Womens Health Diagnostics Market by Application (Biopsy, Cervical & Ovarian Cancer Testing, PAP Smear, HPV, TORCH, Prenatal Testing, Hepatitis, Ultrasound, Obstetrics), End User (Hospitals, Clinics, Home Care) & Region - Global Forecast to 2025

Market Growth Outlook Summary

The global womens health diagnostics market growth forecasted to transform from $25.0 billion in 2020 to $36.6 billion by 2025, driven by a CAGR of 7.9%. The market growth is mainly driven by growing awareness about various health-related disorders, rising incidence of chronic and lifestyle disorders, and the high prevalence of infectious diseases such as HIV and hepatitis in women across the globe. The increasing adoption of POC diagnostic testing and the growth in the number of diagnostic and imaging centers are also expected to support the growth of this market during the forecast period. However, the high cost of diagnostic devices, tests, and procedures; shortage of skilled laboratory technicians; and insufficient reimbursements for diagnostic tests are expected to restrain this market's growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Womens Health Diagnostics Market Dynamics

Driver: High prevalence of infectious diseases in women

Diagnostic tests such as POC tests are commonly used to detect HIV among patients. A rapid POC HIV test enables physicians to provide results and the HIV status of patients during the same visit. It does not require pre-test and post-test counseling of patients, as is common during traditional laboratory analysis. In addition to HIV, women are more susceptible to other sexually transmitted diseases (STDs) and their long-term complications. In the US, more than 50% of preventable infertility cases are related to STDs. Most sexually transmitted pathogens can be passed to the fetus or infant, sometimes with fatal consequences. Rapid POC tests can improve the management of infectious diseases, such as HIV, UTIs, and tuberculosis, especially in developing countries where access to timely medical care is a challenge and the healthcare infrastructures are outdated.

Restraint: High cost of diagnostic imaging systems and procedures

Most hospitals in developing countries cannot afford high-cost diagnostic imaging systems. The average cost of MRI machines is approximately USD 1.5 million to USD 2.0 million, while CT machines cost approximately USD 1.0 million to USD 1.5 million. Due to the high cost of these systems and low financial resources of hospitals, healthcare facilities such as hospitals and diagnostic centers are reluctant to invest in expensive equipment. Healthcare facilities that purchase these costly systems often depend on third-party payers (such as Medicare, Medicaid, or private health insurance plans) to get reimbursements for the costs incurred in the diagnostic and screening procedures performed using these devices.

Opportunity: Growing number of regulatory approvals for immunoassay diagnostic techniques

Immunoassays are a commonly used technology/platform for diagnosing various conditions in women. In the past few years, many new immunoassays have received FDA or CE Mark approvals. Some examples are listed below:

- In September 2019, Roche Diagnostics Ltd. (Switzerland) received FDA approval for the cobas HBV and cobas HCV viral load test assays to be used with its cobas 6800 and cobas 8800 Systems.?

- In March 2018, Alere, Inc. (US) received the IVD CE Mark for its Alere q HIV-1/2 Detect assay, a new molecular diagnostic platform that offers POC access for acute detection of HIV in mothers and infants.

- In July 2018, Alere’s Determine HIV-1/2 Ag/Ab Combo was approved by the FDA to detect the HIV p24 antigen and antibodies to HIV-1 and/ or HIV-2 through POC testing.

Challenge: Increasing adoption of refurbished diagnostic imaging systems

Many hospitals in developing countries cannot invest in diagnostic imaging equipment due to their high cost, poor reimbursement rates, and budgetary constraints. However, due to the high demand for diagnostic imaging procedures in these nations, hospitals that cannot afford to invest in new imaging systems opt for refurbished ones. Refurbished systems are priced lower than new systems, costing approximately in the range of 40% to 60% of the original price of the equipment.

Owing to this, many market leaders are now promoting refurbished devices through various programs. For instance, Siemens’ Medical Proven Excellence Program, GE Healthcare’s Gold Seal Program, and Philips’ Diamond Select Program are some noteworthy global refurbishing programs promoting the utilization of refurbished diagnostic imaging systems.

The breast cancer testing segment accounts for the largest share of the womens health diagnostics industry, by application, in 2019

Based on application, the womens health diagnostics market is divided into nine segments—osteoporosis testing, OVC testing, cervical cancer testing, breast cancer testing, pregnancy & fertility testing, prenatal genetic screening & carrier testing, infectious disease testing, STD testing, and ultrasound tests. The breast cancer testing segment accounted for the larger market share in 2019. The large share of this segment can be attributed to the increasing incidence of breast cancer and rising awareness about advanced breast cancer diagnostic techniques, such as ABUS.

The home care settings segment of the womens health diagnostics industry is expected to grow at the highest CAGR during the forecast period

Based on end users, the womens health diagnostics market is segmented into hospitals & clinics, diagnostic & imaging centers, and home care settings. The home care settings segment is expected to witness the highest growth during the forecast period. The increasing advantages of using self-testing kits will continue to drive market growth. Patient self-testing enables patients to better manage their diseases by utilizing home/self-testing kits. Technological advancements have made many self-testing kits available for various conditions, such as pregnancy and ovulation.

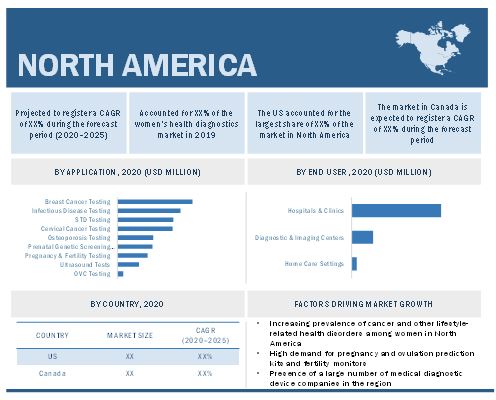

North America is expected to account for the largest share of the womens health diagnostics industry in 2019

In 2019, North America accounted for the largest share of the womens health diagnostics industry, followed by Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The large share of this market segment can be attributed to the increasing prevalence of cancer among women, the growing focus of manufacturers of women’s health diagnostic products on expanding their presence in this region, and the increasing demand for fertility testing monitors. In addition, the rising acceptance of POC diagnostics and PST practices is also expected to drive the growth of this regional segment during the forecast period.

The prominent players in this market are Quest Diagnostics Incorporated (US), Hologic, Inc. (US), Abbott Laboratories (US), Siemens AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Cardinal Health, Inc. (US), General Electric Company (US), and Becton, Dickinson and Company (US).

Scope of the Womens Health Diagnostics Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$25.0 billion |

|

Estimated Value by 2025 |

$36.6 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.9% |

|

Market Driver |

High prevalence of infectious diseases in women |

|

Market Opportunity |

Growing number of regulatory approvals for immunoassay diagnostic techniques |

The study categorizes the global Womens Health Diagnostics Market to forecast revenue and analyze trends in each of the following submarkets:

By Application

-

Osteoporosis Testing

- Bone Densitometry

- In Vitro Blood Tests

-

OVC Testing

- OVC Tumor Marker Tests

- OVC Diagnostic Imaging Tests

- Other OVC Tests

-

Cervical Cancer Testing

- Pap Smears

- HPV Testing

-

Breast Cancer Testing

- Mammography

- Breast Cancer Tumor Marker Tests

- Biopsies

- Other Breast Cancer Tests

-

Pregnancy & Fertility Testing

- Lab-based Testing

- Pregnancy Testing & Ovulation Prediction Kits

- Fertility Monitors

-

Prenatal Genetic Screening & Carrier Testing

- CF Testing

- Down’s Syndrome and Edwards’ Syndrome Testing

- TORCH Testing

- Other Prenatal Genetic Disease Tests

-

Infectious Disease Testing

- MRSA Testing

- UTI Testing

- Hepatitis Testing

- Tuberculosis Testing

- Other Infectious Disease Tests

-

STD Testing

- CT/NG Testing

- HIV Testing

- Other STD Tests

-

Ultrasound Tests

- Breast Imaging

- OB/GYN Imaging

By End User

- Hospitals & Clinics

- Diagnostic and Imaging Centers

- Home Care Settings

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments of Womens Health Diagnostics Industry

- In 2021, F. Hoffmann-La Roche Ltd. Launched the uPath HER2 (4B5) Image Analysis and uPath Dual ISH Image Analysis.

- In 2021, Hologic, Inc. acquired Biotheranostics, a privately held, commercial-stage company that provides molecular diagnostic tests for breast and metastatic cancers, to strengthen its presence in the women’s health diagnostics market.

- In 2020, Hologic, Inc. launched the 3DQuorum Imaging Technology in Europe.

- In 2019, Carestream Health, Inc. opened a new global business operations center in Mumbai, India, expanding its market presence.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global womens health diagnostics market?

The global womens health diagnostics market boasts a total revenue value of $36.6 billion by 2025.

What is the estimated growth rate (CAGR) of the global womens health diagnostics market?

The global womens health diagnostics market has an estimated compound annual growth rate (CAGR) of 7.9% and a revenue size in the region of $25.0 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 WOMENS HEALTH DIAGNOSTICS MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

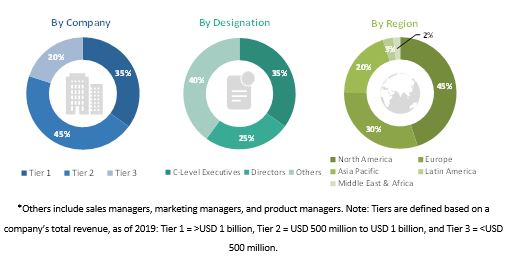

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 MARKET ANALYSIS APPROACH

FIGURE 8 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION APPROACH

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSING THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 12 WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2020 VS. 2025

FIGURE 13 WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2020 VS. 2025

FIGURE 14 GEOGRAPHIC SNAPSHOT: MARKET

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 WOMENS HEALTH DIAGNOSTICS MARKET OVERVIEW

FIGURE 15 RISING INCIDENCE OF CHRONIC AND LIFESTYLE-RELATED DISORDERS TO DRIVE GROWTH IN THE WOMENS HEALTH DIAGNOSTICS INDUSTRY

4.2 APAC: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE (2019)

FIGURE 16 PREGNANCY TESTING & OVULATION PREDICTION KITS DOMINATED THE APAC PREGNANCY & FERTILITY TESTING MARKET IN 2019

4.3 GEOGRAPHIC SNAPSHOT OF THE MARKET

FIGURE 17 THE US COMMANDED THE LARGEST SHARE OF THE MARKET IN 2019

4.4 GEOGRAPHIC MIX: MARKET

FIGURE 18 APAC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 1 WOMENS HEALTH DIAGNOSTICS MARKET: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 High prevalence of infectious diseases in women

5.2.1.2 Rising incidence of chronic and lifestyle-related disorders in women

5.2.1.3 Increasing awareness about fertility testing in women and initiatives by government and health organizations

5.2.1.4 Increased adoption of POC and rapid diagnostic tests

5.2.1.5 Growth in the number of private diagnostic and imaging centers

5.2.1.6 Public-private partnerships are expected to enhance infrastructure in diagnostic imaging centers

5.2.2 MARKET RESTRAINTS

5.2.2.1 High cost of diagnostic imaging systems and procedures

5.2.2.2 Shortage of skilled laboratory technicians

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Improving healthcare infrastructure in emerging markets

5.2.3.2 Growing number of regulatory approvals for immunoassay diagnostic techniques

5.2.4 MARKET CHALLENGES

5.2.4.1 Stringent regulatory guidelines

5.2.4.2 Increasing adoption of refurbished diagnostic imaging systems

6 INDUSTRY INSIGHTS (Page No. - 68)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 GROWING FOCUS ON MICROFLUIDICS- AND NANOTECHNOLOGY-BASED POC DEVICES FOR DIAGNOSTICS

6.2.1.1 Microfluidics-based LOC devices for laboratory testing

6.2.1.2 Evolution of paper-based microfluidic POC diagnostic devices

6.2.2 RISING FOCUS OF MARKET COMPANIES ON PREGNANCY AND FERTILITY ISSUES IN EMERGING REGIONS

6.3 CLINICAL TRIALS ASSESSMENT FOR BREAST CANCER DIAGNOSTICS

FIGURE 19 CLINICAL STUDIES FOR BREAST CANCER DIAGNOSTIC DEVICES (2016-2019)

6.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 PORTER’S FIVE FORCES ANALYSIS

6.4.1 THREAT OF NEW ENTRANTS

6.4.2 THREAT OF SUBSTITUTES

6.4.3 BARGAINING POWER OF SUPPLIERS

6.4.4 BARGAINING POWER OF BUYERS

6.4.5 INTENSITY OF COMPETITIVE RIVALRY

6.5 REGULATORY ANALYSIS

6.5.1 NORTH AMERICA

6.5.1.1 US

6.5.1.2 Canada

TABLE 3 PRIMARY BREAST CANCER SCREENING MODALITIES IN CANADA

6.5.2 EUROPE

6.5.3 ASIA PACIFIC

6.5.3.1 Japan

6.5.3.2 China

6.6 VALUE CHAIN ANALYSIS

FIGURE 20 WOMENS HEALTH DIAGNOSTICS INDUSTRY: VALUE CHAIN ANALYSIS

6.7 ECOSYSTEM ANALYSIS

6.7.1 ECOSYSTEM ANALYSIS FOR THE MARKET

FIGURE 21 MARKET: ECOSYSTEM ANALYSIS

6.8 IMPACT OF COVID-19 ON THE MARKET

6.9 PATENT ANALYSIS

6.9.1 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR WOMEN’S HEALTH DIAGNOSTICS

FIGURE 22 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR WOMEN’S HEALTH DIAGNOSTICS PATENTS (2015–2020)

6.9.2 TOP INVENTORS FOR WOMEN’S HEALTH DIAGNOSTICS

FIGURE 23 TOP INVENTORS FOR WOMEN’S HEALTH DIAGNOSTICS PATENTS (2015–2020)

6.9.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR WOMEN’S HEALTH DIAGNOSTICS PATENTS

FIGURE 24 TOP APPLICANT COUNTRIES FOR WOMEN’S HEALTH DIAGNOSTICS PATENTS (2015–2020)

7 WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION (Page No. - 84)

7.1 INTRODUCTION

TABLE 4 WOMENS HEALTH DIAGNOSTICS INDUSTRY: PRODUCT PORTFOLIO ANALYSIS

TABLE 5 MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

7.2 BREAST CANCER TESTING

TABLE 6 BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 7 BREAST CANCER TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.2.1 MAMMOGRAPHY

7.2.1.1 Rising awareness of early detection of breast cancer to fuel the market growth

TABLE 8 MAMMOGRAPHY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.2.2 BREAST CANCER TUMOR MARKER TESTS

7.2.2.1 Increasing number of newly diagnosed breast cancer cases will drive the demand for breast cancer tumor marker tests

TABLE 9 BREAST CANCER TUMOR MARKER TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.2.3 BLOOD CHEMISTRY & BLOOD CELL COUNT TESTS

7.2.3.1 Growing need for checking the proper functioning of body organs and preventing the spread of infection to other organs will drive market growth

TABLE 10 BLOOD CHEMISTRY & BLOOD CELL COUNT TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.2.4 BIOPSIES

7.2.4.1 Growing incidence of breast cancer and high demand for minimally invasive procedures to augment market growth

TABLE 11 BIOPSIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.2.5 OTHER BREAST CANCER TESTS

TABLE 12 OTHER BREAST CANCER TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3 INFECTIOUS DISEASE TESTING

TABLE 13 INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 14 INFECTIOUS DISEASE TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.1 UTI TESTING

7.3.1.1 Technological advancements like CT scans and ultrasound increase the need for UTI testing

TABLE 15 UTI TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.2 HEPATITIS TESTING

7.3.2.1 Dynamic shift from traditional diagnostic procedures to portable tests is expected to propel market growth

TABLE 16 HEPATITIS TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.3 TUBERCULOSIS TESTING

7.3.3.1 Rising tuberculosis cases in women will drive the demand for infectious disease testing

TABLE 17 TUBERCULOSIS TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.4 MRSA TESTING

7.3.4.1 Development of rapid MRSA tests will drive the market growth

TABLE 18 MRSA TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.3.5 OTHER INFECTIOUS DISEASE TESTS

TABLE 19 OTHER INFECTIOUS DISEASE TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 CERVICAL CANCER TESTING

TABLE 20 CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 21 CERVICAL CANCER TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.4.1 HPV TESTING

7.4.1.1 Easy availability of advanced tests and growing demand for using Pap/HPV co-testing to support market growth

TABLE 22 HPV TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.4.2 PAP SMEARS

7.4.2.1 Rising cervical cancer cases and government initiatives are propelling the growth of the market

TABLE 23 PAP SMEARS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5 STD TESTING

TABLE 24 STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 25 STD TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.1 HIV TESTING

7.5.1.1 Increasing government support and technological advancements are major factors driving market growth

TABLE 26 HIV TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.2 CT/NG TESTING

7.5.2.1 Technological advancements and rapid testing to drive market growth in this application segment

TABLE 27 CT/NG TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.5.3 OTHER STD TESTS

TABLE 28 OTHER STD TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.6 OSTEOPOROSIS TESTING

TABLE 29 OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 30 OSTEOPOROSIS TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.6.1 IN VITRO BLOOD TESTS

7.6.1.1 Growing risk of osteoporosis in women during menopause to drive the demand for in vitro blood tests

TABLE 31 IN VITRO BLOOD TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.6.2 BONE DENSITOMETRY

7.6.2.1 Growing aging population and high prevalence of osteoporosis in woman to drive the demand for this application segment

TABLE 32 BONE DENSITOMETRY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7 PRENATAL GENETIC SCREENING & CARRIER TESTING

TABLE 33 PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 34 PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.1 DOWN’S SYNDROME AND EDWARDS’ SYNDROME TESTING

7.7.1.1 Rising need for prenatal screening and easy availability of these tests to support market demand

TABLE 35 DOWN’S SYNDROME AND EDWARDS’ SYNDROME TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.2 TORCH TESTING

7.7.2.1 Various advantages of TORCH testing to drive the market demand

TABLE 36 TORCH TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.3 CF TESTING

7.7.3.1 Growing awareness about genetic disorders like cystic fibrosis to increase the demand for CF testing

TABLE 37 CF TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.7.4 OTHER PRENATAL GENETIC DISEASE TESTS

TABLE 38 OTHER PRENATAL GENETIC DISEASE TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.8 PREGNANCY & FERTILITY TESTING

TABLE 39 PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 PREGNANCY & FERTILITY TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.8.1 PREGNANCY TESTING & OVULATION PREDICTION KITS

7.8.1.1 Growing preference for confidentiality and accessibility of test results will drive market demand

TABLE 41 PREGNANCY TESTING & OVULATION PREDICTION KITS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.8.2 LAB-BASED TESTING

7.8.2.1 Increasing reliability of lab-based fertility tests to fuel market growth

TABLE 42 LAB-BASED TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.8.3 FERTILITY MONITORS

7.8.3.1 Fast and accurate data generation to increase the demand for fertility monitors

TABLE 43 FERTILITY MONITORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.9 ULTRASOUND TESTS

TABLE 44 ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 ULTRASOUND TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.9.1 OB/GYN IMAGING

7.9.1.1 Growing demand for minimally invasive techniques in gynecological applications to support market growth

TABLE 46 OB/GYN IMAGING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.9.2 BREAST IMAGING

7.9.2.1 Growing cases of breast cancer and the need for non-invasive procedures will drive the market demand for breast imaging

TABLE 47 BREAST IMAGING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.10 OVC TESTING

TABLE 48 OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 OVC TESTING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.10.1 OVC TUMOR MARKER TESTS

7.10.1.1 Need for early diagnosis of OVC will drive the demand for advanced diagnostic devices

TABLE 50 OVC TUMOR MARKER TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.10.2 OVC DIAGNOSTIC IMAGING TESTS

7.10.2.1 Rising prevalence of women’s health-related disorders and growing awareness about various imaging tests to drive market growth

TABLE 51 OVC DIAGNOSTIC IMAGING TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7.10.3 OTHER OVC TESTS

TABLE 52 OTHER OVC TESTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

8 WOMENS HEALTH DIAGNOSTICS MARKET, BY END USER (Page No. - 129)

8.1 INTRODUCTION

8.2 COVID-19 IMPACT ON THE WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER

TABLE 53 MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3 HOSPITALS & CLINICS

8.3.1 HOSPITALS & CLINICS ARE EXPECTED TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 54 MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2018–2025 (USD MILLION)

8.4 DIAGNOSTIC & IMAGING CENTERS

8.4.1 INCREASING NUMBER OF PRIVATE IMAGING CENTERS TO DRIVE MARKET GROWTH

TABLE 55 MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

8.5 HOME CARE SETTINGS

8.5.1 INCREASING ADVANTAGES OF USING SELF-TESTING KITS TO DRIVE GROWTH IN THE MARKET

TABLE 56 MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2018–2025 (USD MILLION)

9 WOMENS HEALTH DIAGNOSTICS MARKET, BY REGION (Page No. - 134)

9.1 INTRODUCTION

9.2 COVID-19 IMPACT ON VARIOUS REGIONS IN THE WOMENS HEALTH DIAGNOSTICS INDUSTRY

FIGURE 25 MARKET: GEOGRAPHIC SNAPSHOT (2019)

TABLE 57 MARKET, BY REGION, 2018–2025 (USD MILLION)

9.3 NORTH AMERICA

FIGURE 26 NORTH AMERICA: WOMENS HEALTH DIAGNOSTICS MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 NORTH AMERICA: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 NORTH AMERICA: WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.3.1 US

9.3.1.1 The US dominates the North American WOMENS HEALTH DIAGNOSTICS MARKET

TABLE 70 US: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 US: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 US: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 US: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 US: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 US: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 US: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 US: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 US: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 US: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 US: WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Surge in chronic lifestyle diseases and infectious diseases to support market growth in Canada

TABLE 81 CANADA: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 82 CANADA: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 CANADA: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 CANADA: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 CANADA: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 CANADA: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 CANADA: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 CANADA: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 CANADA: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 CANADA: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4 EUROPE

TABLE 92 EUROPE: WOMENS HEALTH DIAGNOSTICS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 94 EUROPE: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 EUROPE: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 EUROPE: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 EUROPE: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 EUROPE: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 EUROPE: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 EUROPE: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 EUROPE: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 EUROPE: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Growing investments by government and private contributors to fuel market growth

TABLE 104 GERMANY: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 105 GERMANY: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 GERMANY: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 GERMANY: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 GERMANY: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 GERMANY: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 GERMANY: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 111 GERMANY: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 GERMANY: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 GERMANY: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 GERMANY: WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.4.2 UK

9.4.2.1 Rising incidence of PCOS to increase the demand for diagnostic tests

TABLE 115 UK: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 116 UK: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 UK: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 UK: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 UK: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 120 UK: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 121 UK: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 UK: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 UK: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 UK: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 125 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Growing infertility rate among women in the country and rising cancer cases to drive the market

TABLE 126 FRANCE: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 127 FRANCE: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 FRANCE: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 129 FRANCE: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 130 FRANCE: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 FRANCE: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 FRANCE: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 133 FRANCE: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 FRANCE: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 FRANCE: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 136 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Increasing acceptance of molecular diagnostics-based personalized medicine and rising chronic diseases are major driving factors

TABLE 137 ITALY: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 138 ITALY: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 ITALY: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 ITALY: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 141 ITALY: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 142 ITALY: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 143 ITALY: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 144 ITALY: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 145 ITALY: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 146 ITALY: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 147 ITALY: WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 Improving healthcare system and increasing healthcare expenditure in Spain to drive market growth

TABLE 148 SPAIN: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 149 SPAIN: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 SPAIN: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 151 SPAIN: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 152 SPAIN: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 153 SPAIN: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025, (USD MILLION)

TABLE 154 SPAIN: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 SPAIN: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 156 SPAIN: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 157 SPAIN: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 158 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.4.6 ROE

TABLE 159 ROE: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 160 ROE: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 161 ROE: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 ROE: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 163 ROE: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 164 ROE: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 165 ROE: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 166 ROE: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 167 ROE: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 168 ROE: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 169 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5 APAC

FIGURE 27 APAC: WOMENS HEALTH DIAGNOSTICS MARKET SNAPSHOT

TABLE 170 APAC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 171 APAC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 172 APAC: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 APAC: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 174 APAC: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 175 APAC: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 176 APAC: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 177 APAC: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 178 APAC: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 179 APAC: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 180 APAC: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 181 APAC: WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.5.1 CHINA

9.5.1.1 Increasing urbanization and growing government initiatives to drive market growth in China

TABLE 182 CHINA: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 183 CHINA: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 184 CHINA: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 185 CHINA: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 186 CHINA: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 187 CHINA: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 188 CHINA: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 189 CHINA: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 190 CHINA: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025, (USD MILLION)

TABLE 191 CHINA: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 192 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.2 JAPAN

9.5.2.1 Presence of a universal healthcare reimbursement scenario and well-developed healthcare system to drive market growth in Japan

TABLE 193 JAPAN: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 194 JAPAN: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 195 JAPAN: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 196 JAPAN: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 197 JAPAN: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 198 JAPAN: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 199 JAPAN: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 200 JAPAN: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 201 JAPAN: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 202 JAPAN: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 203 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.5.3 INDIA

9.5.3.1 Improving healthcare infrastructure and growing private and public investments to support the market growth

TABLE 204 INDIA: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 205 INDIA: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 206 INDIA: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 207 INDIA: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 208 INDIA: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 209 INDIA: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 210 INDIA: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 211 INDIA: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 212 INDIA: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 213 INDIA: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 214 INDIA: WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.5.4 ROAPAC

TABLE 215 ROAPAC: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 216 ROAPAC: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 217 ROAPAC: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 218 ROAPAC: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 219 ROAPAC: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 220 ROAPAC: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 221 ROAPAC: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 222 ROAPAC: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 223 ROAPAC: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 224 ROAPAC: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 225 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 AVAILABILITY OF ADVANCED CARE AND INCREASING AWARENESS PROGRAMS TO FUEL MARKET GROWTH

TABLE 226 LATIN AMERICA: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 227 LATIN AMERICA: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 228 LATIN AMERICA: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 229 LATIN AMERICA: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 230 LATIN AMERICA: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 231 LATIN AMERICA: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 232 LATIN AMERICA: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 233 LATIN AMERICA: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 234 LATIN AMERICA: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 235 LATIN AMERICA: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 236 LATIN AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9.7 MIDDLE EAST & AFRICA

9.7.1 INCREASING INCIDENCE OF LIFESTYLE DISEASES TO AUGMENT MARKET GROWTH IN THE MIDDLE EAST & AFRICA

TABLE 237 MIDDLE EAST & AFRICA: WOMENS HEALTH DIAGNOSTICS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 238 MIDDLE EAST & AFRICA: BREAST CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 239 MIDDLE EAST & AFRICA: OSTEOPOROSIS TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 240 MIDDLE EAST & AFRICA: INFECTIOUS DISEASE TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 241 MIDDLE EAST & AFRICA: PREGNANCY & FERTILITY TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 242 MIDDLE EAST & AFRICA: ULTRASOUND TESTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 243 MIDDLE EAST & AFRICA: STD TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 244 MIDDLE EAST & AFRICA: PRENATAL GENETIC SCREENING & CARRIER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 245 MIDDLE EAST & AFRICA: CERVICAL CANCER TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 246 MIDDLE EAST & AFRICA: OVC TESTING MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 247 MIDDLE EAST & AFRICA: WOMENS HEALTH DIAGNOSTICS INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 213)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES

10.3 REVENUE SHARE ANALYSIS OF TOP PLAYERS

FIGURE 28 REVENUE ANALYSIS OF TOP PLAYERS IN THE WOMENS HEALTH DIAGNOSTICS MARKET

10.4 MARKET SHARE ANALYSIS

FIGURE 29 WOMENS HEALTH DIAGNOSTICS INDUSTRY SHARE, BY KEY PLAYER, 2019

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVES

10.5.4 PARTICIPANTS

FIGURE 30 WOMENS HEALTH DIAGNOSTICS INDUSTRY: COMPETITIVE LEADERSHIP MAPPING (2019)

10.6 COMPANY PRODUCT FOOTPRINT

10.7 COMPANY GEOGRAPHIC FOOTPRINT OF MAJOR PLAYERS IN THE WOMENS HEALTH DIAGNOSTICS INDUSTRY

FIGURE 32 GEOGRAPHIC REVENUE MIX: WOMEN’S HEALTH DIAGNOSTICS MARKET (2019)

10.8 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

10.8.1 PROGRESSIVE COMPANIES

10.8.2 DYNAMIC COMPANIES

10.8.3 STARTING BLOCKS

10.8.4 RESPONSIVE COMPANIES

FIGURE 33 MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2019)

10.9 COMPETITIVE SCENARIO

10.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

TABLE 248 PRODUCT LAUNCHES & ENHANCEMENTS

10.9.2 EXPANSIONS

10.9.3 ACQUISITIONS

10.9.4 OTHER STRATEGIES

11 COMPANY PROFILES (Page No. - 226)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments)*

11.1.1 QUEST DIAGNOSTICS INCORPORATED

FIGURE 34 QUEST DIAGNOSTICS INCORPORATED: COMPANY SNAPSHOT (2019)

11.1.2 HOLOGIC, INC.

FIGURE 35 HOLOGIC, INC.: COMPANY SNAPSHOT (2020)

11.1.3 SIEMENS AG

FIGURE 36 SIEMENS AG: COMPANY SNAPSHOT (2020)

11.1.4 F. HOFFMANN-LA ROCHE LTD.

FIGURE 37 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2019)

11.1.5 ABBOTT LABORATORIES

FIGURE 38 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2019)

11.1.6 BECTON, DICKINSON AND COMPANY

FIGURE 39 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2020)

11.1.7 GENERAL ELECTRIC COMPANY

FIGURE 40 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT (2019)

11.1.8 PERKINELMER, INC.

FIGURE 41 PERKINELMER, INC.: COMPANY SNAPSHOT (2019)

11.1.9 KONINKLIJKE PHILIPS N.V.

FIGURE 42 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2019)

11.1.10 BIOMÉRIEUX SA

11.2 SME PLAYERS

11.2.1 CARDINAL HEALTH, INC.

FIGURE 43 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2020)

11.2.2 SUPERSONIC IMAGINE

11.2.3 FUJIFILM HOLDINGS CORPORATION

11.2.4 GUIDED THERAPEUTICS, INC.

11.2.5 DIALAB GMBH

11.2.6 CARESTREAM HEALTH, INC.

11.2.7 MEDGYN PRODUCTS, INC.

11.2.8 COOK MEDICAL, INC.

11.2.9 OSTEOMETER MEDITECH, INC.

11.2.10 NEUROLOGICA CORPORATION

*Business Overview, Products Offered, Recent Developments, might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 262)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global womens health diagnostics market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The supply side's primary sources include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the womens health diagnostics market. The primary sources from the demand side include industry experts such as medical device manufacturers, hospitals, clinics, laboratories, research scientists, and other related key opinion leaders.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study,download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by application type, end user, and region).

Data Triangulation

After arriving at the market size, the total womens health diagnostics market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the womens health diagnostics market by application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall womens health diagnostics market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the womens health diagnostics market in five main regions along with their respective key countries, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the womens health diagnostics market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as acquisitions, new product launches, expansions, collaborations, and partnerships, of the leading players in the women’s health diagnostics market

- To benchmark players within the women’s health diagnostics market using the “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Asia Pacific womens health diagnostics market into Australia, New Zealand, and others

- Further breakdown of European womens health diagnostics market into the Netherlands, Denmark, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Womens Health Diagnostics Market

Who are the target audience for the global study of Women’s Health Diagnostics Market?

I want more detailed overview of emerging trends in the global Women’s Health Diagnostics Market. Thank you

Which of the key players will hold the largest share of the global Women’s Health Diagnostics Market by 2028?