Adsorbents Market by Type (Molecular Sieves, Activated Carbon, Silica Gel, Activated Alumina), Application (Petroleum refining, Chemicals/Petrochemicals, Gas refining, Water treatment, Air Separation & Drying, Packaging), & Region - Global Forecast to 2026

Updated on : May 23, 2024

Adsorbents Market

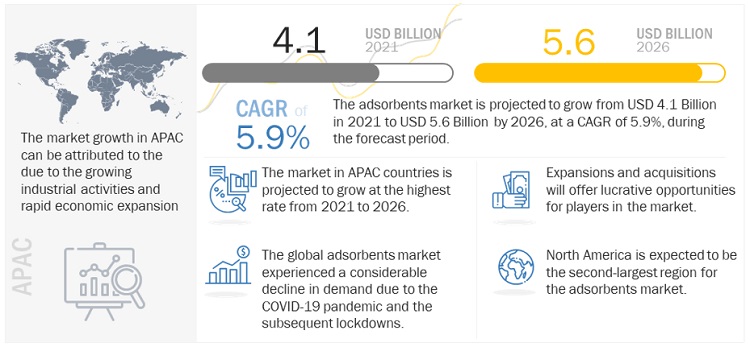

The global adsorbents market is estimated to be USD 4.1 billion in 2021 and projected to reach USD 5.6 billion by 2026, at a CAGR of 5.9%. The driving factors for the adsorbents market is the industry growth is backed by the large-scale developments in oil & gas processing and socio-economic advancements such as the increased use of adsorbents in maintaining purity standards in various applications and because of environmental concerns.

Global Adsorbents Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Adsorbents Market Dynamics

DRIVERS: Increase in demand for oxygen concentrators

With the increase in COVID-19 cases and the shortage of oxygen cylinders across several states in India, oxygen concentrators are among the most sought-after devices for oxygen therapy, especially among patients in home isolation and for hospitals running out of oxygen. An oxygen concentrator is a medical device that concentrates oxygen from ambient air. Atmospheric air has about 78% nitrogen and 21% oxygen, with other gases making up the remaining 1%. The oxygen concentrator takes in this air, filters it through a sieve, releases the nitrogen back into the air, and works on the remaining oxygen.

Concentrators are portable and, unlike LMO that needs to be stored and transported in cryogenic tankers, need no special temperature. Unlike cylinders that require refilling, concentrators only need a power source to draw in ambient air. For this, pressure swing adsorption (PSA) is a technology used to separate some gas species from a mixture of gases under pressure according to the species' molecular characteristics and affinity for an adsorbent material. This has driven the demand for adsorbents.

RESTRAINT: Reduced service life due to high level of impurities

Adsorbent materials have the ability to attract molecules on their surfaces, but this ability is limited. Once the capacity is over, further continuation with the refining and purification will create an equilibrium leading to desorption. Adsorbents are used for refining and purification treatments, for adsorption of various contaminants and impurities such as (carbon dioxide or hydrogen sulfide), mercaptans, production chemicals, and hydrate inhibitors. At this time, the present impurities react with adsorbents, resulting in the regeneration of the adsorbent. These contaminants either regenerate the adsorbent or remove it. The service life of adsorbents is based on the regeneration capacity of the material, and this can be the restraint for the overall adsorbents market.

OPPORTUNITIES: Denitrogenation/desulfurization technology

Increasing demand for distillate fuels and decreasing supplies of lighter, easy-to-process crude are forcing refineries to process heavier stocks. The major problems encountered during the processing of these types of stocks are the higher nitrogen and sulfur contents, which on burning produce nitrogen and sulfur oxides that cause serious environmental hazards.

Hydrogenation and hydro-sulfurization using hydro-treating catalysts are the conventional processes employed in refineries globally for removing organic nitrogen/sulfur compounds from liquid fuels. These processes normally require high temperatures, high pressure, and hydrogen consumption. The current hydro-desulfurization process is effective in removing only easy sulfur compounds but not the refractory sulfur compounds present in liquid fuels. In addition, although there is no regulation on nitrogen compounds, these compete with sulfur compounds on the active sites of catalysts in the conventional process. Therefore, nitrogen compounds should be removed as much as possible.

The adsorbent material is developed to selectively remove both nitrogen and sulfur compounds at room temperatures and atmospheric pressure without the use of hydrogen. The technique will allow refineries to produce qualified liquid fuels in a cost-effective way. This technology can prove milestones in the coming years in the adsorbents market.

CHALLENGES: Depletion of raw materials

The basic raw materials that are used in the manufacturing of adsorbents are coal, bauxite, silicate, zeolite, and clay. All these mineral resources are naturally available, so to preserve them, the excess extraction and mining of these raw materials are not suitable. Since there are finite mineral resources, the exponential growth and expanding consumption are unmanageable. These depleting mineral resources can be a major challenge to the adsorbents market.

The Adsorbents market is projected to register a CAGR of 5.93% during the forecast period, in terms of value.”

The global Adsorbents market is estimated to be USD 4,198.95 million in 2021 and is projected to reach USD 5,600.42 million by 2026, at a CAGR of 5.93% from 2021 to 2026. The driving factors for the adsorbents market is the industry growth is backed by the large-scale developments in oil & gas processing and socio-economic advancements such as the increased use of adsorbents in maintaining purity standards in various applications and because of environmental concerns.

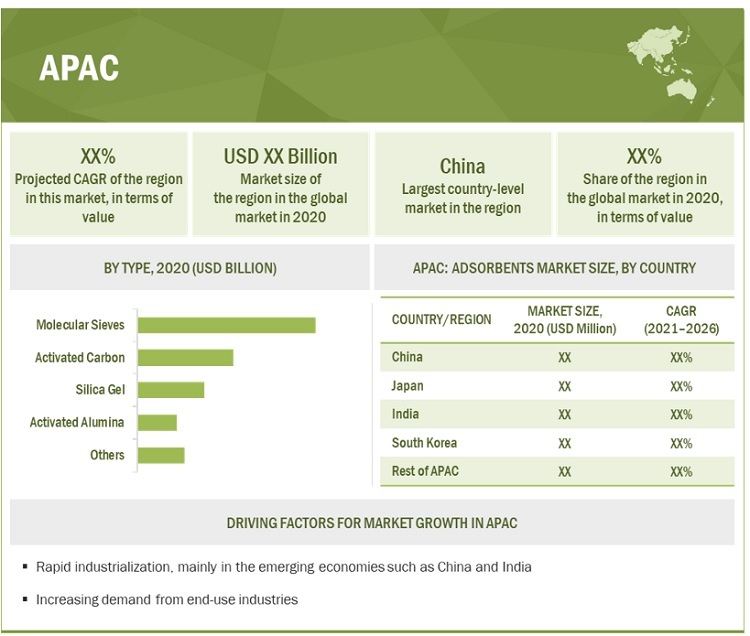

APAC is the largest market for Adsorbents .

APAC accounted for the largest share of the Adsorbents market in 2020. The adsorbents market in APAC is driven by the demand from countries such as China, Japan, and India. Rapid industrialization, mainly in emerging economies such as China and India, has been one of the major factors driving the global adsorbents market.

To know about the assumptions considered for the study, download the pdf brochure

Adsorbents Market Players

The adsorbents market is dominated by a few globally established players such as Arkema SA(France), Honeywell International Inc(US), Axens(France), BASF SE (Germany), Cabot Corporation(US),, among others.

Adsorbents Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2019-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD million) and Volume (Kilo Tons) |

|

Segments Covered |

Type, Application, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, |

|

Companies Covered |

Some of the leading players operating in the Adsorbents market include Arkema SA(France), Honeywell International Inc(US), Axens(France), BASF SE (Germany), Cabot Corporation(US) |

This research report categorizes the Adsorbents market based on type, application, and region.

Adsorbents Market, By Type

- Molecular Sieves

- Activated Carbon

- Silica Gel

- Activated Alumina

- Others

Adsorbents Market, By Application

- Petroleum refining

- Chemicals/Petrochemicals

- Gas refining

- Water treatment

- Air Separation & Drying

- Packaging

- Others

Adsorbents Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East

- South America

Recent Developments

- In June 2019, The company launched Durasorb HG, a mercury removal adsorbent. Durasorb HG is a non-regenerable, mixed metal oxide adsorbent, which is designed to work in wet conditions. The launch of new and improved products at regular intervals would help BASF to retain and attract new customers.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for type segment except offering.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- U.K.

- Italy

- Russia

- Rest of Europe

What is the COVID-19 impact on the Adsorbents market?

Industry experts believe that COVID-19 would have a significant impact on the Adsorbents market. There seems to be a decrease in the demand for Adsorbents from end-use industries, during COVID-19.

Which region will lead the adsorbents market in the future?

Asia Pacific is expected to lead the adsorbents market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 ADSORBENTS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 1 ADSORBENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION APPROACH

2.2.1 ESTIMATION OF ADSORBENTS MARKET SIZE BASED ON MARKET SHARE ANALYSIS

FIGURE 2 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

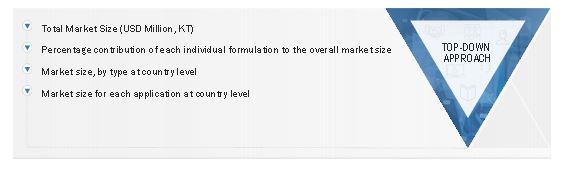

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 ADSORBENTS MARKET: DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 LIMITATIONS

2.5.2 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 6 MOLECULAR SIEVES TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 7 PETROLEUM REFINING TO BE THE LARGEST APPLICATION SEGMENT

FIGURE 8 APAC TO GROW AT THE HIGHEST RATE IN THE ADSORBENTS MARKET

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 APAC TO WITNESS HIGH GROWTH DUE TO INCREASE IN DEMAND FROM SEVERAL END-USE INDUSTRIES

FIGURE 9 GROWING DEMAND FROM THE PETROLEUM REFINING SEGMENT TO DRIVE THE ADSORBENTS MARKET

4.2 ADSORBENTS MARKET: BY REGION AND TYPE, 2020

FIGURE 10 APAC AND MOLECULAR SIEVES SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.3 ADSORBENTS MARKET: BY REGION AND APPLICATION, 2020

FIGURE 11 APAC AND PETROLEUM REFINING SEGMENT LED THE MARKET

4.4 ADSORBENTS MARKET, BY COUNTRY

FIGURE 12 INDIA TO WITNESS THE HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ADSORBENTS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing environmental concerns and regulations

TABLE 1 TOP EMITTERS OF CARBON DIOXIDE, 2018

5.2.1.2 Adsorbents are cost-effective

5.2.1.3 Increase in demand for oxygen concentrators

5.2.2 RESTRAINTS

5.2.2.1 Moderate growth for end-use industries

5.2.2.2 Reduced service life due to high level of impurities

5.2.3 OPPORTUNITIES

5.2.3.1 Denitrogenation/desulfurization technology

5.2.4 CHALLENGES

5.2.4.1 Depletion of raw materials

5.3 YC & YCC SHIFT

5.3.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR ADSORBENT MANUFACTURERS

FIGURE 14 REVENUE SHIFT FOR ADSORBENT MANUFACTURERS

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 ADSORBENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 2 ADSORBENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 VALUE CHAIN

FIGURE 16 ADSORBENTS MARKET: VALUE CHAIN

5.5.1 ADSORBENT RAW MATERIAL SUPPLIERS

5.5.2 ADSORBENT MANUFACTURERS

5.5.3 END-USE APPLICATIONS OF ADSORBENTS

TABLE 3 ADSORBENTS MARKET: VALUE CHAIN

5.5.4 IMPACT OF COVID-19 ON SUPPLY CHAIN

5.6 REGULATORY LANDSCAPE

5.7 TECHNOLOGY ANALYSIS

5.7.1 NEW-GENERATION NANO-ADSORBENTS FOR THE REMOVAL OF EMERGING CONTAMINANTS IN WATER

5.8 RECYCLING AND REACTIVATION OF ACTIVATED CARBON

5.9 CASE STUDY ANALYSIS

5.9.1 ELIMINATING THE EFFECTS OF REGENERATION REFLUX

5.9.2 TRADE ANALYSIS

TABLE 4 ACTIVATED CARBON IMPORT DATA 2020 (USD THOUSAND)

TABLE 5 ACTIVATED CARBON EXPORT DATA 2020 (USD THOUSAND)

5.10 ECOSYSTEM

FIGURE 17 ECOSYSTEM OF ADSORBENTS MARKET

5.11 PRICING ANALYSIS

TABLE 6 COST IN USD/ KG OF FOLLOWING ADSORBENT TYPES

5.12 PATENT ANALYSIS

TABLE 7 LIST OF PATENTS BY UOP LLC.

TABLE 8 LIST OF PATENTS BY CHINA PETROLEUM & CHEMICAL

TABLE 9 LIST OF PATENTS BY AIR PRODUCTS AND CHEMICALS INC

TABLE 10 LIST OF PATENTS BY ARKEMA FRANCE

TABLE 11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 COVID-19 IMPACT ON ADSORBENTS MARKET (Page No. - 61)

6.1 COVID-19 IMPACT ON CRUDE OIL AND NATURAL GAS PRODUCTION

7 ADSORBENTS MARKET, BY TYPE (Page No. - 62)

7.1 INTRODUCTION

FIGURE 18 MOLECULAR SIEVES TO COMMAND THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 12 ADSORBENTS MARKET SIZE, HISTORIC TABLE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 13 ADSORBENTS MARKET SIZE, HISTORIC TABLE, BY TYPE, 2013–2020 (KILOTON)

TABLE 14 ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 15 ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

7.2 MOLECULAR SIEVES

7.2.1 RISING USE IN THE PETROLEUM INDUSTRY HAS DRIVEN THE MARKET

TABLE 16 MOLECULAR SIEVES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 MOLECULAR SIEVES MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.3 ACTIVATED CARBON

7.3.1 DEMAND FOR PURIFICATION OF LIQUIDS AND WATER TO DRIVE THE MARKET

TABLE 18 ACTIVATED CARBON MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 ACTIVATED CARBON MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.4 SILICA GEL

7.4.1 MOSTLY USED IN DRYING APPLICATIONS

TABLE 20 SILICA GEL MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 SILICA GEL MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.5 ACTIVATED ALUMINA

7.5.1 MOST OF THE FLUIDS ARE DRIED BY ACTIVATED ALUMINA

TABLE 22 ACTIVATED ALUMINA MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 ACTIVATED ALUMINA MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7.6 OTHERS

TABLE 24 OTHER ADSORBENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 OTHER ADSORBENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8 ADSORBENTS MARKET, BY APPLICATION (Page No. - 70)

8.1 INTRODUCTION

FIGURE 19 PETROLEUM REFINING TO COMMAND THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

TABLE 26 ADSORBENTS MARKET SIZE, HISTORIC TABLE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 27 ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 PETROLEUM REFINING

8.2.1 PETROLEUM REFINING ADSORBENTS ARE WIDELY USED IN THE DEHYDRATION PROCESS

TABLE 28 ADSORBENTS MARKET SIZE FOR PETROLEUM REFINING, BY REGION, 2019–2026 (USD MILLION)

8.3 GAS REFINING

8.3.1 ADSORBENTS USED IN GAS REFINING ARE POROUS MATERIALS

TABLE 29 ADSORBENTS MARKET SIZE FOR GAS REFINING, BY REGION, 2019–2026 (USD MILLION)

8.4 CHEMICALS/PETROCHEMICALS

8.4.1 USED FOR THE PURIFICATION OF FEEDSTOCK ALONG WITH THE REMOVAL OF CONTAMINANTS

TABLE 30 ADSORBENTS MARKET SIZE FOR CHEMICALS/PETROCHEMICALS, BY REGION, 2019–2026 (USD MILLION)

8.5 WATER TREATMENT

8.5.1 GROWING CONCERNS OF WATER SANITATION DRIVING THE MARKET

TABLE 31 ADSORBENTS MARKET SIZE FOR WATER TREATMENT, BY REGION, 2019–2026 (USD MILLION)

8.6 AIR SEPARATION & DRYING

8.6.1 INCREASED USE OF ADSORBENTS FOR DEHYDRATION OF INSTRUMENT AIR HAS DRIVEN THE MARKET

TABLE 32 ADSORBENTS MARKET SIZE FOR AIR SEPARATION & DRYING, BY REGION, 2019–2026 (USD MILLION)

8.7 PACKAGING

8.7.1 ADSORBENTS ARE WIDELY USED IN THE PACKAGING APPLICATION AS DRYING AGENTS

TABLE 33 ADSORBENTS MARKET SIZE FOR PACKAGING, BY REGION, 2019–2026 (USD MILLION)

8.8 OTHERS

TABLE 34 ADSORBENTS MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9 ADSORBENTS MARKET, BY REGION (Page No. - 77)

9.1 INTRODUCTION

FIGURE 20 INDIA TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

TABLE 35 ADSORBENTS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 36 ADSORBENTS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 37 ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 38 ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 39 HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 40 HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020 (KILOTON)

TABLE 41 ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 42 HISTORIC ADSORBENTS MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

9.2 APAC

FIGURE 21 APAC: ADSORBENTS MARKET SNAPSHOT

TABLE 43 APAC: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 APAC: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 45 APAC: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 46 APAC: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 47 APAC: HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 48 APAC: HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020 (KILOTON)

TABLE 49 APAC: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 50 APAC :HISTORIC ADSORBENTS MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

9.2.1 CHINA

9.2.1.1 Increasing domestic demand for industrial use driving the market

TABLE 51 CHINA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 CHINA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 53 CHINA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.2 JAPAN

9.2.2.1 Rising R&D activities for adsorbents to drive the market

TABLE 54 JAPAN: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 JAPAN: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 56 JAPAN: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.3 INDIA

9.2.3.1 Industrialization and infrastructural development have led to the growth of several industries, driving the adsorbents market

TABLE 57 INDIA :ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 INDIA : ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 59 INDIA : ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.4 SOUTH KOREA

9.2.4.1 The market in South Korea has high growth potential

TABLE 60 SOUTH KOREA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 SOUTH KOREA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 62 SOUTH KOREA : ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.5 REST OF APAC

TABLE 63 REST OF APAC: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 REST OF APAC: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 65 REST OF APAC: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3 NORTH AMERICA

TABLE 66 NORTH AMERICA: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 68 NORTH AMERICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 70 NORTH AMERICA: HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020(USD MILLION)

TABLE 71 NORTH AMERICA: HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020 (KILOTON)

TABLE 72 NORTH AMERICA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: HISTORIC ADSORBENTS MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

9.3.1 US

9.3.1.1 The US to lead the market in North America by 2026

TABLE 74 US: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 US: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 76 US: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Rising demand from the food & beverage and home & personal care industries drives the market

TABLE 77 CANADA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 CANADA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 79 CANADA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 The growing beverage industry boosts the market in Mexico

TABLE 80 MEXICO: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 MEXICO: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 82 MEXICO: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4 EUROPE

TABLE 83 EUROPE: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 EUROPE: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 85 EUROPE: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 EUROPE: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 87 EUROPE: HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020 (USD MILLION)

TABLE 88 EUROPE: HISTORIC ADSORBENTS MARKET SIZE, BY TYPE, 2013–2020 (KILOTON)

TABLE 89 EUROPE: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 90 EUROPE: HISTORIC ADSORBENTS MARKET SIZE, BY APPLICATION, 2013–2020 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 The market is growing due to high demand for industrial production

TABLE 91 GERMANY: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 GERMANY: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 93 GERMANY: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.2 UK

9.4.2.1 Evolution of refineries to offer lucrative opportunities for the market

TABLE 94 UK: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 UK: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 96 UK: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.3 RUSSIA

9.4.3.1 Massive industrialization and huge development in end-use industries to boost the market

TABLE 97 RUSSIA : ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 RUSSIA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 99 RUSSIA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Increasing demand from water treatment industries to drive the market

TABLE 100 ITALY : ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 ITALY: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 102 ITALY: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.5 REST OF EUROPE

TABLE 103 REST OF EUROPE: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 REST OF EUROPE: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 105 REST OF EUROPE: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

TABLE 106 MIDDLE EAST & AFRICA: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 108 MIDDLE EAST & AFRICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 110 MIDDLE EAST & AFRICA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Saudi Arabia to be the fastest-growing market for adsorbents in the region

TABLE 111 SAUDI ARABIA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 SAUDI ARABIA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 113 SAUDI ARABIA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.2 SOUTH AFRICA

9.5.2.1 Growth in the packaging industry to drive the market

TABLE 114 SOUTH AFRICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 SOUTH AFRICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 116 SOUTH AFRICA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 117 REST OF MIDDLE EAST & AFRICA : ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 REST OF MIDDLE EAST & AFRICA : ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 119 REST OF MIDDLE EAST & AFRICA : ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 120 SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 121 SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 122 SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 124 SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Brazil to dominate the adsorbents market in South America

TABLE 125 BRAZIL: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 BRAZIL: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 127 BRAZIL: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Growing demand in the industrial sector to boost the market

TABLE 128 ARGENTINA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 ARGENTINA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 130 ARGENTINA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 131 REST OF SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 REST OF SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 133 REST OF SOUTH AMERICA: ADSORBENTS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 121)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 22 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY DURING 2019–2021

10.3 MARKET RANKING

FIGURE 23 MARKET RANKING OF KEY PLAYERS, 2020

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 24 REVENUE ANALYSIS FOR KEY COMPANIES IN THE ADSORBENTS MARKET

10.5 MARKET SHARE ANALYSIS

TABLE 134 ADSORBENTS MARKET: MARKET SHARES OF KEY PLAYERS

FIGURE 25 SHARE OF LEADING COMPANIES IN ADSORBENTS MARKET

10.6 COMPANY EVALUATION QUADRANT

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 EMERGING LEADER

FIGURE 26 ADSORBENTS MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2020

10.7 COMPETITIVE BENCHMARKING

TABLE 135 COMPANY PRODUCT FOOTPRINT, BY TYPE

TABLE 136 COMPANY PRODUCT FOOTPRINT, BY APPLICATION

TABLE 137 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 STARTING BLOCKS

10.8.4 DYNAMIC COMPANIES

FIGURE 27 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

10.9 COMPETITIVE SCENARIO AND TRENDS

10.9.1 PRODUCT LAUNCHES

TABLE 138 ADSORBENTS MARKET: PRODUCT LAUNCHES, JULY 2016-JANUARY 2021

10.9.2 DEALS

TABLE 139 ADSORBENTS MARKET: DEALS, JULY 2016-JANUARY 2021

11 COMPANY PROFILES (Page No. - 130)

11.1 MAJOR PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 ARKEMA

TABLE 140 ARKEMA: BUSINESS OVERVIEW

FIGURE 28 ARKEMA: COMPANY SNAPSHOT

11.1.2 HONEYWELL INTERNATIONAL INC.

TABLE 141 HONEYWELL INTERNATIONAL INC: BUSINESS OVERVIEW

FIGURE 29 HONEYWELL INTERNATIONAL INC: COMPANY SNAPSHOT

11.1.3 AXENS

TABLE 142 AXENS: BUSINESS OVERVIEW

FIGURE 30 AXENS: COMPANY SNAPSHOT

11.1.4 BASF SE

TABLE 143 BASF SE: BUSINESS OVERVIEW

FIGURE 31 BASF SE: COMPANY SNAPSHOT

11.1.5 CABOT CORPORATION

TABLE 144 CABOT CORPORATION: BUSINESS OVERVIEW

FIGURE 32 CABOT CORPORATION: COMPANY SNAPSHOT

11.1.6 CLARIANT AG

TABLE 145 CLARIANT AG: BUSINESS OVERVIEW

FIGURE 33 CLARIANT AG: COMPANY SNAPSHOT

11.1.7 W. R. GRACE & CO.-CONN

TABLE 146 W. R. GRACE & CO.-CONN: BUSINESS OVERVIEW

FIGURE 34 W. R. GRACE & CO.-CONN: COMPANY SNAPSHOT

11.1.8 CALGON CARBON CORPORATION

TABLE 147 CALGON CARBON CORPORATION: BUSINESS OVERVIEW

11.1.9 ZEOCHEM

TABLE 148 ZEOCHEM: BUSINESS OVERVIEW

11.1.10 JALON

TABLE 149 JALON: BUSINESS OVERVIEW

FIGURE 35 JALON: COMPANY SNAPSHOT

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.1.11 POROCEL

11.1.12 ZEOLYST INTERNATIONAL

11.1.13 HAYCARB PLC

11.1.14 FUJI SILYSIA CHEMICAL, LTD.

11.1.15 AGC CHEMICALS AMERICAS

11.1.16 INTERRA GLOBAL

11.1.17 GRAVER TECHNOLOGIES, LLC

11.1.18 SILICYCLE INC

11.1.19 KUREHA CORPORATION

11.1.20 MOLSIVCN ADSORBENT CO., LTD

11.1.21 SORBEAD INDIA

11.1.22 HENGYE INC

11.1.23 CILICANT

11.1.24 ZETTACHEM INTERNATIONAL

12 APPENDIX (Page No. - 162)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

Overview of Desiccant Market

Desiccants are substances used to absorb moisture from the air and maintain a dry environment. They are commonly used in various industries such as packaging, electronics, pharmaceuticals, and food and beverage to prevent damage or deterioration of products caused by moisture. The global desiccant market is expected to grow at a steady pace in the coming years, driven by the increasing demand for moisture-absorbing materials across various industries.

Desiccants are a type of adsorbent, which means they attract and hold molecules of a gas or liquid onto their surface. However, not all adsorbents are desiccants. Adsorbents can be used for a variety of purposes, such as filtering, purifying, or separating gases or liquids. The adsorbents market includes various types of materials used for these purposes, including activated carbon, silica gel, alumina, zeolites, and more.

As a subset of the adsorbents market, the desiccant market may have some impact on the overall growth and demand for adsorbents. However, the impact is expected to be relatively small, as desiccants are primarily used for moisture control, whereas adsorbents have a wider range of applications. The adsorbents market is expected to continue to grow steadily, driven by the increasing demand for purification and separation technologies across various industries.

Futuristic Growth Use-Cases

In the future, desiccants are expected to find more applications in emerging industries such as renewable energy and energy storage. For example, desiccants can be used to remove moisture from the air and prevent corrosion in wind turbines, solar panels, and other renewable energy infrastructure. They can also be used in battery storage systems to maintain the performance and lifespan of the batteries.

Top Players in Desiccant Market

Some of the top players in the global desiccant market include BASF SE, Clariant International AG, Dow Inc., Evonik Industries AG, W. R. Grace & Co., and Mitsubishi Chemical Corporation. These companies offer a range of desiccant products and solutions for various industries.

Impact on Other Industries

The desiccant market is expected to have a significant impact on industries such as food and beverage, pharmaceuticals, and electronics, where moisture control is critical to maintaining the quality and safety of products. In the food and beverage industry, desiccants are used to prevent spoilage and extend the shelf life of products. In the pharmaceutical industry, they are used to maintain the efficacy of drugs and prevent degradation. In the electronics industry, desiccants are used to prevent corrosion and damage to sensitive components.

Speak to our Analyst today to know more about Desiccant Market!

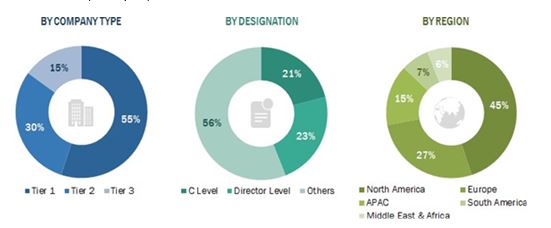

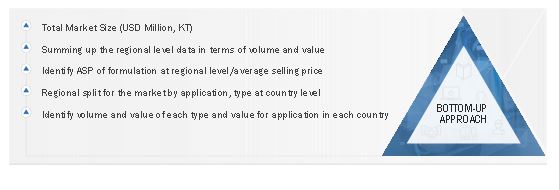

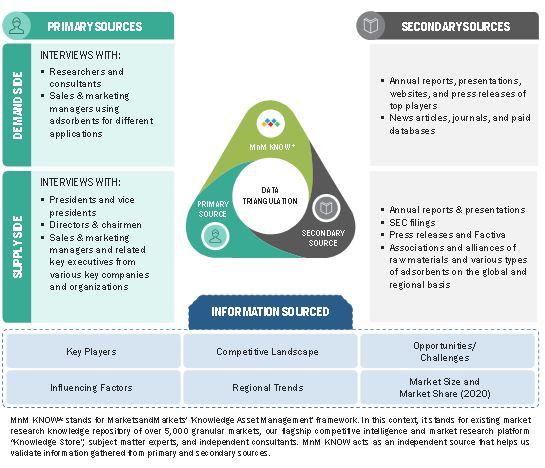

The study involved four major activities in estimating the size of the Adsorbents Market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

The Adsorbents market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the Adsorbents market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of

the Adsorbents market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry and markets were identified through extensive secondary research.

The industry’s supply chain and market size, in terms of value, were determined through

primary and secondary research processes.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Adsorben ts: Bottom-Up Approach

Adsorbents: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Adsorbents market.

Report Objectives

- To define, describe, and forecast the Adsorbents market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on type, and applications

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America and Middle East and Africa (MEA) (along with the key countries in each region)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as new product launch, expansion, mergers & acquisitions, and partnership & collaboration in the Adsorbents market

- To strategically profile the key players and comprehensively analyze their core competencies.

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

- The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Molecular Sieves Market Overview

The growth of the molecular sieves market is expected to have a positive impact on the overall adsorbents market. This is because molecular sieves are a type of adsorbent material that is widely used in various industrial applications, and the increasing demand for molecular sieves is expected to drive the growth of the adsorbents market as a whole.

Molecular Sieves Market Trends

Top Companies in Molecular Sieves Market

Molecular Sieves Market Impact on Different Industries

Speak to our Analyst today to know more about Molecular Sieves Market!

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Adsorbents Market

Market information on Sorbant market for the US

Market information on demand of DMF type 3 silica gel in ASEAN countries

Activated Alumina market in Benelux and UK for academic research

silica gel and molecular sieve by the pharmaceutical industry

Understanding of adsorbent market from water application and land applications

Market data for Zeolite production in India

Market data analysis on BAC adsorbents for Automotive Paint Operations in North America

(Petroleum Refining, Chemicals/Petrochemicals, Gas Refining, Water Treatment, Air Separation & Drying, Packaging, and Others

adsorbents and equipment used for VOC capture for applications success at Auto Paiinting, Printing Industry, Paper Processing, Chemical Production. Food processing Adsorbents should include BAC (Bead Activated Carbon beads). Equipment should include Fluizied Bed Concentrators (FBS).

Market information for adsorbents and equipments that will capture VOC