Adherence Packaging Market by System (Unit-dose, Multi-dose) Type (Blister Card, Pouch) Material (Plastic, Paper & Paperboard, Aluminum) End User (Retail, Long-term care facility, Hospital, Mail-order Pharmacies) - Global Forecast to 2022

[193 Pages Report] The global adherence packaging market is projected to reach USD 917.7 Million by 2022 from a base USD 646.0 Million in 2016, at a CAGR of 6.2%. Market growth can be attributed to the growing need to minimize medication wastage, high rate of medication nonadherence, and technological advancements such as remote dispensing systems. On the other hand, high installation and maintenance costs of automated systems are expected to restrain the overall market growth during the forecast period.

Years considered for this report

- 2016 – Base Year

- 2017 – Estimated Year

- 2022 – Projected Year

Objectives of the Study

- To define, describe, and forecast the adherence packaging market on the basis of systems type, packaging type & material, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies in the global adherence packaging market

- To track and analyze competitive developments such as partnerships, agreements, & collaborations; mergers & acquisitions; product developments; and geographical expansions in the global adherence packaging market

Research Methodology

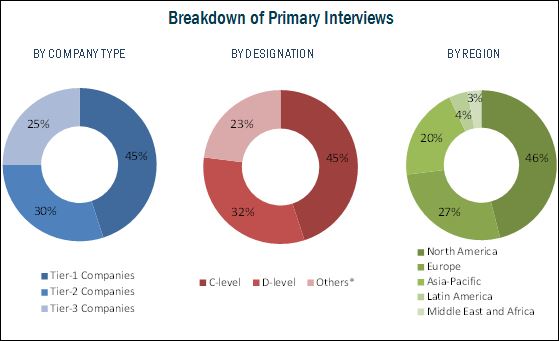

Top-down and bottom-up approaches were used to validate the size of the global medication adherence packaging market and estimate the size of various other dependent submarkets. Major players in the market were identified through secondary sources; directories; databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, journals and their market revenues were determined through primary and secondary research. Secondary research included the study of the annual and financial reports of top market players, whereas primary research included extensive interviews with the key opinion leaders such as CEOs, directors, and marketing executives. The percentage splits, shares, and breakdowns of the product markets were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The global medication adherence packaging market is consolidated in nature with the top five players, namely, Cardinal Health, Inc. (U.S.), Omnicell, Inc. (U.S.), Becton, Dickinson and Company (U.S.), Talyst, LLC (U.S.), and Parata Systems LLC (U.S.) accounting for ~60% of the market share in 2016. The other players in this market include TCGRx (U.S.), McKesson Corporation (U.S.), KUKA AG (Germany), Pearson Medical Technologies LLC (U.S.), RxSafe, LLC (U.S.), ARxIUM, Inc. (U.S.), Manrex Limited (Canada), Accu-Chart Plus Healthcare Systems, Inc. (U.S.), Synergy Medical (Canada), Manchac Technologies, LLC (U.S.), Global Factories B.V. (Netherlands), Drug Package, LLC (U.S.), Jones Packaging Inc. (U.S.), American Health Packaging (AmerisourceBergen) (U.S.), and Medicine-On-Time (U.S.), who collectively accounted for a share of ~40% of the market in 2016. The leading players are continuously developing new and innovative products to maintain their shares in the adherence packaging market.

Target Audience:

- Healthcare institutions (hospitals, medical schools, and outpatient clinics)

- Pharmacy chains

- Long-term care facilities

- Corporate entities

- Market research and consulting firms

- Venture capitalists and investors

Scope of the Report

The research report categorizes the global adherence packaging market into the following segments and subsegments:

-

Global Medication Adherence Packaging Systems Market, By Type

-

Unit-dose Packaging Systems

- Blister Card Packaging Systems

- Pouch/Strip Packaging Systems

-

Multi-dose Packaging Systems

- Blister Card Packaging Systems

- Pouch/Strip Packaging Systems

-

Unit-dose Packaging Systems

-

Global Medication Adherence Packaging Market, By Type & Material

-

By Type

- Blister Cards

- Pouches/Strips

-

By Material

- Plastic

- PVC

- Rigid PVC

- PET

- PE

- PP

- Others

- Paper & paperboard

- Aluminum

-

By Type

-

Global Medication Adherence Packaging Market, By End User

- Retail Pharmacies

- Long-term Care Facilities

- Hospital

- Mail-order Pharmacies

-

Global Medication Adherence Packaging Market, By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- Japan

- China

- South Korea

- Rest of Asia-Pacific

- Latin America

- Middle East and Africa

-

North America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of top companies

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific into India, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the Rest of Latin America into Argentina, Colombia, Chile, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global adherence packaging market is projected to reach USD 917.7 Million by 2022 from an estimated USD 679.1 Million in 2017, at a CAGR of 6.2%. Market growth can be attributed to the growing need to minimize medication wastage, high rate of medication nonadherence, and technological advancements such as remote dispensing systems. On the other hand, high installation and maintenance costs of automated systems are expected to restrain the overall market growth during the forecast period.

In this report, the global medication adherence packaging market is segmented on the basis of systems type, packaging type & material, and end users. This report also provides market information on major regional segments, namely, North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

In 2016, the multi-dose packaging systems dominated the adherence systems market. The multi-dose packaging systems segment is further segmented into blister card packaging systems and strip/pouch packaging systems. The large share and high growth of this segment can primarily be attributed to the benefits of multi-dose packaging, such as assisting patients with complicated prescription regimens, ability to enhance patient safety, and elimination of medication waste.

Based on packaging type, the blister cards segment dominated the adherence packaging market. The large share and high growth of this segment can be attributed to enhanced medication shelf life, better tamper resistance, easy storage & transport, reduced medicine dispensing time, and improved medication adherence. By material, the adherence packaging market is classified into plastic film, paper & paperboard, and aluminum. The plastic film segment is expected to register the highest CAGR during the forecast period. The growth can be attributed to its transparency, malleability, lightweight, and cost-effectiveness.

The major end users of adherence packaging market are retail pharmacies, long-term care facilities, and hospitals. Long-term care is the fastest growing end user segment in the medication adherence packaging market during the forecast period. In 2016, the retail pharmacies dominated the adherence packaging market. Growing need to prevent dispensing errors and thereby improving the operational capacity are the factors driving the adoption of adherence packaging in retail pharmacies.

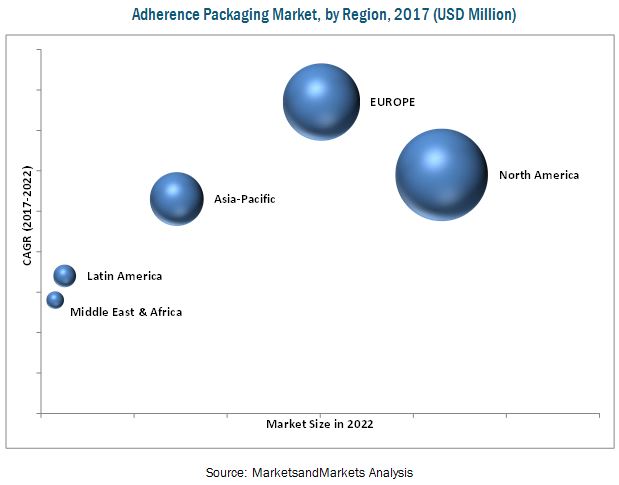

Geographically, the global adherence packaging market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2016, North America dominated the global adherence packaging market. Factors such as the rising prevalence of chronic diseases, increase in healthcare expenditure, rapid growth in the aging population, growing pharmaceuticals market, high rate of medication nonadherence, and increase in funding by government agencies are driving the growth of the adherence packaging market in North America. Europe is the fastest-growing market for adherence packaging market. The growth of the adherence packaging market across the European region is primarily driven by the availability of significant government funding for R&D, presence of leading adherence packaging companies, increasing prevalence of cardiovascular diseases, and growth in aging population drives the demand for effective solutions.

The major players in the medication adherence packaging market are Becton, Dickinson, and Company (U.S.), Omnicell, Inc. (U.S.), Cardinal Health, Inc. (U.S.), McKesson Corporation (U.S.), Parata Systems LLC (U.S), TCGRx (U.S.), RxSafe, LLC (U.S.), Pearson Medical Technologies, LLC (U.S.), Talyst, LLC. (U.S.), Parata Systems LLC (U.S.), ARxIUM, Inc. (Canada), and KUKA AG (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Approach

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Growth Potential of Global Medication Adherence Packaging Market

4.2 APAC: Medication Adherence Packaging Market, By End-User

4.3 Geographic Snapshot of Medication Adherence Packaging Market

4.4 Global Medication Adherence Packaging Market, By Type, 2017 vs 2022 (USD Million)

4.5 Global Medication Adherence Packaging Market: Regional Mix

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Rate of Medication Non-Adherence

5.2.1.2 Growing Need to Minimize Medication Wastage

5.2.1.3 Technological Advancements, Such as Remote Dispensing Systems

5.2.2 Restraint

5.2.2.1 High Installation and Maintenance Costs of Automated Systems

5.2.3 Opportunities

5.2.3.1 Emerging Economies as Untapped Markets

5.2.3.2 Government Initiatives to Improve Medication Adherence

5.2.4 Challenges

5.2.4.1 Limited Applications of Adherence Packaging, Such as Multi-Dose Packaging Systems in High-Acuity Care Environments

5.2.4.2 Lack of Awareness Regarding Medication Adherence Packaging

6 Global Adherence Packaging Market, By System (Page No. - 44)

6.1 Introduction

6.2 Multi-Dose Packaging Systems

6.2.1 Blister Card Packaging Systems

6.2.2 Strip/Pouch Packaging Systems

6.3 Unit-Dose Packaging Systems

6.3.1 Blister Card Packaging Systems

6.3.2 Strip/Pouch Packaging Systems

7 Global Adherence Packaging Market, By Type and Material (Page No. - 54)

7.1 Global Medication Adherence Packaging Market, By Type

7.1.1 Blister Cards

7.1.2 Strips/Pouches

7.2 Global Medication Adherence Packaging Market, By Material

7.2.1 Plastic Film

7.2.1.1 PVC

7.2.1.2 RIGID PVC

7.2.1.3 PET

7.2.1.4 PE

7.2.1.5 PP

7.2.1.6 Other Plastic Films

7.2.2 Paper & Paperboard

7.2.3 Aluminum

8 Global Adherence Packaging Market, By End-User (Page No. - 70)

8.1 Introduction

8.2 Retail Pharmacies

8.3 Long-Term Care Facilities

8.4 Hospitals

8.5 Mail-Order Pharmacies

9 Global Adherence Packaging Market, By Region (Page No. - 76)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Spain

9.3.5 Italy

9.3.6 Rest of Europe (RoE)

9.4 APAC

9.4.1 Japan

9.4.2 China

9.4.3 South Korea

9.4.4 Rest of APAC (RoAPAC)

9.5 Latin America

9.6 MEA

10 Competitive Landscape (Page No. - 139)

10.1 Introduction

10.2 Market Share Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Emerging Companies

10.3.4 Dynamic Differentiators

10.4 Competitive Benchmarking

10.4.1 Strength of Product Portfolio (For 25 Players)

10.4.2 Business Strategy Excellence (For 25 Players)

11 Company Profiles (Page No. - 145)

Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments

11.1 Omnicell, Inc.

11.2 Tcgrx

11.3 Parata Systems, LLC

11.4 Mckesson Corporation

11.5 Cardinal Health, Inc.

11.6 Becton, Dickinson and Company

11.7 Kuka Aktiengesellschaft

11.8 Pearson Medical Technologies LLC

11.9 Rxsafe, LLC

11.10 Arxium, Inc.

11.11 Talyst, LLC.

11.12 Manrex Limited

11.13 Medicine-On-Time

11.14 Accu-Chart Plus Healthcare Systems, Inc.

*Overview, Products Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 181)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (174 Tables)

Table 1 Impact Analysis: Market Drivers

Table 2 Impact Analysis: Market Restraint

Table 3 Impact Analysis: Market Opportunities

Table 4 Impact Analysis: Market Challenges

Table 5 Global Medication Adherence Packaging Market, By System, 2015-2022 (USD Million)

Table 6 Multi-Dose Packaging Systems Offered By Prominent Players

Table 7 Global Multi-Dose Packaging Systems Market, By Type, 2015-2022 (USD Million)

Table 8 Global Multi-Dose Packaging Systems Market, By Country, 2015-2022 (USD Million)

Table 9 Global Multi-Dose Blister Card Packaging Systems Market, By Country, 2015-2022 (USD Million)

Table 10 Global Multi-Dose Strip/Pouch Packaging Systems Market, By Country, 2015-2022 (USD Million)

Table 11 Unit-Dose Packaging Systems Offered By Prominent Players

Table 12 Global Unit-Dose Packaging Systems Market, By Type, 2015-2022 (USD Million)

Table 13 Global Unit-Dose Packaging Systems Market, By Country, 2015-2022 (USD Million)

Table 14 Global Unit-Dose Blister Card Packaging Systems Market, By Country, 2015-2022 (USD Million)

Table 15 Global Unit-Dose Strip/Pouch Packaging Systems Market, By Country, 2015-2022 (USD Million)

Table 16 Global Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 17 Global Medication Adherence Blister Cards Packaging Market, By Country, 2015–2022 (USD Million)

Table 18 Global Medication Adherence Strips/Pouches Packaging Market, By Country, 2015–2022 (USD Million)

Table 19 Global Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 20 Global Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 21 Global Medication Adherence Packaging Market for Plastic Films, By Country, 2015–2022 (USD Million)

Table 22 Global Medication Adherence Packaging Market for PVC, By Country, 2015–2022 (USD Million)

Table 23 Global Medication Adherence Packaging Market for RIGID PVC, By Country, 2015–2022 (USD Million)

Table 24 Global Medication Adherence Packaging Market for PET, By Country, 2015–2022 (USD Million)

Table 25 Global Medication Adherence Packaging Market for PE, By Country, 2015–2022 (USD Million)

Table 26 Global Medication Adherence Packaging Market for PP, By Country, 2015–2022 (USD Million)

Table 27 Global Medication Adherence Packaging Market for Other Plastic Films, By Country, 2015–2022 (USD Million)

Table 28 Global Medication Adherence Packaging Market for Paper & Paperboard, By Country, 2015–2022 (USD Million)

Table 29 Global Medication Adherence Packaging Market for Aluminum, By Country, 2015–2022 (USD Million)

Table 30 Global Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 31 Global Medication Adherence Packaging Market for Retail Pharmacies, By Country, 2015–2022 (USD Million)

Table 32 Global Medication Adherence Packaging Market for Long-Term Care Facilities, By Country, 2015–2022 (USD Million)

Table 33 Global Medication Adherence Packaging Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 34 Global Medication Adherence Packaging Market for Mail-Order Pharmacies, By Country, 2015–2022 (USD Million)

Table 35 Global Medication Adherence Packaging Market, By Region, 2015–2022 (USD Million)

Table 36 North America: Medication Adherence Packaging Market, By Country, 2015–2022 (USD Million)

Table 37 North America: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 38 North America: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 39 North America: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 40 North America: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 41 North America: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 42 North America: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 43 North America: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 44 North America: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 45 U.S.: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 46 U.S.: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 47 U.S.: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 48 U.S.: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 49 U.S.: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 50 U.S.: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 51 U.S.: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 52 U.S.: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 53 Canada: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 54 Canada: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 55 Canada: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 56 Canada: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 57 Canada: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 58 Canada: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 59 Canada: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 60 Canada: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 61 Europe: Medication Adherence Packaging Market, By Country, 2015–2022 (USD Million)

Table 62 Europe: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 63 Europe: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 64 Europe: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 65 Europe: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 66 Europe: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 67 Europe: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 68 Europe: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 69 Europe: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 70 Germany: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 71 Germany: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 72 Germany: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 73 Germany: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 74 Germany: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 75 Germany: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 76 Germany: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 77 Germany: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 78 France: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 79 France: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 80 France: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 81 France: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 82 France: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 83 France: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 84 France: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 85 France: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 86 U.K.: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 87 U.K.: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 88 U.K.: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 89 U.K.: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 90 U.K.: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 91 U.K.: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 92 U.K.: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 93 U.K.: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 94 Spain: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 95 Spain: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 96 Spain: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 97 Spain: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 98 Spain: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 99 Spain: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 100 Spain: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 101 Spain: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 102 Italy: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 103 Italy: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 104 Italy: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 105 Italy: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 106 Italy: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 107 Italy: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 108 Italy: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 109 Italy: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 110 RoE: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 111 RoE: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 112 RoE: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 113 RoE: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 114 RoE: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 115 RoE: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 116 RoE: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 117 RoE: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 118 APAC: Medication Adherence Packaging Market, By Country, 2015–2022 (USD Million)

Table 119 APAC: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 120 APAC: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 121 APAC: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 122 APAC: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 123 APAC: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 124 APAC: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 125 APAC: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 126 APAC: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 127 Japan: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 128 Japan: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 129 Japan: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 130 Japan: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 131 Japan: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 132 Japan: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 133 Japan: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 134 Japan: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 135 China: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 136 China: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 137 China: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 138 China: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 139 China: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 140 China: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 141 China: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 142 China: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 143 South Korea: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 144 South Korea: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 145 South Korea: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 146 South Korea: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 147 South Korea: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 148 South Korea: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 149 South Korea: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 150 South Korea: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 151 RoAPAC: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 152 RoAPAC: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 153 RoAPAC: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 154 RoAPAC: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 155 RoAPAC: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 156 RoAPAC: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 157 RoAPAC: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 158 RoAPAC: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 159 Latin America: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 160 Latin America: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 161 Latin America: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 162 Latin America: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 163 Latin America: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 164 Latin America: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 165 Latin America: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 166 Latin America: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

Table 167 MEA: Medication Adherence Packaging Market, By Product, 2015–2022 (USD Million)

Table 168 MEA: Medication Adherence Packaging Market, By System, 2015–2022 (USD Million)

Table 169 MEA: Multi-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 170 MEA: Unit-Dose Packaging Systems Market, By Type, 2015–2022 (USD Million)

Table 171 MEA: Medication Adherence Packaging Market, By Type, 2015–2022 (USD Million)

Table 172 MEA: Medication Adherence Packaging Market, By Material, 2015–2022 (USD Million)

Table 173 MEA: Medication Adherence Packaging Market for Plastic Films, By Type, 2015–2022 (USD Million)

Table 174 MEA: Medication Adherence Packaging Market, By End-User, 2015–2022 (USD Million)

List of Figures (31 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Global Medication Adherence Packaging Market, By System, 2017 vs 2022 (USD Million)

Figure 7 Global Medication Adherence Packaging Market, By Material, 2017 vs 2022 (USD Million)

Figure 8 Global Medication Adherence Packaging Market, By Type, 2017 vs 2022 (USD Million)

Figure 9 Global Multi-Dose Packaging Systems Market, By Type, 2017 vs 2022 (USD Million)

Figure 10 Global Medication Adherence Packaging Market, By End-User, 2017 vs 2022 (USD Million)

Figure 11 Geographical Snapshot of Global Medication Adherence Packaging Market

Figure 12 High Rate of Medication Non-Adherence–Major Factor Driving the Medication Adherence Packaging Market During the Forecast Period

Figure 13 Retail Pharmacies Segment Held the Largest Share in 2016

Figure 14 The U.S. Held Largest Share of Global Medication Adherence Packaging Market in 2016

Figure 15 Blister Cards Segment to Lead Medication Adherence Packaging Market, 2017-2022 (USD Million)

Figure 16 Europe to Register Highest CAGR, 2017-2022 (USD Million)

Figure 17 Global Medication Adherence Packaging Market: Drivers, Restraint, Opportunities, & Challenges

Figure 18 Multi-Dose Packaging Segment to Lead Global Medication Adherence Packaging Market, By System, 2017-2022 (USD Million)

Figure 19 Blister Cards Segment to Lead Global Medication Adherence Packaging Market, By Type, 2017-2022 (USD Million)

Figure 20 Plastic Film Segment to Lead Global Medication Adherence Packaging Market, By Material, 2017-2022 (USD Million)

Figure 21 Medication Adherence Packaging Market: Geographic Growth Opportunities

Figure 22 North America: Medication Adherence Packaging Market Snapshot

Figure 23 Europe: Medication Adherence Packaging Market Snapshot

Figure 24 APAC: Medication Adherence Packaging Market Snapshot

Figure 25 Global Medication Adherence Packaging Market Share Analysis, By Player, 2016

Figure 26 Medication Adherence Packaging Market (Global) Competitive Leadership Mapping, 2017

Figure 27 Omnicell, Inc.: Company Snapshot (2016)

Figure 28 Mckesson Corporation: Company Snapshot (2016)

Figure 29 Cardinal Health, Inc.: Company Snapshot (2016)

Figure 30 Becton, Dickinson and Company: Company Snapshot (2016)

Figure 31 Kuka Aktiengesellschaft: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Adherence Packaging Market