Water Treatment Chemicals Market

Water Treatment Chemicals Market by Type (Flocculant & Coagulant, Corrosion Inhibitors, Scale Inhibitors, Biocides & Disinfectants, Chelating Agents), Sales Channel, Source, End-use (Residential, Commercial & Industrial), & Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

During the forecast period, the water treatment chemicals market is projected to reach USD 46.64 billion by 2029 from USD 38.37 billion in 2024, at a CAGR of 4.0%. The growth of the water treatment chemicals market is driven by increasing urbanization, industrialization, and tightening environmental regulations that demand effective wastewater management. Rising concerns over water scarcity and contamination have accelerated investments in municipal and industrial water treatment plants, while technological advancements in membrane treatment, biocides, and corrosion inhibitors further support market expansion.

KEY TAKEAWAYS

-

BY TYPEThe water treatment chemicals market type includes Coagulants & Flocculants, Corrosion Inhibitors, Scale Inhibitors, Biocides & Disinfectants, Chelating Agents, Anti Foaming Agents, pH Adjusters & Stabilizers and other types of chemicals. These chemicals are designed to purify, protect, and enhance water quality across industrial, municipal, and commercial applications. Each type plays a crucial role in maintaining system efficiency, ensuring regulatory compliance, and extending the lifespan of water treatment infrastructure.

-

BY SOURCEWater treatment chemicals are derived from various synthetic and bio-based sources. Synthetic chemicals, derived from petroleum or inorganic compounds, dominate due to their cost-effectiveness and high efficiency in treating large-scale water systems. However, the market is witnessing a growing shift toward bio-based and green chemicals sourced from renewable materials such as plant extracts, enzymes, and organic acids. This transition is driven by increasing environmental regulations, sustainability goals, and the rising demand for eco-friendly solutions in industrial and municipal water treatment processes.

-

BY SALES CHANNELWater treatment chemicals report provides in-depth analysis of the distribution and procurement mechanisms shaping the industry. This sales channel is segmented into direct sales, distributors, and online marketplaces. Large chemical manufacturers typically engage in direct sales to major industrial and municipal clients, offering customized formulations and on-site technical support. Meanwhile, distributors and regional partners cater to smaller utilities and commercial facilities, ensuring localized supply and service coverage. Increasingly, digital sales platforms and performance-based service models are emerging, enabling real-time monitoring, automated dosing, and long-term customer partnerships across industries.

-

BY APPLICATIONThe water treatment chemicals market finds applications across boiler water treatment, cooling water treatment, raw water treatment, water desalination, and other specialized uses. In boiler and cooling systems, these chemicals prevent scaling, corrosion, and microbial growth, ensuring operational efficiency and equipment longevity. Raw water treatment uses coagulants and flocculants to remove impurities before industrial or municipal use, while desalination relies on antiscalants and biocides to enhance membrane performance. Other applications include wastewater recycling, sludge treatment, and chemical dosing in food, pharmaceutical, and power generation sectors, reflecting the market’s broad industrial relevance.

-

BY END-USE INDUSTRYThe water treatment chemicals market caters to a diverse range of end users, including residential, commercial, and industrial sectors. In the residential segment, these chemicals ensure safe drinking water and maintain household water systems. The commercial sector—covering hospitals, hotels, and office complexes—uses them to maintain HVAC systems and meet hygiene standards. The industrial segment dominates the market, driven by high demand from manufacturing, power generation, oil & gas, and food & beverage industries for process water purification, corrosion control, and wastewater management.

-

BY REGIONAsia Pacific is projected to be the fastest-growing region in the water treatment chemicals market, driven by rapid industrialization, urbanization, and increasing regulatory pressure for environmentally sustainable water treatment solutions. Rising municipal water infrastructure investments, expanding industrial wastewater management, and growing awareness of eco-friendly chemical alternatives are boosting market adoption.

-

COMPETITIVE LANDSCAPEMajor players in the water treatment chemicals market are pursuing both organic and inorganic growth strategies, including acquisitions, partnerships, and development of synthetic and bio-based water treatment solutions. Companies such as Kemira (Finland), Veolia (France), Ecolab (US), BASF (Germany), Dow (US), Solvay (Belgium), Nouryon (Netherlands), Kurita (Japan), Solenis (US), SNF Floerger (France) are expanding their product portfolios with coagulants, flocculants, antiscalants, and corrosion inhibitors, while also targeting regional expansions to meet increasing demand for water treatment solutions globally.

The water treatment chemicals market is witnessing strong growth driven by rapid industrialization, rising freshwater scarcity, and stricter wastewater discharge norms. Innovation is focused on eco-friendly, high-performance formulations, such as bio-based coagulants, biodegradable scale inhibitors, and smart chemical dosing systems that optimize usage and reduce waste. Opportunities are emerging in industrial reuse, desalination, and zero-liquid discharge systems, supported by digital monitoring technologies and modular plant designs. This shift toward sustainability, coupled with increasing investments in infrastructure and clean water initiatives, continues to accelerate market expansion globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The effects on water treatment chemical manufacturers are driven by evolving client imperatives and end-user transformations. Hotspots include municipal utilities, industrial water users, EPC contractors, and integrated water service providers, with target sectors spanning wastewater treatment, power generation, oil & gas, and food & beverage industries. Shifts in the market—such as the push for sustainable chemistry, digital water monitoring, and decentralized treatment systems—are reshaping client strategies and investments. These disruptions, driven by stricter environmental norms and ESG commitments, will influence the revenues of both end users and service providers, thereby boosting demand for advanced, bio-based, and high-efficiency water treatment chemicals.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for chemically treated water in various end-use industries

-

Growing focus on water reuse and scarcity management

Level

-

Availability of alternative water treatment technologies

-

High cost of water treatment processes

Level

-

Growiing population and rapid urbanization in emerging economies

-

Increasing demand for specialty formulations

Level

-

Difficulties associated with eco-friendly formulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for chemically treated water in various end-use industries

The water treatment chemicals market is undergoing a period of healthy growth with the rising demand of chemically treated water in the various end-use markets in the power generation, oil and gas, food and beverage, pharmaceutical, pulp and paper, and textile industries. With the increasing rate of industrialization in the world, issues of water contamination and scarcity have become a serious concern forcing industries to consider and implement effective chemical-based treatment processes to not only make the processes efficient, equipments long-lasting, and the environment observant. Coagulants, flocculants, corrosion inhibitors, biocides and scale control agents are these chemicals, and they are critical in ensuring the water quality and its reuse in close-loop systems. Moreover, increased imposition of tough discharge laws and zero liquid discharge (ZLD) laws especially in Asia Pacific and Europe are forcing industries to incorporate high-level chemical treatment procedures. Increasing accuracy and cost-effectiveness of chemical applications is also being improved by the emergence of smart dosing and monitoring technologies. Also, the transition to bio-based and environmentally sustainable formulations is associated with the sustainability goal and ESG objectives, which further increases the market potential. With the efforts of industries to minimize the risks in their operations and the use of water, specialty and high-performance water treatment chemicals are likely to be under great demand in the next few years.

Restraint: Availability of alternative water treatment technologies

The presence of alternative water treatment technologies poses a huge limitation on the water treatment chemicals market development. The use of emerging physical and biological treatment techniques (membrane filtration, ultraviolet (UV) disinfection, reverse osmosis (RO), ion exchange, and advanced oxidation process (AOPs)) is becoming popular both as an alternative and as a supplementary solution to chemical-based treatment. These technologies have been associated with the benefits of decreasing chemical dependence, decreasing the amount of sludge and causing the smallest amount of secondary pollution, which is why they can be considered by industries and municipalities that need to find sustainable water management solutions. Furthermore, the fact that operational costs are on the lower end and that efficiency of these advanced systems is increasing has also propelled their use especially in developed countries such as North America and Europe where there are tough environmental and sustainability requirements that prefer chemical free solutions. The transition to green and circular water management practices also contributes to the implementation of physical-biological and non-conventional chemicals in place of traditional ones. Nevertheless, these technologies save a lot of chemicals, but they usually cost a lot of capital to implement and the maintenance is complicated, which makes them impossible to roll out to the developing world. However, the increasing technological sophistication of these alternatives remains a threat on the traditional demand of water treatment chemicals in the long term, forcing producers to be creative, and focused towards hybrid and environmentally friendly formulations.

Opportunity: Growiing population and rapid urbanization in emerging economies

The increasing number of people and high urbanization rate in the emerging economy is a big opportunity to the water treatment chemicals market. India, China, Indonesia, Brazil and South Africa are already experiencing faster urbanization, industrial growth and increased water use and consequently the need to find efficient ways of treating water and waste water. The growth of towering cities is exerting a lot of pressure on the available water systems forcing the governments and the industry to invest on municipal water treatment, desalination and wastewater recycling plants. This generates a long-term demand of coagulants, flocculants, biocides, scale inhibitors, and corrosion inhibitors in order to sustain water quality and standards set by regulations. Moreover, the growing interest on safe drinking water, sanitation, and industrial water reuse are in line with such efforts as the Jal Jeevan Mission of India and water ten plan of China, which creates new possibilities in the work of chemical suppliers. The quick pace of industrialization also exposes the system to higher effluent loads which in turn require sophisticated chemical treatment so that the requirements of discharge norms are met. With the existing and increasing urban population, the need of chemically-treated water in the municipal and industrial industries of the emerging economies will take off, making them the areas of significant growth to innovative, high-performance and sustainable water treatment chemicals.

Challenge: Difficulties associated with eco-friendly formulations

The challenges linked to the design and commercialization of environmental-friendly formulations also present a huge challenge to the water treatment chemicals market. Although the pressure on regulators and industries is increasing to switch to bio-based, biodegradable and non-toxic chemicals, similar performance and stability to traditional synthetic formulations are still complicated. The problem is that eco-friendly alternatives tend to be restricted in terms of efficacy, shelf life and cost competitiveness, especially in extreme operating conditions, i.e. high temperature, salinity or changing pH conditions encountered in industrial operations. In addition, the cost of production on bio-based raw materials is high and requires specialized formulation technologies that limit large scale adoption, particularly in price-sensitive markets such as municipal and small-scale industrial markets. It also incurs extra costs in the form of compliance with various regional regulation like Europe and U.S.EPA, which results in higher cost in the field of R&D and postpones the commercialization of products. Also, performance benchmarks involving performance of green water treatment chemicals have not been standardized as yet thus the end users struggle to evaluate reliability and ROI. Because of this, in spite of the increasing environmental consciousness, these issues seem to hinder the quick adoption of sustainable formulation, thus forcing manufacturers to balance between performance, costs and compliance by means of constant innovation and hybrid chemistries.

Water Treatment Chemicals Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implementation of advanced coagulant and flocculant programs for municipal wastewater treatment facilities in Finland and Germany. | Improved removal of suspended solids and phosphates; reduced sludge volume; enhanced process stability and compliance with EU water directives. |

|

Deployment of Veolia’s Hydrex™ chemical formulations in industrial effluent treatment plants for the food & beverage sector in France. | Achieved optimized chemical dosing, lower operating costs, and improved biological treatment efficiency; ensured compliance with discharge standards. |

|

Use of Kurita’s Cetamine® film-forming amine technology for boiler and cooling water treatment in power plants across the U.S. and Japan. | Reduced corrosion rates and CO2 emissions; improved heat transfer efficiency; minimized chemical consumption and operational downtime. |

|

Application of MicrOx® hydrogen peroxide and Advanox™ UV treatment systems for micropollutant removal in European municipal water plants. | Achieved >90% removal of pharmaceutical residues; enhanced water quality; compliance with stringent EU wastewater discharge norms. |

|

Deployment of proprietary antiscalants, corrosion inhibitors, and dispersants in paper & pulp manufacturing and industrial cooling systems in the U.K. | Improved water reuse and equipment reliability; reduced chemical and water consumption; enhanced operational sustainability and ESG performance. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The water treatment chemicals industry has a complicated ecosystem consisting of manufacturers, including Kemira (Finland), Ecolab (US), Veolia (France), raw material suppliers, distributors, government, and end-use industries. Leading companies in this industry include the established, financially stable manufacturers of water treatment chemicals. These companies have been in the industry for many years and have diversified product portfolios and robust global sales and marketing networks.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Water Treatment Chemicals Market, By Type

The largest market in the water treatment chemicals market, by type is coagulants & flocculants which are used widely in the municipal and industrial wastewater treatment, power generation, mining, and food & beverage processing industries. These chemicals are very crucial in the pretreatment of water to aggregate the suspended solids, colloidal particles and organic elements into bigger flocs so that they would be easily separated and purified. Their demand has increased due to rising international attention to the supply of clean water and wastewater reuse, as well as the tightening of emission standards, particularly in developing countries, where the population of the urban population grows, and the water infrastructure is insufficient. Moreover, the use of polymer and bio-based coagulants is also being developed in order to improve the treatment capacity in addition to being sustainable. The trend in the industries is moving towards high-performance and low dosage to generate less sludge and minimise the cost of operation. The most popular end-use segment is municipal wastewater treatment, which is backed by the massive infrastructure development in developing nations like India, China, and Brazil. As the water shortage and environmental issues continue to rise, the need to have efficient, cost-efficient, and environmentally friendly coagulants & flocculants is likely to prevail.

Water Treatment Chemicals Market, By Source

The bio-based water treatment chemicals are seen as the fastest growing market in the global market due to increased awareness about the environment and strict rules on discharge of chemicals. These chemicals are a sustainable substitute to the commonly prevalent petroleum-derived forms because they are manufactured out of renewable resources like plant extracts, biopolymers, and natural enzymes. They are becoming popular in such applications as in coagulation, disinfection, and conditioning of sludge where environmental-friendly solutions are becoming a top priority. Bio-based formulations are being embraced by industries and municipalities to reduce ecological impact, minimize toxicity and increase biodegradability according to the goals of sustainability in the world and the principles of the circular economy. Constant research and innovation have enhanced their functionality, economical nature and scalability rendering them competitive to conventional products. The boom of bio-based water treatment chemicals will achieve high growth rates in the next years with the strong regulations, particularly in Europe and North America, and an increase of the usage in emerging economies, the market will transform to favor greener solutions.

Water Treatment Chemicals Market, By Sales Channel

Direct sales channel is the most popular sales channel segment in the water treatment chemicals market, as it is a channel where good customer relations, delivery of the product, and technical support can be ensured. In industries such as power generation, food and beverage, oil and gas, and municipal water treatment, manufacturers of chemicals such as Kemira, Solenis and Kurita often deal directly with end users to offer specific chemical solutions and process optimization services. Direct sales will enable the suppliers to provide custom dosing programs, on-site monitoring and constant technical support to guarantee the best chemical performance and customer retention. The strategy also aids in keeping prices, quality of products and brand loyalty checked. Given that the growing demands among the end users are to have integrated water management solutions rather than independent chemicals, the direct sales distribution channel is the preferred one. The major status of the channel will probably be maintained, with the help of the development of industrial relationships and the increase in the complexity of the water treatment procedures.

Water Treatment Chemicals Market, By Application

Boiler water treatment is the most significant and the fastest expanding application markets in the water treatment chemicals, which is provided by the increasing demands of efficient generation of steam in industries like power generation, oil and gas, chemicals and food and beverage. To avoid scaling, corrosion and furring, which may be extremely important to heat transfer effectiveness and equipment life, boiler systems must be carefully managed in terms of chemicals. The heightened level of concern with energy efficiency and the reliability of operations has prompted the resort to the use of special chemicals like oxygen scavengers, corrosion inhibitors, and scale control agents. Also, the growth of industrial infrastructure especially in Asia Pacific is driving the market growth as the adoption of high-pressure boilers in manufacturing industry and energy is on the rise. The implementation of high-tech, environmentally friendly, and low-maintenance treatment systems, combined with intelligent monitoring systems, only improves the performance of the system, and boiler water treatment is a highly important and rapidly growing direction of the water treatment chemicals business.

Water Treatment Chemicals Market, By End user

The industrial sector is projected to be the fastest-growing end-use industry in the water treatment chemicals market. Power generation, oil and gas, petrochemicals, food and beverage, and pulp and paper are some of the industries that heavily depend on quality process water and efficient management of the waste water to ensure their operations run effectively and in a manner that does not violate the regulations. The quantity and the complexity of effluents are ever increasing with industrial processes and thus, sophisticated chemical treatments like coagulants, corrosion inhibitors, biocides, scale control agents, and antifoaming agents are in demand. These are vital chemicals that reduce scaling, microbial growth and corrosion to ensure optimum equipment performance and long life of the plant. More so, industries are going more toward sustainable and digitalized treatment systems, integrating smart dosing and monitoring technologies with environmentally friendly formulations. As the need to curb the amount of water used increases and the target to attain zero-liquid discharge (ZLD) the industrial sector will continue to be a key driver of the water treatment chemicals market in the world.

REGION

Asia Pacific to be the fastest-growing region in the global water treatment chemicals market during the forecast period

The Asia Pacific region is projected to register the highest CAGR during the forecast period due to tremendous industrialization, increasing awareness of the environment, and government initiatives. Growth in this market is expected to be centered around China and India, mainly due to their growing manufacturing sectors and their demand for sustainable materials in various applications. There is growing demand of treated water in by municipal, industrial and residential sectors in the countries like China, India, Japan and South Korea. Increased manufacturing processes, together with firm water discharges policies, are also promoting the use of coagulants, flocculants, corrosion inhibitors, and biocides to retain the quality of water and assure compliance with regulation. The governments within the region are extensively investing in modernizing water infrastructure, desalination and recycling of wastewater which are further increasing chemical usage. Furthermore, the increasing demand of clean water in power generating, food and beverages as well as textile industries are raising market potential. The availability of dominant regional suppliers, affordable manufacturing as well as growing use of eco- friendly, bio-based formulations are enhancing the standing of Asia Pacific as a major growth market in the worldwide water treatment chemicals over the next 10 years.

Water Treatment Chemicals Market: COMPANY EVALUATION MATRIX

In the landscape of the water treatment chemicals industry, Ecolab (Star) has a significant market share, offering a diverse product portfolio with coagulants & flocculants, biocides & disinfectants, corrosion inhibitors, scale inhibitors, and chelating agents offered for direct sales and made available for municipalities and industrial treatment markets. Solenis (Emerging Leader) is gaining awareness with its specialty water treatment chemistries, innovating with niche product launches and expanding into a new product mix. While Ecolab dominates through scale and a broad sustainable portfolio, Solenis shows significant potential to move toward the leaders' quadrant as demand for water treatment solutions continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 37.13 Billion |

| Market Forecast in 2029 (value) | USD 46.64 Billion |

| Growth Rate | CAGR of 4.0% from 2024 to 2029 |

| Years Considered | 2021–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Water Treatment Chemicals Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Water Treatment Chemicals Manufacturer |

|

|

| Industrial Water Treatment Solutions Provider |

|

|

| Eco-Friendly Water Treatment Formulations Developer |

|

|

RECENT DEVELOPMENTS

- November 2024 : Ecolab acquired Barclay Water Management, a provider of water safety and digital monitoring solutions for industrial and institutional clients in the northeastern US. Barclay offers systems such as the iChlor Monochloramine System for Legionella treatment, enhancing water quality and enabling continuous monitoring and control.

- November 2024 : Solenis has acquired BASF's flocculants business, a strategic move that significantly enhances its portfolio in the mining sector, this acquisition allows Solenis to expand its offerings in specialty chemicals essential for mineral extraction, bolstering its position in a competitive market.

- September 2024 : Kemira completed the acquisition of Norit’s UK reactivation business, entering the activated carbon market for micropollutant removal. The acquisition includes a UK facility for regenerating spent activated carbons used in potable water and food-related applications.

- June 2024 : Kurita Water Industries Ltd. announced the establishment of a local company in India to enhance its sales and distribution of water treatment chemicals.

- May 2023 : Kurita acquired Arcade Engineering AG to strengthen its position in Europe and Asia. The move enhances Kurita’s manufacturing and supply chain for semiconductor water treatment and processing plants, fostering innovative solutions for energy and water efficiency.

- April 2023 : Nouryon expanded its operations by launching a new Global Service Center in Mumbai, India, to improve customer support and advance business development initiatives in the Asia Pacific region.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the water treatment chemicals market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, corporate documents, white papers, certified publications, trade directories, certified publications, articles from recognized authors, associations, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The water treatment chemicals market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end user. Various primary sources from the supply and demand sides of the water treatment chemicals market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the water treatment chemicals industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, source, sales channel, applications, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of water treatment chemicals and the future outlook of their business which will affect the overall market.

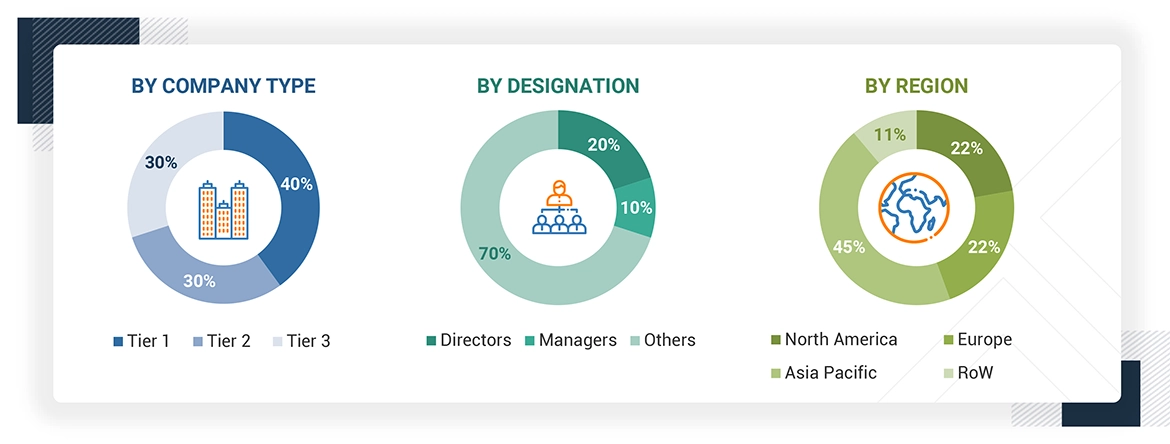

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for water treatment chemicals for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, source, sales channel, application, end-use industry, and region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

The market size include the following:

Data Triangulation

After arriving at the total market size from the estimation process of water treatment chemicals above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Water treatment chemicals (WTCs) can be defined as chemical compounds used in the water treatment process to remove impurities that cause corrosion, scales, high turbidity, and biological imbalance. These impurities can be metallic, organic, or non-organic. Corrosion inhibitors, coagulants & flocculants, scale inhibitors, chelating agents, biocides & disinfectants, and pH adjusters are among the chemicals used to eliminate impurities from water.

Stakeholders

- Water treatment chemicals manufacturers

- Raw material suppliers

- End-use companies, water treatment chemicals companies

- Water treatment chemicals traders, distributors, and suppliers

- Research organizations

- Industry associations

- Governments and research organizations

Report Objectives

- To define, describe, and forecast the size of the water treatment chemicals market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, source, sales channel, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micro markets concerning individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships, mergers, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Water Treatment Chemicals Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Water Treatment Chemicals Market