4

MARKET OVERVIEW

Automation demand and Industry 4.0 drive market growth amid high costs and infrastructure challenges.

48

4.2.1.1

RISING DEMAND FOR AUTOMATION ACROSS DIVERSE INDUSTRIES

4.2.1.2

GROWING EMPHASIS ON IMPROVING WORKPLACE SAFETY

4.2.1.3

TRANSITION FROM MASS PRODUCTION TOWARD FLEXIBLE, CUSTOMIZED MANUFACTURING

4.2.1.4

SURGING DEMAND FOR ADVANCED MATERIAL HANDLING TECHNOLOGIES

4.2.1.5

BOOMING E-COMMERCE INDUSTRY

4.2.2.1

HIGH INSTALLATION, MAINTENANCE, AND SWITCHING COSTS

4.2.2.2

GROWING PREFERENCE FOR MOBILE ROBOTS OVER AGVS

4.2.2.3

INFRASTRUCTURE LIMITATIONS IN DEVELOPING MARKETS

4.2.3.1

TRANSFORMATION OF WAREHOUSING THROUGH ADOPTION OF INDUSTRY 4.0 TECHNOLOGIES

4.2.3.2

GROWING INVESTMENT IN AGVS BY SMALL AND MEDIUM-SIZED ENTERPRISES

4.2.3.3

RAPID INDUSTRIALIZATION AND E-COMMERCE EXPANSION IN EMERGING MARKETS

4.2.3.4

ONGOING INNOVATIONS TO IMPROVE AGV PERFORMANCE

4.2.4.1

LOWER LABOR EXPENSES IN EMERGING MARKETS

4.2.4.2

OPERATIONAL DOWNTIME DUE TO TECHNICAL ISSUES

4.3

INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

4.4

STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5

INDUSTRY TRENDS

Dive into the evolving dynamics shaping industry landscapes through strategic analysis and emerging trends.

58

5.1

PORTER’S FIVE FORCES ANALYSIS

5.1.1

BARGAINING POWER OF SUPPLIERS

5.1.2

BARGAINING POWER OF BUYERS

5.1.3

THREAT OF NEW ENTRANTS

5.1.4

THREAT OF SUBSTITUTES

5.1.5

INTENSITY OF COMPETITIVE RIVALRY

5.2

MACROECONOMIC OUTLOOK

5.2.2

GDP TRENDS AND FORECAST

5.2.3

TRENDS IN GLOBAL E-COMMERCE & RETAIL INDUSTRY

5.2.4

TRENDS IN AUTOMOTIVE INDUSTRY

5.5.1

PRICING RANGE OF AUTOMATED GUIDED VEHICLES, BY KEY PLAYER, 2025

5.5.2

AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021–2025

5.5.3

AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021–2025

5.6

INVESTMENT AND FUNDING SCENARIO

5.7.1

IMPORT SCENARIO (842710)

5.7.2

EXPORT SCENARIO (842710)

5.8

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.9

KEY CONFERENCES AND EVENTS, 2026

5.10.1

TOYOTA ADOPTS MASTERMOVER'S AGV300 TO ENHANCE PRODUCTIVITY AND REDUCE WASTE

5.10.2

SCOTT PROVIDES AGV AND PALLETISING SYSTEM TO ENHANCE PRODUCT AND WORKER SAFETY AND MINIMIZE DOWNTIME

5.10.3

E80 GROUP IMPLEMENTS LGVS AT METSÄ TISSUE’S WAREHOUSES TO IMPROVE OPERATIONAL PERFORMANCE

5.11

IMPACT OF 2025 US TARIFF – AUTOMATED GUIDED VEHICLE MARKET

5.11.3

PRICE IMPACT ANALYSIS

5.11.4

IMPACT ON COUNTRIES/REGIONS

5.11.5

IMPACT ON INDUSTRIES

6

TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

AI-driven innovations revolutionize automated guided vehicles, enhancing market potential and technological integration.

82

6.1.1

ARTIFICIAL INTELLIGENCE

6.2

ADJACENT TECHNOLOGIES

6.2.1

INDUSTRIAL INTERNET OF THINGS

6.2.2

NEXT-GENERATION WIRELESS TECHNOLOGIES

6.3

COMPLEMENTARY TECHNOLOGIES

6.3.1

COLLABORATIVE ROBOTS

6.3.2

DIGITAL TWIN TECHNOLOGY

6.4

TECHNOLOGY/PRODUCT ROADMAP

6.6

IMPACT OF AI ON AUTOMATED GUIDED VEHICLE MARKET

6.6.1

TOP USE CASES AND MARKET POTENTIAL

6.6.2

BEST PRACTICES FOLLOWED BY OEMS IN AUTOMATED GUIDED VEHICLE MARKET

6.6.3

CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTOMATED GUIDED VEHICLE MARKET

6.6.4

INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

6.6.5

CLIENTS’ READINESS TO ADOPT AI-INTEGRATED AUTOMATED GUIDED VEHICLES

7

REGULATORY LANDSCAPE

Navigate global compliance with a comprehensive map of regulatory bodies and industry standards.

91

7.1

REGULATORY LANDSCAPE AND COMPLIANCE

7.1.1

REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8

CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

Understand stakeholder influence and unmet needs to navigate complex industrial buying landscapes effectively.

97

8.1

DECISION-MAKING PROCESS

8.2

KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

8.2.1

KEY STAKEHOLDERS IN BUYING PROCESS

8.3

ADOPTION BARRIERS AND INTERNAL CHALLENGES

8.4

UNMET NEEDS OF VARIOUS INDUSTRIES

9

TECHNOLOGIES AND POTENTIAL APPLICATIONS OF AUTOMATED GUIDED VEHICLES

Unlock new efficiencies in airports and construction with advanced AGV technologies like LiDAR and camera vision.

103

9.2

STANDARD TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES

9.3

POTENTIAL APPLICATIONS OF AUTOMATED GUIDED VEHICLES

9.3.2

CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT PROJECTS

10

BATTERY TYPES AND CHARGING ALTERNATIVES FOR AUTOMATED GUIDED VEHICLES

Explore optimal battery solutions and innovative charging methods for efficient automated guided vehicle operations.

106

10.2

TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES

10.2.1

LEAD-ACID BATTERIES

10.2.2

LITHIUM-ION BATTERIES

10.2.3

NICKEL-BASED BATTERIES

10.2.4

PURE LEAD BATTERIES

10.3

BATTERY CHARGING ALTERNATIVES

10.3.1

AUTOMATIC AND OPPORTUNITY CHARGING

10.3.1.1

WIRELESS CHARGING

10.3.2.1

MANUAL BATTERY SWAP

10.3.2.2

AUTOMATIC BATTERY SWAP

10.3.3.1

MANUAL PLUG-IN CHARGING

10.3.3.2

AUTOMATIC PLUG-IN CHARGING

11

COMPONENTS AND SERVICES OFFERED FOR AUTOMATED GUIDED VEHICLES

Explore cutting-edge hardware and software driving automated guided vehicle innovation.

109

11.3

SOFTWARE AND SERVICES

12

RECENT TRENDS IN AUTOMATED GUIDED VEHICLES

AI-driven AGVs revolutionize industry with IoT connectivity and real-time, sustainable operations.

111

12.2

INTERNET OF THINGS CONNECTIVITY

12.3

ADOPTION OF COLLABORATIVE AGVS

12.4

SCALABILITY AND MODULAR DESIGN

12.5

ADVANCED NAVIGATION TECHNOLOGIES

12.6

ENERGY EFFICIENCY AND SUSTAINABILITY

12.7

INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

12.8

EDGE COMPUTING FOR REAL-TIME DATA PROCESSING

13

APPLICATIONS OF AUTOMATED GUIDED VEHICLES

Revolutionize efficiency with AGVs in pick-and-place, packaging, and assembly operations.

113

13.3

PACKAGING AND PALLETIZING

13.4

ASSEMBLY AND STORAGE

14

AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million and Units | 28 Data Tables

116

14.2.1

POTENTIAL TO AUTOMATE MATERIAL MOVEMENT AND IMPROVE OPERATIONAL EFFICIENCY TO BOOST DEMAND

14.3.1

FOCUS ON MINIMIZING PRODUCT DAMAGE WHILE TRANSPORTING TO EXTERNAL LOGISTICS DEPARTMENT TO DRIVE DEMAND

14.4.1

ABILITY TO HANDLE PALLETS, SKELETON CONTAINERS, RACKS, TUBS, BOXES, AND ROLLS TO ACCELERATE ADOPTION

14.5

ASSEMBLY LINE VEHICLES

14.5.1

COST ADVANTAGES OVER CHAIN-BASED CONVEYANCE SYSTEMS TO SUPPORT DEPLOYMENT

14.6.1

PROFICIENCY IN HANDLING DIFFERENT PALLET SIZES AND LOAD FORMATS TO INCREASE DEMAND

15

AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million | 2 Data Tables

135

15.2.1

ABILITY TO EFFICIENTLY MANAGE SMALL LOADS AND REDUCE WORKFORCE FATIGUE TO ENHANCE ADOPTION

15.3.1

POTENTIAL TO REDUCE WORKPLACE CONGESTION AND EFFECTIVELY MANAGE INVENTORY TO FACILITATE DEPLOYMENT

15.4.1

ABILITY TO HANDLE VERY HEAVY LOADS TO DRIVE SEGMENT GROWTH

16

AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million | 14 Data Tables

140

16.2.1

ENHANCED ACCURACY AND FLEXIBILITY TO CONTRIBUTE TO MARKET EXPANSION

16.3.1

SIMPLE INSTALLATION, ROBUST PERFORMANCE, AND MINIMAL MAINTENANCE TO ACCELERATE ADOPTION

16.4.1

ABILITY TO PERFORM EFFECTIVELY IN DUSTY AND HIGH-TRAFFIC INDUSTRIAL ENVIRONMENTS TO PROMOTE IMPLEMENTATION

16.5

OPTICAL TAPE GUIDANCE

16.5.1

EASE OF DEPLOYMENT AND HIGH FLEXIBILITY TO SUPPORT MARKET GROWTH

16.6.1

HIGH RELIABILITY AND EASY MANEUVERABILITY IN COMPLEX SPACES TO BOOST ADOPTION

16.7

OTHER NAVIGATION TECHNOLOGIES

17

AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

Market Size & Growth Rate Forecast Analysis to 2032 in USD Million | 98 Data Tables

151

17.2.1

INCREASING DEMAND FOR AFTER-SALES SPARE PARTS TO SUPPORT MARKET GROWTH

17.3.1

SIGNIFICANT FOCUS ON ENHANCING SAFETY, EFFICIENCY, AND COMPETITIVENESS TO ACCELERATE MARKET GROWTH

17.4.1

RISING DEMAND FOR STREAMLINED AIRCRAFT PRODUCTION TO FUEL MARKET GROWTH

17.5

SEMICONDUCTOR & ELECTRONICS

17.5.1

EMPHASIS ON REVOLUTIONIZING CLEANROOM OPERATIONS TO DRIVE MARKET

17.6.1

NECESSITY TO ENHANCE ORDER ACCURACY AND PROMPT DELIVERY TO FUEL ADOPTION

17.7.1

SURGING DEMAND FOR FRESH, SAFE, AND READILY ACCESSIBLE FOOD PRODUCTS TO STIMULATE MARKET GROWTH

17.8.1

STRINGENT REGULATORY AND CLEANLINESS REQUIREMENTS TO SPIKE DEMAND

17.9.1

NEED TO FOLLOW INFECTION CONTROL PRACTICES AND IMPROVE WORKPLACE SAFETY TO PROPEL MARKET

17.10

METALS & HEAVY MACHINERY

17.10.1

SIGNIFICANT FOCUS ON IMPROVING SAFETY AND OPTIMIZING WORKFLOW TO SPUR DEMAND

17.11.1

EMPHASIS ON REDUCING WAREHOUSE SPACE AND LABOR COSTS TO ELEVATE ADOPTION

17.12.1

NEED TO ADHERE TO SAFETY STANDARDS AND ENSURE HIGHER THROUGHPUT TO SPIKE DEPLOYMENT

18

AUTOMATED GUIDED VEHICLE MARKET, BY REGION

Comprehensive coverage of 9 Regions with country-level deep-dive of 20 Countries | 68 Data Tables.

194

18.2.1.1

ESTABLISHED AUTOMOTIVE AND WAREHOUSING BASE TO ACCELERATE MARKET GROWTH

18.2.2.1

CONTINUED ADOPTION OF AUTOMATION ACROSS KEY INDUSTRIES TO SUPPORT MARKET GROWTH

18.2.3.1

STRONG MANUFACTURING BASE TO CONTRIBUTE TO MARKET GROWTH

18.3.1.1

STRONG FOCUS ON LAUNCHING INNOVATIVE AND ADVANCED AGVS TO EXPEDITE MARKET GROWTH

18.3.2.1

THRIVING AUTOMOTIVE SECTOR TO FUEL MARKET GROWTH

18.3.3.1

EXPANSION OF E-COMMERCE SECTOR TO DRIVE MARKET

18.3.4.1

RISING DEMAND FOR SMART LOGISTICS AND AUTOMATION SOLUTIONS TO FOSTER MARKET GROWTH

18.3.5.1

INTEGRATION OF AI, IOT, BLOCKCHAIN, 5G TECHNOLOGIES IN LOGISTICS TO BOOST DEMAND

18.3.6.1

ADVANCED SUPPLY CHAIN NETWORKS AND MODERN WAREHOUSING INFRASTRUCTURE TO SPIKE DEMAND

18.4.1.1

INCREASING INVESTMENTS IN TRANSPORTATION, WAREHOUSING, AND LOGISTICS ECOSYSTEM TO DRIVE MARKET

18.4.2.1

RISING LABOR COSTS AND DIVERSIFIED INDUSTRIAL BASE TO FACILITATE ADOPTION

18.4.3.1

SUSTAINED AUTOMATION ACROSS MANUFACTURING, LOGISTICS, AND MINING OPERATIONS TO STIMULATE DEMAND

18.4.4.1

PRESENCE OF GLOBAL AGV PLAYERS TO PROPEL MARKET

18.4.5.1

EMPHASIS ON BUILDING SMART FACTORIES TO CREATE GROWTH OPPORTUNITIES

18.4.6.1

THRIVING MANUFACTURING AND LOGISTICS SECTORS TO PROMOTE AGV ADOPTION

18.4.7.1

FOCUS ON EXPANDING DOMESTIC MANUFACTURING CAPACITY TO SPUR DEMAND

18.4.8.1

RISING ADOPTION OF DIGITAL TECHNOLOGIES ACROSS INDUSTRIES TO FUEL MARKET GROWTH

18.4.9.1

ONGOING INFRASTRUCTURE DEVELOPMENT PROJECTS TO CREATE LUCRATIVE OPPORTUNITIES

18.4.10

REST OF ASIA PACIFIC

18.5.1.2

REST OF MIDDLE EAST

18.5.2.1

GOVERNMENT INITIATIVES TO AUTOMATE FOOD & BEVERAGES INDUSTRY TO SPUR DEMAND

18.5.3.1

GROWING IMPORTS OF CONSUMER GOODS TO FOSTER MARKET GROWTH

19

COMPETITIVE LANDSCAPE

Discover key players' winning strategies and market positioning in the competitive landscape.

248

19.2

KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021–2025

19.3

REVENUE ANALYSIS, 2020–2024

19.4

MARKET SHARE ANALYSIS, 2025

19.5

COMPANY VALUATION AND FINANCIAL METRICS, 2025

19.6

BRAND/PRODUCT COMPARISON

19.6.1

DAIFUKU CO., LTD. (JAPAN)

19.6.3

KION GROUP AG (GERMANY)

19.6.4

KUKA SE & CO. KGAA (GERMANY)

19.6.5

TOYOTA INDUSTRIES CORPORATION (JAPAN)

19.7

COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

19.7.5

COMPANY FOOTPRINT: KEY PLAYERS, 2025

19.7.5.1

COMPANY FOOTPRINT

19.7.5.2

REGION FOOTPRINT

19.7.5.3

NAVIGATION TECHNOLOGY FOOTPRINT

19.7.5.5

INDUSTRY FOOTPRINT

19.8

COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

19.8.1

PROGRESSIVE COMPANIES

19.8.2

RESPONSIVE COMPANIES

19.8.5

COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

19.8.5.1

DETAILED LIST OF KEY STARTUPS/SMES

19.8.5.2

COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

19.9

COMPETITIVE SCENARIO

19.9.4

OTHER DEVELOPMENTS

20

COMPANY PROFILES

In-depth Company Profiles of Leading Market Players with detailed Business Overview, Product and Service Portfolio, Recent Developments, and Unique Analyst Perspective (MnM View)

271

20.1.1.1

BUSINESS OVERVIEW

20.1.1.2

PRODUCTS/SOLUTIONS/SERVICES OFFERED

20.1.1.3

RECENT DEVELOPMENTS

20.1.1.4.2

STRATEGIC CHOICES

20.1.1.4.3

WEAKNESSES AND COMPETITIVE THREATS

20.1.4

TOYOTA INDUSTRIES CORPORATION

20.1.5

KUKA SE & CO. KGAA

20.1.10

MEIDENSHA CORPORATION

20.1.11

MITSUBISHI LOGISNEXT CO., LTD.

20.1.12

OCEANEERING INTERNATIONAL, INC.

20.2.1

NEURA MOBILE ROBOTS GMBH

20.2.2

AMERICA IN MOTION, INC.

20.2.4

SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

20.2.5

JIANGXI DANBAHE ROBOT CO., LTD.

20.2.10

NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.

20.2.12

SIMPLEX ROBOTICS PVT. LTD.

20.2.13

SYSTEM LOGISTICS S.P.A.

21

RESEARCH METHODOLOGY

326

21.1.1

SECONDARY AND PRIMARY RESEARCH

21.1.2.1

LIST OF MAJOR SECONDARY SOURCES

21.1.2.2

KEY DATA FROM SECONDARY SOURCES

21.1.3.1

PRIMARY INTERVIEWS WITH EXPERTS

21.1.3.2

KEY DATA FROM PRIMARY SOURCES

21.1.3.3

KEY INDUSTRY INSIGHTS

21.1.3.4

BREAKDOWN OF PRIMARIES

21.2

MARKET SIZE ESTIMATION

21.2.1

BOTTOM-UP APPROACH

21.2.3

MARKET SIZE CALCULATION FOR BASE YEAR

21.3

MARKET FORECAST APPROACH

21.5

RESEARCH ASSUMPTIONS

21.6

RESEARCH LIMITATIONS

22.2

KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

22.3

CUSTOMIZATION OPTIONS

TABLE 1

INCLUSIONS AND EXCLUSIONS IN AUTOMATED GUIDED VEHICLE MARKET

TABLE 2

INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

TABLE 3

STRATEGIC FOCUS OF MAJOR COMPANIES IN AUTOMATED GUIDED VEHICLE MARKET

TABLE 4

AUTOMATED GUIDED VEHICLE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5

GDP GROWTH RATES (%), BY KEY COUNTRY, 2021–2030

TABLE 6

ROLE OF PLAYERS IN ECOSYSTEM

TABLE 7

PRICING RANGE OF AUTOMATED GUIDED VEHICLES, BY KEY PLAYER, 2025

TABLE 8

AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021–2025 (USD)

TABLE 9

AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021–2025 (USD)

TABLE 10

IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 11

EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION)

TABLE 12

AUTOMATED GUIDED VEHICLE MARKET: LIST OF KEY CONFERENCES AND EVENTS

TABLE 13

US-ADJUSTED RECIPROCAL TARIFF RATES

TABLE 14

TECHNOLOGY ROADMAP IN AUTOMATED GUIDED VEHICLE MARKET

TABLE 15

AUTOMATED GUIDED VEHICLE MARKET: LIST OF KEY PATENTS, 2021–2024

TABLE 16

TOP USE CASES AND MARKET POTENTIAL

TABLE 17

BEST PRACTICES FOLLOWED BY COMPANIES IN AUTOMATED GUIDED VEHICLE MARKET

TABLE 18

CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTOMATED GUIDED VEHICLES

TABLE 19

INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

TABLE 20

NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21

EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 22

ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 23

ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 24

AUTOMATED GUIDED VEHICLE INDUSTRY STANDARDS

TABLE 25

INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR INDUSTRIES (%)

TABLE 26

KEY BUYING CRITERIA FOR MAJOR INDUSTRIES

TABLE 27

UNMET NEEDS IN AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

TABLE 28

AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 29

AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 30

AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (THOUSAND UNITS)

TABLE 31

AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (THOUSAND UNITS)

TABLE 32

TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 33

TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 34

TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 35

TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 36

UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 37

UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 38

UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 39

UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 40

PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 41

PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 42

PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 43

PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 44

ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 45

ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 46

ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 47

ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 48

FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 49

FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 50

FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 51

FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 52

OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 53

OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 54

OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 55

OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 56

AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 57

AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 58

AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 59

AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 60

LASER GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 61

LASER GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 62

MAGNETIC GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 63

MAGNETIC GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 64

INDUCTIVE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 65

INDUCTIVE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 66

OPTICAL TAPE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 67

OPTICAL TAPE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 68

VISION GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 69

VISION GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 70

OTHER NAVIGATION TECHNOLOGIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 71

OTHER NAVIGATION TECHNOLOGIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 72

AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 73

AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 74

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 75

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 76

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 77

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 78

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 79

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 80

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 81

AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 82

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 83

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 84

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 85

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 86

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 87

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 88

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 89

CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 90

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 91

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 92

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 93

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 94

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 95

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 96

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 97

AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 98

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 99

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 100

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 101

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 102

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 103

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 104

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 105

SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 106

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 107

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 108

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 109

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 110

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 111

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 112

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 113

E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 114

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 115

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 116

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 117

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 118

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 119

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 120

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 121

FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 122

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 123

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 124

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 125

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 126

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 127

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 128

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 129

PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 130

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 131

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 132

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 133

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 134

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 135

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 136

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 137

MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 138

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 139

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 140

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 141

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 142

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 143

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 144

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 145

METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 146

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 147

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 148

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 149

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 150

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 151

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 152

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 153

LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 154

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 155

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 156

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 157

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 158

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 159

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 160

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 161

PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 162

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION)

TABLE 163

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION)

TABLE 164

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION)

TABLE 165

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION)

TABLE 166

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION)

TABLE 167

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION)

TABLE 168

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 169

OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 170

AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 171

AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 172

NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 173

NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 174

NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

TABLE 175

NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

TABLE 176

US: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 177

US: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 178

CANADA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 179

CANADA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 180

MEXICO: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 181

MEXICO: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 182

EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 183

EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 184

EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

TABLE 185

EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

TABLE 186

GERMANY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 187

GERMANY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 188

UK: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 189

UK: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 190

FRANCE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 191

FRANCE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 192

ITALY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 193

ITALY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 194

SPAIN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 195

SPAIN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 196

NETHERLANDS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 197

NETHERLANDS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 198

REST OF EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 199

REST OF EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 200

ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 201

ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 202

ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

TABLE 203

ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

TABLE 204

CHINA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 205

CHINA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 206

JAPAN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 207

JAPAN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 208

AUSTRALIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 209

AUSTRALIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 210

SOUTH KOREA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 211

SOUTH KOREA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 212

INDIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 213

INDIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 214

MALAYSIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 215

MALAYSIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 216

INDONESIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 217

INDONESIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 218

SINGAPORE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 219

SINGAPORE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 220

THAILAND: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 221

THAILAND: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 222

REST OF ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 223

REST OF ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 224

ROW: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 225

ROW: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 226

ROW: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION)

TABLE 227

ROW: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION)

TABLE 228

MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 229

MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 230

MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

TABLE 231

MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

TABLE 232

GCC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2021–2025 (USD MILLION)

TABLE 233

GCC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY, 2026–2032 (USD MILLION)

TABLE 234

SOUTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 235

SOUTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 236

AFRICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION)

TABLE 237

AFRICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION)

TABLE 238

OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET, 2021–2025

TABLE 239

AUTOMATED GUIDED VEHICLE MARKET: DEGREE OF COMPETITION

TABLE 240

AUTOMATED GUIDED VEHICLE MARKET: REGION FOOTPRINT

TABLE 241

AUTOMATED GUIDED VEHICLE MARKET: NAVIGATION TECHNOLOGY FOOTPRINT

TABLE 242

AUTOMATED GUIDED VEHICLE MARKET: TYPE FOOTPRINT

TABLE 243

AUTOMATED GUIDED VEHICLE MARKET: INDUSTRY FOOTPRINT

TABLE 244

AUTOMATED GUIDED VEHICLE MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 245

AUTOMATED GUIDED VEHICLE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 246

AUTOMATED GUIDED VEHICLE MARKET: PRODUCT LAUNCHES, MARCH 2021 AND NOVEMBER 2025

TABLE 247

AUTOMATED GUIDED VEHICLE MARKET: DEALS, MARCH 2021 AND NOVEMBER 2025

TABLE 248

AUTOMATED GUIDED VEHICLE MARKET: EXPANSIONS, MARCH 2021 AND NOVEMBER 2025

TABLE 249

AUTOMATED GUIDED VEHICLE MARKET: OTHER DEVELOPMENTS, MARCH 2021 AND NOVEMBER 2025

TABLE 250

DAIFUKU CO., LTD.: COMPANY OVERVIEW

TABLE 251

DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 252

DAIFUKU CO., LTD.: DEALS

TABLE 253

DAIFUKU CO., LTD.: EXPANSIONS

TABLE 254

JBT: COMPANY OVERVIEW

TABLE 255

JBT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256

JBT: PRODUCT LAUNCHES

TABLE 257

KION GROUP AG: BUSINESS OVERVIEW

TABLE 258

KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 259

KION GROUP AG: PRODUCT LAUNCHES

TABLE 260

KION GROUP AG: EXPANSIONS

TABLE 261

TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

TABLE 262

TOYOTA INDUSTRIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 263

TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES

TABLE 264

TOYOTA INDUSTRIES CORPORATION: DEALS

TABLE 265

KUKA SE & CO. KGAA: COMPANY OVERVIEW

TABLE 266

KUKA SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 267

KUKA SE & CO. KGAA: PRODUCT LAUNCHES

TABLE 268

KUKA SE & CO. KGAA: DEALS

TABLE 269

SCOTT: COMPANY OVERVIEW

TABLE 270

SCOTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271

SCOTT: PRODUCT LAUNCHES

TABLE 272

SSI SCHAEFER: COMPANY OVERVIEW

TABLE 273

SSI SCHAEFER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 274

SSI SCHAEFER: DEALS

TABLE 275

SSI SCHAEFER: OTHER DEVELOPMENTS

TABLE 276

HYSTER-YALE, INC.: COMPANY OVERVIEW

TABLE 277

HYSTER-YALE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 278

HYSTER-YALE, INC.: DEVELOPMENTS

TABLE 279

JUNGHEINRICH AG: COMPANY OVERVIEW

TABLE 280

JUNGHEINRICH AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 281

JUNGHEINRICH AG: PRODUCT LAUNCHES

TABLE 282

JUNGHEINRICH AG: DEALS

TABLE 283

JUNGHEINRICH AG: EXPANSIONS

TABLE 284

MEIDENSHA CORPORATION: COMPANY OVERVIEW

TABLE 285

MEIDENSHA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 286

MEIDENSHA CORPORATION: PRODUCT LAUNCHES

TABLE 287

MITSUBISHI LOGISNEXT CO., LTD.: COMPANY OVERVIEW

TABLE 288

MITSUBISHI LOGISNEXT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 289

MITSUBISHI LOGISNEXT CO., LTD.: DEALS

TABLE 290

OCEANEERING INTERNATIONAL, INC.: COMPANY OVERVIEW

TABLE 291

OCEANEERING INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 292

OCEANEERING INTERNATIONAL, INC.: EXPANSIONS

TABLE 293

OCEANEERING INTERNATIONAL, INC.: OTHER DEVELOPMENTS

TABLE 294

NEURA MOBILE ROBOTS GMBH: COMPANY OVERVIEW

TABLE 295

AMERICA IN MOTION, INC.: COMPANY OVERVIEW

TABLE 296

ASSECO CEIT, A.S.: COMPANY OVERVIEW

TABLE 297

SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.: COMPANY OVERVIEW

TABLE 298

JIANGXI DANBAHE ROBOT CO., LTD.: COMPANY OVERVIEW

TABLE 299

E80 GROUP S.P.A.: COMPANY OVERVIEW

TABLE 300

GLOBAL AGV: COMPANY OVERVIEW

TABLE 301

GRENZEBACH GROUP: COMPANY OVERVIEW

TABLE 302

IDC CORPORATION: COMPANY OVERVIEW

TABLE 303

NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.: COMPANY OVERVIEW

TABLE 304

SAFELOG GMBH: COMPANY OVERVIEW

TABLE 305

SIMPLEX ROBOTICS PVT. LTD.: COMPANY OVERVIEW

TABLE 306

SYSTEM LOGISTICS S.P.A.: COMPANY OVERVIEW

TABLE 307

BALYO: COMPANY OVERVIEW

TABLE 308

LIST OF KEY SECONDARY SOURCES

TABLE 309

PRIMARY INTERVIEW PARTICIPANTS

TABLE 310

KEY DATA FROM PRIMARY SOURCES

TABLE 311

AUTOMATED GUIDED VEHICLE MARKET: RISK ASSESSMENT

FIGURE 1

AUTOMATED GUIDED VEHICLE MARKET SEGMENTATION AND REGIONAL SCOPE

FIGURE 2

DURATION COVERED

FIGURE 4

GLOBAL AUTOMATED GUIDED VEHICLE MARKET, 2021–2032

FIGURE 5

MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET, 2021–2025

FIGURE 6

DISRUPTIONS INFLUENCING GROWTH OF AUTOMATED GUIDED VEHICLE MARKET

FIGURE 7

HIGH-GROWTH SEGMENTS IN AUTOMATED GUIDED VEHICLE MARKET, 2026–2032

FIGURE 8

ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMATED GUIDED VEHICLE MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

FIGURE 9

RISING DEMAND FOR AUTOMATION SOLUTIONS IN VARIOUS INDUSTRIES TO DRIVE MARKET

FIGURE 10

TOW VEHICLES TO CAPTURE MAJORITY OF MARKET SHARE IN 2032

FIGURE 11

LASER GUIDANCE TECHNOLOGY TO ACCOUNT FOR PROMINENT MARKET SHARE IN 2032

FIGURE 12

AUTOMOTIVE INDUSTRY TO HOLD LEADING MARKET SHARE IN 2032

FIGURE 13

MEDIUM-DUTY AGVS TO LEAD MARKET IN 2032

FIGURE 14

E-COMMERCE & RETAIL INDUSTRY AND US TO HOLD LARGEST MARKET SHARE IN 2032

FIGURE 15

CHINA TO BE FASTEST-GROWING MARKET FOR AUTOMATED GUIDED VEHICLES DURING FORECAST PERIOD

FIGURE 16

AUTOMATED GUIDED VEHICLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 17

IMPACT ANALYSIS OF DRIVERS

FIGURE 18

IMPACT ANALYSIS OF RESTRAINTS

FIGURE 19

IMPACT ANALYSIS OF OPPORTUNITIES

FIGURE 20

IMPACT ANALYSIS OF CHALLENGES

FIGURE 21

AUTOMATED GUIDED VEHICLE MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 22

AUTOMATED GUIDED VEHICLE VALUE CHAIN ANALYSIS

FIGURE 23

AUTOMATED GUIDED VEHICLE ECOSYSTEM

FIGURE 24

AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021–2025

FIGURE 25

AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021–2025

FIGURE 26

INVESTMENT AND FUNDING SCENARIO, 2021–2024

FIGURE 27

IMPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020–2024

FIGURE 28

EXPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020–2024

FIGURE 29

TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 30

AUTOMATED GUIDED VEHICLE MARKET: PATENT ANALYSIS, 2015–2024

FIGURE 31

DECISION-MAKING FACTORS CONSIDERED WHILE BUYING AUTOMATED GUIDED VEHICLES

FIGURE 32

INFLUENCE OF STAKEHOLDERS FROM MAJOR INDUSTRIES ON BUYING PROCESS

FIGURE 33

KEY BUYING CRITERIA FOR MAJOR INDUSTRIES

FIGURE 34

ADOPTION BARRIERS AND INTERNAL CHALLENGES

FIGURE 35

EMERGING TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES

FIGURE 36

TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES

FIGURE 37

AUTOMATED GUIDED VEHICLE COMPONENTS AND SERVICES

FIGURE 38

KEY APPLICATIONS OF AUTOMATED GUIDED VEHICLES

FIGURE 39

AUTOMATED GUIDED VEHICLE MARKET, BY TYPE

FIGURE 40

TOW VEHICLES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2032

FIGURE 41

AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY

FIGURE 42

MEDIUM-DUTY AGVS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

FIGURE 43

AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY

FIGURE 44

LASER GUIDANCE NAVIGATION TECHNOLOGY TO CAPTURE LARGEST MARKET SHARE IN 2032

FIGURE 45

AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY

FIGURE 46

AUTOMOTIVE INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2032

FIGURE 47

AUTOMATED GUIDED VEHICLE MARKET, BY REGION

FIGURE 48

CHINA TO REGISTER HIGHEST CAGR IN GLOBAL AUTOMATED GUIDED VEHICLE MARKET FROM 2026 TO 2032

FIGURE 49

ASIA PACIFIC TO HOLD LARGEST SHARE OF AUTOMATED GUIDED VEHICLE MARKET IN 2026

FIGURE 50

NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

FIGURE 51

EUROPE: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

FIGURE 52

ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

FIGURE 53

ROW: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT

FIGURE 54

REVENUE ANALYSIS OF KEY PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET, 2020–2024

FIGURE 55

AUTOMATED GUIDED VEHICLE MARKET SHARE ANALYSIS, 2025

FIGURE 56

COMPANY VALUATION, 2025

FIGURE 57

FINANCIAL METRICS (EV/EBITDA), 2025

FIGURE 58

BRAND/PRODUCT COMPARISON

FIGURE 59

AUTOMATED GUIDED VEHICLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

FIGURE 60

COMPANY FOOTPRINT

FIGURE 61

AUTOMATED GUIDED VEHICLE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

FIGURE 62

DAIFUKU CO., LTD.: COMPANY SNAPSHOT

FIGURE 63

JBT: COMPANY SNAPSHOT

FIGURE 64

KION GROUP AG: COMPANY SNAPSHOT

FIGURE 65

TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

FIGURE 66

KUKA SE & CO. KGAA: COMPANY SNAPSHOT

FIGURE 67

SCOTT: COMPANY SNAPSHOT

FIGURE 68

HYSTER-YALE, INC.: COMPANY SNAPSHOT

FIGURE 69

JUNGHEINRICH AG: COMPANY SNAPSHOT

FIGURE 70

MEIDENSHA CORPORATION: COMPANY SNAPSHOT

FIGURE 71

MITSUBISHI LOGISNEXT CO., LTD.: COMPANY SNAPSHOT

FIGURE 72

OCEANEERING INTERNATIONAL, INC.: COMPANY SNAPSHOT

FIGURE 73

AUTOMATED GUIDED VEHICLE MARKET: RESEARCH DESIGN

FIGURE 74

AUTOMATED GUIDED VEHICLE MARKET: RESEARCH APPROACH

FIGURE 75

KEY DATA FROM SECONDARY SOURCES

FIGURE 76

KEY INSIGHTS FROM INDUSTRY EXPERTS

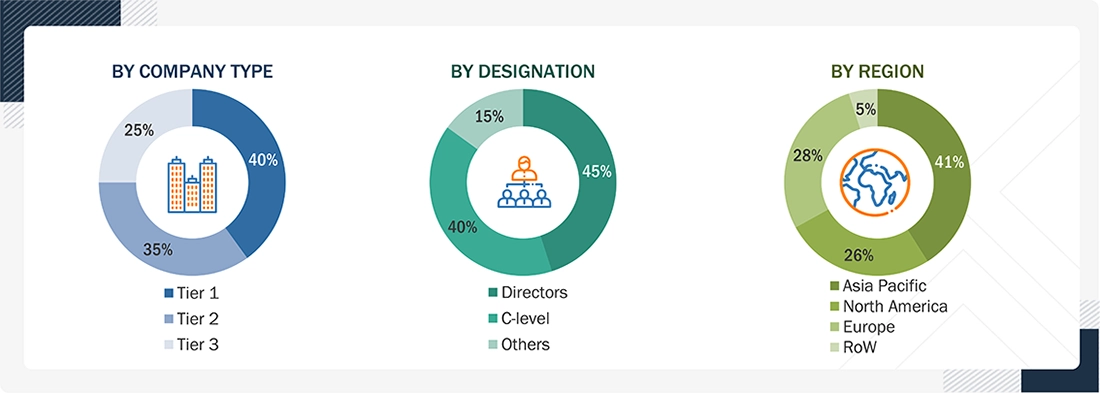

FIGURE 77

BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 78

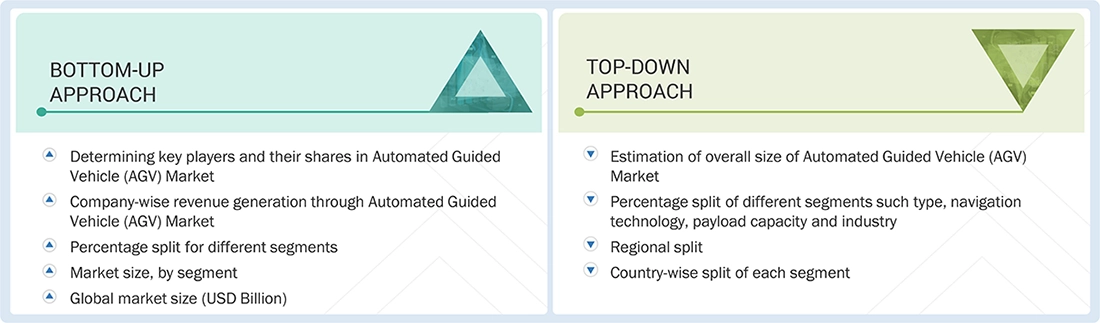

AUTOMATED GUIDED VEHICLE MARKET: BOTTOM-UP APPROACH

FIGURE 79

AUTOMATED GUIDED VEHICLE MARKET: TOP-DOWN APPROACH

FIGURE 80

MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 81

AUTOMATED GUIDED VEHICLE MARKET: DATA TRIANGULATION

FIGURE 82

ASSUMPTIONS FOR RESEARCH STUDY

Growth opportunities and latent adjacency in Automated Guided Vehicle (AGV) Market