Anti-Slip Coating Market by Resin (Epoxy, Polyurethane, Polyaspartic & Acrylic), Type (Water-based, Solvent-based), End-use Industry, and Region (North America, Europe, APAC, Middle East & Africa, South America) - Global Forecast to 2023

Updated on : October 25, 2024

Anti-Slip Coating Market

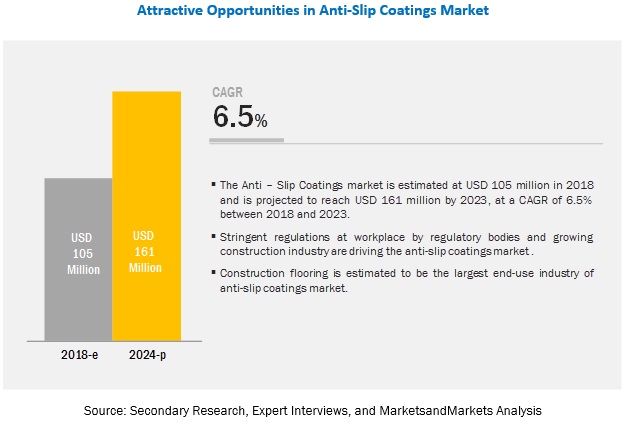

The global anti-slip coating market was valued at USD 105 million in 2018 and is projected to reach USD 161 million by 2023, growing at 6.5% cagr from 2018 to 2023. Anti-slip coatings are used on various surfaces such as workshop floors, stairs, scaffolds, and so on. It is wear resistant and resists oils, acids, detergents, and others. Anti-slip coatings can be directly used without the need for any previous mixing.

Construction flooring segment is projected to be the fastest-growing end user of anti-slip coatings during the forecast period.

According to the national PMI (Project Management Institute), the growth in manufacturing is expected to be more in developed nations. Europe is the strongest performing region. This increase in global manufacturing resulted in increased employment and construction of industrial facilities. Flooring is also an essential part of industrial facilities such as manufacturing plants, offices, restaurants, and warehouses. Increasing industrialization in countries such as India, Taiwan, Malaysia, Brazil, Turkey, South Africa, Norway, Denmark, and Belgium is driving the market for anti-slip coatings.

Epoxy resin is estimated to be the largest segment in the overall anti-slip coatings market during the forecast period.

Epoxy resin is widely used as protective and performance coatings due to their strong properties such as good adhesion, flexibility, solvent resistance, hardness, and wear and tear strength. It is a predominantly thermosetting resin, which becomes irreversibly hard after curing. In industrial flooring, epoxy resins are preferred as they provide a hard and strong surface to walk. They are used in industries where accidents due to slips are more likely to happen.

The growth of epoxy resin-based anti-slip coating depends on the market for protective and performance coating. Traditionally, epoxy coatings have been applied as solvent-borne systems. However, due to the growing importance of reducing VOC (Volatile Organic Compound) emission, the use of water-borne coating is increasing.

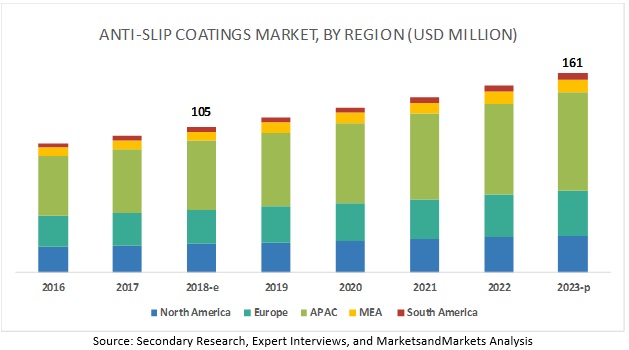

APAC is estimated to account for the largest share of the market during the forecast period.

APAC is estimated to dominate the overall anti-slip coatings market in 2018. The region has emerged as the largest consumer of anti-slip coatings, owing to the growth in demand for anti-slip coatings in countries such as China, Japan, India, South Korea, and Australia. The growing industrialization in these countries is expected to drive the market for anti-slip coatings in the region during the forecast period. The construction sector is expected to grow in the future, especially in countries located in Asia. The global economy is growing and is expected to continue to grow in the near future. With the growth of the economy, the construction market is estimated to experience huge growth, at an average of 3.5% in the coming 10 years.

Anti-Slip Coating Market Players

3M is one of the leading manufacturers of anti-slip coatings. Coatings offered by the company are used in various end-use industries like construction flooring, marine deck, aerospace, industrial equipment, and packaging. The company’s strong focus on research & development activities is considered to be the major reason for the growth in sales and profit. In 2019, the company plans to invest USD 2 billion in research & development. 3M has its distribution network all over the world and continuously focuses on growth, operational efficiency, and strong customer relationship. On the other hand, Axalta Coating Systems is a core technology driven company and invests a significant share of its budget in research & development. The company believes in serving its customer in a better way by constantly improving and localizing its resources. Hempel has huge investments in new research and development. The company is also actively organizing internal compliance and audits to maintain the quality of the product. It is also focusing on more greener technologies of manufacturing.

Anti-Slip Coating Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016–2023 |

|

Base year |

2017 |

|

Forecast period |

2018–2023 |

|

Units considered |

USD million (value) and ton (volume)_ |

|

Segments |

Resin, type, End-use industry, and Region |

|

Geographies |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

3M (US), PPG Industries (US), Axalta Coating Systems (US), Hempel A/S (Europe), RPM International (Mexico), and Sherwin Williams (US), among others |

This research report categorizes the global anti-slip coating market on the basis of resin, type, end-use industry and region.

Anti-Slip Coating Market on the basis of Resin:

- Epoxy

- Polyurethane

- Polyaspartic & acrylic

Anti-Slip Coating Market on the basis of Type:

- Water-based

- Solvent-based

Anti-Slip Coating Market on the basis of End-use industry:

- Construction flooring

- Marine deck

Anti-Slip Coating Market on the basis of Region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- In February 2015, 3M launched its anti-slip floor coating to improve safety. This floor coating combines anti-slip properties with peelable removability. It is a combination of translucent beads and polymer dispersion.

- In March 2017, PPG completed its high-performance waterborne and high-solids coatings production line in China. This line enhances the production and service capabilities of PPG’s automotive coatings business for customers in China.

- In June 2017, Axalta acquired Valspar Corporation’s North American Industrial Coatings.

Key Questions addressed by the report

- What are the global trends regarding the demand for anti-slip coatings? Will the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for anti-slip coatings? Which resin is used the most in the manufacturing of the same?

- What were the revenue pockets for the anti-slip coatings market in 2017?

- What are the effects of VOCs on the environment and why there is a need for using water-based coatings?

- Who are the major anti-slip coatings manufacturers globally?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for Market Size Estimation in the Report

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

2.3.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Data Triangulation

2.6 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Anti-Slip Coatings Market

4.2 APAC Anti-Slip Coatings Market, By Resin and Country

4.3 Anti-Slip Coatings Market, By Major Countries

5 Market Overview (Page No. - 34)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 New Safety Regulations to Avoid Accidents Caused Due to Slipping

5.1.1.2 Increasing Industrialization

5.1.2 Restraints

5.1.2.1 Stringent Environmental Regulations

5.1.2.2 Availability of Easy-To-Install Substitutes Such as Anti-Slip Panels

5.1.3 Opportunities

5.1.3.1 Development of New Anti-Slip Coating Technology

5.1.3.2 High Growth of the Construction Sector

5.1.4 Challenges

5.1.4.1 Requirement for Efficient Curing of Anti-Slip Coatings

5.2 Porter’s Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Suppliers

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

6 Anti-Slip Coatings Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Water-Based

6.2.1 The Demand for Environment Friendly Coating With Less Voc Component Will Increase the Demand for Water-Based Coating

6.3 Solvent-Based

6.3.1 The Increasing Demand Due to Lesser Stringent Regulations for Solvent-Based in APAC Will Drive the Market

7 Anti-Slip Coatings Market, By Resin (Page No. - 45)

7.1 Introduction

7.2 Epoxy Resin

7.2.1 Polyurethane Resin

7.2.1.1 Increasing Consumption in Domestic, Residential, and Commercial Markets Will Increase the Demand for Polyurethane Resin

7.2.2 Polyaspartic & Acrylic

7.2.2.1 The Demand for Polyaspartic Coating Will Grow as they Have Low Voc Content and are Solvent Free

8 Anti-Slip Coatings Market, By End-Use Industry (Page No. - 51)

8.1 Introduction

8.2 Construction Flooring

8.2.1 Increasing Safety Regulations in Construction Industry Will Increase the Market for Anti-Slip Coatings

8.3 Marine Deck

8.3.1 Properties of Anti-Slip Coatings Such as Withstanding the Effects of Saltwater, High Foot Traffic, and Spilled Fuel on the Deck Will Drive the Market

8.4 Others

9 Anti-Slip Coatings Market, By Region (Page No. - 56)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Stringent Regulations at Workplace By Osha is Driving Growth of Anti-Slip Coatings Market

9.2.2 Canada

9.2.2.1 Increased Investments in Commercial and Residential Construction are Driving the Anti-Slip Coatings Market

9.2.3 Mexico

9.2.3.1 Federal Government’s Infrastructure and Development Programs are Expected to Boost the Anti-Slip Coatings Market

9.3 APAC

9.3.1 China

9.3.1.1 High Demand for Water Treatment Projects and Growth of the Industrial Sector are Fueling the Market

9.3.2 India

9.3.2.1 Increasing Investments in Infrastructure are Expected to Impact the Anti-Slip Coatings Market Growth

9.3.3 Japan

9.3.3.1 Construction Flooring is the Major Consumer of Anti-Slip Coatings in Japan

9.3.4 South Korea

9.3.4.1 Presence of A Large Industrial Base is Driving the Market

9.3.5 Rest of APAC

9.4 Europe

9.4.1 Germany

9.4.1.1 Growing Residential Construction is Expected to Drive the Demand for Anti-Slip Coatings

9.4.2 UK

9.4.2.1 Increasing Investments in Construction Projects are Driving the Demand for Anti-Slip Coatings

9.4.3 France

9.4.3.1 The Ongoing Recovery in the Construction Industry is Driving the Demand for Anti-Slip Coatings

9.4.4 Italy

9.4.4.1 Renovation of Buildings has Increased the Demand for Anti-Slip Coatings

9.4.5 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Growth of the Construction Industry is Driving the Demand for Anti-Slip Coatings

9.5.2 UAE

9.5.2.1 Growth of Construction, Oil & Gas, and Transportation Industries are Driving the Demand for Anti-Slip Coatings

9.5.3 South Africa

9.5.3.1 Expansion of Industrial and Construction Sectors Expected to Fuel the Growth of Anti-Slip Coatings Market

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Expanding Economy and Growing Construction Industry Will Boost Consumption of Anti-Slip Coatings

9.6.2 Argentina

9.6.2.1 Increasing Public Spending On Commercial, Industrial, And Residential Construction Will Drive The Demand For Anti-Slip Coatings

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 113)

10.1 Introduction

10.2 Competitive Scenario

10.2.1 Expansion

10.2.2 New Product Development

10.2.3 Merger & Acquisition

11 Company Profiles (Page No. - 116)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 3M

11.2 PPG Industries

11.3 Axalta Coating Systems

11.4 Hempel A/S

11.5 RPM International

11.6 Sherwin Williams

11.7 Amsteps Products

11.8 Randolph Products Co.

11.9 No Skidding Products

11.10 Paramelt Rmc B.V.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11.11 Other Key Players

11.11.1 Safemate Anti-Slip Pty Ltd.

11.11.2 Skidproof

11.11.3 Industrial Applications, Inc

11.11.4 Halosurfaces International Ltd.

11.11.5 Wooster Products Inc.

11.11.6 Anti-Slip Anywhere

11.11.7 Tesoplas

11.11.8 American Safety Technologies

11.11.9 Diamond Safety Concepts

12 Appendix (Page No. - 135)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Related Reports

12.4 Author Details

List of Tables (187 Tables)

Table 1 Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 2 Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 3 Water-Based Anti-Slip Coatings Market Size, By Region, 2016–2023 (Ton)

Table 4 Water-Based Anti-Slip Coatings Market Size, By Region, 2016–2023 (USD Million)

Table 5 Solvent-Based Anti-Slip Coatings Market Size, By Region, 2016–2023 (Ton)

Table 6 Solvent-Based Anti-Slip Coatings Market Size, By Region, 2015–2023 (USD Million)

Table 7 Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 8 Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 9 Epoxy Resin: Anti-Slip Coatings Market By Region, 2016–2023 (Ton)

Table 10 Epoxy Resin: Anti-Slip Coatings Market By Region, 2016–2023 (USD Million)

Table 11 Polyurethane Resin: Anti-Slip Coatings Market By Region, 2016–2023 (Ton)

Table 12 Polyurethane Resin: Anti-Slip Coatings Market By Region, 2016–2023 (USD Million)

Table 13 Polyaspartic & Acrylic: Anti-Slip Coatings Market By Region, 2016–2023 (Ton)

Table 14 Polyaspartic & Acrylic: Anti-Slip Coatings Market By Region, 2016–2023 (USD Million)

Table 15 Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 16 Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 17 Anti-Slip Coatings Market Size in Construction Flooring, By Region, 2016–2023 (Ton)

Table 18 Anti-Slip Coatings Market Size in Construction Flooring, By Region, 2016–2023 (USD Million)

Table 19 Anti-Slip Coatings Market Size in Marine Deck, By Region, 2016–2023 (Ton)

Table 20 Anti-Slip Coatings Market Size in Marine Deck, By Region, 2016–2023 (USD Million)

Table 21 Anti-Slip Coatings Market Size in Other Industries, By Region, 2016–2023 (Ton)

Table 22 Anti-Slip Coatings Market Size in Other Industries, By Region, 2015–2023 (USD Million)

Table 23 Anti-Slip Coatings Market Size, By Region, 2016–2023 (USD Million)

Table 24 Anti-Slip Coatings Market Size, By Region, 2016–2023 (Ton)

Table 25 North America: Anti-Slip Coatings Market Size, By Country, 2016–2023 (USD Million)

Table 26 North America: Anti-Slip Coatings Market Size, By Country, 2016–2023 (Ton)

Table 27 North America: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 28 North America: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 29 North America: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 30 North America: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 31 North America: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 32 North America: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 33 US: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 34 US: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 35 US: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 36 US: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 37 US: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 38 US: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 39 Canada: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 40 Canada: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 41 Canada: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 42 Canada: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 43 Canada: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 44 Canada: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 45 Mexico: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 46 Mexico: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 47 Mexico: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 48 Mexico: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 49 Mexico: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 50 Mexico: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 51 APAC: Anti-Slip Coatings Market Size, By Country, 2016–2023 (USD Million)

Table 52 APAC: Anti-Slip Coatings Market Size, By Country, 2016–2023 (Ton)

Table 53 APAC: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 54 APAC: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 55 APAC: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 56 APAC: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 57 APAC: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 58 APAC: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 59 China: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 60 China: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 61 China: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 62 China: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 63 China: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 64 China: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 65 India: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 66 India: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 67 India: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 68 India: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 69 India: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 70 India: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 71 Japan: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 72 Japan: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 73 Japan: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 74 Japan: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 75 Japan: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 76 Japan: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 77 South Korea: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 78 South Korea: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 79 South Korea: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 80 South Korea: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 81 South Korea: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 82 South Korea: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 83 Rest of APAC: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 84 Rest of APAC: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 85 Rest of APAC: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 86 Rest of APAC: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 87 Rest of APAC: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 88 Rest of APAC: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 89 Europe: Anti-Slip Coatings Market Size, By Country, 2016–2023 (USD Million)

Table 90 Europe: Anti-Slip Coatings Market Size, By Country, 2016–2023 (Ton)

Table 91 Europe: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 92 Europe: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 93 Europe: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 94 Europe: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 95 Europe: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 96 Europe: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 97 Germany: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 98 Germany: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 99 Germany: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 100 Germany: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 101 Germany: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 102 Germany: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 103 UK: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 104 UK: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 105 UK: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 106 UK: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 107 UK: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 108 UK: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 109 France: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 110 France: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 111 France: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 112 France: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 113 France: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 114 France: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 115 Italy: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 116 Italy: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 117 Italy: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 118 Italy: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 119 Italy: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 120 Italy: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 121 Rest of Europe: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 122 Rest of Europe: Anti-Slip Coatings Market Size, By Resin,2016–2023 (Ton)

Table 123 Rest of Europe: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 124 Rest of Europe: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 125 Rest of Europe: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 126 Rest of Europe: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 127 Middle East & Africa: Anti-Slip Coatings Market Size, By Country, 2016–2023 (USD Million)

Table 128 Middle East & Africa: Anti-Slip Coatings Market Size, By Country, 2016–2023 (Ton)

Table 129 Middle East & Africa: Anti-Slip Coatings Market Size, By Resin,2016–2023 (USD Million)

Table 130 Middle East & Africa: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 131 Middle East & Africa: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 132 Middle East & Africa: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 133 Middle East & Africa: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 134 Middle East & Africa: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 135 Saudi Arabia: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 136 Saudi Arabia: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 137 Saudi Arabia: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 138 Saudi Arabia: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 139 Saudi Arabia: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 140 Saudi Arabia: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 141 UAE: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 142 UAE: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 143 UAE: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 144 UAE: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 145 UAE: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 146 UAE: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 147 South Africa: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 148 South Africa: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 149 South Africa: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 150 South Africa: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 151 South Africa: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 152 South Africa: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 153 Rest of Middle East & Africa: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 154 Rest of Middle East & Africa: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 155 Rest of Middle East & Africa: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 156 Rest of Middle East & Africa: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 157 Rest of Middle East & Africa: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 158 Rest of Middle East & Africa: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 159 South America: Anti-Slip Coatings Market Size, By Country, 2016–2023 (USD Million)

Table 160 South America: Anti-Slip Coatings Market Size, By Country, 2016–2023 (Ton)

Table 161 South America: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 162 South America: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 163 South America: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 164 South America: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 165 South America: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 166 South America: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 167 Brazil: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 168 Brazil: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 169 Brazil: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 170 Brazil: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 171 Brazil: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 172 Brazil: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 173 Argentina: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 174 Argentina: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 175 Argentina: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 176 Argentina: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 177 Argentina: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 178 Argentina: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 179 Rest of South America: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (USD Million)

Table 180 Rest of South America: Anti-Slip Coatings Market Size, By Resin, 2016–2023 (Ton)

Table 181 Rest of South America: Anti-Slip Coatings Market Size, By Type, 2016–2023 (USD Million)

Table 182 Rest of South America: Anti-Slip Coatings Market Size, By Type, 2016–2023 (Ton)

Table 183 Rest of South America: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (USD Million)

Table 184 Rest of South America: Anti-Slip Coatings Market Size, By End-Use Industry, 2016–2023 (Ton)

Table 185 Expansion, 2015–2017

Table 186 New Product Development, 2015–2017

Table 187 Merger & Acquisition, 2015–2017

List of Figures (30 Figures)

Figure 1 Anti-Slip Coatings Market Segmentation

Figure 2 Global Anti-Slip Coatings Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Global Anti-Slip Coating Market: Data Triangulation

Figure 6 Epoxy Held the Largest Share of the Overall Anti-Slip Coatings Market in 2017

Figure 7 Construction Flooring to Be the Fastest-Growing End User of Anti-Slip Coatings

Figure 8 APAC to Be the Fastest-Growing Anti-Slip Coatings Market

Figure 9 Stringent Regulations at Workplace By Osha to Drive the Market

Figure 10 China Accounted for the Largest Share of the Market in 2017

Figure 11 China to Be the Fastest-Growing Anti-Slip Coatings Market

Figure 12 Drivers, Restraints, Opportunities, and Challenges in Anti- Slip Coatings Market

Figure 13 Porter’s Five Forces Analysis: Anti-Slip Coatings Market

Figure 14 China to Be the Fastest-Growing Anti-Slip Coatings Market

Figure 15 North America: Anti-Slip Coatings Market Snapshot

Figure 16 APAC: Anti-Slip Coatings Market Snapshot

Figure 17 Europe: Anti-Slip Coatings Market Snapshot

Figure 18 Companies Majorly Adopted Organic Growth Strategies Between 2015 and 2017

Figure 19 Market Evaluation Framework

Figure 20 3M: Company Snapshot

Figure 21 PPG Industries: Company Snapshot

Figure 22 PPG High Performance Coatings: SWOT Analysis

Figure 23 Axalta Coating Systems: Company Snapshot

Figure 24 Axalta Coating Systems: SWOT Analysis

Figure 25 Hempel A/S: Company Snapshot

Figure 26 Hempel A/S: SWOT Analysis

Figure 27 RPM International: Company Snapshot

Figure 28 RPM International A/S: SWOT Analysis

Figure 29 Sherwin Williams: Company Snapshot

Figure 30 Sherwin Williams Company A/S: SWOT Analysis

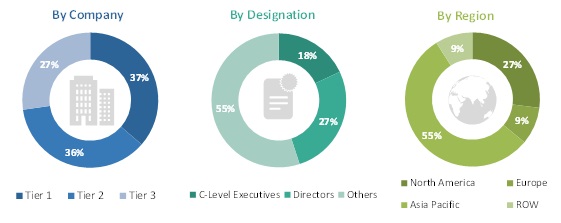

The study involved four major activities in estimating the current market size for anti-slip coatings. Exhaustive secondary research was done to collect information on the market. The next step was validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market sizes of the segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; food safety organizations; regulatory bodies; trade directories; and databases.

Primary Research

The anti-slip coatings market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the construction, marine deck, aerospace, industrial equipment, and packaging industries. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global anti-slip coatings market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sourcestop-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the anti-slip coatings market, in terms of value

- To provide detailed information regarding the significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market size on the basis of resin, type, and end-use industry

- To forecast the market size of different segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze competitive developments such as expansions, acquisitions, mergers, and product development activities in the market

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of the global anti-slip coatings market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Anti-Slip Coating Market