Agrochemical Tank Market by Type (Conical, Vertical, Horizontal), Size (200-500, 500-1,000, 1,000-15,000, 15,000-30,000, and >30,000 Liters), Application (Water Storage, Fertilizer Storage, Chemical Storage), and Region- Global Forecast to 2027

Agrochemical Tank Market Analysis

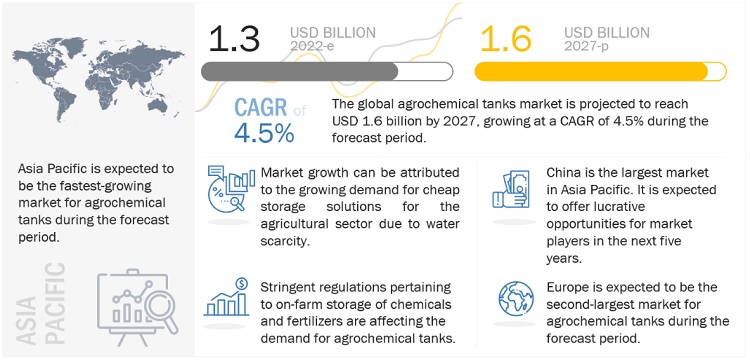

Agrochemical Tank Market was valued at USD 1.3 billion in 2022 and is projected to reach USD 1.6 billion by 2027, growing at a cagr 4.5% from 2022 to 2027. Growing demand of storage tanks for high performance is driving the market.

Global Agrochemical Tanks Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The propagation of the COVID-19 pandemic worldwide has slowed down the growth of numerous industries. The actions taken by businesses and governments to contain the spread of the virus have resulted in a significant and swift reduction in the demand for electricity generation. As of July 26, 2021, 222 countries had been impacted by the pandemic, and the governments of individual countries had ordered nationwide lockdowns. Large-scale shutdowns and disruptions in global trade have led to a decline in demand for power systems. This acts as a challenge for the growth of the Agrochemical tanks market The breakdown of supply chains is expected to have an adverse effect on the manufacturers of Agrochemical storage tanks. The agriculture sector has been taking extra precautions to combat the pandemic, and no country has reported the forced shutdown of agriculture storage tanks as a result of COVID-19's effects on the workforce or supply chains.

Market Dynamics

Driver: Rising adoption of tanks due to limited availability of water

The deployment of tanks in the agriculture sector is being driven by the limited water supply. Even in times of drought, tanks offer farmers a dependable source of water for irrigation and other uses. The use of tanks is anticipated to increase as the need for water grows more urgent, giving farmers a crucial tool for assuring the viability of their crops. Tanks are especially popular in arid and semi-arid locations where water is scarce and unreliable. Tanks are commonly utilized in these locations to retain rainfall or water from irrigation systems, providing farmers with a consistent source of water even during droughts. Tanks are often utilized in humid climates where water is easily accessible. During the dry season, when water is more limited, tanks are frequently employed in these locations to store water for agriculture.

Restraints: Stringent regulations governing production and making of agrochemical tanks

Regulatory agencies have established strict regulations for the manufacturing, labeling, and marketing of organic products. Different regions have different regulatory organizations, and the rules that apply to each region may differ slightly. This could lead to the manufacturer focusing on production in a way that caters to the regulatory circumstances in the importing region. The interruption and conceptions for each region differ, which could increase the entire production cost of the product, raising the price of the end product offered to customers. In agriculture, agrochemical tanks, also known as spray tanks or applicator tanks, are used to store and apply pesticides, herbicides, and fertilizers.

Opportunities: Increasing capital expenditure for water infrastructure

Increasing capital expenditure for agricultural water infrastructure is critical for sustainable and effective farming operations. It can assist in enhancing irrigation systems, conserving water supplies, lowering farmer expenses, and increasing farming communities' resilience to climate change. Adequate water infrastructure is required for irrigation, which is critical for crop growth in many places. Water infrastructure investment can assist farmers in improving their irrigation systems, resulting in more effective use of water resources and greater crop yields. Upgrading infrastructure can also aid in the prevention of water loss due to leaks and seepage. This not only saves vital water resources, but it can also save farmers money because they won't have to pump as much water to their crops. Investing in new technologies, such as precision irrigation, can assist in cutting water consumption while increasing crop yields. This is especially critical in areas where water supplies are scarce or when agricultural, industrial, and home users compete for water. Investing in agricultural water infrastructure can also help to improve farming communities' resilience to climate change. Adequate water infrastructure can assist farmers in weathering droughts and floods and protect crops from harm caused by extreme weather occurrences. Investing in agricultural water infrastructure can help rural communities by providing them with the necessary resources to continue producing crops. This is critical for food security and the local economy.

Challenges: Limited availability of raw materials

The agricultural tank industry has considerable challenges because of the scarcity of raw materials. Many of the materials required to build agricultural tanks, such as plastic and steel, are in high demand and may experience price volatility, making it difficult to anticipate prices and plan for future projects. The increased demand for farm tanks due to the rising population and increased food production puts pressure on raw material availability. This is exacerbated by the fact that many of these resources are sourced from outside the country, exposing them to geopolitical risks and trade disruptions. The scarcity of raw materials might cause delays in the delivery of agricultural tanks, substantially influencing the agricultural industry. Farmers, for example, may experience reduced yields and financial losses if they cannot reach the tanks required to store and transport their harvests.

Furthermore, the scarcity of raw materials can raise the cost of agricultural tanks. As demand for these materials grows, producers may be obliged to pay more for them, which might be passed on to customers in the form of higher tank prices. This can make it more difficult for farmers to buy the required tanks, especially in nations with limited resources.

Manufacturers may need to explore readily available and less expensive alternatives to tackle the difficulty of limited raw material supply. This could involve using composites or bioplastics, which can be created from renewable resources and are less harmful to the environment. Furthermore, producers may need to establish new supply chain strategies to maintain a consistent and reliable flow of raw materials.

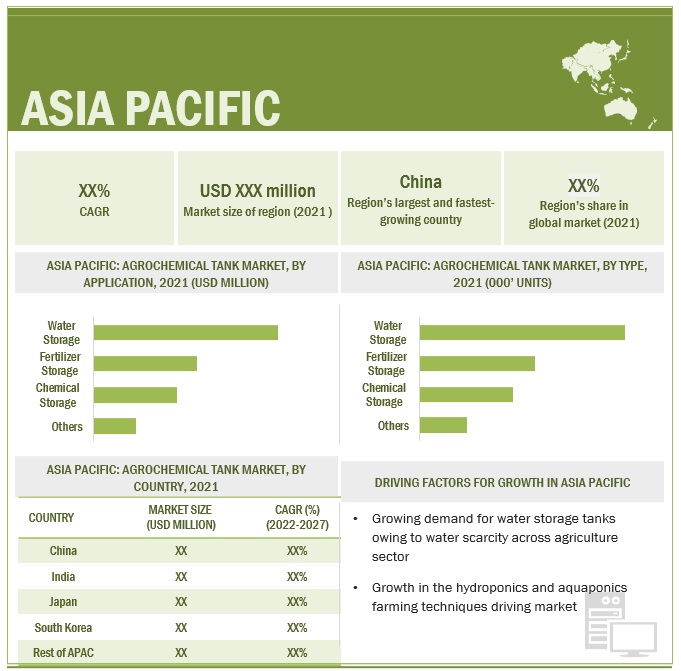

Asia Pacific is expected to dominate the global Agrochemical tanks market

The Asia Pacific region is expected to dominate the worldwide agrochemical tanks market in the future years. This expansion can be linked to numerous important factors, including rising food demand, the expansion of the agriculture business, and the increased usage of agrochemicals in the region. The Asia Pacific region's population is quickly increasing, as is food consumption. To meet this demand, the region's agriculture business is developing, which is generating demand for agrochemicals such as fertilisers and insecticides. The increased usage of these agrochemicals is boosting the demand for storage solutions, such as agrochemical tanks, in the region. The Asia Pacific region is also home to some of the world's major agricultural economies, including China and India. These economies are heavily investing in agriculture, fueling demand for agrochemicals and related storage solutions. The Asia Pacific area also has some of the most advanced agricultural technologies and practises in the world. Precision agriculture, for example, is growing increasingly popular in the region, raising demand for agrochemical tanks that can be easily incorporated into these systems. This tendency is projected to continue in the future years, fueling the growth of the region's agrochemical tanks market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the global Agrochemical Tanks market are Rotoplas(Maxico), Synder Industries(US), Polymaster(Australia), Sintex(India), Enduramaxx(UK).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Application, Type, Size, Region. |

|

Geographies covered |

Asia Pacific, North America, South America , Europe, and Middle East & Africa |

|

Companies covered |

market Rotoplas(Maxico), Synder Industries(US), Polymaster(Australia), Sintex(India), Enduramaxx(UK), LF manufracturing(US), Assmann Corporation(US),Sherman rototank(Texas), Poly Processing(Louisiana), Tank holding corporation(USA), |

This research report categorizes the Agrochemical storage Tanks market based on by type, by application by size and region.

Based on By Type, the Agrochemical Tanks market has been segmented as follows:

- Vertical Tanks

- Conical Tans

- Horizontal Tanks

-

Others

- Mother Tanks

- PCU Tanks

Based on Application, the Agrochemical Tanks market has been segmented as follows:

- Water Storage tanks

- Chemical Storage tanks

- Fertilizer Storage tanks

- Others

- Wine/Fuel Storage tanks

Based on By Size, the Agrochemical Tanks market has been segmented as follows:

- 200 – 500 liters

- 500 -1000 liters

- 1000 – 15000 liters

- 15000 – 30000 liters

- <30,000 liters

Based on the region, the Agrochemical Tanks market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In June 2018, Rotoplas acquired IPS specializing in the manufacturing of pipes and connections in Argentina. And with this acquisition the company has become the largest provider of polypropylene pipes in the Americas.

- In June 2013, Snyder industries developed the revolutionary chemical injection tanks system to help optimize process within oil and gas drilling market segment

Frequently Asked Questions (FAQ):

What is the current size of the Agrochemical Tanks market?

The current market size of the global Agrochemical Tanks market is 1.3 billion in 2022.

What are the major drivers for Agrochemical Tanks market?

- Rising adoption of tanks due to limited availability of water.

- Growing water harvesting trends in agriculture.

Which is the fastest-growing region during the forecasted period in the Agrochemical Tanks market?

Asia Pacific accounted for the largest market share in 2021. The Asia Pacific region is expected to dominate the worldwide agrochemical tanks market in the future years. This expansion can be linked to numerous important factors, including rising food demand, the expansion of the agriculture business, and the increased usage of agrochemicals in the region

Which is the fastest-growing segment, by Application the forecasted period in Agrochemical Tanks market?

Fertilizer storage tanks are the fastest growing market segment. This expansion is being driven by the increased usage of fertilisers in agriculture as farmers strive to increase crop yields and productivity. Fertilizer storage tanks offer a safe and secure solution to store these vital nutrients, ensuring that they are readily available when needed. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of agrochemical tanks due to limited availability of water- Growing trends in water harvestingRESTRAINTS- Stringent regulations governing production of agrochemical tanksOPPORTUNITIES- Surge in investments in new technologies- Growing use of hydroponics and aquaponics in agricultureCHALLENGES- Fluctuation in commodity prices- Limited availability of raw materials

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREATS FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 IMPACT OF COVID-19

- 6.2 AVERAGE PRICE ANALYSIS, BY REGION

-

6.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSADDITIVE SUPPLIERS- Fillers- Plasticizers- Stabilizers- Other additivesPOLYMER MANUFACTURERSTANK MANUFACTURERSDISTRIBUTORSEND-CONSUMERS

-

6.4 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

6.5 AGROCHEMICAL TANKS MARKET REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS

-

6.6 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET PLAYERS

-

6.8 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 VERTICALRISING DEMAND FOR HIGH-CAPACITY AGRICULTURAL STORAGE TANKS

-

7.3 HORIZONTALINCREASING NEED FOR FERTILIZER TRANSPORTATION

-

7.4 CONICALRISE IN DEMAND FROM COMMERCIAL AND MANUFACTURING SECTORS

- 7.5 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 200–500 LITERSAPPROPRIATE FOR SMALL AND MEDIUM-SIZED FARMS

-

8.3 500–1,000 LITERSGROWING DEMAND FOR TANKS WITH HIGH TOLERANCE TOWARD TEMPERATURE CHANGES

-

8.4 1,000–15,000 LITERSHIGH USE OF CHEMICALS AND FERTILIZERS

-

8.5 15,000–30,000 LITERSGROWING DEMAND FOR TANKS WITH STRONG WALLS

-

8.6 >30,000 LITERSINCREASE IN WATER HARVESTING

- 9.1 INTRODUCTION

-

9.2 WATER STORAGEINCREASING CONCERNS REGARDING RAINWATER HARVESTING

-

9.3 CHEMICAL STORAGEGROWING USE OF CHEMICALS IN AGRICULTURE

-

9.4 FERTILIZER STORAGEHIGH CONSUMPTION OF FERTILIZERS TO INCREASE AGRICULTURAL OUTPUT

- 9.5 OTHER APPLICATIONS

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

-

10.3 RECESSION IMPACTCHINA- Financial support by government to induce mechanization, industrialization, and productivityJAPAN- Growing use of hydroponics and aeroponics in farmingINDIA- Limited supply of water in farmsSOUTH KOREA- Growing use of fertilizers and chemicalsREST OF ASIA PACIFIC

- 10.4 NORTH AMERICA

-

10.5 RECESSION IMPACTUS- Advancements in agriculture and livestockCANADA- Rising diversification to enhance farming practicesMEXICO- Rising demand for fertilizer tanks

-

10.6 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Significant agricultural outputSOUTH AFRICA- Growing adoption of enhanced agricultural techniquesREST OF MIDDLE EAST & AFRICA

- 10.7 EUROPE

-

10.8 RECESSION IMPACTUK- Growing use of liquid fertilizers as alternativesFRANCE- High consumption and storage of fertilizersGERMANY- Rising food consumption to boost modern agricultural practicesITALY- Increasing need for significant amount of water during dry spellsSPAIN- Growing preference for hydroponic farming over conventional farmingREST OF EUROPE

- 10.9 SOUTH AMERICA

-

10.10 RECESSION IMPACTBRAZIL- Steady increase in agricultural area and productionPERU- Growing adoption of modern agricultural practicesREST OF SOUTH AMERICA

- 11.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2021

-

11.3 EVALUATION MATRIX/QUADRANT FOR KEY PLAYERS, 2021STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

11.4 EVALUATION QUADRANT FOR STARTUPS/SMES, 2021PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.5 COMPETITIVE BENCHMARKING

- 11.6 AGROCHEMICAL TANKS MARKET: COMPANY FOOTPRINT

- 11.7 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSGRUPO ROTOPLAS S.A.B. DE C.V- Business overview- Products offered- MnM viewSNYDER INDUSTRIES- Business overview- Products offered- MnM viewPOLYMASTER- Business overview- Products offeredSINTEX- Business overview- Products offered- MnM viewENDURAMAXX- Business overview- Products offeredLF MANUFACTURING- Business overview- Products offered- Recent developments- MnM viewASSMAN CORPORATION- Business overview- Products offeredSHERMAN ROTO TANK- Business overview- Products offeredPOLY PROCESSING SOLUTIONS- Business overview- Products offered- MnM viewTANK HOLDING CORP.- Business overview- Products offered

-

12.2 OTHER PLAYERSNEL TANKSMERIDIAN MANUFACTURING INCBALMORAL TANKS LTD.FORTI TECHNOLOGY GROUPSIEGEN PHILIPPINES CORPORATIONPRETTECH MACHINERY MAKING CO. LTD.BNH GAS TANKSHIGHBERG SOLUTIONSF.LLI SAVI DI SAVI DARIO & C.SNCJOSHI AGRO INDUSTRIESSTAFCOAGROCHEM INC.TCE PLASTICSBALSON POLYPLAST PVT. LTD.NATIONAL TANK OUTLET

- 13.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 AGROCHEMICAL TANKS MARKET SNAPSHOT

- TABLE 2 PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 AVERAGE PRICE TRENDS, BY REGION (USD PER UNIT)

- TABLE 4 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019–2027

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AGROCHEMICAL TANKS MARKET: STANDARDS AND REGULATIONS

- TABLE 9 EXPORT SCENARIO FOR HS CODE: 392510, BY KEY COUNTRIES, 2021 (USD MILLION)

- TABLE 10 IMPORT SCENARIO FOR HS CODE: 392510, BY KEY COUNTRIES, 2021 (USD MILLION)

- TABLE 11 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR AGROCHEMICAL TANKS

- TABLE 12 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 13 AGROCHEMICAL TANKS MARKET, BY TYPE, 2018–2027 (USD MILLION)

- TABLE 14 AGROCHEMICAL TANKS MARKET, BY TYPE, 2018–2027 (‘000 UNITS)

- TABLE 15 AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (USD MILLION)

- TABLE 16 AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (‘000 UNITS)

- TABLE 17 AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 18 AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 19 WATER STORAGE: AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (USD MILLION)

- TABLE 20 WATER STORAGE: AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (‘000 UNITS)

- TABLE 21 CHEMICAL STORAGE: AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (USD MILLION)

- TABLE 22 CHEMICAL STORAGE: AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (‘000 UNITS)

- TABLE 23 FERTILIZER STORAGE: AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (USD MILLION)

- TABLE 24 FERTILIZER STORAGE: AGROCHEMICAL TANKS MARKET, BY SIZE, 2018–2027 (‘000 UNITS)

- TABLE 25 AGROCHEMICAL TANKS MARKET, BY REGION, 2018–2027 (USD MILLION)

- TABLE 26 AGROCHEMICAL TANKS MARKET, BY REGION, 2018–2027 (‘000 UNITS)

- TABLE 27 AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 28 AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 29 ASIA PACIFIC: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (‘000 UNITS)

- TABLE 31 ASIA PACIFIC: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 33 CHINA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 34 CHINA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 35 JAPAN: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 36 JAPAN: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 37 INDIA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 38 INDIA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

- TABLE 39 SOUTH KOREA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 40 SOUTH KOREA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 41 REST OF ASIA PACIFIC: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 42 REST OF ASIA PACIFIC: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 43 NORTH AMERICA: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2022–2027 (‘000 UNITS)

- TABLE 45 NORTH AMERICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 47 US: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 48 US: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 49 US: AGROCHEMICAL TANKS MARKET, BY REGION, 2018–2027 (USD MILLION)

- TABLE 50 CANADA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 51 CANADA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 52 MEXICO: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 53 MEXICO: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 54 MIDDLE EAST & AFRICA: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

- TABLE 55 MIDDLE EAST & AFRICA: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (‘000 UNITS)

- TABLE 56 MIDDLE EAST & AFRICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 57 MIDDLE EAST & AFRICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 58 SAUDI ARABIA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 59 SAUDI ARABIA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 60 SOUTH AFRICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 61 SOUTH AFRICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 62 REST OF MIDDLE EAST & AFRICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 63 REST OF MIDDLE EAST & AFRICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 64 EUROPE: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

- TABLE 65 EUROPE: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (‘000 UNITS)

- TABLE 66 EUROPE: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 67 EUROPE: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 68 UK: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 69 UK: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 70 FRANCE: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 71 FRANCE: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 72 GERMANY: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 73 GERMANY: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 74 ITALY: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 75 ITALY: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 76 SPAIN: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 77 SPAIN: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 78 REST OF EUROPE: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 79 REST OF EUROPE: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 80 SOUTH AMERICA: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (USD MILLION)

- TABLE 81 SOUTH AMERICA: AGROCHEMICAL TANKS MARKET, BY COUNTRY, 2018–2027 (‘000 UNITS )

- TABLE 82 SOUTH AMERICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 83 SOUTH AMERICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 84 BRAZIL: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 85 BRAZIL: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2022–2027 (‘000 UNITS)

- TABLE 86 PERU: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 87 PERU: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 88 REST OF SOUTH AMERICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (USD MILLION)

- TABLE 89 REST OF SOUTH AMERICA: AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2018–2027 (‘000 UNITS)

- TABLE 90 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 91 LIST OF STARTUPS/SMES, 2021

- TABLE 92 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY APPLICATION, 2021

- TABLE 93 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY SIZE, 2021

- TABLE 94 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY TYPE, 2021

- TABLE 95 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION, 2021

- TABLE 96 COMPANY FOOTPRINT FOR KEY PLAYERS, BY APPLICATION, 2021

- TABLE 97 COMPANY FOOTPRINT FOR KEY PLAYERS, BY TYPE, 2021

- TABLE 98 COMPANY FOOTPRINT FOR KEY PLAYERS, BY SIZE, 2021

- TABLE 99 COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION, 2021

- TABLE 100 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS, 2021

- TABLE 101 AGROCHEMICAL TANKS MARKET: PRODUCT LAUNCHES, 2013

- TABLE 102 AGROCHEMICAL TANKS MARKET: DEALS, 2018

- TABLE 103 GRUPO ROTOPLAS S.A.B. DE C.V.: COMPANY OVERVIEW

- TABLE 104 GRUPO ROTOPLAS S.A.B. DE C.V.: PRODUCT OFFERINGS

- TABLE 105 SNYDER INDUSTRIES: COMPANY OVERVIEW

- TABLE 106 SNYDER INDUSTRIES: PRODUCT OFFERINGS

- TABLE 107 POLYMASTER: COMPANY OVERVIEW

- TABLE 108 POLYMASTER: PRODUCT OFFERINGS

- TABLE 109 SINTEX: COMPANY OVERVIEW

- TABLE 110 SINTEX: PRODUCT OFFERINGS

- TABLE 111 ENDURAMAXX: COMPANY OVERVIEW

- TABLE 112 ENDURAMAXX: PRODUCT OFFERINGS

- TABLE 113 LF MANUFACTURING: COMPANY OVERVIEW

- TABLE 114 LF MANUFACTURING: PRODUCT OFFERINGS

- TABLE 116 ASSMANN CORPORATION: BUSINESS OVERVIEW

- TABLE 117 ASSMANN CORPORATION: PRODUCTS OFFERED

- TABLE 118 SHERMANN ROTO TANK: BUSINESS OVERVIEW

- TABLE 119 SHERMANN ROTO TANK: PRODUCTS OFFERED

- TABLE 120 POLYPROCESSING SOLUTIONS: BUSINESS OVERVIEW

- TABLE 121 POLYPROCESSING SOLUTIONS: PRODUCTS OFFERED

- TABLE 122 TANK HOLDING CORP.: BUSINESS OVERVIEW

- TABLE 123 TANK HOLDING CORP.: PRODUCTS OFFERED

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE CALCULATION

- FIGURE 7 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR AGROCHEMICAL TANKS

- FIGURE 8 NORTH AMERICA TO LEAD MARKET IN 2022

- FIGURE 9 WATER STORAGE SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 10 15,000–30,000 LITERS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 VERTICAL STORAGE SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 12 RISING NEED FOR STORAGE SOLUTIONS IN AGRICULTURAL SECTOR TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 VERTICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 15 WATER STORAGE SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 16 WATER STORAGE AND CHINA ACCOUNTED FOR SIGNIFICANT SHARE IN 2021

- FIGURE 17 AGROCHEMICAL TANKS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 REVENUE SHIFT OF AGROCHEMICAL TANK PROVIDERS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR AGROCHEMICAL TANKS

- FIGURE 22 KEY BUYING CRITERIA FOR AGROCHEMICAL TANKS

- FIGURE 23 VERTICAL TANKS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

- FIGURE 24 15,000–30,000 LITERS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2022

- FIGURE 25 AGROCHEMICAL TANKS MARKET, BY APPLICATION, 2021

- FIGURE 26 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC: AGROCHEMICAL TANKS MARKET SNAPSHOT

- FIGURE 28 NORTH AMERICA: AGROCHEMICAL TANKS MARKET SNAPSHOT

- FIGURE 29 EUROPE: AGROCHEMICAL TANKS MARKET SNAPSHOT

- FIGURE 30 RANKING OF TOP 5 PLAYERS, 2021

- FIGURE 31 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- FIGURE 32 EVALUATION MATRIX FOR KEY PLAYERS, 2021

- FIGURE 33 EVALUATION QUADRANT FOR STARTUPS/SMES, 2021

- FIGURE 34 GRUPO ROTOPLAS S.A.B. DE C.V.: COMPANY SNAPSHOT

- FIGURE 35 SINTEX: COMPANY SNAPSHOT

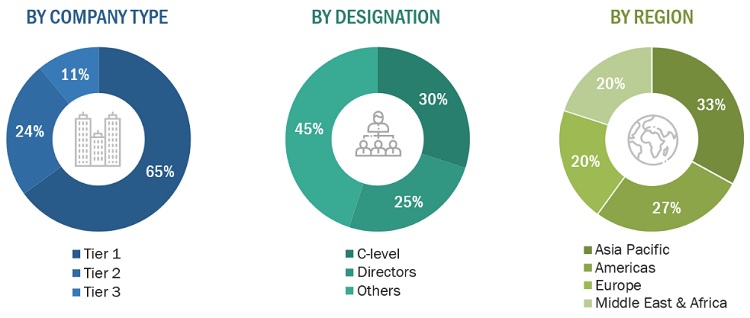

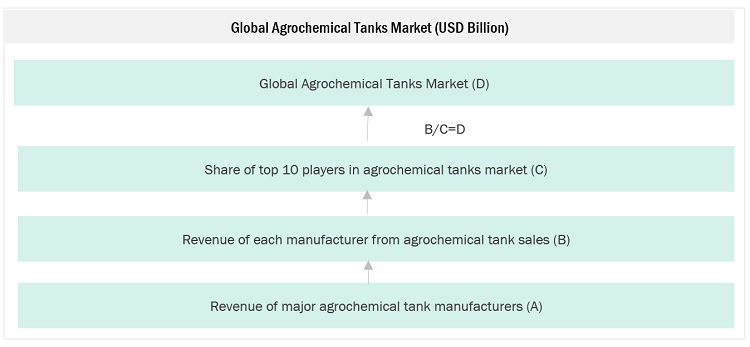

This study involved two major activities in estimating the current size of the Agrochemical Tanks market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the Agrochemical tanks market involved the extensive use of secondary sources referred to for this research study include press releases, white papers, certified publications, articles by recognized authors, directories, and databases of various companies and associations. Secondary research was used to obtain key information about the supply chain of the industry, key players offering various Agrochemical Tanks components, market classification, and segmentation according to the offerings of the leading players along with the industry trends to the bottommost level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

In the primary research process, primary sources from the supply side were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as chief executive officers (CEO), assistant general managers, nuclear design engineers, R&D test engineers, project officers, business development managers, and related key executives from various companies and organizations operating in the Agrochemical Tanks market. In the complete market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process to list key information/insights throughout the report.

The breakdown of primary respondents is given below:

Note: Other designations include sales managers, engineers, and regional managers. The tiers of companies are defined based on their total revenue as of 2020; Tier 1: revenue more than USD 1 billion, Tier 2: revenue between USD 500 million and USD 1 billion, and Tier 3: revenue lesser than USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the Agrochemical Tanks market and its dependent submarkets. The key players in the market were identified through secondary research. The research methodology included the study of the top market players and interviews with industry experts, such as chief executive officers (CEO), assistant general managers, nuclear design engineers, R&D test engineers, project officers, and business development managers, for key quantitative and qualitative insights related to the Agrochemical Tanks market. The following sections provide details about the overall market size estimation process employed in this study.

- The key players in the industry and market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Nuclear Power plant & Equipment marketMarket Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. Data triangulation procedure has been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from the demand side. Along with this, the market size has been validated using top-down and bottom-up approaches.

Report Objectives

- To define and describe the agrochemical tanks market based on type, size, and application, in terms of value & volume.

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To estimate the market size in terms of value & volume.

- To strategically analyze micromarkets1 with respect to individual growth trends, future expansions, and their contributions to the overall agrochemical tanks market.

- To provide post-pandemic estimation for the agrochemical tanks market and analyze the impact of the pandemic on market growth.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders.

- To forecast the growth of the agrochemical tanks market with respect to five key regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries.

- To strategically profile the key players and comprehensively analyze their core competencies2.

- To analyze competitive developments, such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the agrochemical tanks market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agrochemical Tank Market