Specialty Fertilizers Market by Technology (Controlled-release Fertilizers, Micronutrients, Water Soluble Fertilizers, and Liquid Fertilizers), Form (Dry and Liquid), Application Method, Type, Crop Type and Region - Global Forecast to 2027

Global Specialty Fertilizers Market Report

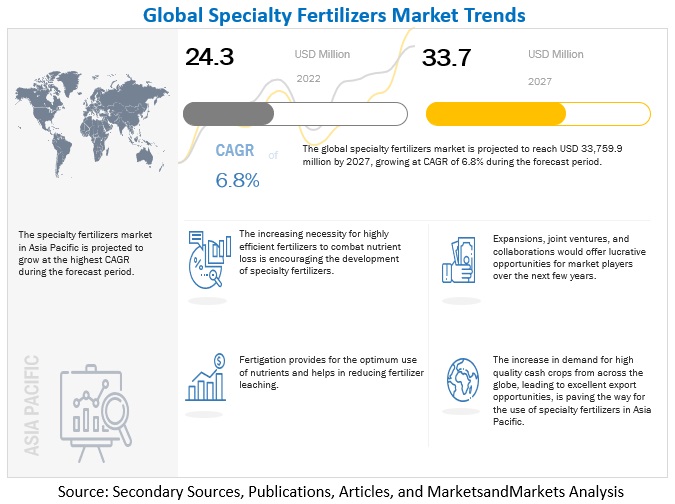

The global specialty fertilizers market, valued at USD 24.3 billion in 2022, is projected to grow to USD 33.7 billion by 2027, with a compound annual growth rate (CAGR) of 6.8%. The high nutrient use efficiency and precise & localized application associated with the specialty fertilizers help reduce growers’ dependency on commercial fertilizer usage and simultaneously achieve higher quality crops and yields with a lower environmental impact. This trend is expected to drive the market significantly in value sales during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Favorable government policies and regulations

Government policies and regulations have always been one of the key factors propelling and promoting the production of a particular commodity or system.

Labeling and manufacturing guidelines for specialty fertilizers, which serve as a mark of a superior standard or trust, have been mandatorily adopted and regulated in many nations, especially the US and European countries. Domestic fertilizer regulatory agencies promote these products under government policy frameworks to minimize the environmental hazards caused by leaching and nutrient loss. For instance, China’s guiding catalog of Industrial Infrastructure Adjustment (2011 edition) classified CRFs as encouraging items, indicating the development of CRFs to speed up during China’s 13th five-year plan from 2016–2020.

The five-year plan indicates reduced use of pesticides and fertilizers and the introduction of water, food control, and safety management. During the last 15 years, the share of CRF has witnessed a growth rate of 6% in the country. China has included water-soluble micronutrients under record filing, which is one way to register fertilizers, as it is easier and does not require explicit administrative approval. The European fertilizer industry has made huge improvements in the energy efficiency of its ammonia production through European Green Deal. In the future, ammonia will be produced with zero or near-zero carbon footprint. The government of India has imposed no restrictions on the import of MOP. To trade MOP as fertilizers in the country, the importer must obtain a license/registration under FCO from the states/UTs where the importer intends to sell the same. They also provide concession—to claim it under the Concession Scheme, the importer must apply to the Department of Fertilizers to be listed as an importer under the guidelines on the Concession Scheme issued on 5.8.2002. Such government policies and well-defined regulations act as a boosting factor for the growth of this market at the global level.

Restraints: Improper management of controlled-release fertilizers

The application costs of CRFs are comparatively low due to the fewer labor requirements and reduced application cycles. However, training and management of CRFs are prerequisites for adopting the technology. Improper application methods and storage techniques can deteriorate the results expected from these fertilizers. Furthermore, there is a lack of awareness about the brands in the market due to the unorganized market presence. Despite considerable efforts by agronomists, most farmers do not prefer CRFs.

The mixing rate of fertilizers for fertigation or soil application is of prime importance to ensure proper diffusion of the nutrients into the soil and avoid nutrient leaching. On the contrary, managing conventional fertilizers requires minimal conditions; hence, farmers show a high preference for using conventional fertilizers. Appropriate training/knowledge to the farmers on controlled-release technology and management of these fertilizers must be provided to fully utilize their benefits to increase crop productivity. Regulated labeling of CRFs, such as in the US, emphasizing the directions of use and hazards associated (serious soil degradation, nitrogen leaching, soil compaction, reduction in soil organic matter, and loss of soil carbon) with improper management, must be encouraged across the globe.

The Asia Pacific is one of the leading markets for CRFs due to its large agricultural area and the rising awareness about sustainable cultivation to meet the growing food demand. Hence, government awareness campaigns in developing countries could encourage more farmers to adopt this technology.

Opportunities: Crop-specific nutrient management through precision farming

Precision agriculture focuses on growing crops efficiently in a site-specific manner with specialized application equipment, which can help retain water and nutrients in the root zone. The work scheme of precision agriculture can be summarized in three stages:

- Geo-referenced remote area information using certain sensors

- Analysis of data obtained through an appropriate system of information processing

- Adjustment of the amount applied depending on the needs of each location

Precision farming can improve production and nutrient use efficiency, ensuring that nutrients do not leach from or accumulate in excessive concentrations in parts of the field. Precision farming has been gaining importance in developed countries for efficient usage of fertigation. The release patterns and coating technology of CRFs can be fed into the information system for an accurate analysis of the nutrient requirements of crops, the application rate, and the mixing ratio required within the fertigation system. Precision agriculture involves a growing range of digital technologies to make farming more efficient while increasing crop yields and quality.

Various precision agriculture tools support the 4Rs by helping farmers monitor and meet crops’ nutrient needs, such as soil sensors, variable rate prescriptions, yield maps, decision support software, soil mapping, multispectral imaging, auto-guidance systems, and leaf color charts. Precision farming also combines data analytics, AI, and sensor systems to determine how much fertilizer and water plants need at any given time and by deploying autonomous vehicles to deliver nutrients in prescribed amounts and locations. Installing precision systems is costly, so only large-scale operations tend to have them. In contrast, precision farming using CRFs is a sustainable approach. Advanced CRFs are inexpensive and could be a front-line technology to help farmers sustainably increase crop production.

Challenges: Lack of domestic infrastructure for manufacturing specialty fertilizers in India

India is agriculture-dependent, with the agricultural sector meeting most of the total demand. Agriculture is the most important end-user sector for fertilizers, and demand is increasing rapidly. Due to limited domestic availability, India imports fertilizers such as muriate of potash (MOP) and other specialty fertilizers.

According to Gujarat State Fertilizers & Chemicals Limited, India consumes about 1.25 lakh tons of calcium nitrate, a water-soluble fertilizer, worth INR 225 crore per year, which is completely imported; about 76% comes from China. The import of water-soluble fertilizers is higher as compared to domestic production, with more than 80% potassium nitrate (13-0-45), 95% potassium sulfate (0-0-50), and mono-ammonium phosphate (12-61-0) being imported. Only 16% of the total demand for specialty fertilizers is met through domestic production because of a lack of technologies and high production costs.

However, India’s Rashtriya Chemicals and Fertilizers Ltd, National Fertilizers Ltd, Madras Fertilizers Ltd, Fertilisers and Chemicals Travancore, and India Potash Ltd. are expected to sign a three-year deal for potash, and specialty fertilizers with Russian companies, including Phosagro and Uralkali in 2022, to meet the demand for fertilizers in the country, which may help alleviate the effects of this challenge.

UAN Provides Prolonged Nutrition to the Plants and have High Application Efficiency

UAN is one of the predominant nitrogen fertilizer sources used on pastures in the US. It provides prolonged nutrition in plants with nitrogen and has high application efficiency in all climatic zones, including dry climates. UAN application is widely used in liquid fertilizer compared to solid and granular types. The Asia Pacific holds the largest share of the specialty fertilizers market for phosphorus, owing to the high production of cereals & grains and fruits & vegetables in China, India, and Japan.

UAN is an excellent irrigation fertilizer for cereal production and irrigated plant cultivation. The application of UAN could significantly increase the yield, promote the absorption and utilization of nitrogen, and reduce the residual amount of soil nitrogen. As a liquid nitrogen fertilizer, UAN is simple to combine with other nutrients or chemicals and is suitable for sprinkler fertigation. It can be mixed with herbicides, pesticides, and other nutrients, allowing farmers to save labor costs by applying multiple materials at once rather than in separate applications.

Micronutrients are Essential for Plant Growth, Which Drives Demand For Micronutrient Fertilizers

Micronutrients consist of a fine blend of mineral elements comprising zinc (Zn), copper (Cu), manganese (Mn), iron (Fe), boron (B), and molybdenum (Mo). Mineral elements nurture horticultural crops, cereals, pulses, oilseeds, spices, and plantations. Despite their low demand, critical plant functions are hindered if micronutrients are unavailable, which results in plant deformations, lower yield, and diminished growth. Micronutrients are crucial for plant growth and play an important role in balancing crop nutrition. Micronutrient deficiency is easily identified from visual symptoms on crops and by testing soil and plant tissues. To understand these visual symptoms, it is necessary to know the role each micronutrient plays in plant growth and development.

Micronutrients are important in crop nutrition because of the increased demand for higher-yielding crops and intensive cropping. Plants require micronutrients in relatively trace amounts, which play an important role in plant metabolism, chlorophyll synthesis, production of carbohydrates, and fruit and seed development. Apart from the direct benefits of increased crop production, micronutrients increase the efficiency of macronutrient fertilizers. The most common method of micronutrient application for crops is soil application.

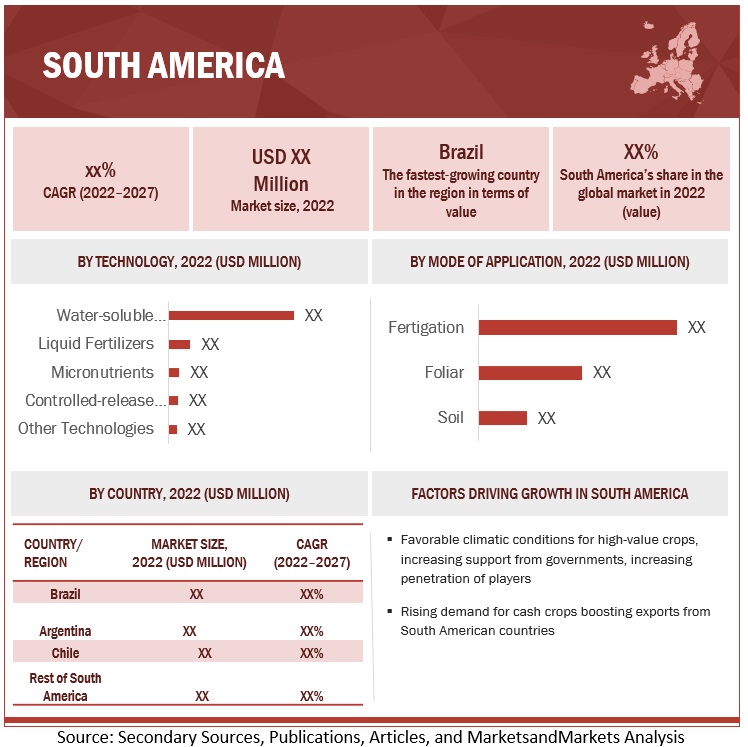

The South America is Growing With the Fastest CAGR During the Forecasted Period

The South American market includes Brazil, Argentina, Chile, and the Rest of South America. According to USDA, Brazil is one of the few nations in the world with the ability to boost agricultural yields and area. The rising adoption of agrochemicals, advancements in farming techniques in Brazil & Argentina, and extensive distribution channels of global agrochemical players are projected to drive market growth.

Brazil and Argentina occupied the major market share for specialty fertilizers in South America in 2021. However, according to FAO, these countries also depend on other nations for fertilizers since domestic production could not meet the rising demand in 2020. The climatic conditions of these countries help in the cultivation of diverse crops. Soybean, sugarcane, corn, rice, fruits, and vegetables are the major crops cultivated in this region.

Other growth drivers include the use of new techniques and technologies to bring unusable and barren lands into productivity. Crop production in South America has risen dramatically in recent decades and is expected to rise further as growers expand the planted area and push for higher yields. This will support specialty fertilizer consumption.

To know about the assumptions considered for the study, download the pdf brochure

Specialty Fertilizers Market Share

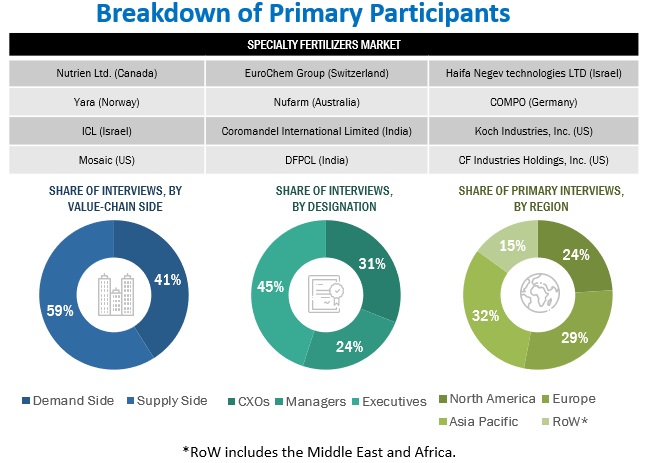

The key players in this market include Nutrien Ltd. (Canada), Yara (Norway), ICL (Israel), The Mosaic Company (US), CF Industries and Holdings, Inc. (US), Nufarm (Australia), SQM SA (Chile), OCP Group (Morocco), Kingenta (China), K+S Aktiengesellschaft (Germany), OCI Nitrogen (Netherlands), EuroChem (Switzerland), Coromandel International Limited (India), Zuari Agro Chemicals Ltd. (India), and Deepak Fertilizers and Petrochemicals Corporation Limited (India)

Report Scope

|

Report Metric |

Details |

|

Market Size Forecast 2027 |

USD 33.7 billion |

|

Market Size at 2022 |

USD 24.3 billion |

|

Growth Rate |

CAGR of 6.8 % from 2022 to 2027 |

|

Currency and Unit |

USD |

|

Research Duration Considered |

2022-2027 |

|

Historical Base Year |

2021 |

|

Segmentation |

|

|

Growing Market Geographies |

|

|

Dominant Geography |

North America |

|

Key Companies Profiled |

|

Scope of the Report

This research report categorizes the specialty fertilizers market, based on type, technology, form, application method, crop type and region

By Type

- Urea Ammonium Nitrate (UAN)

- Calcium Ammonium Nitrate (CAN)

- Monoammonium Phosphate (MAP)

- Sulfate of Potash (SOP)

- Potassium Nitrate

- Urea Derivatives

- Blends of NPK

- Other Types*

By Technology

- Controlled-release Fertilizers

- Water-soluble Fertilizers

- Liquid Fertilizers

- Micronutrients

- Other Technologies*

By Form

- Dry

- Liquid

By Application Methods

- Fertigation

- Foliar

- Soil

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Crops*

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)**

* Other types include ammonium sulfate, ammonium nitrate, monopotassium phosphate (MKP), and muriate of potash (MOP).

* Other technologies include customized fertilizers and fortified fertilizers.

*Other crops include turf & ornamental, plantation crops, fiber crops, and silage & forage.

**Rest of the World (RoW) includes the Middle East and Africa.

Target Audience:

- Specialty fertilizers raw material suppliers

- Specialty fertilizer manufacturers

- Intermediate suppliers, such as traders and distributors of specialty fertilizers

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- World Health Organization (WHO)

- European Food Safety Authority (EFSA)

- U.S. Food and Drug Administration

- Environmental Protection Agency

Specialty Fertilizers Industry News

- In September 2022, ICL launched Eqo.x, a rapidly biodegradable release technology for open-field agriculture. The solution will help farmers maximize agricultural crop performance by reducing nutrient loss and increasing NUE to 80%.

- In September 2022, Coromandel launched an organic specialty fertilizer, Cumist Calcium. The new product will provide specialty nutrients and improve efficiency and soil health. The product launch will help Coromandel broaden its specialty fertilizer portfolio.

- In June 2022, K+S signed an agreement with Cinis Fertilizer for the synthetic production of SOP. K+S intended to supply Cinis Fertilizer with its entire MOP requirements. In return, K+S Aktiengesellschaft could purchase up to 600,000 tons of SOP per year from Cinis Fertilizer.

- In June 2022, ICL announced a long-term agreement with India Potash Limited (India) to supply polysulfate through 2026 with a renewable option. The availability of polysulfate is expected to boost the Government of India’s organic agriculture program. It will also help ICL penetrate and serve the Indian market’s potential for specialty fertilizers.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the specialty fertilizers market?

The specialty fertilizers market is expected to grow in Asia Pacific and is expected to dominate during the forecast period, the fertilizer industry in most Asia Pacific countries has shifted from developing fertilizer grades to technology up-gradation, management, and sustainability of fertilizers. The projected growth rate of the Japanese market is also high compared to other regions due to the precision and advanced farming systems and controlled-environment agriculture.

What is the current size of the global specialty fertilizers market?

The global specialty fertilizers market size is estimated to be valued at USD 24.3 billion in 2022 and is projected to reach USD 33.7 billion by 2027, recording a CAGR of 6.8% in terms of value.

Which are the key players in the market, and how intense is the competition?

The key players in this market include Nutrien Ltd. (Canada), Yara (Norway), ICL (Israel), The Mosaic Company (US), CF Industries and Holdings, Inc. (US), Nufarm (Australia), SQM SA (Chile), OCP Group (Morocco), Kingenta (China), K+S Aktiengesellschaft (Germany), OCI Nitrogen (Netherlands), EuroChem (Switzerland), Coromandel International Limited (India), Zuari Agro Chemicals Ltd. (India), and Deepak Fertilizers and Petrochemicals Corporation Limited (India). The global specialty fertilizers market witnesses increased scope for growth. The market is seeing an increase in the number of mergers and acquisitions and new product launches. Moreover, the companies involved in the production of specialty fertilizers are investing a considerable proportion of their revenues in research and development activities. .

What are the benefits of using specialty fertilizers?

Specialty fertilizers offer several advantages, including improved nutrient uptake efficiency, reduced environmental impact due to minimized nutrient leaching, enhanced crop quality and yield, and better soil health over time. They also allow for more precise management of nutrient requirements, leading to optimized plant growth and reduced fertilizer wastage.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2021

1.7 UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

FIGURE 2 SPECIALTY FERTILIZERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 SPECIALTY FERTILIZERS MARKET SIZE ESTIMATION (DEMAND-SIDE)

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 6 SPECIALTY FERTILIZERS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY-SIDE)

FIGURE 7 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 ASSUMPTIONS

TABLE 2 ASSUMPTIONS

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

TABLE 3 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 55)

TABLE 4 SPECIALTY FERTILIZERS MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 9 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY FORM, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY CROP TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SPECIALTY FERTILIZERS MARKET

FIGURE 15 GROWING NEED FOR HIGH-EFFICIENCY FERTILIZERS TO DRIVE MARKET GROWTH

4.2 SPECIALTY FERTILIZERS MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO DOMINATE THE SPECIALTY FERTILIZERS MARKET IN TERMS OF VALUE

4.3 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY

FIGURE 17 WATER-SOLUBLE FERTILIZERS TO ACCOUNT FOR LARGEST MARKET SHARE

FIGURE 18 MONOAMMONIUM PHOSPHATE TO GROW AT THE HIGHEST CAGR IN TERMS OF VOLUME

4.4 SPECIALTY FERTILIZERS MARKET, BY FORM

FIGURE 19 DRY SPECIALTY FERTILIZERS HOLD LARGER MARKET SHARE

4.5 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION

FIGURE 20 FERTIGATION TO REGISTER LARGEST MARKET SIZE

4.6 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE

FIGURE 21 CEREALS & PULSES DOMINATE CROP MARKET OVER FORECAST PERIOD

4.7 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY KEY TECHNOLOGY & COUNTRY

FIGURE 22 CHINA AND WATER-SOLUBLE FERTILIZERS ACCOUNT FOR SIGNIFICANT SHARES

FIGURE 23 VIETNAM, GERMANY, AND BRAZIL TO GROW AT HIGH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 67)

5.1 INTRODUCTION

5.2 MACROINDICATORS

5.2.1 RISING CROP LOSSES DUE TO SOIL DEGRADATION

5.2.2 RISING IMPORTANCE OF MICRONUTRIENTS IN HUMAN CONSUMPTION

FIGURE 24 DEFICIENCY OF MACRO AND MICRONUTRIENTS IN INDIAN SOIL, 2019

5.3 MARKET DYNAMICS

FIGURE 25 SPECIALTY FERTILIZERS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Need to switch to efficient fertilizers to avoid environmental concerns

FIGURE 26 FACTORS CONTRIBUTING TO WATER POLLUTION

5.3.1.2 Favorable government policies and regulations

5.3.1.3 Easy application and usage of specialty fertilizers

5.3.2 RESTRAINTS

5.3.2.1 High R&D costs

5.3.2.2 Improper management of controlled-release fertilizers

5.3.2.3 High handling costs of liquid fertilizers

5.3.3 OPPORTUNITIES

5.3.3.1 Product innovations and technological advancements in specialty fertilizers

5.3.3.2 Crop-specific nutrient management through precision farming

5.3.4 CHALLENGES

5.3.4.1 Rising prices of specialty fertilizers

FIGURE 27 FERTILIZER AFFORDABILITY INDEX (UREA, MOP), 2014–2022

5.3.4.2 Lack of domestic infrastructure for manufacturing specialty fertilizers in India

6 INDUSTRY TRENDS (Page No. - 77)

6.1 OVERVIEW

6.2 REGULATORY FRAMEWORK

6.2.1 NORTH AMERICA

6.2.1.1 US

6.2.1.1.1 California

6.2.1.1.2 Iowa

6.2.1.1.3 Texas

6.2.1.1.4 Minnesota

6.2.1.1.5 Illinois

6.2.1.1.6 Wisconsin

6.2.1.1.7 Pennsylvania

6.2.1.2 Canada

6.2.2 EUROPE

6.2.3 ASIA PACIFIC

6.2.3.1 India

6.2.3.2 China

6.2.3.3 Japan

6.2.4 SOUTH AMERICA

6.2.4.1 Brazil

6.2.5 ROW

6.2.5.1 South Africa

6.2.5.2 Israel

6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.4 PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS APPROVED FOR SPECIALTY FERTILIZERS IN THE GLOBAL MARKET, 2011–2021

FIGURE 29 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR SPECIALTY FERTILIZERS, 2019–2022

TABLE 10 RECENT PATENTS GRANTED FOR SPECIALTY FERTILIZERS MARKET

6.5 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS

6.6 YC-YCC SHIFT

FIGURE 31 TRENDS/DISRUPTIONS IMPACTING BUYERS IN THE SPECIALTY FERTILIZERS MARKET

6.7 MARKET ECOSYSTEM

TABLE 11 SPECIALTY FERTILIZERS MARKET ECOSYSTEM

FIGURE 32 MARKET MAP

6.8 TRADE ANALYSIS

TABLE 12 EXPORT VALUE OF FERTILIZERS INCLUDING MONOAMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

TABLE 13 IMPORT VALUE OF FERTILIZERS INCLUDING MONOAMMONIUM PHOSPHATE, SULFATE OF POTASH, AND AMMONIUM NITRATE FOR KEY COUNTRIES, 2021 (USD THOUSAND)

6.9 AVERAGE SELLING PRICE ANALYSIS

6.9.1 AVERAGE SELLING PRICE ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016–2021

FIGURE 33 PRICING ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016–2021 (USD/KG)

6.9.2 AVERAGE SELLING PRICE ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021

FIGURE 34 PRICING ANALYSIS: SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD/KG)

6.9.3 INDICATIVE PRICING ANALYSIS

FIGURE 35 AVERAGE SELLING PRICES OF DISTINGUISHED PLAYERS FOR TOP THREE TECHNOLOGIES

TABLE 14 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP TECHNOLOGIES IN USD/TON

6.10 TECHNOLOGY ANALYSIS

6.10.1 Y-DROP FERTIGATION

6.10.2 VARIABLE-RATE TECHNOLOGY/APPLICATION

6.11 CASE STUDY ANALYSIS

6.11.1 CASE 1: NEW SUSTAINABLE FERTILIZER INCREASED MICRONUTRIENT BIOAVAILABILITY

6.11.2 CASE 2: USE OF CRF TO CONTROL HBL IN CITRUS PLANTATIONS

6.12 KEY CONFERENCES & EVENTS (2022–2023)

TABLE 15 SPECIALTY FERTILIZERS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.13 KEY STAKEHOLDERS & BUYING CRITERIA

6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 36 INFLUENCE OF STAKEHOLDERS ON THE BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE MODES OF APPLICATION

6.13.2 BUYING CRITERIA

FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES

TABLE 17 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

6.14 PORTER’S FIVE FORCES ANALYSIS

TABLE 18 PORTER’S FIVE FORCES ANALYSIS

6.14.1 THREAT FROM NEW ENTRANTS

6.14.2 THREAT FROM SUBSTITUTES

6.14.3 BARGAINING POWER OF SUPPLIERS

6.14.4 BARGAINING POWER OF BUYERS

6.14.5 INTENSITY OF COMPETITIVE RIVALRY

7 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY (Page No. - 112)

7.1 INTRODUCTION

FIGURE 38 WATER-SOLUBLE FERTILIZERS PROJECTED TO DOMINATE MARKET

TABLE 19 SPECIALTY FERTILIZERS MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 20 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 21 MARKET, BY TECHNOLOGY, 2016–2021 (KILOTONS)

TABLE 22 MARKET, BY TECHNOLOGY, 2022–2027 (KILOTONS)

7.2 CONTROLLED-RELEASE FERTILIZERS

7.2.1 CONTROLLED-RELEASE FERTILIZERS BALANCE PLANT NUTRIENT NEEDS TO PROTECT CROPS

TABLE 23 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2016–2021 (KILOTONS)

TABLE 26 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2022–2027 (KILOTONS)

7.3 WATER-SOLUBLE FERTILIZERS

7.3.1 SIMPLICITY OF USAGE AND EFFICACY IN FERTIGATION TO DRIVE MARKET

TABLE 27 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 29 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2016–2021 (KILOTONS)

TABLE 30 WATER-SOLUBLE FERTILIZERS MARKET, BY REGION, 2022–2027 (KILOTONS)

7.4 LIQUID FERTILIZERS

7.4.1 LIQUID FERTILIZERS OFFER PRECISE FERTILIZER DISTRIBUTION

TABLE 31 LIQUID FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 LIQUID FERTILIZERS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 LIQUID FERTILIZERS MARKET, BY REGION, 2016–2021 (KILOTONS)

TABLE 34 LIQUID FERTILIZERS MARKET, BY REGION, 2022–2027 (KILOTONS)

7.5 MICRONUTRIENTS

7.5.1 MICRONUTRIENTS ESSENTIAL FOR PLANT GROWTH, WHICH DRIVES DEMAND FOR MICRONUTRIENT FERTILIZERS

TABLE 35 MICRONUTRIENTS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 MICRONUTRIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 37 MICRONUTRIENTS MARKET, BY REGION, 2016–2021 (KILOTONS)

TABLE 38 MICRONUTRIENTS MARKET, BY REGION, 2022–2027 (KILOTONS)

7.6 OTHER TECHNOLOGIES

TABLE 39 OTHER TECHNOLOGIES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 OTHER TECHNOLOGIES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 41 OTHER TECHNOLOGIES MARKET, BY REGION, 2016–2021 (KILOTONS)

TABLE 42 OTHER TECHNOLOGIES MARKET, BY REGION, 2022–2027 (KILOTONS)

8 SPECIALTY FERTILIZERS MARKET, BY TYPE (Page No. - 125)

8.1 INTRODUCTION

FIGURE 39 UREA-AMMONIUM NITRATE PROJECTED TO DOMINATE SPECIALTY FERTILIZERS MARKET DURING THE FORECAST PERIOD

TABLE 43 SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 44 MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2 UREA-AMMONIUM NITRATE

8.2.1 REDUCTION OF RESIDUAL AMOUNT OF SOIL NITROGEN DUE TO UAN APPLICATION TO DRIVE MARKET

TABLE 45 UAN SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 CALCIUM AMMONIUM NITRATE

8.3.1 CAN PROTECTS PLANTS, PREVENTS LEAF AND BUD DEFORMATION, AND PROMOTES SOIL HEALTH—KEY FACTORS DRIVING ADOPTION

TABLE 47 CAN SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 MONOAMMONIUM PHOSPHATE

8.4.1 USAGE OF MONOAMMONIUM PHOSPHATE FOR NEUTRAL AND HIGH-PH SOIL TO DRIVE MARKET

TABLE 49 MAP SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 SULFATE OF POTASH

8.5.1 SOP PROVIDES BEST SOURCE OF POTASSIUM AND SULFUR IN CROPS

TABLE 51 SOP SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 POTASSIUM NITRATE

8.6.1 POTASSIUM NITRATE WIDELY USED IN HIGH-VALUE CASH CROPS

TABLE 53 POTASSIUM NITRATE SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 UREA DERIVATIVES

8.7.1 WIDE USAGE OF UREA DERIVATIVE ATTRIBUTED TO HIGH NITROGEN AVAILABILITY

TABLE 55 UREA DERIVATIVE SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 BLENDS OF NPK

8.8.1 BLENDS OF NPK USED TO PROVIDE BALANCED NUTRIENT FEED TO PLANTS

TABLE 57 BLENDS OF NPK SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 BLENDS OF NPK SPECIALTY FERTILIZERS MARKET, BY REGION, 2022–2027 (USD MILLION)

8.9 OTHER SPECIALTY FERTILIZERS

TABLE 59 OTHER SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 OTHER SPECIALTY FERTILIZERS MARKET, BY REGION, 2022–2027 (USD MILLION)

9 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE (Page No. - 139)

9.1 INTRODUCTION

FIGURE 40 CEREALS & GRAINS SEGMENT PROJECTED TO DOMINATE THE SPECIALTY FERTILIZERS MARKET DURING THE FORECAST PERIOD

TABLE 61 SPECIALTY FERTILIZERS MARKET, BY CROP TYPE, 2016–2021 (USD MILLION)

TABLE 62 MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

9.2 CEREALS & GRAINS

9.2.1 EASIER PENETRATION OF ACTIVE INGREDIENTS AND OTHER ADVANTAGES DRIVE USE OF SPECIALTY FERTILIZERS FOR CEREALS & GRAINS

TABLE 63 SPECIALTY FERTILIZERS MARKET FOR CEREALS & GRAINS, BY TYPE, 2016–2021 (USD MILLION)

TABLE 64 MARKET FOR CEREALS & GRAINS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 65 MARKET FOR CEREALS & GRAINS, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 MARKET FOR CEREALS & GRAINS, BY REGION, 2022–2027 (USD MILLION)

9.2.1.1 Corn

9.2.1.1.1 Rising corn consumption driving demand for specialty fertilizers to mitigate nutrient deficiencies

9.2.1.2 Wheat

9.2.1.2.1 Importance of nitrogen in wheat production to drive use of specialty fertilizers

9.2.1.3 Rice

9.2.1.3.1 Foliar application of specialty fertilizers helps overcome root problems in rice plants

9.2.1.4 Other cereals & grains

9.3 OILSEEDS & PULSES

9.3.1 RISING DEMAND FOR HIGH-YIELD AND DISEASE-RESISTANT SOYBEAN SEEDS TO BOOST ADOPTION OF SPECIALTY FERTILIZERS

TABLE 67 SPECIALTY FERTILIZERS MARKET FOR OILSEEDS & PULSES, BY TYPE, 2016–2021 (USD MILLION)

TABLE 68 MARKET FOR OILSEEDS & PULSES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR OILSEEDS & PULSES, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 MARKET FOR OILSEEDS & PULSES, BY REGION, 2022–2027 (USD MILLION)

9.3.1.1 Soybean

9.3.1.1.1 Importance of timing of phosphate application in soybean driving demand for CRFs

9.3.1.2 Sunflower

9.3.1.2.1 Wide applications of sunflower contributing to market growth

9.3.1.3 Other oilseeds & pulses

9.4 FRUITS & VEGETABLES

9.4.1 MICRONUTRIENTS ESSENTIAL FOR FRUITS & VEGETABLES

TABLE 71 SPECIALTY FERTILIZERS MARKET FOR FRUITS & VEGETABLES, BY TYPE, 2016–2021 (USD MILLION)

TABLE 72 MARKET FOR FRUITS & VEGETABLES, BY TYPE, 2022–2027 (USD MILLION)

TABLE 73 MARKET FOR FRUITS & VEGETABLES, BY REGION, 2016–2021 (USD MILLION)

TABLE 74 MARKET FOR FRUITS & VEGETABLES, BY REGION, 2022–2027 (USD MILLION)

9.4.1.1 Pome fruits

9.4.1.1.1 Micronutrients rich in Ca, Mg, and B needed for growth of pome fruits

9.4.1.2 Citrus fruits

9.4.1.2.1 Citrus fertilization with specialty fertilizers produces greater fruit yield

9.4.1.3 Leafy vegetables

9.4.1.3.1 Requirement of micronutrients for growth to drive market

9.4.1.4 Berries

9.4.1.4.1 Fertilization of blueberries with controlled-release fertilizers can help in optimum growth

9.4.1.5 Roots & tuber vegetables

9.4.1.5.1 High nutrient needs to ensure strong demand for fertilizers

9.4.1.6 Other fruits & vegetables

9.5 OTHER CROPS

TABLE 75 SPECIALTY FERTILIZERS MARKET FOR OTHER CROPS, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 MARKET FOR OTHER CROPS, BY REGION, 2022–2027 (USD MILLION)

10 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION (Page No. - 155)

10.1 INTRODUCTION

FIGURE 41 SPECIALTY FERTILIZERS MARKET, BY MODE OF APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 77 MARKET, BY MODE OF APPLICATION, 2016–2021 (USD MILLION)

TABLE 78 MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

10.2 FERTIGATION

10.2.1 REDUCED LEACHING OF FERTILIZERS AND INCREASED ABSORPTION OF NUTRIENTS TO DRIVE USE OF FERTIGATION

TABLE 79 FERTILIZER EFFICIENCY VIA FERTIGATION

TABLE 80 SPECIALTY FERTILIZERS MARKET FOR FERTIGATION, BY REGION, 2016–2021 (USD MILLION)

TABLE 81 MARKET FOR FERTIGATION, BY REGION, 2022–2027 (USD MILLION)

10.3 FOLIAR

10.3.1 USAGE OF FOLIAR MODE OF APPLICATION TO AVOID DEFICIENCIES AND REDUCE STRESS TO DRIVE DEMAND

TABLE 82 SPECIALTY FERTILIZERS MARKET FOR FOLIAR APPLICATIONS, BY REGION, 2016–2021 (USD MILLION)

TABLE 83 MARKET FOR FOLIAR APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

10.4 SOIL

10.4.1 WIDE USAGE OF SOIL APPLICATION TO DRIVE SEGMENT GROWTH

TABLE 84 SPECIALTY FERTILIZERS MARKET FOR SOIL APPLICATIONS, BY REGION, 2016–2021 (USD MILLION)

TABLE 85 MARKET FOR SOIL APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

11 SPECIALTY FERTILIZERS MARKET, BY FORM (Page No. - 162)

11.1 INTRODUCTION

TABLE 86 ADVANTAGES AND DISADVANTAGES OF LIQUID AND DRY FERTILIZERS

FIGURE 42 DRY FERTILIZERS SEGMENT PROJECTED TO DOMINATE OVERALL MARKET

TABLE 87 SPECIALTY FERTILIZERS MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 88 MARKET, BY FORM, 2022–2027 (USD MILLION)

11.2 DRY SPECIALTY FERTILIZERS

11.2.1 EASY STORAGE AND HIGH EFFICIENCY TO BOOST CONSUMPTION OF DRY SPECIALTY FERTILIZERS

TABLE 89 DRY SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 90 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 LIQUID SPECIALTY FERTILIZERS

11.3.1 EASE OF APPLICATION TO DRIVE MARKET FOR LIQUID FERTILIZERS

TABLE 91 LIQUID SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 92 MARKET, BY REGION, 2022–2027 (USD MILLION)

12 SPECIALTY FERTILIZERS MARKET, BY REGION (Page No. - 168)

12.1 INTRODUCTION

FIGURE 43 GERMANY, ITALY, VIETNAM, AND BRAZIL TO RECORD HIGHEST CAGRS

FIGURE 44 SPECIALTY FERTILIZERS MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 93 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 94 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 95 MARKET, BY REGION, 2016–2021 (KILOTONS)

TABLE 96 MARKET, BY REGION, 2022–2027 (KILOTONS)

12.2 NORTH AMERICA

TABLE 97 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 100 NORTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (KILOTONS)

TABLE 104 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (KILOTONS)

TABLE 105 NORTH AMERICA: MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY MODE OF APPLICATION, 2016–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY CROP TYPE, 2016–2021 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.2.1 US

12.2.1.1 Sustainable agriculture systems and stringent environmental regulations to drive micronutrients-based specialty fertilizers

TABLE 111 US: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 112 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Rising demand from food processing industry for cereals & grains to drive market

TABLE 113 CANADA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 114 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Government focus on sustainable agriculture to drive demand for micronutrients-based specialty fertilizers

TABLE 115 MEXICO: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 116 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3 EUROPE

TABLE 117 EUROPE: SPECIALTY FERTILIZERS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY TECHNOLOGY, 2016–2021 (KILOTONS)

TABLE 124 EUROPE: MARKET, BY TECHNOLOGY, 2022–2027 (KILOTONS)

TABLE 125 EUROPE: MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY MODE OF APPLICATION, 2016–2021 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 129 EUROPE: MARKET, BY CROP TYPE, 2016–2021 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Support for switching from conventional to specialty fertilizers to drive market

TABLE 131 GERMANY: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 132 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.2 FRANCE

12.3.2.1 Growing demand for high-value crops to boost use of specialty fertilizers

TABLE 133 FRANCE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 134 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.3 UK

12.3.3.1 Adoption of agronomic bio-fortification to boost demand for micronutrients

TABLE 135 UK: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 136 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.4 RUSSIA

12.3.4.1 Move toward sustainable agricultural solutions to support domestic crop production

TABLE 137 RUSSIA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 138 RUSSIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.5 POLAND

12.3.5.1 Poland to showcase strong growth opportunities for market players

TABLE 139 POLAND: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 140 POLAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.6 ITALY

12.3.6.1 Rising demand for cereals and grains to drive market growth

TABLE 141 ITALY: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 142 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.3.7 REST OF EUROPE

TABLE 143 REST OF EUROPE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 144 REST OF EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET SNAPSHOT

TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2016–2021 (KILOTONS)

TABLE 152 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2027 (KILOTONS)

TABLE 153 ASIA PACIFIC: MARKET, BY MODE OF APPLICATION, 2016–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY CROP TYPE, 2016–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Rising consumption of ammonium and phosphorus-based specialty fertilizers to drive market growth

TABLE 159 CHINA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 160 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.2 INDIA

12.4.2.1 Growing demand for micronutrients for fertilization to drive adoption of innovative specialty fertilizers

TABLE 161 INDIA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 162 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Use of advanced agricultural practices to drive growth

TABLE 163 JAPAN: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.4 AUSTRALIA & NEW ZEALAND

12.4.4.1 Increasing consumption of specialty fertilizers and decreasing arable land—key growth factors

TABLE 165 AUSTRALIA & NEW ZEALAND: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 166 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.5 VIETNAM

12.4.5.1 Micronutrient loss caused by soil erosion to drive market

TABLE 167 VIETNAM: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 168 VIETNAM: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 169 REST OF ASIA PACIFIC: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5 SOUTH AMERICA

FIGURE 46 SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET SNAPSHOT, 2022

TABLE 171 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 172 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 173 SOUTH AMERICA: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 174 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 175 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 176 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 177 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2016–2021 (KILOTONS)

TABLE 178 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2027 (KILOTONS)

TABLE 179 SOUTH AMERICA: MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 180 SOUTH AMERICA: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 181 SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2016–2021 (USD MILLION)

TABLE 182 SOUTH AMERICA: MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 183 SOUTH AMERICA: MARKET, BY CROP TYPE, 2016–2021 (USD MILLION)

TABLE 184 SOUTH AMERICA: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.5.1 BRAZIL

12.5.1.1 Brazil to dominate Latin American specialty fertilizers market

TABLE 185 BRAZIL: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 186 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.2 ARGENTINA

12.5.2.1 Growing use of agrochemicals and advancements in farming techniques contribute to market growth

TABLE 187 ARGENTINA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 188 ARGENTINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.3 CHILE

12.5.3.1 Increasing demand for controlled-release fertilizers to increase farm productivity

TABLE 189 CHILE: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 190 CHILE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.5.4 REST OF SOUTH AMERICA

TABLE 191 REST OF SOUTH AMERICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 192 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6 REST OF THE WORLD

TABLE 193 ROW: SPECIALTY FERTILIZERS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 194 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 195 ROW: MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 196 ROW: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 197 ROW: MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

TABLE 198 ROW: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 199 ROW: MARKET, BY TECHNOLOGY, 2016–2021 (KILOTONS)

TABLE 200 ROW: MARKET, BY TECHNOLOGY, 2022–2027 (KILOTONS)

TABLE 201 ROW: MARKET, BY FORM, 2016–2021 (USD MILLION)

TABLE 202 ROW: MARKET, BY FORM, 2022–2027 (USD MILLION)

TABLE 203 ROW: MARKET, BY MODE OF APPLICATION, 2016–2021 (USD MILLION)

TABLE 204 ROW: MARKET, BY MODE OF APPLICATION, 2022–2027 (USD MILLION)

TABLE 205 ROW: MARKET, BY CROP TYPE, 2016–2021 (USD MILLION)

TABLE 206 ROW: MARKET, BY CROP TYPE, 2022–2027 (USD MILLION)

12.6.1 MIDDLE EAST

12.6.1.1 Wide availability of controlled-release fertilizers due to presence of firms such as ICL and Haifa Chemicals

TABLE 207 MIDDLE EAST: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 208 MIDDLE EAST: MARKET, BY TYPE, 2022–2027 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Growing need for liquid fertilizers and micronutrients to combat nutrition deficiency to support market growth

TABLE 209 AFRICA: SPECIALTY FERTILIZERS MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 210 AFRICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 232)

13.1 OVERVIEW

13.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 47 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD MILLION)

13.3 MARKET SHARE ANALYSIS, 2021

TABLE 211 SPECIALTY FERTILIZERS MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

13.4 KEY PLAYER STRATEGIES

TABLE 212 STRATEGIES ADOPTED BY KEY SPECIALTY FERTILIZER MANUFACTURERS

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE PLAYERS

13.5.4 PARTICIPANTS

FIGURE 48 SPECIALTY FERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

13.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 49 SPECIALTY FERTILIZERS MARKET: COMPANY EVALUATION QUADRANT, 2021 (START-UPS/SMES)

13.6.5 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 213 SPECIALTY FERTILIZERS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 214 MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

13.7 COMPANY FOOTPRINT

TABLE 215 COMPANY PRODUCT FOOTPRINT

TABLE 216 COMPANY TECHNOLOGY FOOTPRINT

TABLE 217 COMPANY REGIONAL FOOTPRINT

TABLE 218 OVERALL COMPANY FOOTPRINT

13.8 COMPETITIVE SCENARIO

13.8.1 PRODUCT LAUNCHES

TABLE 219 SPECIALTY FERTILIZERS: PRODUCT LAUNCHES, 2019-2022

13.8.2 DEALS

TABLE 220 SPECIALTY FERTILIZERS: DEALS, 2018–2022

13.8.3 OTHER DEVELOPMENTS

TABLE 221 SPECIALTY FERTILIZERS: OTHER DEVELOPMENTS, 2018–2022

14 COMPANY PROFILES (Page No. - 254)

(Business overview, Products offered, Recent Developments, MNM view)*

14.1 KEY PLAYERS

14.1.1 NUTRIEN, LTD.

TABLE 222 NUTRIEN, LTD.: BUSINESS OVERVIEW

FIGURE 50 NUTRIEN, LTD.: COMPANY SNAPSHOT

TABLE 223 NUTRIEN, LTD.: PRODUCTS OFFERED

TABLE 224 NUTRIEN, LTD.: DEALS

TABLE 225 NUTRIEN, LTD.: OTHER DEVELOPMENTS

14.1.2 YARA

TABLE 226 YARA: BUSINESS OVERVIEW

FIGURE 51 YARA: COMPANY SNAPSHOT

TABLE 227 YARA: PRODUCTS OFFERED

TABLE 228 YARA: DEALS

14.1.3 ICL

TABLE 229 ICL: BUSINESS OVERVIEW

FIGURE 52 ICL: COMPANY SNAPSHOT

TABLE 230 ICL: PRODUCTS OFFERED

TABLE 231 ICL: PRODUCT LAUNCHES

TABLE 232 ICL: DEALS

TABLE 233 ICL: OTHER DEVELOPMENTS

14.1.4 K+S AKTIENGESELLSCHAFT

TABLE 234 K+S AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

FIGURE 53 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

TABLE 235 K+S AKTIENGESELLSCHAFT: PRODUCTS OFFERED

TABLE 236 K+S AKTIENGESELLSCHAFT: DEALS

TABLE 237 K+S AKTIENGESELLSCHAFT: OTHER DEVELOPMENTS

14.1.5 SQM SA

TABLE 238 SQM SA: BUSINESS OVERVIEW

FIGURE 54 SQM SA: COMPANY SNAPSHOT

TABLE 239 SQM SA: PRODUCTS OFFERED

14.1.6 EUROCHEM GROUP

TABLE 240 EUROCHEM GROUP: BUSINESS OVERVIEW

FIGURE 55 EUROCHEM GROUP: COMPANY SNAPSHOT

TABLE 241 EUROCHEM GROUP: PRODUCTS OFFERED

TABLE 242 EUROCHEM GROUP: DEALS

TABLE 243 EUROCHEM GROUP: OTHER DEVELOPMENTS

14.1.7 CF INDUSTRIES HOLDINGS, INC.

TABLE 244 CF INDUSTRIES HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 56 CF INDUSTRIES HOLDINGS, INC.: COMPANY SNAPSHOT

TABLE 245 CF INDUSTRIES HOLDINGS, INC.: PRODUCTS OFFERED

TABLE 246 CF INDUSTRIES HOLDINGS, INC.: OTHER DEVELOPMENTS

14.1.8 NUFARM

TABLE 247 NUFARM: BUSINESS OVERVIEW

FIGURE 57 NUFARM: COMPANY SNAPSHOT

TABLE 248 NUFARM: PRODUCTS OFFERED

14.1.9 THE MOSAIC COMPANY

TABLE 249 THE MOSAIC COMPANY: BUSINESS OVERVIEW

FIGURE 58 THE MOSAIC COMPANY: COMPANY SNAPSHOT

TABLE 250 THE MOSAIC COMPANY: PRODUCTS OFFERED

TABLE 251 THE MOSAIC COMPANY: PRODUCT LAUNCHES

TABLE 252 THE MOSAIC COMPANY: DEALS

14.1.10 OCI NITROGEN

TABLE 253 OCI NITROGEN: BUSINESS OVERVIEW

FIGURE 59 OCI NITROGEN: COMPANY SNAPSHOT

TABLE 254 OCI NITROGEN: PRODUCTS OFFERED

TABLE 255 OCI NITROGEN: DEALS

TABLE 256 OCI NITROGEN: OTHER DEVELOPMENTS

14.1.11 OCP GROUP

TABLE 257 OCP GROUP: BUSINESS OVERVIEW

FIGURE 60 OCP GROUP: COMPANY SNAPSHOT

TABLE 258 OCP GROUP: PRODUCTS OFFERED

TABLE 259 OCP GROUP: PRODUCT LAUNCHES

TABLE 260 OCP GROUP: DEALS

TABLE 261 OCP GROUP: OTHER DEVELOPMENTS

14.1.12 KINGENTA

TABLE 262 KINGENTA: BUSINESS OVERVIEW

FIGURE 61 KINGENTA: COMPANY SNAPSHOT

TABLE 263 KINGENTA: PRODUCTS OFFERED

TABLE 264 KINGENTA: DEALS

14.1.13 COROMANDEL INTERNATIONAL LIMITED

TABLE 265 COROMANDEL INTERNATIONAL LIMITED: BUSINESS OVERVIEW

FIGURE 62 COROMANDEL INTERNATIONAL LIMITED: COMPANY SNAPSHOT

TABLE 266 COROMANDEL INTERNATIONAL LIMITED: PRODUCTS OFFERED

TABLE 267 COROMANDEL INTERNATIONAL LIMITED: PRODUCT LAUNCHES

TABLE 268 COROMANDEL INTERNATIONAL LIMITED: DEALS

14.1.14 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED

TABLE 269 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: BUSINESS OVERVIEW

FIGURE 63 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: COMPANY SNAPSHOT

TABLE 270 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: PRODUCTS OFFERED

TABLE 271 DEEPAK FERTILIZERS AND PETROCHEMICALS CORPORATION LIMITED: PRODUCT LAUNCHES

14.1.15 ZUARI AGRO CHEMICALS LTD.

TABLE 272 ZUARI AGRO CHEMICALS LTD.: BUSINESS OVERVIEW

FIGURE 64 ZUARI AGRO CHEMICALS: COMPANY SNAPSHOT

TABLE 273 ZUARI AGRO CHEMICALS LTD: PRODUCTS OFFERED

14.2 STARTUPS/SMES/OTHER PLAYERS

14.2.1 KUGLER COMPANY

TABLE 274 KUGLER COMPANY: BUSINESS OVERVIEW

TABLE 275 KUGLER COMPANY: PRODUCTS OFFERED

14.2.2 HAIFA NEGEV TECHNOLOGIES

TABLE 276 HAIFA NEGEV TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 277 HAIFA NEGEV TECHNOLOGIES: PRODUCTS OFFERED

TABLE 278 HAIFA NEGEV TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 279 HAIFA NEGEV TECHNOLOGIES: DEALS

TABLE 280 HAIFA NEGEV TECHNOLOGIES: OTHER DEVELOPMENTS

14.2.3 COMPO EXPERT GMBH

TABLE 281 COMPO EXPERT GMBH: BUSINESS OVERVIEW

TABLE 282 COMPO EXPERT GMBH: PRODUCTS OFFERED

TABLE 283 COMPO EXPERT GMBH: DEALS

14.2.4 WILBUR-ELLIS COMPANY LLC

TABLE 284 WILBUR-ELLIS COMPANY LLC: BUSINESS OVERVIEW

TABLE 285 WILBUR-ELLIS COMPANY LLC: PRODUCTS OFFERED

14.2.5 VALAGRO

TABLE 286 VALAGRO: BUSINESS OVERVIEW

TABLE 287 VALAGRO: PRODUCTS OFFERED

TABLE 288 VALAGRO: DEALS

TABLE 289 VALAGRO: OTHER DEVELOPMENTS

14.2.6 BRANDT

14.2.7 AGROLIQUID

14.2.8 PLANT FOOD COMPANY, INC.

14.2.9 KOCH INDUSTRIES, INC.

14.2.10 AGZON AGRO

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT & RELATED MARKETS (Page No. - 319)

15.1 INTRODUCTION

15.2 CONTROLLED RELEASE FERTILIZERS MARKET

15.2.1 LIMITATIONS

15.2.2 MARKET DEFINITION

15.2.3 MARKET OVERVIEW

15.2.4 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE

TABLE 290 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 291 CONTROLLED-RELEASE FERTILIZERS MARKET, BY TYPE, 2021–2026 (USD MILLION)

15.2.5 CONTROLLED-RELEASE FERTILIZERS MARKET, BY END USE

15.2.6 CONTROLLED-RELEASE FERTILIZERS MARKET, BY MODE OF APPLICATION

15.2.7 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION

TABLE 292 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 293 CONTROLLED-RELEASE FERTILIZERS MARKET, BY REGION, 2021–2026 (USD MILLION)

15.3 AGRICULTURAL MICRONUTRIENTS MARKET

15.3.1 LIMITATIONS

15.3.2 MARKET DEFINITION

15.3.3 MARKET OVERVIEW

15.3.4 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE

TABLE 294 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 295 AGRICULTURAL MICRONUTRIENTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.5 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION

TABLE 296 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 297 AGRICULTURAL MICRONUTRIENTS MARKET, BY REGION, 2022–2027 (USD MILLION)

16 APPENDIX (Page No. - 327)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 CUSTOMIZATION OPTIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the specialty fertilizers market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the specialty fertilizers market.

Secondary Research

The secondary sources referred for this research study include government sources, such as the Food and Agriculture Organization (FAO), International Fertilizer Association (IFA) and Association of American Plant Food Control Officials (AAPFCO), Micronutrient Manufacturers Association (MMA), US Department of Agriculture (USDA), agricultural ministries in various governments, corporate filings (such as annual reports, press releases, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Secondary research was mainly used to obtain key information about the industry’s supply chain—the total pool of key players, market classification and segmentation, and geographical markets according to the industry trends from market-oriented perspectives.

Primary Research

The specialty fertilizers market comprises several stakeholders, including raw material suppliers, agrochemical suppliers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, manufacturers, importers & exporters of specialty fertilizers, and technology providers. Primary sources from the demand side include distributors, wholesalers, key opinion leaders, growers, farmers, and agronomists through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Specialty Fertilizers Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the specialty fertilizers market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The parent market—the fertilizers market—was considered to validate the details of the specialty fertilizers market.

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. The approach was employed to determine the overall size of the specialty fertilizers market in particular regions. Its share in the fertilizers market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall specialty fertilizers market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- Determining and projecting the size of the specialty fertilizers market based on type, technology, form, application method, crop type and region, over a six-year period, ranging from 2022 to 2027

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key market players in the specialty fertilizers market

- Determining the share of key players operating in the specialty fertilizers market

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths, weaknesses, opportunities, and threats

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by the key companies

- Analyzing the patents registered and regulatory frameworks across regions and their impact on prominent market players

- Analyzing the market dynamics and competitive situations & trends across regions and their impact on prominent market players

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for specialty fertilizers into Spain, Greece, Sweden, Belgium, Switzerland, and other EU & non-EU countries

- Further breakdown of the Rest of Asia Pacific market for specialty fertilizers into Thailand, Indonesia, South Korea, Malaysia, Singapore, and other ASEAN countries

- Further breakdown of the Rest of South America market for specialty fertilizers into Colombia, Peru, Uruguay, and Venezuela

- Further breakdown of other countries in the RoW market for specialty fertilizers market into Middle East and Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Specialty Fertilizers Market