Automated Test Equipment Market Size, Share, Statistics and Industry Growth Analysis Report by Components, Type, Vertical (Semiconductor Fabrication, Automotive and Transportation, Medical, Aerospace and Defense, Consumer Electronics), and Geography (North America, Europe, APAC, RoW) - Global Forecast to 2027

Updated on : April 24, 2023

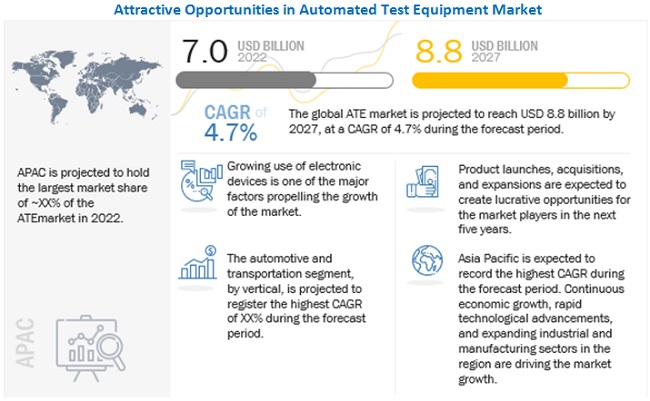

[232 Pages Report] The Automated Test Equipment Market Size is estimated to attain a size of USD 8.8 billion by 2027, with a CAGR of 4.7% during the forecast period.

The market growth is propelled by the surging demand for this equipment in the consumer electronics sector and the remarkable reduction in manufacturing time achieved through their use. Additionally, the government's efforts to bolster the semiconductors industry will further create opportunities for the market expansion during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Automated Test Equipment Market Segment Overview

Handlers to account for the highest CAGR of the Automated Test Equipment Industry by 2027

Handlers is expected to have the highest CAGR of the Market in 2027. automated test equipment systems used for testing such integrated systems and package devices are interfaced with an automated placement tool termed as a handler.

A handler physically places the DUT on an interface test adapter (ITA) so that it can be measured by the equipment. A customized test device, along with the handler, has replaced the general-purpose tester for fitting in the specified requirements directly. This helps in meeting the goal quickly and reducing the test cost.

In the back end of the integrated chip (IC) process, handlers help in sorting different type of packages available in the ICs. The automated test equipment, therefore, can successfully test the IC in a real environment instead of carrying out simulation by IC testers. This helps in testing the complicated IC with high fault coverage at a low cost and additionally improves the test quality.

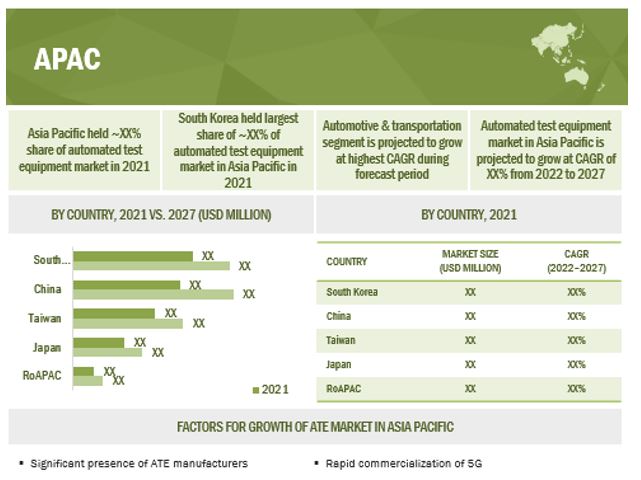

APAC to have the largest market share in the Automated Test Equipment Market during the forecast period

APAC is expected to witness the highest CAGR during the forecast period. The APAC region has the largest market share in the automated test equipment industry. This is mainly attributed to several OEMs as well as semiconductor devices and product manufacturers based out of APAC.

Moreover, favorable regulatory policies for the approval of new semiconductor technologies and the saturation of the market in developed countries are further intensifying the interest of players in APAC. As such, the scope for testing is also enhanced in this region, thereby leading to the Automated Test Equipment Market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players in Automated Test Equipment Industry

The Automated Test Equipment Companies is dominated by a few globally established players such as:

- Advantest Corporation (Japan),

- Teradyne (US),

- National Instruments (US),

- Chroma ATE (Taiwan),

- Cohu (US),

- Astronics Corporation (US),

- STAr Technologies (Taiwan),

- Roos Instruments (US),

- Marvin Test Solutions (US), and

- OMRON Corporation (Japan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Automated Test Equipment Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 7.0 Billion |

| Projected Market Size | USD 8.8 Billion |

| Growth Rate | CAGR of 4.7% |

|

Market size available for years |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

A total of 27 players covered in Automated Test Equipment Market. |

| Key Market Driver | Use of Automated Test Equipment reduces manufacturing time and cost |

| Largest Growing Region | Asia Pacific (APAC) |

| Highest CAGR Segment | Handlers Segment |

Automated Test Equipment Industry Dynamics:

Driver: Use of Automated Test Equipment reduces manufacturing time and cost

Manual testing involves a human operation on a computer wherein a careful execution of each test step is carried out. In automated test equipment, the testing process includes the use of an automation tool to execute the test case suite.

It also includes automation software that can enter test data into the DUT and compare the expected results with the actual results, thereby generating detailed test reports. automated test equipment enables testing on semiconductor devices such as the Printed Circuit Boards (PCBs) to be carried out very swiftly and at a much faster rate. Since the time of production is considered a major element of the overall production cost of an item of any electronic equipment, it is extremely important to reduce the production time as much as possible. This can be achieved easily with the use of an automated test equipment market.

The current scenario of the semiconductor industry involves designing more complex devices for better applications. It is, therefore, essential to increase the throughput of the test systems and thereby reduce the maintenance cost. Besides reducing maintenance costs, ATE systems are concerned with increasing the throughput and reliability of the manufacturing test system. The hardware handshaking form of scanning, one of the methods of automated test equipment, helps in increasing the throughput as it allows direct communication between the switch and the instrument without any software intervention. Here, all the trigger interaction is controlled through the hardware.

This helps in minimizing the time wasted between measurements, thereby guaranteeing maximum throughput. automated test equipment helps manufacturers to increase the system’s longevity for long-term success. Therefore, the demand for automated test equipmentis increasing as it offers high efficiency, maximum reliability, and high throughput. This proves to be a driver for the automated test equipment industry as more manufacturers are adopting automated test equipment testing to reduce the manufacturing time and the associated cost.

Restraint: High costs associated with testers and testing components

Automated test equipment systems are not adopted by many manufacturers due to the high cost associated with them. The testers and testing components, such as handlers and probers, are too expensive for many start-ups in the semiconductor industry.

The cost of the automated test equipment handler used for memory testing is more expensive than the cost of the memory tester. Even in the case of automated test equipment for MEMS and sensor testing, the handlers used are very costly. Hence, it is not possible for every semiconductor device manufacturer to adopt automated test equipment testing. Hence, several manufacturers prefer other testing methods, such as manual testing. This has been hampering the consumption of automated test equipment systems, thereby restraining the growth of the overall automated test equipment market.

Opportunity: Advancement in automotive sector

Semiconductor devices find ample applications in the automotive environment. There is an increase in the consumption of semiconductors in the automotive industry.

Most automobile vehicles nowadays use advanced driving assistant systems (ADAS), which provide features like adaptive cruise control, automatic brakes, and blind-spot monitoring, among others. Automotive applications such as advanced and sophisticated structures of cars, hybrid electric vehicles, and rail tractions have a bright future. According to the US International Trade Commission (USITC) report published in May 2019, the semiconductor components value in hybrid electric vehicles (HEV) has increased from USD 1,000 to USD 3,500.

Since the electronic devices used in the automotive semiconductor and electronics industry can provide a higher level of system performance, the testing of such devices is extremely essential. Due to the consistent growth of the HEV industry and the constant increase in demand for complex systems, such as braking systems, it is very important to provide efficient and reliable automated testing solutions. The automated test equipment industry, therefore, will have a huge demand in the automotive sector.

Challenge: Difficulty associated with interfacing of DUT

Upcoming technologies in the semiconductor industry involve complex designing of products, which nowadays have advanced features to meet various applications.

Due to this, the devices carry exceptional electronics specifications such as high voltage/current carrying capacity, low power consumption, high reliability, and efficiency. The designing of such automated test equipment components and systems is a tedious task. The interfacing of DUT (device under test) of high specifications with an automated test equipment is a difficult job. This has a direct effect on the implementation of automated test equipment systems for the purpose of testing complex DUTs.

Automated Test Equipment Industry Categorization:

This research report categorizes the Automated Test Equipment Market Share based on Components, Type, Vertical and Region

Based on Component, the Automated Test Equipment Market been Segmented as follows:

- Industrial PCs

- Handlers/Probers

- Mass Interconnects

- Others

Based on Type, the Automated Test Equipment Market been Segmented as follows:

- Integrated Circuit (IC) Testing

- Printed Circuit Board (PCB) Testing

- Hard Disk Drive Testing

- Modules & Others

Based on Vertical, the Automated Test Equipment Market been Segmented as follows:

-

Semiconduxtor Fabrication

- Non-Contact Test Equipment

- Contact Test Equipment

- Consumer Electronics

- Automotive & Transportation

- Aerospace & Defense

- Medical

- Others

Based on Region, the Automated Test Equipment Market been Segmented as follows:

- North America

- Europe

- APAC

- RoW

Recent Developments in Automated Test Equipment Industry

- In March 2022, National Instruments announced its Test Workflow subscription bundle for automated test systems. This offering expands engineers’ access to the software needed to design and automate a test or measurement system through a single software license.

- In December 2021, Advantest Corporation introduced and has begun shipping the fourth generation of its high-speed image-processing engine that applies heterogeneous computing technology to detect defects in the data output from today's most advanced CMOS image sensors (CIS). When integrated into the proven T2000 ISS platform, the new T2000 IP Engine 4 (Image Processing Engine 4) system provides the optimal means of evaluating the latest high-resolution, high-speed CIS devices used in advanced smartphone cameras.

- In April 2021, Astronics Corporation announced its next-generation circuit card diagnostic and test system, the PinPoint 3-PXIe (P3-PXIe). The P3-PXIe helps to identify failures down to the component level and can test a variety of mixed-signal products with the flexibility of PXIe.

- In January 2021, Teradyne announced that the company’s UltraFLEX test platform has enabled AI chip company Syntiant Corp. to successfully ship millions of its microwatt-power, deep learning Neural Decision Processors to customers worldwide. Using its UltraFLEX test platform, Teradyne is currently supporting the qualification and production ramp of the Syntiant NDP120 and Syntiant NDP121 Neural Decision Processors, Syntiant Corp’s second-generation hardware platforms, to run multiple audio applications simultaneously at under 1mW power consumption.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the automated test equipment market?

The product launch, acquisition and collaboration has been and continues to be some of the major strategies adopted by the key players to grow in the automated test equipment market.

What region dominates automated test equipment market?

APAC region will dominate automated test equipment market

Who are the major companies in the automated test equipment market?

Advantest Corporation (Japan), Teradyne (US), National Instruments (US), Chroma ATE (Taiwan), Cohu (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AUTOMATED TEST EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 3 PROCESS FLOW: AUTOMATED TEST EQUIPMENT (ATE) MARKET SIZE ESTIMATION

FIGURE 4 AUTOMATED TEST EQUIPMENT (ATE) MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 List of key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insight

2.1.3.3 Primary interviews with expert

2.1.3.4 List of key primary respondent

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 5 AUTOMATED TEST EQUIPMENT MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for deriving market size by top-down analysis

FIGURE 6 AUTOMATED TEST EQUIPMENT (ATE) MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 8 IMPACT OF COVID-19 ON AUTOMATED TEST EQUIPMENT (ATE) MARKET

3.1 POST-COVID-19 SCENARIO

TABLE 2 POST-COVID-19 REALISTIC SCENARIO: ATE MARKET, 2022–2027 (USD MILLION)

3.2 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 3 OPTIMISTIC SCENARIO (POST-COVID-19): ATE MARKET, 2022–2027 (USD MILLION)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 4 PESSIMISTIC SCENARIO (POST-COVID-19): ATE MARKET, 2022–2027 (USD MILLION)

FIGURE 9 HANDLERS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 INTEGRATED CIRCUIT (IC) TESTING TO CAPTURE LARGEST SIZE OF ATE MARKET DURING FORECAST PERIOD

FIGURE 11 AUTOMOTIVE & TRANSPORTATION VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 APAC ACCOUNTED FOR LARGEST SHARE OF ATE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMATED TEST EQUIPMENT MARKET

FIGURE 13 GROWING USE OF ATE IN AUTOMOTIVE AND TRANSPORATION TO FUEL MARKET GROWTH FROM 2022 TO 2027

4.2 MARKET, BY TYPE

FIGURE 14 PRINTED CIRCUIT BOARD TESTING TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY VERTICAL

FIGURE 15 SEMICONDUCTOR FABRICATION VERTICAL TO HOLD LARGEST SHARE OF ATE MARKET DURING FORECAST PERIOD

4.4 AUTOMATES TEST EQUIPMENT MARKET, BY COMPONENT

FIGURE 16 APAC TO HAVE LARGEST MARKET SIZE FOR INDUSTRIAL PCS DURING FORECAST PERIOD

4.5 MARKET, BY REGION (2027)

FIGURE 17 ATE MARKET TO RECORD HIGHEST CAGR IN ASIA PACIFIC IN 2027

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 ATE MARKET: DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Use of ATE reduces manufacturing time and cost

5.2.1.2 Decreasing PCB real state and surge in demand for complex integrated circuits (ICs)

5.2.1.3 Increasing applications in consumer goods

5.2.2 RESTRAINTS

5.2.2.1 High cost associated with testers and testing components

5.2.2.2 Requirement for new ATE with technological advancements

5.2.3 OPPORTUNITIES

5.2.3.1 Government initiatives to boost semiconductor industry

5.2.3.2 Advancements in automotive sector

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in semiconductor industry’s supply chain due to COVID-19

5.2.4.2 Difficulty associated with interfacing of DUT

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 ATE MARKET: VALUE CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 ATE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 ATE ECOSYSTEM ANALYSIS

FIGURE 20 ATE ECOSYSTEM

TABLE 6 ATE MARKET: ECOSYSTEM

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS/BUYERS

FIGURE 21 REVENUE SHIFT FOR ATE MARKET

5.7 CASE STUDY ANALYSIS

5.7.1 TBG SOLUTIONS

TABLE 7 TBG SOLUTIONS PROVIDED AUTOMATED TEST SYSTEM TO TEST SEAT BELT QUALITY IN LESSER TIME

5.7.2 VIEWPOINT SYSTEMS

TABLE 8 VIEWPOINT SYSTEMS PROVIDED RELIABLE SENSOR SUBSYSTEM THAT ENSURED UNINTERRUPTED DATA TO CLIENT

5.7.3 TBG SOLUTIONS

TABLE 9 TBG SOLUTIONS PROVIDED WITH TEST SYSTEM THAT TESTED RANGE OF LED PRODUCTS

5.8 TECHNOLOGY ANALYSIS

5.8.1 COMMERCIALIZATION OF IOT TECHNOLOGY

5.8.2 INCLINATION TOWARD ADOPTION OF ATE EQUIPMENT ON RENTAL BASIS

5.8.3 TREND OF MODULAR TEST INSTRUMENTS

5.8.4 EMERGENCE OF 5G NETWORK

5.9 PATENT ANALYSIS

FIGURE 22 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 10 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 23 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

TABLE 11 LIST OF PATENTS

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATIONS PERTAINING TO ELECTRIC AND ELECTRONIC TESTING

TABLE 12 REGULATIONS IN US

5.10.2 STANDARDS RELATED TO ELECTRICAL EQUIPMENT

TABLE 13 STANDARD AND DESCRIPTION

5.10.3 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

5.11 TRADE ANALYSIS AND TARIFF ANALYSIS

5.11.1 TRADE ANALYSIS

5.11.1.1 Trade data for HS code 9030

FIGURE 24 IMPORT DATA FOR HS CODE 9030, BY COUNTRY, 2017−2021 (USD THOUSAND)

FIGURE 25 EXPORT DATA FOR HS CODE 9030, BY COUNTRY, 2017−2021 (USD THOUSAND)

5.11.1.2 Trade data for HS code 903141

FIGURE 26 IMPORT DATA FOR HAS CODE 903141, BY COUNTRY, 2017−2021 (USD THOUSAND)

FIGURE 27 EXPORT DATA FOR HS CODE 903041, BY COUNTRY, 2017−2021 (USD THOUSAND)

5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 14 ATE MARKET: DETAILED LIST OF CONFERENCES ND EVENTS

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 VERTICALS (%)

6 AUTOMATED TEST EQUIPMENT MARKET, BY COMPONENT (Page No. - 72)

6.1 INTRODUCTION

FIGURE 29 MARKET, BY COMPONENT

FIGURE 30 HANDLERS TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 16 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 17 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 INDUSTRIAL PCS

6.2.1 DEMAND FOR INDUSTRIAL PCS IS INCREASING DUE TO THEIR EFFICIENT DESIGN

TABLE 18 INDUSTRIAL PCS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 19 INDUSTRIAL PCS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 20 INDUSTRIAL PCS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 INDUSTRIAL PC: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 MASS INTERCONNECTS

6.3.1 AEROSPACE AND DEFENSE INDUSTRIES TO FUEL DEMAND FOR MASS INTERCONNECT SYSTEMS

TABLE 22 MASS INTERCONNECTS: AUTOMATED TEST EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 23 MASS INTERCONNECTS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 24 MASS INTERCONNECTS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 MASS INTERCONNECTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 HANDLERS/PROBERS

6.4.1 HANDLERS

6.4.1.1 Handlers help in sorting different types of packages available in ICs

TABLE 26 HANDLERS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 27 HANDLERS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 28 HANDLERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 HANDLERS: MARKET, BY REGION, 2022–2027(USD MILLION)

6.4.2 PROBERS

6.4.2.1 Probers act as interface between wafers and automated test equipment

TABLE 30 PROBERS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 31 PROBERS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 32 PROBERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 PROBERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.5 OTHERS

TABLE 34 OTHERS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 OTHERS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 36 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 AUTOMATED TEST EQUIPMENT MARKET, BY TYPE (Page No. - 84)

7.1 INTRODUCTION

FIGURE 31 MARKET, BY TYPE

FIGURE 32 PRINTED CIRCUIT BOARD TESTING TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 38 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 39 MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.2 INTEGRATED CIRCUIT (IC) TESTING

7.2.1 INCREASING USE OF ICS IN CONSUMER ELECTRONICS TO DRIVE DEMAND FOR IC TESTING

TABLE 40 INTEGRATED CIRCUIT TESTING: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 41 INTEGRATED CIRCUIT TESTING: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 42 INTEGRATED CIRCUIT TESTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 INTEGRATED CIRCUIT TESTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PRINTED CIRCUIT BOARD TESTING

7.3.1 COMPLEX PCBS TO DRIVE DEMAND FOR AUTOMATED TEST EQUIPMENT

TABLE 44 PRINTED CIRCUIT BOARD TESTING: AUTOMATED TEST EQUIPMENT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 45 PRINTED CIRCUIT BOARD TESTING: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 46 PRINTED CIRCUIT BOARD TESTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 PRINTED CIRCUIT BOARD TESTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 HARD DISK DRIVE TESTING

7.4.1 INCREASE IN STORAGE DEMAND TO FUEL NEED FOR HARD DISK DRIVE TESTING

TABLE 48 HARD DISK DRIVE TESTING: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 49 HARD DISK DRIVE TESTING: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 50 HARD DISK DRIVE TESTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 HARD DISK DRIVE TESTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 MODULES & OTHERS

TABLE 52 MODULES & OTHERS: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 53 MODULES & OTHERS: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 54 MODULES & OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MODULES & OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 AUTOMATED TEST EQUIPMENT MARKET, BY VERTICAL (Page No. - 94)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY VERTICAL

TABLE 56 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)–

TABLE 57 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

8.2 SEMICONDUCTOR FABRICATION

8.2.1 INCREASING CHIP SHORTAGE TO DRIVE DEMAND FOR ATE FROM SEMICONDUCTOR FABRICATION FACILITIES

TABLE 58 SEMICONDUCTOR FABRICATION: AUTOMATED TEST EQUIPMENT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 SEMICONDUCTOR FABRICATION: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 60 SEMICONDUCTOR FABRICATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 SEMICONDUCTOR FABRICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2.2 NON-CONTACT TEST EQUIPMENT

8.2.2.1 Automated optical inspection (AOI)

8.2.2.2 Automated X-ray inspection (AXI)

TABLE 62 NON-CONTACT TEST EQUIPMENT MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 63 NON-CONTACT TEST EQUIPMENT MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.2.3 CONTACT TEST EQUIPMENT

8.3 CONSUMER ELECTRONICS

8.3.1 INCREASING CONSUMER ELECTRONICS DEVICE MANUFACTURING CREATING DEMAND FOR ATE

TABLE 64 CONSUMER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 65 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 AUTOMOTIVE AND TRANSPORTATION

8.4.1 INCORPORATION OF SOPHISTICATED ELECTRONIC SYSTEMS IN VEHICLES FUELING DEMAND FOR ATE

TABLE 66 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 AUTOMOTIVE & TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 AEROSPACE & DEFENSE

8.5.1 AEROSPACE & DEFENSE INDUSTRY USES ATE FOR RADAR AND ELECTRONIC WARFARE EQUIPMENT

TABLE 68 AEROSPACE & DEFENSE: AUTOMATED TEST EQUIPMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 69 AEROSPACE & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 MEDICAL

8.6.1 NEED TO ENHANCE EFFICIENCY AND ACCURACY OF MEDICAL DEVICES ACCELERATES DEMAND FOR ATE

TABLE 70 MEDICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 MEDICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 OTHERS

TABLE 72 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 REGIONAL ANALYSIS (Page No. - 106)

9.1 INTRODUCTION

FIGURE 34 MARKET IN CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 74 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: AUTOMATED TEST EQUIPMENT MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: ATE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: ATE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 Surging adoption of electric vehicles to garner lucrative opportunities for ATE market

TABLE 80 US: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 81 US: ATE MARKET, BY VERTICAL, 2022–2027(USD MILLION)

9.2.2 CANADA

9.2.2.1 Increasing initiatives and investments by government to drive market in Canada

TABLE 82 CANADA: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 83 CANADA: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Growing development in IoT and 5G to boost market

TABLE 84 MEXICO: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 85 MEXICO: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

FIGURE 36 IMPACT OF COVID-19 ON NORTH AMERICAN ATE MARKET

TABLE 86 PRE-COVID-19 & POST-COVID-19 SCENARIO: ATE MARKET IN NORTH AMERICA, 2022–2027 (USD MILLION)

9.3 EUROPE

FIGURE 37 EUROPE: AUTOMATED TESTING EQUIPMENT MARKET SNAPSHOT

TABLE 87 EUROPE: ATE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 EUROPE: ATE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing demand for ADAS to create opportunities for ATE market

TABLE 91 GERMANY: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 92 GERMANY: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Presence of major aerospace companies to boost market growth

TABLE 93 FRANCE: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 94 FRANCE: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.3 UK

9.3.3.1 Growing medical vertical to propel demand for ATE

TABLE 95 UK: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 96 UK: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increase in number of semiconductor manufacturing fabrication plants to accelerate ATE market

TABLE 97 ITALY: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 98 ITALY: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.3.5 REST OF EUROPE

9.3.6 IMPACT OF COVID-19 ON EUROPEAN ATE MARKET

TABLE 99 PRE-COVID-19 & POST-COVID19 SCENARIO: ATE MARKET IN EUROPE, 2022–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: AUTOMATED TEST EQUIPMENT MARKET SNAPSHOT

TABLE 100 ASIA PACIFIC: ATE MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 ASIA PACIFIC: ATE MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Rise of medical equipment manufacturing to fuel demand for automated test equipment in coming years

TABLE 104 CHINA: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 105 CHINA: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Increase in demand for consumer electronics and automotive to boost ATE market

TABLE 106 JAPAN: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 107 JAPAN: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.3 SOUTH KOREA

9.4.3.1 Significant development in manufacturing sector to drive market growth

TABLE 108 SOUTH KOREA: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 109 SOUTH KOREA: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.4 TAIWAN

9.4.4.1 Growth of automotive and transportation vertical to drive demand for ATE

TABLE 110 TAIWAN: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 111 TAIWAN: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.4.5 REST OF APAC

9.4.6 IMPACT OF COVID-19 ON ATE MARKET IN ASIA PACIFIC

TABLE 112 PRE-COVID-19 & POST-COVID-19 SCENARIO: ATE MARKET IN ASIA PACIFIC, 2022–2027 (USD MILLION)

9.5 ROW

FIGURE 39 ROW: AUTOMATED TEST EQUIPMENT MARKET SNAPSHOT

TABLE 113 ROW: ATE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 114 ROW: ATE MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 115 ROW: ATE MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 116 ROW: ATE MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Favorable government initiatives and high military investments to boost market growth

9.5.2 SOUTH AMERICA

9.5.2.1 High adoption of wireless communication to enhance market growth

9.5.3 IMPACT OF COVID-19 ON ATE MARKET IN ROW

TABLE 117 PRE-COVID-19 & POST-COVID-19 SCENARIO: ATE MARKET IN ROW, 2022–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 136)

10.1 OVERVIEW

10.2 TOP FIVE PLAYERS – THREE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 40 REVENUE ANALYSIS, 2019–2021 (USD BILLION)

10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 118 KEY STRATEGIES OF TOP PLAYERS IN ATE MARKET

10.4 MARKET SHARE ANALYSIS (2021)

TABLE 119 ATE MARKET: MARKET SHARE ANALYSIS

FIGURE 41 MARKET SHARE ANALYSIS: ATE MARKET, 2021

10.5 COMPANY EVALUATION QUADRANT, 2021

10.5.1 STAR

10.5.2 PERVASIVE

10.5.3 EMERGING LEADER

10.5.4 PARTICIPANT

FIGURE 42 ATE MARKET: COMPANY EVALUATION QUADRANT, 2021

10.5.5 COMPANY FOOTPRINT

TABLE 120 COMPANY FOOTPRINT: AUTOMATED TEST EQUIPMENT MARKET

TABLE 121 COMPANY VERTICAL FOOTPRINT: MARKET

TABLE 122 COMPANY TYPE FOOTPRINT: MARKET

TABLE 123 COMPANY REGION FOOTPRINT: AUTOMATED TEST EQUIPMENT(ATE) MARKET

10.6 SMALL AND MEDIUM ENTERPRISE (SME) EVALUATION QUADRANT, 2021

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 43 ATE MARKET: SME EVALUATION QUADRANT, 2020

TABLE 124 ATE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

10.7 COMPETITIVE SCENARIO

TABLE 125 ATE MARKET: PRODUCT LAUNCHES, JANUARY 2020 TO JANUARY 2022

TABLE 126 ATE MARKET: DEALS, JANUARY 2020 TO JANUARY 2022

11 COMPANY PROFILES (Page No. - 151)

(Business Overview, Products Offered, Recent Developments, COVID-19-related Developments, and MnM View)*

11.1 KEY PLAYERS

11.1.1 ADVANTEST CORPORATION

TABLE 127 ADVANTEST CORPORATION: BUSINESS OVERVIEW

FIGURE 44 ADVANTEST CORPORATION: COMPANY SNAPSHOT

TABLE 128 ADVANTEST CORPORATION: PRODUCTS OFFERED

TABLE 129 ADVANTEST CORPORATION: PRODUCT LAUNCHES

TABLE 130 ADVANTEST CORPORATION: DEALS

TABLE 131 ADVANTEST CORPORATION: OTHERS

11.1.2 TERADYNE, INC.

TABLE 132 TERADYNE, INC.: BUSINESS OVERVIEW

FIGURE 45 TERADYNE, INC.: COMPANY SNAPSHOT

TABLE 133 TERADYNE, INC.: PRODUCTS OFFERED

TABLE 134 TERADYNE, INC.: PRODUCT LAUNCHES

TABLE 135 TERADYNE, INC.: DEALS

TABLE 136 TERADYNE, INC.: OTHERS

11.1.3 NATIONAL INSTRUMENTS

TABLE 137 NATIONAL INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 46 NATIONAL INSTRUMENTS: COMPANY SNAPSHOT

TABLE 138 NATIONAL INSTRUMENTS: PRODUCTS OFFERED

TABLE 139 NATIONAL INSTRUMENTS: PRODUCT LAUNCHES

TABLE 140 NATIONAL INSTRUMENTS: DEALS

TABLE 141 NATIONAL INSTRUMENTS: OTHERS

11.1.4 CHROMA ATE

TABLE 142 CHROMA ATE: BUSINESS OVERVIEW

FIGURE 47 CHROMA ATE: COMPANY SNAPSHOT

TABLE 143 CHROMA ATE: PRODUCTS OFFERED

TABLE 144 CHROMA ATE: PRODUCT LAUNCHES

TABLE 145 CHROMA ATE: DEALS

TABLE 146 CHROMA ATE: OTHERS

11.1.5 COHU INC.

TABLE 147 COHU INC.: BUSINESS OVERVIEW

FIGURE 48 COHU INC.: COMPANY SNAPSHOT

TABLE 148 COHU INC.: PRODUCTS OFFERED

TABLE 149 COHU INC.: PRODUCT LAUNCHES

TABLE 150 COHU INC.: DEALS

TABLE 151 COHU INC.: OTHERS

11.1.6 ASTRONICS CORPORATION

TABLE 152 ASTRONICS CORPORATION: BUSINESS OVERVIEW

FIGURE 49 ASTRONICS CORPORATION: COMPANY SNAPSHOT

TABLE 153 ASTRONICS CORPORATION: PRODUCTS OFFERED

TABLE 154 ASTRONICS CORPORATION: PRODUCT LAUNCHES

TABLE 155 ASTRONICS CORPORATION: DEALS

TABLE 156 ASTRONICS CORPORATION: OTHERS

11.1.7 STAR TECHNOLOGIES

TABLE 157 STAR TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 158 STAR TECHNOLOGIES: PRODUCTS OFFERED

TABLE 159 STAR TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 160 STAR TECHNOLOGIES: OTHERS

11.1.8 ROOS INSTRUMENTS

TABLE 161 ROOS INSTRUMENTS: BUSINESS OVERVIEW

TABLE 162 ROOS INSTRUMENTS: PRODUCTS OFFERED

TABLE 163 ROOS INSTRUMENTS: PRODUCT LAUNCHES

11.1.9 MARVIN TEST SOLUTIONS

TABLE 164 MARVIN TEST SOLUTIONS: BUSINESS OVERVIEW

TABLE 165 MARVIN TEST SOLUTIONS: PRODUCTS OFFERED

TABLE 166 MARVIN TEST SOLUTIONS: PRODUCT LAUNCHES

TABLE 167 MARVIN TEST SOLUTIONS: OTHERS

11.1.10 OMRON CORPORATION

TABLE 168 OMRON CORPORATION: BUSINESS OVERVIEW

FIGURE 50 OMRON CORPORATION: COMPANY SNAPSHOT

TABLE 169 OMRON CORPORATION: PRODUCTS OFFERED

TABLE 170 OMRON CORPORATION: PRODUCT LAUNCHES

TABLE 171 OMRON CORPORATION: OTHERS

11.2 OTHER KEY PLAYERS

11.2.1 TESEC CORPORATION

11.2.2 DANAHER

11.2.3 ESPEC NORTH AMERICA

11.2.4 JTAG TECHNOLOGIES

11.2.5 VAUNIX

11.2.6 JFW INDUSTRIES

11.2.7 AEMULUS

11.2.8 FESTO LTD

11.2.9 NIKON METROLOGY

11.2.10 CARL ZEISS AG

11.2.11 VISCOM AG

11.2.12 KEYSIGHT TECHNOLOGIES

11.2.13 ARTIFLEX ENGINEERING

11.2.14 VITROX CORPORATION

11.2.15 SAKI CORPORATION

11.2.16 TEST RESEARCH INC. (TRI)

11.2.17 SHENZHEN J-WIDE ELECTRONICS EQUIPMENT CO., LTD.

11.2.18 CHINO WORKS AMERICA

Business Overview, Products Offered, Recent Developments, COVID-19-related Developments, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 226)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATION

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

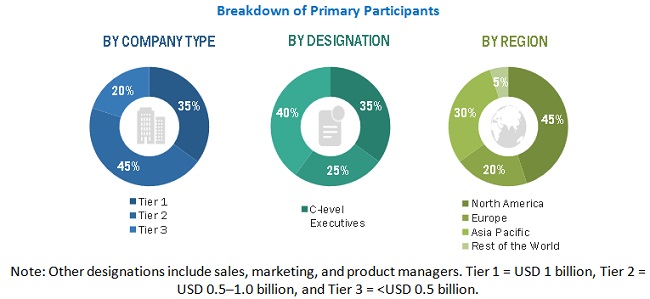

The study involved four major activities in estimating the current size of the automated test equipment market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include automated test equipment market journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the automated test equipment market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the automated test equipment market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Automated Test Equipment Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments.To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the automated test equipment market, in terms of components, type, vertical and region.

- To provide the market size estimation for North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth.

- To provide a detailed overview of the automated test equipment market value chain

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies.

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market.

- To analyze competitive developments in the market, such as expansion, agreements, partnerships, contracts, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Test Equipment Market