Hydrophilic Coating Market by Substrate (Polymers, Glass/Ceramics, Metals, Nanoparticles), End User (Medical Devices, Optics, Automotive, Aerospace, Marine), and Region (APAC, North America, Europe, MEA, South America) - Global Forecast to 2027

Updated on : August 08, 2024

Hydrophilic Coating Market

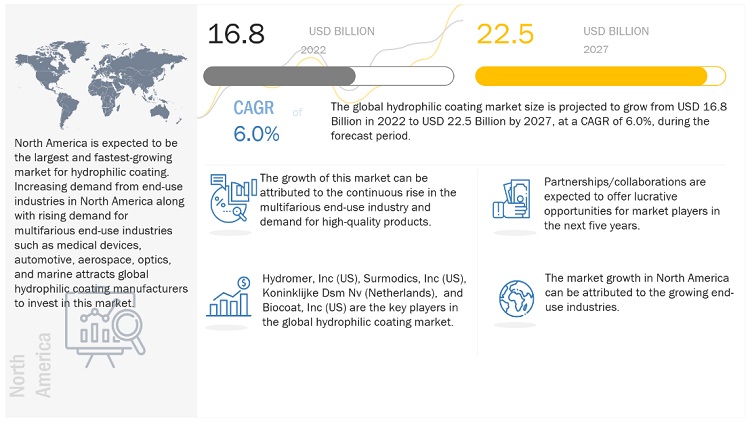

The global hydrophilic coating market was valued at USD 16.8 billion in 2022 and is projected to reach USD 22.5 billion by 2027, growing at 6.0% cagr from 2022 to 2027. Prime manufacturers of hydrophilic coating concentrate more on new product development, which caters to various end-use industries. Companies are investing heavily in R&D to build a new product that enhances their market share in the overall hydrophilic coating market. Biocoat incorporated a new product in a hydrophilic coating called HYDAK in 2020. HYDAK hydrophilic coating technology provides industry-leading performance in the three coating effectiveness criteria (lubricity, durability, and particles). The high-performance characteristics of HYDAK are due to the utilization of a bi-laminar coating platform, which covalently bonds the coating to the substrate. The base coat from HYDAK is used to "normalize" the substrate material and prepare it for chemical attachment to the lubricious topcoat. This cross-linked chemistry is responsible for HYDAK's durability and lubricity throughout the operation.

Attractive Opportunities in Hydrophilic Coating Market

Source: Interviews with Experts, Secondary Research, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrophilic Coating Market Dynamics

Driver: Growing automobile and medical devices production

According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle sales have increased from 78.7 million units in 2020 to 82.6 million units in 2021. Of these, the sales of passenger cars were 53.9 million units in 2020, which increased to 56.3 million units in 2021. This demand increased at an annual average growth rate (AAGR) of about 4.4% from 2020 to 2021. Similar trends are witnessed with increasing population, purchasing power, improving lifestyles & living standards, and developing infrastructure across the globe, boosting the automotive industry.

According to OICA, global vehicle production increased from 91.7 million units in 2019 to 77.6 million units in 2020 to 80.1 million units in 2021. 2020 did not see a significant increase in overall new internal combustion engine automobile registrations. The global market for all kinds of automobiles was affected due to the COVID-19 pandemic and the subsequent economic collapse. Amid the pandemic, worldwide EV sales were extremely uncertain at the start of the year. However, as time passed, 2020 proved to be a surprisingly good year, with worldwide EV sales increasing by 43% from 2019 and the global electric car industry share reaching a record 4,6%. In 2021, the number of electric vehicles (EVs) sold in September exceeded those sold in 2012. EVs are expected to play a key part in the goal of zero-emission objectives set for 2050, for which the industry is preparing.

In the clean energy world, few areas are as dynamic as the electric car market. In 2012, about 130,000 electric cars were sold worldwide, which are sold in a single week. Growth has been particularly impressive over the last three years, even as the market for conventional cars shrank due to the pandemic and as manufacturers started grappling with supply chain bottlenecks. Around 2.2 million electric cars were sold in 2019, representing just 2.5% of global car sales. In 2020, the overall car market contracted, but electric car sales bucked the trend, rising to 3 million and representing 4.1% of total car sales. In 2021, electric car sales more than doubled to 6.6 million, representing close to 9% of the global car market and more than tripling their market share from two years earlier. All the net growth in global car sales in 2021 came from electric cars.

Emerging markets in Asia Pacific, such as China, India, South Korea, and Southeast Asian countries, are attracting global players to set up their manufacturing bases in this region. The increased investments in various technological, infrastructural, and R&D sectors have necessitated coating manufacturers to supply qualitative products to these end users to capitalize on the increased demand in the region. These markets are also propelled by economic growth and subsequent increase in consumption from end-use industries. The Asia Pacific region expects heavy Foreign Direct Investment (FDI) in China, Indonesia, Vietnam, the Philippines, Myanmar, Malaysia, Thailand, India, Sri Lanka, and Bangladesh. Hence, the automotive production is expected to boost during the forecast period. To sustain the demands of these automobile manufacturers, the coating manufacturers have also started focusing on expansions in these regions.

The development of new technologies and techniques and an aging population have fueled the rapid expansion of the medical device industry, resulting in fierce rivalry among producers. The worldwide medical device business has been under pressure to keep prices under control while maintaining product quality. Original equipment manufacturers (OEMs) can cut operational costs, minimize regulatory violations, expedite time to market, and boost return on investment by outsourcing some services. Offering regulatory services is an important aspect of medical device contract manufacturing. Due to regulatory constraints in various countries, many smaller players and some established players have outsourced a significant portion of their manufacturing operations to capable contract manufacturing organizations. Although medical device contract manufacturing has faced challenges due to the pandemic, the underlying demand remains strong. The pandemic adversely affected the medical device industry as elective surgical procedures were abruptly halted worldwide. Medical device contract manufacturing experienced similar trends due to the lower predictability of demand. Supply chain disruptions also challenged CMOs at the pandemic’s onset.

Restraint: High initial cost and lack of skilled workforce

Manufacturing automation inhibits creativity owing to the availability of automation/machinery and a shortage of workers within the manufacturing plant. To build specific products to cater to established end users in the market, companies require a skilled workforce that gives accuracy to their final product. Many manufacturers are intrigued by the cost-reduction benefits of implementing automation and technology within their manufacturing facilities. While the benefits can help cut costs and ultimately increase profits, high initial investment costs can be involved. It is important to adequately evaluate the long-term benefits of adding various types of technology within operations to determine whether the initial implementation cost will be worth it.

Opportunity: Increasing public-private partnerships in operational markets of end-use industries

The COVID-19 pandemic has created much uncertainty for stakeholders in the automotive and infrastructure development industries. To survive in such a situation, businesses can form a public-private partnership which will enable them to win new contracts, generating huge demand for new vehicles and propelling the hydrophilic coating market forward. This method is widely used in several countries, and it is gaining popularity in the US as a result of its application in large-scale projects. Furthermore, coordination between government and business sector partners can save millions of dollars, and this is being followed in developing countries such as India. In the previous decade and a half, India has seen a significant increase in PPPs. Due to many policies and institutional measures implemented by central and state governments, it has emerged as one of the world’s major PPP markets. This trickles down to hydrophilic coating demand growth as well, as they find application in almost all major end-use industries, namely automotive, aerospace, medical devices, optics, and marine. For instance, Surmodics and Abbott have a partnership for hydrophilic coatings and Abbott pays royalties on that right Mitsui Chemicals Group is the primary manufacturer and supplier of value-added specialty chemicals, plastics, and performance materials for a wide range of sectors, including agricultural, automotive, construction, civil engineering, electronics, energy, healthcare, and packaging. To provide end-to-end hydrophilic coating services to its clients, Mitsui Chemicals, Inc acquired FSI Coating Technologies in 2010. This also enhances the company's product portfolio and expands its operations in different geographies.

Challenge: Challenges in supply chain

Following the COVID-19 pandemic, the medical device supply chain has faced new issues. From a lack of raw materials needed to manufacture medical equipment to the absence of commodities critical to the medical device supply chain sector, the load on the supply chain may be higher than ever. The accumulation of issues is placing strain on the supply chain. The management of Med-Tech enterprises will confront some critical decisions in terms of planning, considering existing supply chain difficulties and employing predictive analytics. Their judgments will be critical in eventually relieving strain on the medical device supply chain and in rebuilding a robust and trustworthy supply chain. Medical device contract manufacturers must participate as well, concentrating on discovering new, inventive solutions to these difficulties; in the present context, proactive supply chain solutions will be a priority for medical device makers. Making plans around extremely long lead times, locating replacement components, and even redesigning device parts to meet supply availability need more visibility and agility. It is critical to swiftly identify which parts are most vulnerable and pivot where feasible to ensure the required supply to bring key healthcare equipment to the people whose lives depend on them.

The glass/ceramics segment is expected to register the highest CAGR during the forecast period.

The glass/ceramics substrate type segment is expected to register the highest CAGR during the forecast period. Optical devices are prone to fogging (formation of tiny water droplets that distract the optical transmittance) when their surface temperature is approaching or below the dew point of the surrounding atmosphere, leading to substantial performance detriments or even disastrous consequences in health and safety. For instance, fog formed on the camera lens makes images blurred and distorted; drivers’ vision may be impaired by fog on the vehicle windscreen or rearview mirrors, which is one of the main causes of traffic accidents. In addition, fog on optical sensors or instruments often reduces the precision of spectrographs. Therefore, effective antifogging strategies for optical devices are highly demanded.

The antifogging coating is regarded as the most promising approach to avoid fog formation on optical devices and hydrophilic coating plays a crucial role in anti-fogging. Hydrophilic coating is almost the opposite of hydrophobic coating, in which the water is attracted to the coating and spreads out. Similar to hydrophobic coating, hydrophilic coating plays a part in the self-cleaning aspect, but rather than preventing substances from adhering to the glass, the hydrophilic coating breaks down organic matter when exposed to UV light. After a day in the sun, dirt and organic matter can be washed away when rain or other water applied to the surface runs flat and quickly across the surface of the glass.

The optics segment is expected to be the fastest-growing segment, by end user, in the hydrophilic coating market during the forecast period.

The eyeglasses industry is more complicated than it looks. In reality, the whole market may be segmented by product, yielding four categories: prescription frames (without lenses), sunglasses, ophthalmic lenses, and contact lenses. According to National Association of Optical Goods Manufacturer, from 2017 to 2019, the CAGR for total revenues was 2.4%. The sunglasses segment recorded the highest growth, with an annual growth rate of 2.9% for the same years, although the lens segment led the total revenue for the three-year period with 49%.

The global eyewear market, which is made up of spectacles, contact lenses, sunglasses, and other eyewear products, was estimated to be worth around USD 170 billion in 2022 and was forecast to reach a value of roughly USD 323.8 billion by 2030. The US was the leading eyewear market in the world as of 2021. Eyewear revenues in the country were more than double the size of those in China, which was the next biggest market. Luxottica is not only one of the largest eyewear companies in the US, but worldwide. The eyewear brands Ray-Ban, Persol, and Oakley are part of Luxottica’s brand portfolio.

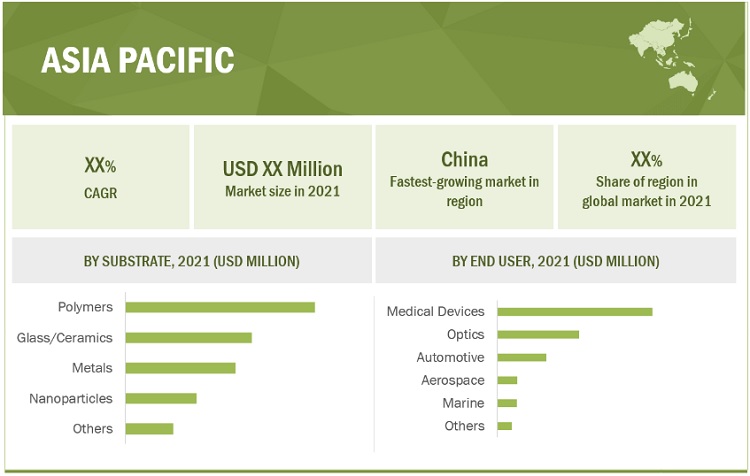

The hydrophilic coating market in Asia Pacific is expected to register the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is a rapidly developing region that offers opportunities for various industry players. Most of the leading players in North America and Europe are planning to move their production bases to this region because of inexpensive raw materials, low production costs, and the need to serve the local markets better. The demand for premium products is increasing in the region due to the growth of the middle-class population. Government initiatives are also helping the growth of the automotive industry. These factors are expected to play an important role in driving the hydrophilic coating market.

Asia's robust economic resurgence from earlier this year is losing steam due to a weaker-than-expected second quarter. The IMF has reduced its predictions for growth for Asia Pacific to 4% this year and 4.3% next year, significantly below the 5.5% average over the previous two decades. Despite this, Asia remains a relatively bright light in an otherwise gloomy global economy. A rapid tightening of financial conditions is boosting government borrowing costs that are projected to become much more constructive as central banks in major advanced economies continue to raise interest rates to contain the fastest-growing inflation in decades. Rapid currency depreciation may exacerbate policy issues. China’s strict zero-COVID-19 policy and the related lockdowns, coupled with a deepening turmoil in the real estate sector, led to an uncharacteristic and sharp slowdown in growth, which, in turn, is weakening momentum in connected economies.

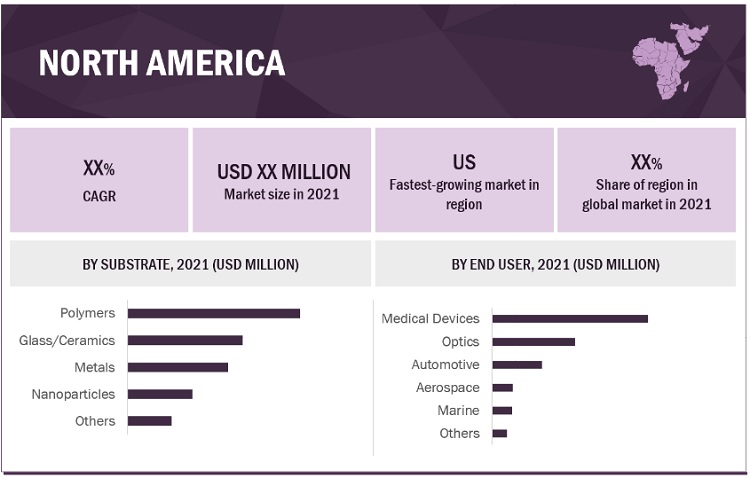

North America shows tremendous growth during the forecast period.

North America is a diversified market and has many hydrophilic coating manufacturing companies. These companies primarily focus on new product developments to cater to the increasing demand from end users. The North American hydrophilic coating market is driven by technological advancements in manufacturing and high-quality end product.

Today's economies are undergoing tremendous transformations due to emerging market expansion, the rapid introduction of new technology, environmental legislation, and shifting consumer ownership choices. Other sectors have been transformed by digitization and new business models, and the car industry will be no different. These pressures are giving rise to four disruptive technology-driven developments in the automobile sector: diversified mobility, autonomous driving, electrification, and connectivity. Most industry participants and analysts believe that these four technology-driven trends will reinforce and accelerate one another, and the sector is ready for upheaval. Despite popular belief that game-changing disruption is already on the horizon, there is no comprehensive view of how the automobile industry will look in 10 to 15 years due to these developments.

Hydrophilic Coating Market Players

Hydromer, Inc (US), Harland Medical Systems, Inc (US), Surmodics, Inc (US), Koninklijke DSM NV (Netherlands), Biocoat, Inc (US), Aculon, Inc (US), AST Products, Inc (US), AdvanSource Biomaterials Corporation (US), Surface Solutions Group, LLC (US), Teleflex, Inc (US) are the key players operating in the global market.

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Hydrophilic Coating Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Billion) |

|

Segments |

Substrate, and End User |

|

Regions |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies |

Hydromer, Inc (US), Harland Medical Systems, Inc (US), Surmodics, Inc (US), Koninklijke DSM NV (Netherlands), Biocoat, Inc (US), Aculon, Inc (US), AST Products, Inc (US), AdvanSource Biomaterials Corporation (US), Surface Solutions Group, LLC (US), Teleflex, Inc (US) |

This research report categorizes the hydrophilic coating market based on substrate, end user, and region.

Based on substrate, the hydrophilic coatings market has been segmented as follows:

- Polymers

- Glass/Ceramics

- Metals

- Nanoparticles

- Others

Based on end user, the hydrophilic coating market has been segmented as follows:

- Medical Devices

- Optics

- Automotive

- Aerospace

- Marine

- Others

Based on the region, the hydrophilic coating market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In September 2022, Harland Medical Systems, Inc. announced the opening of its European headquarters in Cork, Ireland. This will serve the customer’s needs better by providing access to equipment, materials, and coating expertise.

- In April 2020, Hydromer signed a new commercial agreement with multiple clients. The company will provide its custom coating equipment, hydrophilic coatings formulations, and complete technical support to its clients.

- In February 2020, Biocoat, Inc. launched Hydak UV. The new version of its original HYDAK coating is designed to be cured using ultraviolet (UV) light, allowing for flexible integration with industry-standard UV coating systems. The innovative coating is built on the proven bi-laminar platform used in Biocoat existing thermal heat cure coating technology.

Frequently Asked Questions (FAQ):

Does this report cover the different substrate type of hydrophilic coating market?

Yes, the report covers the different substrate type of hydrophilic coating.

Does this report covers different end user of hydrophilic coating?

Yes the report covers different end user of hydrophilic coating.

Does report covers the volume tables in addition to value tables?

Yes, the report covers the market both in terms of volume as well as value.

What is the current competitive landscape in the hydrophilic coating market in terms of new applications, production, and sales?

The market has various large, medium, and small-scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which all countries are considered in the report?

US, China, Japan, Germany, UK and France are major countries considered in the report. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing automobile and medical devices production- Technological advancements in hydrophilic coatingsRESTRAINTS- Rising raw material prices- High initial cost and lack of skilled workforceOPPORTUNITIES- Establishing authenticity through various certifications- Increasing public-private partnerships in operational markets of end-use industriesCHALLENGES- Challenges in supply chain- Stringent regulatory policies and product quality concerns

-

5.3 PORTER'S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.4 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC OVERVIEW AND KEY TRENDSINTRODUCTIONTRENDS AND FORECAST OF GDPTRENDS IN AUTOMOTIVE INDUSTRY

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

-

5.8 HYDROPHILIC COATING ECOSYSTEM AND INTERCONNECTED MARKETS

- 5.9 YC AND YCC SHIFT

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

- 5.12 CASE STUDY ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

- 5.14 KEY CONFERENCES & EVENTS, 2023

-

5.15 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 POLYMERSHIGH DURABILITY TO CREATE APPLICATIONS IN MULTIPLE END-USE INDUSTRIES

-

6.3 GLASS/CERAMICSGROWING DEMAND FOR EYEWEAR AND ANTI-FOGGING PROPERTY TO DRIVE DEMAND

-

6.4 METALSCAPABILITY OF BEARING POTENT FORCE IN UNFAVORABLE CONDITIONS TO SUPPORT MARKET

-

6.5 NANOPARTICLESGROWING DEMAND FOR MEDICAL DEVICES WITH HIGH ACCURACY TO DRIVE MARKET

- 6.6 OTHERS

- 7.1 INTRODUCTION

-

7.2 MEDICAL DEVICESINCREASING DEMAND FOR ADVANCED AND PERSONALIZED TREATMENT AND AVAILABILITY OF HEALTHCARE SERVICES TO DRIVE DEMAND

-

7.3 OPTICSPREVALENCE OF COMPUTER VISION SYNDROME AND DIGITAL SERVICES TO DRIVE MARKET

-

7.4 AUTOMOTIVEACCELERATING PER CAPITA AND DISPOSABLE INCOME OF POPULACE IN DEVELOPING COUNTRIES TO PROPEL MARKET

-

7.5 AEROSPACERISING INVESTMENTS IN AEROSPACE SECTOR TO BOOST DEMAND FOR HYDROPHILIC COATINGS

-

7.6 MARINEINCREASED TOURISM AND SURGING DEMAND FOR GLOBAL SEA TRADE TO BOOST MARKET

- 7.7 OTHERS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAUS- Growing automotive and healthcare industries to boost marketCANADA- Government investments in healthcare and automotive sectors to propel marketMEXICO- Favorable trade agreements attracting hydrophilic coating manufacturers to drive market

-

8.3 EUROPEGERMANY- Presence of major distribution channels to increase demandUK- BREXIT to hamper automotive industry growth in short termFRANCE- Government initiatives and advanced technology in automotive industry to drive marketRUSSIA- Government investments in automotive and medical devices industries to stabilize prices and boost demandSPAIN- Investments and government approach toward sustainability to drive marketITALY- High disposable income and rising FII investmentsTÜRKIYE- New manufacturing facilities to boost demand for hydrophilic coatingsREST OF EUROPE

-

8.4 ASIA PACIFICCHINA- Large investments by global manufacturers to boost demand for hydrophilic coatingsJAPAN- High economic growth and government support toward medtech industry to boost demand for hydrophilic coatingsSOUTH KOREA- Technology-driven economy to drive marketINDIA- Resources availability, rapid economic growth, increasing disposable income, and urbanization to drive marketREST OF ASIA PACIFIC

-

8.5 SOUTH AMERICABRAZIL- Expansion of production capacity and established distribution channels to propel marketARGENTINA- Government initiatives to boost demand for hydrophilic coatingREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICAUAE- Investments in new business ventures and rising medical devices industry to boost marketSAUDI ARABIA- Government investments for production expansion to create immense demandSOUTH AFRICA- Growth of various manufacturing industries to boost marketREST OF MIDDLE EAST & AFRICA

- 9.1 OVERVIEW

-

9.2 COMPETITIVE LEADERSHIP MAPPING, 2021STARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

-

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) MATRIX, 2021RESPONSIVE COMPANIESPROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 9.4 STRENGTH OF PRODUCT PORTFOLIO

- 9.5 BUSINESS STRATEGY EXCELLENCE

- 9.6 COMPETITIVE BENCHMARKING

- 9.7 MARKET SHARE ANALYSIS

- 9.8 MARKET RANKING ANALYSIS

- 9.9 REVENUE ANALYSIS

-

9.10 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKMARKET EVALUATION MATRIX

- 9.11 STRATEGIC DEVELOPMENTS

-

10.1 KEY PLAYERSHYDROMER, INC.- Business overview- Products offered- Recent developments- MnM viewHARLAND MEDICAL SYSTEMS, INC.- Business overview- Products offered- Recent developments- MnM viewSURMODICS, INC.- Business overview- Products offered- MnM viewKONINKLIJKE DSM NV- Business overview- Products offered- MnM viewBIOCOAT, INC.- Business overview- Products offered- Recent developments- MnM viewACULON, INC.- Business overview- Products offered- Recent developments- MnM viewAST PRODUCTS, INC.- Business overview- Products offered- MnM viewADVANSOURCE BIOMATERIALS CORPORATION- Business overview- Products offered- MnM viewSURFACE SOLUTIONS GROUP, LLC- Business overview- Products offered- MnM viewTELEFLEX, INC- Business overview- Products offered- MnM view

-

10.2 OTHER KEY COMPANIESBIOINTERACTIONS LTD- Products offeredPANGOLIN MEDICAL- Products offeredDONTECH INC- Products offeredFORMACOAT LLC- Products offeredJONINN- Products offeredDUKE EMPIRICAL INC- Products offeredCUUMED CATHETER MEDICAL CO., LTD- Products offeredNOANIX CORPORATION- Products offeredLOTUS LEAF COATINGS, INC- Products offeredAPPLIED MEDICAL COATINGS, LLC- Products offeredHEMOTEQ AG- Products offeredFSI COATING TECHNOLOGIES, INC (MITSUI CHEMICALS)- Products offeredSHANGHAI HUZHENG NANOTECHNOLOGY CO., LTD- Products offeredINNOVATIVE SURFACE TECHNOLOGIES INC.- Products offeredMEDICHEM NANO TEKNOLOJI SAN. VE TIC. A.S.- Products offered

- 11.1 INTRODUCTION

- 11.2 PAINTS & COATINGS MARKET LIMITATIONS

- 11.3 PAINTS & COATINGS MARKET DEFINITION

- 11.4 PAINTS & COATINGS MARKET OVERVIEW

- 11.5 PAINTS & COATINGS MARKET ANALYSIS, BY TECHNOLOGY

- 11.6 PAINTS & COATINGS MARKET ANALYSIS, BY RESIN TYPE

- 11.7 PAINTS & COATINGS MARKET ANALYSIS, BY END-USE INDUSTRY

- 11.8 PAINTS & COATINGS MARKET ANALYSIS, BY REGION

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 HYDROPHILIC COATING MARKET SNAPSHOT, 2022 VS. 2027

- TABLE 2 HYDROPHILIC COATING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA FOR HYDROPHILIC COATING

- TABLE 5 REAL GDP GROWTH BY COUNTRY (ANNUAL PERCENTAGE CHANGE), 2020–2027

- TABLE 6 AUTOMOTIVE INDUSTRY PRODUCTION (2020–2021)

- TABLE 7 HYDROPHILIC COATING MARKET: SUPPLY CHAIN

- TABLE 8 COUNTRY-WISE EXPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE IMPORT DATA, 2019–2021 (USD THOUSAND)

- TABLE 10 RECENT PATENTS BY OWNERS

- TABLE 11 HYDROPHILIC COATING MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018–2021 (USD MILLION)

- TABLE 15 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (USD MILLION)

- TABLE 16 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018–2021 (KILOTON)

- TABLE 17 HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (KILOTON)

- TABLE 18 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 19 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 20 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 21 POLYMERS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 22 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 23 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 24 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 25 GLASS/CERAMICS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 26 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 27 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 28 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 29 METALS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 30 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 31 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 32 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 33 NANOPARTICLES: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 34 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 35 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 36 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 37 OTHER SUBSTRATES: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 38 HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 39 HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 40 HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (KILOTON)

- TABLE 41 HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (KILOTON)

- TABLE 42 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 43 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 44 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 45 MEDICAL DEVICES: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 46 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 47 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 48 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 49 OPTICS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 50 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 51 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 52 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 53 AUTOMOTIVE: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 54 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 55 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 56 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 57 AEROSPACE: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 58 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 59 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 60 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 61 MARINE: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 62 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 63 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 64 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 65 OTHERS: HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 66 HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 67 HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 68 HYDROPHILIC COATING MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 69 HYDROPHILIC COATING MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 70 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 71 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 73 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 74 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018–2021 (USD MILLION)

- TABLE 75 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018–2021 (KILOTON)

- TABLE 77 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (KILOTON)

- TABLE 78 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 79 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (KILOTON)

- TABLE 81 NORTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (KILOTON)

- TABLE 82 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 83 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 84 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 85 EUROPE: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 86 EUROPE: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018–2021 (USD MILLION)

- TABLE 87 EUROPE: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (USD MILLION)

- TABLE 88 EUROPE: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018–2021 (KILOTON)

- TABLE 89 EUROPE: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (KILOTON)

- TABLE 90 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 91 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 92 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (KILOTON)

- TABLE 93 EUROPE: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (KILOTON)

- TABLE 94 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 95 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 96 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 97 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 98 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018–2021 (USD MILLION)

- TABLE 99 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (USD MILLION)

- TABLE 100 ASIA PACIFIC: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018–2021 (KILOTON)

- TABLE 101 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (KILOTON)

- TABLE 102 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 103 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (KILOTON)

- TABLE 105 ASIA PACIFIC: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (KILOTON)

- TABLE 106 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 107 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 108 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 109 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 110 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018–2021 (USD MILLION)

- TABLE 111 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (USD MILLION)

- TABLE 112 SOUTH AMERICA: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018–2021 (KILOTON)

- TABLE 113 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (KILOTON)

- TABLE 114 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 115 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 116 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (KILOTON)

- TABLE 117 SOUTH AMERICA: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (KILOTON)

- TABLE 118 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 121 MIDDLE EAST & AFRICA: HYDROPHILIC COATINGS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 122 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2018–2021 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: HYDROPHILIC COATINGS MARKET, BY SUBSTRATE, 2018–2021 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2022–2027 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2018–2021 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: HYDROPHILIC COATING MARKET, BY END USER, 2022–2027 (KILOTON)

- TABLE 130 OVERVIEW OF STRATEGIES ADOPTED BY KEY HYDROPHILIC COATING PLAYERS (2018–2022)

- TABLE 131 HYDROPHILIC COATING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 132 HYDROPHILIC COATING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

- TABLE 133 COMPANY EVALUATION MATRIX: HYDROPHILIC COATING

- TABLE 134 HYDROPHILIC COATING MARKET: DEGREE OF COMPETITION, 2021

- TABLE 135 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 136 HIGHEST ADOPTED STRATEGIES

- TABLE 137 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 138 COMPANY INDUSTRY FOOTPRINT

- TABLE 139 COMPANY REGION FOOTPRINT

- TABLE 140 COMPANY FOOTPRINT

- TABLE 141 HYDROPHILIC COATING MARKET: PRODUCT LAUNCHES, 2018–2022

- TABLE 142 HYDROPHILIC COATING MARKET: DEALS, 2018–2022

- TABLE 143 HYDROPHILIC COATING MARKET: OTHERS, 2018–2022

- TABLE 144 HYDROMER, INC.: BUSINESS OVERVIEW

- TABLE 145 HYDROMER, INC: DEALS

- TABLE 146 HARLAND MEDICAL SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 147 HARLAND MEDICAL SYSTEMS, INC.: DEALS

- TABLE 148 SURMODICS, INC: BUSINESS OVERVIEW

- TABLE 149 KONINKLIJKE DSM NV: BUSINESS OVERVIEW

- TABLE 150 BIOCOAT, INC.: BUSINESS OVERVIEW

- TABLE 151 BIOCOAT, INC.: PRODUCT LAUNCH

- TABLE 152 ACULON, INC.: BUSINESS OVERVIEW

- TABLE 153 ACULON, INC.: DEALS

- TABLE 154 AST PRODUCTS, INC.: BUSINESS OVERVIEW

- TABLE 155 ADVANSOURCE BIOMATERIALS CORPORATION: BUSINESS OVERVIEW

- TABLE 156 SURFACE SOLUTIONS GROUP, LLC: BUSINESS OVERVIEW

- TABLE 157 TELEFLEX, INC: BUSINESS OVERVIEW

- TABLE 158 BIOINTERACTIONS LTD: BUSINESS OVERVIEW

- TABLE 159 PANGOLIN MEDICAL: BUSINESS OVERVIEW

- TABLE 160 DONTECH INC: BUSINESS OVERVIEW

- TABLE 161 FORMACOAT LLC: BUSINESS OVERVIEW

- TABLE 162 JONINN: BUSINESS OVERVIEW

- TABLE 163 DUKE EMPIRICAL INC: BUSINESS OVERVIEW

- TABLE 164 CUUMED CATHETER MEDICAL CO., LTD: BUSINESS OVERVIEW

- TABLE 165 NOANIX CORPORATION: BUSINESS OVERVIEW

- TABLE 166 LOTUS LEAF COATINGS, INC: BUSINESS OVERVIEW

- TABLE 167 APPLIED MEDICAL COATINGS, LLC: BUSINESS OVERVIEW

- TABLE 168 HEMOTEQ AG: BUSINESS OVERVIEW

- TABLE 169 FSI COATING TECHNOLOGIES, INC: BUSINESS OVERVIEW

- TABLE 170 SHANGHAI HUZHENG NANOTECHNOLOGY CO., LTD: BUSINESS OVERVIEW

- TABLE 171 INNOVATIVE SURFACE TECHNOLOGIES INC.: BUSINESS OVERVIEW

- TABLE 172 MEDICHEM NANO TEKNOLOJI SAN. VE TIC. A.S.: BUSINESS OVERVIEW

- TABLE 173 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 174 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

- TABLE 175 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 176 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (KILOTON)

- TABLE 177 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

- TABLE 178 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

- TABLE 179 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017–2020 (KILOTON)

- TABLE 180 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021–2026 (KILOTON)

- TABLE 181 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 182 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (USD MILLION)

- TABLE 183 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 184 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTON)

- TABLE 185 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (USD MILLION)

- TABLE 186 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (USD MILLION)

- TABLE 187 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017–2020 (KILOTON)

- TABLE 188 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021–2026 (KILOTON)

- TABLE 189 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 190 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

- TABLE 191 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

- TABLE 192 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

- TABLE 193 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 194 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 195 PAINTS & COATINGS MARKET, BY REGION, 2017–2020 (KILOTON)

- TABLE 196 PAINTS & COATINGS MARKET, BY REGION, 2021–2026 (KILOTON)

- FIGURE 1 HYDROPHILIC COATING MARKET SEGMENTATION

- FIGURE 2 HYDROPHILIC COATING MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 HYDROPHILIC COATING MARKET SIZE ESTIMATION, BY REGION

- FIGURE 6 HYDROPHILIC COATING MARKET, BY SUBSTRATE

- FIGURE 7 HYDROPHILIC COATING MARKET: SUPPLY-SIDE FORECAST

- FIGURE 8 METHODOLOGY FOR SUPPLY-SIDE SIZING OF HYDROPHILIC COATING MARKET

- FIGURE 9 FACTOR ANALYSIS OF HYDROPHILIC COATING MARKET

- FIGURE 10 HYDROPHILIC COATING MARKET: DATA TRIANGULATION

- FIGURE 11 POLYMERS SEGMENT TO DOMINATE HYDROPHILIC COATING MARKET

- FIGURE 12 MEDICAL DEVICES END USER TO LEAD HYDROPHILIC COATING MARKET

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING HYDROPHILIC COATING MARKET

- FIGURE 14 MARKET GROWTH IN NORTH AMERICA DUE TO GROWING AUTOMOTIVE AND MEDICAL DEVICES INDUSTRIES

- FIGURE 15 POLYMERS TO BE LARGEST SUBSTRATE SEGMENT DURING FORECAST PERIOD

- FIGURE 16 DEVELOPING COUNTRIES TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 17 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR IN HYDROPHILIC COATING MARKET

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HYDROPHILIC COATING MARKET

- FIGURE 20 PORTER’S FIVE FORCES ANALYSIS: HYDROPHILIC COATING MARKET

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 22 KEY BUYING CRITERIA FOR HYDROPHILIC COATING

- FIGURE 23 HYDROPHILIC COATING: VALUE CHAIN ANALYSIS

- FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY REGION, 2021

- FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY SUBSTRATE, 2021

- FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY END USER, 2021

- FIGURE 27 AVERAGE PRICE COMPETITIVENESS IN HYDROPHILIC COATING MARKET, BY COMPANIES, 2021

- FIGURE 28 HYDROPHILIC COATING MARKET: ECOSYSTEM

- FIGURE 29 CHANGING REVENUE MIX FOR HYDROPHILIC COATING MARKET

- FIGURE 30 NUMBER OF PATENTS PUBLISHED, 2017–2022

- FIGURE 31 PATENTS PUBLISHED BY JURISDICTIONS, 2017–2022

- FIGURE 32 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2017–2022

- FIGURE 33 POLYMERS SEGMENT TO LEAD HYDROPHILIC COATING MARKET

- FIGURE 34 MEDICAL DEVICES SEGMENT TO DOMINATE HYDROPHILIC COATING MARKET

- FIGURE 35 ASIA PACIFIC EMERGING AS STRATEGIC LOCATION FOR HYDROPHILIC COATING MARKET

- FIGURE 36 NORTH AMERICA: HYDROPHILIC COATING MARKET SNAPSHOT

- FIGURE 37 EUROPE: HYDROPHILIC COATING MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: HYDROPHILIC COATING MARKET SNAPSHOT

- FIGURE 39 BRAZIL TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 40 SOUTH AFRICA IS FASTEST-GROWING COUNTRY IN REGION

- FIGURE 41 HYDROPHILIC COATING MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 42 HYDROPHILIC COATING MARKET: EMERGING COMPANIES’ COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 43 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN HYDROPHILIC COATING MARKET

- FIGURE 44 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN HYDROPHILIC COATING MARKET

- FIGURE 45 MARKET SHARE, BY KEY PLAYERS (2021)

- FIGURE 46 MARKET RANKING ANALYSIS, 2021

- FIGURE 47 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2017–2021

- FIGURE 48 HYDROMER, INC.: COMPANY SNAPSHOT

- FIGURE 49 SURMODICS, INC.: COMPANY SNAPSHOT

- FIGURE 50 KONINKLIJKE DSM NV.: COMPANY SNAPSHOT

- FIGURE 51 ADVANSOURCE BIOMATERIALS CORPORATION (MITSUBISHI CHEMICAL GROUP CORPORATION): COMPANY SNAPSHOT

- FIGURE 52 TELEFLEX, INC: COMPANY SNAPSHOT

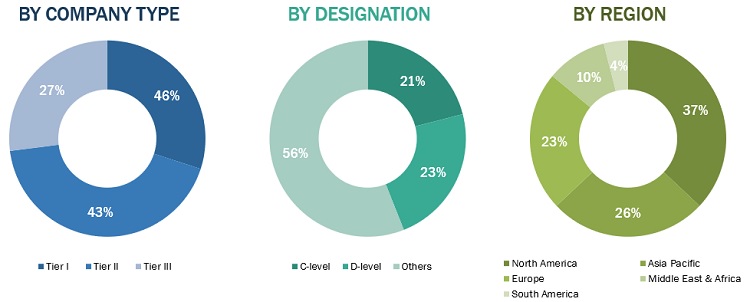

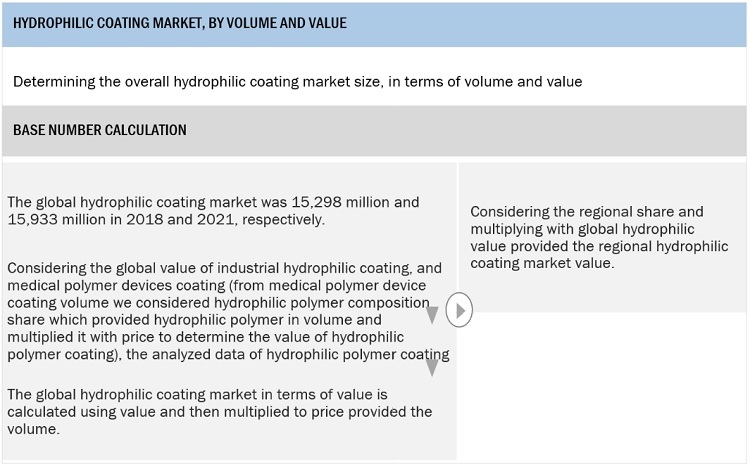

The study involved four major activities in estimating the current market size of hydrophilic coating. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both supply-side and demand-side approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves the use of extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the hydrophilic coating market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The hydrophilic coating market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development of the construction industry and its end uses such as automotive, aerospace, marine, medical devices, optics, and others. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = <USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to gather, verify, and validate the market figures arrived at. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to provide key information/insights throughout the report. The research methodology used to estimate the market size included the following steps:

- The key players in the market were identified in the respective regions through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined through secondary sources and verified through primary sources.

- All possible parameters that affect the market and submarkets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from the MarketsandMarkets data repository and presented in this report .

Global Hydrophilic Coating Market: Top-Down Approach

Source: Secondary Research, and Interviews with Experts

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all the segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources — the top-down approach, the bottom-up approach, and expert interviews. Only when the values arrived at from the three points matched, the data has been assumed to be correct.

Report Objectives

- To analyze and forecast the size of the automotive coatings market in terms of value

- To provide detailed information regarding the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market and its submarkets

- To define, describe, and forecast the size of the market by substrate, end user, and region

- To forecast the size of the market and its submarkets with respect to five regions (along with their major countries), namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To strategically analyze each micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments and provide a competitive landscape of market leaders

- To track and analyze competitive developments such as new product launches, mergers & acquisitions, investment & expansions, and joint ventures in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hydrophilic Coating Market