US General Anesthesia Drugs Market by Route of Administration (Intravenous and Inhalational), End User (Hospitals, Ambulatory Surgery Centers) - Global Forecast to 2025

Updated on : July 12, 2023

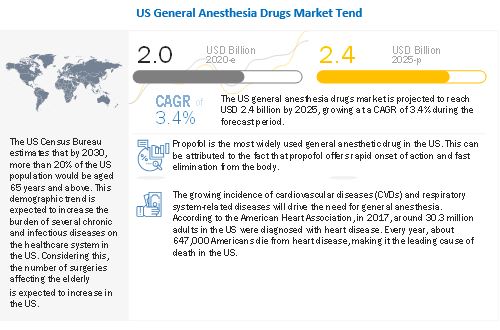

The global US general anesthesia drugs market in terms of revenue was estimated to be worth $2.0 billion in 2020 and is poised to reach $2.4 billion by 2025, growing at a CAGR of 3.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The rising prevalence of cancer, rapid growth in geriatric population, and increasing number of emergency surgeries are some of the major factors driving the growth of the US general anesthesia drugs.

To know about the assumptions considered for the study, Request for Free Sample Report

US General Anesthesia Drugs Market Dynamics

Driver: Rising prevalence of cancer

The prevalence of cancer has increased significantly in the US over the last few decades. According to the National Cancer Institute, as of January 2019, there were an estimated 16.9 million cancer survivors in the US. The number of cancer survivors is projected to increase to 22.2 million by 2030. The most common cancers (listed in descending order according to estimated new cases in 2020) are breast cancer, lung and bronchus cancer, prostate cancer, colon and rectum cancer, melanoma of the skin, bladder cancer, non-Hodgkin lymphoma, kidney and renal pelvis cancer, endometrial cancer, leukemia, pancreatic cancer, thyroid cancer, and liver cancer. Prostate, lung, and colorectal cancers accounted for 43% of all cancers diagnosed in men in 2020. Whereas, in women, breast, lung, and colorectal cancer accounted for over 50% of all new cancers diagnosed in 2020. The rising prevalence of cancer will lead to a rise in the number of surgeries as for many tumors, cancer surgery is the best chance for a cure, especially if the cancer is localized. Thus, the growing prevalence of cancer will fuel the growth of the US general anesthesia market, as general anesthesia is commonly used for surgical procedures to treat cancer.

Restraint: Risks associated with general anesthesia in pediatric patients and pregnant women

The use of pharmacologic agents, including general anesthesia drugs, in pediatric patients, warrants special considerations. In comparison to adults, infants and young children respond differently to anesthesia medications due to many factors, including body composition, protein binding, body temperature, distribution of cardiac output, and functional maturity of the liver and kidneys.

According to various studies, the use of general anesthetics and sedation drugs in pregnant animals and young animals for more than 3 hours caused widespread loss of nerve cells in the brain. Recent human studies suggest that a single, relatively short exposure to general anesthetics and sedation drugs in infants or toddlers is unlikely to have negative effects on behavior or learning.

In view of the same, the US FDA issued new warnings in April 2017, related to the use of general anesthetics and sedation drugs in young children and pregnant women. General anesthetics and sedation drugs are necessary for patients, including young children and pregnant women, who require surgery or other painful and stressful procedures. The US FDA has warned about the repeated or lengthy use of general anesthetics and sedation drugs during surgeries or procedures in children younger than three years and pregnant women. The potential risk associated with the use of general anesthesia drugs in young children and pregnant women can lead to a decrease in the uptake of general anesthetics by healthcare professionals and thus may hinder market growth

Opportunity: Patent expiry of Lusedra

Lusedra (fospropofol disodium) is an intravenous sedative-hypnotic agent. It was approved by the FDA in 2008 for monitored anesthesia care (MAC) sedation in adult patients undergoing diagnostic or therapeutic procedures. This molecule will go off-patent by 2022. The patent expiration of this molecule will pave the way for generic drugs to enter the US market, which is expected to offer a significant growth outlook for the key players operating in the market.

By Route of Administration, the intravenous drugs segment accounted for the largest share of the US general anesthesia drugs industry

The intravenous drugs segment is expected to account for the largest share of the US general anesthesia drugs market. General intravenous anesthesia drugs are less expensive and do not require expensive machines for administration. Moreover, intravenous anesthesia drugs results in less cardiovascular depression and provide better postoperative analgesia. These factors are expected to propel the growth of this segment during the forecast period.

By End user, Hospitals accounted for the largest share of the US general anesthesia drugs industry

Hospitals dominated the US general anesthesia drugs market. Growth in this market segment can largely be attributed to the massive patient footfall in hospitals and the increasing number of surgeries performed in these facilities.

Some of the key players include Baxter International Inc. (US), Hikma Pharmaceuticals plc (UK), Pfizer Inc. (US), Piramal Enterprises Limited (India), AbbVie (US), Fresenius SE & Co. KGaA (Germany), Par Pharmaceutical (US), Teva Pharmaceuticals (Israel), Viatris/Mylan (US), Novartis AG (US), Abbott Laboratories (US), AstraZeneca plc (US), F. Hoffmann-La Roche (Switzerland), GlaxoSmithKline plc (UK), Gilead Sciences, Inc. (US), Bayer AG (Germany), Merck & Co., Inc. (Germany), Sanofi (France), Heritage Pharmaceuticals Inc. (US), Akorn (US), and Apotex (Canada).

Scope of the US General Anesthesia Drugs Industry

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$2.0 billion |

|

Projected Revenue by 2025 |

$2.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 3.4% |

|

Market Drivers |

Rising prevalence of cancer |

|

Market Opportunities |

Patent Expiry of Lusedra |

The study categorizes the US general anesthesia drugs market to forecast revenue and analyze trends in each of the following submarkets:

By Route of Administration

-

Inhalational

- Sevoflurane

- Desflurane

- Isoflurane

- Nitrous Oxide

-

Intravenous

- Propofol

- Benzodiazepines

- Ketamine

- Methohexital Sodium

- Others (Etomidate, Fentanyl, Remifentanil)

By End User

- Hospitals

- Ambulatory Surgery Centers

By Company Type

- Tier 1 Pharmaceutical Companies

- Tier 2 Pharmaceutical Companies

- Tier 3 Pharmaceutical Companies

Recent Developments of US General Anesthesia Drugs Industry

- In 2020, Fresenius Kabi introduced its first medications with smart labels embedded with radio-frequency identification technology. The first RFID smart-labeled product, Diprivan (Propofol) 200 mg per 20 mL (10 mg per mL) Injectable Emulsion, USP, was introduced in the US

- In 2020, Hikma Pharmaceuticals USA Inc. launched the Propofol Injectable Emulsion, USP, 20 mL, 50 mL, and 100 mL vials in the US

- In 2020, AbbVie acquired Allergan to expand its product offerings in key therapeutic areas, including oncology, neuroscience, and anesthetics.

- In 2020, Novartis AG acquired Aspen’s Japanese operations focused on generics and off-patent medicines.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global US general anesthesia drugs market?

The global US general anesthesia drugs market boasts a total revenue value of $2.4 billion by 2025.

What is the estimated growth rate (CAGR) of the global US general anesthesia drugs market?

The global US general anesthesia drugs market has an estimated compound annual growth rate (CAGR) of 3.4% and a revenue size in the region of $2.0 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

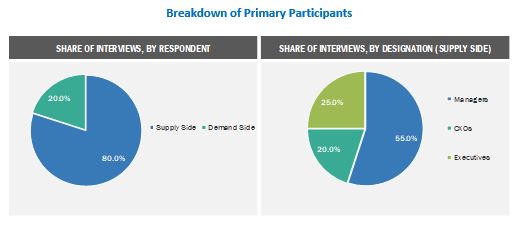

FIGURE 1 BREAKDOWN OF PRIMARIES: US GENERAL ANESTHESIA DRUGS MARKET

2.1.3 MARKET DATA ESTIMATION & TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 MARKET SIZE ESTIMATION (COMPANY REVENUE ANALYSIS-BASED ESTIMATION)

FIGURE 4 MARKET SIZE (USD MILLION)

FIGURE 5 MARKET: GROWTH RATE OF TOP COMPANIES (2018−2019)

FIGURE 6 MARKET: FINAL CAGR PROJECTIONS (2020−2025)

2.3 INDUSTRY INSIGHTS

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 25)

FIGURE 7 US GENERAL ANESTHESIA DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET FOR INTRAVENOUS GENERAL ANESTHETICS, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 MARKET FOR INHALATIONAL GENERAL ANESTHETICS, BY TYPE, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 28)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 10 INCREASING NUMBER OF EMERGENCY SURGERIES AND THE RAPIDLY GROWING AGING POPULATION TO DRIVE MARKET GROWTH

4.2 MARKET, BY END USER, 2020 VS. 2025

FIGURE 11 HOSPITALS HOLD THE LARGEST SHARE OF THE MARKET

5 MARKET OVERVIEW (Page No. - 30)

5.1 MARKET ANALYSIS

5.2 MARKET DYNAMICS

FIGURE 12 US GENERAL ANESTHESIA DRUGS MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 Rapid growth in the geriatric population

5.2.1.2 Rising prevalence of cancer

5.2.1.3 Rising number of emergency surgeries

5.2.2 RESTRAINTS

5.2.2.1 Risks associated with general anesthesia in pediatric patients and pregnant women

TABLE 1 LIST OF GENERAL ANESTHETICS AND SEDATION DRUGS AFFECTED BY LABEL CHANGE

5.2.3 OPPORTUNITIES

5.2.3.1 Patent expiry of Lusedra

5.3 MARKET SIZE

5.3.1 HISTORICAL MARKET TRENDS, 2016–2019

FIGURE 13 US KETAMINE MARKET, 2016–2019 (USD MILLION)

5.3.2 MARKET FORECASTS, 2020–2025

FIGURE 14 US KETAMINE MARKET, 2020–2025 (USD MILLION)

5.4 IMPACT OF COVID-19 ON THE GROWTH OF THE GLOBAL MARKET

6 DISTRIBUTION STRUCTURE (Page No. - 35)

6.1 US KETAMINE MARKET: DISTRIBUTION STRUCTURE

FIGURE 15 DISTRIBUTION STRUCTURE

TABLE 2 US: KETAMINE MARKET, BY DISTRIBUTION CHANNEL, 2016–2019 (USD MILLION)

TABLE 3 US: KETAMINE MARKET, BY DISTRIBUTION CHANNEL, 2020–2025 (USD MILLION)

6.1.1 US KETAMINE MARKET, BY MANUFACTURER

TABLE 4 US: KETAMINE MARKET, BY MANUFACTURER, 2016–2019 (USD MILLION)

TABLE 5 US: KETAMINE MARKET, BY MANUFACTURER, 2016–2019 (KILOGRAM)

TABLE 6 US: KETAMINE MARKET, BY MANUFACTURER, 2020–2025 (USD MILLION)

TABLE 7 US: KETAMINE MARKET, BY MANUFACTURER, 2020–2025 (KILOGRAM)

6.1.2 US KETAMINE MARKET, BY DISTRIBUTION CHANNEL

6.1.2.1 Group purchasing organizations

FIGURE 16 US KETAMINE MARKET SHARE, BY GPO (2019)

TABLE 8 US: KETAMINE MARKET, BY GPO, 2016–2019 (USD MILLION)

TABLE 9 US: KETAMINE MARKET, BY GPO, 2016–2019 (KILOGRAM)

TABLE 10 US: KETAMINE MARKET, BY GPO, 2020–2025 (USD MILLION)

TABLE 11 US: KETAMINE MARKET, BY GPO, 2020–2025 (KILOGRAM)

6.1.2.2 Distributors

FIGURE 17 US KETAMINE MARKET SHARE, BY DISTRIBUTOR (2019)

TABLE 12 US: KETAMINE MARKET, BY DISTRIBUTOR, 2016–2019 (USD MILLION)

TABLE 13 US: KETAMINE MARKET, BY DISTRIBUTOR, 2016–2019 (KILOGRAM)

TABLE 14 US: KETAMINE MARKET, BY DISTRIBUTOR, 2020–2025 (USD MILLION)

TABLE 15 US: KETAMINE MARKET, BY DISTRIBUTOR, 2020–2025 (KILOGRAM)

6.2 KEY LEGAL TRENDS FOR CONTROLLED SUBSTANCES

6.2.1 COMPLIANCE ASSOCIATED WITH THE MANUFACTURING OF NARCOTICS IN THE US

6.2.1.1 Registration

6.2.1.2 Security

6.2.1.3 Labeling and packaging

6.2.1.4 Inventory

6.2.1.5 Records

6.2.2 COMPLIANCE ASSOCIATED WITH VENDORS OF NARCOTICS IN THE US

6.3 PRODUCT CATEGORY ENUMERATION

6.3.1 KETAMINE

6.3.2 OTHER BRANDS

7 US GENERAL ANESTHESIA DRUGS MARKET: KEY INFORMATION (Page No. - 46)

7.1 IMPORT & EXPORT SYSTEMS IN THE US

7.1.1 IMPORT OF CONTROLLED SUBSTANCES

7.1.1.1 Shipment of controlled substances

7.1.1.2 Registration of applicants for the import and export of controlled substances

7.1.2 EXPORT OF CONTROLLED SUBSTANCES

7.1.2.1 Exceptions in exportation for special scientific purposes

7.1.2.2 Custom tariffs for imports

TABLE 16 HARMONIZED TARIFF SCHEDULE FOR ANESTHESIA DRUGS

TABLE 17 ANESTHESIA MOLECULES: CHEMICAL ABSTRACTS SERVICES NUMBERS

7.1.3 TRANSPORT OF CONTROLLED SUBSTANCES

7.1.4 CUSTOMS CLEARANCE

FIGURE 18 CUSTOMS CLEARANCE PROCEDURE FOR IMPORTED CONTROLLED SUBSTANCES IN THE US

FIGURE 19 EXPORT CUSTOMS CLEARANCE PROCEDURE FOR CONTROLLED SUBSTANCES IN THE US

7.1.5 NON-TARIFF BARRIERS

TABLE 18 REGULATORY REQUIREMENTS FOR CONTROLLED SUBSTANCES

7.2 TOP RELATED EXHIBITIONS

TABLE 19 ANESTHESIA EXHIBITIONS/WORKSHOPS/CONFERENCES IN THE US

7.3 DESCRIPTION OF POTENTIAL BUYERS

TABLE 20 POTENTIAL GROUP PURCHASING ORGANIZATIONS

TABLE 21 POTENTIAL DISTRIBUTORS

FIGURE 20 BUSINESS STRATEGY

8 PRODUCT ANALYSIS (Page No. - 60)

8.1 ANESTHESIA DRUGS MARKET SEGMENTATION IN THE US

FIGURE 21 ANESTHESIA DRUGS MARKET SEGMENTATION

FIGURE 22 LOCATION QUOTIENT OF ANESTHESIA SPECIALISTS IN THE US, BY STATE (MAY 2019)

FIGURE 23 ANESTHESIA LANDSCAPE

TABLE 22 ANESTHESIA DRUGS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 23 ANESTHESIA DRUGS MARKET, BY TYPE, 2020–2025 (USD MILLION)

8.2 GENERAL ANESTHESIA

8.2.1 INTRODUCTION

8.2.2 GENERAL ANESTHESIA DRUGS MARKET SEGMENTATION

FIGURE 24 SEGMENTATION OF THE GENERAL ANESTHESIA DRUGS MARKET

TABLE 24 US: GENERAL ANESTHESIA DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2016–2019 (USD MILLION)

TABLE 25 US: GENERAL ANESTHESIA DRUGS MARKET, BY ROUTE OF ADMINISTRATION, 2020–2025 (USD MILLION)

8.3 INTRAVENOUS GENERAL ANESTHETICS

TABLE 26 US: INTRAVENOUS GENERAL ANESTHETICS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 27 US: INTRAVENOUS GENERAL ANESTHETICS MARKET, BY TYPE, 2020–2025 (USD MILLION)

8.4 INHALATIONAL GENERAL ANESTHETICS

TABLE 28 US: INHALATIONAL GENERAL ANESTHETICS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 29 US: INHALATIONAL GENERAL ANESTHETICS MARKET, BY TYPE, 2020–2025 (USD MILLION)

8.4.1 MAJOR BRANDS/MOLECULES

8.4.1.1 Propofol

8.4.1.2 Benzodiazepines

8.4.1.3 Methohexital Sodium

8.5 COMPETITION IN THE US

FIGURE 25 PROPERTIES OF INTRAVENOUS ANESTHESIA DRUGS

FIGURE 26 INTRAVENOUS GENERAL ANESTHETICS MARKET, BY MOLECULE, 2019 (USD MILLION)

8.5.1 SALES PRICE

TABLE 30 PROPOFOL PRICE, 2020 (USD)

TABLE 31 MIDAZOLAM PRICE, 2020 (USD)

TABLE 32 METHOHEXITAL SODIUM PRICE, 2020 (USD)

TABLE 33 ETOMIDATE PRICE, 2020 (USD)

TABLE 34 KETAMINE PRICE, 2020 (USD)

8.5.2 MAJOR BRANDS

TABLE 35 GENERAL INTRAVENOUS ANESTHESIA DRUGS: USAGE TRENDS

8.6 POTENTIAL BUYERS IN THE US

8.6.1 POTENTIAL BUYERS, BY STATE

TABLE 36 GROUP PURCHASING ORGANIZATIONS, BY STATE

TABLE 37 DISTRIBUTORS, BY STATE

9 US GENERAL ANESTHESIA DRUGS MARKET, BY END USER (Page No. - 74)

9.1 INTRODUCTION

TABLE 38 US: GENERAL ANESTHESIA DRUGS MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 39 US: GENERAL ANESTHESIA DRUGS MARKET, BY END USER, 2020–2025 (USD MILLION)

9.1.1 HOSPITALS

9.1.1.1 Growing patient pool in hospitals to drive market growth

9.1.2 AMBULATORY SURGERY CENTERS

9.1.2.1 Increasing number of ASCs in the country to boost the market growth

10 COMPETITIVE LANDSCAPE (Page No. - 77)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS (2019)

FIGURE 27 US GENERAL ANESTHESIA DRUGS MARKET SHARE, BY KEY PLAYER, 2019

10.3 KEY MARKET DEVELOPMENTS

10.3.1 PRODUCT LAUNCHES

10.3.2 ACQUISITIONS

10.3.3 EXPANSIONS

10.3.4 PARTNERSHIPS

11 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 80)

11.1 OVERVIEW

11.2 COMPETITIVE LEADERSHIP MAPPING: MAJOR MARKET PLAYERS (2019)

11.2.1 STARS

11.2.2 EMERGING LEADERS

11.2.3 PERVASIVE PLAYERS

11.2.4 PARTICIPANTS

FIGURE 28 US GENERAL ANESTHESIA DRUGS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12 COMPANY PROFILES (Page No. - 82)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 PFIZER, INC.

FIGURE 29 PFIZER, INC.: COMPANY SNAPSHOT (2019)

12.2 FRESENIUS SE & CO. KGAA

FIGURE 30 FRESENIUS SE & CO. KGAA: COMPANY SNAPSHOT (2019)

12.3 BAXTER INTERNATIONAL INC.

FIGURE 31 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2019)

12.4 HIKMA PHARMACEUTICALS PLC

FIGURE 32 HIKMA PHARMACEUTICALS PLC: COMPANY SNAPSHOT (2019)

12.5 ABBVIE

FIGURE 33 ABBVIE: COMPANY SNAPSHOT (2019)

12.6 PIRAMAL ENTERPRISES LIMITED

FIGURE 34 PIRAMAL ENTERPRISES LIMITED: COMPANY SNAPSHOT (2020)

12.7 ABBOTT LABORATORIES

FIGURE 35 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2019)

12.8 ASTRAZENECA PLC

FIGURE 36 ASTRAZENECA PLC: COMPANY SNAPSHOT (2019)

12.9 NOVARTIS AG

FIGURE 37 NOVARTIS AG: COMPANY SNAPSHOT (2019)

12.10 F. HOFFMANN-LA ROCHE LTD.

FIGURE 38 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2019)

12.11 BAYER AG

FIGURE 39 BAYER AG: COMPANY SNAPSHOT (2019)

12.12 GLAXOSMITHKLINE PLC

FIGURE 40 GLAXOSMITHKLINE PLC: COMPANY SNAPSHOT (2019)

12.13 GILEAD SCIENCES

FIGURE 41 GILEAD SCIENCES: COMPANY SNAPSHOT (2019)

12.14 MERCK & CO., INC.

FIGURE 42 MERCK & CO., INC.: COMPANY SNAPSHOT (2019)

12.15 SANOFI

FIGURE 43 SANOFI: COMPANY SNAPSHOT (2019)

12.16 PAR PHARMACEUTICAL

12.17 TEVA PHARMACEUTICALS

12.18 VIATRIS (MYLAN)

12.19 HERITAGE PHARMACEUTICALS INC.

12.20 AKORN

12.21 APOTEX

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 112)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE

13.3 RELATED REPORTS

13.4 AUTHOR DETAILS

This market research study involved extensive use of secondary sources, directories, and databases to identify and collect important information on the US general anesthesia drugs market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, and to assess market prospects. The size of the market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from the National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), US Food and Drug Administration (FDA), World Bank, World Health Organization (WHO), American Society of Anesthesiologists (ASA), The Association of Anaesthetists, International Anesthesia Research Society, American Association of Nurse Anesthetists, and National Center for Biotechnology Information (NCBI). Secondary sources also included corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the market scenario through secondary research. The primary sources included industry experts from core and related industries and preferred suppliers, manufacturers, distributors, anesthesiologists, doctors, group purchasing organizations (GPOs), alliances, and standards and certification organizations from companies and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, which include key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as to assess future prospects. Approximately 80% and 20% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study,download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by route of administration, end user,and company type).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Report Objectives

- To define, describe, and measure the US general anesthesia drugs market based on route of administration and end user

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the market

- To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the market segments with respect to US

- To profile the key players and comprehensively analyze their core competencies in terms of key developments, product portfolios, and financials

- To track and analyze competitive developments such as partnerships, agreements, alliances, joint ventures, collaborations, product launches, expansions, acquisitions, grants/funds, and licensing agreements, among others, in the market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in US General Anesthesia Drugs Market