Altimeter System and Pitot Tube Market by Platform (Commercial, Military, UAV, General Aviation), by Component (Sensors, Display Units, Transmitters, Pitot Tubes), by System (Static, Air Data, Integrated), by Application (Altitude Measurement, Airspeed Detection, Flight Navigation, Environmental Monitoring), by End User, and by Region — Global Forecast to 2035

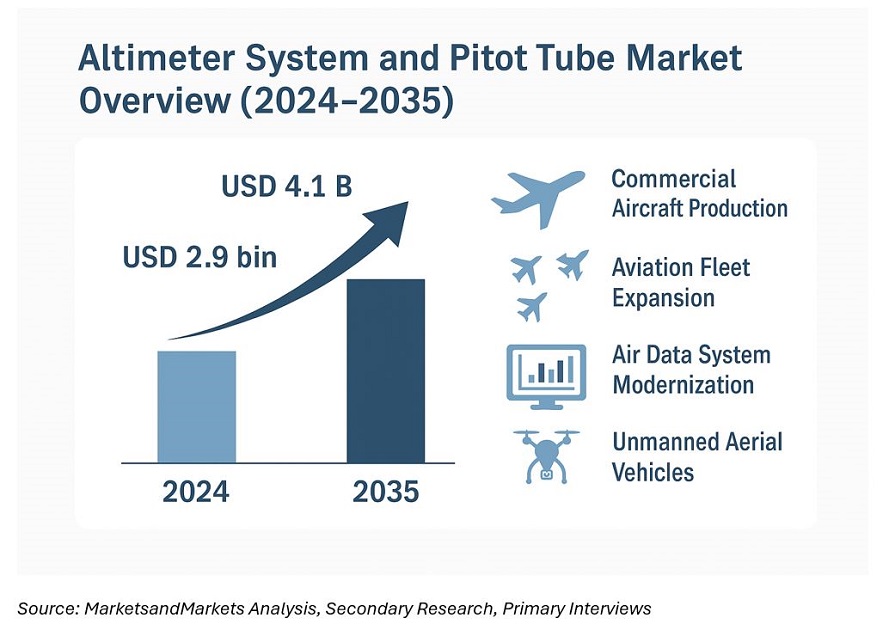

The altimeter system and pitot tube market is a vital global aviation and aerospace instrumentation industry segment. It underpins aircraft flight-safety, navigation accuracy, and air data reliability across all classes of manned and unmanned platforms. The global market is estimated at USD 2.9 billion in 2024 and projected to reach USD 4.1 billion by 2035, growing at a CAGR of 3.2 % during the forecast period.

Growth is driven by rising commercial-aircraft production, the modernization of air data systems, and sustained fleet expansions in both civil and defense aviation. With automation increasing in cockpit architectures, demand for integrated air-data computers (ADC) and digital altimetry sensors has intensified. In parallel, the growing adoption of unmanned aerial vehicles (UAVs) and advanced air-mobility (AAM) platforms has broadened the application base for compact and lightweight pitot-static assemblies.

The market’s evolution is also tied to stricter regulatory frameworks from the Federal Aviation Administration (FAA), European Union Aviation Safety Agency (EASA), and RTCA/DO-160 compliance standards governing pitot-static accuracy, environmental testing, and redundancy requirements for aircraft certification.

Market Dynamics

Drivers

The primary driver is the increased delivery of aircraft and fleet renewals across commercial and business aviation. Airbus and Boeing’s order backlogs—exceeding 13,000 combined aircraft—translate into sustained demand for pitot tubes, static ports, and air-data sensors. The industry’s digital transformation further strengthens demand for smart sensors that feed real-time altitude and airspeed data into fly-by-wire and autopilot systems.

The growing deployment of UAVs for surveillance, logistics, and passenger mobility also supports the development of miniaturized pitot-altimeter units. Moreover, modernization programs for military aircraft—especially refits of transport and fighter fleets with digital air data computers—drive recurring retrofit opportunities.

Restraints

High development costs for high-precision sensing units, stringent qualification testing, and exposure to environmental contaminants (such as icing, dust, and blockage) constrain production flexibility. For UAVs and eVTOL platforms, power and weight constraints limit sensor redundancy, presenting design trade-offs between accuracy and endurance.

Opportunities

Advances in micro-electromechanical system (MEMS) sensors and digital signal processing (DSP) are enabling lighter, more accurate altimeters and pitot assemblies. The emerging AAM/eVTOL ecosystem, projected to commercialize after 2030, will provide a new installed-base opportunity for compact air data systems. Additionally, regulatory emphasis on airspeed validation and post-accident investigations is stimulating demand for smart pitot probes, which are integrated with heating and self-diagnostic functions.

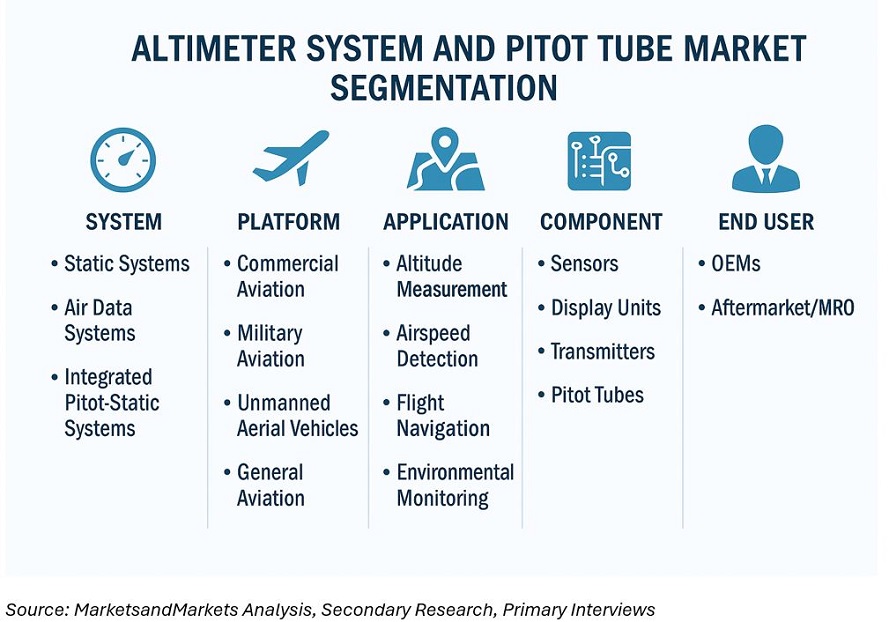

Market Segmentation

By System

The market is segmented into static systems, air data systems, and integrated pitot-static systems.

- Air data systems account for the largest share, providing real-time pressure and temperature data to flight-management computers for altitude, airspeed, and Mach calculations.

- Static systems form the baseline architecture, supporting barometric altitude measurements across general aviation and older fleets.

- Integrated systems combine pitot-static and angle-of-attack sensing, offering redundancy for next-generation fly-by-wire aircraft.

By Platform

Platform coverage spans commercial, military, unmanned aerial, and general aviation categories.

- Commercial aviation remains the largest demand center, driven by narrow-body production and avionics modernization cycles.

- Military aviation demonstrates steady replacement demand, particularly in fighter and transport aircraft requiring advanced air data modules.

- UAVs exhibit the fastest CAGR, reflecting rapid adoption in reconnaissance, mapping, and cargo missions that require reliable, lightweight pressure sensors.

- General aviation (business jets, trainers, light aircraft) sustains consistent aftermarket replacement cycles.

By Component

Key components include sensors, display units, transmitters, and pitot tubes.

- Pitot tubes and sensors collectively dominate revenue, serving as the primary measurement points for total and static pressure.

- Transmitter units convert analog data to digital flight signals, interfacing with ADCs.

- Display and indicator units are evolving toward glass-cockpit integration and real-time flight data overlays.

By Application

The altitude measurement segment leads, encompassing barometric and radar altimetry functions critical to all flight phases. The airspeed detection segment follows, driven by the need for precise airspeed validation under varying environmental conditions. Flight navigation applications integrate data from pitot-static systems into inertial reference and autopilot systems. A smaller but emerging environmental monitoring sub-segment leverages air data sensors for atmospheric research and UAV meteorology payloads.

By End User

OEMs account for the significant revenue share due to line-fit installations during aircraft production. Aftermarket/MRO demand remains resilient, with replacement and calibration services mandated every 12 to 24 months for commercial operators. Military end users focus on life-extension refits and periodic recalibration to maintain mission reliability.

Regional Analysis

North America

North America holds the largest market share, supported by strong aerospace manufacturing in the United States and Canada. Major OEMs, such as Honeywell International, Collins Aerospace, and Garmin Ltd., anchor the supply chain for altimeter systems and pitot tubes. The FAA’s continuous airworthiness directives on pitot probe inspection sustain aftermarket demand.

Europe

Europe ranks second, with key contributions from Thales Group, Safran Electronics & Defense, and Meggitt PLC. Ongoing regional aircraft programs, such as ATR and Airbus A220, generate steady procurement. European Union safety regulations (EASA CS-25 and CS-23) mandate system upgrades to address pitot-icing and calibration compliance.

Asia Pacific

The Asia Pacific region exhibits the highest growth potential due to the expansion of aircraft fleets in China, India, and Southeast Asia. Indigenous programs, such as COMAC C919 and HAL Tejas, as well as regional UAV projects, stimulate local sourcing of pitot-static components. The region’s increasing MRO infrastructure also boosts recurring calibration and maintenance revenue.

Middle East & Africa

Fleet expansions by Middle Eastern carriers and defense modernization (notably in the UAE and Saudi Arabia) are fostering demand for advanced pitot-static systems. Africa’s emerging general-aviation segment, supported by ICAO safety initiatives, is gradually transitioning toward electronic altimetry solutions.

Latin America

Latin America’s market is smaller but growing steadily, led by Brazil’s Embraer production and regional defense upgrades. The expansion of low-cost carriers across Mexico and Colombia supports consistent demand for pitot-static maintenance and spares.

Competitive Landscape

The competitive structure comprises tier-1 avionics OEMs, pitot-static specialists, and sensor technology providers. Key players include Honeywell International Inc., Collins Aerospace (RTX Corporation), Thales Group, Safran Electronics & Defense, Garmin Ltd., Meggitt PLC, Aerosonic Corporation, and Kollsman Inc. (now part of Elbit Systems).

Manufacturers focus on integrating smart probes, MEMS-based sensing modules, and upgrading certifications for digital flight decks. Strategic initiatives include mergers to expand testing capability, partnerships for UAV integration, and R&D investments to improve sensor resistance to icing and contamination.

Sustainability and Technology Outlook

Although indirect, sustainability considerations are influencing the design of altimeters and pitot tubes. Lightweight materials, low-power MEMS sensors, and predictive maintenance reduce fuel burn and waste. Manufacturers are also employing additive manufacturing for precision parts and pursuing RoHS-compliant production. The next decade will emphasize digital twins and predictive calibration—reducing downtime and supporting more efficient flight operations.

Forecast Summary (2024–2035)

|

Year |

Market Size (USD Billion) |

CAGR (2024–2035) |

|

2024 |

2.9 |

|

|

2030 |

3.5 |

|

|

2035 |

4.1 |

3.2 % |

Overall, the altimeter system and pitot tube market is set for stable, long-term growth driven by new aircraft deliveries, retrofits, and the evolution of intelligent air-data sensing. As aviation continues to digitize, the boundary between hardware- and software-based air data management systems becomes increasingly blurred. Companies integrating robust sensing with analytics and self-diagnostics will lead the next phase of competitiveness.

Frequently Asked Questions (FAQs)

Q1. What is the size of the altimeter system and pitot tube market?

It is estimated at USD 2.9 billion in 2024 and projected to reach USD 4.1 billion by 2035.

Q2. Which system segment dominates the market?

Air data systems account for the largest share due to their role in flight-control automation and data integration.

Q3. Which region will witness the fastest growth?

Asia Pacific is projected to record the highest CAGR through 2035, supported by indigenous manufacturing and fleet expansion.

Q4. Who are the key players in this market?

Honeywell International, Collins Aerospace, Thales Group, Safran Electronics & Defense, Garmin, and Meggitt lead the competitive landscape.

Q5. What technological trend is shaping the future?

MEMS-based sensors, integrated air-data computers, and digital diagnostics are defining the next generation of pitot-static systems.

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives

1.2 Report Scope

1.3 Market Definition

1.4 Market Segmentation

1.4.1 Altimeter Systems Sub-Segments

1.4.2 Pitot Tubes Sub-Segments

1.4.3 Other Sensors Sub-Segments

1.5 Bifurcation of Years

1.6 Stakeholders

1.7 Research Methodology

1.7.1 Key Data Taken From Secondary Sources

1.7.2 Key Secondary Sources

1.7.3 Source: Marketsandmarkets Analysis

1.7.4 Key Data Taken From Primary Sources

1.7.5 Market Crackdown

1.8 Assumptions Made for This Report

2 Executive Summary (Page No. - 33)

3 Market Dynamics (Page No. - 34)

3.1 Drivers

3.1.1 Impact Analysis of Drivers

3.1.2 Increase in the Rate of Air Traffic

3.1.3 Regulations By the Aviation Safety Agencies

3.1.4 Need for High Quality Avionic Instruments

3.2 Restraints

3.2.1 Impact Analysis of Restraints

3.2.2 Instrument Error in Conventional Pressure Altimeters and Pitot Tubes

3.2.3 Limitations of Radar Altimeters

3.2.4 Budget Cuts and Regulations By the Defense industry

3.2.5 Installation and Maintenance of Altimeter Systems, Pitot Tubes & Other Sensors

3.3 Challenges

3.3.1 Unpredictable Climatic Conditions

3.3.2 Varying Altitude Level

3.3.3 Product Failure and Customer Satisfaction

3.4 Environmental Threat Opportunity Profile (ETOP) Analysis

4 Trend Analysis (Page No. - 43)

4.1 Market Trends

4.1.1 Joint Ventures and Mergers By Companies

4.1.2 Emerging Products in the Market

4.2 Technology Trends

4.2.1 Digitalization of the Altimeter Systems and Pitot Tubes Industry

4.2.2 Reduction in the Weight and Size of the Instruments

5 Market Analysis (Page No. - 48)

5.1 Global Market Size

5.2 Global Market Sub-Segments

5.2.1 Global Altimeter Systems Market Analysis

5.2.1.1 Global Altimeter Systems Market Analysis: By Application

5.2.1.2 Global Altimeter Systems Market Analysis: By Product

5.2.1.3 Global Altimeter Systems Market Analysis: By Technology

5.2.2 Global Pitot Tubes Market Analysis

5.2.2.1 Global Pitot Tubes Market Analysis: By Platform

5.2.2.2 Global Pitot Tubes Market Analysis: By Product

5.2.2.3 Global Pitot Tubes Market Analysis: By Technology

5.2.3 Global Other Sensors Market Analysis

5.2.3.1 Global Other Sensors Market Analysis: By Platform

5.2.3.2 Global Other Sensors Market Analysis: By Product

6 Geographic Analysis (Page No. - 69)

6.1 Asia-Pacific Market Analysis

6.1.1 Asia-Pacific Altimeter Systems Market Analysis

6.1.1.1 Asia-Pacific Altimeter Systems Market Analysis: By Platform

6.1.1.2 Asia-Pacific Altimeter Systems Market Analysis: By Product

6.1.1.3 Asia-Pacific Altimeter Systems Market Analysis: By Technology

6.1.2 Asia-Pacific Pitot Tubes Market Analysis

6.1.2.1 Asia-Pacific Pitot Tubes Market Analysis: By Platform

6.1.2.2 Asia-Pacific Pitot Tubes Market Analysis: By Product

6.1.2.3 Asia-Pacific Pitot Tubes Market Analysis: By Technology

6.1.3 Asia-Pacific Other Sensors Market Analysis

6.1.3.1 Asia-Pacific Other Sensors Market Analysis: By Platform

6.1.3.2 Asia-Pacific Other Sensors Market Analysis: By Product

6.2 North America Market Analysis

6.2.1 North America Altimeter Systems Market Analysis

6.2.1.1 North America Altimeter Systems Market Analysis: By Platform

6.2.1.2 North America Altimeter Systems Market Analysis: By Product

6.2.1.3 North America Altimeter Systems Market Analysis: By Technology

6.2.2 North America Pitot Tubes Market Analysis

6.2.2.1 North America: Market Analysis: By Platform

6.2.2.2 North America: Market Analysis: By Product

6.2.2.3 North America: Pitot Tubes Market Analysis: By Technology

6.2.3 North America Other Sensors Market Analysis

6.2.3.1 North America Other Sensors Market Analysis: By Platform

6.2.3.2 North America Other Sensors Market Analysis: By Product

6.3 Europe Market Analysis

6.3.1 Europe Altimeter Systems Market Analysis

6.3.1.1 Europe Market Analysis: By Platform

6.3.1.2 Europe Market Analysis: By Products

6.3.1.3 Europe Market Analysis: By Technology

6.3.2 Europe Pitot Tubes Market Analysis

6.3.2.1 Europe Market Analysis: By Platform

6.3.2.2 Europe Market Analysis: By Product

6.3.2.3 Europe Market Analysis: By Technology

6.3.3 Europe Other Sensors Market Analysis

6.3.3.1 Europe Other Sensors Market Analysis: By Platform

6.3.3.2 Europe Other Sensors Market Analysis: By Product

6.4 Latin America Market Analysis

6.4.1 Latin America Altimeter Systems Market Analysis

6.4.1.1 Latin America Altimeter Systems Market Analysis: By Platform

6.4.1.2 Latin America Altimeter Systems Market Analysis: By Products

6.4.1.3 Latin America Altimeter Systems Market Analysis: By Technology

6.4.2 Latin America Pitot Tubes Market Analysis

6.4.2.1 Latin America Pitot Tubes Market Analysis: By Platform

6.4.2.2 Latin America Pitot Tubes Market Analysis: By Product

6.4.2.3 Latin America Pitot Tubes Market Analysis: By Technology

6.4.3 Latin America Other Sensors Market Analysis

6.4.3.1 Latin America Other Sensors Market Analysis: By Platform

6.4.3.2 Latin America Other Sensors Market Analysis: By Product

7 Competitive Landscape (Page No. - 153)

7.1 Market Share Analysis

7.2 Opportunity Analysis, By Region

7.3 Opportunity Analysis, By Product

7.4 Opportunity Analysis, By Development

8 Company Profile (Page No. - 164)

8.1 Garmin International Inc.

8.1.1 Overview

8.1.2 Products

8.1.3 Strategies & Insights

8.1.4 Developments

8.1.5 MNM View

8.1.5.1 Company Review

8.1.5.2 SWOT Analysis

8.2 Aerosonic Corporation

8.2.1 Overview

8.2.2 Products

8.2.3 Strategies & Insights

8.2.4 Developments

8.2.5 MNM View

8.2.5.1 Company Review

8.2.5.2 SWOT Analysis

8.3 Honeywell Aerospace Inc.

8.3.1 Overview

8.3.2 Products

8.3.3 Strategies & Insights

8.3.4 Developments

8.3.5 MNM View

8.3.5.1 Company Review

8.3.5.2 SWOT Analysis

8.4 Rockwell Collins

8.4.1 Overview

8.4.2 Products

8.4.3 Strategies & Insights

8.4.4 Developments

8.4.5 MNM View

8.4.5.1 Company Review

8.4.5.2 SWOT Analysis

8.5 Thales SA

8.5.1 Overview

8.5.2 Products

8.5.3 Strategies & Insights

8.5.4 Developments

8.5.5 MNM View

8.5.5.1 Company Review

8.5.5.2 SWOT Analysis

8.6 Aerocontrolex Group Inc.

8.6.1 Overview

8.6.2 Products

8.6.3 Strategies & Insights

8.6.4 Developments

8.7 UTC Aerospace Systems

8.7.1 Overview

8.7.2 Products

8.7.3 Strategies & Insights

8.7.4 Developments

8.8 Revue Thommen Ag

8.8.1 Overview

8.8.2 Products and Services

8.8.3 Strategies & Insights

8.8.4 Developments

8.9 Free Flight Systems Inc.

8.9.1 Overview

8.9.2 Products

8.9.3 Strategies & Insights

8.9.4 Developments

8.10 Hindustan Aeronautics Limited

8.10.1 Overview

8.10.2 Products

8.10.3 Strategies & Insights

8.10.4 Developments

8.11 Trimble Navigation Limited.

8.11.1 Overview

8.11.2 Products and Services

8.11.3 Strategies & Insights

8.11.4 Developments

8.12 Memscap SA.

8.12.1 Overview

8.12.2 Products

8.12.3 Strategies & Insights

8.12.4 Developments

8.13 Kollsman Inc

8.13.1 Overview

8.13.2 Products and Services

8.13.3 Strategies & Insights

8.13.4 Development

8.14 Dynon Avionics Inc

8.14.1 Overview

8.14.2 Products

8.14.3 Strategies & Insights

8.14.4 Developments

8.15 Pacific Avionics & Instruments

8.15.1 Overview

8.15.2 Products and Services

8.15.3 Strategies & Insights

8.15.4 Development

List of Tables (96 Tables)

Table 1 Bifurcation of the Years Taken Into Account

Table 2 Key Secondary Sources

Table 3 Impact Analysis of Drivers

Table 4 Impact Analysis of Restraints

Table 5 ETOP Analysis: Global Altimeter Systems and Pitot Tubes Market

Table 6 Global Altimeter Systems, Pitot Tubes, & Other Sensors Market Size, By Region, 2014-2020($Million)

Table 7 Global Altimeter Systems, Pitot Tubes, & Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 8 Global Altimeter Systems, Pitot Tubes, & Other Sensors Market Size, By Sub-Segments, 2014-2020($Million)

Table 9 Commercial Altimeter Systems Market Size, By Platform, 2014-2020($Million)

Table 10 Military Altimeter Systems Market Size, By Platform, 2014-2020($Million)

Table 11 Commercial Altimeter Systems Market Size, By Products, 2014-2020($Million)

Table 12 Military Altimeter Systems Market Size, By Product, 2014-2020($Million)

Table 13 Commercial Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 14 Military Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 15 Commercial Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 16 Military Pitot Tubes Market Size, By Type, 2014-2020($Million)

Table 17 Commercial Pitot Tubes Market Size, By Product, 2014-2020($Million)

Table 18 Military Pitot Tubes Market Size, By Product, 2014-2020($Million)

Table 19 Commercial Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Table 20 Military Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Table 21 Commercial Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 22 Military Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 23 Commercial Other Sensors Market Size, By Product, 2014-2020($Million)

Table 24 Military Other Sensors Market Size, By Product, 2014-2020($Million)

Table 25 Asia-Pacific: Altimeter Systems, Pitot Tube, & Other Sensors Market Size, By Application, 2014-2020($Million)

Table 26 Asia-Pacific Altimeter Systems, & Other Sensors Market Size, By Sub-Segments, 2014-2020($Million)

Table 27 Asia-Pacific: Commercial Altimeter Systems Market Size, By Platform, 2014-2020($Million)

Table 28 Asia-Pacific: Military Altimeter System Market Size, By Platform, 2014-2020($Million)

Table 29 Asia-Pacific: Commercial Market Size, By Products, 2014-2020($Million)

Table 30 Asia-Pacific :Military Market Size, By Product, 2014-2020($Million)

Table 31 Asia-Pacific: Commercial Market Size, By Technology, 2014-2020($Million)

Table 32 Asia-Pacific: Military Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 33 Asia-Pacific: Commercial Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 34 Asia-Pacific: Military Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 35 Asia-Pacific: Commercial Pitot Tubes Market Size, By Product, 2014-2020($Million)

Table 36 Asia-Pacific: Military Pitot Tubes Market Size, By Product, 2014-2020($Million)

Table 37 Asia-Pacific: Commercial Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Table 38 Asia-Pacific: Military Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Table 39 Asia-Pacific: Commercial Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 40 Asia-Pacific: Military Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 41 Asia-Pacific: Commercial Other Sensors Market Size, By Product, 2014-2020($Million)

Table 42 Asia-Pacific: Military Other Sensors Market Size, By Product, 2014-2020($Million)

Table 43 North America: Altimeter System, Pitot Tube, & Other Sensors Market Size, By Application, 2014-2020($Million)

Table 44 North America Altimeter System, & Other Sensors Market Size, By Sub-Segments, 2014-2020($Million)

Table 45 North America: Commercial Altimeter Systems Market Size, By Platform, 2014-2020($Million)

Table 46 North America: Military Market Size, By Platform, 2014-2020($Million)

Table 47 North America: Commercial Altimeter Systems Market Size, By Products, 2014-2020($Million)

Table 48 North America :Military Market Size, By Product, 2014-2020($Million)

Table 49 North America: Commercial Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 50 North America: Military Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 51 North America: Commercial Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 52 North America: Military Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 53 North America: Commercial Market Size, By Product, 2014-2020($Million)

Table 54 North America: Military Market Size, By Product, 2014-2020($Million)

Table 55 North America: Commercial Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Table 56 North America: Military Market Size, By Technology, 2014-2020($Million)

Table 57 North America: Commercial Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 58 North America: Military Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 59 North America: Commercial Other Sensors Market Size, By Product, 2014-2020($Million)

Table 60 North America: Military Other Sensors Market Size, By Product, 2014-2020($Million)

Table 61 Europe: Altimeter System, Pitot Tube, & Other Sensors Market Size, By Application, 2014-2020($Million)

Table 62 Europe Altimeter System, & Other Sensors Market Size, By Sub-Segments, 2014-2020($Million)

Table 63 Europe: Commercial Altimeter System Market Size, By Platform, 2014-2020($Million)

Table 64 Europe: Military Market Size, By Platform, 2014-2020($Million)

Table 65 Europe: Commercial Altimeter Systems Market Size, By Products, 2014-2020($Million)

Table 66 Europe :Military Altimeter Systems Market Size, By Product, 2014-2020($Million)

Table 67 Europe: Commercial Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 68 Europe: Military Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 69 Europe: Commercial Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 70 Europe: Military Market Size, By Platform, 2014-2020($Million)

Table 71 Europe: Commercial Market Size, By Product, 2014-2020($Million)

Table 72 Europe: Military Market Size, By Product, 2014-2020($Million)

Table 73 Europe: Commercial Market Size, By Technology, 2014-2020($Million)

Table 74 Europe: Military Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Table 75 Europe: Commercial Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 76 Europe: Military Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 77 Europe: Commercial Other Sensors Market Size, By Product, 2014-2020($Million)

Table 78 Europe: Military Other Sensors Market Size, By Product, 2014-2020($Million)

Table 79 Latin America: Altimeter System, Pitot Tube, & Other Sensors Market Size, By Application, 2014-2020($Million)

Table 80 Latin America Altimeter System, & Other Sensors Market Size, By Sub-Segments, 2014-2020($Million)

Table 81 Latin America: Commercial Altimeter Systems Market Size, By Platform, 2014-2020($Million)

Table 82 Latin America: Military Altimeter Systems Market Size, By Platform, 2014-2020($Million)

Table 83 Latin America: Commercial Altimeter Systems Market Size, By Products, 2014-2020($Million)

Table 84 Latin America :Military Altimeter Systems Market Size, By Product, 2014-2020($Million)

Table 85 Latin America: Commercial Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 86 Latin America: Military Altimeter Systems Market Size, By Technology, 2014-2020($Million)

Table 87 Latin America: Commercial Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 88 Latin America: Military Pitot Tubes Market Size, By Platform, 2014-2020($Million)

Table 89 Latin America: Commercial Market Size, By Product, 2014-2020($Million)

Table 90 Latin America: Military Market Size, By Product, 2014-2020($Million)

Table 91 Latin America: Commercial Market Size, By Technology, 2014-2020($Million)

Table 92 Latin America: Military Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Table 93 Latin America: Commercial Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 94 Latin America: Military Other Sensors Market Size, By Platform, 2014-2020($Million)

Table 95 Latin America: Commercial Other Sensors Market Size, By Product, 2014-2020($Million)

Table 96 Latin America: Military Other Sensors Market Size, By Product, 2014-2020($Million)

List of Figures (80 Figures)

Figure 1 Global Altimeter Systems, Pitot Tubes, & Other Sensors Market Segmentation

Figure 2 Global Altimeter Systems Market Sub-Segments

Figure 3 Global Pitot Tubes Market Sub-Segments

Figure 4 Global Pitot Tubes Market Sub-Segments

Figure 5 Global Altimeter Systems and Pitot Tubes Market: Stakeholders

Figure 6 Global Altimeter Systems and Pitot Tubes Market: Research Methodology

Figure 7 Global Altimeter Systems and Pitot Tubes : Market Size Estimation Methodology

Figure 8 Global Altimeter Systems and Pitot Tubes Market: Data Triangulation Methodology

Figure 9 Global Altimeter Systems and Pitot Tubes: Market Dynamics

Figure 10 ETOP Analysis: Global Altimeter Systems and Pitot Tubes Market

Figure 11 Global Altimeter Systems, Pitot Tubes, & Other Sensors Market Size, 2014 – 2020 ($Million)

Figure 12 Global Market Size, By Application, 2014-2020($Million)

Figure 13 Global Market Size, By Products, 2014-2020($Million)

Figure 14 Global Market Size, By Technology, 2014-2020($Million)

Figure 15 Global Pitot Tubes Market Size, By Application, 2014-2020($Million)

Figure 16 Global Market Size, By Product, 2014-2020($Million)

Figure 17 Global Pitot Tubes Market Size, By Technology, 2014-2020($Million)

Figure 18 Global Other Sensors Market Size, By Platform, 2014-2020($Million)

Figure 19 Global Other Sensors Market Size, By Product, 2014-2020($Million)

Figure 20 Asia-Pacific: Altimeter System, Pitot Tube, & Other Sensors Market Size, 2014 – 2020 ($Million)

Figure 21 Asia-Pacific: Market Size, By Application, 2014-2020($Million)

Figure 22 Asia-Pacific: Market Size, By Products, 2014-2020($Million)

Figure 23 Asia-Pacific Market Size, By Technology, 2014-2020($Million)

Figure 24 Asia-Pacific Pitot Tubes Market Size, By Application, 2014-2020($Million)

Figure 25 Asia-Pacific: Market Size, By Product, 2014-2020($Million)

Figure 26 Asia-Pacific: Market Size, By Technology, 2014-2020($Million)

Figure 27 Asia-Pacific Other Sensors Market Size, By Application, 2014-2020($Million)

Figure 28 Asia-Pacific Other Sensors Market Size, By Product, 2014-2020($Million)

Figure 29 North America: Altimeter System, Pitot Tube, & Other Sensors Market Size, 2014 – 2020 ($Million)

Figure 30 North America: Market Size, By Application, 2014-2020($Million)

Figure 31 North America: Market Size, By Products, 2014-2020($Million)

Figure 32 North America: Market Size, By Technology, 2014-2020($Million)

Figure 33 North America Pitot Tubes Market Size, By Application, 2014-2020($Million)

Figure 34 North America: Market Size, By Product, 2014-2020($Million)

Figure 35 North America: Market Size, By Technology, 2014-2020($Million)

Figure 36 North America Other Sensors Market Size, By Application, 2014-2020($Million)

Figure 37 North America Other Sensors Market Size, By Product, 2014-2020($Million)

Figure 38 Europe: Altimeter System, Pitot Tube, & Other Sensors Market Size, 2014 – 2020 ($Million)

Figure 39 Europe: Market Size, By Application, 2014-2020($Million)

Figure 40 Europe: Market Size, By Products, 2014-2020($Million)

Figure 41 Europe: Market Size, By Technology, 2014-2020($Million)

Figure 42 Europe Pitot Tubes Market Size, By Application, 2014-2020($Million)

Figure 43 Europe: Market Size, By Product, 2014-2020($Million)

Figure 44 Europe: Market Size, By Technology, 2014-2020($Million)

Figure 45 Europe Other Sensors Market Size, By Application, 2014-2020($Million)

Figure 46 Europe Other Sensors Market Size, By Product, 2014-2020($Million)

Figure 47 Latin America: Altimeter System, Pitot Tube, & Other Sensors Market Size, 2014 – 2020 ($Million)

Figure 48 Latin America: Market Size, By Application, 2014-2020($Million)

Figure 49 Latin America: Altimeter Systems Market Size, By Products, 2014-2020($Million)

Figure 50 Latin America: Market Size, By Technology, 2014-2020($Million)

Figure 51 Latin America Pitot Tubes Market Size, By Application, 2014-2020($Million)

Figure 52 Latin America: Market Size, By Product, 2014-2020($Million)

Figure 53 Latin America: Market Size, By Technology, 2014-2020($Million)

Figure 54 Latin America Other Sensors Market Size, By Application, 2014-2020($Million)

Figure 55 Latin America Other Sensors Market Size, By Product, 2014-2020($Million)

Figure 56 Global Altimeter Systems Market Analysis: By Company

Figure 57 Global Pitot Tubes and Other Sensors Market Analysis: By Company

Figure 57 Global Altimeter Systems, Pitot Tubes, and Other Sensors Opportunity Analysis: By Region, 2014-2020

Figure 58 Global Altimeter Systems Opportunity Analysis: By Region, 2014-2020

Figure 59 Global Pitot Tubes Opportunity Analysis: By Region, 2014-2020

Figure 60 Global Other Sensors Opportunity Analysis: By Region, 2014-2020

Figure 61 Global Altimeter Systems, Pitot Tubes, and Other Sensors Opportunity Analysis: By Products, 2014-2020

Figure 62 Global Altimeter Systems Opportunity Analysis: By Products, 2014-2020

Figure 63 Global Pitot Tubes Opportunity Analysis: By Products, 2014-2020

Figure 64 Global Other Sensors Opportunity Analysis: By Products, 2014-2020

Figure 65 Garmin International Inc.: Company Snapshot

Figure 66 Garmin International Inc.: SWOT Analysis

Figure 67 Aerosonic Corporation: Company Snapshot

Figure 68 Aerosonic Corporation: SWOT Analysis

Figure 69 Honeywell International Inc.: Company Snapshot

Figure 70 Honeywell International Inc.: SWOT Analysis

Figure 71 Rockwell Collins, Inc.: Company Snapshot

Figure 72 Rockwell Collins, Inc. : SWOT Analysis

Figure 73 Thales SA: Company Snapshot

Figure 74 Thales SA: SWOT Analysis

Figure 75 Hindustan Aeronautics Limited: Company Snapshot

Figure 76 Trimble Navigation Limited: Company Snapshot

Figure 77 Memscap SA.: Company Snapshot

Figure 78 Kollsman Inc.: Company Snapshot

Figure 79 Dynon Avionics Inc: Company Snapshot

Figure 80 Pacific Avionics & Instruments: Company Snapshot

Growth opportunities and latent adjacency in Altimeter System and Pitot Tube Market