Managed Network Services Market

Managed Network Services Market by Type (Managed LAN, Managed Wi-Fi, Managed WAN, Managed VPN, Network Monitoring, Managed NFV, Managed Network Security), Vertical (BFSI, IT & Telecom, Manufacturing), and Region - Global Forecast to 2030

OVERVIEW

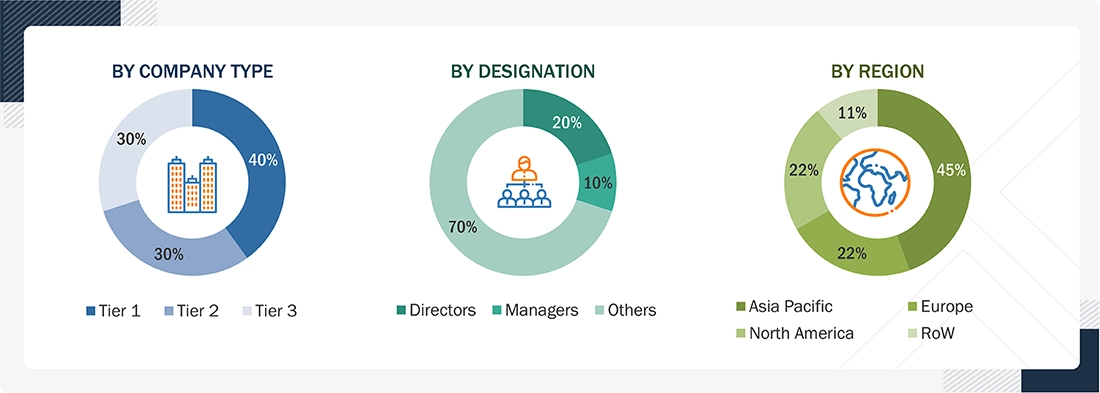

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The managed network services market is projected to expand from USD 120.74 billion in 2025 to USD 172.04 billion by 2030, at a CAGR of 7.3% during the forecast period. The managed network services market is experiencing strong growth as enterprises outsource connectivity and security to meet the challenges of rapid digital expansion. Businesses are demanding networks that are smarter, more secure, and more adaptable. Managed service providers are responding with AI-powered platforms that offer automation, ongoing visibility, and integrated threat prevention.

KEY TAKEAWAYS

-

BY TYPEManaged LAN services are crucial for organizations with complex network infrastructures or limited IT resources. They enable businesses to focus on their core activities while ensuring smooth, secure, and cost-effective network performance.

-

BY MANAGED NETWORK SECURITYRapidly evolving threats, such as ransomware and supply chain attacks, are forcing organizations to have continuous detection and fast incident response capabilities that many lack internally. This pushes firms to buy managed network security for expert monitoring and threat hunting.

-

BY VERTICALWith the rise of mobile banking, networks are exposed to threats due to network tampering or cyberattacks. This may lead to network failure or financial instability, driving the demand for managed network services for the BFSI vertical.

-

BY REGIONThe managed network services market covers North America, Europe, Asia Pacific, Latin America, the Middle East & Africa. Asia Pacific is projected to record the highest CAGR during 2025–2030, fueled by the rapid rollout of 5G networks, large-scale government digital infrastructure, and smart city programs, increasing demand for managed network deployments and operations.

-

COMPETITIVE LANDSCAPEMajor market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Cisco (US), AT&T (US), Huawei (China) and Verizon (US) have entered into a number of agreements and partnerships to cater to the growing demand for managed network services across innovative applications.

The managed network services market is entering a new growth cycle as enterprises shift from owning network assets to relying on expert providers for performance, resilience, and security. Companies are increasingly prioritizing predictable service levels, simplified management, and cost efficiency while focusing internal teams on digital transformation

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of SD-WAN, SASE, and zero trust, network-as-a-service, AI/automation for assurance, cloud-native orchestration, and edge integration, and are shifting networks from device-centric to service-centric subscription models with unified security. Disruptions include virtualization, vendor consolidation, and real-time analytics. End users gain faster provisioning, lower OPEX, higher uptime, and new revenue streams.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Outsourcing of IT expertise by small and medium-sized businesses.

-

Technological advancements impacting enterprise networks

Level

-

Privacy and security concerns in outsourcing network management

-

Increasing regulations and compliance issues

Level

-

Exponential growth in global IP traffic and cloud traffic

-

Ability to provide value-added services above and beyond core network infrastructure

Level

-

Navigating customer support depending on MSP response times

-

Establishing clear expectations and requirements

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Outsourcing of IT expertise by small and medium-sized businesses.

The rapid outsourcing of IT expertise by small and medium-sized businesses is set to drive strong growth in the managed network services market. SMEs are increasingly relying on managed service providers to overcome skill shortages, manage complex networks, and ensure uninterrupted operations. With digital transformation becoming essential, smaller enterprises prefer outsourcing to access advanced technologies like AI-driven monitoring, SD-WAN, and zero-trust security without large capital investments. This shift enables them to focus on core operations while benefiting from enterprise-grade network management. The demand from SMEs will expand sharply as network complexity rises and hybrid work models persist. Managed network providers that offer affordable, scalable, and integrated solutions tailored to smaller organizations will capture a significant portion of new market growth, making SME adoption one of the most powerful long-term demand drivers.

Restraint: Privacy and security concerns in outsourcing network management

Privacy and security concerns remain a major restraint in the managed network services market, particularly as organizations become more cautious about sharing sensitive data with external providers. Outsourcing network management introduces risks related to data access, regulatory compliance, and potential exposure to cyber threats. Enterprises handling confidential information — especially in sectors like BFSI, healthcare, and government — often hesitate to grant third parties control over core network functions. As a result, adoption may be slower in highly regulated industries unless providers can demonstrate compliance, transparency, and strong data governance. The security assurance is expected to be a decisive factor in vendor selection. Managed service providers that invest in advanced encryption, zero-trust frameworks, and compliance certifications such as ISO 27001 will gain customer confidence. Addressing privacy risks through stronger accountability and secure-by-design architectures will be key to unlocking further market growth

Opportunity: Exponential growth in global IP traffic and cloud traffic

The exponential rise in global IP and cloud traffic presents a major opportunity for managed network service providers. As enterprises move more workloads to the cloud, their networks must support higher data volumes, more distributed users, and greater application diversity. This surge is driving demand for managed solutions that can optimize performance, maintain reliability, and ensure secure data exchange across complex hybrid environments. The proliferation of video collaboration, IoT devices, and digital platforms is pushing networks beyond traditional limits. Managed service providers that offer AI-based traffic management, network analytics, and edge orchestration will benefit the most. The ability to deliver scalable bandwidth and intelligent traffic optimization will become a key differentiator. This rising data intensity will reinforce the value of managed services as essential enablers of efficient, high-performance, and secure digital connectivity across all industries

Challenge: Navigating customer support depending on MSP response times

Customer experience and response time remain key challenges for managed network service providers. Enterprises expect instant resolution of network disruptions and proactive communication from their providers. Delays in issue detection or escalation can lead to downtime, productivity loss, and customer dissatisfaction. As networks become more distributed and complex, managing service quality at scale becomes increasingly difficult. During the forecast period, response time performance is expected to become a primary factor influencing customer retention and competitive positioning. Providers must enhance their support frameworks with AI-driven monitoring, predictive maintenance, and automated incident response to meet rising expectations. Those failing to ensure consistent, transparent communication risk losing credibility. The growth of the providers that combine technology excellence with service agility, offering round-the-clock support and measurable service-level commitments. In an era of always-on operations, responsiveness will define long-term success in managed network services.

Managed Network Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Managed SD-WAN and SASE for retail, branch and hybrid enterprises (site onboarding, transport + security) | Centralized SD-WAN orchestration, integrated security, and faster site rollouts |

|

Managed network services with application-aware SD-WAN and proactive performance monitoring for large enterprises | App-aware routing, performance assurance, and reduced network ops burden |

|

Cloud-managed campus/branch networking + managed SD-WAN and partner MSP programs for multi-site customers | Cloud orchestration, automation, unified security, and telemetry |

|

End-to-end managed LAN, WAN, SD-WAN, private wireless and edge services with global lifecycle delivery | Global operations, multi-vendor integration, faster incident resolution, and lower OPEX |

|

Flexible SD-WAN / SD-Branch and managed global connectivity with cloud integration for multinational customers | Scalable secure connectivity, cloud on-ramps, and centralized global management |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The managed network services market is very competitive, with many vendors targeting specific or niche segments. In recent years, the market has seen several changes. Vendors are forming various partnerships and collaborations to create comprehensive solutions that meet a broad spectrum of needs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Managed Network Services Market, By Type

The managed WAN segment is undergoing a major transformation as enterprises seek to modernize connectivity for agility, reliability, and security. Businesses are shifting from traditional WAN models toward service-driven architectures that deliver real-time adaptability and operational transparency. Managed WAN providers now integrate AI-powered monitoring and cloud-native control systems to ensure seamless application performance across multiple environments. In 2024, BT Group upgraded its managed SD WAN portfolio for global clients using Fortinet’s secure networking technology, providing optimized traffic routing, advanced threat protection, and unified management. This deployment underscores how providers are blending connectivity and security into a single managed framework. As organizations expand into multi-cloud and edge ecosystems, managed WAN services will continue to evolve into intelligent, outcome-based solutions that align network behavior with business goals, driving the next wave of digital transformation across industries.

Managed Network Services Market, By Managed Network Security

The managed firewall market is rapidly growing as enterprises seek proactive, intelligent protection against complex cyber threats. Businesses are moving away from static, device-based firewalls toward cloud-managed solutions that provide visibility, automation, and seamless integration across global networks. Managed service providers are incorporating behavioral analytics and real-time threat intelligence to deliver adaptive security tailored to each customer’s risk profile. In 2024, Orange Cyberdefense strengthened its managed firewall offering by integrating Check Point’s Infinity platform, allowing customers to achieve unified security management and automated incident response across multiple regions. This shift demonstrates the value of managed firewalls as strategic enablers of digital resilience. Looking ahead, organizations will prioritize providers that combine operational expertise with AI-driven insights, ensuring consistent protection and performance across distributed environments. The managed firewall segment will remain a cornerstone of enterprise security modernization in the coming years.

Managed Network Services Market, By Vertical

Healthcare providers are turning to managed network services to power connected care, digital hospitals, and telehealth platforms. The Cleveland Clinic’s Mentor Hospital launched in 2023 with an Ericsson-powered private 5G mmWave network, integrating connectivity for medical imaging, asset tracking, and real-time patient data exchange. This illustrates how healthcare organizations are embedding managed connectivity from the ground up to ensure reliability and compliance. Market growth is being driven by rising telemedicine adoption, the proliferation of IoT medical devices, and the need to secure electronic health records under strict data protection laws such as HIPAA and GDPR. Increasing reliance on cloud-based diagnostics, AI-enabled imaging, and remote patient monitoring will further accelerate the shift toward managed, intelligent, and resilient network solutions across the healthcare ecosystem.

REGION

North America to be largest region in global managed network services market during forecast period

The managed network services market across the Asia Pacific region is experiencing robust growth, driven by widespread enterprise cloud integration, the proliferation of remote operational paradigms, and government-driven digital transformation initiatives. Organizations are increasingly outsourcing network management functions to optimize operational efficiency, enhance network visibility, and secure complex, distributed infrastructures. The surge in IoT deployments and inter-data center connectivity is further accelerating regional expansion, with demand mounting for scalable, agile, and AI-enabled service architectures. Over the forecast period, managed network services will be integral for enterprises striving to balance innovation, security, and operational resilience within an increasingly interconnected digital ecosystem.

Managed Network Services Market: COMPANY EVALUATION MATRIX

In the managed network services market matrix, Cisco (Star) leads with a strong market share and extensive product footprint, driven by its offering customized solutions as per customers' requirements and adopting growth strategies to achieve advanced technology consistently. Deutsche Telekom (Emerging Leader) is gaining visibility with its innovative solutions to cater to future managed network services demands. While Cisco dominates through scale and a diverse portfolio, Deutsche Telekom shows significant potential to move toward the leaders’ quadrant as demand for managed network services continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 120.74 Billion |

| Market Forecast in 2030 (Value) | USD 172.04 Billion |

| Growth Rate | CAGR of 7.3% from 2025 to 2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Managed Network Services Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Telecom Operator (India) | Market Share Analysis: Market Share Analysis of Global vs Regional Players for Each Region—North America, Europe, Asia Pacific, Middle East & Africa, and Latin America | Identifying regional white spaces, regulatory or delivery constraints, and realistic revenue/market-entry targets |

| Leading Telecom Operator (India) | Market Share Analysis: Market Share Analysis of Type of Players | Supports M&A scouting, partner prioritization and positioning |

| Leading Telecom Operator (India) | Major Global Players and List of Regional Players in the Managed Network Services Market | Speeds vendor selection, partnership outreach and operational planning by exposing delivery footprints, strengths and gaps at both global and local levels |

RECENT DEVELOPMENTS

- August 2025 : AT&T Business and Cisco partnered to introduce a new, cloud-delivered Secure Access Service Edge (SASE) solution. This collaboration combines AT&T’s network expertise with Cisco’s security and networking technologies to offer a unified service that simplifies IT management, strengthens security, and ensures reliable connectivity. The goal is to provide a single, consistent platform that helps businesses of all sizes, from mid-sized companies to large global enterprises, securely connect users and devices to applications from anywhere.

- September 2025 : Fujitsu Limited, its subsidiary 1Finity Inc., and Arrcus Inc. announced a strategic partnership to deliver next-generation network solutions for the AI era. The collaboration combines Fujitsu's global customer reach and AI expertise, 1Finity's network infrastructure leadership, and Arrcus's hyperscale networking software to target network operators, enterprises, and data center providers with comprehensive solutions spanning design, deployment, and managed services.

- May 2025 : The company strengthened a long-term partnership for cloud connectivity services and a comprehensive network software program, integrating 6WIND’s virtualized routing technologies with Orange’s managed networking services for enhanced enterprise solutions.

Table of Contents

Methodology

The research study involved four major activities in estimating the managed network services market size. Exhaustive secondary research was conducted to gather key information about the market and its peer markets. The next step was to validate these findings and assumptions, and size them up with the help of primary research involving industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. After the market breakdown, data triangulation was utilized to estimate the sizes of segments and sub-segments.

Secondary Research

The revenue generated by the companies offering managed network services to various end users was determined based on the secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. These include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was primarily used to gather critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on industry trends, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from managed network services vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use managed network services solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their use of managed network services solutions which is expected to affect the overall managed network services market growth.

Note: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies have revenues between USD

500 million and 1 billion, and Tier 3 companies have revenues less than USD 500 million.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the managed network services market. These methods were also used extensively to estimate the size of various subsegments in the market.

Managed Network Services Market : Top-Down and Bottom-Up Approach

Data Triangulation

The managed network services market was segmented into several categories and subcategories after determining the overall market size through the above estimation process. To complete the overall market engineering process and obtain precise statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, as applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The managed network services market size was validated using top-down and bottom-up approaches.

Market Definition

Managed network services (MNS) are a type of IT service in which a third-party provider takes over the responsibility of managing, maintaining, and supporting an organization’s network. Instead of a company’s in-house IT team handling these tasks, they outsource them to a specialized provider. This provider uses its expertise, technology, and staff to ensure the network operates efficiently, securely, and reliably. Key aspects of MNS are outsourcing network management, network design and implementation, performance management, security management, and cloud connectivity.

Stakeholders

- Cloud Service Providers (CSPs)

- Independent Software Vendors (ISVs)

- System Integrators

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Small and Medium-sized Enterprises (SMEs)

- IT Strategy Consultants

- Managed Service Consulting Vendors

- Technology Partners

- Research Organizations

- Enterprise Users

- Technology Providers

Report Objectives

- To determine and forecast the global managed network services market by type (managed LAN, managed Wi-Fi, managed VPN, managed WAN, network monitoring, managed NFV, and managed network security), managed network security, vertical, and region from 2025 to 2030, and analyze various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments concerning North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the managed network services market

- To strategically analyze the macro and micromarkets with concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the managed network services market

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Managed Network Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Managed Network Services Market