Smart Learning Market

Smart Learning Market, By Offering (Hardware, Solutions (Integrated Solutions and Standalone Solutions), Learning Type (Synchronous Learning and Asynchronous Learning), End User (Academic, Higher Education, Enterprises)- Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global smart learning market is estimated to reach USD 80.69 billion in 2025. It is projected to grow to USD 178.62 billion by 2030, registering a CAGR of 17.2% during the forecast period. The market is gaining traction as education and training providers adjust to more flexible and technology-enabled learning models. Learning delivery is no longer limited to physical classrooms and fixed schedules. Instead, institutions are supporting a mix of in-person, remote, and hybrid formats across schools, universities, and corporate training programs. This shift is driving the demand for platforms that can manage digital content, assessments, and learner progress across multiple environments. As learning models continue to diversify, smart learning platforms are becoming a central part of modern education and workforce development strategies.

KEY TAKEAWAYS

-

By OfferingThe software segment is projected to achieve the highest CAGR of 18.8% during the forecast period.

-

By Learning TypeThe synchronous learning segment is projected to grow at the highest rate during the forecast period.

-

By End UserThe enterprises segment is projected to dominate the smart learning market during the forecast period.

-

Competitive Landscape - Key PlayersIBM (US), Cisco (US), Anthology (US), SMART Technologies (Canada), Oracle (US), and Microsoft (US) were identified as some of the star players in the smart learning market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsKnowledgewhere (US), Instructure (US), and Paradiso Solutions (US) have distinguished themselves among startups and SMEs in the smart learning market.

The global smart learning market is driving growth as educational institutions and enterprises are increasingly serving learner groups that are large, diverse, and geographically dispersed. Organizations are adopting smart learning platforms that allow content to be delivered in a consistent format, while giving learners flexibility in how and when they engage. Moreover, centralized progress tracking also makes it easier to monitor participation and outcomes across locations. As budget pressure and performance accountability grow, smart learning systems are being used to support more efficient delivery without compromising learning standards in distributed environments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The smart learning market is gradually moving away from one-time software and hardware purchases toward subscription-based platforms and data-led services. Cloud-based learning systems are increasingly being deployed by schools, universities, enterprises, and public agencies to support hybrid delivery, personalization, and performance monitoring. This shift has been shaped by the need to reach learners across locations, improve engagement, and link training outcomes more closely to workforce needs. As a result, spending is increasingly directed toward adaptive content, learning analytics, and scalable digital platforms that offer consistent learning experiences while improving cost visibility and outcome measurement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Shift toward flexible and hybrid learning models

-

Rising demand for scalable digital learning infrastructure

Level

-

Fragmented digital infrastructure across institutions

-

Budget constraints in public education and smaller institutions

Level

-

Growing demand for data-informed teaching and learning decisions

-

Increasing adoption of cloud-based learning platforms in emerging markets

Level

-

Managing data privacy and trust in digital learning environments

-

Ensuring consistent learning quality across digital and physical formats

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Shift toward flexible and hybrid learning models

Learning environments are shifting away from fixed, classroom-only delivery models as institutions expand blended and remote formats. This change reflects the need to support learners who are spread across campuses, homes, and workplaces at the same time. As delivery becomes more distributed, coordinating content, assessments, and learner progress across locations becomes harder using static tools. These operational gaps are pushing institutions to adopt smart learning platforms that centralize content delivery and progress tracking. By bringing instructional data into a shared system, these platforms reduce coordination effort and improve consistency. As hybrid learning becomes part of routine operations rather than a temporary adjustment, scalable digital learning platforms are increasingly viewed as essential infrastructure.

Restraint: Fragmented digital infrastructure across institutions

Despite wider interest in smart learning, many institutions still operate with disconnected systems built over long investment cycles. Learning platforms, administrative databases, and content tools often sit in parallel, with limited links between them. This fragmentation increases administrative workload and complicates efforts to gain a unified view of learner progress and outcomes. Smaller institutions and public education systems face additional constraints due to budget limits and uneven access to reliable connectivity. As long as legacy platforms remain in use without integration frameworks, the adoption of fully connected smart learning environments tends to progress gradually rather than at scale.

Opportunity: Growing demand for data-informed teaching and learning decisions

As learning activities increasingly move online, institutions are gaining access to detailed information on participation, performance, and engagement. However, turning this information into practical insight remains a challenge. Smart learning solutions that support analytics, adaptive content delivery, and early identification of learning gaps are gaining attention as institutions look to improve outcomes rather than simply digitize content. These capabilities help educators adjust instruction, support at-risk learners, and align training with skill requirements. As accountability around learning outcomes grows in academic and corporate settings, platforms that translate learning data into actionable decisions represent a clear growth opportunity.

Challenge: Managing data privacy and trust in digital learning environments

Smart learning platforms depend on ongoing collection of learner data, ranging from assessment results to usage behavior. As these systems are adopted more widely, questions around consent, data handling, and regulatory compliance are becoming harder for institutions to manage, particularly in regions with evolving education and data protection policies. Analytics-driven personalization can offer clear instructional benefits, but it also requires tighter controls around how data is stored, shared, and accessed. For many institutions, especially in public education, these requirements influence platform selection and slow deployment timelines. In the absence of consistent governance frameworks, advanced features are often rolled out cautiously or avoided altogether due to higher levels of stakeholder and regulatory scrutiny.

SMART LEARNING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Microsoft deployed Teams for Education and Microsoft 365 learning tools across public school districts and universities to support remote and hybrid instruction. The platform enabled virtual classrooms, assignment management, and collaboration between students and teachers, ensuring continuity of learning during periods of campus disruption. | Improved learning continuity | Better student-teacher collaboration | Standardized digital classroom experience |

|

Universities globally adopted Canvas Learning Management System (LMS) to manage online and blended courses. Canvas was used to centralize course content, assessments, grading, and student engagement analytics across departments and campuses. | Simplified course management | Improved learner engagement | Scalable hybrid learning delivery |

|

Pearson implemented its digital curriculum and assessment platforms across high education institutions to support online learning and continuous assessment. Digital content delivery replaced traditional print materials, enabling faster updates and flexible access for students. | Wider access to learning content | Faster curriculum updates | Improved assessment consistency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart learning ecosystem includes hardware providers (Google, Apple, Microsoft, SMART Technologies, BenQ, and Promethean) that supply devices and classroom equipment used for digital instruction; solution providers [Instructure, D2L (Brightspace), Blackboard, Moodle, Adobe, Google, and Pearson] that offer learning management platforms, digital content, and assessment tools; service providers (IBM, Accenture, Infosys, PwC, and KPMG) that support deployment, cloud migration, and ongoing platform management; and system integrators (Tata Consultancy Services, Wipro, Cognizant, HCL, DXC Technology, and Capgemini) that focus on implementation and system integration across education institutions and enterprises.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Learning Market, By Offering

The software segment is projected to achieve the highest growth rate during the forecast period. Schools buy software packages for classrooms with interactive screens and student devices. Businesses deploy these packages for employee training across offices. Moreover, software providers bundle management tools with delivery platforms, and this one-stop approach cuts procurement time for buyers. As a result, pure content or hardware sales trail since customers want integrated setups.

Smart Learning Market, By Learning Type

The asynchronous learning segment is projected to lead the smart learning market during the forecast period. Asynchronous setups let students access materials and complete work on their own schedules. Platforms deliver video lessons, quizzes, and assignments through learning management systems. Workers complete modules during breaks or off-hours. This format fits busy schedules in schools and companies. Students review tough topics multiple times and progress tracking works through automated grading.

REGION

Asia Pacific to be fastest-growing region in global smart learning market during forecast period

Asia Pacific is projected to grow at the highest rate in the global smart learning market during the forecast period. This growth is supported by sustained public investment in digital education infrastructure across China, India, and several Southeast Asian economies. Online learning platforms are being expanded to improve access for students in remote and underserved areas. The demand for training is also rising, particularly among manufacturers and service providers to support automation and new production technologies. Additionally, upgrades to network infrastructure are allowing more frequent use of video-led instruction and interactive course formats, especially in urban and industrial centers. Moreover, digital learning content is increasingly being adapted to local languages and curriculum requirements rather than delivered as standardized global material. These developments are closely tied to the region’s large learner population and the practical need to deliver education and training at scale, rather than to isolated technology adoption alone.

SMART LEARNING MARKET: COMPANY EVALUATION MATRIX

In the smart learning evaluation matrix, IBM (Star) leads with substantial market share and broad platform capabilities, powered by Watson AI analytics and skills training solutions adopted across corporate upskilling and higher education sectors. On the other hand, Ellucian (Emerging Leader) is strengthening its position through its high education-focused platforms, including student information systems, learning analytics, and cloud-based campus solutions that support integrated academic and administrative workflows. While IBM commands through comprehensive AI-driven ecosystems and enterprise scale, Ellucian displays solid potential to advance toward the leaders’ quadrant as institutions prioritize data-driven decision-making and unified digital campus environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- IBM (US)

- Samsung (South Korea)

- Adobe (US)

- Anthology (US)

- SMART Technologies (Canada)

- SAP (Germany)

- Microsoft (US)

- Cornerstone OnDemand (US)

- Pearson (UK)

- BenQ (Taiwan)

- Google (US)

- McGraw Hill (US)

- Huawei (China)

- Cisco (US)

- Oracle (US)

- D2L (Canada)

- Ellucian (US)

- Alphabet (US)

- Upside LMS (India)

- Edsys (India)

- echo360 (US)

- Knowledge Anywhere (US)

- Instructure (US)

- SkyPrep (Canada)

- Paradiso Solutions (US)

- CYPHER Learning (US)

- Schoology (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 67.07 Billion |

| Market Forecast in 2030 (Value) | USD 178.62 Billion |

| Growth Rate | CAGR of 17.2% from 2025–2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: SMART LEARNING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider | Regional Analysis of smart learning market including breakdown of the North America smart learning market, of the Europe smart learning market, of the Asia Pacific smart learning market, and of the Middle East & Africa smart learning market, and of the Latin America smart learning market |

|

RECENT DEVELOPMENTS

- July 2025 : Instructure and OpenAI announced a global partnership to integrate OpenAI's AI technology directly into the Canvas Learning Management System (LMS). This collaboration, part of Instructure’s IgniteAI initiative, would allow educators to create "LLM-Enabled Assignments," which are custom, GPT-like experiences.

- June 2025 : Pearson and Google Cloud formed a multi-year partnership to accelerate the development of new AI-powered educational tools. This collaboration would leverage Google’s AI models, including Gemini, to create personalized learning experiences for K–12 students and provide educators with data-driven insights.

- October 2024 : Transact Campus and Anthology announced a strategic partnership to enhance their higher education solutions. The collaboration would create seamless, integrated payment and credentialing systems that work with Anthology's products, including its student information system (Anthology Student) and CRM (Anthology Reach).

- September 2024 : Cisco Philippines and Mapúa University partnered to launch the country's first digital classrooms, leveraging AI-powered collaboration tools to redefine hybrid learning. The classrooms, equipped with Cisco Webex Boards and AI features, support Mapúa's flexible "Tri-x" teaching model, allowing students to seamlessly participate in face-to-face, synchronous, or asynchronous lessons.

Table of Contents

Methodology

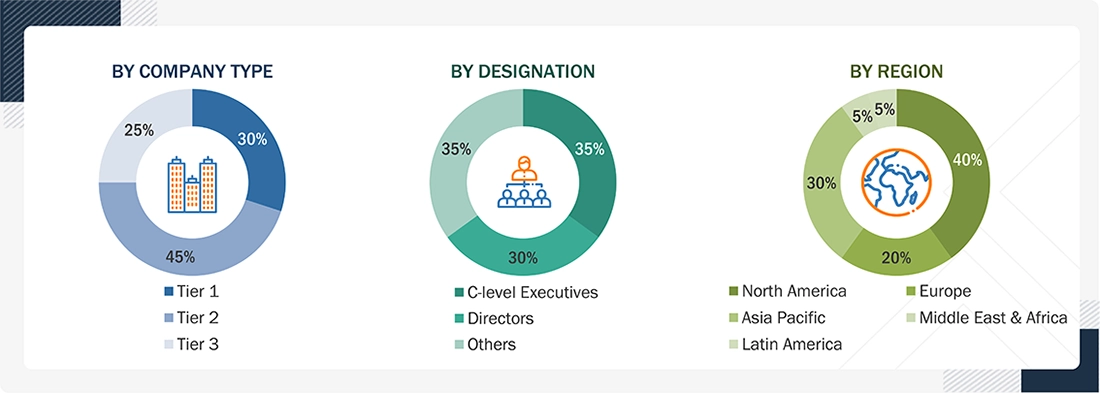

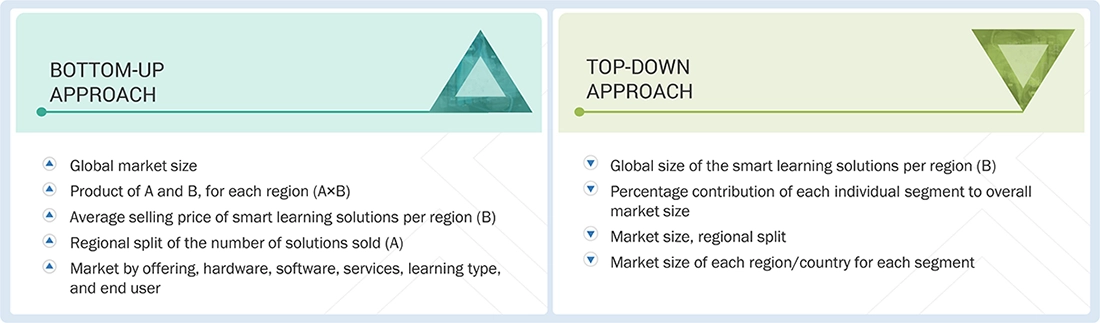

The research study involved four major activities in estimating the smart learning market size. Exhaustive secondary research was done to collect important information about the market and peer markets. The next step was to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the market size. After this step, market breakdown and data triangulation were adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering smart learning solutions to various end users was arrived at based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals were also referred to. Some of these journals include the International Journal of Computer Science and Information Technology and Security (IJCSITS), ScienceDirect, ResearchGate, Academic Journals, and Scientific.Net; and various telecom and Smart Learning associations/forums, Citizens Broadband Radio Service (CBRS) Alliance, MulteFire Alliance, and 3GPP.

Secondary research was used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the smart learning market.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use smart learning, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of smart learning hardware, software, and services, which are expected to affect the overall smart learning market growth.

Notes:

Tier 1 Companies: Revenue of more than USD 10 billion; Tier 2 Companies: Revenue from USD 1 billion to USD 10 billion; and Tier 3 Companies: Revenue from USD 500 million to USD 1 billion

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the smart learning market, as well as other dependent submarkets. The research methodology used to estimate the market sizes included the following steps:

- Focusing on top-line investments and spending in the ecosystem, and significant developments

- Tracking the recent and upcoming developments, including investments, R&D activities, product launches, collaborations, mergers & acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Conducting multiple discussions with key opinion leaders to learn about the diverse types of authentications and brand protection offerings used, and the applications for which they are used, to analyze the breakdown of the scope of work carried out by major companies

- Segmenting the market based on technology types concerning applications, wherein the types are to be used, and deriving the size of the global application market

- Segmenting the overall market into various market segments

- Validating estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operations managers, and finally with the domain experts at MarketsandMarkets

Smart Learning Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the smart learning market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were used, wherever applicable. The data was then triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Smart learning is a form of digital education that employs technologies and techniques, either alone or in combination with other information and communications technology (ICT) solutions, to enable interactive learning at any time and from any place. Offerings that are a part of the smart learning process include interactive hardware devices (interactive displays, interactive whiteboards, smartboards, and smart tables). Software solutions include [learning management system (LMS)/learning content management system (LCMS), student information system (SIS), classroom management software, and services.

Key Stakeholders

- Smart Learning Software Vendors

- Smart Learning Service Providers

- Smart Learning Hardware Vendors

- E-learning Course Providers

- Education Consultants

- System Integrators

- Telecommunications Service Provider

- Educationists

- Corporate Trainers

- Compliance Regulatory Authorities

- Cloud Service Providers

- Government Authorities

- University Bodies

- Service Providers

- Professors and Teachers

Report Objectives

- To determine and forecast the global smart learning market by offering, hardware, software, service, learning type, end user, and region, and analyze the various macroeconomic and microeconomic factors affecting market growth

- To forecast the size of the market across five central regions, namely North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the smart learning market.

- Analyze each submarket concerning individual growth trends, prospects, and contributions to the overall smart learning market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the smart learning market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape

- Track and analyze competitive developments in the market, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities

Customization Options

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific smart learning market into countries contributing 75% to the regional market size

- Further breakup of the North America smart learning market into countries contributing 75% to the regional market size

- Further breakup of the Latin America smart learning market into countries contributing 75% to the regional market size

- Further breakup of the Middle East Africa smart learning market into countries contributing 75% to the regional market size

- Further breakup of the Europe smart learning market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Learning Marke

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Learning Marke