Aerospace Plastics Market by Polymer Type (PEEK, PMMA, PC, PPS, ABS), Aircraft Type (Commerical, General & Business, Military, Rotary), Application (Cabin Windows & windshield, Cabin Lighting, Overhead Storage Bins), and Region - Global Forecast to 2023

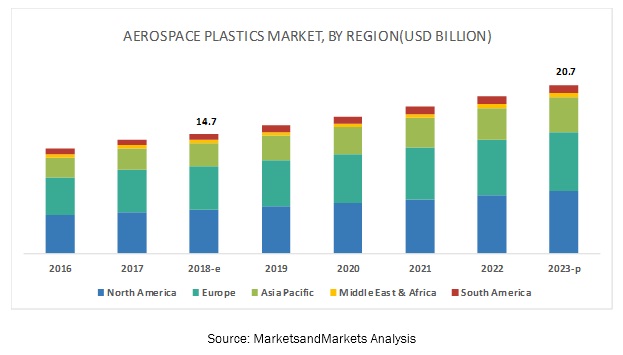

[160 Pages Report] The aerospace plastics market is projected to grow from USD 14.7 billion in 2018 to USD 20.7 billion by 2023 at a Compound Annual Growth Rate (CAGR) of 7.1% during the forecast period. The growth of the aerospace plastics market can be attributed to the growth in the commercial and general & business aircraft segment.

Based on type of polymer type, PMMA is expected to grow at the highest CAGR during the forecast period

Polymethyl Methacrylate (PMMA), also known as acrylic or acrylic glass, is a transparent thermoplastic. It is also known trade names Crylux, Plexiglas, Acrylite, Lucite, and Perspex. Polymethyl methacrylate is an economical alternative to polycarbonate. In the aerospace industry, it is widely used in manufacturing the canopies of aircraft. For military aircraft, polymethyl methacrylate is used as an alternative for glass to manufacture airplane windows.

Polymethyl methacrylate is also used in aircraft cockpits, portholes, windshields, and exterior lighting. It is also used in helicopter windscreens.

Increasing demand for lightweight and more efficient aircraft

The demand for next-generation, lightweight, and fuel-efficient aircraft is expected to be the major driver of the aerospace plastics market in the near future. The Advisory Council for Aeronautics Research in Europe (ACARE) mandates all aircraft OEMs to comply with certain rules with a vision to maintain a stable and clean environment by 2020. These rules include (a) halving the time to market and (b) reducing CO2 emissions by 50% and nitrogen oxide emissions by 80% in the major developed economies.

Aerospace plastics can be classified into commercial aircraft, general & business aviation, military aircraft, rotary aircraft, and others. Among these segments, commercial aircraft is projected to grow at the highest CAGR in terms of value between 2018 and 2023. The expanding global economy and increasing air passenger traffic are expected to boost the demand for commercial aircraft, thereby increasing the demand for aerospace plastics.

North America is expected to be leading region in the aerospace plastics market during the forecast period

North America is the leading market for aerospace plastics, followed by Europe and Asia Pacific. Demand is higher in North America, as key aircraft manufacturers such as Boeing (US) and Bombardier (Canada) are based here. Various leading players have adopted the strategies of expansions, new product launches, and agreements, to meet the growing demand for aerospace plastics.

Key Market Players

Major companies in the aerospace plastics market include SABIC (Saudi Arabia), Victrex (UK), Drake Plastics Ltd. (US), Solvay (Belgium), BASF SE (Germany), and Evonik (Germany) are among the leading players operating in the aerospace plastics market. These companies have adopted various strategies such as expansions, new product launches, and agreements to meet the growing demand for aerospace plastics as well as increase their market presence.

Scope of the report:

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD), Volume (KT) |

|

Segments covered |

Aircraft Type, Application, Polymer Type, and Region |

|

Geographies covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

SABIC (Saudi Arabia), Victrex (UK), Drake Plastics Ltd. (US), Solvay (Belgium), BASF SE (Germany), and Evonik (Germany), are some of the leading players operating in the aerospace plastics market. |

This research report categorizes the aerospace plastics market based on the aircraft type, application, polymer type, and region.

Aerospace Plastics Market, By Polymer Type

- PMMA

- PC

- ABS

- PEEK

- PPS

- Others

- Nylon 6

- POM-C

- PES

Aerospace Plastics Market, By Aircraft Type

- Commercial Aircrafts

- General & Business Aircrafts

- Military Aircrafts

- Rotary Aircrafts

- Others

- UAV

- Spacecraft

Aerospace Plastics Market, By Application

- Cabin Windows & Windshields

- Cabin Lighting

- Overhead Storage Bins

- Aircraft Panels

- Aircraft Canopy

- Others

- Cabin Seat Components

- Lavatory Fixtures

Aerospace Plastics Market, By Region

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In February 2018, SABIC planned to increase the Ultem resin production in Singapore for its customers based in Asia. This expansion will help in increasing the global production by 50%. The new production facility in Singapore is expected to begin in the first half of 2021.

- In September 2018, Victrex partnered with University of Exeter (UK) to introduce next-generation PAEK polymers and composites for additive manufacturing to be used in aerospace industry. This partnership became a stepping stone for both parties to develop a broader platform for new and current additive manufacturing technologies.

- In March 2017, Drake Plastics Ltd. Co, added extruded Ryton R4 to its product portfolio. Rytons properties and characteristics such as strength, stiffness, and chemical inertness across different environments make it suitable for aerospace applications.

Key Questions addressed by the report

- How is the FST regulation impacting the growth of the aerospace plastics market?

- How the demand for lightweight aircrafts is unlocking opportunities for plastics?

- How are expansions helping the growth of the aerospace plastics market?

- Who are the leading players in the aerospace plastics market?

- How can new product launches unlock new opportunities for growth in the aerospace plastics market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Regional Scope

1.4.1 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in Aerospace Plastics Market

4.2 Aerospace Plastics Market, By Polymer Type

4.3 Aerospace Plastics Market, By Aircraft Type

4.4 Aerospace Plastics Market, By Application

4.5 Aerospace Plastics Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.3 Drivers

5.3.1 Increasing Demand for Lightweight and More Efficient Aircraft

5.3.2 Increasing Demand of Passenger Aircrafts in Emerging Regions

5.3.3 Replacement of Old Aircraft and Modernization of Existing Aircraft

5.4 Restraints

5.4.1 Lack of Standardization in Manufacturing Technologies and Trained Personnel

5.4.2 Limited Range of Material Options

5.5 Opportunities

5.5.1 Growing Demand for Commercial Aircraft

5.5.2 Influence of Low-Cost Airlines

5.6 Challenges

5.6.1 Costly Maintenance, Repair, and Overhaul Services

5.7 Porters Five Forces Analysis

5.7.1 Bargaining Power of Suppliers

5.7.2 Bargaining Power of Buyers

5.7.3 Threat of Substitutes

5.7.4 Threat of New Entrants

5.7.5 Intensity of Competitive Rivalry

5.8 Regulatory Landscape

5.9 Fire Safety

5.9.1 Flammability

5.9.2 Smoke & Toxicity

5.10 Component Design

5.10.1 Weight

5.10.2 Strength & Stifness

5.11 Airline Operations

5.11.1 Durability

5.11.2 Reparability

5.11.3 Cleanability

5.12 Manufacturing

5.12.1 Raw Material

5.12.2 Reproducibility

6 Aerospace Plastics Market, By Polymer Type (Page No. - 46)

6.1 Introduction

6.2 Polyetheretherketone (PEEK)

6.2.1 North America is Projected to Dominate the Polyetheretherketone Aerospace Plastics Market During the Forecast Period

6.3 Polyphenyl Sulfide (PPS)

6.3.1 Europe is Expected to Dominate the Polyphenyl Sulfide Aerospace Market During the Forecast Period

6.4 Polycarbonate (PC)

6.4.1 Asia Pacific is Projected to Grow at the Highest CAGR in the Polycarbonate Aerospace Plastics Market During the Forecast Period

6.5 Acrylonitrile Butadiene Styrene (ABS)

6.5.1 North America is Projected to Dominate the Acrylonitrile Butadiene Styrene Aerospace Plastics Market During the Forecast Period

6.6 Polymethyl Methacrylate (PMMA)

6.6.1 Asia Pacific Polymethyl Methacrylate Aerospace Plastics Market is Projected to Grow With the Highest CAGR During the Forecast Period

6.7 Others

7 Aerospace Plastics Market, By Aircraft Type (Page No. - 58)

7.1 Introduction

7.2 Commercial Aircraft

7.2.1 North America is Projected to Lead the Aerospace Plastics Market for Commercial Aircraft During the Forecast Period

7.3 General & Business Aircraft

7.3.1 North America is Projected to Lead the Aerospace Plastics Market for General & Business Aircraft During the Forecast Period

7.4 Military Aircraft

7.4.1 Asia Pacific Aerospace Plastics Market for Military Aircraft is Projected to Grow at the Highest CAGR During the Forecast Period

7.5 Rotary Aircraft

7.5.1 North America is Projected to Lead Aerospace Plastics Market for Rotary Aircraft During the Forecast Period

7.6 Others

8 Aerospace Plastics Market, By Application (Page No. - 69)

8.1 Introduction

8.2 Cabin Windows and Windshields

8.2.1 North America is Expected to Lead Aerospace Plastics Market in the Cabin Windows & Windshields Segment During the Forecast Period

8.3 Cabin Lighting

8.3.1 North America is Expected to Lead Aerospace Plastics Market in the Cabin Lighting Segment During the Forecast Period

8.4 Overhead Storage Bins

8.4.1 Europe is Expected to Account for Second-Highest Consumption of Aerospace Plastics in the Overhead Storage Bins Segment During the Forecast Period

8.5 Aircraft Panels

8.5.1 Asia Pacific is Expected to Account for Third-Highest Consumption of Aerospace Plastics in the Aircraft Panels Segment During the Forecast Period

8.6 Aircraft Canopy

8.6.1 North America is Expected to Lead Aerospace Plastics Market in the Aircraft Canopy Segment During the Forecast Period

8.7 Others

9 Aerospace Plastics Market, By Region (Page No. - 81)

9.1 Introduction

9.2 Asia Pacific

9.2.1 China

9.2.1.1 Polymethyl Methacrylate Segment is Expected to Dominate the China Aerospace Plastics Market During the Forecast Period

9.2.2 India

9.2.2.1 Polymethyl Methacrylate Segment is Expected to Dominate the India Aerospace Plastics Market During the Forecast Period

9.2.3 Japan

9.2.3.1 Polycarbonate Segment is Expected to Hold Second Largest Share in the Japan Aerospace Plastics Market During the Forecast Period

9.2.4 Korea

9.2.4.1 Polymethyl Methacrylate Segment is Expected to Dominate the Korea Aerospace Plastics Market During the Forecast Period

9.2.5 Indonesia

9.2.5.1 Polycarbonate Segment is Expected to Hold Second Largest Share in the Indonesia Aerospace Plastics Market During the Forecast Period

9.2.6 Malaysia

9.2.6.1 Polymethyl Methacrylate Segment is Expected to Dominate the Malaysia Aerospace Plastics Market During the Forecast Period

9.2.7 Singapore

9.2.7.1 Polycarbonate Segment is Expected to Hold Second Largest Share in the Singapore Aerospace Plastics Market During the Forecast Period

9.2.8 Rest of Asia Pacific

9.3 North America

9.3.1 US

9.3.1.1 Polymethyl Methacrylate Segment is Expected to Dominate the US Aerospace Plastics Market During the Forecast Period

9.3.2 Canada

9.3.2.1 Polycarbonate Segment is Expected to Grow at the Second Fastest CAGR in the Canada Aerospace Plastics Market During the Forecast Period

9.3.3 Mexico

9.3.3.1 Polymethyl Methacrylate Segment is Expected to Dominate the Mexico Aerospace Plastics Market During the Forecast Period

9.4 Europe

9.4.1 France

9.4.1.1 Polymethyl Methacrylate Segment is Expected to Dominate the France Aerospace Plastics Market During the Forecast Period

9.4.2 Germany

9.4.2.1 Polycarbonate Segment is Expected to Hold Second Largest Share in the Germany Aerospace Plastics Market During the Forecast Period

9.4.3 UK

9.4.3.1 Acrylonitrile Butadiene Styrene Segment is Expected to Grow at the Second Fastest CAGR in the UK Aerospace Plastics Market During the Forecast Period

9.4.4 Italy

9.4.4.1 Polymethyl Methacrylate Segment is Expected to Dominate the Italy Aerospace Plastics Market During the Forecast Period

9.4.5 Russia

9.4.5.1 Polycarbonate Segment is Expected to Hold Second Largest Share in the Russia Aerospace Plastics Market During the Forecast Period

9.4.6 Spain

9.4.6.1 Polymethyl Methacrylate Segment is Expected to Dominate the Spain Aerospace Plastics Market During the Forecast Period

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Polymethyl Methacrylate Segment is Expected to Dominate the Saudi Arabia Aerospace Plastics Market During the Forecast Period

9.5.2 UAE

9.5.2.1 Polyetheretherketone Segment is Expected to Hold Second Largest Share in Terms of Value in the UAE Aerospace Plastics Market During the Forecast Period

9.5.3 Morocco

9.5.3.1 Polycarbonate Segment is Expected to Grow at the Second Fastest CAGR in the Morocco Aerospace Plastics Market During the Forecast Period

9.5.4 South Africa

9.5.4.1 Polymethyl Methacrylate Segment is Expected to Dominate the South Africa Aerospace Plastics Market During the Forecast Period

9.5.5 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Polymethyl Methacrylate Segment is Expected to Dominate the Brazil Aerospace Plastics Market During the Forecast Period

9.6.2 Rest of South America

10 Competitive Landscape (Page No. - 129)

10.1 Overview

10.2 Market Ranking of Key Players

10.3 Competitive Scenario

10.3.1 Expansions

10.3.2 New Product Launches

10.3.3 Acquisitions

10.3.4 Joint Ventures

10.3.5 Investment

10.3.6 Partnership

10.3.7 Contract

11 Company Profiles (Page No. - 135)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Sabic

11.2 Victrex

11.3 Drake Plastics Ltd

11.4 Solvay

11.5 BASF SE

11.6 Evonik Industries AG

11.7 Vantage Plane Plastics

11.8 Quadrant Engineering Plastics

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.9 Other Key Players

11.9.1 PACO Plastics & Engineering Inc.

11.9.2 3P - Performance Plastics Products

11.9.3 Polyflour Plastics

11.9.4 Big Bear Plastics

11.9.5 Grafix Plastics

11.9.6 Loar Group

11.9.7 Zeus

11.9.8 Curbell Plastics

11.9.9 Ensinger GmbH

12 Appendix (Page No. - 153)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (140 Tables)

Table 1 Aerospace Plastics Market Snapshot

Table 2 Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 3 Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 4 Polyetheretherketone Aerospace Plastics Market, By Region, 20162023 (USD Million)

Table 5 Polyetheretherketone Aerospace Plastics Market, By Region, 20162023 (Tons)

Table 6 Polyphenyl Sulfide Aerospace Plastics Market, By Region, 20162023 (USD Million)

Table 7 Polyphenyl Sulfide Aerospace Plastics Market, By Region, 20162023 (Tons)

Table 8 Polycarbonate Aerospace Plastics Market, By Region, 20162023 (USD Million)

Table 9 Polycarbonate Aerospace Plastics Market, By Region, 20162023 (Tons)

Table 10 Acrylonitrile Butadiene Styrene Aerospace Plastics Market, By Region, 20162023 (USD Million)

Table 11 Acrylonitrile Butadiene Styrene Aerospace Plastics Market, By Region, 20162023 (Tons)

Table 12 Polymethyl Methacrylate Aerospace Plastics Market, By Region, 20162023 (USD Million)

Table 13 Polymethyl Methacrylate Aerospace Plastics Market, By Region, 20162023 (Tons)

Table 14 Other Polymer Types Aerospace Plastics Market, By Region, 20162023 (USD Million)

Table 15 Other Polymer Types Aerospace Plastics Market, By Region, 20162023 (Tons)

Table 16 Aerospace Plastics Market, By Aircraft Type, 20162023 (USD Million)

Table 17 Aerospace Plastics Market, By Aircraft Type, 20162023 (Tons)

Table 18 Aerospace Plastics Market for Commercial Aircraft, By Region, 20162023 (USD Million)

Table 19 Aircraft Aerospace Plastics Market for Commercial Aircraft, By Region, 20162023 (Tons)

Table 20 Aerospace Plastics Market for General & Business Aircraft, By Region, 20162023 (USD Million)

Table 21 Aerospace Plastics Market for General & Business Aircraft, By Region, 20162023 (Tons)

Table 22 Aerospace Plastics Market for Military Aircraft, By Region, 20162023 (USD Million)

Table 23 Aerospace Plastics Market for Military Aircraft, By Region, 20162023 (Tons)

Table 24 Aerospace Plastics Market for Rotary Aircraft, By Region, 20162023 (USD Million)

Table 25 Aerospace Plastics Market for Rotary Aircraft, By Region, 20162023 (Tons)

Table 26 Aerospace Plastics Market for Other Aircraft Type, By Region, 20162023 (USD Million)

Table 27 Aerospace Plastics Market for Other Aircraft Type, By Region, 20162023 (Tons)

Table 28 Aerospace Plastics Market, By Application, 20162023 (USD Million)

Table 29 Aerospace Plastics Market, By Application, 20162023 (Tons)

Table 30 Aerospace Plastics Market Size for Cabin Windows and Windshields, By Region, 20162023 (USD Million)

Table 31 Aerospace Plastics Market Size for Cabin Windows and Windshields, By Region, 20162023 (Tons)

Table 32 Aerospace Plastics Market Size for Cabin Lighting, By Region, 20162023 (USD Million)

Table 33 Aerospace Plastics Market Size for Cabin Lighting, By Region, 20162023 (Tons)

Table 34 Aerospace Plastics Market Size for Overhead Storage Bins, By Region, 20162023 (USD Million)

Table 35 Aerospace Plastics Market Size for Overhead Storage Bins, By Region, 20162023 (Tons)

Table 36 Aerospace Plastics Market Size for Aircraft Panels, By Region, 20162023 (USD Million)

Table 37 Aerospace Plastics Market Size for Aircraft Panels, By Region, 20162023 (Tons)

Table 38 Aerospace Plastics Market Size for Aircraft Canopy, By Region, 20162023 (USD Million)

Table 39 Aerospace Plastics Market Size for Aircraft Canopy, By Region, 20162023 (Tons)

Table 40 Aerospace Plastics Market Size for Other Applications, By Region, 20162023 (USD Million)

Table 41 Aerospace Plastics Market Size for Other Applications, By Region, 20162023 (Tons)

Table 42 Aerospace Plastics Market, By Region, 20162023 (USD Million)

Table 43 Aerospace Plastics Market, By Region, 20162023 (Tons)

Table 44 Asia Pacific Aerospace Plastics Market, By Country, 20162023 (USD Million)

Table 45 Asia Pacific Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 46 Asia Pacific Aerospace Plastics Market, By Aircraft Type, 20162023 (USD Million)

Table 47 Asia Pacific Aerospace Plastics Market, By Aircraft Type, 20162023 (Tons)

Table 48 Asia Pacific Aerospace Plastics Market, By Application, 20162023 (USD Million)

Table 49 Asia Pacific Aerospace Plastics Market, By Application, 20162023 (Tons)

Table 50 Asia Pacific Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 51 Asia Pacific Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 52 China Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 53 China Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 54 India Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 55 India Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 56 Japan Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 57 Japan Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 58 Korea Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 59 Korea Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 60 Indonesia Aerospace Plastics Market, By Type, 20162023 (USD Million)

Table 61 Indonesia Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 62 Malaysia Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 63 Malaysia Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 64 Singapore Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 65 Singapore Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 66 Rest of Asia Pacific Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 67 Rest of Asia Pacific Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 68 North America Aerospace Plastics Market, By Country, 20162023 (USD Million)

Table 69 North America Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 70 North America Aerospace Plastics Market, By Aircraft Type, 20162023 (USD Million)

Table 71 North America Aerospace Plastics Market, By Aircraft Type, 20162023 (Tons)

Table 72 North America Aerospace Plastics Market, By Application, 20162023 (USD Million)

Table 73 North America Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 74 North America Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 75 North America Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 76 US Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 77 US Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 78 Canada Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 79 Canada Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 80 Mexico Aerospace Plastics Market, By Type, 20162023 (USD Million)

Table 81 Mexico Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 82 Europe Aerospace Plastics Market, By Country, 20162023 (USD Million)

Table 83 Europe Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 84 Europe Aerospace Plastics Market, By Aircraft Type, 20162023 (USD Million)

Table 85 Europe Aerospace Plastics Market, By Aircraft Type, 20162023 (Tons)

Table 86 Europe Aerospace Plastics Market, By Application, 20162023 (USD Million)

Table 87 Europe Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 88 Europe Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 89 Europe Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 90 France Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 91 France Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 92 Germany Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 93 Germany Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 94 UK Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 95 UK Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 96 Italy Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 97 Italy Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 98 Russia Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 99 Russia Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 100 Spain Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 101 Spain Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 102 Rest of Europe Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 103 Rest of Europe Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 104 Middle East & Africa Aerospace Plastics Market, By Country, 20162023 (USD Million)

Table 105 Middle East & Africa Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 106 Middle East & Africa Aerospace Plastics Market, By Aircraft Type, 20162023 (USD Million)

Table 107 Middle East & Africa Aerospace Plastics Market, By Aircraft Type, 20162023 (Tons)

Table 108 Middle East & Africa Aerospace Plastics Market, By Application, 20162023 (USD Million)

Table 109 Middle East & Africa Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 110 Middle East & Africa Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 111 Middle East & Africa Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 112 Saudi Arabia Aerospace Plastics Market, By Type, 20162023 (USD Million)

Table 113 Saudi Arabia Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 114 UAE Aerospace Plastics Market, By Type, 20162023 (USD Million)

Table 115 UAE Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 116 Morocco Aerospace Plastics Market, By Type, 20162023 (USD Million)

Table 117 Morocco Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 118 South Africa Aerospace Plastics Market, By Type, 20162023 (USD Million)

Table 119 South Africa Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 120 Rest of Middle East & Africa Aerospace Plastics Market, By Type, 20162023 (USD Million)

Table 121 Rest of Middle East & Africa Aerospace Plastics Market, By Type, 20162023 (Tons)

Table 122 South America Aerospace Plastics Market, By Country, 20162023 (USD Million)

Table 123 South America Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 124 South America Aerospace Plastics Market, By Aircraft Type, 20162023 (USD Million)

Table 125 South America Aerospace Plastics Market, By Aircraft Type, 20162023 (Tons)

Table 126 South America Aerospace Plastics Market, By Application, 20162023 (USD Million)

Table 127 South America Aerospace Plastics Market, By Country, 20162023 (Tons)

Table 128 South America Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 129 South America Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 130 Brazil Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 131 Brazil Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 132 Rest of South America Aerospace Plastics Market, By Polymer Type, 20162023 (USD Million)

Table 133 Rest of South America Aerospace Plastics Market, By Polymer Type, 20162023 (Tons)

Table 134 Expansions, February 2018August 2018

Table 135 New Product Launches, October 2015March 2018

Table 136 Acquisitions, December 2015December 2018

Table 137 Joint Ventures, February 2017

Table 138 Investments, December 2017

Table 139 Partnerships, September 2018

Table 140 Contracts, September 2018

List of Figures (50 Figures)

Figure 1 Aerospace Plastics Market: Research Design

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Aerospace Plastics Market: Data Triangulation

Figure 5 Based on Polymer Type, PMMA Segment Expected to Lead Aerospace Plastics Market and Grow at Highest CAGR Between 2018 and 2023

Figure 6 Based on Aircraft Type, Commercial Aircraft Segment Expected to Lead Aerospace Plastics Market Between 2018 and 2023

Figure 7 Based on Application, Cabin Windows and Windshields Segment Expected to Lead Aerospace Plastics Market Between 2018 and 2023

Figure 8 North America Estimated to Account for Highest Share in Aerospace Plastics Market in 2018

Figure 9 Growing Demand for Lightweight Materials in Aircraft Creates Growth Opportunities for Aerospace Plastics in Global Market

Figure 10 PMMA Segment Expected to Lead Aerospace Plastics Market From 2018 to 2023

Figure 11 Commercial Aircraft Segment Expected to Lead Aerospace Plastics Market From 2018 to 2023

Figure 12 Cabin Windows and Windshields Segment Expected to Lead Aerospace Plastics Market From 2018 to 2023

Figure 13 Asia Pacific Aerospace Plastics Market Expected Grow at Highest CAGR From 2018 to 2023

Figure 14 Evolution of Aerospace Composites and Its Application

Figure 15 Aerospace Plastics Market Dynamics

Figure 16 Aerospace Plastics Market: Porters Five Forces Analysis

Figure 17 Regulatory Landscape for Aircraft Interior Design

Figure 18 Polymethyl Methacrylate Segment Expected to Lead Aerospace Plastics Market From 2018 to 2023

Figure 19 North America is Projected to Lead Polyetheretherketone Aerospace Plastics Market From 2018 to 2023

Figure 20 Europe is Projected Expected to Lead the Polyphenyl Sulfide Aerospace Plastics Market From 2018 to 2023

Figure 21 Asia Pacific Polycarbonate Aerospace Plastics Market Projected to Grow at the Highest CAGR From 2018 to 2023

Figure 22 North America Projected to Lead Acrylonitrile Butadiene Styrene Aerospace Plastics Market From 2018 to 2023

Figure 23 Asia Pacific Polymethyl Methacrylate Aerospace Plastics Market Projected to Grow From the Highest CAGR From 2018 to 2023

Figure 24 North America to Lead Other Polymer Types Aerospace Plastics Market From 2018 to 2023

Figure 25 Commercial Aircraft Segment Projected to Lead Aerospace Plastics Market From 2018 to 2023

Figure 26 North America Projected to Lead Aerospace Plastics Market for Commercial Aircraft From 2018 to 2023

Figure 27 North America Projected to Lead Aerospace Plastics Market for General & Business Aircraft From 2018 to 2023

Figure 28 Asia Pacific Aerospace Plastics Market for Military Aircraft Projected to Grow at the Highest CAGR From 2018 to 2023

Figure 29 North America Projected to Lead Aerospace Plastics Market for Rotary Aircraft From 2018 to 2023

Figure 30 North America to Lead Aerospace Plastics Market for Other Aircraft From 2018 to 2023

Figure 31 Cabin Windows & Windshields Segment Expected to Lead Aerospace Plastics Market From 2018 to 2023

Figure 32 North America Expected to Lead Aerospace Plastics Market in the Cabin Windows & Windshields Segment From 2018 to 2023

Figure 33 North America Expected to Lead Aerospace Plastics Market in the Cabin Lighting Segment From 2018 to 2023

Figure 34 Europe Expected to Account for Second-Highest Consumption of Aerospace Plastics in the Overhead Storage Bins Segment From 2018 to 2023

Figure 35 Asia Pacific Expected to Account for Third-Highest Consumption of Aerospace Plastics in the Aircraft Panels Segment From 2018 to 2023

Figure 36 North America Expected to Lead Aerospace Plastics Market in the Aircraft Canopy Segment From 2018 to 2023

Figure 37 North America Expected to Lead Aerospace Plastics Market in the Others Application Segment From 2018 to 2023

Figure 38 China Aerospace Plastics Market Projected to Grow at the Highest CAGR From 2018 to 2023

Figure 39 Asia Pacific Projected to Grow at the Highest CAGR From 2018 to 2023

Figure 40 North America Aerospace Plastics Market

Figure 41 Europe Aerospace Plastics Market

Figure 42 Middle East & Africa Aerospace Plastics Market

Figure 43 South America Aerospace Plastics Market

Figure 44 Companies Adopted Organic Growth Strategies Between January 2015 and July 2018 to Strengthen Their Position in Aerospace Plastics Market

Figure 45 Sabic Expected to Lead Aerospace Plastics Market in 2018

Figure 46 Sabic: Company Snapshot

Figure 47 Victrex: Company Snapshot

Figure 48 Solvay: Company Snapshot

Figure 49 BASF SE: Company Snapshot

Figure 50 Evonik Industries AG: Company Snapshot

This research study involved four major activities in estimating the current market size for aerospace plastics. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study. These secondary sources included the annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

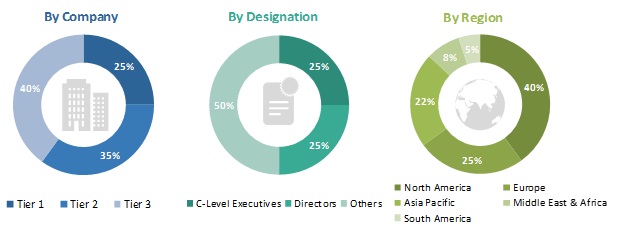

The aerospace plastics market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the growth of the commercial, general & business aircrafts, and the demand for lightweight aircrafts. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the aerospace plastics market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the commercial, general & business, rotary, and military aircraft industries.

Report Objectives

- To define, describe, and forecast the aerospace plastics market based on aircraft type, application, polymer type, and region

- To provide detailed information about key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape of the market

- To forecast the market size in terms of value and volume with respect to 5 main regions, namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America, along with their key countries

- To analyze competitive developments such as expansions, new product launches, and agreements activities in the aerospace plastics market

- To strategically profile the key players operating in the aerospace plastics market and comprehensively analyze their core competencies

The following customization options are available for the report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

- Further breakdown of Rest of Asia Pacific, Rest of Europe, and Rest of Middle East & Africa

- Detailed analysis and profiling of the additional market players (up to five)

- Product matrix, which gives a detailed comparison of product portfolio of each company

- Further breakdown of polymer type by application at regional level

Growth opportunities and latent adjacency in Aerospace Plastics Market