Structured Cabling Market Size, Share & Industry Growth Analysis Report by Solution Type, Cable Type (Category 5E, Category 6, Category 6A), Offering (Hardware, Services, and Software), Industry Vertical (IT & Telecommunications, Residential & Commercial, Government & Education), and Geography - Global Forecast to 2027

Updated on : November 08, 2024

The Structured Cabling Market size is witnessing significant growth, fueled by the increasing demand for high-speed data transmission and reliable network infrastructure across various industries. As businesses embrace digital transformation, the need for robust cabling solutions that support advanced communication technologies—such as 5G, IoT, and cloud computing—has become paramount. Key trends in the market include the adoption of standardized cabling systems that enhance scalability and flexibility, allowing organizations to easily adapt to changing technology requirements. Additionally, the rise in smart buildings and the integration of automation systems are driving further demand for structured cabling solutions. Looking to the future, the market is expected to expand as innovations in materials and installation techniques emerge, promoting greater efficiency and performance in network systems.This ongoing evolution positions structured cabling as a critical component in the foundation of modern communication networks.

Structured Cabling Market Size & Growth

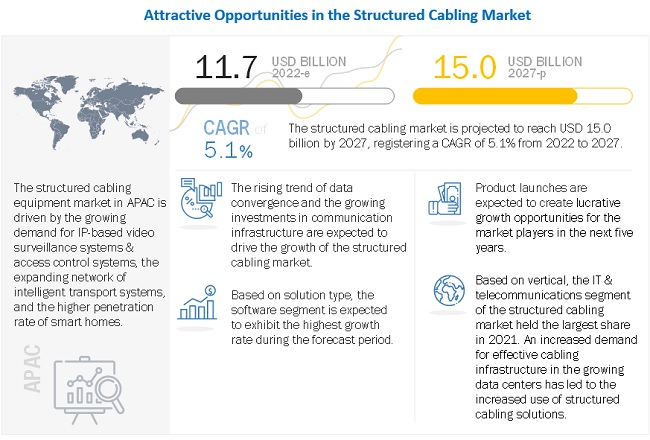

The global Structured Cabling Market size is estimated to be USD 11.7 billion in 2022 and is projected to reach USD 15.0 billion by 2027, Growing at a CAGR of 5.1% during the forecast period from 2022 to 2027

The surging adoption of IoT, and spurring communication infrastructure are the key factors driving structured cabling industry growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Structured Cabling Market Trends and Segment Overview:

The software segment is projected to grow at the highest CAGR during the forecast period

The software segment is projected to grow at the highest CAGR during the forecast period due to advancements in technologies. Additionally, the growth is due to the increasing complexity of the network infrastructures.

Thus, companies prefer software solutions to design a virtual network infrastructure and check for proper voice and data flow in that network connection.

In 2023, the Category 6 cable type is expected to hold the largest share

In 2021, the Category 6 cable type dominated the structured cabling market. Category 6 is priced moderately compared to its upgraded module i.e., Category 6A. Further, category 6 cabling is backward compatible with the Category 5/5e standard.

The efficient functionalities and cost-effective nature of the cable are responsible for its maximum share.

The residential and commercial segment is anticipated to hold the second largest share of market in 2027

The residential and commercial segment is anticipated to hold the second largest share of the structured cabling market in 2027. The residential & commercial vertical is also creating a major demand for communication services for personal as well as business purposes.

The continuous need for a convenient and comfortable lifestyle among homeowners has led to the rapid development of connected solutions in smart homes. Further, commercial enterprises rely on internal and external communication and connectivity networks. Structured cabling in commercial enterprises is a cost-effective solution.

Structured Cabling Market Regional Analysis

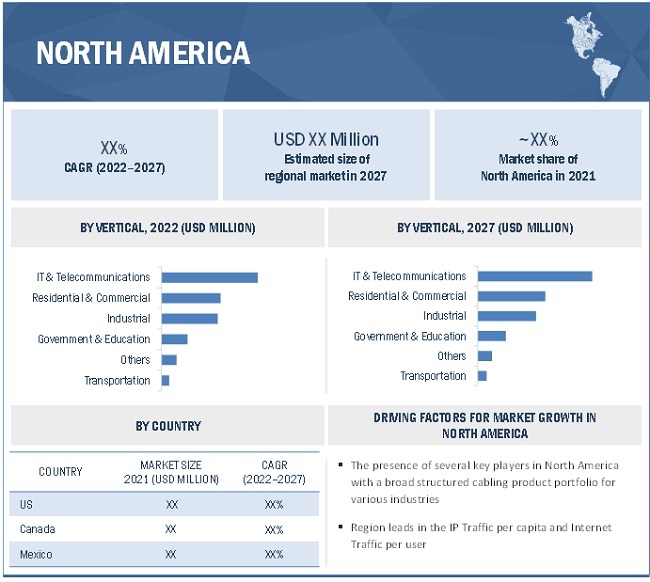

In 2027, the North America is projected to hold the largest share of the overall structured cabling market

North America held the largest share of the structured cabling market in 2021 and is expected to dominate the market during the forecast period.

The key driving factors for the growth of the North American structured cabling companies include the presence of several key players in North America with a broad structured cabling product portfolio for various industries. Some of them are Belden, Inc., Corning Incorporated., Panduit Corp., CommScope Holding Company, Inc., and The Siemon Company. Further, the region leads inleads in the IP Traffic per capita and Internet Traffic per user.

To know about the assumptions considered for the study, download the pdf brochure

Structured Cabling Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size in 2022 |

USD 11.7 Billion |

|

Market size value in 2027 |

USD 15.0 Billion |

|

Growth rate |

CAGR of 5.1% |

|

Market Size Availability for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

|

| Key Market Driver | Spurring Communication Infrastructure |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Category 6 Cable Type |

| Highest CAGR Segment | Software Segment |

Structured Cabling Market Dynamics:

Driver: Spurring communication infrastructure

The global information & communication technology sector has been growing at a moderate rate and is witnessing consistent investments in communication infrastructure.

Structured cabling is an integral part of the communication infrastructure. The installation and maintenance of structured cabling are the basic requirements of commercial, residential, and industrial markets to form a foundation for communication systems. Various services related to information transport systems, communication cabling, and wireless infrastructure are being provided by vendors and the focus is on providing cost-effective and innovative data communication network solutions with the help of copper and fiber structured cabling technologies. The rising need for an integrated cabling system for voice & data transmission is driving the global market for structured cabling.

The telecommunications sector, which is a major application vertical for structured cabling, has seen tremendous technological advances over the past few decades, with mobility, broadband, and internet services growing in terms of capability and coverage across the world. In addition, more than half of the world’s population is now online and almost the entire world population lives in an area covered by a mobile network. In 2019, 96.5% of the global population was covered by at least a 2G network.

Restraint: Higher cost and susceptibility of transmission losses of fiber optic components

Fiber optic components are expensive when compared to electrical interfaces. These include fiber optic transmitters, receivers, connectors, and panels, which are relatively costlier due to various factors such as the lack of standardization, a smaller number of equipment suppliers, and a high production cost.

Fiber optic network interface cards (NICs) are also more expensive when compared to copper NICs.

Fiber optic components are fragile and prone to transmission losses. Fiber optic networks are also susceptible to fiber fuse as too much light would damage the fiber cable within a short period. The transmission on the optical fiber requires repeating at distance intervals. The fibers can be broken or have transmission losses when wrapped around curves of only a few centimeters radius. In addition, fiber optic cables are delicate, they need to have strong, protective sheathing to suit the environment where they are to be installed. Hence, the high cost of fiber components and huge data transmission losses in fiber optic networks poses a key hurdle for the growth of structured cabling market players.

Opportunity: Transition from analog to IP-based video surveillance systems

The rapid transition from analog surveillance devices to IP video surveillance systems, which can also be integrated with IP telephones, access control systems, and intelligent management systems, has created various opportunities for the structured cabling market.

The need for faster data transmission and uninterrupted performance by cabling systems across a wider frequency range have been reflected in the high acceptance level of category 6, category 7, and fiber optic cabling products for surveillance systems.

An IP surveillance system with a dedicated network video recorder (NVR) has several advantages over an analog camera and a digital video recorder (DVR) system. The IP-based systems are easy to install, more cost-effective in the long run, faster than analog cameras, and enable access to video files from any location in the world through the internet. The IP video surveillance market has been growing at a rapid pace. This trend is likely to have a positive impact on the structured cabling market since the benefits of using structured cabling infrastructure to support surveillance devices and systems are huge. Structured cabling systems provide the ability to support high-definition applications, compact storage, the convergence of voice, video, and data applications, and efficient infrastructure management.

Challenge: Challenges such as increased call drops, less data quality, and huge network traffic for service providers due to bolstering telecommunications sector

The telecommunications sector consists of digital infrastructures that include telecommunication towers, active networks, cloud services, broadband connections, and data centers. Several telecom players—from broadband to mobile to data center operators—have profited from a surge in the traffic of data and voice.

However, the increased dependency on telecom networks and other restrictions on account of COVID-19 have raised a different set of challenges, such as increased call drops, less data quality, and huge network traffic for telecom service providers. Additionally, the attractive prices and the discounts offered by the telecom providers and the streaming service providers have also added to the use of telecommunication services, which has led to an increase in internet traffic. According to the Indian Department of Telecommunications, mobile and broadband download speeds in India had fallen in March due to the strain on the networks. Hence, the Cellular Operators Association of India (COAI) had requested the government to ask streaming service providers such as Netflix, Amazon Prime Video, and Zee5 to switch to lower-definition streaming and reduce advertisements and pop-ups to ease the strain on existing networks. Hence, the rise in the number of internet users, heavy network congestion, and increasing number of call drops poses a key challenge for the structured cabling market

Structured Cabling Market Categorization:

This research report categorizes the market based on solution type, cable type, vertical, and region

Based on Solution type:

-

Products

- Cables

- Communication Outlets

- Patch Panels & Cross Connects

- Patch Cords & Cable Assemblies

- Racks & Cabinets

-

Services

- Installation & Consultation

- Managed Services

- Maintenance & Support

- Software

Based on Cable Type:

- Category 5E

- Category 6

- Category 6A

- Others (Category 7, Category 7A, and Category 8)

Based on Vertical:

- IT & Telecommunications

- Residential & Commercial

- Government & Education

- Transportation

- Industrial

- Others (Banking, Financial Services, and Insurance (BFSI), Healthcare, and Hospitality)

Based on Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- UK

- France

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

Rest of the world

- South America

- Middle East

- Africa

Recent Developments in Structured Cabling Industry

- In January 2022, Panduit Corp. launched RapidID Network Mapping System, an offering designed to reduce the time and cost of patch cord documentation by up to 50%. It is a software-enabled network mapping system for smart, scalable, and efficient connectivity solutions.

- In November 2021, Nexans unveiled its Mobiway Un’Reel solution, which makes cable installation simpler, smarter, more cost-effective, and secure across a range of different low and medium-voltage cables.

- In November 2021, R&M aimed to expand its production capacities at the cable plant in Dìèín, Czech Republic. R&M will invest several million Swiss francs in new fiber optic cable production facilities by the end of 2022.

Frequently Asked Questions (FAQ):

Which are the major companies in the structured cabling market? What are their major strategies to strengthen their market presence?

The major companies in the structured cabling market are – CommScope Holding Company, Inc. (US), Corning Incorporated (US), Legrand (France), Nexans (France), Panduit Corp. (US), Belden Inc. (US), R&M (Switzerland), Furukawa Electric Co., Ltd. (Japan), Schneider Electric (France), The Siemon Company (US). The major strategies adopted by these players are product launches, expansions, partnerships, collaborations, contracts, and mergers and acquisitions.

Which is the potential market for structured cabling in terms of the region?

The North America region is expected to dominate the structured cabling market due to the presence of numerous provider companies and end users.

Who are the winners in the global structured cabling market?

Companies such as CommScope Holding Company, Inc. (US), Corning Incorporated (US), Legrand (France), Nexans (France), and Panduit Corp. (US) fall under the winners category. These companies cater to the requirements of their customers by providing technological advanced structured cabling solutions. Moreover, these companies have multiple supply contracts with global OEMs and have effective supply chain strategies. Such advantages give these companies an edge over other structured cabling ecosystem players.

What are the drivers and opportunities for the structured cabling market?

Factors such as growing trend of data center convergence penetrating IT infrastructure market and spurring communication infrastructure are among the major drivers of the structured cabling market Moreover, the extensive growth of LED lighting systems and transition from analog to IP-based video surveillance systems are among the significant opportunities in the structured cabling market for start-up companies.

Who are the major verticals of structured cabling that are expected to drive the growth of the market in the next 5 years?

The major verticals for structured cabling are IT & telecommunications, residential & commercial, government & education, transportation, and industrial are expected to have a significant share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 STRUCTURED CABLING MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 FACTOR ANALYSIS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (TOP-DOWN, SUPPLY-SIDE) – REVENUES GENERATED BY COMPANIES FROM SALE OF STRUCTURED CABLING SOLUTION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (TOP-DOWN, SUPPLY-SIDE) – ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (BOTTOM UP, DEMAND-SIDE) – DEMAND FOR STRUCTURED CABLING BY DIFFERENT VERTICALS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for obtaining market size/share using bottom-up analysis (demand side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for obtaining market share/size using top-down analysis (supply side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 49)

3.1 IMPACT OF COVID-19 ON MARKET

FIGURE 9 GLOBAL PROPAGATION OF COVID-19

FIGURE 10 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.2 REALISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

3.4 PESSIMISTIC SCENARIO

FIGURE 11 GROWTH PROJECTION OF MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 12 PRE- AND POST-COVID-19 SCENARIOS OF MARKET

FIGURE 13 SOFTWARE SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

FIGURE 14 CATEGORY 6 SEGMENT TO DOMINATE MARKET IN 2022

FIGURE 15 IT & TELECOMMUNICATIONS SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2022 TO 2027

FIGURE 16 APAC TO BE FASTEST-GROWING REGIONAL MARKET FOR STRUCTURED CABLING DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 17 RISING TREND OF DATA CONVERGENCE TO FUEL MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET, BY CABLE TYPE AND VERTICAL

FIGURE 18 CATEGORY 6A AND IT & TELECOMMUNICATIONS SEGMENTS TO HOLD LARGEST SHARES OF MARKET BY 2027

4.3 MARKET, BY SOLUTION TYPE

FIGURE 19 PRODUCTS TO CAPTURE LARGEST SHARE OF MARKET IN 2027

4.4 MARKET, BY COUNTRY

FIGURE 20 SOUTH KOREA TO RECORD HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.5 MARKET, BY REGION

FIGURE 21 NORTH AMERICA TO HOLD LARGEST SHARE OF STRUCTURED CABLING MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing trend of data center convergence penetrating IT infrastructure market

5.2.1.2 Spurring communication infrastructure

5.2.1.3 Rising emergence of smart cities

TABLE 1 SMART CITY INITIATIVES AND INVESTMENTS

5.2.1.4 Surging adoption of IoT

FIGURE 23 DRIVERS AND THEIR IMPACT ON MARKET

5.2.2 RESTRAINTS

5.2.2.1 Poor EMC impedance tolerance of UTP cabling

5.2.2.2 Higher cost and susceptibility of transmission losses of fiber optic components

FIGURE 24 RESTRAINTS AND THEIR IMPACT ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Extensive growth of LED lighting systems

5.2.3.2 Transition from analog to IP-based video surveillance systems

FIGURE 25 OPPORTUNITIES AND THEIR IMPACT ON MARKET

5.2.4 CHALLENGES

5.2.4.1 Need for modification and retrofitting of older infrastructures

5.2.4.2 Challenges such as increased call drops, less data quality, and huge network traffic for service providers due to bolstering telecommunications sector

FIGURE 26 CHALLENGES AND THEIR IMPACT ON MARKET

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 27 STRUCTURED CABLING MARKET: SUPPLY CHAIN

TABLE 2 MARKET: ECOSYSTEM

5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

FIGURE 28 REVENUE SHIFT IN MARKET

5.5 MARKET ECOSYSTEM

FIGURE 29 ECOSYSTEM OF STRUCTURED CABLING

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 KEY STAKEHOLDERS & BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS

TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

5.7.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

TABLE 5 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

5.8 CASE STUDIES

5.8.1 PANDUIT’S ENTERPRISE SOLUTION PROVIDED WIRELESS INFRASTRUCTURE TO SUPPORT PURDUE UNIVERSITY’S MISSION

5.8.2 BELDEN’S HIGH-DENSITY FIBER SOLUTIONS STRENGTHENED ESTRUXTURE DATA CENTER

5.8.3 TELMEX USED SIEMON COMPANY’S CATEGORY 7A TERATM SOLUTION IN ITS TIER-4 DATA CENTER

5.8.4 VECTORUSA HELPED TO ACCOMPLISH NAVY’S MISSION THROUGH ITS LSZH FIBER-OPTIC CABLE INFRASTRUCTURE

5.9 TECHNOLOGY ANALYSIS

5.9.1 5G AND FTTX

5.9.2 POWER OVER ETHERNET

5.10 AVERAGE SELLING PRICE ANALYSIS

TABLE 6 AVERAGE SELLING PRICES OF LITHOGRAPHY STRUCTURED CABLING

FIGURE 33 STRUCTURED CABLING MARKET: AVERAGE PRICE OF CABLES

5.11 TRADE ANALYSIS

5.11.1 IMPORTS SCENARIO

TABLE 7 IMPORTS DATA, BY COUNTRY, 2016–2020 (USD BILLION)

5.11.2 EXPORTS SCENARIO

TABLE 8 EXPORTS DATA, BY COUNTRY, 2016–2020 (USD BILLION)

5.12 PATENTS ANALYSIS, 2018–2021

FIGURE 34 NUMBER OF PATENTS GRANTED WORLDWIDE FROM 2011 TO 2021

TABLE 9 TOP 20 PATENT OWNERS IN US FROM 2011 TO 2021

FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2011 TO 2021

5.13 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 10 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 APAC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 TARIFFS AND REGULATIONS

5.14.2.1 Tariffs

5.14.2.2 Regulations

5.14.2.3 Standards

6 MARKET, BY SOLUTION TYPE (Page No. - 95)

6.1 INTRODUCTION

FIGURE 36 MARKET, BY SOLUTION TYPE

FIGURE 37 PRODUCT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF STRUCTURED CABLING MARKET IN 2027

TABLE 15 MARKET, BY SOLUTION TYPE, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

6.2 PRODUCTS

FIGURE 38 MARKET, BY PRODUCT TYPE

TABLE 17 MARKET, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 19 MARKET FOR PRODUCTS, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 20 MARKET FOR PRODUCTS, BY VERTICAL, 2022–2027 (USD MILLION)

6.2.1 CABLES

6.2.1.1 Copper cables

6.2.1.1.1 Copper cables are currently dominating market

6.2.1.2 Fiber optic cables

6.2.1.2.1 Market for fiber optic cables is growing at faster rate

TABLE 21 COMPARISON AMONG COPPER CABLES AND FIBER OPTIC CABLES

TABLE 22 MARKET FOR CABLES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 MARKET FOR CABLES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 24 MARKET FOR CABLES, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 25 MARKET FOR CABLES, BY VERTICAL, 2022–2027 (USD MILLION)

6.2.2 COMMUNICATION OUTLETS

6.2.2.1 Communication outlets include modular connectors, configurable or integrated faceplates, jacks, mounting boxes, multimedia outlets, and adapters & switches

TABLE 26 MARKET FOR COMMUNICATION OUTLETS, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR COMMUNICATION OUTLETS, BY VERTICAL, 2022–2027 (USD MILLION)

6.2.3 PATCH PANELS & CROSS CONNECTS

6.2.3.1 Patch panels can provide interconnect or cross-connect patching methods to splice and terminate cables

TABLE 28 MARKET FOR PATCH PANELS & CROSS CONNECTS, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 29 MARKET FOR PATCH PANELS & CROSS CONNECTS, BY VERTICAL, 2022–2027 (USD MILLION)

6.2.4 PATCH CORDS & CABLE ASSEMBLIES

6.2.4.1 Patch cords may be used to connect switch ports or servers to structured cabling systems

TABLE 30 STRUCTURED CABLING MARKET FOR PATCH CORDS & CABLE ASSEMBLIES, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR PATCH CORDS & CABLE ASSEMBLIES, BY VERTICAL, 2022–2027 (USD MILLION)

6.2.5 RACKS & CABINETS

6.2.5.1 Racks and cabinets are used for housing servers and other electrical/electronic equipment

TABLE 32 MARKET FOR RACKS & CABINETS, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR RACKS & CABINETS, BY VERTICAL, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 39 MARKET, BY SERVICE TYPE

TABLE 34 MARKET FOR SERVICES, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR SERVICES, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 36 MARKET FOR SERVICES, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR SERVICES, BY VERTICAL, 2022–2027 (USD MILLION)

6.3.1 INSTALLATION & CONSULTATION

6.3.1.1 Market for installation & consultation services holds largest share in service market

TABLE 38 MARKET FOR INSTALLATION & CONSULTATION, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR INSTALLATION & CONSULTATION, BY VERTICAL, 2022–2027 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Managed services are key contributors to service market of structured cabling systems

TABLE 40 MARKET FOR MANAGED SERVICES, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR MANAGED SERVICES, BY VERTICAL, 2022–2027 (USD MILLION)

6.3.3 MAINTENANCE & SUPPORT

6.3.3.1 Maintenance & support deals with routine maintenance activities and troubleshooting problems

TABLE 42 MARKET FOR MAINTENANCE & SUPPORT, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR MAINTENANCE & SUPPORT, BY VERTICAL, 2022–2027 (USD MILLION)

6.4 SOFTWARE

6.4.1 SOFTWARE SOLUTIONS PLAY VITAL ROLE IN SECURING NETWORK INFRASTRUCTURE FROM HACKERS TO AVOID ILLEGAL DATA TRANSFER

TABLE 44 MARKET FOR SOFTWARE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR SOFTWARE, BY VERTICAL, 2022–2027 (USD MILLION)

7 TYPES OF NETWORKS IN MARKET (Page No. - 115)

7.1 INTRODUCTION

FIGURE 40 MARKET, TYPES OF NETWORKS

7.2 LOCAL AREA NETWORK

7.2.1 STRUCTURED CABLING-INFUSED LAN NETWORK OFFERS STANDARDIZATION, RELIABILITY, AND DEPENDABILITY

7.3 WIDE AREA NETWORK

7.3.1 STRUCTURED CABLING SYSTEMS ARE EFFECTIVE FOR COMPANIES AND OFFICES CONNECTED THROUGH WAN

8 STRUCTURED CABLING MARKET, BY CABLE TYPE (Page No. - 117)

8.1 INTRODUCTION

FIGURE 41 MARKET, BY CABLE TYPE

FIGURE 42 CATEGORY 6 CABLE TYPE IS EXPECTED TO HOLD LARGEST SHARE IN MARKET IN 2022

TABLE 46 MARKET, BY CABLE TYPE, 2018–2021 (USD MILLION)

TABLE 47 MARKET, BY CABLE TYPE, 2022–2027 (USD MILLION)

TABLE 48 MARKET, BY CABLE TYPE, 2018–2021 (MILLION FEET)

TABLE 49 MARKET, BY CABLE TYPE, 2022–2027 (MILLION FEET)

8.2 CATEGORY 5E

8.2.1 CATEGORY 5E IS ENHANCED VERSION OF CATEGORY 5 CABLES

8.3 CATEGORY 6

8.3.1 CATEGORY 6 HOLDS LARGEST SHARE OF MARKET

8.4 CATEGORY 6A

8.4.1 CATEGORY 6A SUPPORTS TWICE MAXIMUM BANDWIDTH THAN CATEGORY 6

8.5 OTHERS

TABLE 50 COMPARISON AMONG DIFFERENT CABLE TYPES

9 MARKET, BY VERTICAL (Page No. - 123)

9.1 INTRODUCTION

FIGURE 43 MARKET, BY VERTICAL

FIGURE 44 IT & TELECOMMUNICATIONS VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 51 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 52 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 IT & TELECOMMUNICATIONS

FIGURE 45 MARKET FOR IT & TELECOMMUNICATIONS, BY VERTICAL

TABLE 53 MARKET FOR IT & TELECOMMUNICATIONS, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 MARKET FOR IT & TELECOMMUNICATIONS, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 55 MARKET FOR IT & TELECOMMUNICATIONS, BY SOLUTION TYPE, 2018–2021 (USD MILLION)

TABLE 56 MARKET FOR IT & TELECOMMUNICATIONS, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 57 MARKET FOR PRODUCTS IN IT & TELECOMMUNICATIONS, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 58 MARKET FOR PRODUCTS IN IT & TELECOMMUNICATIONS, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 59 MARKET FOR SERVICES IN IT & TELECOMMUNICATIONS, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 60 MARKET FOR SERVICES IN IT & TELECOMMUNICATIONS, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 61 MARKET FOR IT & TELECOMMUNICATIONS, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MARKET FOR IT & TELECOMMUNICATIONS, BY REGION, 2022–2027 (USD MILLION)

9.2.1 DATA CENTERS

9.2.1.1 Rapidly increasing number of data centers is expected to foster growth of market in coming years

9.2.2 TELECOM OPERATORS

9.2.2.1 Upgrade of network infrastructure for next-generation technologies boosts market

9.2.3 OTHERS

9.3 RESIDENTIAL & COMMERCIAL

FIGURE 46 MARKET FOR RESIDENTIAL & COMMERCIAL VERTICAL, BY VERTICAL

TABLE 63 MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR RESIDENTIAL & COMMERCIAL, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 65 STRUCTURED CABLING MARKET FOR RESIDENTIAL & COMMERCIAL, BY SOLUTION TYPE, 2018–2021 (USD MILLION)

TABLE 66 MARKET FOR RESIDENTIAL & COMMERCIAL, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 67 MARKET FOR PRODUCTS IN RESIDENTIAL & COMMERCIAL, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR PRODUCTS IN RESIDENTIAL & COMMERCIAL, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR SERVICES IN RESIDENTIAL & COMMERCIAL, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR SERVICES IN RESIDENTIAL & COMMERCIAL, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 71 MARKET FOR RESIDENTIAL & COMMERCIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR RESIDENTIAL & COMMERCIAL, BY REGION, 2022–2027 (USD MILLION)

9.3.1 RESIDENTIAL

9.3.1.1 Home automation/smart homes are driving market for structured cabling for residential applications

9.3.2 COMMERCIAL ENTERPRISES

9.3.2.1 Need for video surveillance, web security, and remote network monitoring are driving market for structured cabling for commercial applications

9.4 GOVERNMENT & EDUCATION

FIGURE 47 MARKET FOR GOVERNMENT & EDUCATION, BY VERTICAL

TABLE 73 MARKET FOR GOVERNMENT & EDUCATION, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR GOVERNMENT & EDUCATION, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 75 MARKET FOR GOVERNMENT & EDUCATION, BY SOLUTION TYPE, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR GOVERNMENT & EDUCATION, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 77 MARKET FOR PRODUCTS IN GOVERNMENT & EDUCATION, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 78 MARKET FOR PRODUCTS IN GOVERNMENT & EDUCATION, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 79 MARKET FOR SERVICES IN GOVERNMENT & EDUCATION, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR SERVICES IN GOVERNMENT & EDUCATION, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 81 MARKET FOR GOVERNMENT & EDUCATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 MARKET FOR GOVERNMENT & EDUCATION, BY REGION, 2022–2027 (USD MILLION)

9.4.1 MILITARY & DEFENSE

9.4.1.1 Structured cabling is used for secured and encrypted communication in military & defense applications

9.4.2 GOVERNMENT ENTERPRISES

9.4.2.1 Digitalization process in government institutes may create opportunities for market

9.4.3 EDUCATIONAL INSTITUTIONS

9.4.3.1 Online class forums, e-books, and video lectures are driving market for structured cabling for educational applications

9.5 TRANSPORTATION

9.5.1 TECHNOLOGICAL ADVANCEMENTS IN INTELLIGENT TRANSPORT SYSTEMS MAY DRIVE MARKET FOR STRUCTURED CABLING

TABLE 83 MARKET FOR TRANSPORTATION, BY SOLUTION TYPE, 2018–2021 (USD MILLION)

TABLE 84 MARKET FOR TRANSPORTATION, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 85 MARKET FOR PRODUCTS IN TRANSPORTATION, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 86 MARKET FOR PRODUCTS IN TRANSPORTATION, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 87 MARKET FOR SERVICES IN TRANSPORTATION, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 88 STRUCTURED CABLING MARKET FOR SERVICES IN TRANSPORTATION, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 89 MARKET FOR TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 90 MARKET FOR TRANSPORTATION, BY REGION, 2022–2027 (USD MILLION)

9.6 INDUSTRIAL

FIGURE 48 MARKET FOR INDUSTRIAL, BY APPLICATION

TABLE 91 MARKET FOR INDUSTRIAL, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 MARKET FOR INDUSTRIAL, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 93 MARKET FOR INDUSTRIAL, BY SOLUTION TYPE, 2018–2021 (USD MILLION)

TABLE 94 MARKET FOR INDUSTRIAL, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 95 MARKET FOR PRODUCTS IN INDUSTRIAL, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 96 MARKET FOR PRODUCTS IN INDUSTRIAL, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 97 MARKET FOR SERVICES IN INDUSTRIAL, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 98 MARKET FOR SERVICES IN INDUSTRIAL, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 99 MARKET FOR INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 MARKET FOR INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

9.6.1 ENERGY & POWER

9.6.1.1 Structured cabling systems are used to establish network connections for information sharing and communication between any two substations

9.6.2 OIL & GAS

9.6.2.1 Oil & gas sector requires communication channels to connect remote sites and to control and monitor all kinds of environments with different temperature conditions

9.6.3 FOOD & BEVERAGES

9.6.3.1 Waterproof structured cabling products are used in F&B sector

9.6.4 METALS & MINING

9.6.4.1 Structured cabling systems enable use of new sensing technologies and IP–based surveillance systems in metals & mining sector to establish real-time communication

9.6.5 OTHERS

9.7 OTHERS

TABLE 101 MARKET FOR OTHER VERTICALS, BY SOLUTION TYPE, 2018–2021 (USD MILLION)

TABLE 102 MARKET FOR OTHER VERTICALS, BY SOLUTION TYPE, 2022–2027 (USD MILLION)

TABLE 103 MARKET FOR PRODUCTS IN OTHER VERTICALS, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

TABLE 104 MARKET FOR PRODUCTS IN OTHER VERTICALS, BY PRODUCT TYPE, 2022–2027 (USD MILLION)

TABLE 105 MARKET FOR SERVICES IN OTHER VERTICALS, BY SERVICE TYPE, 2018–2021 (USD MILLION)

TABLE 106 MARKET FOR SERVICES IN OTHER VERTICALS, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 107 STRUCTURED CABLING MARKET FOR OTHER VERTICALS, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 MARKET FOR OTHER VERTICALS, BY REGION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 154)

10.1 INTRODUCTION

FIGURE 49 MARKET, BY REGION

FIGURE 50 NORTH AMERICA ACCOUNTS FOR LARGEST SHARE OF MARKET IN 2022

TABLE 109 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 110 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 51 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 111 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 112 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 114 MARKET IN NORTH AMERICA, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Presence of large number of data centers propels market growth in US

10.2.2 CANADA

10.2.2.1 High growth of telecommunications sector to drive Canadian market growth

10.2.3 MEXICO

10.2.3.1 Increased demand for structured cabling in IT & telecommunications sector in Mexico

10.3 EUROPE

FIGURE 52 SNAPSHOT OF MARKET IN EUROPE

TABLE 115 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 MARKET IN EUROPE, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 118 MARKET IN EUROPE, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Market growth in UK is attributed to increasing demand for fiber optic cabling systems

10.3.2 GERMANY

10.3.2.1 Germany ranks first in European structured cabling market

10.3.3 FRANCE

10.3.3.1 Expanding IT & telecommunications sector to boost market growth

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 53 SNAPSHOT OF MARKET IN APAC

TABLE 119 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 120 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 121 MARKET IN APAC, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 122 MARKET IN APAC, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to dominate market in APAC during forecast period

10.4.2 JAPAN

10.4.2.1 Expanding data center market to boost market growth in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Growing adoption of structured cabling in retail and transportation sectors

10.4.4 REST OF APAC

10.5 REST OF THE WORLD (ROW)

TABLE 123 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 124 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 125 MARKET IN ROW, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 126 MARKET IN ROW, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Increasing demand for cloud services and establishment of new data centers

10.5.2 MIDDLE EAST

10.5.2.1 Middle East holds largest share of market in RoW

10.5.3 AFRICA

10.5.3.1 Market in Africa to grow at significant rate

10.6 IMPACT OF COVID-19 ON STRUCTURED CABLING MARKET IN VARIOUS REGIONS

10.6.1 MOST IMPACTED REGION

10.6.1.1 North America

FIGURE 54 PRE- AND POST-COVID-19 COMPARISON OF MARKET IN NORTH AMERICA

10.6.2 LEAST IMPACTED REGION

10.6.2.1 APAC

FIGURE 55 PRE- AND POST-COVID-19 COMPARISON OF MARKET IN APAC

11 COMPETITIVE LANDSCAPE (Page No. - 173)

11.1 STRUCTURED CABLING OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

TABLE 127 OVERVIEW OF STRATEGIES DEPLOYED BY KEY STRUCTURED CABLING COMPANIES

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC STRATEGIES

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 128 MARKET: MARKET SHARE ANALYSIS (2021)

11.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 56 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET, 2017–2021

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 57 STRUCTURED CABLING MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 START-UP/SME EVALUATION MATRIX

TABLE 129 MARKET: DETAILED LIST OF KEY START-UP/SMES

TABLE 130 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UP/SMES (SOLUTION FOOTPRINT)

TABLE 131 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UP/SMES (VERTICAL FOOTPRINT)

TABLE 132 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UP/SMES (REGION FOOTPRINT)

TABLE 133 START-UPS/SMES IN MARKET

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 58 MARKET, START-UP/SME EVALUATION MATRIX, 2021

11.7 COMPANY FOOTPRINT

TABLE 134 COMPANY FOOTPRINT

TABLE 135 COMPANY-WISE SOLUTION TYPE FOOTPRINT

TABLE 136 COMPANY-WISE VERTICAL FOOTPRINT

TABLE 137 COMPANY-WISE REGION FOOTPRINT

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 138 PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2022

11.8.2 DEALS

TABLE 139 DEALS, JANUARY 2018–JANUARY 2022

11.8.3 OTHERS

TABLE 140 CONTRACTS, INVESTMENTS, AND EXPANSIONS, JANUARY 2018–JANUARY 2022

12 COMPANY PROFILES (Page No. - 206)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY COMPANIES

12.1.1 COMMSCOPE HOLDING COMPANY, INC.

TABLE 141 COMMSCOPE HOLDING COMPANY, INC.: BUSINESS OVERVIEW

FIGURE 59 COMMSCOPE HOLDING COMPANY, INC.: COMPANY SNAPSHOT

TABLE 142 COMMSCOPE HOLDING COMPANY, INC.: PRODUCT OFFERINGS

TABLE 143 COMMSCOPE HOLDING COMPANY, INC.: DEALS

TABLE 144 COMMSCOPE HOLDING COMPANY, INC.: OTHERS

12.1.2 CORNING INCORPORATED

TABLE 145 CORNING INCORPORATED: BUSINESS OVERVIEW

FIGURE 60 CORNING INCORPORATED: COMPANY SNAPSHOT

TABLE 146 CORNING INCORPORATED: PRODUCT OFFERINGS

TABLE 147 CORNING INCORPORATED: PRODUCT LAUNCHES

TABLE 148 CORNING INCORPORATED: DEALS

TABLE 149 CORNING INCORPORATED: OTHERS

12.1.3 LEGRAND

TABLE 150 LEGRAND: BUSINESS OVERVIEW

FIGURE 61 LEGRAND: COMPANY SNAPSHOT

TABLE 151 LEGRAND: PRODUCT OFFERINGS

TABLE 152 LEGRAND: DEALS

12.1.4 NEXANS

TABLE 153 NEXANS: BUSINESS OVERVIEW

FIGURE 62 NEXANS: COMPANY SNAPSHOT

TABLE 154 NEXANS: PRODUCT OFFERINGS

TABLE 155 NEXANS: PRODUCT LAUNCHES

TABLE 156 NEXANS: DEALS

TABLE 157 NEXANS: OTHERS

12.1.5 PANDUIT CORP.

TABLE 158 PANDUIT CORP.: BUSINESS OVERVIEW

TABLE 159 PANDUIT CORP.: PRODUCT OFFERINGS

TABLE 160 PANDUIT CORP.: PRODUCT LAUNCHES

TABLE 161 PANDUIT CORP.: DEALS

TABLE 162 PANDUIT CORP.: OTHERS

12.1.6 BELDEN INC.

TABLE 163 BELDEN INC.: BUSINESS OVERVIEW

FIGURE 63 BELDEN INC.: COMPANY SNAPSHOT

TABLE 164 BELDEN INC.: PRODUCT OFFERINGS

TABLE 165 BELDEN INC.: PRODUCT LAUNCHES

TABLE 166 BELDEN INC.: DEALS

TABLE 167 BELDEN INC.: OTHERS

12.1.7 R&M

TABLE 168 R&M: BUSINESS OVERVIEW

FIGURE 64 R&M: COMPANY SNAPSHOT

TABLE 169 R&M: PRODUCT OFFERINGS

TABLE 170 R&M: PRODUCT LAUNCHES

TABLE 171 R&M: DEALS

TABLE 172 R&M: OTHERS

12.1.8 FURUKAWA ELECTRIC CO., LTD.

TABLE 173 FURUKAWA ELECTRIC CO., LTD.: BUSINESS OVERVIEW

FIGURE 65 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

TABLE 174 FURUKAWA ELECTRIC CO., LTD.: PRODUCT OFFERINGS

TABLE 175 FURUKAWA ELECTRIC CO., LTD.: PRODUCT LAUNCHES

TABLE 176 FURUKAWA ELECTRIC CO., LTD.: DEALS

TABLE 177 FURUKAWA ELECTRIC CO., LTD.: OTHERS

12.1.9 SCHNEIDER ELECTRIC

TABLE 178 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 66 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 179 SCHNEIDER ELECTRIC: PRODUCT OFFERINGS

TABLE 180 SCHNEIDER ELECTRIC: DEALS

12.1.10 THE SIEMON COMPANY

TABLE 181 THE SIEMON COMPANY: BUSINESS OVERVIEW

TABLE 182 THE SIEMON COMPANY: PRODUCT OFFERINGS

TABLE 183 THE SIEMON COMPANY: PRODUCT LAUNCHES

TABLE 184 THE SIEMON COMPANY: DEALS

12.2 OTHER PLAYERS

12.2.1 MOLEX, LLC

TABLE 185 MOLEX, LLC: COMPANY OVERVIEW

12.2.2 LEVITON MANUFACTURING CO., INC.

TABLE 186 LEVITON MANUFACTURING CO., INC.: COMPANY OVERVIEW

12.2.3 AFL

TABLE 187 AFL: COMPANY OVERVIEW

12.2.4 HUBBELL

TABLE 188 HUBBELL: COMPANY OVERVIEW

12.2.5 ELECTRA LINK, INC.

TABLE 189 ELECTRA LINK, INC.: COMPANY OVERVIEW

12.2.6 TEKNON CORPORATION

TABLE 190 TEKNON CORPORATION: COMPANY OVERVIEW

12.2.7 CODECOM

TABLE 191 CODECOM: COMPANY OVERVIEW

12.2.8 BLACK BOX NETWORK SERVICES

TABLE 192 BLACK BOX NETWORK SERVICES: COMPANY OVERVIEW

12.2.9 CONNECTIX LTD.

TABLE 193 CONNECTIX LTD.: COMPANY OVERVIEW

12.2.10 DÄTWYLER IT INFRA GMBH

TABLE 194 DÄTWYLER IT INFRA GMBH: COMPANY OVERVIEW

12.2.11 VERTEX SECURITY

TABLE 195 VERTEX SECURITY: COMPANY OVERVIEW

12.2.12 HUAWEI TECHNOLOGIES CO., LTD.

TABLE 196 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

12.2.13 WARREN & BROWN TECHNOLOGIES

TABLE 197 WARREN & BROWN TECHNOLOGIES: COMPANY OVERVIEW

12.2.14 FIBER MOUNTAIN

TABLE 198 FIBER MOUNTAIN: COMPANY OVERVIEW

12.2.15 TELECO INC.

TABLE 199 TELECO INC.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 261)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

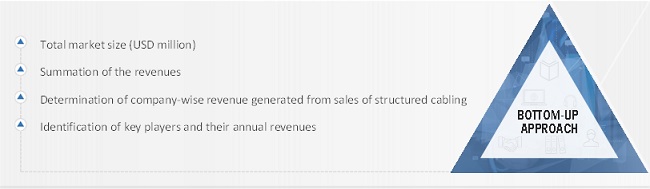

The study involved four major activities in estimating the size of the structured cabling market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the structured cabling market. Secondary sources considered for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of the structured cabling industry to identify the key players based on their products, as well as to identify the prevailing industry trends in the structured cabling market based on solution type, cable type, vertical, and region. It also includes information about the key developments undertaken from both market- and technology-oriented perspectives.

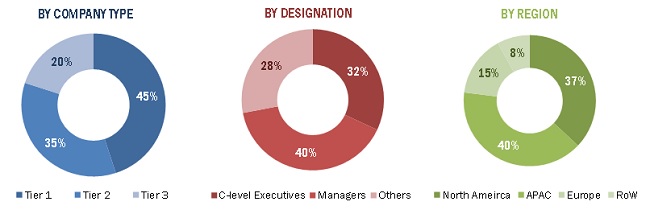

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the structured cabling market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand and supply sides across four major regions: North America, Europe, APAC, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. This primary data has been collected mainly through telephonic interviews, which account for 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the structured cabling market.

- Identifying company-wise revenue for structured cabling manufacturers

- Calculating company-wise revenue generated from the sales of structured cabling

- Conducting multiple discussion sessions with the key opinion leaders to understand different types of products, services, and software deployed by players in the structured cabling market. This would help analyze the breakup of the scope of work carried out by each major structured cabling company.

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEOs), directors, and operation managers

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, for the company- and region-specific developments undertaken in the structured cabling market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down approach has been used to estimate and validate the total size of the structured cabling market.

- Initially focusing on the investments and expenditures being made in the ecosystem of the structured cabling industry

- Splitting the market by solution type, cable type, and vertical and listing key developments in key market areas

- Identifying all major players in the market offering different solution types and cable types based on different technologies and their adoption by various verticals through secondary research.

- Verifying the information obtained through industry experts

- Analyzing revenues, product mix, geographic presence, and key end users of structured cabling served by all identified players to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the structured cabling market.

Report Objectives

- To describe and forecast the global size of the structured cabling market, in terms of value

- To describe and forecast the overall size of the market, in terms of value, by solution type, cable type, and vertical

- To provide the market size for category 6A, in terms of volume

- To describe different types of networks— Local Area Network (LAN) and Wide Area Network (WAN)

- To describe and forecast the market size, in terms of value, for four key regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the structured cabling ecosystem, along with the average selling prices of structured cabling

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market understudy

- To describe the impact of COVID-19 on the market in detail

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze competitive developments such as product launches, expansions, partnerships, collaborations, contracts, and mergers and acquisitions in the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Structured Cabling Market

Hello, does your report include a market size and market share analysis of variosu companies operating specifically in the US or North America? Does your report include percentage based market shares for product types in the US or North America?

Can you provide detailed information pertaining to structured cabling in Singapore & Malaysia market including market numbers, manufacturers, market shares and recent activities of these companies in this space.

We would like to have a dedicated report on South America market information about structured cabling, including market size.

Is it possible to profile local players in the market such as Voksel, Jembo, Sucaco, Kabel Metal & Kabelindo in the Indonesia & APAC market. What would be the addional cost for this?

We would like to understand the structured cable market in the USA and Canada. We are a US domestic company with offices in Florida and and Illinois.