Automotive Relay Market by Relay Type, Application, Ampere, Vehicle Type, Electric Vehicle Relay Market by Ampere, Electric Vehicle Relay Market by Relay Type, Electric Vehicle Relay Market by Vehicle Type, Region - Global Forecast to 2027

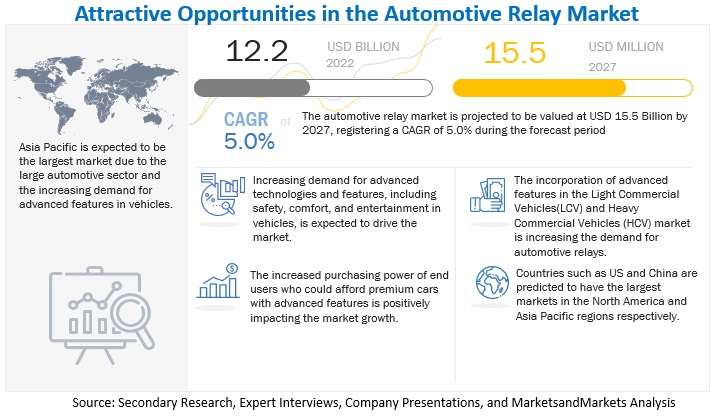

The automotive relay market was valued at USD 12.2 billion in 2022 and is expected to reach USD 15.5 billion by 2027, at a CAGR of 5.0% during the forecast period 2022-2027. The base year for the report is 2021, and the forecast period is from 2022 to 2027. The market would witness growth owing to driving factors such as the increasing need for safer and more comfortable vehicles and increasing sales of electric and hybrid vehicles, raising the demand for high-voltage relays.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Increasing need for safer and more comfortable vehicles

The demand for increased safety and comfort features in automobiles has greatly increased in recent years. This demand for better safety and comfort features has led automakers to offer advanced technologies and features. This has increased the usage of relays in such electronic systems. For instance, incorporating advanced driving assistance systems (ADAS) has also increased the number of electronic components in vehicles. In addition, electromechanical relays have been replaced with electronic relays that are compact and efficient.

The advancements in cloud mobility, deep learning, and artificial intelligence technologies have greatly contributed to the advanced processors in electronic vehicle systems. These processors are used to develop a 3D spatial model of a car’s environment and detect threat levels using relays to deliver outputs. GPS tracking system transmits signals to electronic devices indicating speed, time, and direction, thereby increasing the number of relays used. According to industry experts, with increasing electrification, the number of relays used per vehicle is around 30 to 40 for an economy ICE passenger vehicle and around 60 to 70 for an electric vehicle.

Furthermore, the increasing safety regulations around the globe demand a greater number of safety features to be mandatory in vehicles. In the United States, the Federal Motor Vehicle Safety Standards (FMVSS) and National Highway Traffic Safety Administration (NHTSA) are the governing bodies for vehicle safety. They have implemented safety regulations that incorporate various electronic systems in vehicles.

In 2019, the European Union adopted the General Safety Regulation (GSR) to reduce fatality and serious injuries during accidents. This included special safety requirements for buses and heavy commercial vehicles and mandated many safety systems apart from lane departure warning systems and emergency brake assistance systems. All these implications further increase the incorporation of relays in electronic safety systems, driving the market.

RESTRAINT: Lack of standardization in relay design

Automobiles have evolved with the advancing electronic systems in terms of safety, performance, comfort, and others. Automakers utilize various types of automotive relays in their applications. For instance, compact relays are miniature versions with high current carrying capacity. Arc-proof DC power relays are designed for electric cars to ensure high-voltage DC switching without producing any arc. With the advent of a greater variety of relays, the standardization of automotive relays remains a cause of concern. Generally, automotive relays can be categorized by terminal arrangements and different functions. This flexibility allows a relay to be designed according to its usability. Though this versatile and modular configuration is helpful for specific requirements, the automotive relay market has many different relays. Each OEMs follow different standards of relay specification, such as switching current, switching voltage, coil voltage/current, coil power, and others. This makes the automotive relay industry non-standard, and difficult for the relay manufacturers to mass produce a standard relay compatible with a greater number of vehicles. For instance, the automotive wiper is one of the essential components of a vehicle. It is a well-standardized market with universal products, where a particular size of wipers are compatible with a greater number of vehicle models from different OEMs.

Furthermore, the relays are also segmented by their types apart from the contact arrangement, load capacity, and others. For instance, there are three major automotive relays: PCB, Plug-in, and Combined. PCB relays are soldered on the PCB board. The plug-in relays generally have different sizes 2.8mm, 4.8mm, 6.3mm, and 9.5mm; the terminal layout is divided into ISO categories (micro-ISO, mini-ISO, power mini ISO) and 280 categories (ultra 280, micro 280, mini 280). Moreover, there are combined relays, PCB relays, and relay modules. Hence, different types of relays are combined, further increasing the choice of automotive relays. Also, the introduction of electric vehicles has increased the deployment of relays. Therefore, it has become difficult for relay manufacturers to develop a standard relay design. This lack of standardization can potentially hamper the growth of the automotive relay market.

OPPORTUNITY: Demand for higher switching capacity relays for electric, hybrid, and autonomous vehicles

The rising trend of electrification of the powertrain (BEV, PHEV, and HEV) in passenger cars and commercial vehicles has increased the demand for high-voltage DC relays for switching purposes. Various applications in electric vehicles (EV), such as battery management systems, HVAC, power steering pumps, and others, require an appropriate design for switching the relay on or off. Owing to the highly inductive nature of the load, a relay with high switching capacity, magnetic blowout, and sufficient spacing is required for various applications of electric vehicles.

In the case of electric vehicles, relays are used for main and pre-charging and DC charging interfaces. Panasonic has patented its EV relays segment and provides relays suitable for stringent conditions of short circuits and adaptive to higher system voltage. These relays have contacts enclosed in hermetically sealed ceramic capsule construction, and the contact chamber is filled with hydrogen gas owing to its better conductivity of heat than air. This helps in the quick and efficient dissipation of heat generated while arching, resulting in better switching performance. Other key manufacturers invest heavily in research and development to develop EV relays for high-switching applications. The sales of electric and hybrid vehicles have increased tremendously, and the electrification of these vehicles is influencing the demand for relays.

Moreover, concerning the rapidly growing electric vehicle market, the electric vehicle is being developed with higher battery and motor capacities to increase its performance and efficiency. For instance, the Tesla Roadster has a performance of 0-60 Mph in 1.9 seconds and is equipped with an enormous 200kWh battery pack. In 2019, the German carmaker Porche developed a new electric SUV with quad motor technology. These four motors were coupled to individual wheel hubs and were aimed to offer the maximum electric off-road capabilities. Such an increase in motors and battery capacities will demand a relay designed to operate with high switching capacities. The growth of the e-bike, electric moped, electric construction equipment markets, and others are also driving the growth of the automotive relays market. These new electric vehicle segments require relays for their operation.

For instance, according to MarketsandMarkets analysis, it is predicted that the e-bike market will grow at a CAGR of 10.2% from 2022 to 2027. Moreover, heavy electric equipment, including electric mining and construction equipment, is designed with high-performance motors and massive battery packs. Such applications would also demand relays with very high switching capacities. It is predicted that the electric construction equipment market will reach a value of USD 24.8 billion by 2027 at a CAGR of 22.0% during the forecast period, according to the MarketsandMarkets analysis. The growth of autonomous vehicles also demands a greater number of high-tech electronic systems. These electronic systems often require high-speed data and signal communications. A highly efficient relay is needed of uninterrupted signal transfers and precise switching of the applications. Therefore, the growth of autonomous vehicles, in turn, contributes to the growth of the automotive relay market.

CHALLENGE: Connected smart junction box and smart fuse box for autonomous cars

Though there are very limited direct alternatives to the automotive relays, Lear Corporation’s smart junction box (SJB) is one of them. This SJB integrates passive junction box features with electronic module functionality. The technology incorporates a microcontroller for switching the power and controlling the vehicle's functions. It utilizes integrating power and control functions into a single module. These SJBs also replace the relays and fuses with solid-state electronic drivers, improving the quality and reducing weight with less packaged size, up to 8%. This was an award-winning innovation by the company aimed to control and power the window door locks, interior and exterior lighting, and audio system. The other advantages of the SJBs were that they eliminated the need to access the fuse box and benefited customers with improved reliability. Automakers were impressed by its compactness and reduced packaged size and found it easier to manufacture.

Furthermore, in an electric vehicle, a relatively greater number of relays and fuses are needed than in an ICE vehicle, as it requires the transfer of charge from the battery to a group of loads. With the increasing use of 48V power for start-stop systems and other mild hybrid systems, it is difficult for the relays to switch between power requirements for heavy vehicles. A high-end vehicle can have up to 100 fuses and four fuse boxes that consume a larger amount of space. This also facilitates the incorporation of a smart junction box, which can eliminate most of the complications of relays. Though this is a relatively expensive option, one of the disadvantages of the SJBs, a few automakers find it as an alternative to switch power over fuses and relays, which can hamper the relay market growth.

Automotive Relay Market: Ecosystem Analysis

To know about the assumptions considered for the study, download the pdf brochure

Main Relays are expected to dominate the electric & hybrid vehicle relay market during the forecast period

Main relays are used to disconnect the battery ranges of 80–300A and incorporated in the Battery Discharge Unit (BDU) of electric vehicles. The main relay disconnects the electrical supply between battery and traction motor while turning off to ensure adequate vehicle safety. It is installed in both the positive and negative lines of the battery system. These BDUs demand these main relays for proper functioning and safe discharging. With a growing focus on longer-range cars and fast charging technology, the demand of cars installed with high-voltage batteries are expected in the year to come, which requires effective main relays to offer satisfactory performance while operating conditions for electric and hybrid vehicles. These factors would drive the market for main relays in the electric and hybrid vehicle segment

Battery Electric Vehicles (BEV) are expected to dominate the EV relay market over the forecast period

BEVs are predicted to have the largest market share in the electric vehicle relay market by EV type. As per MnM Analysis, global sales of electric & hybrid vehicles are expected to grow from 8,142 thousand units in 2022 to 38,983 thousand units by 2030, of which more than 70% share belongs to BEVs. The BEVs comprise the battery system, traction motor, and other power electronic modules. In addition, several auxiliary components include an AC compressor, headlight, tail lamp, interior lighting, electric power steering, and liquid heater PTC, among others. All these components are installed with electric circuits, and these circuits demand the installation of relays with different power ratings for their proper functioning. Further, rising demand for electric luxury vehicles, advanced features such as grille shutters, active and passive cabin ventilation, active seat ventilation, ADAS technologies, and some other advanced would require additional relays. In contribution towards the reduction of global Co2 emission level, automotive OEMs have planned to launch a medium to premium range of electric vehicles in the next 2-3 years, which will ultimately accelerate the demand for relays installed in these vehicles for advanced safety and comfort applications.

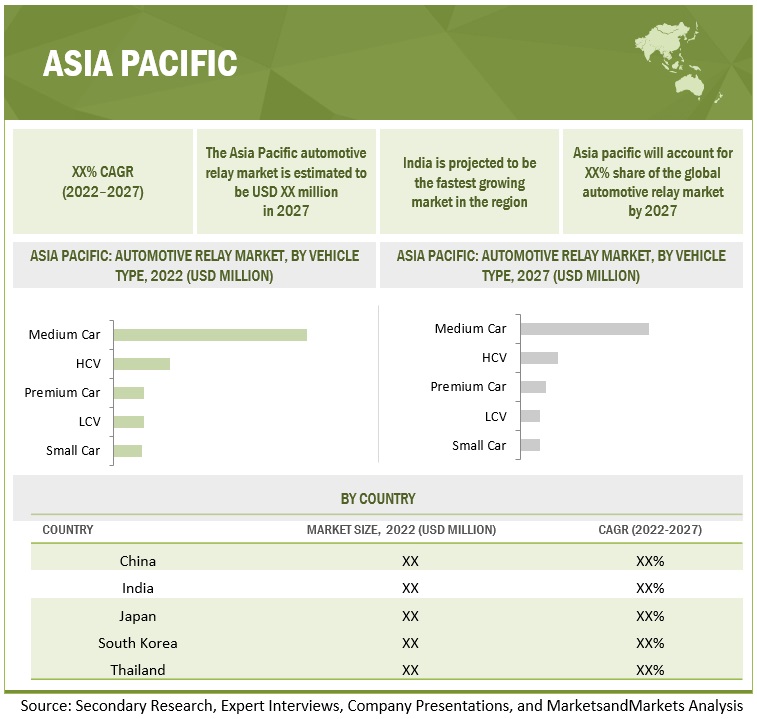

Asia Pacific is projected to dominate the Automotive Relay market by 2027

The Asia Pacific region holds the largest market share in the automotive relay market. China accounts for the largest share owing to shifting consumer preferences, increasing per capita income of the middle-class population, and cost advantages that have led OEMs to increase vehicle production in the region. Thus, strong demand has been noticed in China, India, and Japan, accelerating the market growth. In 2021, the demand for economy and mid-range cars was highest, with more than 90% of the share in total passenger car production. The demand for entry-level and medium-price range cars is growing in countries such as India, China and Thailand due to more product launches with advanced features in this segment at a competitive price bracket. Further, increased demand for luxury cars with superior safety and cabin comfort installed with some high-end technologies such as adaptive cruise control, intelligent park assist, advanced braking, automatic multi-climate air conditioning etc., would spur the demand for automotive relays market in the region

Key Market Players & Start-ups

The automotive relay market is led by globally established players such as TE Connectivity (Switzerland), Omron Corporation (Japan), Panasonic Corporation (Japan), Hongfa Technologies Co. (China), and Fujitsu Component Limited (Japan). These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth market.

Scope of the Report

|

Report Metrics |

Details |

| Base year for estimation | 2021 |

| Forecast period | 2022 - 2027 |

| Market Growth and Revenue forecast | $ 15.5 billion by 2027, at a CAGR of 5.0% |

| Top Players | TE Connectivity (Switzerland), Omron Corporation (Japan), Panasonic Corporation (Japan), Hongfa Technologies Co. (China), Fujitsu Component Limited (Japan). |

| Fastest Growing Market | Asia Pacific |

| Largest Market | Asia Pacific |

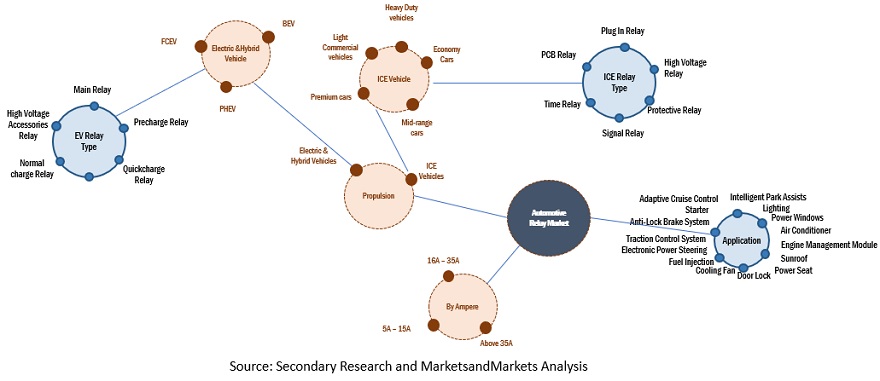

| Segments covered | |

| By Relay Type | PCB Relays, Plug In Relays, High Voltage Relays, Protective Relays, Signal Relays, Time Relays |

| By Application | Door Lock, Power Windows, Sunroof, Power Seat, Electronic Power Steering (EPS), Lighting, Fuel Injection, Air Conditioner, Starter, Anti-Lock Braking System (ABS), Traction Control System (TCS), Cooling Fan, Engine Management Module, Adaptive Cruise Control, Intelligent Park Assist |

| By Ampere | 5A-15A, 16A-35A, >35A |

| By Vehicle Type | Economy cars, Mid-range cars, Premium cars, Light Commercial Vehicle, Heavy Duty Vehicles |

| Electric Vehicle Relay Market, By Ampere | 5A-15A, 16A-35A, >35A |

| Electric Vehicle Relay Market, By Relay Type | Main Relay, Precharge Relay, QuickCharge Relay, Normal Charge Relay, High Voltage Accessories Relay |

| Electric Vehicle Relay Market, By Vehicle Type | Battery Electric Vehicle, Fuel Cell Electric Vehicle, Plug In Hybrid Electric Vehicle |

| By Region | Asia Pacific, Europe, North America, And Rest of The World |

| Additional Customization to be offered | Automotive Relay Market, By Application And Vehicle Type |

The study categorizes the automotive relay market based on relay type, application, ampere, vehicle type, electric vehicle relay market by relay type, electric vehicle relay market by ampere. electric vehicle relay market by vehicle type, and region at regional and global levels.

By Relay Type

- PCB Relays

- Plug In Relays

- High Voltage Relays

- Protective Relays

- Signal Relays

- Time Relays

By Application

- Door Lock

- Power Windows

- Sunroof

- Power Seat

- Electronic Power Steering (EPS)

- Lighting

- Fuel Injection

- Air Conditioner

- Starter

- Anti-Lock Braking System (ABS)

- Traction Control System (TCS)

- Cooling Fan

- Engine Management Module

- Adaptive Cruise Control

- Intelligent Park Assist)

By Ampere

- 5A-15A

- 16A-35A

- >35A

By Vehicle Type

- Economy cars,

- Mid-range cars,

- Premium cars,

- Light Commercial Vehicle,

- Heavy Duty Vehicles

Electric Vehicle Relay Market, By Ampere

- 5A-15A

- 16A-35A

- >35A

Electric Vehicle Relay Market, By Vehicle Type

- Battery Electric Vehicle

- Fuel Cell Electric Vehicle

- Plug In Hybrid Electric Vehicle

Electric Vehicle Relay Market, By Relay Type

- Main Relay,

- Precharge Relay,

- QuickCharge Relay,

- Normal Charge Relay,

- High Voltage Accessories Relay

Electric Vehicle Relay Market, By Vehicle Type

- Battery Electric Vehicle

- Fuel Cell Electric Vehicle

- Plug In Hybrid Electric Vehicle

By Region

- Asia Pacific,

- Europe,

- North America, and

- Rest of The World

Recent Developments

- In June 2022, Hongfa Technology Co. developed two new automotive relays in response to the market demand for miniature, lightweight, and energy-saving ones—a micro relay HFV26 and a mini relay HFV15A. These products are designed to be incorporated into various applications, including defogging control of the rear window, battery short circuit device control, HVAC, and others.

- In June 2022, Hongfa Technology Co. has developed its new On-Board Charger (OBC) relays for the rapidly growing energy vehicle market. These relays are claimed to provide more efficiency and safety for onboard chargers. OBC relays are designed with maximum current capacities of 20A and 32A and a temperature range of up to 105° C.

- In November 2020, Fujitsu Component Limited expanded its product portfolio by introducing the 12-colt DC PCB relay, FBR53-HC. It features a 1 Form U dual contact arrangement for increased reliability. This relay can be incorporated into electric power steering, radiator fans, fuel pumps, seat heaters, headlamps, and motor braking circuits.

- In January 2020, Fujitsu Component Limited introduced its new PCB relay, FTR-K5. It is the second of the company’s EV and plug-in hybrid vehicle components. This relay 8YH is designed for the e-mobility market and provides a range of 6.6 kW at 250 volt AC, with faster charging time.

Frequently Asked Questions (FAQ):

How big is the automotive relay market?

The automotive relay market was valued at USD 12.2 billion in 2022 and is expected to reach USD 15.5 billion by 2027, at a CAGR of 5.0% during the forecast period 2022-2027.

Who are the winners in the global automotive relay market?

The automotive relay market is led by globally established players such as TE Connectivity (Switzerland), Omron Corporation (Japan), Panasonic Corporation (Japan), Hongfa Technologies Co. (China), and Fujitsu Component Limited (Japan). These companies adopted expansion strategies and undertook collaborations, partnerships, and mergers & acquisitions to gain traction in the high-growth forklift market.

Which region is expected to dominate the automotive relay market?

Asia Pacific is estimated to dominate the automotive relay market during the forecast period.

What are the new market opportunities in the automotive relay market?

Demand for higher switching capacity relays for electric, hybrid and autonomous vehicles

Increasing use of DC motor in automotive body electronics

Relay failure prevention systems

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

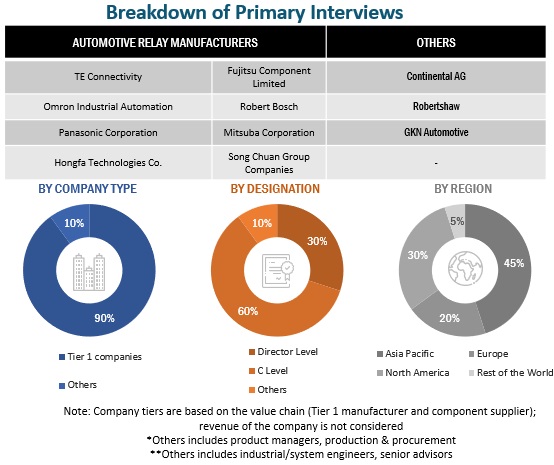

The research study involved extensive use of secondary sources such as company annual reports/presentations, industry association publications, automotive relay magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases to identify and collect information on the automotive relay market. Primary sources—experts from related industries, automotive relay manufacturers, and suppliers—were interviewed to obtain and verify critical information, as well as to assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors of business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as automotive relay production forecast, market forecast, future technology trends, and upcoming technologies. Data triangulation of all these points was done with the information gathered from secondary research and company revenues. Stakeholders from the demand and supply sides were interviewed to understand their views on the aforementioned points.

Primary interviews were conducted with market experts from both the demand (OEM) and supply-side players across four major regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World. Approximately 30% of interviews were conducted from the demand side, while 70% of primary interviews were conducted from the supply side. The primary data was collected through questionnaires, e-mails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales and operations, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the opinions of the in-house subject matter experts, has led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

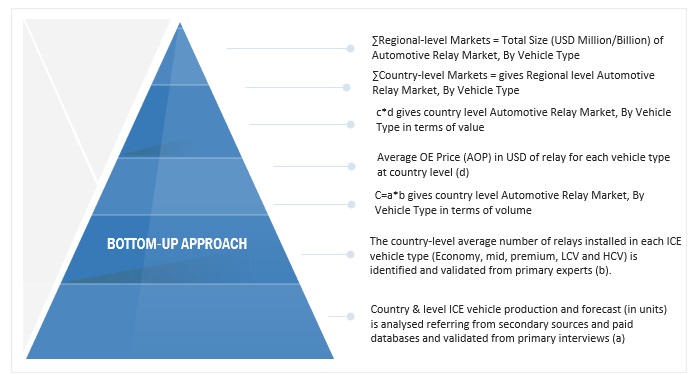

Bottom-Up Approach: Automotive Relay Market

The bottom-up approach was used to estimate and validate the size of the market. In this approach, the country-level production and forecast of ICE vehicles (passenger cars, LCV and heavy duty vehicles) (in units) were derived from secondary sources and various databases. Further, average number of relays installed in each vehicle type derived through secondary research and validated through primary interviews. Multiplication of country level vehicle production and average number of relays per vehicle type provides country-level market, in terms of volume. Further, country-level average selling OE price of relays per vehicle type has been analyzed and multiplication with volume gives country-level market, in terms of value. Summation of country-level markets provided the regional-level markets. The further summation of regional-level markets provided the global market in terms of volume (units), by region, and vehicle type. Similar approach followed to analyze electric vehicle market, by EV type in terms of volume and value

To know about the assumptions considered for the study, Request for Free Sample Report

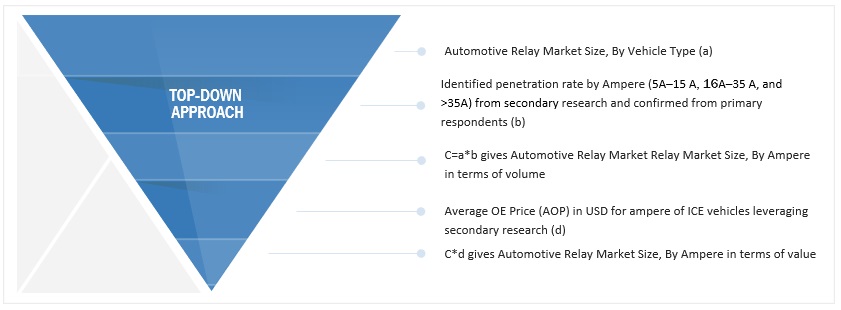

Top-Down Approach: Automotive Relay Market

The top-down approach was followed to determine the market size by ampere and relay type for both ICE and electric vehicles in terms of volume and value for automotive relays. The region-wise market by volume and value at regional level (Asia Pacific, North America, Europe, and the Rest of the World) were derived by vehicle type. The percentage share of relays by ampere, and relay type was derived from secondary sources and validated through primaries. It was further multiplied by the region-wise relay market volume and value. Through this, the regional level and global level for market by ampere and relay type for both ICE and electric vehicles in terms of volume (thousand units) and value (USD million) were derived.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

-

To define, describe, and forecast the forklift market in terms of value (USD million/USD billion) and volume (thousand units) based on the following segments:

- By Relay Type (PCB Relays, Plug In Relays, High Voltage Relays, Protective Relays, Signal Relays, Time Relays)

- By Application (Door Lock, Power Windows, Sunroof, Power Seat, Electronic Power Steering (EPS), Lighting, Fuel Injection, Air Conditioner, Starter, Anti-Lock Braking System (ABS), Traction Control System (TCS), Cooling Fan, Engine Management Module, Adaptive Cruise Control, Intelligent Park Assist)

- ICE Vehicle Relay Market, By Ampere (5A-15A, 16A-35A, >35A)

- By Vehicle Type (Economy cars, Mid-range cars, Premium cars, Light Commercial Vehicle, Heavy Duty Vehicles)

- Electric Vehicle Relay Market, By Ampere (5A-15A, 16A-35A, >35A)

- Electric Vehicle Relay Market, By Relay Type (Main Relay, Precharge Relay, Quick Charge Relay, Normal Charge Relay, High Voltage Accessories Relay)

- Electric Vehicle Relay Market, By EV Type (Battery Electric Vehicle, Fuel Cell Electric Vehicle, Plug In Hybrid Electric Vehicle)

- By Region (Asia Pacific, Europe, North America, And Rest of The World)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the forklift market and provide patent analysis, case study analysis, supply chain analysis, trade analysis, Porter’s Five Force Analysis, and ecosystem analysis

- To analyze the share of the key players operating in the automotive relay market

- To develop competitive evaluation matrix and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies

- To analyze recent developments such as deals, expansions, new product launches, and other activities carried out by key industry players in the automotive relay market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Automotive Relay Market, By Application And Vehicle Type

- Passenger cars

- Light commercial vehicles

Note: The market will be provided for all application considered under study for ICE Vehicle type only

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Relay Market

I want a detailed analysis of the Forecast 2022 to 2030 Automotive Relay Market, It would be good if I could get an analysis for US region.