2022 (Kiloton)

Table 154 Rest of South America: Market Size, By Type, 2015–2022 (USD Million)

Table 155 Rest of South America: Market Size, By End-Use Industry, 2015–2022 (Kiloton)

Table 156 Rest of South America: Market Size, By End-Use Industry, 2015–2022 (USD Million)

Table 157 Spray Adhesives Market Players Ranking, 2016

Table 158 Merger & Acquisitions

Table 159 Expansions

Table 160 New Product Developments

List of Figures (37 Figures)

Figure 1 Market of Spray Adhesives: Research Design

Figure 2 Data Triangulation: Spray Adhesives Market

Figure 3 Synthetic Rubber Spray Adhesives to Lead Market Between 2017 and 2022

Figure 4 Hot Melt Spray Adhesives to Witness Fastest-Growth Between 2017 and 2022

Figure 5 Transportation End-Use Industry to Lead Market of Spray Adhesives Between 2017 and 2022

Figure 6 APAC Market to Witness Highest Growth During Forecast Period

Figure 7 Increasing Demand From Transportation and Furnitrue Industries to Drive the Market of Spray Adhesives

Figure 8 China Dominated Market of Spray Adhesives in APAC in 2016

Figure 9 APAC to Be the Largest and Fastest Growing Market for Spray Adhesives During Forecast Period

Figure 10 APAC Accounted for Major Market Share Across All End User Industries in 2016

Figure 11 Spray Adhesives: Market Dynamics

Figure 12 Market: Porter’s Five Forces Analysis

Figure 13 APAC to Be the Fastest-Growing Market for Epoxy Spray Adhesives

Figure 14 APAC to Dominate the market of Polyurethane Spray Adhesives During the Forecast Period

Figure 15 Europe to Be the Second-Largest Market for Synthetic Rubber Spray Adhesives

Figure 16 North America is Largest Market for Vinyl Acetate Ethylene Spray Adhesives

Figure 17 Asia-Pacific to Be the Fastest-Growing Market for Solvent-Based Spray Adhesives

Figure 18 North America to Be the Largest Market of Water-Based Spray Adhesives

Figure 19 Europe is the Second Largest Market of Hot Melt Spray Adhesives in 2017

Figure 20 Transportation Accounted for Largest Share Market of Spray Adhesives in 2016

Figure 21 APAC to Lead Market of Spray Adhesives in Transportation Industry During Forecast Period

Figure 22 North America to Be Fastest-Growing Market of Spray Adhesives in Construction Industry

Figure 23 Europe to Be Second-Largest Market of Spray Adhesives in Furniture Industry

Figure 24 APAC to Be Largest Market of Spray Adhesives in Other Industries

Figure 25 Regional Snapshot: India to Lead Global Market Growth, 2017–2022

Figure 26 North American Market Snapshot: Mexico Projected to Be Fastest-Growing Market

Figure 27 APAC Market Snapshot: China Largest Market, 2017–2022

Figure 28 Transportation Industry Led Market of Spray Adhesives in Europe in 2016

Figure 29 Transportation Was Largest End User of Spray Adhesives in 2016

Figure 30 Companies Adopted Acquisition as the Key Growth Strategy in the Last Three Years

Figure 31 Henkel: Company Snapshot

Figure 32 3M Company: Company Snapshot

Figure 33 H.B. Fuller: Company Snapshot

Figure 34 Avery Dennison Corp.: Company Snapshot

Figure 35 Bostik: Company Snapshot

Figure 36 Sika AG: Company Snapshot

Figure 37 ITW : Company Snapshot

Growth opportunities and latent adjacency in Spray Adhesives Market