Ambulatory Surgical Centers Market by Product (EHR, Practice Management, Telehealth, Healthcare Analytics, PHM, Supply Chain Management, RCM, Surgical planning, Quality Management), Specialty Type (Single, Multi-specialty) - Global Forecast to 2025

Market Growth Outlook Summary

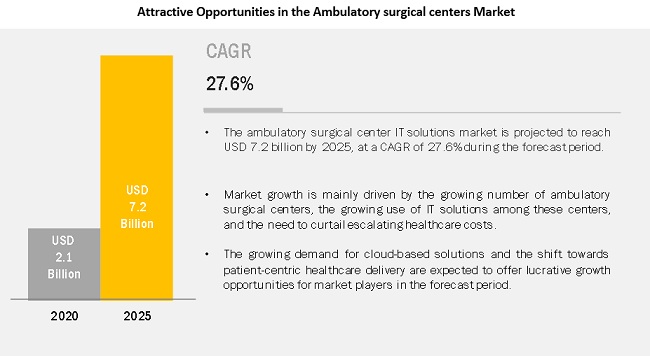

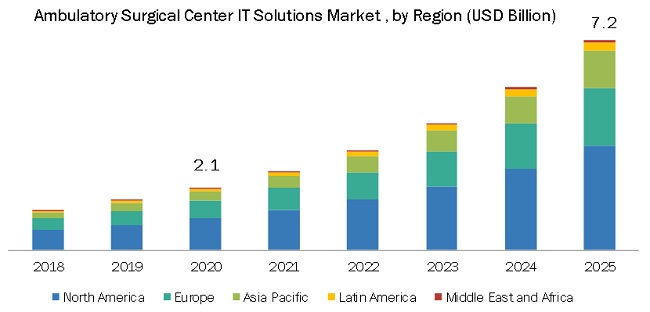

The global ambulatory surgical centers market growth forecasted to transform from $2.1 billion in 2020 to $7.2 billion by 2025, driven by a CAGR of 27.6%. Key drivers include the growing need to reduce healthcare costs, the shift to outpatient procedures, and increasing demand for IT solutions like telehealth and remote monitoring. However, high deployment costs and reluctance to adopt new technologies hinder growth. The market is segmented by products (clinical solutions, non-clinical solutions, HCIT outsourcing), components (services, software, hardware), and specialties (single, multi-specialty). North America holds the largest market share, driven by major players like Cerner, McKesson, and Philips Healthcare. Recent innovations include cloud-based solutions and telehealth integration.

By-products and services, the clinical solutions segment accounted for the largest share of the Ambulatory surgical centers industry

Based on products and services, the Ambulatory surgical centers market is segmented into clinical solutions, non-clinical solutions, and HCIT outsourcing services. In 2019, the clinical solutions segment accounted for the largest share of the market. The need to control the increasing healthcare costs and improve the efficiency of healthcare services by reducing medical errors are a major driver that propels the demand for healthcare provider solutions.

By components, the services segment accounted for the largest industry share

Based on components, the Ambulatory surgical centers market is segmented into services, software, and hardware. The services segment accounted for the largest market share in 2019. This is due to the introduction of complex software, the need for integration and interoperability of software, the growing demand for consulting and outsourcing of various healthcare processes such as revenue cycle management, EHR management, and fraud detection.

By specialty, the multi-specialty segment accounted for the largest share of the Ambulatory surgical centers industry

Based on specialty, the Ambulatory surgical centers industry is segmented into single and multi-specialty. In 2019, the multi-specialty segment accounted for the largest share of the Ambulatory surgical centers market. The large share of this segment can be attributed to the large number of surgical procedures performed in these facilities and the availability of reimbursement for these procedures.

North America will continue to dominate the Ambulatory surgical centers industry during the forecast period

North America accounted for the largest share of the Ambulatory surgical centers market, followed by Europe. The large share of this region can be attributed to the high adoption of Ambulatory surgical centers for reducing the soaring healthcare costs, increasing volume of surgical procedures performed, and the presence of significant market players, such as Epic Systems Corporation (US), Cerner Corporation (US), McKesson Corporation (US), Philips Healthcare (Netherlands), and Allscripts Healthcare Solutions, Inc. (US).

The prominent players of this market are Cerner Corporation (US), McKesson Corporation (US), Allscripts Healthcare Solutions, Inc. (US), GE Healthcare (US), Philips Healthcare (Netherlands), athenahealth, Inc. (US), Optum (US), Epic Systems Corporation (US), Medical Information Technology, Inc. (MEDITECH) (US), eClinicalWorks (US), athenahealth, Inc. (US), Advanced Data Systems Corporation (US), NextGen Healthcare (US), CureMD (US), HST Pathways (US), and Surgical Information Systems (US).

Scope of the Ambulatory Surgical Centers Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$2.1 billion |

|

Projected Revenue Size by 2025 |

$7.2 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 27.6% |

|

Market Driver |

Increasing number of ambulatory surgical centers |

|

Market Opportunity |

Growing demand cloud-based solutions |

The research report categorizes the ambulatory surgical centers market to forecast revenue and analyze trends in each of the following submarkets:

By Products & services

-

CLINICAL IT SOLUTIONS

- EHRs

- Population Health Management Solutions

- Medical Image Analysis Solutions

- e-prescribing Solutions

- Practice Management Software

- Surgical Planning Software

- Telehealth Solutions

- Healthcare Integration Solutions

- Other Clinical Solutions

-

NON-CLINICAL HEALTHCARE IT SOLUTIONS

- Revenue Cycle Management Solutions

- Healthcare Analytics Solutions

- Healthcare Supply Chain Management Solutions

- Healthcare Quality Management Solutions

- Healthcare Interoperability Solutions

- Other Non-clinical Solutions

- HCIT OUTSOURCING SERVICES

By Components

- SERVICES

- SOFTWARE

- HARDWARE

By Specialty

- Single Specialty

- Multi-specialty

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

Asia Pacific

- Japan

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Ambulatory Surgical Centers Industry

- In 2019, NextGen Healthcare launched NextGen Health Data Hub

- In 2019, GE Healthcare launched Edison Datalogue and my. Cryochain software

- In 2019, MEDITECH collaborated with Google to offer EHR data through the Google Cloud Platform. This helped to securely deliver patient data, enhance scalability, and facilitate interoperability.

- In 2019, Epic Systems partnered with Teledoc Health to integrate Teledoc Health’s virtual care platform to Epic’s App Orchard that would help the company conduct telehealth video visits.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ambulatory surgical centers market?

The global ambulatory surgical centers market boasts a total revenue value of $7.2 billion by 2025.

What is the estimated growth rate (CAGR) of the global ambulatory surgical centers market?

The global ambulatory surgical centers market has an estimated compound annual growth rate (CAGR) of 27.6% and a revenue size in the region of $2.1 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH APPROACH

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 GROWTH FORECAST

2.3 DATA TRIANGULATION APPROACH

2.4 MARKET SHARE ESTIMATION

3 EXECUTIVE SUMMARY (Page No. - 31)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 AMBULATORY SURGICAL CENTERS INDUSTRY OVERVIEW

4.2 MARKET, BY PRODUCT & SERVICE AND COMPONENT

4.3 MARKET, BY REGION (2018–2025)

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 MARKET DRIVERS

5.2.1.1 Increasing number of Ambulatory Surgical Centerss

5.2.1.2 Need to curtail escalating healthcare costs

5.2.1.3 Growing use of IT solutions among ASCs

5.2.2 MARKET RESTRAINTS

5.2.2.1 Heavy infrastructure investments and high cost of deployment

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Growing demand for cloud-based solutions

5.2.3.2 Shift towards patient-centric healthcare delivery

5.2.4 MARKET CHALLENGES

5.2.4.1 Interoperability issues

5.3 INDUSTRY TRENDS

5.3.1 CLOUD -BASED IT SOLUTIONS

5.3.2 SHIFT FROM INPATIENT SURGICAL PROCEDURES TO OUTPATIENT SURGICAL PROCEDURES

6 AMBULATORY SURGICAL CENTERS MARKET, BY PRODUCT & SERVICE (Page No. - 47)

6.1 INTRODUCTION

6.2 CLINICAL SOLUTIONS

6.2.1 ELECTRONIC HEALTH RECORDS

6.2.1.1 Favorable government initiatives and advancements in EHRs are driving market growth

6.2.2 PRACTICE MANAGEMENT SOFTWARE

6.2.2.1 Incentives offered for the use of practice management software are supporting their adoption

6.2.3 MEDICAL IMAGE ANALYSIS SOLUTIONS

6.2.3.1 Increasing demand for imaging modalities is supporting the adoption of medical image analysis solutions

6.2.4 E-PRESCRIBING SOLUTIONS

6.2.4.1 Integrated e-prescribing solutions offer significant benefits over standalone systems

6.2.5 TELEHEALTH SOLUTIONS

6.2.5.1 Telehealth solutions facilitate remote doctor-patient consultations and monitoring of vital signs

6.2.6 SURGICAL PLANNING SOFTWARE

6.2.6.1 Technological advancements in cloud computing and growing demand among surgeons to streamline surgical intervention are the major factors driving market growth

6.2.7 HEALTHCARE INTEGRATION SOLUTIONS

6.2.7.1 Healthcare integration solutions make healthcare more cost-effective

6.2.8 POPULATION HEALTH MANAGEMENT SOLUTIONS

6.2.9 OTHER CLINICAL SOLUTIONS

6.3 NON-CLINICAL SOLUTIONS

6.3.1 REVENUE CYCLE MANAGEMENT SOLUTIONS

6.3.1.1 RCM Solutions will continue to dominate the non-clinical solutions market

6.3.2 HEALTHCARE SUPPLY CHAIN MANAGEMENT SOLUTIONS

6.3.2.1 Procurement management solutions

6.3.2.1.1 Procurement management solutions form an important element of supply chain management as they maximize profits on each purchase order and efficiently manage purchasing cycle times

6.3.2.2 Inventory management solutions

6.3.2.2.1 Inventory management solutions play an essential role in maintaining optimum inventory levels within healthcare organizations

6.3.3 HEALTHCARE ANALYTICS SOLUTIONS

6.3.4 HEALTHCARE INTEROPERABILITY SOLUTIONS

6.3.4.1 ASCs can improve operational and clinical efficiencies with the implementation of healthcare interoperability solutions

6.3.5 HEALTHCARE QUALITY MANAGEMENT SOLUTIONS

6.3.5.1 Data security concerns and the high cost of quality reporting are expected to restrain the growth of this market

6.3.6 OTHER NON-CLINICAL SOLUTIONS

6.4 HCIT OUTSOURCING SERVICES

7 AMBULATORY SURGICAL CENTERS MARKET, BY COMPONENT (Page No. - 73)

7.1 INTRODUCTION

7.2 SERVICES

7.2.1 NEED FOR SOFTWARE INTEGRATION & INTEROPERABILITY IS A MAJOR FACTOR SUPPORTING THE SERVICES SEGMENT

7.3 SOFTWARE

7.3.1 INCREASING NUMBER OF HEALTHCARE ORGANIZATIONS SHIFTING FROM ON-PREMISE MODELS TO WEB- OR CLOUD-BASED MODELS FOR CORE APPLICATIONS IS A MAJOR FACTOR DRIVING GROWTH

7.4 HARDWARE

7.4.1 NEED FOR FASTER DATA EXCHANGE & BETTER INTEROPERABILITY ARE INCREASING THE ADOPTION OF HARDWARE IN HEALTHCARE ORGANIZATIONS

8 AMBULATORY SURGICAL CENTERS MARKET, BY REGION (Page No. - 81)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 US

8.2.1.1 Growing need to curtail soaring healthcare costs to drive market growth in the US

8.2.2 CANADA

8.2.2.1 Growing need for cost containment in healthcare to propel market growth

8.3 EUROPE

8.3.1 GERMANY

8.3.1.1 High adoption of EHRs in the country to drive market growth

8.3.2 UK

8.3.2.1 The UK is rapidly transforming its organizations into paperless environments through EHRs and medical document management systems

8.3.3 FRANCE

8.3.3.1 Upcoming retirement of a large number of French doctors will draw attention to the need for effective patient management solutions

8.3.4 REST OF EUROPE (ROE)

8.4 ASIA PACIFIC

8.4.1 JAPAN

8.4.1.1 Japan is the largest Ambulatory Surgical Centers Industry in the APAC

8.4.2 REST OF ASIA PACIFIC (ROAPAC)

8.5 LATIN AMERICA

8.5.1 DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

8.6 MIDDLE EAST & AFRICA

8.6.1 GROWING MEDICAL TOURISM TO SUPPORT MARKET GROWTH IN THE MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE (Page No. - 123)

9.1 OVERVIEW

9.2 COMPETITIVE LEADERSHIP MAPPING

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 DYNAMIC DIFFERENTIATORS

9.2.4 EMERGING COMPANIES

9.3 MARKET SHARE ANALYSIS

9.4 PRODUCT PORTFOLIO MATRIX

9.5 COMPETITIVE SITUATION & TRENDS

9.5.1 NEW PRODUCT LAUNCHES

9.5.2 PARTNERSHIPS, COLLABORATIONS, & AGREEMENTS

9.5.3 ACQUISITIONS

10 COMPANY PROFILES (Page No. - 130)

(Business Overview, Products Offered, Recent Developments, MnM View)*

10.1 CERNER CORPORATION

10.2 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

10.3 MCKESSON CORPORATION

10.4 NEXTGEN HEALTHCARE

10.5 EPIC SYSTEMS CORPORATION

10.6 PHILIPS HEALTHCARE

10.7 GE HEALTHCARE

10.8 MEDICAL INFORMATION TECHNOLOGY, INC.

10.9 ECLINICAL WORKS

10.10 ATHENAHEALTH, INC.

10.11 ADVANCED DATA SYSTEMS CORPORATION

10.12 OPTUM (A PART OF UNITEDHEALTH GROUP)

10.13 CUREMD

10.14 HST PATHWAYS

10.15 SURGICAL INFORMATION SYSTEMS, LLC

10.16 WRS HEALTH

10.17 DAVLONG BUSINESS SOLUTIONS

10.18 COMPULINK HEALTHCARE SOLUTIONS

10.19 AMBLITEL

10.20 DRCHRONO

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 169)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (112 TABLES)

TABLE 1 AMBULATORY SURGICAL CENTERS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 2 AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 3 AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 4 EHR/EMR SYSTEMS PROVIDED BY KEY PLAYERS

TABLE 5 ELECTRONIC HEALTH RECORDS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 6 PRACTICE MANAGEMENT SOFTWARE PROVIDED BY KEY PLAYERS

TABLE 7 PRACTICE MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 8 MEDICAL IMAGE ANALYSIS SOLUTIONS PROVIDED BY KEY PLAYERS

TABLE 9 MEDICAL IMAGE ANALYSIS SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 E-PRESCRIBING SOLUTIONS PROVIDED BY KEY PLAYERS

TABLE 11 E-PRESCRIBING SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 TELEHEALTH SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 13 SURGICAL PLANNING SOFTWARE PROVIDED BY KEY PLAYERS

TABLE 14 SURGICAL PLANNING SOFTWARE MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 HEALTHCARE INTEGRATION SOLUTIONS PROVIDED BY KEY PLAYERS, 2018

TABLE 16 HEALTHCARE INTEGRATION SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 PHM SOLUTIONS PROVIDED BY KEY PLAYERS

TABLE 18 POPULATION HEALTH MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 19 OTHER CLINICAL SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 20 AMBULATORY SURGICAL CENTERS IT NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 21 AMBULATORY SURGICAL CENTERS IT NON-CLINICAL SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 SUPPLY CHAIN MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 HEALTHCARE ANALYTICS SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 25 HEALTHCARE INTEROPERABILITY SOLUTIONS PROVIDED BY KEY PLAYERS

TABLE 26 HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 HEALTHCARE QUALITY MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 OTHER NON-CLINICAL SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 HCIT OUTSOURCING SERVICES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 AMBULATORY SURGICAL CENTERS INDUSTRY, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 31 AMBULATORY SURGICAL CENTERS IT SERVICES PROVIDED BY KEY PLAYERS

TABLE 32 AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET FOR SERVICES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET FOR SOFTWARE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET FOR HARDWARE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 NORTH AMERICA: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 42 US: KEY MACROINDICATORS

TABLE 43 US: MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 44 US: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 45 US: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 46 US: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 47 US: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 CANADA: KEY MACROINDICATORS

TABLE 49 CANADA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 50 CANADA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 51 CANADA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 52 CANADA: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 CANADA: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: AMBULATORY SURGICAL CENTERS INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 56 EUROPE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 57 EUROPE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 GERMANY: KEY MACROINDICATORS

TABLE 61 GERMANY: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 62 GERMANY: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 63 GERMANY: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 64 GERMANY: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 GERMANY: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 UK: KEY MACROINDICATORS

TABLE 67 UK: MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 68 UK: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 69 UK: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 70 UK: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 UK: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 FRANCE: KEY MACROINDICATORS

TABLE 73 FRANCE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 74 FRANCE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 75 FRANCE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 76 FRANCE: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 FRANCE: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 ROE: AMBULATORY SURGICAL CENTERS INDUSTRY, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 79 ROE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 80 ROE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 81 ROE: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 ROE: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 83 APAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 84 APAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 85 APAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 86 APAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 87 APAC: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 APAC: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 JAPAN: KEY MACROINDICATORS

TABLE 90 JAPAN: MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 91 JAPAN: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 92 JAPAN: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 93 JAPAN: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 JAPAN: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 ROAPAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 96 ROAPAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 97 ROAPAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 98 ROAPAC: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 ROAPAC: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 LATIN AMERICA: AMBULATORY SURGICAL CENTERS INDUSTRY, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 101 LATIN AMERICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 102 LATIN AMERICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 103 LATIN AMERICA: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 LATIN AMERICA: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 MIDDLE EAST & AFRICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 106 MIDDLE EAST & AFRICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2018–2025 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 NEW PRODUCT LAUNCHES

TABLE 111 PARTNERSHIPS, COLLABORATIONS, & AGREEMENTS

TABLE 112 ACQUISITIONS, 2019

LIST OF FIGURES (36 FIGURES)

FIGURE 1 AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET

FIGURE 2 RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 HYPOTHESIS TESTING BUILDER

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 DATA TRIANGULATION METHODOLOGY

FIGURE 8 ASSUMPTIONS FOR THE RESEARCH STUDY

FIGURE 9 AMBULATORY SURGICAL CENTERS INDUSTRY, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD BILLION)

FIGURE 10 AMBULATORY SURGICAL CENTERS CLINICAL SOLUTIONS MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 AMBULATORY SURGICAL CENTERS NON-CLINICAL SOLUTIONS MARKET, BY TYPE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY SPECIALTY, 2020 VS. 2025 (USD BILLION)

FIGURE 13 AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, 2020 VS. 2025 (USD BILLION)

FIGURE 14 GEOGRAPHICAL SNAPSHOT OF THE AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET

FIGURE 15 GROWING NUMBER OF AMBULATORY SURGICAL CENTERSS TO DRIVE MARKET GROWTH

FIGURE 16 SERVICES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET IN 2019

FIGURE 17 NORTH AMERICA WILL CONTINUE TO DOMINATE THE AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET IN 2025

FIGURE 18 AMBULATORY SURGICAL CENTERS INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 19 US: NUMBER OF ASCS, 2010–2017

FIGURE 20 CLOUD ADOPTION IN THE US HEALTH SECTOR (2016)

FIGURE 21 CLINICAL SOLUTIONS DOMINATED THE AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY PRODUCT & SERVICE, IN 2019

FIGURE 22 SERVICES ACCOUNTED FOR THE LARGEST SHARE OF THE AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET, BY COMPONENT, IN 2019

FIGURE 23 NORTH AMERICA: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET SNAPSHOT

FIGURE 24 EUROPE: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET SNAPSHOT

FIGURE 25 APAC: AMBULATORY SURGICAL CENTERS IT SOLUTIONS MARKET SNAPSHOT

FIGURE 26 PARTNERSHIPS, COLLABORATIONS, & AGREEMENTS—KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS FROM 2017 TO FEBRUARY 2020

FIGURE 27 AMBULATORY SURGICAL CENTERS INDUSTRY (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 28 AMBULATORY EHR FOR FREE STANDING AMBULATORY SURGICAL CENTERS (2019)

FIGURE 29 CERNER CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 30 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2018)

FIGURE 31 MCKESSON CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 32 NEXTGEN HEALTHCARE: COMPANY SNAPSHOT (2019)

FIGURE 33 PHILIPS HEALTHCARE: COMPANY SNAPSHOT (2019)

FIGURE 34 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

FIGURE 35 MEDITECH: COMPANY SNAPSHOT (2019)

FIGURE 36 OPTUM: COMPANY SNAPSHOT (2018)

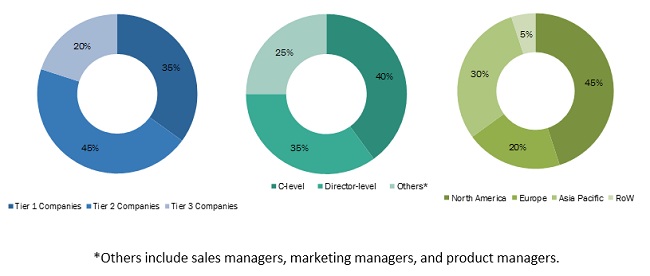

The study involved four major activities in estimating the size of the Ambulatory Surgical Centers market. Exhaustive secondary research was done to collect information on the adoption of different technologies and their regional adoption trends. Industry experts further validated the data obtained through secondary research through primary research. Furthermore, the market size estimates and forecast provided in this study are derived through a mix of the bottom-up approach (country-level data for outpatient surgical procedures) and top-down approach (assessment of utilization/adoption/penetration trends, by product and services, components, and specialty type). After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources such as the US Department of Health and Human Services, Healthcare Information and Management Systems Society (HIMSS), National Association of Healthcare Quality, Centers for Disease Control and Prevention (CDC), Centers for Medicare and Medicaid Services (CMS), US Department of Labor, The Agency for Healthcare Research and Quality (AHRQ), Medical Records Institute, General Physician Hospital Organization (GPHO), Association of Information and Image Management (AIIM), The Economist Intelligence Unit, American Health Information Management Association (AHIMA), Healthcare IT News, World Health Organization (WHO), annual reports/SEC filings as well as investor presentations and press releases of key players have been used to identify and collect information useful for the study of this market.

Primary Research

Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess the dynamics of this market. The primary participants mainly include product managers, business development directors, sales managers, and healthcare providers across the industry. The breakdown of primaries is shown in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to anticipate and validate the size of the Ambulatory Surgical Centers market and to estimate the size of various other dependent submarkets.

Data Triangulation

After arriving at the market size, the total Ambulatory Surgical Centers market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To define, describe, and forecast the Ambulatory Surgical Centers market concerning segments in product & service, component, specialty, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as acquisitions, new tests/technology developments, geographical expansions, and research & development activities of the leading players in the market

Target Audience:

- Ambulatory Surgical Centers manufacturers

- Ambulatory Surgical Centers distributors

- Healthcare payer companies

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Segment Analysis

- Further breakdown of the healthcare IT integration market into the interface engine, medical device integration, and media integration

- Further collapse of the E-prescribing market into integrated solutions and standalone solutions

- Further breakdown of the Population Health Management market into web-based, cloud-based, and on-premise

- Further breakdown of the EHR market into integrated solutions and independent solutions

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific Ambulatory Surgical Centers market into China, South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe Ambulatory Surgical Centers market into Italy, Spain, Russia, the Netherlands, Switzerland, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ambulatory Surgical Centers Market