Medical Packaging Films Market by Material (Polyethylene, Polypropylene, Polyvinyl Chloride, Polyamide), Type (Thermoformable Film, High Barrier Film, Metallized Film), Application (Bags, Tubes), and Region - Global Forecast to 2028

Updated on : June 27, 2024

Medical Packaging Films Market

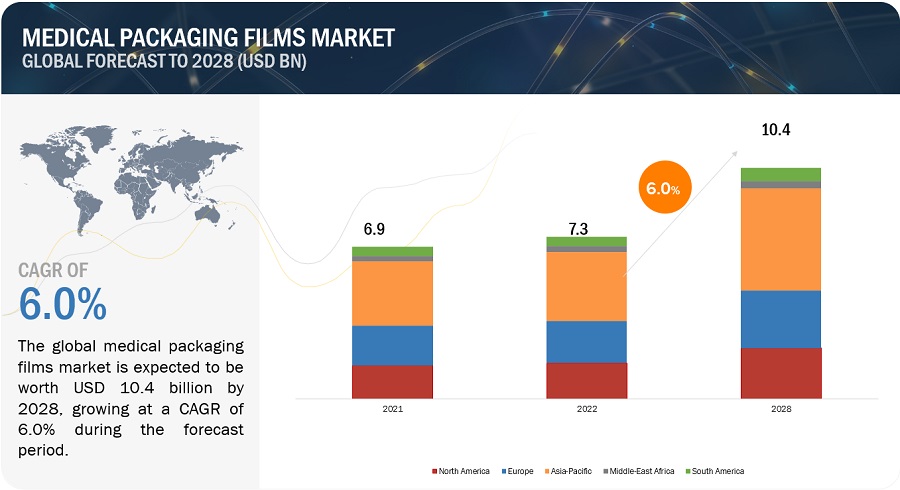

The medical packaging films market was valued at USD 7.8 billion in 2023 and is projected to reach USD 10.4 billion by 2028, growing at 6.0% cagr from 2023 to 2028. The growth of the medical packaging films market is propelled by factors such as the rising prevalence of chronic diseases, expanded investments in healthcare infrastructure, increasing interest in bioplastic materials, and the growing demand for bi-axially oriented films.

Global Medical Packaging Films Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Packaging Films Market Dynamics

Driver: Increasing healthcare expenditures, alongside a growing incidence of chronic diseases

The burgeoning growth of the healthcare and medical industry stands as a significant driver for the medical packaging films market. As urbanization accelerates and disposable incomes rise globally, more consumers are interested in increasing the expenditure on healthcare facilities. This helps to grow the demand for medical packaging films. As medical packaging films offer several benefits such as product protection, longer shelf life, maintain sterility, good barrier properties against oxygen, chemicals, and other contaminants, etc. Due to such benefits, it is used highly in the medical industry in several application areas such as bags, tubes, and others.

Restraint: Variability in the cost of raw materials

The medical packaging industry has faced significant challenges in its pursuit of delivering top-tier packaging solutions at reduced costs. Fluctuations in the prices of raw materials have had an adverse impact on the profitability of the medical packaging film sector. Contributing to the cost pressures on raw material suppliers are environmental concerns and the volatility in oil and resin prices. These price increases are driven by a variety of factors, including geopolitical instability and stricter environmental regulations, coupled with occasional supply shortages. Moreover, it is expected that both fuel and transportation costs will see substantial increases. These factors have posed barriers for new entrants to the medical packaging market, as the combined expenses of operation, raw materials, and energy have added to production costs.

Opportunity: Increasing interest in eco-friendly packaging alternatives

Industry dynamics are experiencing significant shifts, driven by the implementation of new regulatory initiatives. Entities like the FDA, the European Parliament, and Council have played a pivotal role in influencing manufacturers to innovate in their packaging approaches. Additionally, heightened concerns about the environmental impact of plastics in medical packaging have spurred manufacturers to create sustainable packaging alternatives that prioritize both safety and security. To address cost pressures while upholding product packaging integrity, manufacturers are exploring sustainable packaging solutions that require fewer resources for production, decrease transportation expenses, and extend the shelf life of products.

Challenges: Stringent government rules and regulations

While stringent regulations governing medical packaging films can present challenges, they are relatively manageable for the market. Adhering to these regulations is imperative, as even the slightest flaw in packaging could result in the contamination of medicines and devices, potentially causing severe repercussions. Moreover, non-compliance can have adverse effects on the manufacturer's profitability. Medical packaging for healthcare products and devices necessitates factors such as moisture control, product integrity, light barrier properties, and convenient transportation. This will become a challenge for the manufacturers to maintain the quality of the product by following the regulations and keeping the operational costs as much as possible.

Medical Packaging Films Market Ecosystem

Dominance of bags in the Medical packaging films application segment:

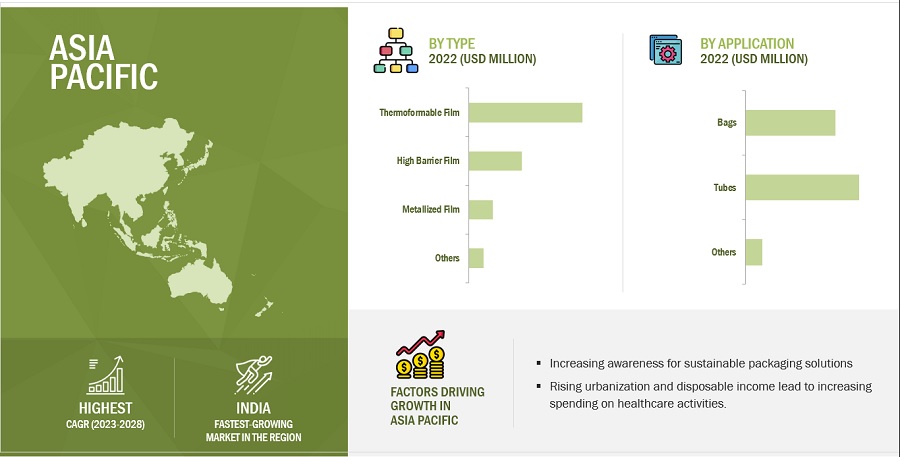

In terms of application, the bags segment is anticipated to take the forefront in the medical packaging films market from 2023 to 2028, in terms of value. Medical bags play a pivotal role within the industry, especially when there's a demand for cost-effective packaging in substantial quantities. Bags offer multiple advantages, including the safeguarding of medical products, convenient transportation, and a platform for brand promotion. They are extensively employed for storing items like first aid kits, medications, and medical equipment. Additionally, pouches serve as a practical choice for housing tools or liquid medications.

“Polypropylene is the fastest growing material segment of the medical packaging films market.”

In the medical packaging films market, the polypropylene segment is expected to exhibit the highest compound annual growth rate (CAGR) in terms of value throughout the forecast period. Polypropylene, or PP, is an economical thermoplastic known for its high clarity, gloss, and enhanced tensile strength. Notably, it boasts a higher melting point than polyethylene (PE), rendering it well-suited for applications demanding high-temperature sterilization. Furthermore, the capacity for metallization enhances its gas barrier properties, particularly in applications where extending the product's shelf life is a critical consideration.

“Thermoformable Film is the largest type segment of the medical packaging films market.”

Thermoformable film, often referred to as thermoforming film, is a type of packaging material that can be easily shaped or molded using heat. It is typically a thin, flexible plastic film designed to become pliable when exposed to heat, allowing it to take on a specific shape or contour. These are used to create custom-shaped trays and clamshell packaging for medical devices. This packaging ensures the safe and secure storage and transportation of devices like syringes, catheters, and surgical instruments.

“APAC is the speediest-growing market for medical packaging films market.”

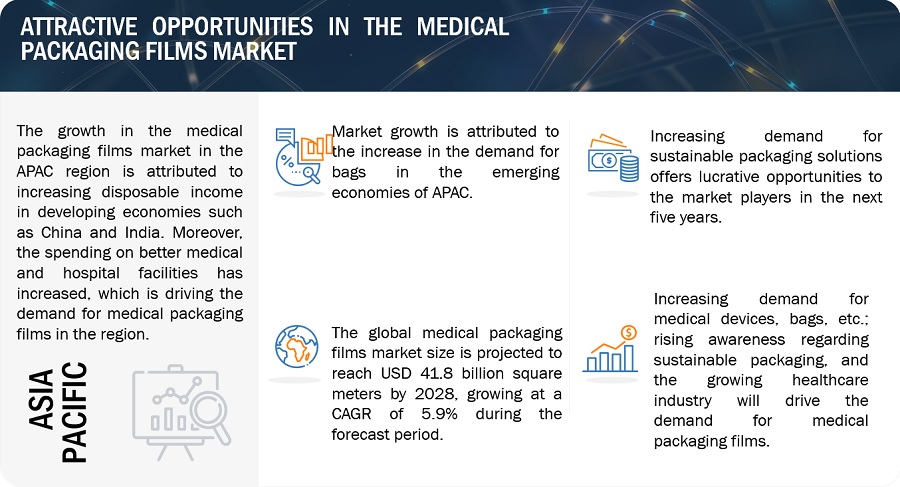

The Asia Pacific medical packaging films market is poised to experience the most robust Compound Annual Growth Rate (CAGR) between 2023 and 2028 in terms of value. This growth is attributed to the escalating demand for medical packaging films in densely populated nations like India and China. These packaging solutions are favored for their cost-efficiency, sustainability, and their ability to ensure the safety of packaged products. Furthermore, the Asia Pacific region is expected to lead the market both in terms of value and volume throughout the forecast period. This projection is driven by the region's robust industrial infrastructure, the increasing demand for sustainable packaging solutions across various applications, and the presence of key manufacturers in the medical packaging films market.

To know about the assumptions considered for the study, download the pdf brochure

Medical Packaging Films Market Players

Key stakeholders steering the trajectory of the medical packaging films market include Amcor Plc (Switzerland), Berry Global Inc. (US), DuPont de Nemours Inc. (US), RENOLIT SE (Germany), Weigao Group (China), Sealed Air Corporation (US), Covestro AG (Germany), 3M (US), Toppan, Inc. (Japan), Wipak (Finland), and Mitsubishi Chemical Corporation (Japan). To solidify their positions in this competitive market, these industry frontrunners have judiciously employed a range of growth strategies. This encompasses acquisitions, diversifying their product lineup, geographical expansions, and forging productive partnerships, collaborations, and agreements. Through these strategic maneuvers, they aim to cater to the escalating demand for medical packaging films, particularly from dynamic emerging markets.

Medical Packaging Films Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion), Volume (Million Square Meters) |

|

Segments |

Type, Material, Product Type, End-Use Sector, and Region |

|

Regions |

Asia-Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies |

The major players are Amcor Plc (Switzerland), Berry Global Inc. (US), DuPont de Nemours Inc. (US), Covestro AG (Germany), and Weigao Group (China) and others are covered in the Medical packaging films market. |

This research report categorizes the global medical packaging films market on the basis of Type, Application, and Region.

Medical Packaging Films Market by Type

- Thermoformable film

- High barrier film

- Metallized film

- Others

Medical Packaging Films Market by Material

- Polyethylene

- Polypropylene

- Polyvinyl chloride

- Polyamide

- Others

Medical Packaging Films Market by Application

- Bags

- Tubes

- Others

Medical Packaging Films Market by Region

- Asia Pacific (APAC)

- North America

- Europe

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In July 2023, Berry Global Inc. (US) has collaborated with Deaconess Midtown Hospital, Nexus Circular, and Evansville Packaging Supply, to recycle non-hazardous, sterile, plastic packaging and nonwoven fabric from the hospital’s surgical suite, pharmaceutical, laboratory, and warehouse.

- In April 2023, Berry Global Inc. (US) has opened its new state-of-the-art healthcare manufacturing facility and Global Centre of Excellence in Bangalore, India.

- In March 2023, Amcor Plc (Switzerland) has partnered with Procter & Gamble, Delterra, and Mars, to scale upstream and downstream solutions for a circular plastics economy.

- In March 2023, Toppan, Inc.(Japan) has opened a film manufacturing plant in the Czech Republic.

- In January 2023, Amcor Plc (Switzerland) has entered into an agreement to acquire the Shanghai-based medical devices packaging company i.e., Mdk (Shanghai) Medical Packing Co., Ltd.

- In December 2022, Amcor Plc (Switzerland) has announced the opening of its new state-of-the-art flexible packaging manufacturing plant in Huizhou, China.

- In April 2022, Covestro AG (Germany) has announced the expansion of production capacities for thermoplastic polyurethane (TPU) Films in the Platilon range, in Germany.

Frequently Asked Questions (FAQ):

What growth prospects does the medical packaging films market present?

Increasing Healthcare Expenditure, Rising Chronic Disease Rates, Increasing aging population, and rising awareness for health, are forecasted to drive a significant portion of the global medical packaging films market growth.

How do material choices influence the medical packaging films market dynamics?

The market is categorized based on materials into segments like polyethylene, polypropylene, polyamide, polyvinyl chloride, and others. Polyethylene is considered a biocompatible material, meaning it is compatible with biological systems and does not produce harmful reactions when in contact with medical products or devices, PE can withstand various sterilization methods, including gamma irradiation, ethylene oxide (EtO) gas, and steam sterilization, without compromising its structural integrity, PE offers several barrier properties, which helps to influence the market of medical packaging films.

Which application predominantly utilizes medical packaging films?

Segmented by application, the market spans bags, tubes, and others. The bags segment claims the largest market share, with medical packaging films being the chosen packaging for blood, first aid kits, medicines, and other fluids.

Which companies are at the forefront of the medical packaging films market?

Major market players include Amcor Plc (Switzerland), Berry Global Inc. (US), DuPont de Nemours Inc. (US), RENOLIT SE (Germany), Weigao Group (China), Sealed Air Corporation (US), Covestro AG (Germany), 3M (US), Toppan, Inc. (Japan), Wipak (Finland), and Mitsubishi Chemical Corporation (Japan), and others.

What are the pivotal factors poised to influence the market in the forecast period?

Rising expenditure in healthcare facilities, increasing awareness towards health, and rising disposable income propels the market of medical packaging films. Key contributors to this growth trajectory include the eco-friendly nature of medical packaging films, strong demand for bi-axially oriented films, and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising healthcare costs and escalating prevalence of chronic illnesses- Growing need for bioplastic and eco-friendly packaging solutions- Rise in demand for bi-axially oriented filmsRESTRAINTS- Volatile raw material costOPPORTUNITIES- Increasing interest in eco-friendly packaging alternativesCHALLENGES- Stringent government rules and regulations

-

6.1 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

-

6.4 KEY MARKETS FOR IMPORT AND EXPORT (TRADE ANALYSIS)EXPORT SCENARIO OF MEDICAL PACKAGING FILMSIMPORT SCENARIO OF MEDICAL PACKAGING FILMS

-

6.5 MACROECONOMIC OVERVIEWGLOBAL GDP OUTLOOK

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.8 TARIFF AND REGULATORY LANDSCAPETARIFF RELATED TO MEDICAL PACKAGING FILMSLIST OF BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.9 CASE STUDY ANALYSISCOEXTRUDED BARRIER STRUCTURE HELPS COMMERCIALIZE NEW DRUG DELIVERY SYSTEM- Problem statement- Solution statement

- 6.10 KEY CONFERENCES & EVENTS, 2022–2023

-

6.11 PRICING ANALYSISCHANGES IN MEDICAL PACKAGING FILMS PRICING IN 2022AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIALPRICING ANALYSIS BASED ON REGION

-

6.12 MARKET MAP/ECOSYSTEM

-

6.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 PATENT ANALYSISINTRODUCTION

- 7.1 INTRODUCTION

-

7.2 THERMOFORMABLE FILMPRODUCT PROTECTION, COST-EFFECTIVENESS, AND SUSTAINABILITY TO DRIVE DEMAND

-

7.3 HIGH BARRIER FILMEXTENSIVE USE IN HEALTHCARE INDUSTRY TO DRIVE MARKET

-

7.4 METALLIZED FILMESTHETIC VALUE TO INCREASE DEMAND

- 7.5 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 POLYETHYLENE (PE)HIGH DEMAND FOR LOW-COST, CHEMICAL & MOISTURE RESISTANT FILMS TO DRIVE DEMAND

-

8.3 POLYPROPYLENE (PP)GOOD TENSILE STRENGTH AND HIGH MELTING POINT TO INCREASE DEMAND

-

8.4 POLYAMIDE (PA)HIGH MECHANICAL STRENGTH AND RESISTANCE TO TEAR AND TEMPERATURE TO DRIVE DEMAND

-

8.5 POLYVINYL CHLORIDE (PVC)INCREASING USE IN MEDICAL BAGS TO DRIVE MARKET

- 8.6 OTHER MATERIALS

- 9.1 INTRODUCTION

-

9.2 BAGSBETTER BARRIER PROPERTIES AND LONGER SHELF LIFE TO DRIVE DEMAND IN SEVERAL APPLICATIONSBLOOD BAGS- Rising blood transfusion needs to drive demandPARENTERAL NUTRITION BAGS- Compounding and storing sterile medical solution applications to drive demandDRAINAGE BAGS- Rising applications to drive marketBIOMEDICAL BAGS- Rising safe waste collection of used or contaminated medical products to drive demandOTHER BAGS

-

9.3 TUBESREQUIREMENT OF RIGID AND FLEXIBLE TUBES FOR DIFFERENT MEDICAL PURPOSES TO DRIVE MARKET

- 9.4 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACTUS- Advancements in strength, puncture resistance, and barrier properties of bags to drive marketCANADA- Rigorous infection-control standards to drive marketMEXICO- Increasing disposable income and rising technological advancements to grow market

-

10.3 EUROPERECESSION IMPACTGERMANY- Growing investment in medical devices industries to drive marketUK- Increased spending on healthcare sector to provide growth opportunitiesFRANCE- Increase in demand for medical equipment to drive marketITALY- Increasing healthcare expenditure to accelerate demandREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACTCHINA- Expanding healthcare industry to drive marketINDIA- Rise in middle-class population to drive marketJAPAN- Growing medical industry to drive marketAUSTRALIA- Growing medical product manufacturing activities to drive marketREST OF ASIA PACIFIC

-

10.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Increasing demand for medical packaging solutions to drive marketARGENTINA- Increasing investment in healthcare system to drive marketREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACTUAE- Growing healthcare industry to drive marketSAUDI ARABIA- Growing government spending on healthcare sector to increase demandSOUTH AFRICA- Growing healthcare industry to drive marketTURKEYREST OF MIDDLE EAST & AFRICA

- 11.1 KEY PLAYER STRATEGIES

- 11.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY MEDICAL PACKAGING FILM PLAYERS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 START-UPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.7 COMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONS

-

12.1 KEY PLAYERSAMCOR PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBERRY GLOBAL INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDUPONT DE NEMOURS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRENOLIT SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWEIGAO GROUP- Business overview- Products/Solutions/Services offered- MnM viewSEALED AIR CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewCOVESTRO AG- Business overview- Products/Solutions/Services offered- MnM view3M- Business overview- Products/Solutions/Services offered- MnM viewTOPPAN INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWIPAK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI CHEMICAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

12.2 OTHER PLAYERSTORAY INDUSTRIES, INC.KLÖCKNER PENTAPLASTDUNMORETEKNIPLEXAPTARGROUP, INC.EAGLE FLEXIBLE PACKAGINGPRINTPACKUFP TECHNOLOGIESPROFOL GMBHSÜDPACKAMERICAN POLYFILM, INC.ADAPA GROUPOLIVERPOLYCINE GMBHGLENROY, INC.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 MEDICAL PACKAGING FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 WORLD GDP GROWTH PROJECTION, 2019–2026 (USD BILLION)

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MEDICAL PACKAGING FILMS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TOP 3 MATERIALS (USD/SQUARE METERS)

- TABLE 9 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2021–2028 (USD/SQUARE METERS)

- TABLE 10 MEDICAL PACKAGING FILMS MARKET: ECOSYSTEM

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS (%)

- TABLE 12 KEY BUYING CRITERIA FOR MEDICAL PACKAGING FILMS FOR APPLICATIONS

- TABLE 13 PATENTS IN MEDICAL PACKAGING FILMS MARKET, 2022–2023

- TABLE 14 MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 15 MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 16 MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 17 MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 18 MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 19 MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 20 MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 21 MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 22 MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 23 MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 24 MEDICAL PACKAGING FILMS MARKET, BY BAG, 2019–2021 (USD MILLION)

- TABLE 25 MEDICAL PACKAGING FILMS MARKET, BY BAG, 2022–2028 (USD MILLION)

- TABLE 26 MEDICAL PACKAGING FILMS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 27 MEDICAL PACKAGING FILMS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 28 MEDICAL PACKAGING FILMS MARKET, BY REGION, 2019–2021 (MILLION SQUARE METERS)

- TABLE 29 MEDICAL PACKAGING FILMS MARKET, BY REGION 2022–2028 (MILLION SQUARE METERS)

- TABLE 30 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 31 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2019–2021 (MILLION SQUARE METERS)

- TABLE 33 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (MILLION SQUARE METERS)

- TABLE 34 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 35 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 37 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 38 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 39 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 41 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 42 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 43 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2019–2021 (USD MILLION)

- TABLE 45 NORTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2022–2028 (USD MILLION)

- TABLE 46 US: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 47 US: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 48 US: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 49 US: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 50 US: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 51 US: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 52 US: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 53 US: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 54 US: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 55 US: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 56 CANADA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 57 CANADA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 58 CANADA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 59 CANADA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 60 CANADA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 61 CANADA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 62 CANADA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 63 CANADA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 64 CANADA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 65 CANADA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 66 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 67 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 68 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 69 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 70 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 71 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 72 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 73 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 74 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 75 MEXICO: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 76 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 77 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 78 EUROPE: MEDICAL PACKAGING FILMS MARKE, BY COUNTRY, 2019–2021 (MILLION SQUARE METERS)

- TABLE 79 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (MILLION SQUARE METERS)

- TABLE 80 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 81 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 82 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 83 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 84 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 85 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 86 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 87 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 88 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 89 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 90 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2019–2021 (USD MILLION)

- TABLE 91 EUROPE: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2022–2028 (USD MILLION)

- TABLE 92 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 93 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 94 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 95 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 96 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 97 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 98 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 99 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 100 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 101 GERMANY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 102 UK: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 103 UK: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 104 UK: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 105 UK: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 106 UK: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 107 UK: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 108 UK: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 109 UK: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 110 UK: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 111 UK: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 112 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 113 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 114 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 115 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 116 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 117 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 118 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 119 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 120 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 121 FRANCE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 122 ITALY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 123 ITALY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 124 ITALY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 125 ITALY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 126 ITALY: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 127 ITALY: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 128 ITALY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 129 ITALY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 130 ITALY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 131 ITALY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 132 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 133 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 135 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 136 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 137 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 139 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 141 REST OF EUROPE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 142 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKE, BY COUNTRY, 2019–2021 (MILLION SQUARE METERS)

- TABLE 145 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (MILLION SQUARE METERS)

- TABLE 146 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 149 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 150 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 153 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 154 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 155 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2019–2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2022–2028 (USD MILLION)

- TABLE 158 CHINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 159 CHINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 160 CHINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 161 CHINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 162 CHINA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 163 CHINA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 164 CHINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 165 CHINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 166 CHINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 167 CHINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 168 INDIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 169 INDIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 170 INDIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 171 INDIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 172 INDIA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 173 INDIA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 174 INDIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 175 INDIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 176 INDIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 177 INDIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 178 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 179 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 180 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 181 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 182 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 183 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 184 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 185 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 186 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 187 JAPAN: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 188 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 189 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 190 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 191 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 192 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 193 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 194 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 195 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 196 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 197 AUSTRALIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 198 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 201 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 202 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 207 REST OF ASIA PACIFIC: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 208 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 209 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 210 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKE, BY COUNTRY, 2019–2021 (MILLION SQUARE METERS)

- TABLE 211 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (MILLION SQUARE METERS)

- TABLE 212 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 213 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 214 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 215 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 216 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 217 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 218 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 219 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 220 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 221 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 222 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2019–2021 (USD MILLION)

- TABLE 223 SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2022–2028 (USD MILLION)

- TABLE 224 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 225 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 226 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 227 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 228 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 229 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 230 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 231 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 232 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 233 BRAZIL: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 234 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 235 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 236 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 237 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 238 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 239 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 240 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 241 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 242 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 243 ARGENTINA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 244 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 245 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 246 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 247 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 248 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 249 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 250 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 251 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 253 REST OF SOUTH AMERICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 254 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2019–2021 (MILLION SQUARE METERS)

- TABLE 257 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY COUNTRY, 2022–2028 (MILLION SQUARE METERS)

- TABLE 258 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 261 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 262 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 265 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 266 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2019–2021 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY BAG, 2022–2028 (USD MILLION)

- TABLE 270 UAE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 271 UAE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 272 UAE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 273 UAE: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 274 UAE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 275 UAE: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 276 UAE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 277 UAE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 278 UAE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 279 UAE: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 280 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 281 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 282 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 283 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 284 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 285 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 286 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 287 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 288 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 289 SAUDI ARABIA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 290 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 291 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 292 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 293 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 294 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 295 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 296 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 297 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 298 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 299 SOUTH AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 300 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 301 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 302 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 303 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 304 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 305 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 306 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 307 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 308 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 309 TURKEY: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 310 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2019–2021 (MILLION SQUARE METERS)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY TYPE, 2022–2028 (MILLION SQUARE METERS)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 315 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY APPLICATION, 2022–2028 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (USD MILLION)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2019–2021 (MILLION SQUARE METERS)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: MEDICAL PACKAGING FILMS MARKET, BY MATERIAL, 2022–2028 (MILLION SQUARE METERS)

- TABLE 320 MEDICAL PACKAGING FILMS MARKET: DEGREE OF COMPETITION

- TABLE 321 MEDICAL PACKAGING FILMS MARKET: APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 322 MEDICAL PACKAGING FILMS MARKET: REGIONAL FOOTPRINT (25 COMPANIES)

- TABLE 323 MEDICAL PACKAGING FILMS MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 324 MEDICAL PACKAGING FILMS MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 325 MEDICAL PACKAGING FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 326 MEDICAL PACKAGING FILMS MARKET: PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2023

- TABLE 327 MEDICAL PACKAGING FILMS MARKET: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 328 MEDICAL PACKAGING FILMS MARKET: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 329 AMCOR PLC: COMPANY OVERVIEW

- TABLE 330 AMCOR PLC: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 331 AMCOR PLC: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 332 BERRY GLOBAL INC.: COMPANY OVERVIEW

- TABLE 333 BERRY GLOBAL INC.: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 334 BERRY GLOBAL INC.: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 335 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- TABLE 336 DUPONT DE NEMOURS, INC.: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 337 DUPONT DE NEMOURS, INC.: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 338 RENOLIT SE: COMPANY OVERVIEW

- TABLE 339 RENOLIT SE: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 340 RENOLIT SE: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 341 WEIGAO GROUP: COMPANY OVERVIEW

- TABLE 342 SEALED AIR CORPORATION: COMPANY OVERVIEW

- TABLE 343 COVESTRO AG: COMPANY OVERVIEW

- TABLE 344 COVESTRO AG: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 345 3M: COMPANY OVERVIEW

- TABLE 346 TOPPAN INC.: COMPANY OVERVIEW

- TABLE 347 TOPPAN INC.: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 348 TOPPAN INC.: PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2023

- TABLE 349 TOPPAN INC.: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 350 WIPAK: COMPANY OVERVIEW

- TABLE 351 WIPAK: DEALS, JANUARY 2019–DECEMBER 2023

- TABLE 352 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 353 MITSUBISHI CHEMICAL CORPORATION: EXPANSIONS, JANUARY 2019–DECEMBER 2023

- TABLE 354 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 355 KLÖCKNER PENTAPLAST: COMPANY OVERVIEW

- TABLE 356 DUNMORE: COMPANY OVERVIEW

- TABLE 357 TEKNIPLEX: COMPANY OVERVIEW

- TABLE 358 APTARGROUP, INC.: COMPANY OVERVIEW

- TABLE 359 EAGLE FLEXIBLE PACKAGING: COMPANY OVERVIEW

- TABLE 360 PRINTPACK: COMPANY OVERVIEW

- TABLE 361 UFP TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 362 PROFOL GMBH: COMPANY OVERVIEW

- TABLE 363 SÜDPACK: COMPANY OVERVIEW

- TABLE 364 AMERICAN POLYFILM, INC.: COMPANY OVERVIEW

- TABLE 365 ADAPA GROUP: COMPANY OVERVIEW

- TABLE 366 OLIVER: COMPANY OVERVIEW

- TABLE 367 POLYCINE GMBH: COMPANY OVERVIEW

- TABLE 368 GLENROY, INC.: COMPANY OVERVIEW

- TABLE 369 FLEXIBLE PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 370 FLEXIBLE PACKAGING MARKET, BY REGION, 2020–2027 (KILOTON)

- FIGURE 1 MEDICAL PACKAGING FILMS MARKET SEGMENTATION

- FIGURE 2 MEDICAL PACKAGING FILMS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

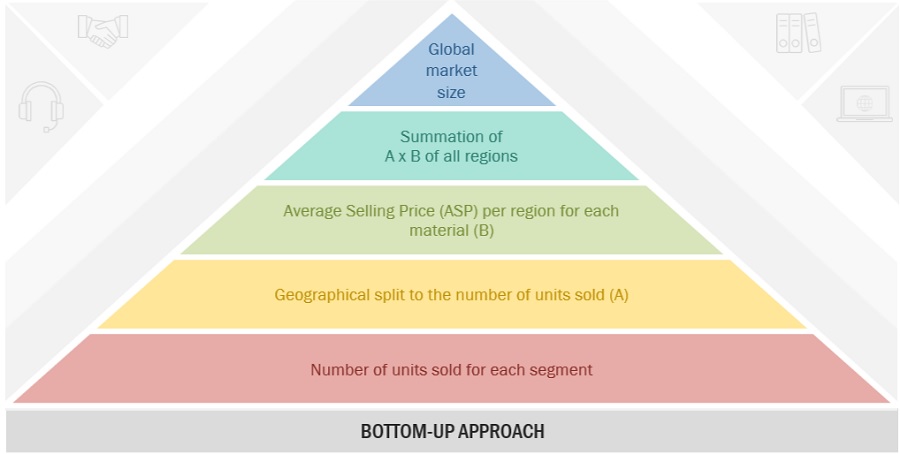

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

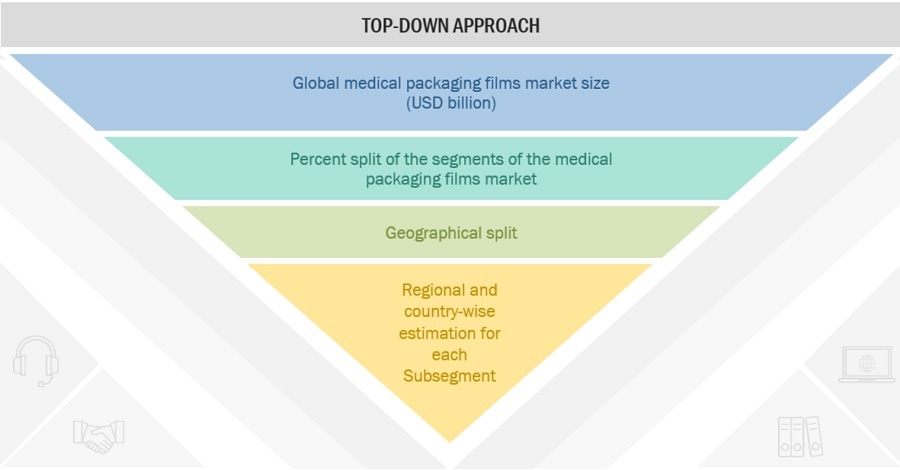

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MEDICAL PACKAGING FILMS MARKET: DATA TRIANGULATION

- FIGURE 7 POLYETHYLENE LEAD MEDICAL PACKAGING FILMS MARKET DURING FORECAST PERIOD

- FIGURE 8 THERMOFORMABLE FILM SEGMENT TO BE LARGEST SEGMENT THROUGH 2028

- FIGURE 9 BAGS TO DOMINATE MEDICAL PACKAGING FILMS MARKET BY 2028

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN FORECAST PERIOD

- FIGURE 11 EMERGING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN MEDICAL PACKAGING FILMS MARKET

- FIGURE 12 ASIA PACIFIC: CHINA ACCOUNTED FOR LARGEST SHARE OF MEDICAL PACKAGING FILMS MARKET IN 2022

- FIGURE 13 THERMOFORMABLE FILM SEGMENT TO LEAD MEDICAL PACKAGING FILMS MARKET DURING FORECAST PERIOD

- FIGURE 14 POLYPROPYLENE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 15 INDIA MEDICAL PACKAGING FILMS MARKET TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 MEDICAL PACKAGING FILMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 PERCENTAGE OF POPULATION AGED 65 YEARS OR OVER

- FIGURE 18 FLUCTUATIONS IN RAW MATERIAL PRICES, 2022–2023 (USD/BARREL)

- FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 MEDICAL PACKAGING FILMS: VALUE CHAIN ANALYSIS

- FIGURE 21 PLATES, SHEETS, FILM, FOIL, ETC. (3920) EXPORTS, BY KEY COUNTRY, 2018–2022 (USD BILLION)

- FIGURE 22 PLATES, SHEETS, FILM, FOIL, ETC. (3920) EXPORTS, BY KEY COUNTRY, 2018–2022 (USD BILLION)

- FIGURE 23 GROWING CONCERN FOR SUSTAINABILITY, TECHNOLOGICAL ADVANCEMENTS TO BRING IN CHANGE IN FUTURE REVENUE MIX

- FIGURE 24 MEDICAL PACKAGING FILMS MARKET: AVERAGE SELLING PRICE, BY REGION (USD/SQUARE METER)

- FIGURE 25 ECOSYSTEM MAP

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 28 NUMBER OF PATENTS GRANTED FOR URINARY CATHETERS (2013–2023)

- FIGURE 29 REGIONAL ANALYSIS OF PATENT GRANTED FOR URINARY CATHETERS, 2013–2023

- FIGURE 30 THERMOFORMABLE FILM TO DOMINATE MEDICAL PACKAGING FILMS MARKET IN 2023

- FIGURE 31 POLYETHYLENE TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 32 BAGS SEGMENT TO DOMINATE MEDICAL PACKAGING FILMS MARKET IN 2023

- FIGURE 33 MEDICAL PACKAGING FILMS MARKET GROWTH RATE, BY COUNTRY, 2023–2028

- FIGURE 34 EUROPE: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS FOR KEY PLAYERS IN MEDICAL PACKAGING FILMS MARKET

- FIGURE 37 MEDICAL PACKAGING FILMS MARKET: MARKET SHARE ANALYSIS

- FIGURE 38 COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 MEDICAL PACKAGING FILMS MARKET: PRODUCT FOOTPRINT (25 COMPANIES)

- FIGURE 40 START-UPS/SMES EVALUATION MATRIX: MEDICAL PACKAGING FILMS MARKET, 2022

- FIGURE 41 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 42 BERRY GLOBAL INC: COMPANY SNAPSHOT

- FIGURE 43 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

- FIGURE 44 WEIGAO GROUP: COMPANY SNAPSHOT

- FIGURE 45 SEALED AIR CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 47 3M: COMPANY SNAPSHOT

- FIGURE 48 TOPPAN INC.: COMPANY SNAPSHOT

- FIGURE 49 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Medical packaging films market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Medical packaging films market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, managers, directors, and CEOs of companies in the Medical packaging films market. Primary sources from the supply side include associations and institutions involved in the Medical packaging films industry, key opinion leaders, and processing players.

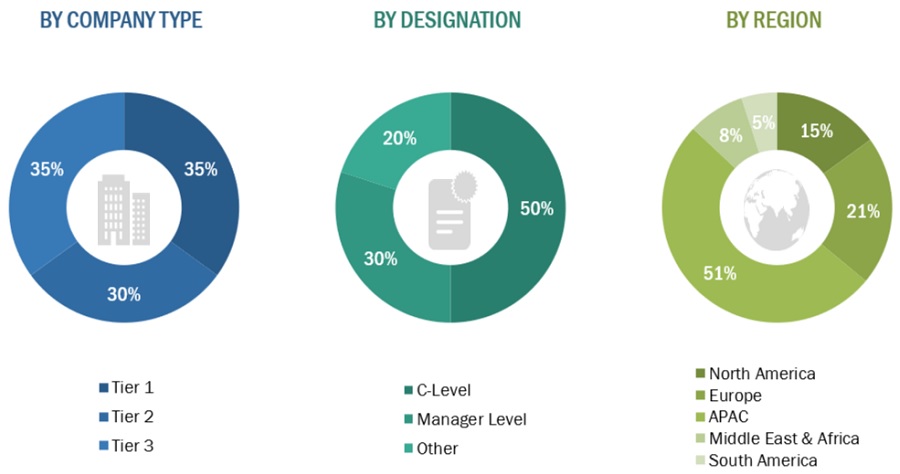

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Medical packaging films market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

Medical packaging films are specialized materials used in the healthcare and medical industry for the purpose of packaging and protecting various medical products, including, medical devices, diagnostic kits, and other healthcare supplies. These films are designed to meet specific requirements and standards to ensure the safety, sterility, and integrity of the packaged items. These films are made up from several materials such as polyethylene, polypropylene, polyvinyl chloride, polyamide, and others.

Key Stakeholders

- Material Suppliers and Producers

- Regulatory Bodies

- End User

- Research and Development Organizations

- Industrial Associations

- Medical packaging films manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global Medical packaging films market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, material, applications, and region

- To forecast the market size, in terms of value and volume, with respect to five main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Medical packaging films market

- Further breakdown of the Rest of Europe’s Medical packaging films market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Medical Packaging Films Market