Cloud Computing in Education Market by Service Model (SaaS, PaaS, and IaaS), Deployment Model (Private Cloud, Public Cloud, Hybrid Cloud, and Community Cloud), User Type (K-12 and Higher Education) and Region - Global Forecast to 2021

[157 Pages Report] The cloud computing in education market size is estimated to grow from USD 8.13 billion in 2016 to USD 25.36 billion by 2021, at an estimated Compound Annual Growth Rate (CAGR) of 25.6%.

The report on the cloud computing in education market considered 2015 as base year and the forecast period from 2016 to 2021. The market aims at providing internet-based services to K-12 and higher education in order to streamline their business management and teaching-learning processes. The report aims at estimating the market size and future growth opportunities of the cloud computing in education market across different segments such as service models, deployment models, user types, and regions. Growing need for a centralized system for the management of academic processes and competition among academic institutions are the major driving forces of the market.

Market Dynamics

Drivers

- Need for centralized system for the management of academic processes

- Competition among academic institutions

- Learning beyond classrooms boundary

- Strong need to reduce management burden

Restraints

- Risks associated with data protection and account management

- Rigid design of cloud-based systems

Opportunities

- Implementation of cloud - based ERP systems

- Implementation of upgradable cloud services

- Emerging potential markets

Challenges

- Integration of management software solutionsLess skilled professionals

- Concerns over cloud security holding back market growth

Increasing Need for centralized system for the management of academic processes drives the global cloud computing in education market

In this era of technology, every academic institution starting from kindergarten to graduation institutes, are employing latest IT technologies and services to centrally manage their various business processes such as admissions and registration, student management, faculty management, course management, and library management, among others. Moving towards advancement of cloud computing have resulted in a number of extra benefits to the academic institutions such as improved collaboration between student and institute, better learning and innovation, higher student success, higher administrative efficiency, better knowledge sharing, and improved consultancy to students. Nowadays, academic institutions, students, and teachers are well equipped with their mobile communicating devices with better connecting technologies. Availability of mobile devices and high speed connectivity with cloud, enable them to receive administrative emails, track their performance, use online resources, and share notes, assignments, and projects.

Objectives of the Study:

The following are the major objectives of the study.

- To describe and forecast the global cloud computing in education market on the basis of segments which include service model, deployment model, user type and region

- To forecast the market size of the market segments with respect to the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the cloud computing in education market and comprehensively analyze their market size and core competencies in the market.

- To track and analyze competitive developments such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities in the market

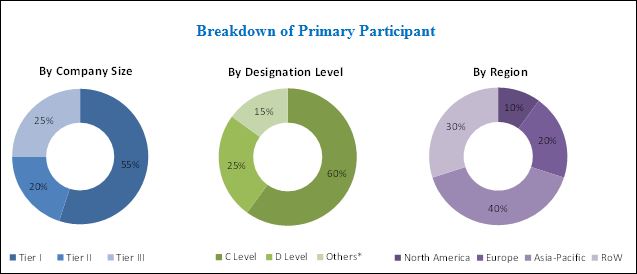

The research methodology used to estimate and forecast the cloud computing in education market begins with the collection and analysis of data on key vendor product offerings and business strategies from secondary sources, such as press releases, investor presentations of companies, white papers, technology journals, certified publications, articles from recognized authors, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global cloud computing in education market from the revenue of key players (companies) and their shares in this market. After arriving at the overall market size, the total market was split into several segments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all segments. The breakdown of profiles of the primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Industry Ecosystem

The ecosystem of cloud computing in education market consists of cloud service providers such as Adobe Systems, Microsoft, NetApp, and Ellucian; internet service providers such as Cisco Systems, WindStream, Sandvine, and Interoute; system integrators such as IBM Corporation, Oracle Corporation, N2N services, Workday, and Pearson; resellers such as BRLINK, Fractalyst, and Cloud Cover Inc.; and user types such as K-12 and higher education. Stakeholders of the market include schools, government authorities, and distributors.

Target audience For cloud computing in education market:

- Cloud Service Providers

- Cloud-Based Application Developers

- Service Integrators

- Internet Service Providers

- Academic Institutes

- IT developers

- Third-party vendors

- System integrators

Scope of the Report

The research report segments the cloud computing in education market into following submarkets:

By Service Model:

- Software-as-a-Service (SaaS)

- Platform-as-a-Service (PaaS)

- Infrastructure-as-a-Service (IaaS)

Cloud Computing in Education Market By Deployment Model:

- Private Cloud

- Public Cloud

- Hybrid Cloud

- Community Cloud

By User Type:

- K-12

- Higher Education

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis `

- Further breakdown of the North American global cloud computing in education market

- Further breakdown of the European global market

- Further breakdown of the APAC global market

- Further breakdown of the MEA global market

- Further breakdown of the Latin American global market

Company Information

- Detailed analysis and profiling of additional market players

The cloud computing in education market is expected to grow from USD 8.13 billion in 2016 to USD 25.36 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 25.6% during the forecast period. The strong need to reduce management burden and demand for a centralized system for the management of academic processes is driving the market across all regions. The need to streamline academic processes such as learning, administration, and evaluation are some of the other drivers of the market. The implementation of upgradable cloud services offers great opportunity for cloud providers in the education industry.

The cloud computing in education market is segmented by service model, deployment mode, user type, and region. The community cloud deployment mode is expected to grow at the highest CAGR during the forecast period. Community cloud model is mutually shared between many organizations belonging to same community and is projected to witness the highest demand as it offers highly secured features at a competitive price.

Software as a service (SaaS) model is expected to hold the largest market share in the service model segment from 2016 to 2021 as SaaS based model requires less setup cost along with seamless integration. Platform as a service (PaaS) is expected to play a key role in changing the cloud ecosystem, and it is expected to grow at the highest growth rate during the forecast period as end-users demand services and data that are offered through the platform provider. Moreover, the service model allows educational institutes to create various applications as per the need and execute them anywhere, anytime.

The cloud computing model is being increasingly adopted by end users, such as K-12 schools and higher education, which has led to the growth of the market across the globe. Colleges and universities have been implementing educational products for a more flexible and innovative learning experience leading to higher adoption in higher education user type. The higher education user segment is expected to dominate the cloud computing in education market among user types, contributing the largest market share during the forecast period.

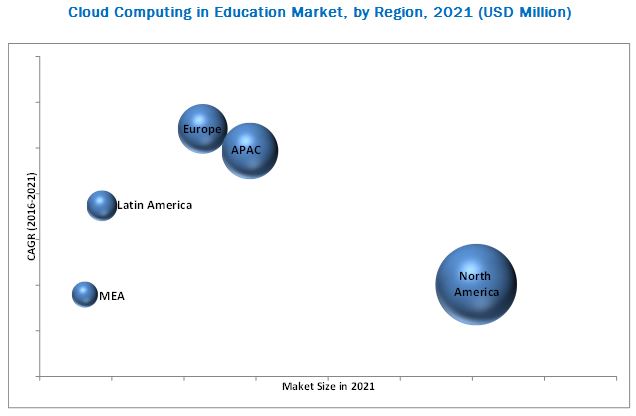

The global market has been segmented on the basis of regions into North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America to provide a region-specific analysis in the report. The North American region, followed by Europe, is expected to be the largest revenue generating region for cloud computing in education service providers in 2016. This is mainly because there is high focus on innovations obtained from research & development and technology adoption, especially in the developed economies of the U.S. and Canada. The APAC region is expected to be the fastest-growing region in the cloud computing in education market. This growth will be driven by potential growth opportunities, as end users such as schools and universities are turning toward cloud services to offer high quality services that help users to collaborate, share, and track multiple versions of a document.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming digital trends in the education industry?

- What should be your go-to-market strategy to expand the reach into developing countries across APAC, MEA, and Latin America?

The security and privacy issues with cloud solutions and services pose restraint on the adoption of cloud technologies in education industry. This is one of the major identified restraints affecting the widespread adoption of cloud computing in education market along with the challenge of integrating different management solutions used in education institutes.

Capabilities like learning beyond classrooms boundary is expected to provide great opportunities to the cloud computing in education solution vendors to grow in the future. The major vendors that offer cloud computing in education services across the globe are Adobe System Inc. (U.S.), Cisco System Inc. (U.S.), IBM Corporation (U.S.), VMware Inc. (U.S.), Microsoft Corporation (U.S.), NEC Corporation (U.S.), NetApp Inc. (U.S.), Amazon Web Services (U.S.), and Ellucian (U.S.). These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, partnerships & collaborations, and mergers & acquisitions to expand their offerings in the cloud computing in education market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities in the Cloud Computing in Education Market

4.2 Market: Top Three Deployment Models

4.3 Global Market, By Region and Service Model

4.4 Market Potential

4.5 Market, By User Type (2021)

4.6 Market, By Region

4.7 Deployment Model Growth Matrix

4.8 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Service Model

5.3.2 By Deployment Model

5.3.3 By User Type

5.3.4 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need for Centralized System for the Management of Academic Processes

5.4.1.2 Competition Among Academic Institutions

5.4.1.3 Learning Beyond Classrooms Boundary

5.4.1.4 Strong Need to Reduce Management Burden

5.4.2 Restraints

5.4.2.1 Risks Associated With Data Protection and Account Management

5.4.2.2 Rigid Design of Cloud-Based Systems

5.4.3 Opportunities

5.4.3.1 Implementation of Cloud - Based Erp Systems

5.4.3.2 Implementation of Upgradable Cloud Services

5.4.3.3 Emerging Potential Markets

5.4.4 Challenges

5.4.4.1 Integration of Management Software Solutions

5.4.4.2 Concerns Over Cloud Security Holding Back Market Growth

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Cloud Computing in Education Architecture

6.3 Value Chain Analysis

6.4 Innovation Spotlight

7 Cloud Computing in Education Market Analysis, By Service Model (Page No. - 53)

7.1 Introduction

7.2 Software-As-A-Service (SaaS)

7.3 Platform-As-A-Service (PaaS)

7.4 Infrastructure-As-A-Service (IaaS)

8 Market Analysis, By Deployment Model (Page No. - 60)

8.1 Introduction

8.2 Private Cloud

8.3 Public Cloud

8.4 Hybrid Cloud

8.5 Community Cloud

9 Cloud Computing in Education Market Analysis, By User Type (Page No. - 68)

9.1 Introduction

9.2 K-12

9.3 Higher Education

10 Geographic Analysis (Page No. - 75)

10.1 Introduction

10.2 North America

10.3 United States (U.S.)

10.4 Canada

10.5 Europe

10.6 United Kingdom (U.K.)

10.7 Germany

10.8 Others

10.9 Asia-Pacific (APAC)

10.10 Australia and New Zealand

10.11 Singapore

10.12 Others

10.13 Middle East and Africa (MEA)

10.14 Latin America

11 Competitive Landscape (Page No. - 104)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches / Upgradation

11.2.2 Partnerships, Agreements, and Collaborations

11.2.3 Mergers and Acquisitions

11.2.4 Expansions

12 Company Profiles (Page No. - 110)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 Introduction

12.2 Adobe Systems, Inc.

12.3 Cisco Systems, Inc.

12.4 IBM Corporation

12.5 Oracle Corporation

12.6 Microsoft Corporation

12.7 NEC Corporation

12.8 Netapp

12.9 VMware, Inc.

12.10 Amazon Web Services, Inc.

12.11 Ellucian Company L.P.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Key Innovators (Page No. - 142)

13.1 Citrix Systems, Inc.

13.1.1 Business Overview

13.1.2 Key Strategies

13.2 Huawei Technologies

13.2.1 Business Overview

13.2.2 Key Strategies

13.3 Educomp Solutions Ltd

13.3.1 Business Overview

13.3.2 Key Strategies

14 Appendix (Page No. - 144)

14.1 Other Developments

14.1.1 Other Developments: New Product Launches, 20142016

14.1.2 Other Developments: Partnerships, Agreements, and Collaborations, 20142016

14.1.3 Other Developments: Expansions, 20142016

14.2 Industry Excerpts

14.3 Discussion Guide

14.4 Knowledge Store: Marketsandmarkets Subscription Portal

14.5 Introducing RT: Real Time Market Intelligence

14.6 Available Customizations

14.7 Related Reports

List of Tables (71 Tables)

Table 1 Global Cloud Computing in Education Market Size and Growth Rate, 20142021 (USD Billion, Y-O-Y %)

Table 2 Market Size, By Service Model, 20142021 (USD Million)

Table 3 SaaS: Market Size, By User Type, 20142021 (USD Million)

Table 4 SaaS: Market Size, By Region, 20142021 (USD Million)

Table 5 PaaS: Market Size, By User Type, 20142021 (USD Million)

Table 6 PaaS: Market Size, By Region, 20142021 (USD Million)

Table 7 IaaS: Market Size, By User Type, 20142021 (USD Million)

Table 8 IaaS: Market Size, By Region, 20142021 (USD Million)

Table 9 Market Size, By Deployment Model, 20142021 (USD Million)

Table 10 Private Cloud: Cloud Computing in Education Market Size, By User Type, 20142021 (USD Million)

Table 11 Private Cloud: Market Size, By Region, 20142021 (USD Million)

Table 12 Public Cloud: Market Size, By User Type, 20142021 (USD Million)

Table 13 Public Cloud: Market Size, By Region, 20142021 (USD Million)

Table 14 Hybrid Cloud: Market Size, By User Type, 20142021 (USD Million)

Table 15 Hybrid Cloud: Market Size, By Region, 20142021 (USD Million)

Table 16 Community Cloud: Cloud Computing in Education Market Size, By User Type, 20142021 (USD Million)

Table 17 Community Cloud: Market Size, By Region, 20142021 (USD Million)

Table 18 Market Size, By User Type, 20142021 (USD Million)

Table 19 K-12: Market Size, By Service Model, 20142021 (USD Million)

Table 20 K-12: Market Size, By Deployment Model, 20142021 (USD Million)

Table 21 K-12: Market Size, By Region, 20142021 (USD Million)

Table 22 Higher Education: Market Size, By Service Model, 20142021 (USD Million)

Table 23 Higher Education: Market Size, By Deployment Model, 20142021 (USD Million)

Table 24 Higher Education: Market Size, By Region, 20142021 (USD Million)

Table 25 Market Size, By Region, 20142021 (USD Million)

Table 26 North America: Market Size, By Service Model, 20142021 (USD Million)

Table 27 North America: Cloud Computing in Education Market Size, By Deployment Model, 20142021 (USD Million)

Table 28 North America: Market Size, By User Type, 20142021 (USD Million)

Table 29 U.S.: Market Size, By Service Model, 20142021 (USD Million)

Table 30 U.S.: Market Size, By Deployment Model, 20142021 (USD Million)

Table 31 U.S.: Market Size, By User Type, 20142021 (USD Million)

Table 32 Canada: Market Size, By Service Model, 20142021 (USD Million)

Table 33 Canada: Cloud Computing in Education Market Size, By Deployment Model, 20142021 (USD Million)

Table 34 Canada: Market Size, By User Type, 20142021 (USD Million)

Table 35 Europe: Market Size, By Service Model, 20142021(USD Million)

Table 36 Europe: Market Size, By Deployment Model, 20142021 (USD Million)

Table 37 Europe: Market Size, By User Type, 20142021 (USD Million)

Table 38 U.K.: Market Size, By Service Model, 20142021 (USD Million)

Table 39 U.K.: Market Size, By Deployment Model, 20142021 (USD Million)

Table 40 U.K.: Market Size, By User Type, 20142021 (USD Million)

Table 41 Germany: Market Size, By Service Model, 20142021 (USD Million)

Table 42 Germany: Market Size, By Deployment Model, 20142021 (USD Million)

Table 43 Germany: Market Size, By User Type, 20142021(USD Million)

Table 44 Others: Market Size, By Service Model, 20142021 (USD Million)

Table 45 Others: Market Size, By Deployment Model, 20142021 (USD Million)

Table 46 Others: Cloud Computing in Education Market Size, By User Type, 20142021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Service Model, 20142021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Deployment Model, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By User Type, 20142021(USD Million)

Table 50 Australia & New Zealand: Market Size, By Service Model, 20142021 (USD Million)

Table 51 Australia & New Zealand: Market Size, By Deployment Model, 20142021 (USD Million)

Table 52 Australia & New Zealand: Market Size, By User Type, 20132020 (USD Million)

Table 53 Singapore: Market Size, By Service Model, 20142021 (USD Million)

Table 54 Singapore: Market Size, By Deployment Model, 20142021 (USD Million)

Table 55 Singapore: Market Size, By User Type, 20142021 (USD Million)

Table 56 Others: Cloud Computing in Education Market Size, By Service Model, 20142021 (USD Million)

Table 57 Others: Market Size, By Deployment Model, 20142021 (USD Million)

Table 58 Others: Market Size, By User Type, 20142021 (USD Million)

Table 59 Middle East and Africa: Market Size, By Service Model, 20142021 (USD Million)

Table 60 Middle East and Africa: Market Size, By Deployment Model, 20142021 (USD Million)

Table 61 Middle East and Africa: Market Size, By User Type, 20142021 (USD Million)

Table 62 Latin America: Cloud Computing in Education Market Size, By Service Model, 20142021 (USD Million)

Table 63 Latin America: Market Size, By Deployment Model, 20132020 (USD Million)

Table 64 Latin America: Market Size, By User Type, 20142021 (USD Million)

Table 65 New Product Launches, 2016

Table 66 Partnerships, Agreements, and Collaborations, 2016

Table 67 Mergers and Acquisitions, 20142016

Table 68 Expansions, 20152016

Table 69 Other Developments: New Product Launches, 20142016

Table 70 Other Developments: Partnerships, Agreements, and Collaborations, 20142016

Table 71 Other Developments: Expansions, 20142016

List of Figures (63 Figures)

Figure 1 Markets Covered

Figure 2 Cloud Computing in Education: Research Design

Figure 3 Breakdown of Primaries: By Company, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Service Model Snapshot (2016-2021): Market for PaaS is Expected to Grow at the Highest CAGR

Figure 8 Deployment Model Snapshot (2016-2021): Public Cloud is Expected to Dominate the Cloud Computing in Education Market

Figure 9 User Type Snapshot (2016-2021): Higher Education is Expected to Dominate the Market

Figure 10 North America is Estimated to Hold the Largest Market Share in 2016

Figure 11 Reduction of Management Burden is Driving the Market

Figure 12 Hybrid Cloud is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 13 North America is Expected to Hold the Largest Market Share Among All Regions in the Market

Figure 14 Asia-Pacific is Expected to Witness the Highest Growth Potential Till 2021

Figure 15 Higher Education is Expected to Dominate the Market in 2021

Figure 16 Asia-Pacific is Expected to Grow at the Highest CAGR During the Forecast Period in the Cloud Computing in Education Market

Figure 17 Public Cloud is Expected to Have the Highest Impact on the Market

Figure 18 Regional Lifecycle: Asia-Pacific is Estimated to Be in the Growth Phase in 2016

Figure 19 Software-As-A-Service is Expected to Play A Crucial Role in the Market

Figure 20 Market Segmentation

Figure 21 Market Segmentation: By Service Model

Figure 22 Market Segmentation: By Deployment Model

Figure 23 Market Segmentation: By User Type

Figure 24 Market Segmentation: By Region

Figure 25 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 26 Cloud Computing in Education Architecture

Figure 27 Cloud Computing in Education Market: Value Chain Analysis

Figure 28 SaaS is Expected to Lead Among Service Models During the Forecast Period

Figure 29 SaaS Expected to Grow at the Highest CAGR in Asia-Pacific

Figure 30 IaaS is Expected to Grow at the Highest CAGR in Asia-Pacific During the Forecast Period

Figure 31 Public Cloud is Expected to Be the Highest Contributor in Terms of Market Size Among All Deployment Models During the Forecast Period

Figure 32 Public Cloud is Expected to Grow at the Highest CAGR in Asia-Pacific During the Forecast Period

Figure 33 Hybrid Cloud is Expected to Grow at the Highest CAGR in Europe

Figure 34 K-12 User Segment is Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 35 K-12 is Expected to Grow at the Highest CAGR in Asia-Pacific During the Forecast Period

Figure 36 Higher Education User Segment in Europe is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 37 Geographic Snapshot Asia-Pacific is Expected to Grow With the Highest CAGR During the Forecast Period

Figure 38 Asia-Pacific: an Attractive Destination for Cloud Computing Service Models

Figure 39 Geographic Snapshot (20162021): Asia-Pacific and Europe Offers Lucrative Opportunities in the Cloud Computing in Education Market

Figure 40 North America Market Snapshot

Figure 41 U.S. Market Snapshot

Figure 42 Canada Market Snapshot

Figure 43 PaaS is Expected to Exhibit the Highest Growth Rate in Europe During the Forecast Period

Figure 44 Higher Education User Segment is Expected to Have the Largest Market Size in Europe During the Forecast Period

Figure 45 Asia-Pacific Market Snapshot

Figure 46 Asia-Pacific is Expected to Grow at the Highest CAGR in the Cloud Computing in Education Market

Figure 47 Companies Adopted New Product Launch as the Key Growth Strategy Between 2014 - 2016

Figure 48 Market Evaluation Framework

Figure 49 Battle for Market Share: New Product Launches and Partnerships Were the Key Strategies

Figure 50 Geographic Revenue Mix of Top 5 Market Players

Figure 51 Adobe Systems, Inc.: Company Snapshot

Figure 52 Adobe Systems, Inc.: SWOT Analysis

Figure 53 Cisco Systems, Inc.: Company Snapshot

Figure 54 Cisco Corporation: SWOT Analysis

Figure 55 IBM Corporation: Company Snapshot

Figure 56 IBM Corporation: SWOT Analysis

Figure 57 Oracle Corporation: Company Snapshot

Figure 58 Oracle Corporation: SWOT Analysis

Figure 59 Microsoft Corporation: Company Snapshot

Figure 60 Microsoft Corporation: SWOT Analysis

Figure 61 NEC Corporation: Company Snapshot

Figure 62 Netapp: Company Snapshot

Figure 63 VMware, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Cloud Computing in Education Market