Automotive Fuel Injection Systems Market by Technology (Port Fuel, Gasoline Direct, & Direct Diesel), Fuel Type (Gasoline & Diesel), Region (APAC, Europe, North America, & RoW), Vehicle Type (PC, LCV, & HCV), and by Component - Trends & Forecast to 2020

[183 Pages Report] This report estimates the global automotive fuel injection systems market for 2015 and projects the demand for the same by 2020. The report segments the market based on vehicle types (passenger car, light commercial vehicles, and heavy commercial vehicles), by region (Asia-Pacific, Europe, North America, and rest of the world), by fuel types (gasoline and diesel), by technology (gasoline port injection, gasoline direct injection, and diesel direct injection), components (injectors, ECU, pressure regulators, and fuel pumps), and provides market forecast in terms of volume (in thousand units) and value (USD million) for abovementioned segments. The report also covers Porters Five Forces Analysis, value chain, and qualitative data about drivers, restraints, and opportunities presented by the global automotive fuel injection systems market.

The purpose of the fuel injection system is to calibrate and optimize the fuel/air ratio that enters the engine of the vehicle. The injection system consists of electronic components and sensors. It must be well-calibrated to maximize engine power and efficiency and to reduce gas consumption. The fuel injection system in gasoline engine cars is mostly indirect, with gasoline being injected into the inlet manifold or inlet port rather than directly into the combustion chambers. This ensures that the fuel is well mixed with the air before it enters the chamber. However, gasoline direct injection is an advanced injection system for gasoline engines that offers improved performances, and significant reductions in fuel consumption and emissions. Most of the diesel engines, however, use direct injection, where diesel is injected directly into the cylinder filled with compressed air.

The market in the Asia-Pacific region is growing at a good pace, given the increasing automotive production in these regions. Growing purchasing power, increasing demand for fuel-efficient vehicles, and enforcement of stringent emission norms in emerging economies such as China and India has resulted in an increase in the demand for fuel injection systems. Asia-Pacific is estimated to be the largest market for automotive fuel injection systems market and is projected to grow at the highest rate from 2015 to 2020.

Factors such as increasing global vehicle production, increasing need for fuel efficiency and stringent emission norms are driving the research and growth of the automotive fuel injection systems market. However, constantly fluctuating prices of the raw materials can affect the profitability of the tier-I suppliers. The increasing demand from countries such as China, India, and Brazil for two-wheelers is creating new growth opportunities for fuel injection systems

Major market players of automotive fuel injection systems market include Continental AG (Germany), Delphi Automotive PLC (U.K.), Denso Corporation (Japan), Robert Bosch (Germany), Hitachi Limited (Japan), and Magneti Marelli (Italy) among others.

Scope of the Report

- By Region

- Asia-Pacific

- Europe

- North America

- RoW

- By Components

- Fuel injectors

- Electronic Control Unit (ECU)

- Fuel Pressure Regulator (FPR)

- Fuel pump

- By Vehicle Types

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Engine Types

- Gasoline/Petrol

- Diesel

- By Technology

- Gasoline injection

- Port fuel injection

- Direct injection

- Diesel injection

- Direct injection

- Gasoline injection

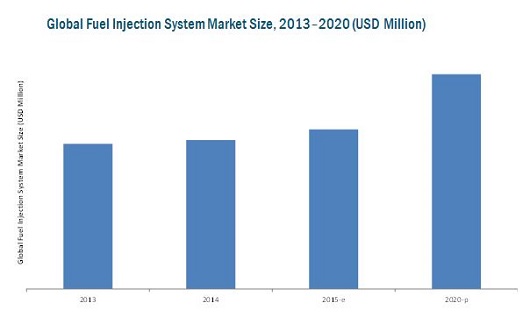

In 2015, the global automotive fuel injection systems market is estimated to be at USD 54.72 Billion, which would reach USD 73.62 Billion by 2020, growing at a CAGR of 6.11%.

The demand for automotive fuel injection system is governed by global vehicle production. Improved fuel efficiency & power output, and stringent exhaust emissions are some of the factors are driving demand for fuel injection systems in the automobile industry. Rising demand from countries such as China, India, and Brazil for two-wheeler is creating new growth opportunities for fuel injection systems. The overall demand of fuel injection system is expected to increase at a promising rate in the future.

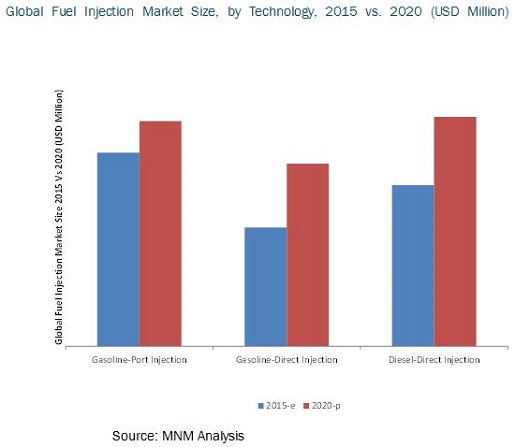

Growing concerns over fuel efficiency, increasing fuel prices & environmental regulations, and vehicle exhaust gases have made companies look for alternative technologies. In case of gasoline engines, the gasoline direct injection technology can offer all these benefits at a reasonable cost. This technology has already started gaining a significant market share over gasoline port fuel injection technology in all the developed countries and developing countries. The diesel direct injection technology is widely preferred across the globe.

This report estimates the global automotive fuel injection systems market for 2015 and projects the demand for the same by 2020. The report segments the market based on vehicle types (passenger car, light commercial vehicles, and heavy commercial vehicles), by region (Asia-Pacific, Europe, North America, and the rest of the world), fuel types (gasoline and diesel), by technology (port injection, gasoline direct injection, and diesel direct injection), and components (injectors, ECU, pressure regulators, and fuel pumps).

The market in Asia-Pacific region is growing at a good pace, given the increasing automotive production in these regions. Growing purchasing power, demand for high fuel efficient vehicles, and enforcement of stringent emission norms in emerging nations such as China, Thailand, and India has resulted in an increase in demand for fuel injection system. The market in Asia-Pacific is estimated to be the largest market for automotive fuel injection systems market and is projected to grow at the highest rate from 2015 to 2020.

The global automotive fuel injection systems market is dominated by few top players such as Continental AG (Germany), Delphi Automotive PLC (U.K.), Denso Corporation (Japan), Robert Bosch (Germany), Hitachi Limited (Japan), and Magneti Marelli (Italy) among others along with regional suppliers.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.2.1 Key Industry Insights

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Vehicle Production Increasing in Developing Countries

2.4.2.2 Impact of GDP on Commercial Vehicle Sales

2.4.2.3 Urbanization vs Passenger Cars Per 1,000 People

2.4.2.4 Infrastructure: Roadways

2.4.3 Supply Side Analysis

2.4.3.1 Technological Advancements

2.4.3.2 Influence of Other Factors

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Introduction

4.2 Attractive Market Opportunities in Automotive Fuel Injection Systems Market

4.3 Rising Demand for Automotive Fuel Injection Systems Market Expected in Emerging Regions

4.4 Asia-Pacific to Capture the Maximum Market Share in Automotive Fuel Injection Systems Market in 2015

4.5 Automotive Fuel Injection Systems Market: Rapidly Growing Technology

4.6 Automotive Fuel Injection Systems Growth Rate, By Major Countries

4.7 Automotive Fuel Injection Systems Market: By Region

4.8 Global Automotive Fuel Injection Systems Market, By Vehicle Type

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Region & Vehicle Type

5.2.2 By Technology & Fuel Type

5.2.3 By Off-Highway

5.2.4 By Components

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Need for Fuel Efficient Vehicles

5.3.1.2 Stringent Emission Control Norms

5.3.2 Restraints

5.3.2.1 Technological Design Complexity

5.3.2.2 Changing Prices of Raw Materials

5.3.3 Opportunities

5.3.3.1 Growing Two-Wheeler Market for Fuel Injection System

5.3.3.2 Product Development Opportunities in Natural Gas Vehicles

5.3.4 Challenges

5.3.4.1 Different Emission Norms Followed By Different Countries

5.3.4.2 Increasing Penetration of Electric Vehicles

5.3.5 Burning Issue

5.3.5.1 Adulterated Fuel

5.4 Porters Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

5.5 Value Chain

5.6 Technological Evolution

6 Automotive Fuel Injection Systems Market, By Vehicle Type (Page No. - 53)

6.1 Introduction

6.1.1 Passenger Car (PC)

6.1.2 Light Commercial Vehicle (LCV)

6.1.3 Heavy Commercial Vehicle (HCV)

6.1.4 Hybrid Vehicles

7 Global Fuel Injection Systems Market, By Components (Page No. - 69)

7.1 Introduction

7.1.1 Engine Control Unit

7.1.2 Fuel Injectors

7.1.3 Fuel Pressure Regulator

7.1.4 Fuel Pump

8 Automotive Fuel Injection Systems Market, By Fuel Type (Page No. - 82)

8.1 Introduction

8.1.1 Gasoline

8.1.2 Diesel

9 Automotive Fuel Injection Systems Market, By Technology (Page No. - 87)

9.1 Introduction

9.1.1 Gasoline Port Injection

9.1.2 Gasoline Direct Injection

9.1.3 Diesel Direct Injection

10 Global Automotive Fuel Injection Systems Market, By Regi0n (Page No. - 93)

10.1 Introduction

10.2 Pest Analysis

10.2.1 Political Factors

10.2.1.1 Europe

10.2.1.2 Asia-Pacific

10.2.1.3 North America

10.2.1.4 Rest of World

10.2.2 Economic Factors

10.2.2.1 Europe

10.2.2.2 Asia-Pacific

10.2.2.3 North America

10.2.2.4 Rest of the World

10.2.3 Social Factors

10.2.3.1 Europe

10.2.3.2 Asia-Pacific

10.2.3.3 North America

10.2.3.4 Rest of the World

10.2.4 Technological Factors

10.2.4.1 Europe

10.2.4.2 Asia-Pacific

10.2.4.3 North America

10.2.4.4 Rest of the World

10.3 Asia-Pacific

10.3.1 China

10.3.2 Japan

10.3.3 South Korea

10.3.4 India

10.3.5 Rest of Asia-Pacific

10.4 Europe

10.4.1 Germany

10.4.2 France

10.4.3 U.K.

10.4.4 Spain

10.4.5 Rest of Europe

10.5 North America

10.5.1 U.S.

10.5.2 Mexico

10.5.3 Canada

10.6 Rest of the World

10.6.1 Brazil

10.6.2 Russia

11 Off-Highway Fuel Injection Systems Market in Tractor & Construction Equipment (Page No. - 124)

11.1 Introduction

11.1.1 Tractor

11.1.2 Construction Equipment

12 Overview of Upcoming Legislations for Exhaust Emissions (Page No. - 128)

12.1 Introduction

12.2 European Union

12.3 Asia- Pacific

12.3.1 China

12.3.2 Japan

12.3.3 India

12.4 North-America

12.4.1 U.S.

12.4.2 Mexico

12.4.3 Canada

12.5 Rest of the World

12.5.1 Brazil

12.5.2 Russia

13 Competitive Landscape (Page No. - 133)

13.1 Market Share Analysis: Automotive Fuel Injection Systems Market

13.2 Competitive Situation & Trends

13.3 New Product Launches

13.4 Expansions

13.5 Mergers & Acquisitions

13.6 Agreements/Joint Ventures/Supply Contracts/Partnerships

13.7 Product Mapping Fuel Injection Market

13.8 Customer Mapping

13.9 Buying Criteria

13.9.1 Product Related Criteria

13.9.2 Other Buying Criteria

14 Company Profiles (Page No. - 141)

14.1 Introduction

(Overview, Financials, Products & Services, Strategy, and Developments)*

14.2 Continental AG

14.3 Delphi Automotive PLC

14.4 Denso Corporation

14.5 Robert Bosch

14.6 Infineon Technologies AG

14.7 Carter Fuel Systems

14.8 Edelbrock LLC

14.9 Hitachi Ltd.

14.10 Keihin Corporation.

14.11 Magneti Marelli S.P.A.

14.12 NGK Spark Plug Co., Ltd.

14.13 Ti Automotive Inc.

14.14 UCI International Inc. (UCI Fram Group)

14.15 Woodward Inc.

14.16 Westport Innovations Inc.

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 177)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Introducing RT: Real Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (119 Tables)

Table 1 Micro & Macro Factor Analysis

Table 2 Impact of Restraints on the Automotive Fuel Injection Systems Market

Table 3 Impact of Opportunities on the Automotive Fuel Injection Systems Market

Table 4 Impact of Challenges on the Automotive Fuel Injection Systems Market

Table 5 Type of Fuel Adulteration

Table 6 Developments in Gasoline Engine

Table 7 Global Automotive Fuel Injection Systems Market Size, By Vehicle Type, 20132020 (000 Units)

Table 8 Global Automotive Fuel Injection Systems Market Size, By Vehicle Type, 20132020 (USD Million)

Table 9 Passenger Car: Automotive Engine Control Unit Market Size, By Region, 20132020 (000 Units)

Table 10 Passenger Car: Automotive Engine Control Unit Market Size, By Region, 20132020 (USD Million)

Table 11 Passenger Car: Automotive Fuel Injectors Market Size, By Region, 20132020 (000 Units)

Table 12 Passenger Car: Automotive Fuel Injector Market Size, By Region, 20132020 (USD Million)

Table 13 Passenger Car: Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (000 Units)

Table 14 Passenger Car: Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (USD Million)

Table 15 Passenger Car: Automotive Fuel Pump Market Size, By Region, 20132020 (000 Units)

Table 16 Passenger Car: Automotive Fuel Pump Market Size, By Region, 20132020 (USD Million)

Table 17 LCV: Automotive Engine Control Unit Market Size, By Region, 20132020 (000 Units)

Table 18 LCV: Automotive Engine Control Unit Market Size, By Region, 20132020 (USD Million)

Table 19 LCV: Automotive Fuel Injector Market Size, By Region, 20132020 (000 Units)

Table 20 LCV: Automotive Fuel Injector Market Size, By Region, 20132020 (USD Million)

Table 21 LCV: Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (000 Units)

Table 22 LCV: Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (USD Million)

Table 23 LCV: Automotive Fuel Pump Market Size, By Region, 20132020 (000 Units)

Table 24 LCV: Automotive Fuel Pump Market Size, By Region, 20132020 (USD Million)

Table 25 HCV: Automotive Engine Control Unit Market Size, By Region, 20132020 (000 Units)

Table 26 HCV: Automotive Engine Control Unit Market Size, By Region, 20132020 (USD Million)

Table 27 HCV: Automotive Fuel Injector Market Size, By Region, 20132020 (000 Units)

Table 28 HCV Automotive Fuel Injector Market Size, By Region, 20132020 (USD Million)

Table 29 HCV: Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (000 Units)

Table 30 HCV: Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (USD Million)

Table 31 HCV: Automotive Fuel Pump Market Size, By Region, 20132020 (000 Units)

Table 32 HCV: Automotive Fuel Pump Market Size, By Region, 20132020 (USD Million)

Table 33 Automotive Fuel Injection Systems Market Size, By Components, 20132020 (000 Units)

Table 34 Automotive Fuel Injection Systems Market Size, By Components, 20132020 (USD Million)

Table 35 Automotive ECU Market Size, By Region, 20132020 (000 Units)

Table 36 Automotive ECU Market Size, By Region, 20132020 (USD Million)

Table 37 Electric Control Unit Market Size, By Region, 20132020 (000 Units)

Table 38 Electric Control Unit Market Size, By Region, 20132020 (USD Million)

Table 39 Temperature Sensor Market Size, By Region, 20132020 (000 Units)

Table 40 Temperature Sensor Market Size, By Region, 20132020 (USD Million)

Table 41 Fuel Pressure Sensor Market Size, By Region, 20132020 (000 Units)

Table 42 Fuel Pressure Sensor Market Size, By Region, 20132020 (USD Million)

Table 43 Position Sensors Market Size, By Region, 20132020 (000 Units)

Table 44 Position Sensor Market Size, By Region, 20132020 (USD Million)

Table 45 Oxygen Sensors Size, By Region, 20132020 (000 Units)

Table 46 Oxygen Sensor Market Size, By Region, 20132020 (USD Million)

Table 47 Airflow Sensors Market Size, By Region, 20132020 (000 Units)

Table 48 Airflow Sensor Market Size, By Region, 20132020 (USD Million)

Table 49 Knock Sensor Market Size, By Region, 20132020 (000 Units)

Table 50 Knock Sensor Market Size, By Region, 20132020 (USD Million)

Table 51 Other Sensors Market Size, By Region, 20132020 (USD Million)

Table 52 Automotive Fuel Injector Market Size, By Region, 20132020 (000 Units)

Table 53 Automotive Fuel Injector Market Size, By Region, 20132020 (USD Million)

Table 54 Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (000 Units)

Table 55 Automotive Fuel Pressure Regulator Market Size, By Region, 20132020 (000 Units)

Table 56 Automotive Fuel Pump Market Size, By Region, 20132020 (000 Units)

Table 57 Automotive Fuel Pump Market Size, By Region, 20132020 (USD Million)

Table 58 Automotive FIS Market Size, By Fuel Type, 20132020 (000 Units)

Table 59 Automotive FIS Market Size, By Fuel Type, 20132020 (USD Million)

Table 60 Gasoline: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (000 Units)

Table 61 Gasoline: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (USD Million)

Table 62 Diesel: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (000 Units)

Table 63 Diesel: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (000 Units)

Table 64 Automotive Fuel Injection Systems Market Size, By Technology, 20132020 (000 Units)

Table 65 Automotive Fuel Injection Systems Market Size, By Technology, 20132020 (USD Million)

Table 66 Gasoline Port Injection: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (000 Units)

Table 67 Gasoline Port Injection: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (USD Million)

Table 68 Gasoline Direct Injection: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (000 Units)

Table 69 Gasoline Direct Injection: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (USD Million)

Table 70 Diesel Direct Injection: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (000 Units)

Table 71 Diesel Direct Injection : Automotive Fuel Injection Systems Market Size, By Region, 20132020 (USD Million)

Table 72 Global Automotive Fuel Injection Systems Market, By Region, 20132020 ('000 Units)

Table 73 Global Automotive Fuel Injection Systems Market, By Region, 20132020 (USD Million)

Table 74 Asia-Pacific: Automotive Fuel Injection Systems Market , By Country, 20132020 ('000 Units)

Table 75 Asia-Pacific: Automotive Fuel Injection Systems Market, By Country, 20132020 (USD Million)

Table 76 China: Automotive Fuel Injection Systems Market, By Component, 20132020 ('000 Units)

Table 77 China: Automotive Fuel Injection Systems Market, By Component, 20132020 (USD Million)

Table 78 Japan: Automotive Fuel Injection Systems Market, By Component, 20132020 ('000 Units)

Table 79 Japan: Automotive Fuel Injection Systems Market, By Component, 20132020 (USD Million)

Table 80 South Korea: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 81 South Korea: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 82 India: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 83 India: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 84 Rest of Asia-Pacific: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 85 Rest of Asia-Pacific: Automotive Fuel Injection Systems Market, By Component, 20132020 (USD Million)

Table 86 Europe: Automotive FIS Market, By Country, 20132020 ('000 Units)

Table 87 Europe: Automotive FIS Market, By Country, 20132020 (USD Million)

Table 88 Germany: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 89 Germany: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 90 France: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 91 France: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 92 U.K.: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 93 U.K.: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 94 Spain: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 95 Spain: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 96 Rest of Europe: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 97 Rest of Europe: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 98 North America: Automotive FIS Market, By Country, 20132020 ('000 Units)

Table 99 North America: Automotive FIS Market, By Country, 20132020 (USD Million)

Table 100 U.S.: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 101 U.S.: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 102 Mexico: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 103 Mexico: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 104 Canada: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 105 Canada: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 106 Rest of the World: Automotive FIS Market, By Country, 20132020 ('000 Units)

Table 107 Rest of the World: Automotive Fuel Injection Systems Market, By Country, 20132020 (USD Million)

Table 108 Brazil: Automotive FIS Market, By Component, 20132020 ('000 Units)

Table 109 Brazil: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 110 Russia: Automotive FIS, By Component, 20132020 ('000 Units)

Table 111 Russia: Automotive FIS Market, By Component, 20132020 (USD Million)

Table 112 Tractors: Automotive FIS Market Size, By Region, 20132020 (000 Units)

Table 113 Tractors: Automotive FIS Market Size, By Vehicle Type, 20132020 (USD Million)

Table 114 Construction Equipment: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (Units)

Table 115 Construction Equipment: Automotive Fuel Injection Systems Market Size, By Region, 20132020 (USD Million)

Table 116 New Product Launches, 20132015

Table 117 Expansions, 20142015

Table 118 Mergers & Acquisitions, 20132015

Table 119 Agreements/Joint Ventures/Supply Contracts/Partnerships, 20132015

List of Figures (71 Figures)

Figure 1 Automotive Fuel Injection Systems Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Vehicle Production, 20092014

Figure 6 Gross Domestic Product (GDP) vs Commercial Vehicle Sales

Figure 7 Urbanization vs Passenger Cars Per 1,000 People

Figure 8 Road Network vs Passenger Car Sales

Figure 9 Market Size Estimation Methodology: Bottom-Up Approach

Figure 10 Market Size Estimation Methodology: Top-Down Approach

Figure 11 ECU: Largest Market for Automotive Fuel Injection System

Figure 12 Passenger Car Segment to Dominate the Automotive Fuel Injection Systems Market During the Forecast Period

Figure 13 Gasoline Port Injection Contributes Largest Market Share of Automotive Fuel Injection Systems Market

Figure 14 Gasoline Automotive Fuel Injection Market (USD Million)

Figure 15 Asia-Pacific: the Most Promising Region as Compared to Others

Figure 16 Automotive Fuel Injection Market to Grow at A CAGR of 6.11% During the Forecast Period

Figure 17 Asia-Pacific Being the Most Promising Region for Automotive Fuel Injection System Market

Figure 18 Gasoline Direct Injection Projected to Grow at the Fastest Rate, 20152020 (USD Million)

Figure 19 Chinese Automotive Fuel Injection Market is Estimated to Grow at Highest CAGR

Figure 20 Asia-Pacific Estimated to Hold Maximum Market Share for Automotive Fuel Injection Systems Market in 2015

Figure 21 Passenger Car Segment hsa A Promising Future

Figure 22 Market Segmentation, By Region & Vehicle Type

Figure 23 Market Segmentation, By Technology

Figure 24 Market Segmentation, By Off-Highway

Figure 25 Market Segmentation, By Components

Figure 26 Automotive Fuel Injection System Market Dynamics

Figure 27 Impact of Drivers on the Automotive Fuel Injection Systems Market

Figure 28 Fluctuating Steel Prices Over the Years, 2011-2014

Figure 29 Porters Five Forces Analysis: Global Automotive Fuel Injection Systems Market

Figure 30 Value Chain Analysis

Figure 31 Global Automotive Fuel Injection Market Growth, By Vehicle Type 2015 vs 2020

Figure 32 Asia-Pacific: Automotive Engine Control Unit to Grow at Highest CAGR During the Forecast Period (000 Units)

Figure 33 Passenger Car: Snapshot of Automotive of Engine Control Unit Market Size, By Region (USD Million)

Figure 34 North America Largest Producer of LCV and Growing at Highest CAGR (USD Million)

Figure 35 North America Dominates the Automotive Engine Control Unit (000 Units)

Figure 36 North America Automotive Engine Control Unit Market is Projected to Grow at the Highest CAGR During the Forecast Period (000 Units)

Figure 37 Asia-Pacific Estimated to Have Highest Market Share for Automotive Engine Control Unit Market in 2015 (USD Million)

Figure 38 Automotive ECU is Set to Have the Highest Growth in the Asian Market (000 Units)

Figure 39 Electric Control Unit to Have the Highest Market Share in Value During the Forecast Period

Figure 40 Fuel Injectors to Gain Momentum in the North American Market (000 Units)

Figure 41 Asia-Pacific to Capture the Largest Market Share for Gasoline Automotive Fuel Injection System, By Volume 2015

Figure 42 Gasoline-Direct Injection Growing at Highest CAGR (Volume-000 Units)

Figure 43 Regional Snapshot, Growth in Value (2015) Developing Countries Emerging as New Hot Spots for the FIS Market

Figure 44 Global Automotive FIS Market Size (USD Million): North American Market is Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 45 Asia-Pacific Automotive Fuel Injection Market Snapshot China to Capture the Largest Market Share in the Fuel Injection Market in 2015

Figure 46 China: Robust Economic Growth & Increasing Vehicle Production to Propel the Market for Automotive Fuel Injection in 2015 & 2020

Figure 47 Germany to Capture the Highest Market Share for Automotive Fuel Injection Market (Volume) During the Forecast Period

Figure 48 North America Automotive Fuel Injection Market Snapshot

Figure 49 U.S. Automotive Fuel Injection Market to Grow at Highest CAGR

Figure 50 Brazil to Dominate the Row Automotive Fuel Injection Market By Volume During the Forecast Period

Figure 51 Brazil: ECU to Capture the Highest Market Share for Automotive Fuel Injection Market, By Value, 2020

Figure 52 Asia-Pacific to Capture Highest Market Share By Value for Tractor Automotive Fuel Injection System in 2015

Figure 53 Increasing Construction Activities to Drive Automotive Fuel Injection System Market for Construction Equipment in 2015

Figure 54 Companies Adopted Product Innovation as the Key Growth Strategy From 2010 to 2015

Figure 55 Automotive Fuel Injection Market Share, 2014

Figure 56 Market Evaluation Framework: New Product Launches Fuelled the Demand for Automotive Fuel Injection Systems From 2013 to 2015

Figure 57 Battle for Market Share: New Product Launch Was the Key Strategy

Figure 58 Region-Wise Revenue Mix of Top 5 Players

Figure 59 Competitive Benchmarking of Key Players (20092013): Denso Corporation Proved to Be A Frontrunner With Its Wide & Robust Product Portfolio

Figure 60 Continental AG. : Company Snapshot

Figure 61 Delphi Automotive PLC.: Company Snapshot

Figure 62 Denso Corporation: Business Overview

Figure 63 Robert Bosch: Company Snapshot

Figure 64 Infineon Technologies AG: Company Snapshot

Figure 65 Hitachi Ltd.: Business Overview

Figure 66 Keihin Corporation: Business Overview

Figure 67 Magneti Marelli S.P.A.: Business Overview

Figure 68 NGK Spark Plug Co., Ltd.: Business Overview

Figure 69 UCI International Inc.: Business Overview

Figure 70 Woodward Inc.: Business Overview

Figure 71 Westport Innovation Inc.: Business Overview

Growth opportunities and latent adjacency in Automotive Fuel Injection Systems Market

I am particularly looking for a report on worldwide market and manufacturers of fuel injection equipment for diesel engines (off-road) and market trends.(also diesel-engines manufcturers for off -road cars could be of benefit). We would like to need to know if the report consist the relevant data. I would also appreciate a prompt response. Thank you. Martina Roskova

Hello my company is an automotive injection decorative trim supplier and we are reviewing our current business technologies. We would like to find out what the current IMD (In-Mould Decorative) market - particularly which automotive brand and model uses IMD and what is the percentage?