Abrasion Resistant Coatings Market by Type (Metal/Ceramic, Polymer), End-Use Industry (Oil & Gas, Marine, Power Generation, Transportation, Mining, Construction), Region (North America, APAC, Europe, MEA, South America) - Global Forecast to 2024

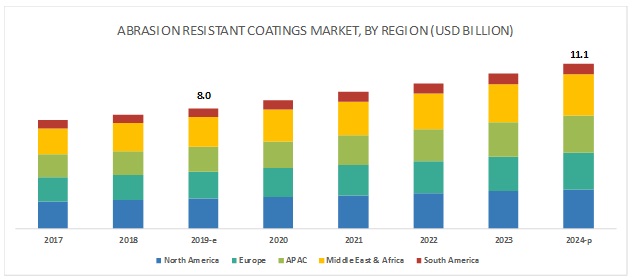

[184 Pages Report] The market for abrasion resistant coatings is projected to grow from USD 8.0 billion in 2019 to USD 11.1 billion by 2024, at a CAGR of 6.5% during the forecast period. Increasing investments in the manufacturing sectors of the APAC region is expected to drive the market. The power generation industry is a major consumer of abrasion resistant coatings.

Power Generation industry is projected to be the fastest-growing end user during the forecast period.

In the power generation sector, abrasion resistance coatings are used in wind turbine blades, concrete cooling towers, valves, containment vessels, nuclear components, generators, dam structure, and turbines. Abrasion resistant coatings are mostly used in the power generation sector to offer protection against the adverse effects of weather conditions. In the wind industry, fluoropolymers based abrasion resistant coatings are used in wind blades, which increases the operability of the blades by 20 years as compared to traditional paints and gelcoats. It improves UV stability, enables minimal dirt pick up, and offers excellent abrasion resistance and low reflectivity.

Ceramic coatings segment expected to boost the overall market growth during the forecast period.

Ceramic-based abrasion resistant coatings are broadly classified into oxide, carbide, and nitride coatings. These coatings have excellent high-temperature and abrasion resistance. Ceramic coatings are more expensive due to costly thermal spray process involved, however, the overall life cycle cost will be lesser as compared to polymer based coatings due to less maintenance involved with ceramic coatings.

Europe to account for the largest market share of the abrasion resistant coatings market during the forecast period.

Europe is an important market for abrasion resistant coatings. The European market comprises Germany, France, Russia, Italy, and the UK, among others. The market for abrasion resistant coatings in Germany is driven by the increasing focus on the generation of renewable energy. The region has been active in renewable power generation.

Key Market Players

The leading players in the abrasion resistant coatings market are AkzoNobel N.V. (Netherlands), Saint-Gobain (France), Jotun A/S (Norway), The Sherwin-Williams Company (US), Hempel A/S (Denmark), Praxair Surface Technologies (UK), Henkel (Germany), and Sika AG (Switzerland). AkzoNobel (Netherlands) is one of the leaders in the manufacturing of paints and coatings. The company operates through two business segments, decorative paints and performance coatings. The performance coatings segment serves the automotive, marine, aerospace & defense, and powder coating industries. The company manufactures abrasion resistant coatings under various brands, including Eclipse ARC, Interzone, 23T3 Series, and 24T3 Series. The company has a strong global presence with more than 400 subsidiaries and offers its product in over 80 countries.

Scope of the Report

|

Report Metric |

Details |

|

Years Considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD Billion) and Volume (Ton) |

|

Segments |

Type, End-use Industry and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies profiled |

AkzoNobel N.V. (Netherlands), Saint-Gobain (France), Jotun A/S (Norway), The Sherwin-Williams Company (US), Hempel A/S (Denmark), Praxair Surface Technologies ( UK), Henkel (Germany), Sika AG (Switzerland). |

This research report categorizes the global abrasion resistant coatings market on the basis of type, end-use industry, and region.

On the basis of type:

- Metal/Ceramic Coatings

- Polymer

On the basis of end-use industry:

- Oil & gas

- Marine

- Power Generation

- Transportation

- Mining

- Construction

On the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- AkzoNobel launched Awlgrip HDT polyurethane clearcoat for yacht. The product has lower VOC content and is also repairable. The company has tested its durability on seven boats in the Volvo Ocean Race Boatyard 2017-2018 edition.

- AkzoNobel inked a two-year deal with Nakilat, a Qatar Gas Transport Company to supply AkzoNobel's product, Intersleek 1100SR. It is a fluoropolymer technology used as hull coating to resist any fouling organism settle on the underwater hull. It also offers abrasion resistance.

Key Questions Addressed by the Report

- What are the global trends in the demand for abrasion resistant coatings? Will the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for abrasion resistant coatings? Which type is used the most in end-use industries?

- What were the revenue pockets for the abrasion resistant coatings market in 2018?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- Which are the major abrasion resistant coatings manufacturers, globally?

Frequently Asked Questions (FAQ):

What are the drivers for the growth of abrasion resistant coating?

What are the types of abrasion resistant coating?

Which industries use abrasion resistant coatings?

What are the challenges for abrasion resistant coating?

What is the restraint for the abrasion resistant coating market?

What are the opportunities for the abrasion resistant coating market?

Who are the key manufacturers for abrasion resistant coatings?

What is the abrasion resistant coating market size in terms of volume?

What is the future outlook of each segment?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Abrasion Resistant Coatings Market

4.2 APAC Abrasion Resistant Coatings Market, By Type and Country

4.3 Abrasion Resistant Coatings Market, By Type

4.4 Abrasion Resistant Coatings Market, By End-Use Industry

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Enforcement of Voc Emission Regulations

5.2.1.2 Demand for High-Temperature Polymer Abrasion Resistant Coatings

5.2.1.3 Superior Properties of Ceramic Coatings

5.2.1.4 Demand for Efficient Processes and Improved Life of Equipment and Devices

5.2.1.5 Increasing Demand From Emerging Economies

5.2.2 Restraints

5.2.2.1 Capital-Intensive Operations for Ceramic Coatings

5.2.3 Opportunities

5.2.3.1 Increase in the Installation of Scrubbers in the Marine Industry

5.2.3.2 Growing Demand for Fluoropolymer Abrasion Resistant Coatings

5.2.3.3 Increasing Activities in Shipbuilding and Pipeline Industries

5.2.4 Challenges

5.2.4.1 Stringent Regulatory Policies and Local Laws for Pollution Control

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Abrasion Resistant Coatings Market, By Type (Page No. - 47)

6.1 Introduction

6.2 Metal/Ceramic Coatings

6.2.1.1 Oxide Coatings

6.2.1.1.1 Wide Applications Will Keep the Demand for Oxide Coatings Grow During the Forecast Period

6.2.1.2 Carbide Coatings

6.2.1.2.1 Demand for Tungsten Carbide Will Drive the Growth of the Carbide Coatings Segment

6.2.1.3 Nitride Coatings

6.2.1.3.1 The Demand for Thin-Film Coatings Will Increase the Demand for Nitride Coatings

6.2.1.4 Others

6.3 Polymer Coatings

6.3.1.1 Epoxy

6.3.1.1.1 The Biocompatible Property of Epoxies is Creating Demands for Epoxy Coatings in the Healthcare Sector

6.3.1.2 Polyurethane

6.3.1.2.1 The Environmentally Friendly Waterborne Polyurethane Coatings Will Drive the Polyurethane Market

6.3.1.3 Fluoropolymer

6.3.1.3.1 The Desirable Set of Fluoropolymer Properties Will Drive the Demand Across Various End-Use Industries

6.3.1.4 Polyester

6.3.1.4.1 The Need for Low Voc Emission Coatings is Driving the Demand for Polyester Coatings

6.3.1.5 Others

7 Abrasion Resistant Coatings Market, By End-Use Industry (Page No. - 54)

7.1 Introduction

7.2 Oil & Gas

7.2.1 Increasing Demand for Coatings That Extend the Service Life of the Component Along With Better Wear and Tear Resistance Will Drive the Market

7.3 Power Generation

7.3.1 Increase in Power Consumption and the Ability of Abrasion Resistant Coatings to Protect Wind Turbine Blades From the Harsh Environment to Spur the Market

7.4 Marine

7.4.1 Growing Requirement for Lng Will Increase the Demand for Abrasion Resistant Coatings

7.5 Transportation

7.5.1 Increasing Air Traffic and Growing Demand for Electric Vehicles Will Create Opportunities in the Market

7.6 Mining

7.6.1 Abrasion Resistant Coatings Significantly Reduce Maintenance Cycles of Equipment in the Mining Industry

7.7 Construction

7.7.1 Abrasion Resistant Coatings Provide Flexibility in Structural Vibrations Without Any Cracking

7.8 Others

8 Abrasion Resistant Coatings Market, By Region (Page No. - 64)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Significant Presence in the Oil & Gas Industry to Drive the Market

8.2.2 Canada

8.2.2.1 Potential Demand From Upcoming on Oil & Gas Pipeline Projects in the Country

8.3 APAC

8.3.1 China

8.3.1.1 Significant Presence of Oem in Different End-Use Industries to Impact the Market Growth

8.3.2 Japan

8.3.2.1 Strong Environment-Friendly Technology in the Marine Sector to Propel the Demand

8.3.3 South Korea

8.3.3.1 Growing Number of Gas Supply Infrastructure Projects and Increasing Focus Toward Renewable Power Likely to Bring More

Opportunities

8.3.4 Taiwan

8.3.4.1 Increasing Dependence on Renewable Sources to Drive the Abrasion Resistant Coatings Market

8.3.5 Rest of APAC

8.4 Europe

8.4.1 Germany

8.4.1.1 Government Support for Enhancing the Shipbuilding Industry to Create A Favorable Environment for the Market Growth

8.4.2 Russia

8.4.2.1 New Oil & Gas Pipeline Projects Spurring the Demand for Abrasion Resistant Coatings

8.4.3 France

8.4.3.1 Stringent Regulations on Voc Emission Will Spur the Demand for Ceramic Abrasion Resistant Coatings

8.4.4 UK

8.4.4.1 Increasing Investments in the Oil & Gas and Wind Power Sectors of the Country to Drive the Market

8.4.5 Italy

8.4.5.1 Growing Gas Supply Infrastructure to Have High Requirement for Abrasion Resistant Coatings

8.4.6 Rest of Europe

8.5 India, Middle East & Africa (Imea)

8.5.1 India

8.5.1.1 One of the Most Attractive Renewable Energy Markets in the World

8.5.2 Saudi Arabia

8.5.2.1 Strong Presence in the Oil & Gas Industry Spurring the Demand for Abrasion Resistant Coatings

8.5.3 South Africa

8.5.3.1 Increase in Maritime Traffic to Drive the Market

8.5.4 Rest of Imea

8.6 Latin America

8.6.1 Mexico

8.6.1.1 Growing Wind Power and Oem Industries Will Create Opportunities for the Abrasion Resistant Coatings Manufacturers

8.6.2 Brazil

8.6.2.1 Increasing Number of Planned Offshore Projects in the Oil & Gas Industry Spurring the Demand for Abrasion Resistant Coatings

8.6.3 Argentina

8.6.3.1 Rise in Investments in Oil & Gas and Wind Power End-Use Industries to Drive the Market for Abrasion Resistant Coatings

8.6.4 Rest of Latin America

9 Competitive Landscape (Page No. - 146)

9.1 Introduction

9.2 Competitive Scenario

9.2.1 Expansions

9.2.2 Acquisitions

9.2.3 New Product Launches

10 Company Profiles (Page No. - 150)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Akzonobel

10.2 The Sherwin-Williams Company

10.3 Hempel

10.4 Jotun Group

10.5 Sika AG

10.6 Axalta Coating Systems

10.7 Saint-Gobain

10.8 Praxair Surface Technologies

10.9 PPG Industries

10.10 Hardide Plc

10.11 Others

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10.11.1 Metal Coating Corporation

10.11.2 SDC Technologies

10.11.3 3M

10.11.4 ASB Industries

10.11.5 Chesterton

10.11.6 Impreglon

10.11.7 NEI Corporation

10.11.8 Precision Coatings

10.11.9 Endura Coating

10.11.10 E/M Coating

10.11.11 The Bodycoat Group

10.11.12 Arkema

11 Appendix (Page No. - 178)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Related Reports

11.4 Author Details

List of Tables (245 Tables)

Table 1 Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 2 Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 3 Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Region, 20172024 (Ton)

Table 4 Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Region, 20172024 (USD Million)

Table 5 Market Size of Polymer Abrasion Resistant Coatings, By Region, 20172024 (Ton)

Table 6 Market Size of Polymer Abrasion Resistant Coatings, By Region, 20172024 (USD Million)

Table 7 Market Size, By End-Use Industry, 20172024 (Ton)

Table 8 Market Size, By End-Use Industry, 20172024 (USD Million)

Table 9 Market Size in Oil & Gas, By Region, 20172024 (Ton)

Table 10 Market Size in Oil & Gas, By Region, 20172024 (USD Million)

Table 11 Market Size in Power Generation, By Region, 20172024 (Ton)

Table 12 Market Size in Power Generation, By Region, 20172024 (USD Million)

Table 13 Market Size in Marine, By Region,20172024 (Ton)

Table 14 Market Size in Marine, By Region, 20172024 (USD Million)

Table 15 Market Size in Transportation, By Region, 20172024 (Ton)

Table 16 Market Size in Transportation, By Region, 20172024 (USD Million)

Table 17 Market Size in Mining, By Region, 20172024 (Ton)

Table 18 Market Size in Mining, By Region, 20172024 (USD Million)

Table 19 Market Size in Construction, By Region, 20172024 (Ton)

Table 20 Market Size in Construction, By Region, 20172024 (USD Million)

Table 21 Market Size in Other End-Use Industries, By Region, 20172024 (Ton)

Table 22 Market Size in Others, By Region, 20172024 (USD Million)

Table 23 Market Size, By Region, 20172024 (Ton)

Table 24 Market Size, By Region, 20172024 (USD Million)

Table 25 North America: Abrasion Resistant Coatings Market Size, By Country, 20172024 (Ton)

Table 26 North America: Scratch Resistant Coating Market Size, By Country, 20172024 (USD Million)

Table 27 North America: Market Size, By Type, 20172024 (Ton)

Table 28 North America: Market Size, By Type, 20172024 (USD Million)

Table 29 North America: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 30 North America: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 31 North America: Market Size of Polymerabrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 32 North America: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 33 North America: Market Size, By End-Use Industry, 20172024 (Ton)

Table 34 North America: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 35 US: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 36 US: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 37 US: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 ()

Table 38 US: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 39 US: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 40 US: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 41 US: Market Size, By End-Use Industry, 20172024 (Ton)

Table 42 US: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 43 Canada: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 44 Canada: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 45 Canada: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 46 Canada: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 47 Canada: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 48 Canada: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 49 Canada: Market Size, By End-Use Industry, 20172024 (Ton)

Table 50 Canada: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 51 APAC: Abrasion Resistant Coatings Market Size, By Country, 20172024 (Ton)

Table 52 APAC: Scratch Resistant Coating Market Size, By Country, 20172024 (USD Million)

Table 53 APAC: Market Size, By Type, 20172024 (Ton)

Table 54 APAC: Market Size, By Type, 20172024 (USD Million)

Table 55 APAC: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 56 APAC: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 57 APAC: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 58 APAC: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 59 APAC: Market Size, By End-Use Industry, 20172024 (Ton)

Table 60 APAC: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 61 China: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 62 China: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 63 China: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 64 China: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 65 China: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 66 China: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 67 China: Market Size, By End-Use Industry, 20172024 (Ton)

Table 68 China: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 69 Japan: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 70 Japan: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 71 Japan: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 72 Japan: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 73 Japan: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 74 Japan: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 75 Japan: Market Size, By End-Use Industry, 20172024 (Ton)

Table 76 Japan: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 77 South Korea: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 78 South Korea: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 79 South Korea: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 80 South Korea: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 81 South Korea: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 82 South Korea: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 83 South Korea: Market Size, By End-Use Industry, 20172024 (Ton)

Table 84 South Korea: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 85 Taiwan: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 86 Taiwan: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 87 Taiwan: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 88 Taiwan: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 89 Taiwan: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 90 Taiwan: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 91 Taiwan: Market Size, By End-Use Industry, 20172024 (Ton)

Table 92 Taiwan: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 93 Rest of APAC: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 94 Rest of APAC: Market Size, By Type, 20172024 (USD Million)

Table 95 Rest of APAC: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 96 Rest of APAC: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 97 Rest of APAC: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 98 Rest of APAC: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 99 Rest of APAC: Market Size, By End-Use Industry, 20172024 (Ton)

Table 100 Rest of APAC: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 101 Europe: Abrasion Resistant Coatings Market Size, By Country, 20172024 (Ton)

Table 102 Europe: Scratch Resistant Coating Market Size, By Country, 20172024 (USD Million)

Table 103 Europe: Market Size, By Type, 20172024 (Ton)

Table 104 Europe: Market Size, By Type, 20172024 (USD Million)

Table 105 Europe: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 106 Europe: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 107 Europe: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 108 Europe: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 109 Europe: Market Size, By End-Use Industry, 20172024 (Ton)

Table 110 Europe: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 111 Germany: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 112 Germany: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 113 Germany: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 114 Germany: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 115 Germany: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 116 Germany: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 117 Germany: Market Size, By End-Use Industry, 20172024 (Ton)

Table 118 Germany: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 119 Russia: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 120 Russia: Market Size, By Type, 20172024 (USD Million)

Table 121 Russia: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 122 Russia: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 123 Russia: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 124 Russia: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 125 Russia: Market Size, By End-Use Industry, 20172024 (Ton)

Table 126 Russia: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 127 France: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 128 France: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 129 France: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 130 France: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 131 France: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 132 France: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 133 France: Market Size, By End-Use Industry, 20172024 (Ton)

Table 134 France: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 135 UK: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 136 UK: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 137 UK: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 138 UK: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 139 UK: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 140 UK: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 141 UK: Market Size, By End-Use Industry, 20172024 (Ton)

Table 142 UK: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 143 Italy: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 144 Italy: Market Size, By Type, 20172024 (USD Million)

Table 145 Italy: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 146 Italy: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 147 Italy: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 148 Italy: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 149 Italy: Market Size, By End-Use Industry, 20172024 (Ton)

Table 150 Italy: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 151 Rest of Europe: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 152 Rest of Europe: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 153 Rest of Europe: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 154 Rest of Europe: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 155 Rest of Europe: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 156 Rest of Europe: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 157 Rest of Europe: Market Size, By End-Use Industry, 20172024 (Ton)

Table 158 Rest of Europe: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 159 Imea: Abrasion Resistant Coatings Market Size, By Country, 20172024 (Ton)

Table 160 Imea: Scratch Resistant Coating Market Size, By Country, 20172024 (USD Million)

Table 161 Imea: Market Size, By Type, 20172024 (Ton)

Table 162 Imea: Market Size, By Type, 20172024 (USD Million)

Table 163 Imea: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 164 Imea: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 165 Imea: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Tons)

Table 166 Imea: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 167 Imea: Market Size, By End-Use Industry, 20172024 (Ton)

Table 168 Imea: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 169 India: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 170 India: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 171 India: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 172 India: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 173 India: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 174 India: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 175 India: Market Size, By End-Use Industry, 20172024 (Ton)

Table 176 India: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 177 Saudi Arabia: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 178 Saudi Arabia: Market Size, By Type, 20172024 (USD Million)

Table 179 Saudi Arabia: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Tons)

Table 180 Saudi Arabia: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 181 Saudi Arabia: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 182 Saudi Arabia: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 183 Saudi Arabia: Market Size, By End-Use Industry, 20172024 (Ton)

Table 184 Saudi Arabia: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 185 South Africa: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 186 South Africa: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 187 South Africa: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 188 South Africa: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 189 South Africa: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 190 South Africa: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 191 South Africa: Market Size, By End-Use Industry, 20172024 (Ton)

Table 192 South Africa: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 193 Rest of Imea: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 194 Rest of Imea: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 195 Rest of Imea: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 196 Rest of Imea: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 197 Rest of Imea: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 198 Rest of Imea: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 199 Rest of Imea: Market Size, By End-Use Industry, 20172024 (Ton)

Table 200 Rest of Imea: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 201 Latin America: Abrasion Resistant Coatings Market Size, By Country, 20172024 (Ton)

Table 202 Latin America: Scratch Resistant Coating Market Size, By Country, 20172024 (USD Million)

Table 203 Latin America: Market Size, By Type, 20172024 (Ton)

Table 204 Latin America: Market Size, By Type, 20172024 (USD Million)

Table 205 Latin America: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 206 Latin America: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 207 Latin America: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 208 Latin America: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 209 Latin America: Market Size, By End-Use Industry, 20172024 (Ton)

Table 210 Latin America: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 211 Mexico: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 212 Mexico: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 213 Mexico: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 214 Mexico: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 215 Mexico: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 216 Mexico: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 217 Mexico: Market Size, By End-Use Industry, 20172024 (Ton)

Table 218 Mexico: Market Size, By End-Use Industry , 20172024 (USD Million)

Table 219 Brazil: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 220 Brazil: Market Size, By Type, 20172024 (USD Million)

Table 221 Brazil: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 222 Brazil: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 223 Brazil: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 224 Brazil: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 225 Brazil: Market Size, By End-Use Industry, 20172024 (Ton)

Table 226 Brazil: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 227 Argentina: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 228 Argentina: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 229 Argentina: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 230 Argentina: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 231 Argentina: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 232 Argentina: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 233 Argentina: Market Size, By End-Use Industry, 20172024 (Ton)

Table 234 Argentina: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 235 Rest of Latin America: Abrasion Resistant Coatings Market Size, By Type, 20172024 (Ton)

Table 236 Rest of Latin America: Scratch Resistant Coating Market Size, By Type, 20172024 (USD Million)

Table 237 Rest of Latin America: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 238 Rest of Latin America: Market Size of Metal/Ceramic Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 239 Rest of Latin America: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (Ton)

Table 240 Rest of Latin America: Market Size of Polymer Abrasion Resistant Coatings, By Type, 20172024 (USD Million)

Table 241 Rest of Latin America: Market Size, By End-Use Industry, 20172024 (Ton)

Table 242 Rest of Latin America: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 243 Expansions, 20152018

Table 244 Acquisitions, 20152017

Table 245 New Product Launches, 20172018

List of Figures (34 Figures)

Figure 1 Abrasion Resistant Coatings Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Abrasion Resistant Coatings Market: Data Triangulation

Figure 5 Polymer Abrasion Resistant Coatings Accounted for the Larger Market Share in the Abrasion Resistant Coatings in 2018

Figure 6 Power Generation Will Be the Fastest-Growing End-Use Industry Between 2019 and 2024

Figure 7 APAC to Be the Fastest-Growing Market for Abrasion Resistant Coatings

Figure 8 Increasing Focus on Extending the Life of an Equipment is Expected to Drive the Market of Abrasion Resistant Coatings Between 2019 and 2024 37

Figure 9 Polymer Abrasion Resistant Coatings Segment Accounted for the Larger Market Share in APAC in 2018

Figure 10 Metal/Ceramic Coatings Segment to Register the Highest CAGR

Figure 11 Power Generation to Be the Fastest-Growing End-Use Industry (20192024)

Figure 12 Overview of Factors Governing the Abrasion Resistant Coatings Market

Figure 13 Market: Porters Five Forces Analysis

Figure 14 Market Share, By Type, 2018 (Ton)

Figure 15 India to Be the Fastest-Growing Market of Abrasion Resistant Coatings

Figure 16 APAC: Market Snapshot

Figure 17 Companies Majorly Adopted Organic Growth Strategies Between 2015 to 2018

Figure 18 Market Evaluation Framework

Figure 19 Akzonobel: Company Snapshot

Figure 20 Akzonobel: SWOT Analysis

Figure 21 The Sherwin-Williams Company: Company Snapshot

Figure 22 The Sherwin-Williams Company: SWOT Analysis

Figure 23 Hempel: Company Snapshot

Figure 24 Hempel: SWOT Analysis

Figure 25 Jotun Group: Company Snapshot

Figure 26 Jotun Group: SWOT Analysis

Figure 27 Sika AG: Company Snapshot

Figure 28 Sika AG: SWOT Analysis

Figure 29 Axalta Coating Systems: Company Snapshot

Figure 30 Axalta Coating Systems: SWOT Analysis

Figure 31 Saint-Gobain: Company Snapshot

Figure 32 Saint-Gobain: SWOT Analysis

Figure 33 PPG Industries: Company Snapshot

Figure 34 Hardide Plc: Company Snapshot

The study involved four major activities in estimating the current market size for abrasion resistant coatings. Exhaustive secondary research was done to collect information on the peer and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases were referred to for identifying and collecting information. Secondary research was used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The abrasion-resistant coatings market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of oil & gas, power generation, marine, transportation, construction, and other industries. The supply side is characterized by advancements in technology and end-use industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

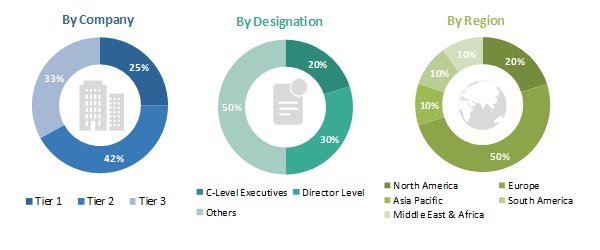

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the abrasion resistant coatings market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, was determined through primary and secondary research.

- All percentage shares were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process, the overall market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there were three sourcestop-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the abrasion resistant coatings market, in terms of value and volume

- To provide detailed information regarding the significant factors (drivers, restraints, challenges, and opportunities) influencing the growth of the market

- To analyze and forecast the market size on the basis of type and end-use industry

- To forecast the market size of the different segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments, such as expansion, acquisition, and agreement

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of the global abrasion resistant coatings market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Abrasion Resistant Coatings Market