Veterinary Vaccines Market Size, Growth, Share & Trends Analysis

Veterinary Vaccines Market by Type (Porcine, Poultry, Livestock, Companion Animals), Technology (Live Attenuated, Inactivated, Toxoid), Route of Administration (Intramuscular, Subcutaneous, Oral), End User (Hospitals, Clinics) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global veterinary vaccines market, valued at US$10.94 billion in 2024, stood at US$11.63 billion in 2025 and is projected to advance at a resilient CAGR of 6.8% from 2025 to 2030, culminating in a forecasted valuation of US$16.15 billion by the end of the period. Among the factors promoting the use of veterinary vaccines are increasing awareness of animal health, as well as the rising pet population and pet ownership. Examples of emerging trends affecting this market include government initiatives to improve animal health and the increased adoption of pet insurance. In developed markets such as North America and Europe, pet owners tend to insure their pets due to increased pet spending. Furthermore, the continuous focus on developing novel and advanced vaccines, combined with the increasing application of these vaccines in emerging economies, is expected to drive market growth.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is the fastest-growing market for veterinary vaccines during the forecast period.

-

BY TYPEBased on type, the livestock vaccines segment accounted for the largest share of 28.6%.

-

BY DISEASEBy disease, the livestock vaccines segment accounted for the largest share of 31.3% in 2024.

-

BY ROUTE OF ADMINISTRATIONBy route of administration, the subcutaneous route of administration accounted for largest market share.

-

BY TECHNOLOGYBy technology, the live attenuated vaccines segment accounted for the largest share of 43.2% of the veterinary vaccines market in 2024.

-

COMPETITIVE LANDSCAPEZoetis, Merck & Co., Inc., and Boehringer Ingelheim International GmbH are identified as star players in the market. These industry leaders have very broad vaccine portfolios, large-scale manufacturing, strong R&D, and global distribution.

-

COMPETITIVE LANDSCAPEHIPRA, Hester Biosciences, and Vaxxinova are identified as high-growth innovators/SMEs. These companies are carving out niches through regional specialization, novel vaccine technologies, and growing presence in emerging markets.

The veterinary vaccines market is poised for healthy growth in the years ahead, due to rising awareness about animal health and increased demand for preventing zoonotic and livestock-related diseases. The growing demand for safe and effective vaccines to protect pets, poultry, and livestock is driven by the expansion of global meat and dairy consumption. Besides, biotechnology is improving with discovery of recombinant and DNA-based vaccines, enhancing efficacy, safety and production efficiency. The use of innovative delivery technology and efficient cold chain logistics is strengthening international access to vaccines. Such new developments are contributing to the larger picture of preventive veterinary care and sustainable livestock management, which position veterinary vaccines as a critical element in the welfare of animals and public health.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The veterinary vaccines market is undergoing a significant transformational wave due to evolving disease patterns. Advancements in vaccine technologies like combinations, vectors, and long-acting are creating an ease of administration and a wider coverage of protection. Meanwhile, the increasing biosecurity needs, tightening regulatory demands, and the perceived need for inexpensive, large-scale immunization in livestock shelters and operations have all shifted procurement and usage patterns. Digital health tools, better vaccination tracking, and extended distribution partnerships are further redefining how vaccines are delivered and monitored. In summary, the market is shifting from classical vaccines to more advanced, innovative, and cost-effective solutions for immunization.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in companion animal population and pet ownership

-

Increasing incidence of infectious zoonotic diseases

Level

-

High cost of vaccine development

Level

-

Technological advancements for veterinary vaccine development

-

Untapped growth potential in emerging economies

Level

-

Limited awareness about animal vaccines and shortage of trained veterinarians in low-income countries

-

Stringent regulatory requirements for licensing veterinary vaccines

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

VETERINARY VACCINES MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Broad vaccine portfolio for livestock (avian influenza, bovine respiratory disease, swine fever) and pets (rabies, parvovirus) | Strong R&D in recombinant/vector vaccines | Improved livestock productivity, reduced outbreak losses, stronger food security, and enhanced pet health |

|

Innovative platforms, including RNA-particle and recombinant vaccines | Targeting zoonotic diseases and production animals | Broader protection spectrum, longer shelf life, better safety profile |

|

Poultry and swine vaccines, plus companion animal lines | Focus on global emerging disease threats | Reduced flock/herd mortality, improved farmer profitability, expanded vaccine access in developing regions |

|

Expanding livestock and companion animal vaccines with scalable production capacity | Greater vaccine availability in emerging markets, better farmer incomes, growth in preventive pet care |

|

Companion animal vaccines with new formulations and delivery routes | Higher pet vaccination compliance, improved household disease prevention, and convenient administration |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The veterinary vaccines market ecosystem is comprised of a network of multinational key players, including Zoetis, Merck, Boehringer Ingelheim, Elanco, Virbac, and Ceva, as well as regional players such as Hester Biosciences. It integrates R&D and manufacturing hubs, government agencies driving mass immunization programs, veterinary clinics and distributors ensuring last-mile delivery, and farmers/pet owners as end users. All these institutions rely on regulations established by governing authorities that determine their safety and effectiveness, as well as cold-chain logistics that maintain their quality. Additionally, they rely on research and academic institutions that further innovations for the next generation. End users include those where these veterinary vaccines are adopted for final production

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Veterinary Vaccines Market, By Type

Based on type, the livestock vaccines segment is the largest segment in the animal vaccines market. Livestock animals are owned for the production of food such as meat or milk. With the increasing global population, the demand for animal-derived food products is on the rise. This is leading to intensified livestock farming to fulfill these requirements. The overall consumption of meat is increasing due to improved production and rising demand, both domestically and globally. According to this report, the US is the largest beef producer in the world in 2023, accounting for over 30% of its farms being used for beef production. (source: Carlisle Technology). As livestock farming becomes more industrialized and regulated, it will further increase the need for vaccines to prevent diseases.

Veterinary Vaccines Market, By Technology

The segment for live attenuated vaccines accounts for the major share of the veterinary vaccines market. Their ease of administration and long-term immune response availability are key drivers behind this growth. They are highly effective, cost-efficient, and provide protection against a range of serious diseases in livestock. Unsurprisingly, this increasing demand is in regions with highly intensive trade of healthy disease-free livestock.

Veterinary Vaccines Market, By End User

In the veterinary vaccines market, the veterinary hospitals segment is the major end user of veterinary vaccines. Interior animal care has significantly improved in veterinary hospitals, serving as a primary care provider for the diagnosis and treatment of various healthcare conditions. Most veterinary vaccine manufacturers prefer to market their vaccines directly to licensed veterinarians or proprietary distributors that sell only to veterinarians rather than to third-party pharmacies. It attracts more veterinary professionals to veterinary hospitals, increases visits to veterinary clinics, and, through advocacy, raises awareness about animal health in developing and emerging countries. Increased spending on animal care has been another driving force behind the rise in hospital vaccinations for pets.

REGION

Asia Pacific to be fastest-growing region in global veterinary vaccines market during forecast period

The Asia Pacific veterinary vaccines market is projected to record the fastest growth during the forecast period. Countries like China and India are also increasing their demand for veterinary care services, such as vaccination, primarily due to increased pet ownership. The need for preventive healthcare, including vaccinations, is growing in animal health, whether for pets or production animals. With increasing economic growth and rising disposable income in the region, it is clear that demand for veterinary services and products will increase.

VETERINARY VACCINES MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS: COMPANY EVALUATION MATRIX

In the veterinary vaccines market, Zoetis (Star) leads with a strong presence around the globe. It has a wide-ranging vaccine portfolio and advanced technologies, ensuring rapid acceptance among commercial farms and veterinary practices. Phibro Animal Health (Emerging Leader) is now on an accelerated path with innovative, cost-effective vaccine solutions. The company emphasizes emerging markets as well as expanding its footprint in animal health.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Zoetis(US)

- Merck & Co, Inc. (US)

- Boehringer Ingelheim International GmbH (Germany)

- Elanco (US)

- Virbac (France)

- Ceva (France)

- Phibro Animal Health Corporation (US)

- Hester Biosciences Limited (India)

- Neogen Corporation (US)

- HIPRA (Spain)

- Biogénesis Bagó (Argentina)

- Tianjin Ringpu Biotechnology Co., Ltd. (China)

- China Animal Husbandry Industry Co., LTD. (China)

- Jinyu Bio-technology Co., Ltd. (China)

- Vaxxinova International B.V. (Netherlands)

- Endovac Animal Health (US)

- Brilliant Bio Pharma Pvt Ltd. (India)

- Aptimmune Biologics, Inc. (US)

- Indian Immunologicals Ltd. (India)

- Torigen Pharmaceuticals, Inc. (US)

- Intas Pharmaceuticals Ltd. (India)

- Ourofino Animal Health (Brazil)

- Biovac Ltd. (Israel)

- Laboratoire LCV (France)

- Kyoritsu Seiyaku Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 10.94 Billion |

| Revenue Forecast in 2030 | USD 16.15 Billion |

| Growth Rate | CAGR of 6.8% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD million/billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: VETERINARY VACCINES MARKET SIZE, GROWTH, SHARE & TRENDS ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Detailed evaluation of veterinary vaccines by type (live attenuated, inactivated, recombinant, etc.), disease target (porcine, poultry, livestock, companion animals, aquaculture), and technology | Insights on market trends, emerging vaccine technologies, and efficacy comparisons to support informed decision-making |

| Company Information | Profiles of leading players, including Zoetis, Merck Animal Health, Elanco, Boehringer Ingelheim, and Phibro, highlighting product portfolios, R&D pipelines, and market presence | Market positioning and competitive benchmarking to identify growth opportunities and strategic advantages |

| Geographic Analysis | Country-level veterinary vaccines demand mapping with a focus on APAC (ASEAN countries), Europe, and key emerging markets; evaluation of regional regulatory frameworks and adoption trends | Analysis of regional regulatory frameworks, vaccination adoption rates, and market access challenges |

RECENT DEVELOPMENTS

- March 2025 : Zoetis Introduced New Formulation of Vanguard® B Intranasal Vaccine to Ensure Enhanced Protection Against Bordetella Bronchiseptica

- November 2024 : Ceva Invested in a new vaccine manufacturing plant in Monor, Hungary. This development will establish a 7,000 m2 plant in Monor, with the most advanced technologies, where Ceva will produce fermentation-based multicomponent inactivated vaccines for animals that will help expand its global production capacity.

- November 2024 : Boehringer Ingelheim International GmbH launched the EURICAN L4 vaccine to protect dogs against the growing threat of leptospirosis, a severe and reemerging infectious disease.

- September 2024 : Merck & Co., Inc. announced the expansion of its NOBIVAC NXT platform with the launch of a groundbreaking new vaccine for Feline Leukemia Virus (FeLV). This vaccine is the first and only to incorporate RNA-Particle Technology, offering a novel alternative for feline FeLV prevention.

- March 2024 : Zoetis announced the purchase of a manufacturing site in Melbourne, Australia, to significantly expand its current operations at the site and increase future capabilities to develop and manufacture vaccines for sheep, cattle, dogs, cats, and horses.

Table of Contents

Methodology

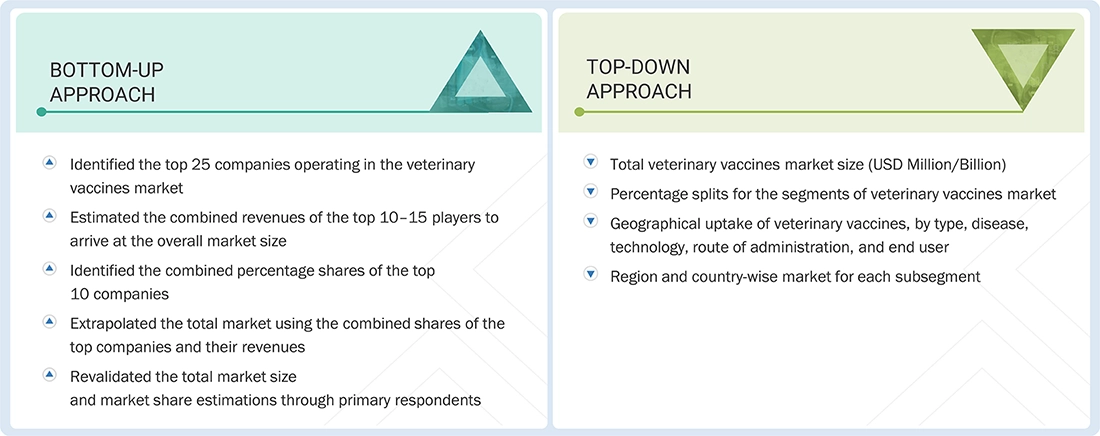

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), American Veterinary Medical Association (AVMA), Animal Health Institute (AHI), National Animal Health Laboratory Network (NAHLN)And Food and Agriculture Organization of the United Nations (FAO)were referred to identify and collect information for the global veterinary vaccines market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the veterinary vaccines market. The primary sources from the demand side include hospitals & clinics, physiotherapy clinics and home care settings. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

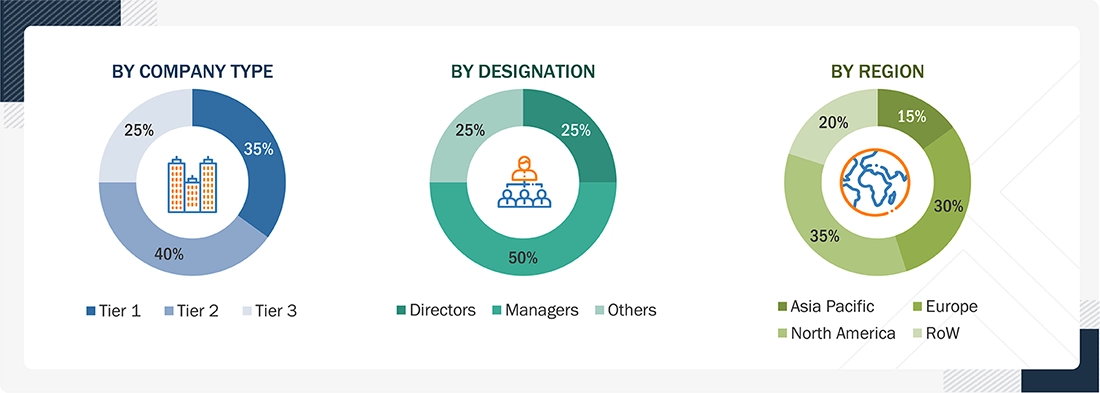

A breakdown of the primary respondents is provided below:

*C-level primaries include CEOs, CFOs, COOs, and VPs.

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global veterinary vaccines market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players (who contribute at least 70-75% of the market share at the global level). Also, the global veterinary vaccines market was split into various segments and sub-segments based on:

- List of major players operating in the veterinary vaccines products market at the regional and/or country level

- Product mapping of various veterinary vaccines manufacturers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from veterinary vaccines (or the nearest reported business unit/product category)

- Revenue mapping of major players to cover at least 70-75% of the global market share as of 2023

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global point-of-care diagnostics market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom Up approach & Top down approach)

Data Triangulation

After arriving at the overall size of the global veterinary vaccines market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

A veterinary vaccine is a biological preparation that provides immunity by stimulating animal’s immune system to recognize and combat specific pathogen. The veterinary vaccines market serves a range of vaccines such as live attenuated, inactivated, recombinant, and toxoid vaccine for a wide range of animals such as poultry, livestock, porcine, aquaculture, and companion animals. Vaccination aids in improving the health of animals, reducing the outbreak of zoonotic diseases, supporting higher productivity, and help securing economic stability.

Stakeholders

- Animal vaccine manufacturers

- Animal healthcare product manufacturers

- Animal vaccine distributors and wholesalers

- Animal welfare associations

- Veterinary clinics and care centers

- Research and consulting firms

- Veterinary Research and Development Organizations

- Contract research organizations

- Contract manufacturing organizations

- Venture capitalists

Report Objectives

- To define, measure, and describe the global veterinary vaccines market by type, disease, technology, route of administration, end user

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze the regulatory scenario, pricing, value chain analysis, supply chain analysis, ecosystem analysis, technology analysis, Porter’s Five Forces analysis, pipeline analysis and patent analysis

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To strategically analyze the market structure, profile the key players in the global veterinary vaccines market, and comprehensively analyze their core competencies

- To track and analyze company developments such as acquisitions, partnerships, expansions, and product launches and approvals in the veterinary vaccines market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Veterinary Vaccines Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Veterinary Vaccines Market