Wi-Fi as a Service Market Size, Share, Growth, Opportunities, Latest Trends

Wi-Fi as a Service Market by Service Type (Fully Managed, Partially Managed, Subscription-based), Location Type (Indoor, Outdoor), Enterprise Size (Large Enterprises, SMEs), End User (Consumer, Enterprise) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

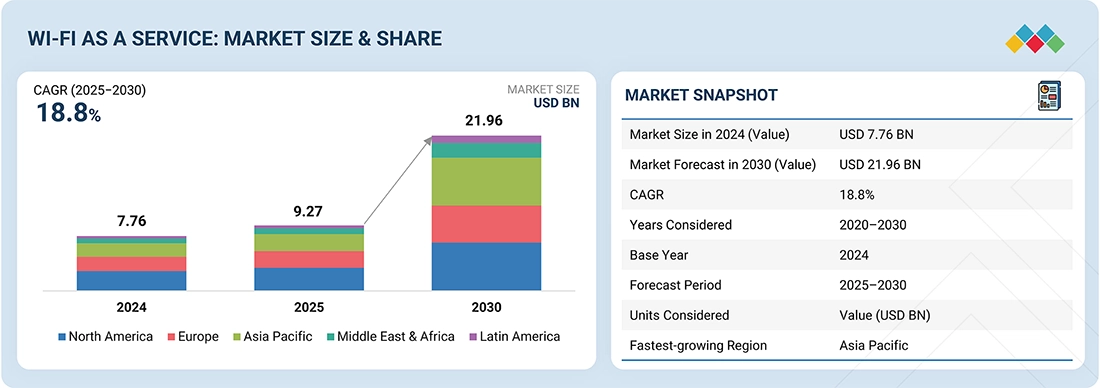

The Wi-Fi as a Service market is projected to grow from USD 9.27 billion in 2025 to USD 21.96 billion by 2030 at a compounded annual growth rate (CAGR) of 18.8% during the forecast period. The increasing demand for cost-effective and scalable Wi-Fi solutions, as organizations shift from traditional CapEx models to OpEx-based subscription models that offer predictable costs and reduced infrastructure burden, is driving the market growth. The growing adoption of cloud-managed Wi-Fi is also fueling market expansion, enabling centralized management, remote troubleshooting, and seamless scalability, particularly for distributed enterprises.

KEY TAKEAWAYS

-

BY ENTERPRISE SIZEThe WaaS market has been segmented into small and medium enterprises (SMEs) and large enterprises based on enterprise size. In terms of organization size, the study of the WaaS market is important as it directly impacts the adoption of WaaS across the globe. The adoption of WaaS in Small and Medium Enterprises is higher than in large enterprises. This is because most large enterprises have already implemented traditional on-premises Wi-Fi services and are reluctant to replace their legacy systems. Increasing mobility in communication and the growing trend of the adoption of Bring Your Own Device (BYOD) in organizations have led to the rise in cost-effective WaaS by SMEs globally. Ease of deployment and availability of several vendors of Wi-Fi services are some of the factors leading to the adoption of WaaS in SMEs.

-

BY END USERThe end user segment is categorized into consumer and enterprise segment, each with distinct needs and usage patterns. This segmentation helps in understanding demand drivers, service expectations, and technology adoption across different user bases. While consumers primarily seek reliable, plug-and-play Wi-Fi solutions for personal, home, and small office use, enterprises require robust, scalable, and secure wireless networks to support complex business operations. The growing digital dependence across both segments is fueling the adoption of WaaS, with tailored offerings designed to meet the unique connectivity, management, and security needs of each user type. Based on enterprise, Wi-Fi as a service market has been segmented into education, retail & eCommerce, travel and hospitality, healthcare and life sciences, BFSI, transportation and logistics, IT and ITeS, manufacturing, government and public sector, and others enterprises.

-

BY REGIONAsia Pacific is projected to register the highest CAGR of 23.3%, fueled by some of the world's fastest-growing economies, including China, India, and Japan. These areas are known for their young, tech-savvy populations that are driving a demand for digital transformation.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships, collaborations, and investments. For instance, in October 2024, e& announced the launch of its Managed Wi-Fi 7 services. Designed to meet the growing demands of businesses, this next-generation wireless solution offers up to four times faster speeds and twice the capacity of previous Wi-Fi generations, delivering enhanced operational efficiency and scalability.

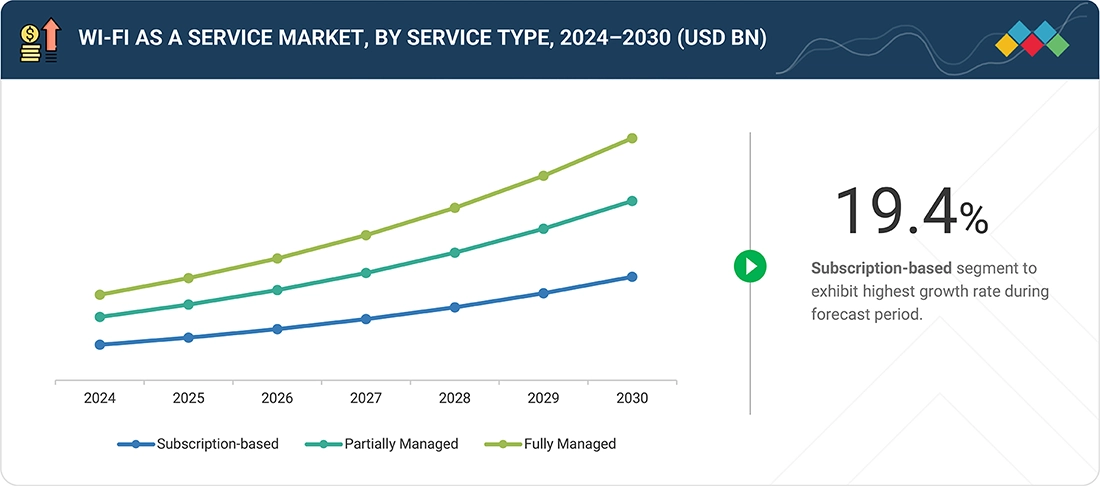

The Wi-Fi as a Service market has been broadly categorized into fully managed, partially managed, and subscription-based services based on service type, each addressing different levels of control, complexity, and customer requirements. Fully managed services provide end-to-end management of Wi-Fi infrastructure, including network design, deployment, monitoring, and support, ideal for organizations seeking minimal in-house involvement. Partially managed services allow clients to retain some control over network operations while leveraging external expertise for specific tasks such as troubleshooting or performance optimization. Subscription-based services, on the other hand, offer flexible, cost-effective access to Wi-Fi solutions through recurring payment models, making them attractive to small businesses, startups, and cost-conscious enterprises.

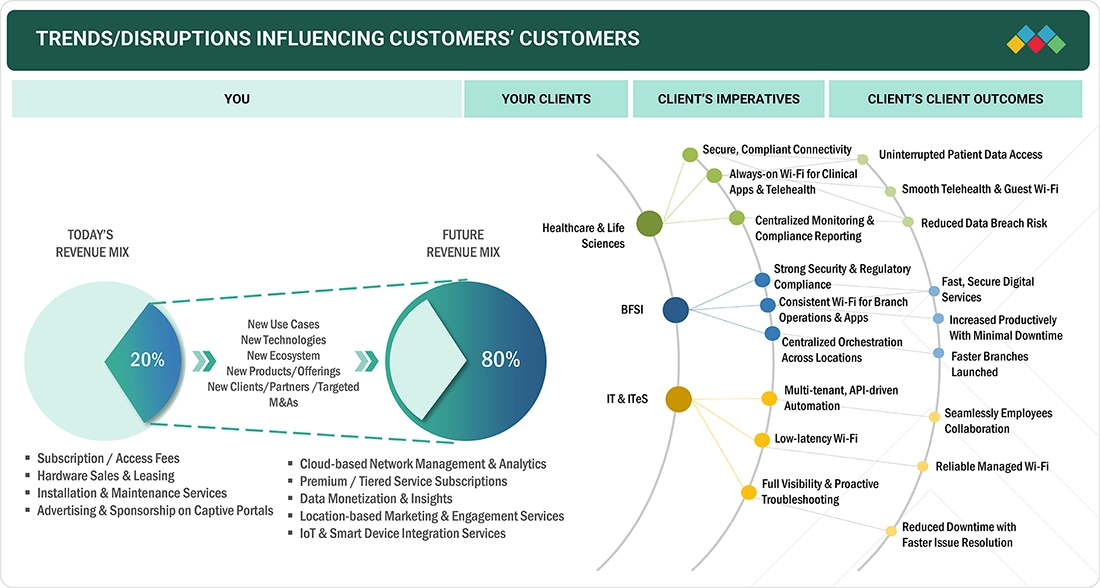

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Wi-Fi as a Service market is undergoing significant transformation, with several trends and disruptions reshaping how customers manage and consume wireless connectivity. One major shift is the move from capital expenditure (CAPEX) to operational expenditure (OPEX) models, enabling businesses to adopt scalable, subscription-based Wi-Fi solutions that reduce upfront investment and improve cash flow. The increasing complexity of networks and the shortage of skilled IT personnel are driving demand for managed services, prompting enterprises to outsource Wi-Fi operations to expert providers. Additionally, the growing need for real-time data processing, especially with the rise of IoT and edge computing, is pushing WaaS vendors to deliver low-latency, high-performance networks. Security remains a top concern, with enterprises requiring advanced features such as zero trust, device segmentation, and automated threat detection. At the same time, cloud-based network management and AI-driven analytics are enhancing visibility, optimization, and proactive troubleshooting. However, disruptions such as hardware supply chain constraints, evolving compliance requirements, and vendor lock-in risks are affecting deployment timelines and flexibility.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Digital transformation initiatives in businesses, paving way for Wi-Fi networks

-

Ease of Wi-Fi infrastructure management and remote troubleshooting

Level

-

Data protection and confidentiality concerns

-

Slower backups and restores

Level

-

Shift from CapEx to OpEx models

-

Increasing demand for Wi-Fi as a Service in small, medium, and distributed companies

Level

-

Poor user experience in high-density environments

-

Lack of skilled workforce

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption of smartphones and wireless devices

The rising adoption of smartphones and wireless devices is a major driver for the growth of the Wi-Fi as a Service (WaaS) market. With increasing smartphone penetration and the widespread use of tablets, laptops, wearables, and IoT devices across both consumer and enterprise environments, there is a growing need for fast, reliable, and scalable wireless connectivity. Traditional Wi-Fi infrastructure often falls short in managing the high volume and dynamic behavior of connected devices, particularly in dense or distributed settings such as campuses, retail chains, hospitals, and warehouses. WaaS addresses this challenge by offering cloud-managed, flexible, and centrally controlled Wi-Fi solutions that can efficiently support large numbers of endpoints. Additionally, the Bring Your Own Device (BYOD) trend in workplaces, along with rising expectations for uninterrupted, high-performance wireless access in public and commercial spaces, further drives demand for managed Wi-Fi services. As connected devices become central to business operations and consumer experiences, WaaS emerges as a strategic solution to deliver seamless connectivity, enhanced user experience, and simplified network management.

Restraint: Data protection and confidentiality concerns

Data protection and confidentiality concerns act as a significant restraint in the Wi-Fi as a Service (WaaS) market, particularly for organizations operating in highly regulated sectors such as finance, healthcare, and government. Since WaaS relies on cloud-based platforms and centralized network management, enterprises often worry about the security of sensitive data, including user credentials, usage logs, and operational insights. The multi-tenant architecture of many WaaS solutions raises fears of data breaches, unauthorized access, and accidental exposure due to misconfigurations or shared infrastructure. Additionally, concerns around data residency and compliance with privacy regulations such as GDPR, HIPAA, or India's DPDP Act further complicate adoption, especially when data is stored across multiple geographic regions. The lack of transparency in service-level agreements regarding data ownership, access rights, and breach response protocols also adds to enterprise hesitation. Furthermore, integrations with third-party services and the involvement of multiple vendors in the service delivery chain can introduce security risks and obscure accountability. As a result, despite the operational and financial advantages WaaS offers, these data protection and confidentiality issues remain a critical barrier to broader market adoption.

Opportunity: Shift from CapEx to OpEx models

The increasing shift from capital expenditure (CapEx) to operational expenditure (OpEx) models presents a major opportunity for the Wi-Fi as a Service (WaaS) market. Traditionally, enterprises have invested heavily in purchasing and maintaining on-premise Wi-Fi infrastructure, which involves high upfront costs and ongoing maintenance. WaaS transforms this approach by offering Wi-Fi connectivity through a subscription-based model, allowing organizations to access the latest wireless technologies without the burden of asset ownership. This OpEx-driven approach provides cost predictability, faster return on investment, and greater scalability, making it especially attractive to small and medium-sized businesses. It also reduces the complexity of network management, as service providers handle installation, monitoring, updates, and security. As more businesses embrace cloud-first strategies and seek agile IT consumption models, the demand for OpEx-based WaaS solutions continues to rise, enabling providers to offer bundled services, drive recurring revenues, and expand into new customer segments.

Challenge: Lack of a skilled workforce

The lack of a skilled workforce poses a significant challenge to the growth and adoption of Wi-Fi as a Service (WaaS). As WaaS evolves to include advanced capabilities such as cloud management, AI-driven analytics, IoT integration, and enhanced cybersecurity protocols, it demands a highly specialized talent pool proficient in wireless networking, cloud orchestration, and compliance management. However, there is a noticeable shortage of professionals who possess this blend of expertise, particularly in emerging markets and Tier 2 and 3 cities. This talent gap leads to delays in deployment, increased reliance on expensive in-house training or third-party services, and higher operational costs for providers. Moreover, academic institutions have been slow to align their curricula with evolving industry needs, exacerbating the shortage of job-ready graduates. The lack of skilled personnel not only hampers service quality and scalability but also restricts innovation and customization for vertical-specific requirements, ultimately impacting customer satisfaction and limiting the competitive landscape of the WaaS market.

wi-fi-as-a-service-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Radford College is an independent co-educational school based in Canberra that has deployed Extreme Wi-Fi 6 managed by ExtremeCloud IQ to enable a digital learning environment. It supports teachers and students for e-learning by offering a secure, strong, flexible modular infrastructure. | Offered flexible, secure, consistent network connection to ensure internet connectivity all over the campus. Improved real-time device visibility helps diagnose problems and errors rapidly and resolve issues quickly. Offered Wi-Fi services at a large-scale to support thousands of users and devices. |

|

Ohso Technical is a service provider based in London. The company has adopted Wi-Fi services offered by Ubiquiti to improve operation in the commercial environment. Ubiquiti has enhanced the network efficiency and provides 5GHz wireless coverage throughout the campus. | Wireless connectivity issue has been resolved. Staff members received fewer complaints after deployment. The company offered services to their clients at a low cost and with less disruption to their business operations. |

|

Anord Mardix has adopted Wi-Fi services offered by Redway Networks to improve production efficiency at its three production facilities in the UK. This new service has increased the network for its employees and provided seamless connectivity throughout the campus. The company has deployed new Wi-Fi with Redway Networks to support internet connectivity in 10,100 sq./ft production area in Blackburn and 140,000 sq./ft of fabrication and production areas across two sites in Kendal. | Anord Mardix is now working on robust Wi-Fi services that enhance the workforce's work efficiency. Enabled remote testing through Wi-Fi in high-quality HD video. Quick error detection and troubleshooting remotely have saved time. |

|

East Bernard is an independent educational school based in n East Bernard, Texas. The school has deployed a high-performance Wi-Fi foundation to enable classroom technology. It also supports BYOD policy and offers seamless internet connectivity to BYOD devices such as tablets given by districts. The school serves approximately 1,000 students and 130 employees. They need internet connectivity in 8 buildings with up to 300 devices connected to Wi-Fi. | ADTRAN enabled BYOD policy in the East Bernard Independent School and provides extensive Wi-Fi connectivity. Increased network flexibility and reduced load on the IT department by offering wireless network management tools and handling daily internet traffic. ADTRAN has offered cost-effective and cost-controlled Wi-Fi services in districts' budget to schools by eliminating extra hardware needs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent players in this market include well-established, financially stable Wi-Fi as a Service providers, as well as regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. The vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wi-Fi as a Service Market, By Service Type

The subscription-based segment accounted for the largest market size in 2024. Subscription-based Wi-Fi services are a flexible and cost-efficient delivery model in which organizations pay a recurring fee, monthly, quarterly, or annually, to access Wi-Fi infrastructure and services without incurring high upfront capital expenditure. Under this model, the service provider typically offers a bundled package that may include Wi-Fi hardware, software licenses, network configuration, security features, remote monitoring, and technical support. These services are particularly attractive to small and medium-sized businesses (SMBs), startups, co-working spaces, SOHOs (Small Office/Home Office), and temporary setups such as events or pop-up stores, where budget constraints, limited IT resources, and the need for fast deployment are common. Subscription-based Wi-Fi solutions are commonly used to deliver guest Wi-Fi, manage employee access, enable cloud-based applications, and run customer engagement platforms through captive portals. One of the primary advantages is the shift from CapEx to OpEx, allowing businesses to manage expenses predictably and scale services as needed. This model also reduces the burden of hardware maintenance, firmware updates, and network troubleshooting, as these are typically handled by the provider

REGION

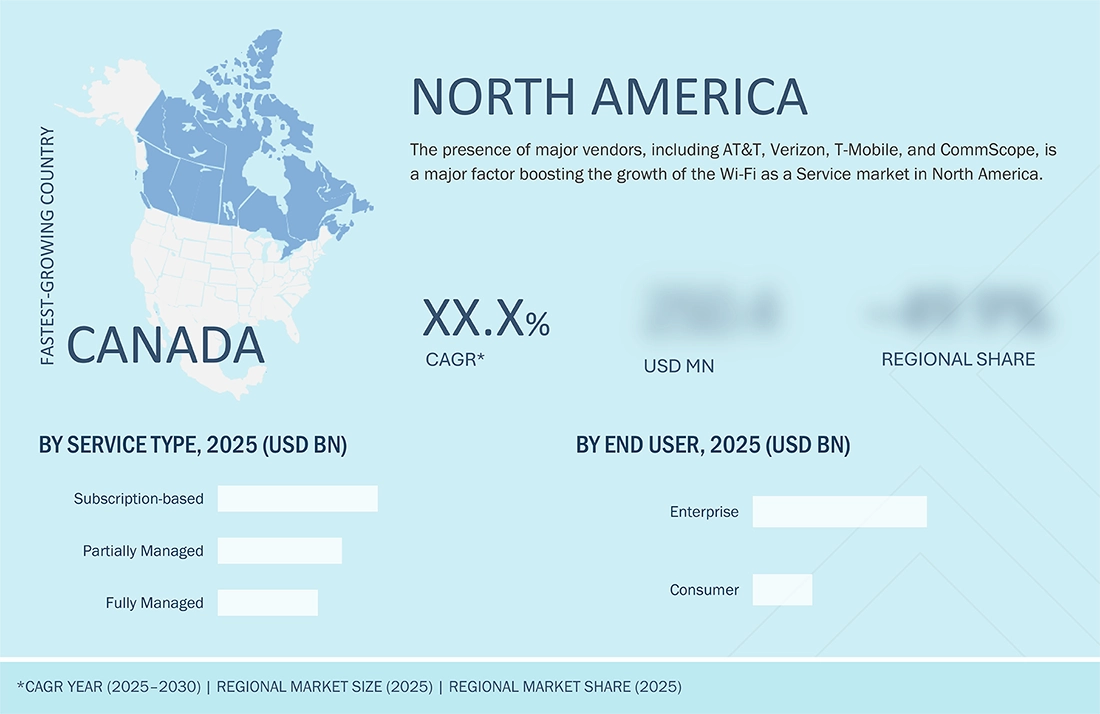

North America is estimated to account for the largest market share during the forecast period

North America holds the leading position in the global Wi-Fi as a Service (WaaS) market, driven by its advanced digital infrastructure, high broadband penetration, and strong enterprise adoption of cloud-based networking solutions. The presence of major WaaS providers such as AT&T, Verizon, and T-Mobile, coupled with a mature IT ecosystem, has accelerated the deployment of managed and subscription-based Wi-Fi services across key industries such as IT & ITeS, BFSI, healthcare, retail, and education. Enterprises in the US and Canada are leveraging WaaS to support hybrid work environments, enhance network flexibility, and optimize operational costs. The growing demand for seamless connectivity, proliferation of IoT devices, and the increasing need for secure, scalable wireless networks further contribute to regional growth. Moreover, supportive regulatory frameworks, a skilled workforce, and rising digital transformation initiatives among SMEs continue to strengthen North America’s dominance in the WaaS market

wi-fi-as-a-service-market: COMPANY EVALUATION MATRIX

In the Wi-Fi as a Service market matrix, AT&T (Star) leads with a strong market presence and comprehensive managed Wi-Fi portfolio, driving widespread adoption across industries such as healthcare, education, and enterprise. Arista Networks (Emerging leader) is gaining momentum with its cloud-driven networking solutions, delivering agility and scalability to enterprises embracing digital transformation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.76 Billion |

| Market Forecast in 2030 (Value) | USD 21.96 Billion |

| Growth Rate | CAGR of 18.8% from 2025-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By service type, location type, enterprise size, end user, and region |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

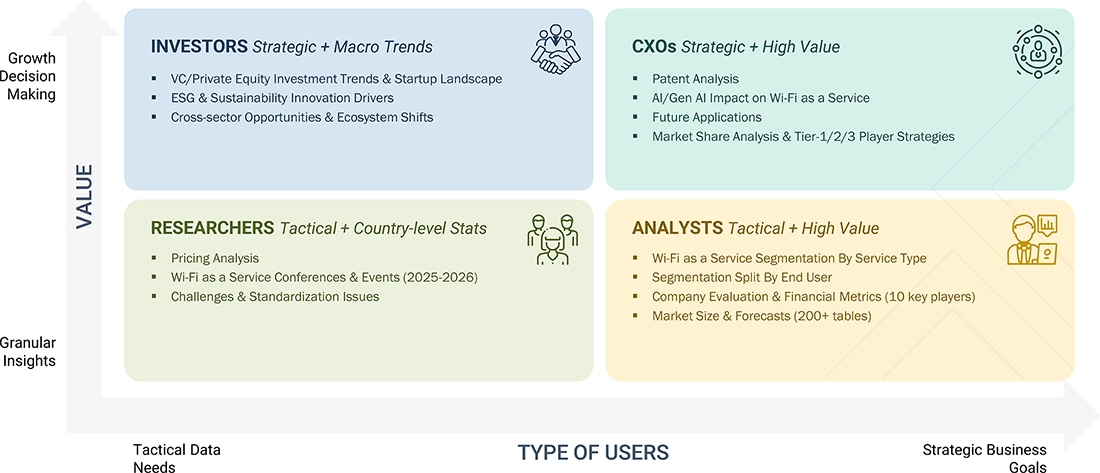

WHAT IS IN IT FOR YOU: wi-fi-as-a-service-market REPORT CONTENT GUIDE

RECENT DEVELOPMENTS

- May 2025 : AT&T reached an agreement to acquire substantially all of Lumen’s Mass Markets fiber business for USD 5.75 billion, subject to purchase price adjustments, in an all-cash transaction that will expand investment in critical US connectivity infrastructure, create new middle-class jobs, and accelerate high-speed fiber internet access to millions of Americans.

- May 2025 : TP-Link announced the launch of its first Tri-Band Six-Stream Omnidirectional BE11000 Outdoor Access Point EAP772-Outdoor. With its 6 GHz band unlocked by AFC, this device achieves true tri-band omnidirectional coverage, surpassing other dual-band products currently on the market.

- April 2025 : T-Mobile partnered with EQT, to acquire fiber-to-the-home provider Lumos. The partnership will expand fiber to millions of customers and bring even more capable broadband options, greater value, and benefits to customers.

- October 2024 : e& announced the launch of its Managed Wi-Fi 7 services. Designed to meet the growing demands of businesses, this next-generation wireless solution offers up to four times faster speeds and twice the capacity of previous Wi-Fi generations, delivering enhanced operational efficiency and scalability.

- September 2024 : Nokia partnered with RUCKUS Networks, a CommScope business, to create an innovative solution for deploying seamless in-building and campus-wide connectivity, which is uniquely tailored to the needs of diverse industry verticals.

Table of Contents

Methodology

This research on the Wi-Fi as a Service market used extensive secondary sources, directories, journals, and databases such as D&B Hoovers, Bloomberg Businessweek, and Factiva to gather information for this technical, market, and commercial study. Primary sources included industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations involved in various segments of the industry’s value chain. In-depth interviews were conducted with key industry participants and subject-matter experts to gather and validate critical qualitative and quantitative data, as well as to evaluate the market’s outlook. These respondents included top industry players, subject-matter experts, C-level executives of major companies, and industry consultants. The primary sources mainly comprised industry specialists from core and related industries, preferred Wi-Fi as a Service providers, third-party service providers, consulting firms, end users, and other commercial organizations. In-depth interviews with these primary respondents helped obtain and confirm essential qualitative and quantitative information and assess growth potential. The following figure illustrates the market research methodology used to develop the Wi-Fi as a Service market report.

Secondary Research

The market size of companies providing Wi-Fi as a Service was calculated using secondary data from both paid and free sources. It was also determined by analyzing the product offerings of leading companies and rating them based on their performance and quality.

In the secondary research process, various sources were used to identify and gather information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and reputable publications; and articles from recognized authors, directories, and databases. Data was also collected from other secondary sources such as journals and related magazines. Wi-Fi as a Service spending by different countries was obtained from the respective sources. Secondary research primarily aimed to gather key information about the industry’s value chain and supply chain to identify key players, market classification, and segmentation based on offerings of major companies; industry trends related to service type, location type, enterprise size, end users, and regions; and significant developments from both market and technology perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing Wi-Fi as a Service solutions and services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

In the market engineering process, both top-down and bottom-up approaches were widely used, along with several data triangulation methods, to estimate and forecast market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were conducted throughout the entire market engineering process to highlight key information and insights for the report.

After completing comprehensive market analysis, including calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation, extensive primary research was carried out to gather information. This research aimed to identify segmentation, industry trends, key players, the competitive landscape, and crucial market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Note 1: Tier 1 companies - Revenue greater than USD 10 billion; Tier 2 companies - Revenue ranges between

USD 1 and 10 billion; and Tier 3 companies - Revenue ranges between USD 500 million and 1 billion

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple methods were used to estimate and forecast the Wi-Fi as a Service market. The first method involved calculating the market size by summing the revenue generated by companies through service sales.

The research methodology used to estimate the market size included the following:

- The revenue contributions of the major market participants in each country were determined using primary and secondary research after they were identified through secondary research.

- Critical insights were obtained through in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, as well as by reviewing the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, which were calculated using secondary sources..

Wi-Fi as a Service Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was established, the market was divided into segments and subsegments using the previously described market size estimation methods. When necessary, market breakdown and data triangulation procedures were utilized to complete the market engineering process and determine the precise figures for each market segment and subsegment. The data was triangulated by analyzing various variables and patterns from the supply and demand sides of government entities.

Market Definition

Wi-Fi as a Service (WaaS) is a model where a provider manages and delivers wireless network infrastructure, including hardware, software, maintenance, and support, to businesses or organizations. Instead of buying and maintaining their own Wi-Fi equipment, customers pay a recurring fee for fully managed, partially managed, or subscription-based, scalable, and secure wireless connectivity. WaaS typically involves network setup, monitoring, upgrades, and troubleshooting, often utilizing cloud-based management for flexibility and ease of use. This enables organizations to concentrate on their core operations while outsourcing Wi-Fi management to specialists.

Stakeholders

- WaaS Providers

- Managed Service Providers

- Cloud Platform Providers

- Hardware Vendors

- Software Providers

- System Integrators

- Enterprise End Users

- Vertical-Specific Users

- Regulatory Bodies & Standards Organizations

- End Consumers

- Internet Service Providers

- Network Security Providers

- Real Estate and Infrastructure Owners

- Channel Partners and Distributors

- Technology Consultants and Advisory Firms

Report Objectives

- To define, describe, and forecast the Wi-Fi as a Service market in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market by service type, location type, enterprise size, end user, and region

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as mergers & acquisitions (M&A), product launches/enhancements, agreements, partnerships, collaborations, expansions, and R&D activities, in the market.

Available Customizations

MarketsandMarkets offers customized options based on the company's specific needs using market data. These include the following:

Product Analysis

- Product matrix – detailed comparison of each company's portfolio

Geographic Analysis as per Feasibility

- Further breakup of Wi-Fi as a Service market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

What is the definition of the Wi-Fi as a Service market?

Wi-Fi as a Service (WaaS) is a model where a provider manages and supplies wireless network infrastructure, including hardware, software, maintenance, and support, to businesses or organizations. Instead of buying and maintaining their Wi-Fi equipment, customers pay a recurring fee for fully managed or partially managed subscription-based, scalable, and secure wireless connectivity. WaaS typically covers network setup, monitoring, upgrades, and troubleshooting, often using cloud-based management for flexibility and ease of use. This approach lets organizations focus on their core operations while delegating Wi-Fi management to specialists.

What is the market size of the Wi-Fi as a Service market?

The Wi-Fi as a Service market is projected to be worth USD 9.27 billion in 2025 and is expected to reach USD 21.96 billion by 2030, with a CAGR of 18.8% from 2025 to 2030.

What are the major drivers in the Wi-Fi as a Service market?

The main drivers in the Wi-Fi as a Service market are digital transformation initiatives in businesses that enable Wi-Fi networks, increasing adoption of smartphones and wireless devices worldwide, ease of Wi-Fi infrastructure management and remote troubleshooting, cost savings through the as-a-service model, and the rising trend of BYOD and CYOD among organizations.

Who are the key players operating in the Wi-Fi as a Service market?

The key market players profiled in the Wi-Fi as a Service market include AT&T (US), Verizon (US), T-Mobile (US), e& (UAE), Singtel (Singapore), Tata Communications (India), CommScope (US), Arista Networks (US), TP-Link (China), Wifirst (UK), Alcatel-Lucent Enterprise (France), Jio (India), Spectra (India), Telstra (Australia), Viasat (US), Adtran (US), Allied Telesis (Japan), 4ipnet (Taiwan), LANCOM Systems (Germany), Ruijie Networks (China), Datto (US), Superloop (Australia), Cambium Networks (US), Redway Networks (England), Cucumber Tony (UK), Tanaza (Italy), and Edgecore Networks (Taiwan).

What are the key technological trends prevailing in the Wi-Fi as a Service market?

The Wi-Fi as a Service market is experiencing key trends such as AI-driven network management, cloud-native Wi-Fi infrastructure, IoT connectivity integration, SASE and Zero Trust adoption, multi-access edge computing (MEC) compatibility, Wi-Fi 6 and Wi-Fi 6E deployment, API-first and open architecture, and Network-as-a-Service (NaaS) convergence.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wi-Fi as a Service Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Wi-Fi as a Service Market