Tilt Sensor Market by Housing Material Type (Metal, and Nonmetal), Technology (Force Balance, MEMS, and Fluid Filled), Vertical (Mining & Construction, Automotive & Transportation, Telecommunications), and Geography - Global Forecast to 2023

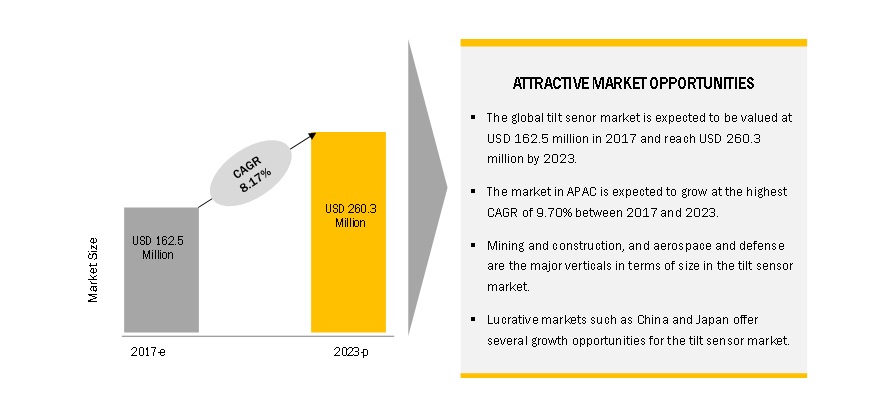

Tilt sensor market [121 Pages Report] is expected to grow from USD 162.5 million in 2017 to USD 260.3 million by 2023, at a CAGR of 8.17% from 2017 to 2023. The growth of this market can be attributed to the ability of these sensors to provide information on the tilting position of objects, which is crucial in various applications for making decisions related to operations as well as for ensuring safety. These sensors are being used in many verticals such as mining, construction, aerospace, defense, automotive, transportation, and telecommunication. The base year used for this study is 2016, and the forecast period considered is between 2017 and 2023.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers

- Increasing demand for the tilt sensors based on MEMS technology

- Rising demand for construction equipment

Restraints

- High cost of tilt sensors based on force balance technology

Opportunities

- Growing application areas

Challenges

- Sustaining the competition in the market

Use of tilt sensors in mining and construction vertical drives the global tilt sensor market

The mining and construction vertical is the largest demand generating segment for the tilt sensors. These sensors are used in a number of mining and construction equipment and machines such as drilling machines, mobile and stationary cranes, and structural monitoring systems. Tilt sensors are applied for providing crucial information about the tilting position of the object with reference to gravity. Moreover, factors such as large-scale investments for infrastructural development, rise in urbanization, and increase in construction activities in emerging economies has led to the rise in the demand for construction equipment. This rise in demand for construction equipment is further expected to fuel the growth of tilt sensor market.

The following are the major objectives of the study.

- To define, describe, and forecast the market segmented on the basis of technology, housing material type, vertical, and geography

- To define, describe, and forecast the global market in terms of volume

- To forecast the size of the market, in terms of value, for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To describe the major market dynamics (drivers, restrains, opportunities, and challenges) affecting the growth of the tilt sensor and its submarkets

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments.

- To strategically profile the key players operating and comprehensively analyze their market ranking and core competencies

- To analyze the strategic developments such as product launches, partnerships, joint ventures, expansions, and contracts in the tilt sensor market

The growth of this market is being propelled by the growing demand for these sensors, especially from the mining and construction, aerospace and defense, and automotive and transportation verticals

The report covers the tilt sensor market on the basis of housing material type, technology, vertical, and geography. The said market is expected to be led by tilt sensors with nonmetal housing material during the forecast period. The growth of this market is being propelled by the high demand for tilt sensors with plastic housing material.

The tilt sensor based on MEMS technology is expected to witness a significant growth in this market during the forecast period. The small size and low cost of this sensor is the major factor leading to its high growth rate in the said market.

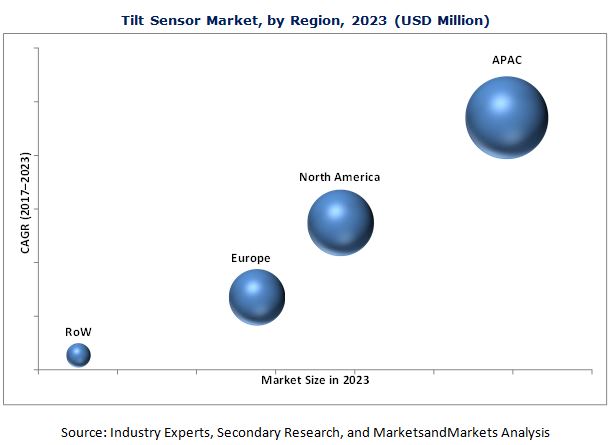

Asia Pacific (APAC) held the largest size of the in 2016 and is expected to witness the highest growth rate during the forecast period. China, Japan, and India are some of the major countries driving the growth of the said market in APAC. APAC is home to a number of prominent mining and construction, aerospace and defense, and automotive and transportation companies. This is one of the major factors that has led to the dominant position of APAC in the overall tilt sensor market. Moreover, a number of key players operating in this market are based in APAC. This factor has a positive impact on the said market in APAC.

TILT SENSOR MARKET, BY REGION, 2023 (USD MILLION)

To know about the assumptions considered for the study, Tilt sensor applications in mining and construction vertical drive the growth of tilt sensor industry.

Mining and construction

Mining and construction is the largest vertical where tilt sensors are being utilized. Tilt sensors are required in drilling machines, hydraulic leveling and road construction machines, mobile and stationary cranes, mining equipment, and aerial lift platform leveling systems. The tilt sensors required for applications in mining and construction vertical needs to be robust as they have to withstand extremely harsh conditions such as shock, vibration, dust, very high or low temperature, and moisture.

Aerospace & Defense

Aerospace and defense is another major vertical where tilt sensors are widely being utilized. Some of the major application areas of the tilt sensor in the aerospace and defense vertical are weapons platform leveling, radar and antenna leveling, production or manufacturing equipment, fire control systems of battle tanks, and missile launches.

Automotive & Transportation

The automotive and transportation vertical is expected to grow a significant rate in the tilt sensor industry during the forecast period. The high adoption of tilt sensors in security systems for protecting the theft of wheels and tires is one of the major reasons fueling the growth of tilt sensor market for automotive and transportation vertical. Moreover, the extensive use of tilt sensors in the railway industry for various applications including measurement of railway track position, alignment and maintenance of railway track, and in train control systems is also leading to the growth of this market.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming verticals for tilt sensors?

“To speak to our analyst for a discussion on the above findings, click the Speak to Analyst tab provided above.”

The tilt sensors based on force balance technology have a high accuracy level; however, these sensors are expensive than the tilt sensors based on other technologies such as MEMS and fluid filled. This is one of the major factors limiting the growth of the said market. Some of the major companies operating in the tilt sensor industry are TE Connectivity (Switzerland), SICK (Germany), Murata Manufacturing (Japan), Pepperl+Fuchs Vertrieb (Germany), and Balluff (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.2.2 Breakdown of Primaries

2.2.3 Key Industry Insights

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Tilt Sensor Market Expected to Have A Huge Growth Opportunity in APAC

4.2 Tilt Sensor Market, By Technology (2017–2023)

4.3 Tilt Sensor Market, By Region and Vertical

4.4 Tilt Sensor Market, By Housing Material Type

4.5 Tilt Sensor Market, By Region (2017)

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for the Tilt Sensors Based on MEMS Technology

5.2.1.2 Rising Demand for Construction Equipment

5.2.2 Restraints

5.2.2.1 High Cost of Tilt Sensors Based on Force Balance Technology

5.2.3 Opportunities

5.2.3.1 Growing Application Areas

5.2.4 Challenges

5.2.4.1 Sustaining the Competition in the Market

5.3 Value Chain Analysis

6 Tlt Sensor Market, By Technology (Page No. - 36)

6.1 Introduction

6.2 Tilt Sensor Based on Force Balance Technology

6.3 Tilt Sensor Based on MEMS Technology

6.4 Tilt Sensor Based on Fluid Filled Technology

6.4.1 Electrolytic Tilt Sensor

6.4.2 Capacitive Tilt Sensor

7 Market, By Housing Material Type (Page No. - 44)

7.1 Introduction

7.2 Metal

7.3 Nonmetal

8 Market, By Vertical (Page No. - 47)

8.1 Introduction

8.2 Mining & Construction

8.3 Aerospace & Defense

8.4 Automotive & Transportation

8.5 Telecommunications

8.6 Others

9 Geographic Analysis (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe (RoE)

9.4 Asia Pacific (APAC)

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of APAC (RoAPAC)

9.5 Rest of the World (RoW)

9.5.1 South America

9.5.2 Middle East and Africa

10 Competitive Landscape (Page No. - 86)

10.1 Overview

10.2 Market Ranking Analysis: Tilt Sensor Market

10.3 Vendor Dive Overview

10.3.1 Vanguards

10.3.2 Dynamic

10.3.3 Innovator

10.3.4 Emerging

10.4 Product Offering

10.5 Business Strategy

Top 25 Companies Analyzed for This Study are - TE Connectivity Ltd. (Switzerland); Sick AG (Germany); Murata Manufacturing Co., Ltd. (Japan); Pepperl+Fuchs Vertrieb GmbH & Co. Kg (Germany); Level Developments Ltd (UK); DIS Sensors Bv (Netherlands); Balluff GmbH (Germany); Baumer (Switzerland); Omron Corporation (Japan); Gefran S.P.A. (Italy); Di-Soric GmbH & Co. Kg (Germany); Geokon, Inc. (US); Jewell Instruments LLC (US); MEMSic, Inc. (US); Meggitt PLC (UK); IFM Electronic GmbH (Germany); Elobau GmbH (Germany); Gemac (Germany); Shenzhen Rion Technology (China); Rieker, Inc. (US); Asm GmbH (Germany); Wyler AG (Switzerland); Spectron Glass & Electronics Inc. (US); the Fredericks Company (US); Shanghai Zhichuan Electronic Tech Co ,Ltd. (China)

11 Company Profiles (Page No. - 91)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Introduction

11.2 TE Connectivity Ltd.

11.3 Sick AG

11.4 Murata Manufacturing Co., Ltd.

11.5 Pepperl+Fuchs Vertrieb GmbH & Co. Kg

11.6 Level Developments Ltd

11.7 IFM Electronic GmbH

11.8 Balluff GmbH

11.9 Jewell Instruments LLC

11.10 The Fredericks Company

11.11 DIS Sensors Bv

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 114)

12.1 Insights of Industry Experts

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (61 Tables)

Table 1 Tilt Sensor, in Terms of Value and Volume, 2014–2023

Table 2 By Technology, 2014–2023 (USD Million)

Table 3 Tilt Sensor Market for Force Balance Technology, By Vertical, 2014–2023 (USD Million)

Table 4 Tilt Sensor Market for Force Balance Technology, By Region, 2014–2023 (USD Million)

Table 5 Tilt Sensor Market for MEMS Technology, By Vertical, 2014–2023 (USD Million)

Table 6 Tilt Sensor Market for MEMS Technology, By Region, 2014–2023 (USD Million)

Table 7 Tilt Sensor Market for Fluid Filled Technology, By Vertical, 2014–2023 (USD Million)

Table 8 Tilt Sensor Market for Fluid Filled Technology, By Region, 2014–2023 (USD Million)

Table 9 Tilt Sensor Market, By Housing Material Type, 2014–2023 (USD Million)

Table 10 Tilt Sensor Market, By Vertical, 2014–2023 (USD Million)

Table 11 Tilt Sensor for Mining & Construction Vertical, By Technology, 2014–2023 (USD Million)

Table 12 Tilt Sensor for Mining & Construction Vertical, By Region, 2014–2023 (USD Million)

Table 13 Tilt Sensor Market for Aerospace & Defense Vertical, By Technology, 2014–2023 (USD Million)

Table 14 Tilt Sensor Market for Aerospace & Defense Vertical, By Region, 2014–2023 (USD Million)

Table 15 Tilt Sensor Market for Automotive & Transportation Vertical, By Technology, 2014–2023 (USD Million)

Table 16 Tilt Sensor Market for Automotive & Transportation Vertical, By Region, 2014–2023 (USD Million)

Table 17 Tilt Sensor Market for Telecommunications Vertical, By Technology, 2014–2023 (USD Million)

Table 18 Tilt Sensor Market for Telecommunications Vertical, By Region, 2014–2023 (USD Million)

Table 19 Tilt Sensor Market for Other Verticals, By Technology, 2014–2023 (USD Million)

Table 20 Tilt Sensor Market for Other Verticals, By Region, 2014–2023 (USD Million)

Table 21 Tilt Sensor Market, By Region, 2014–2023 (USD Million)

Table 22 Tilt Sensor Market in North America, By Country, 2014–2023 (USD Million)

Table 23 Tilt Sensor Market in North America, By Vertical, 2014–2023 (USD Million)

Table 24 Tilt Sensor Market in North America, By Technology, 2014–2023 (USD Million)

Table 25 Tilt Sensor Market in US, By Vertical, 2014–2023 (USD Million)

Table 26 Tilt Sensor Market growth in US, By Technology, 2014–2023 (USD Million)

Table 27 Growth in Canada, By Vertical, 2014–2023 (USD Million)

Table 28 Tilt Sensor Market in Canada, By Technology, 2014–2023 (USD Million)

Table 29 Tilt Sensor in Mexico, By Vertical, 2014–2023 (USD Thousand)

Table 30 Market in Mexico, By Technology, 2014–2023 (USD Million)

Table 31 Tilt Sensor in Europe, By Country, 2014–2023 (USD Million)

Table 32 Market in Europe, By Vertical, 2014–2023 (USD Million)

Table 33 Tilt Sensor in Europe, By Technology, 2014–2023 (USD Million)

Table 34 Market in UK, By Vertical, 2014–2023 (USD Million)

Table 35 Tilt Sensor in UK, By Technology, 2014–2023 (USD Million)

Table 36 Market in Germany, By Vertical, 2014–2023 (USD Million)

Table 37 Tilt Sensor in Germany, By Technology, 2014–2023 (USD Million)

Table 38 Market in France, By Vertical, 2014–2023 (USD Million)

Table 39 Tilt Sensor in France, By Technology, 2014–2023 (USD Million)

Table 40 Tilt Sensor Market in RoE, By Vertical, 2014–2023 (USD Million)

Table 41 Tilt Sensor in RoE, By Technology, 2014–2023 (USD Million)

Table 42 Tilt Sensor Market in APAC, By Country, 2014–2023 (USD Million)

Table 43 Tilt Sensor in APAC, By Vertical, 2014–2023 (USD Million)

Table 44 Tilt Sensor Market in APAC, By Technology, 2014–2023 (USD Million)

Table 45 Tilt Sensor in Japan, By Vertical, 2014–2023 (USD Million)

Table 46 Tilt Sensor Market in Japan, By Technology, 2014–2023 (USD Million)

Table 47 Tilt Sensor in China, By Vertical, 2014–2023 (USD Million)

Table 48 Tilt Sensor Market in China, By Technology, 2014–2023 (USD Million)

Table 49 Tilt Sensor in India, By Vertical, 2014–2023 (USD Million)

Table 50 Tilt Sensor Market in India, By Technology, 2014–2023 (USD Million)

Table 51 Tilt Sensor in RoAPAC, By Vertical, 2014–2023 (USD Million)

Table 52 Tilt Sensor Market in RoAPAC, By Technology, 2014–2023 (USD Million)

Table 53 Tilt Sensor in RoW, By Region, 2014–2023 (USD Million)

Table 54 Tilt Sensor Market in RoW, By Vertical, 2014–2023 (USD Million)

Table 55 Tilt Sensor in RoW, By Technology, 2014–2023 (USD Million)

Table 56 Tilt Sensor Market in South America, By Country, 2014–2023 (USD Million)

Table 57 Tilt Sensor in South America, By Vertical, 2014–2023 (USD Thousand)

Table 58 Tilt Sensor Market in South America, By Technology, 2014–2023 (USD Million)

Table 59 Tilt Sensor in Middle East & Africa, By Vertical, 2014–2023 (USD Thousand)

Table 60 Tilt Sensor Market in Middle East & Africa, By Technology, 2014–2023 (USD Million)

Table 61 Ranking Analysis: Tilt Sensor Market, 2016

List of Figures (34 Figures)

Figure 1 Market Segmentation

Figure 2 Process Flow: Tilt Sensor Size Estimation

Figure 3 Research Design

Figure 4 Bottom-Up Approach for Market Size Estimation

Figure 5 Top-Down Approach for Market Size Estimation

Figure 6 Data Triangulation

Figure 7 Tilt Sensor : Market Size Analysis (2014–2023)

Figure 8 Mining & Construction Vertical to Hold Largest Size of the Market By 2023

Figure 9 APAC Accounted for Largest Share of Tilt Sensor in 2016

Figure 10 Attractive Growth Opportunities in the Tilt Sensor Owing to the Increasing Demand From Mining & Construction Vertical

Figure 11 Tilt Sensor Market for MEMS Technology Expected to Grow at Highest CAGR During Forecast Period

Figure 12 APAC to Hold Largest Share of Tilt Sensor in 2017

Figure 13 Tilt Sensor Market for Tilt Sensors With Metal Housing Material to Grow at Higher CAGR During Forecast Period

Figure 14 US Expected to Hold Largest Share of Tilt Sensor in 2017

Figure 15 Increasing Demand for Tilt Sensors Based on MEMS Technology Drives the Market

Figure 16 Rise in Financial Commitments of World Bank Toward Infrastructure Projects, 2013–2014

Figure 17 Value Chain Analysis: Major Value Addition During Manufacturing and Assembly Phase

Figure 18 Tilt Sensor : Segmentation

Figure 19 Tilt Sensors Based on MEMS Technology Expected to Lead the Market During Forecast Period

Figure 20 Automotive & Transportation Vertical Expected to Grow at the Highest Rate in the Market for Fluid Filled Technology During Forecast Period

Figure 21 Tilt Sensor, By Housing Material Type

Figure 22 Tilt Sensors With Nonmetal Housing Material Expected to Lead the Market During Forecast Period

Figure 23 Tilt Sensor, By Vertical

Figure 24 Automotive & Transportation Vertical Expected to Witness Highest Growth Rate During Forecast Period

Figure 25 MEMS Technology Expected to Lead Market for Automotive and Transportation Vertical During Forecast Period

Figure 26 Geographic Snapshot (2016): APAC Countries, Such as China and Japan, Expected to Witness Significant Growth During Forecast Period

Figure 27 Snapshot of Market in North America: Automotive & Transportation Vertical Expected to Grow at Highest Rate Between 2017 and 2023

Figure 28 Snapshot of Market in Europe: Tilt Sensors Based on MEMS Technology Expected to Hold Largest Size of the Market During Forecast Period

Figure 29 Snapshot of Market in APAC: Japan Expected to Hold Largest Size of the Market During Forecast Period

Figure 30 Dive Chart: Market

Figure 31 Geographic Revenue Mix of Top Market Players

Figure 32 TE Connectivity Ltd.: Company Snapshot

Figure 33 Sick AG: Company Snapshot

Figure 34 Murata Manufacturing Co., Ltd.: Company Snapshot

The research methodology used to estimate and forecast begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as IEEE journals, sensor journals, Factiva, Hoovers, and OneSource. Moreover, the vendor offerings have been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size from the revenue of the key players in the market.

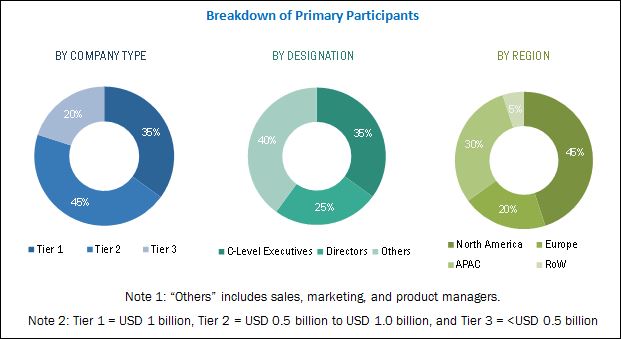

After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with officials holding key positions in the industry such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries has been depicted in the following figure:

BREAKDOWN OF PRIMARY PARTICIPANTS

Note 1: “Others” includes sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies include companies with revenues more than USD 1 billion; tier 2 companies have revenues between USD 1 billion and USD 0.5 billion; and tier 3 companies have revenues up to USD 0.5 billion.

The tilt sensor ecosystem comprises tilt sensor vendors such as TE Connectivity (Switzerland), SICK (Germany), Murata Manufacturing (Japan), Pepperl+Fuchs Vertrieb (Germany), and Level Developments (UK) who sell these products and solutions to end users according to their unique requirements. The end users of tilt sensor industry consists of companies such as mining and construction, aerospace and defense, automotive and transportation, and telecommunications.

Target Audience:

- Tilt sensor manufacturers

- Original equipment manufacturers (OEMs)

- Research organizations and consulting companies

- Tilt sensor-related associations, organizations, forums, and alliances

- Distributors and traders

- Government bodies such as regulating authorities and policy makers

- Venture capitalists, private equity firms, and startup companies

Report Scope:

By Housing Material Type:

- Metal

- Nonmetal

By Technology:

- Force Balance

- MEMS

- Fluid Filled

By Vertical:

- Mining and Construction

- Aerospace and Defense

- Automotive and Transportation

- Telecommunications

- Others

- Others

By Geography:

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, and Others)

- Asia Pacific (China, Japan, India, and Others)

- Rest of the World

- Critical questions which the report answers

- What are new verticals which the tilt sensor companies are exploring?

- Which are the key players in the market?

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Tilt Sensor Market