Aircraft Filters Market by Aircraft Type (Fixed Wing, Rotary Wing, UAV), Sales Channel (OEM, Aftermarket), Type (Fluid, Air), Application (Engine, Hydraulic System, Avionics, Cabin, Pneumatic system), Material, Region (2021-2026)

Updated on : Nov 06, 2024

[330 Pages Report] The Aircraft Filters Market size is projected to grow from an estimated USD 823 million in 2021 to USD 1002 million by 2026, at a CAGR of 4.0% during the forecast period.The increase in aircraft renewals and aircraft deliveries is a key factor driving the Aircraft Filters Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Filters Market Dynamics:

Driver: Short replacement cycle of aircraft filters

The short replacement cycle of an aircraft filter is a key factor driving demand in the MRO segment. The replacement cycle of an aircraft filter depends on the number of flight hours and calendar days (whichever occurs first). This cycle can range from 6 months to 18 months, and from 300 flight hours to 3,500 flight hours. High passenger traffic means a high number of cycles for the aircraft filters. According to World Bank data, the number of passengers traveling by air increased from 2.628 billion in 2010 to 4.397 billion in 2019 at a CAGR of around 6%, an increase of around 1.8 billion passengers in a decade. A similar increase in air traffic post the COVID-19 pandemic will reinforce the demand for aircraft filters and drive the market.

Restraint:Decline in orders for large and very large aircraft

The decrease in commercial aircraft orders for large and very large aircraft in the last few years has been a major restraint for the aircraft filters market. Although there has been an increase in passenger traffic across the globe due to the increasing disposable incomes, the rise in domestic airline traffic has led to a fall in demand for large aircraft. The other reason for the recent decline might be a general reduction in demand during the COVID-19 pandemic. The figure given below is the approximate cumulative annual demand for aircraft of Boeing and Airbus, which occupy the majority of the aircraft market.

Opportunity:Emergence of aircraft manufacturers in Asia Pacific and Latin America

The emergence of aircraft manufacturers like Commercial Aircraft Corporation of China, Ltd. (COMAC), Embraer SA (Brazil), and Mitsubishi Aircraft Corporation (Japan) in the Asia Pacific and Latin American regions is one of the major opportunities for the growth of the aircraft filters market in the coming years. Other companies, like Cebu Pacific of the Philippines, that are planning to grow their passenger capacity will also provide more opportunities for aircraft filter manufacturers.

Challenge:Possible decline in demand due to increasing demand for electric and alternate fuel aircraft

Significant research & development is being conducted in the field of electric and alternate fuel aircraft, such as hydrogen aircraft, to reduce the carbon footprint of aircraft in the long term. Since electric aircrafts are relatively simpler in construction, they require a lesser number of parts, including filters. Also, since there would be no fuel to be combusted, the need for fuel filters would be altogether eliminated. This could be a major challenge for aircraft filter manufacturers.

An example of a hybrid-eVTOL-based urban air mobility option is a startup named Urban Aeronautics Ltd., based in Israel, established in 2001. The company has begun production of hydrogen-powered urban air mobility solutions that include emergency medical services (EMS) aircraft. The rise of such aircraft that do not use jet fuel may pose a significant challenge to the aircraft fuel filters market.

Based on platform, Unmanned Aerial Vehicles segment is expected to grow at the highest CAGR in the aircraft filters market during the forecast period

Based on platform, the unmanned aerial vehicles segment is projected to grow at the highest CAGR from 2021 to 2026. The growth of this segment can be attributed to the rising demand for UAVs in military sector.Though UAVs currently account for a small portion of the market for aerospace filters, future developments in UAV technology might make them fit for human transportation, which might lead to a surge in demand for aerospace filters for UAVs in the future.

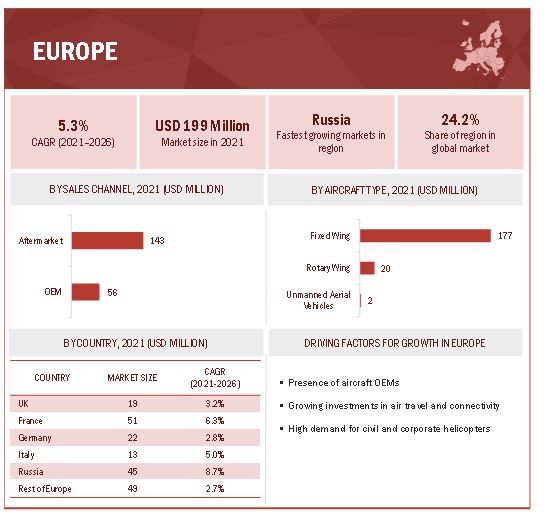

Europe is expected to be the fastest-growing region for the aircraft filters market during the forecast period

Europe is the fastest growing regioninthe aerospacefilters market. The growth of the market in Europe is driven by the increase in air travel in the region. The market in Europe is matured with the presence of key manufacturers and end users such as aircraft manufacturers. This is again a major driver for the growth of aerospace filters market in Europe. The presence of leading OEMs is driving the market growth of the entire North American aerospacefilters market. In addition, aircraft modernization programs carried out in various countries are considered to fuel the regional demand for the aerospace filters. The growth of the market in Asia Pacific is driven by increasing air passenger traffic in the region which is boosting the development or procurement of new aircraft. This increasing demand for new aircraft in the region is expected to stimulate the aerospace filters market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

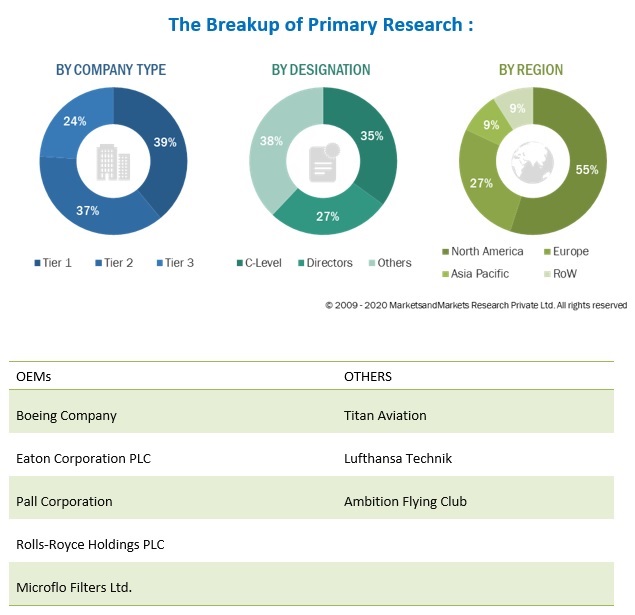

The Aerospace Filters Companies are dominated by a few globally established players such as Parker Hannifin Corporation (US), Donaldson Inc. (US), Safran (France), Porvair PLC (UK), and Freudenberg & Co.KG (Germany) among others. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific, Latin America, Middle East and Africa.

Recent developments

- In February 2017, Parker Hannifin Corporation announced the acquisition of CLARCOR Inc., a major manufacturer of filtration products. The company stated that the purpose of this strategic transaction was to create a combined organization with a comprehensive portfolio of filtration products and technologies, offering customers a single streamlined source for their filtration needs.

- In May 2017, Donaldson, Inc. announced the acquisition of Hy-Pro Corporation (US), which designs and manufactures filtration systems and replacement filters for stationary hydraulic and industrial lubrication filtration applications.

- In September 2019, Porvair PLC acquired Dahlman Industrial Group B.V. (Netherlands), which provides filtration solutions to the oil & gas industry in the form of liquid and gas filters. The group also manufactures flue gas filters for use in aerospace applications.

- In January 2021, Filtration Group announced the acquisition of AFPRO Filters (Netherlands), a leading manufacturer of air filters. The addition of AFPRO’s vertically integrated production capabilities will allow Filtration Group to expand its global presence and further enhance its portfolio of filtration solutions.

Frequently Asked Questions (FAQ):

What is the current size of the ultralight and light market?

The aircraft filters market is projected to grow from an estimated USD 823 million in 2021 to USD 1002 million by 2026, at a CAGR of 4.0% during the forecast period.

Who are the winners in the ultralight and light market?

Parker Hannifin Corporation (US), Donaldson Inc. (US), Safran (France), Porvair PLC (UK), and Freudenberg & Co.KG (Germany),are some of the winners in the market.

Mention a challenge the market is facing?

Industry experts believe that the possible decline in demand due to increasing for electric and alternate fuel aircraft can set challenge to the market.

Mention a technological advancement in the market?

Use of aircraft filters for space applications

What are the factors driving the growth of the market?

Short replacement cycle of aircraft filters and increasing demand for military UAVs are some of the key factors driving the growth in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 2 INCLUSIONS AND EXCLUSIONS IN AIRCRAFT FILTERS MARKET

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 AIRCRAFT FILTERS MARKET FOR OEM

FIGURE 3 MARKET SIZE CALCULATION FOR OEM

2.3.3 AIRCRAFT FILTERS AFTERMARKET

FIGURE 4 MARKET SIZE CALCULATION FOR AFTERMARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.4 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 TRIANGULATION & VALIDATION

FIGURE 7 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 8 FLUID FILTERS SEGMENT PROJECTED TO LEAD MARKET IN 2021

FIGURE 9 HYDRAULIC SYSTEM TO BE LARGEST APPLICATION OF MARKET IN 2021

FIGURE 10 GLASS FIBER PROJECTED TO DOMINATE MARKET BY MATERIAL IN 2021

FIGURE 11 AFTERMARKET PROJECTED TO DOMINATE MARKET BY SALES CHANNEL IN 2021

FIGURE 12 NORTH AMERICA TO BE LARGEST MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN AIRCRAFT FILTERS MARKET

FIGURE 13 INCREASING AIRCRAFT ORDERS DRIVE AIRCRAFT FILTERS MARKET

4.2 AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE

FIGURE 14 FIXED WING SEGMENT PROJECTED TO DOMINATE AIRCRAFT FILTERS MARKET DURING FORECAST PERIOD

4.3 AIRCRAFT FILTERS MARKET, BY SALES CHANNEL

FIGURE 15 AFTERMARKET SEGMENT TO LEAD AIRCRAFT FILTERS MARKET DURING FORECAST PERIOD

4.4 AIRCRAFT FILTERS MARKET, BY COUNTRY

FIGURE 16 AIRCRAFT FILTERS MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 AIRCRAFT FILTERS: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Short replacement cycle of aircraft filters

5.2.1.2 Increasing demand for military UAVS

FIGURE 18 PRODUCTION OF STRATEGIC UNMANNED AERIAL VEHICLES/ DRONES, 2016-2020

5.2.2 RESTRAINTS

5.2.2.1 Decline in orders for large and very large aircraft

FIGURE 19 MAJOR AIRCRAFT ORDERS FROM 2015 TO 2020, BY YEAR

5.2.2.2 Stringent regulatory norms for development of new aircraft filters

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of aircraft manufacturers in Asia Pacific and Latin America

5.2.4 CHALLENGES

5.2.4.1 Possible decline in demand due to increasing demand for electric and alternate fuel aircraft

5.3 AVERAGE/APPROXIMATE SELLING PRICE (ASP)

FIGURE 20 AVERAGE SELLING PRICE OF AIRCRAFT FILTERS, BY TYPE (USD)

TABLE 3 AVERAGE OEM SELLING PRICE: AIRCRAFT FILTERS, BY APPLICATION (USD), 2020

TABLE 4 AVERAGE AFTERMARKET SELLING PRICE: AIRCRAFT FILTERS, BY APPLICATION (USD), 2020

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 AIRCRAFT FILTER MARKET: VALUE CHAIN ANALYSIS

5.5 MARKET ECOSYSTEM MAP

FIGURE 22 AIRCRAFT FILTERS MARKET: MARKET ECOSYSTEM

5.5.1 RAW MATERIAL SUPPLIERS

TABLE 5 LIST OF RAW MATERIAL SUPPLIERS

5.5.2 PROMINENT COMPANIES

5.5.3 SMALL AND MEDIUM ENTERPRISES

TABLE 6 TOP MANUFACTURERS OF AIRCRAFT FILTERS

5.5.4 END USERS (AIRCRAFT MANUFACTURERS, AIRLINE COMPANIES, AND MRO COMPANIES)

TABLE 7 LIST OF TOP AIRCRAFT MANUFACTURERS

TABLE 8 TOP AIRCRAFT MRO SERVICE COMPANIES

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INTEGRATED MARINE AUTOMATION SYSTEM MARKET

FIGURE 23 REVENUE SHIFT IN AIRCRAFT FILTERS MARKET

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 BARGAINING POWER OF SUPPLIERS EXPECTED TO HAVE A LOW IMPACT

TABLE 9 PORTER’S FIVE FORCES ANALYSIS

5.7.1 INTENSITY OF COMPETITIVE RIVALRY

5.7.1.1 High competition at primary stage

5.7.1.2 Existing market players are well established

5.7.1.3 Significant number of manufacturers

5.7.1.4 Research and innovation

5.7.2 BARGAINING POWER OF BUYERS

5.7.2.1 Limited number of buyers

5.7.2.2 Possible diversification in the future

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.3.1 Higher number of suppliers

5.7.3.2 Growing demand for efficient and durable filters

5.7.4 THREAT OF NEW ENTRANTS

5.7.4.1 Strict government and safety regulations

5.7.4.2 Advanced technological requirements

5.7.5 THREAT OF SUBSTITUTES

5.7.5.1 Limited number of substitutes

5.8 TRADE DATA STATISTICS

5.8.1 EXPORT DATA

FIGURE 25 TOTAL EXPORT VALUE: AIRCRAFT AND AIRCRAFT PARTS (USD BILLION)

FIGURE 26 EXPORT SHARE: AIRCRAFT AND AIRCRAFT PARTS, BY COUNTRY

5.8.2 IMPORT DATA

FIGURE 27 TOTAL IMPORT VALUE: AIRCRAFT AND AIRCRAFT PARTS (USD BILLION)

FIGURE 28 IMPORT SHARE: AIRCRAFT AND AIRCRAFT PARTS, BY COUNTRY

5.9 TARIFF AND REGULATORY LANDSCAPE

TABLE 10 REGULATIONS FOR AIRCRAFT FILTER

TABLE 11 TARIFF FOR AIRCRAFT FILTER

5.10 USE CASES

5.10.1 IMPROVEMENT IN AIRCRAFT FUEL FILTRATION USING DIRT DEFENSE TECHNOLOGY

5.10.2 ENVIRONMENTAL CONTROL SYSTEM (CABIN AIR) FILTRATION USING HEPA FILTERS

5.10.3 SUPER ABSORBENT POLYMERS (SAP) FILTERS AND OTHER ALTERNATIVES

5.11 TECHNOLOGY ANALYSIS

5.11.1 HEPA FILTERS

5.11.2 LIGHTWEIGHT FILTERS

5.12 OPERATIONAL DATA

TABLE 12 GLOBAL AIRCRAFT DELIVERIES, 2017-2020

TABLE 13 GLOBAL MILITARY AIRCRAFT FLEET, BY COUNTRY

TABLE 14 GLOBAL MILITARY AIRCRAFT FLEET, BY AIRCRAFT TYPE

5.13 RANGE/SCENARIOS

FIGURE 29 IMPACT OF COVID-19 ON AIRCRAFT FILTERS MARKET: GLOBAL SCENARIOS

TABLE 15 IMPACT OF COVID-19 ON AIRCRAFT FILTERS MARKET SCENARIOS & RANGE

6 INDUSTRY TRENDS (Page No. - 87)

6.1 INTRODUCTION

6.2 AIRCRAFT FILTERS FOR SPACE APPLICATIONS

6.2.1 INCREASE IN MANNED SPACE MISSIONS

6.2.2 RISE IN NUMBER OF ROCKET LAUNCHES

6.2.3 FUTURE MANNED MISSIONS TO MOON/MARS & SPACE TOURISM

6.3 IMPACT OF MEGATRENDS

6.3.1 IMPACT OF COVID-19 PANDEMIC ON AIRCRAFT FILTERS

6.3.2 IMPACT OF RAPID INCREASE IN AIR TRAVEL ON AIRCRAFT FILTERS MARKET

6.4 PATENT & INNOVATION ANALYSIS

6.4.1 PATENT ANALYSIS

TABLE 16 AIRCRAFT FILTERS: PATENTS

6.4.2 INNOVATION ANALYSIS

6.4.2.1 Safran Filtration Systems improves filtration technology

6.4.2.2 ICAO monitoring R&D for aircraft filters in accordance with United Nations Sustainable Development Goals (SDGS)

7 AIRCRAFT FILTERS MARKET, BY PLATFORM (Page No. - 91)

7.1 INTRODUCTION

FIGURE 30 AIRCRAFT FILTERS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 17 AIRCRAFT FILTERS MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 18 AIRCRAFT FILTERS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

7.2 FIXED WING

7.2.1 COMMERCIAL AVIATION

7.2.1.1 Growing fleet of commercial aircraft to drive market

TABLE 19 FIXED-WING AIRCRAFT FILTERS MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 20 FIXED-WING AIRCRAFT FILTERS MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.2.1.2 Narrow-body Aircraft

7.2.1.3 Wide-body Aircraft

7.2.1.4 Regional transport aircraft

7.2.2 BUSINESS & GENERAL AVIATION

7.2.2.1 Increase in demand for business and private jets during and after COVID-19 pandemic to drive market

TABLE 21 FIXED-WING AIRCRAFT FILTERS MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 22 FIXED-WING AIRCRAFT FILTERS MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.2.2.2 Business jets

7.2.2.3 Light aircraft

7.2.3 MILITARY AVIATION

TABLE 23 FIXED-WING MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 24 FIXED-WING MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.2.3.1 Fighter & combat aircraft

7.2.3.2 Transport aircraft

7.2.3.3 Special-mission Aircraft

7.3 ROTARY WING

TABLE 25 ROTARY WING: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 26 ROTARY WING: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

7.3.1 CIVIL HELICOPTERS

7.3.1.1 Increasing usage of civil helicopters for multiple purposes drives demand

7.3.1.2 Light

7.3.1.3 Medium

7.3.1.4 Heavy

7.3.2 MILITARY HELICOPTERS

7.3.2.1 Increased use of military helicopters for critical missions and rescue services fuels segment growth

7.3.2.2 Light

7.3.2.3 Medium

7.3.2.4 Heavy

7.4 UNMANNED AERIAL VEHICLES

TABLE 27 UNMANNED AERIAL VEHICLES: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 28 UNMANNED AERIAL VEHICLES: MARKET, BY TYPE, 2021–2026 (USD MILLION)

8 AIRCRAFT FILTERS MARKET, BY APPLICATION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 31 AIRCRAFT FILTERS MARKET, BY APPLICATION, 2021- 2026 (USD MILLION)

TABLE 29 AIRCRAFT FILTERS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 AIRCRAFT FILTERS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 ENGINE

8.3 CABIN AIR FILTRATION SYSTEM

8.4 AVIONICS COOLING SYSTEM

8.5 HYDRAULIC SYSTEM

8.6 PNEUMATIC SYSTEM

8.7 FUEL SYSTEM

9 AIRCRAFT FILTERS MARKET, BY TYPE (Page No. - 104)

9.1 INTRODUCTION

FIGURE 32 AIRCRAFT FILTERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 31 AIRCRAFT FILTERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 32 AIRCRAFT FILTERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2 AIR FILTERS

9.3 LIQUID FILTERS

TABLE 33 AIRCRAFT FLUID FILTERS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 34 AIRCRAFT FLUID FILTERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.3.1 FUEL FILTERS

9.3.2 OIL FILTERS

9.3.3 OTHER FILTERS

10 AIRCRAFT FILTERS MARKET, BY SALES CHANNEL (Page No. - 109)

10.1 INTRODUCTION

FIGURE 33 AIRCRAFT FILTERS MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

TABLE 35 AIRCRAFT FILTERS MARKET, BY SALES CHANNEL, 2017–2020 (USD MILLION)

TABLE 36 AIRCRAFT FILTERS MARKET, BY SALES CHANNEL, 2021–2026 (USD MILLION)

10.2 VOLUME DATA

TABLE 37 OEM: AIRCRAFT FILTERS MARKET, BY FIXED WING AND ROTARY WING AIRCRAFT TYPE (UNITS)

TABLE 38 AFTERMARKET: AIRCRAFT FILTERS MARKET, BY FIXED WING AND ROTARY WING AIRCRAFT TYPE (UNITS)

10.3 ORIGINAL EQUIPMENT MANUFACTURERS (OEM)

10.3.1 ADOPTION OF UAVS IN AVIATION BOOSTS DEMAND

TABLE 39 COMMERCIAL AVIATION: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 40 COMMERCIAL AVIATION: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 41 BUSINESS & GENERAL AVIATION: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 42 BUSINESS & GENERAL AVIATION: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 43 MILITARY AVIATION: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 44 MILITARY AVIATION: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 45 ROTARY WING: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 46 ROTARY WING: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 47 UNMANNED AERIAL VEHICLES: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 48 UNMANNED AERIAL VEHICLES: AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

10.4 AFTERMARKET

10.4.1 SHORT REPLACEMENT CYCLE FUELS SEGMENT GROWTH

TABLE 49 COMMERCIAL AVIATION: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 50 COMMERCIAL AVIATION: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 51 BUSINESS & GENERAL AVIATION: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 52 BUSINESS & GENERAL AVIATION: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 53 MILITARY AVIATION: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 54 MILITARY AVIATION: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 55 ROTARY WING: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 56 ROTARY WING: AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

11 AIRCRAFT FILTERS MARKET, BY MATERIAL (Page No. - 118)

11.1 INTRODUCTION

FIGURE 34 AIRCRAFT FILTERS MARKET, BY MATERIAL, 2021- 2026 (USD MILLION)

TABLE 57 AIRCRAFT FILTERS MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 58 AIRCRAFT FILTERS MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.2 GLASS FIBER

11.3 ACTIVATED CARBON

11.4 ALUMINUM

11.5 PLASTIC

12 REGIONAL ANALYSIS (Page No. - 121)

12.1 INTRODUCTION

12.2 GLOBAL SCENARIOS OF AIRCRAFT FILTERS MARKET

FIGURE 35 GLOBAL SCENARIOS OF AIRCRAFT FILTERS MARKET

12.3 COVID-19 IMPACT ON AIRCRAFT FILTERS MARKET, BY REGION

TABLE 59 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 61 AIRCRAFT FILTERS OEM MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 AIRCRAFT FILTERS OEM MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 63 AIRCRAFT FILTERS AFTERMARKET MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 AIRCRAFT FILTERS AFTERMARKET MARKET, BY REGION, 2021–2026 (USD MILLION)

12.4 NORTH AMERICA

12.4.1 INTRODUCTION

12.4.2 PESTLE ANALYSIS

FIGURE 37 NORTH AMERICA AIRCRAFT FILTERS MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: AIRCRAFT FILTERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: AIRCRAFT FILTERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.3 OEM MARKET

TABLE 69 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.4 AFTERMARKET

TABLE 79 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.5 US

12.4.5.1 Presence of leading OEMS to drive market in US

TABLE 87 US: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 88 US: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.5.2 OEM MARKET

TABLE 89 US: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 90 US: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 91 US: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 92 US: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 93 US: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 94 US: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 95 US: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 96 US: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 97 US: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 98 US: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.5.3 Aftermarket

TABLE 99 US: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 100 US: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 101 US: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 102 US: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 103 US: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 104 US: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 105 US: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 106 US: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.6 CANADA

12.4.6.1 Aircraft modernization programs to drive market in Canada

TABLE 107 CANADA: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 108 CANADA: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.6.2 OEM Market

TABLE 109 CANADA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 110 CANADA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 111 CANADA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 112 CANADA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 113 CANADA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 114 CANADA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 115 CANADA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 116 CANADA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.4.6.3 Aftermarket

TABLE 117 CANADA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 118 CANADA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 119 CANADA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 120 CANADA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 121 CANADA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 122 CANADA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 123 CANADA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 124 CANADA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5 EUROPE

12.5.1 INTRODUCTION

12.5.2 PESTLE ANALYSIS

FIGURE 38 EUROPE AIRCRAFT FILTERS MARKET SNAPSHOT

TABLE 125 EUROPE: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 126 EUROPE: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 127 EUROPE: AIRCRAFT FILTERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 128 EUROPE: AIRCRAFT FILTERS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.5.3 OEM MARKET

TABLE 129 EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 130 EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 131 EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 132 EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 133 EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 134 EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 135 EUROPE: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 136 EUROPE: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 137 EUROPE: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 138 EUROPE: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.4 AFTERMARKET

TABLE 139 EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 140 EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 141 EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 142 EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 143 EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 144 EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 145 EUROPE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 146 EUROPE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.5 UK

12.5.5.1 Presence of MRO service providers boosts market in UK

TABLE 147 UK: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 148 UK: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.5.2 OEM Market

TABLE 149 UK: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 150 UK: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 151 UK: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 152 UK: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.5.3 Aftermarket

TABLE 153 UK: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 154 UK: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 155 UK: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 156 UK: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 157 UK: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 158 UK: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 159 UK: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 160 UK: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.6 GERMANY

12.5.6.1 Government’s long-term military plan to drive the Germany aircraft filters market

TABLE 161 GERMANY: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 162 GERMANY: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 163 GERMANY: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 164 GERMANY: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 165 GERMANY: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 166 GERMANY: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE 2021–2026 (USD MILLION)

TABLE 167 GERMANY: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 168 GERMANY: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.6.2 Aftermarket

TABLE 169 GERMANY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 170 GERMANY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 171 GERMANY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 172 GERMANY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 173 GERMANY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 174 GERMANY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 175 GERMANY: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 176 GERMANY: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.7 FRANCE

12.5.7.1 Presence of MRO service providers boosts market in France

TABLE 177 FRANCE: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 178 FRANCE: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.7.2 OEM Market

TABLE 179 FRANCE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 180 FRANCE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 181 FRANCE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 182 FRANCE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 183 FRANCE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 184 FRANCE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 185 FRANCE: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 186 FRANCE: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 187 FRANCE: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 188 FRANCE: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.7.3 Aftermarket

TABLE 189 FRANCE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 190 FRANCE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 191 FRANCE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 192 FRANCE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 193 FRANCE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 194 FRANCE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 195 FRANCE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 196 FRANCE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.8 RUSSIA

12.5.8.1 Presence of aircraft manufacturers drives market in Russia

TABLE 197 RUSSIA: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 198 RUSSIA: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.8.2 OEM Market

TABLE 199 RUSSIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 200 RUSSIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 201 RUSSIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 202 RUSSIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 203 RUSSIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 204 RUSSIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 205 RUSSIA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 206 RUSSIA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 207 RUSSIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 208 RUSSIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.8.3 Aftermarket

TABLE 209 RUSSIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 210 RUSSIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 211 RUSSIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 212 RUSSIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 213 RUSSIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 214 RUSSIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 215 RUSSIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 216 RUSSIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.9 ITALY

12.5.9.1 Presence of aircraft filter suppliers boosts market in Italy

TABLE 217 ITALY: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 218 ITALY: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.9.2 OEM Market

TABLE 219 ITALY: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 220 ITALY: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 221 ITALY: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 222 ITALY: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 223 ITALY: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 224 ITALY: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.9.3 Aftermarket

TABLE 225 ITALY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 226 ITALY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 227 ITALY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 228 ITALY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 229 ITALY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 230 ITALY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 231 ITALY: ROTARY WING AIRCRAFT FILTERS AFTERMARKET MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 232 ITALY: ROTARY WING AIRCRAFT FILTERS AFTERMARKET MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.10 REST OF EUROPE

12.5.10.1 Increasing aircraft fleet size will boost market in Rest of Europe

TABLE 233 REST OF EUROPE: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 234 REST OF EUROPE: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.10.2 OEM Market

TABLE 235 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 236 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 237 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 238 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 239 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 240 REST OF EUROPE: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 241 REST OF EUROPE: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 242 REST OF EUROPE: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.5.10.3 Aftermarket

TABLE 243 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 244 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 245 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 246 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 247 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 248 REST OF EUROPE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 249 REST OF EUROPE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 250 REST OF EUROPE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6 ASIA PACIFIC

12.6.1 INTRODUCTION

12.6.2 PESTLE ANALYSIS

FIGURE 39 ASIA PACIFIC AIRCRAFT FILTERS MARKET SNAPSHOT

TABLE 251 ASIA PACIFIC: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 252 ASIA PACIFIC: AIRCRAFT FILTERS MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 253 ASIA PACIFIC: AIRCRAFT FILTERS MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 254 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.3 OEM MARKET

TABLE 255 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 256 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 257 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 258 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 259 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 260 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 261 ASIA PACIFIC: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 262 ASIA PACIFIC: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 263 ASIA PACIFIC: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 264 ASIA PACIFIC: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.4 AFTERMARKET

TABLE 265 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 266 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 267 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 268 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 269 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 270 ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 271 ASIA PACIFIC: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 272 ASIA PACIFIC: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.5 CHINA

TABLE 273 CHINA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 274 CHINA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.5.1 OEM Market

TABLE 275 CHINA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 276 CHINA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 277 CHINA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 278 CHINA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 279 CHINA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 280 CHINA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 281 CHINA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 282 CHINA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 283 CHINA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 284 CHINA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.5.2 Aftermarket

TABLE 285 CHINA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 286 CHINA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 287 CHINA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 288 CHINA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 289 CHINA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 290 CHINA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 291 CHINA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 292 CHINA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.6 INDIA

TABLE 293 INDIA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 294 INDIA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.6.1 OEM Market

TABLE 295 INDIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 296 INDIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 297 INDIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 298 INDIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 299 INDIA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 300 INDIA: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 301 INDIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 302 INDIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.7 AFTERMARKET

TABLE 303 INDIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 304 INDIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 305 INDIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 306 INDIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 307 INDIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 308 INDIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 309 INDIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 310 INDIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.8 JAPAN

TABLE 311 JAPAN: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 312 JAPAN: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.8.1 OEM Market

TABLE 313 JAPAN: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 314 JAPAN: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 315 JAPAN: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 316 JAPAN: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 317 JAPAN: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 318 JAPAN: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 319 JAPAN: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.8.2 Aftermarket

TABLE 320 JAPAN: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 321 JAPAN: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 322 JAPAN: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 323 JAPAN: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 324 JAPAN: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 325 JAPAN: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 326 JAPAN: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 327 JAPAN: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.9 AUSTRALIA

12.6.9.1 Tourism in Australia promotes growth of aircraft filters aftermarket

TABLE 328 AUSTRALIA: Aircraft Filters MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 329 AUSTRALIA: Aircraft Filters MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.9.2 OEM Market

TABLE 330 AUSTRALIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 331 AUSTRALIA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 332 AUSTRALIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 333 AUSTRALIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.9.3 Aftermarket

TABLE 334 AUSTRALIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 335 AUSTRALIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 336 AUSTRALIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 337 AUSTRALIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 338 AUSTRALIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 339 AUSTRALIA: FIXED WING AIRCRAFT FILTERS AFTER MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 340 AUSTRALIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 341 AUSTRALIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.10 SOUTH KOREA

12.6.10.1 Major expansions in aviation sector driving growth of market in South Korea

TABLE 342 SOUTH KOREA: Aircraft Filters MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 343 SOUTH KOREA: Aircraft Filters MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.10.2 OEM Market

TABLE 344 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 345 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 346 SOUTH KOREA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 347 SOUTH KOREA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.10.3 Aftermarket

TABLE 348 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 349 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 350 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 351 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 352 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 353 SOUTH KOREA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 354 SOUTH KOREA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 355 SOUTH KOREA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.11 REST OF ASIA PACIFIC

TABLE 356 REST OF ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 357 REST OF ASIA PACIFIC: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.11.1 OEM Market

TABLE 358 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 359 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 360 REST OF ASIA PACIFIC: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 361 REST OF ASIA PACIFIC: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.6.11.2 Aftermarket

TABLE 362 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 363 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 364 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 365 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 366 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 367 REST OF ASIA PACIFIC: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 368 REST OF ASIA PACIFIC: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 369 REST OF ASIA PACIFIC: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7 MIDDLE EAST

12.7.1 INTRODUCTION

12.7.2 PESTLE ANALYSIS

TABLE 370 MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 371 MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 372 MIDDLE EAST: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 373 MIDDLE EAST: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.7.2.1 OEM Market

TABLE 374 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 375 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 376 MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 377 MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 378 MIDDLE EAST: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 379 MIDDLE EAST: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.2.2 Aftermarket

TABLE 380 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 381 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 382 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 383 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 384 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 385 MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 386 MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 387 MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.3 ISRAEL

12.7.3.1 Increase in defense spending to drive market in Israel

TABLE 388 ISRAEL: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 389 ISRAEL: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.3.2 OEM Market

TABLE 390 ISRAEL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 391 ISRAEL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 392 ISRAEL: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 393 ISRAEL: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.3.3 Aftermarket

TABLE 394 ISRAEL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 395 ISRAEL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 396 ISRAEL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 397 ISRAEL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 398 ISRAEL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 399 ISRAEL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 400 ISRAEL: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 401 ISRAEL: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.4 UAE

TABLE 402 UAE: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 403 UAE: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.4.1 OEM Market

TABLE 404 UAE : UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 405 UAE : UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.4.2 Aftermarket

TABLE 406 UAE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 407 UAE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 408 UAE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 409 UAE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 410 UAE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 411 UAE: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 412 UAE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 413 UAE: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.5 SAUDI ARABIA

12.7.5.1 High military expenditure fuels market growth in Saudi Arabia

FIGURE 40 SAUDI ARABIA DEFENSE BUDGET, 2010–2019

TABLE 414 SAUDI ARABIA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 415 SAUDI ARABIA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.5.2 OEM Market

TABLE 416 SAUDI ARABIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 417 SAUDI ARABIA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.5.3 Aftermarket

TABLE 418 SAUDI ARABIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 419 SAUDI ARABIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 420 SAUDI ARABIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 421 SAUDI ARABIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 422 SAUDI ARABIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 423 SAUDI ARABIA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 424 SAUDI ARABIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 425 SAUDI ARABIA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.6 TURKEY

12.7.6.1 Substantial rise in military spending and development of UAVs to drive the market

TABLE 426 TURKEY: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 427 TURKEY: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.6.2 OEM Market

TABLE 428 TURKEY: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 429 TURKEY: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 430 TURKEY: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.6.3 Aftermarket

TABLE 431 TURKEY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 432 TURKEY: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 433 TURKEY: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 434 TURKEY: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.7 REST OF MIDDLE EAST

TABLE 435 REST OF MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 436 REST OF MIDDLE EAST: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.7.1 OEM Market

TABLE 437 REST OF MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 438 REST OF MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 439 REST OF MIDDLE EAST: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 440 REST OF MIDDLE EAST: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.7.7.2 Aftermarket

TABLE 441 REST OF MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 442 REST OF MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 443 REST OF MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 444 REST OF MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 445 REST OF MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 446 REST OF MIDDLE EAST: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 447 REST OF MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 448 REST OF MIDDLE EAST: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8 LATIN AMERICA

12.8.1 INTRODUCTION

12.8.2 PESTLE ANALYSIS

TABLE 449 LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 450 LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 451 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 452 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.8.3 OEM MARKET

TABLE 453 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 454 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 455 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 456 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 457 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 458 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 459 LATIN AMERICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 460 LATIN AMERICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.4 AFTERMARKET

TABLE 461 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 462 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 463 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 464 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 465 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 466 LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 467 LATIN AMERICA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 468 LATIN AMERICA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.5 BRAZIL

12.8.5.1 Presence of leading airlines and aircraft manufacturers drives market in Brazil

TABLE 469 BRAZIL: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 470 BRAZIL: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.5.2 OEM Market

TABLE 471 BRAZIL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 472 BRAZIL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 473 BRAZIL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 474 BRAZIL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 475 BRAZIL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 476 BRAZIL: FIXED WING AIRCRAFT FILTERS OEM MARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 477 BRAZIL: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 478 BRAZIL: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.5.3 Aftermarket

TABLE 479 BRAZIL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 480 BRAZIL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 481 BRAZIL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 482 BRAZIL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 483 BRAZIL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 484 BRAZIL: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 485 BRAZIL: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 486 BRAZIL: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.6 MEXICO

12.8.6.1 Increase in number of aircraft fleet to

TABLE 487 MEXICO: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 488 MEXICO: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.6.2 OEM Market

TABLE 489 MEXICO: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 490 MEXICO: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.6.3 Aftermarket

TABLE 491 MEXICO: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 492 MEXICO: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 493 MEXICO: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 494 MEXICO: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 495 MEXICO: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 496 MEXICO: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 497 MEXICO: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 498 MEXICO: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.7 REST OF LATIN AMERICA

TABLE 499 REST OF LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 500 REST OF LATIN AMERICA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.7.1 OEM Market

TABLE 501 REST OF LATIN AMERICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 502 REST OF LATIN AMERICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.8.7.2 Aftermarket

TABLE 503 REST OF LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 504 REST OF LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN COMMERCIAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 505 REST OF LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 506 REST OF LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN BUSINESS & GENERAL AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 507 REST OF LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 508 REST OF LATIN AMERICA: FIXED WING AIRCRAFT FILTERS AFTERMARKET IN MILITARY AVIATION, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 509 REST OF LATIN AMERICA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 510 REST OF LATIN AMERICA: ROTARY WING AIRCRAFT FILTERS AFTERMARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

12.9 AFRICA

12.9.1 INTRODUCTION

12.9.2 PESTLE ANALYSIS

TABLE 511 AFRICA: MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 512 AFRICA: MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

TABLE 513 AFRICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 514 AFRICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.9.3 OEM MARKET

TABLE 515 AFRICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 516 AFRICA: UAV AIRCRAFT FILTERS OEM MARKET, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)