Automotive 3D Printing Market by Vehicle Type (ICE & Electric Vehicles), Offering (Hardware & Software), Component, Material (Metals, Plastics, Resin & Composites), Technology (SLA, SLS, EBM, FDM, LOM, 3DIP), Application, & Region - Global Forecast to 2027

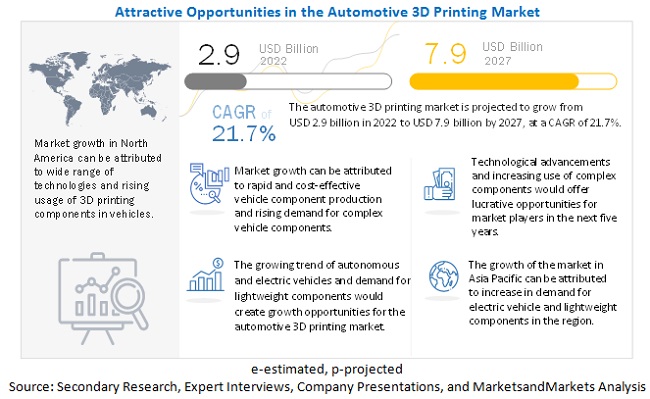

[252 Pages Report] The Automotive 3D Printing Market is projected to grow from USD 2.9 billion in 2022 to USD 7.9 billion by 2027, at a CAGR of 21.7%. The need for decreased development time with fewer prototypes, which would eventually decrease the production cost, is driving the demand for 3D printing technology. Alternatively, initiatives & investments by major OEMs towards the same are further fueling the growth of the automotive 3D printing market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Increasing initiatives & investments by major OEMs to drive the growth in automotive 3D printing

3D printing in the automotive sector is helping OEMs to reduce costs and produce cost-effective auto parts in reduced production time. Even though implementing this new technology is challenging at the beginning, OEMs have experienced a positive impact on their production process and end products. Thus, OEMs have intensified their investments in 3D printing and made it a vital part of their manufacturing process.

Companies are investing heavily in R&D, supplementing the growth of the 3D printing market. Various technological advancements in 3D printing techniques and materials in the past two decades have paved the way for new technologies that facilitate the production of different custom products. Industry leaders such as Stratasys (Israel) and 3D Systems (US) have invested significantly in 3D printing technology, which gives them a competitive advantage.

Several start-ups and small companies are investing in R&D for automotive 3D printing technologies to introduce new and innovative technologies. Some of these players are - Biomedical Modeling (US), SLM Solutions GmbH (Germany), Xilloc Medical BV (Netherlands), Surgival Group (Spain), GPI Prototype (US), and 3T RPD (UK). The advent of new 3D printing technologies and materials would create various application areas and increase the penetration of 3D printing in diverse industries. R&D focuses primarily on improving and expanding the capabilities of existing technologies and related software and materials to attain high accuracy and efficiency. Companies also attempt to develop more affordable products and a universally compatible and customer-friendly software system for 3D printing applications. The factor would have a significant impact from 2020 to 2025.

RESTRAINT: Material availability, cost, and standardization to slow down the automotive 3D printing market

The excessive cost associated with 3D printing materials is the key factor restricting the adoption of 3D printing; the cost of 3D printing materials is higher than bulk resin or powder counterparts. This excessive cost is attributed to factors such as the high level of purity and the need for uniformity in composition and size for specific 3D printing processes. The limited availability of 3D printing material suppliers compels customers to buy proprietary material from big players, which results in excessive costs.

Given the lack of proper standards for mechanical properties of the materials, manufacturers are reluctant to use 3D printed components in their final product. The lack of standards also hampers the accuracy and reliability of the product created by 3D printing. The choice of materials used depends on the 3D printing technology. Material properties include mechanical testing, porosity, powder composition, particle homogeneity, distribution, size, and morphology. Therefore, the lack of material standardization for 3D printing is a significant issue that restrains the growth of the 3D printing market. 3D printing materials frequently do not meet the desired specification, resulting in the final product lacking the desired quality.

OPPORTUNITY: Untapped adjacent markets for 3D printing applications

The progression of 3D printing applications from rapid prototyping to direct digital manufacturing (DDM) of products has generated interest in the future applications of 3D printing technologies in diverse fields such as healthcare, consumer products, and automotive. 3D printing possesses substantial commercial potential and will significantly impact various industries, including aerospace and medical, with more customized and sophisticated applications expected soon.

CHALLENGE: Manufacturers VS. IPR & copyright issues

3D printing is an innovative technology that has the potential to change the face of industrial manufacturing. Its ability to print almost any shape with various materials (polymers, metals, ceramics, sand, paper, and living tissue) presents numerous opportunities for manufacturers. However, like any other high-potential, innovative technology (such as computing and the internet), the future abilities of 3D printing are becoming an area of concern in terms of the framework of existing intellectual rights and copyright laws. The Digital Millennium Copyright Act (DMCA) limits 3D printing technology within a desired legal framework to avoid violations and infringements. These limitations threaten both makers/personal users and copyright/patent-holders. 3D printing can potentially infringe patents, copyright, trademarks, and design rights protection.

However, the overall percentage of personal printers and the consumer market for 3D printing is still very restricted, primarily due to the high price of the machines and scarcity of materials. However, printers and printing services are becoming increasingly affordable due to multiple R&D projects; the adoption of personal printers is therefore expected to increase at a high rate in the coming future. The 3D printing process uses a digital blueprint file (CAD file) to create an object by placing layer upon layer. Thousands of component designs and blueprints are freely available on different websites; this poses a threat to the patent-holder. Several ongoing debates are attempting to determine the possible impact of 3D printing on intellectual property rights (IPR); for instance, whether the reproduction of a patented component at home for personal use is an IP infringement or not.

The prototyping and tooling segment is to lead the automotive 3D printing market

The prototyping and tooling segment is to register the largest share in the market. The segment has been ever-growing over the years and is set to grow in the future. The main reasons for this are the quick production of the prototype, reasonably straightforward process, cost reduction, choices of filaments that could be used, agility to design changes, and reduced wastages. Compared to conventional practices, the prototypes now require the shortest possible lead times and minimal expense and wastage. The design modification is possible anytime as only a final CAD design is sent for printing. The prototypes can now be made using different materials tested on different criteria and environments, as there are wider options of filament materials to choose.

North America is estimated to be the largest market in 2022

North America is estimated to hold the largest share of the global 3D printing market in 2022; this can be attributed to the continuous technological advancements in this field and hundreds of carmakers in the region. Europe is estimated to be the fastest-growing 3D printing market and is expected to lead the 3D printing market. The major reason for this is the usage of additive manufacturing by leading automotive manufacturers extensively for their R&D, such as prototyping and fixtures. The main factor for using 3D printing in R&D is the cost-effectiveness of the technology. The polymers printed by 3D printers can be recycled for optimum usage.

The US is expected to dominate the North American automotive 3D printing market. The US has a significant production of ICE vehicles and rapid development of electric vehicles, so there is high demand for 3D-printed parts. The US is estimated to lead the plastic 3D printing market. The main reason for this is the presence of hundreds of carmakers in the country whose R&D and components such as interior trims, dashboards, and exterior components demand plastic additive manufacturing technology.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The automotive 3D printing market is dominated by a few globally established companies such as Stratasys (Israel), 3D Systems, Inc. (US), EOS (Germany), Arcam AB (Sweden), Renishaw plc. (UK), HP (US), Materialise (Belgium).

These companies have adopted strategies such as new product development, expansion, mergers, and joint ventures to gain traction in the 3D printing market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Application (prototyping & tooling, research, development & innovation, manufacturing complex components, and others), By Technology (Stereolithography, Selective Laser Sintering, Electron Beam Melting (EBM), Fused Deposition Modeling, Laminated Object Manufacturing, Three Dimensional Inject Printing, and others), By Material (metals - aluminum, titanium, metal alloys, and stainless steel; plastics - acrylonitrile butadiene styrene (ABS), nylon, polylactic acid (PLA), and others; resin & composites; and others, By Offering (hardware & software), by Vehicle Type (ICE vehicles & electric vehicles), By Component (interior components & exterior components) and By Region (Asia Pacific, Europe, North America, and Rest of the World) |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World [RoW] |

|

Companies covered |

Stratasys (Israel), 3D Systems (US), EOS (Germany), Arcam AB (Sweden), Renishaw plc. (UK), HP (US), Materialise (Belgium), Desktop Metal (US), Carbon (US), SLM Solutions Group AG (Germany), and Voxeljet (Germany), Farsoon Technologies (China) and Sinterit (Poland), Protolabs (US), Nexa3D (US), EPlus3D (China), and Ultimaker (Netherlands) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the automotive 3D printing market :

By Application

- Prototyping & Tooling

- Research, Development & Innovation

- Manufacturing Complex Components

- Others

By Technology

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- Electron Beam Melting (EBM)

- Fused Deposition Modeling (FDM)

- Laminated Object Manufacturing (LOM)

- Three-Dimensional Inject Printing

- Others

By Material

-

Metals

- Stainless Steel

- Titanium

- Aluminum

- Metal Alloys

-

Plastic

- Acrylonitrile Butadiene Styrene (ABS)

- Polylactic Acid (PLA)

- Nylon

- Composites and Resins

- Others

By Offering

- Hardware

- Software

By Component

- Interior components

- Exterior components

By Vehicle Type

- ICE vehicles

- Electric vehicles

By Region

- Asia Pacific

- North Americ

- Europe

- Rest of the World [RoW]

Recent Developments

- In May 2022, Renishaw launched a new range of RenAM 500 3D printing machinery. The RenAM 500S Flex which is a single laser 3D printing machine and the RenAM 500Q Flex, which is a four-laser 3D printing machine. Both the systems featured a simplified powder handling system, which is suited for research and development (R&D), pre-production or bureau environments.

- In February 2022, 3D Systems added extrusion technology to its solution portfolio with the acquisition of Titan Additive LLC, a market leader in polymer extrusion technology. This will broaden the range for its customers.

- In May 2021, Materialise announced its qualification by Airbus to manufacture flight-ready parts using laser sintering technology. The material used in the process, produced by EOS, is a flame-retardant polyamide (PA 2241 FR). With this development, Materialise and EOS became the first suppliers to be qualified by Airbus to produce laser sintered parts under the Airbus Process Specification AIPS 03-07-022

- In April 2021, Stratasys announced the introduction of three new 3D printers - Origin One, H350, and F770. The three printers find their use in various industries, including automobile

- In October 2020, HP Inc introduced their new software solution, the HP Universal Build Manager, which is designed to achieve increased productivity and efficiency as well as automation to additive build management for leading 3D printing processes.

- In October 2020, UK-based additive manufacturing facility, the Digital Manufacturing Centre (DMC) confirmed its purchase of two Renishaw RenAM 500Q machines for increasing efficiencies and quality but also to reduce each part's weight, waste, and costs. The two companies also announced their joint development collaboration.

- In 2020, Porsche introduced its 3D-printed seats that can be customized with the specifications and requirements of the customer. 3D printing helped the company produce the seats considering the customer’s body contours. Materials such as polypropylene and polyurethane-based cushions were used.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive 3D printing market?

The global automotive 3D printing market is estimated to be USD 2.9 Billion in 2022, with North America dominating the market.

Which application is currently leading the automotive 3D printing market?

Prototype and tooling application is leading in the automotive 3D printing market.

Many companies are operating in the automotive 3D printing market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

The 3D printing market is dominated by a few globally established companies such as Stratasys (Israel), 3D Systems, Inc. (US), EOS (Germany), Arcam AB (Sweden), Renishaw plc. (UK), HP (US), Materialise (Belgium). These companies have adopted strategies such as new product development, expansion, mergers, and joint ventures to gain traction in the 3D printing market.

How is the demand for automotive 3D printing varies by region?

North America is estimated to be the largest market for automotive 3D printing during the forecast period, followed by Europe. The growth of the automotive 3D printing market in North America is mainly attributed to the higher demand for automotive 3D printing from US due to higher vehicle production.

What are the growth opportunities for the automotive 3D printing supplier?

The demand for electric, connected and autonomous vehicles would create growth opportunities for the automotive 3D printing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

TABLE 1 AUTOMOTIVE 3D PRINTING MARKET: INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED

1.5 SUMMARY OF CHANGES

1.6 CURRENCY

1.7 PACKAGE SIZE

1.8 LIMITATIONS

1.9 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

FIGURE 2 RESEARCH METHODOLOGY MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 TOP-DOWN APPROACH: BY APPLICATION, TECHNOLOGY, VEHICLE TYPE, MATERIAL, OFFERING, COMPONENT, AND REGION

FIGURE 4 TOP-DOWN APPROACH: AUTOMOTIVE 3D PRINTING MARKET, BY APPLICATION

FIGURE 5 TOP-DOWN APPROACH: MARKET, BY REGION & MATERIAL

2.5 FACTOR ANALYSIS

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.7 ASSUMPTIONS AND RISK ASSESSMENT

TABLE 2 ASSUMPTIONS AND RISK ASSESSMENT

2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

3.1 INTRODUCTION

3.2 PRE- VS POST-COVID-19 SCENARIO

FIGURE 7 PRE- & POST-COVID-19 SCENARIOS: AUTOMOTIVE 3D PRINTING MARKET, 2019–2027 (USD MILLION)

TABLE 3 MARKET: PRE- VS. POST-COVID-19 SCENARIO, 2019–2027 (USD MILLION)

3.3 REPORT SUMMARY

FIGURE 8 MARKET, BY TECHNOLOGY, 2022 VS. 2027

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE 3D PRINTING MARKET

FIGURE 9 REDUCTION IN COST & TIME OF RAPID PROTOTYPING AND INCORPORATION OF 3D-PRINTED PARTS IN VEHICLES TO DRIVE MARKET

4.2 MARKET, BY TECHNOLOGY

FIGURE 10 STEREOLITHOGRAPHY (SLA) SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 11 MANUFACTURING OF COMPLEX COMPONENTS SEGMENT TO SHOWCASE FASTEST GROWTH

4.4 MARKET, BY MATERIAL

FIGURE 12 PLASTICS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 MARKET, BY OFFERING

FIGURE 13 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.6 MARKET, BY COMPONENT

FIGURE 14 INTERIOR COMPONENTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.7 MARKET, BY VEHICLE TYPE

FIGURE 15 ICE VEHICLES SEGMENT TO LEAD THE MARKET DURING FORECAST PERIOD

4.8 MARKET, BY REGION

FIGURE 16 NORTH AMERICA ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.1.1 3D PRINTING PROCESS

FIGURE 17 AUTOMOTIVE 3D PRINTING MARKET: MARKET DYNAMICS

5.2 DRIVERS

5.2.1 INCREASE IN DEMAND TO REDUCE VEHICLE WEIGHT, PRODUCTION COST, AND DEVELOPMENT TIME

5.2.2 INCREASING INITIATIVES AND INVESTMENTS BY MAJOR OEMS

TABLE 4 3D PRINTING INITIATIVES & INVESTMENTS BY MAJOR OEMS

5.3 RESTRAINTS

5.3.1 MATERIAL AVAILABILITY, COST, AND STANDARDIZATION

TABLE 5 PROPERTIES AND COST OF 3D PRINTING MATERIALS

5.4 OPPORTUNITIES

5.4.1 UNTAPPED ADJACENT MARKETS FOR 3D PRINTING APPLICATIONS

5.4.2 GROWING TRENDS AND ADVANCEMENTS IN AUTOMOTIVE 3D PRINTING

TABLE 6 COMPARATIVE ANALYSIS OF DIFFERENT 3D PRINTING APPLICATIONS

5.4.3 REDUCTION IN SUPPLY CHAIN COST AND MAKE-ON-DEMAND USING 3D PRINTING

FIGURE 18 COMPARATIVE ANALYSIS OF TRADITIONAL SUPPLY CHAIN VS FUTURE SUPPLY CHAIN

FIGURE 19 UNIT MANUFACTURING COST: 3D PRINTING VS TRADITIONAL MANUFACTURING

5.5 CHALLENGES

5.5.1 MANUFACTURERS VS. COPYRIGHT ISSUES

5.5.2 HIGH COST AND TIME INVESTMENT IN POST-PROCESSING OF 3D-PRINTED AUTO COMPONENTS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 TRADE ANALYSIS

TABLE 8 IMPORT TRADE DATA, BY KEY COUNTRIES, 2021 (USD)

TABLE 9 EXPORT TRADE DATA, BY KEY COUNTRIES, 2021 (USD)

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 21 REVENUE SHIFT FOR AUTOMOTIVE 3D PRINTING MARKET

5.9 CASE STUDIES

5.9.1 PORSCHE’S 3D-PRINTED CUSTOM SEATS

5.9.2 FORD 3D PRINTS PARTS FOR HIGH-PERFORMANCE MUSTANG SHELBY GT500

5.9.3 3D PRINTING SPARE PARTS FOR CLASSIC CARS

5.9.4 BMW OPTS FOR ADDITIVE MANUFACTURING

5.9.5 BUGATTI BOLIDE IS LIGHTER AND FASTER THANKS TO 3D PRINTING

5.9.6 DALLARA AND ITS 3D-PRINTED HEAT EXCHANGERS

5.9.7 FERRARI AND METAL ADDITIVE MANUFACTURING

5.9.8 FORD’S 3D PRINTING PROJECTS

5.9.9 LAMBORGHINI USES ADDITIVE MANUFACTURING TO PERSONALIZE SIAN ROADSTER

5.9.10 MCLAREN’S NEW ARTURA HYBRID SUPERCAR

5.9.11 TOYOTA COROLLA

5.9.12 VOLKSWAGEN

5.10 PATENT ANALYSIS

5.11 VALUE CHAIN ANALYSIS

FIGURE 22 AUTOMOTIVE 3D PRINTING MARKET: VALUE CHAIN ANALYSIS

5.12 MARKET ECOSYSTEM

TABLE 10 ROLE OF COMPANIES IN MARKET ECOSYSTEM

5.13 REGULATORY ANALYSIS

5.13.1 MARKET: QUALITY STANDARDS

TABLE 11 MARKET: QUALITY STANDARDS

5.14 AVERAGE SELLING PRICE (ASP) ANALYSIS

5.14.1 AUTOMOTIVE 3D PRINTING: ASP ANALYSIS, BY MATERIAL, 2021 (USD PER KG)

TABLE 12 AUTOMOTIVE 3D PRINTING: ASP ANALYSIS, BY MATERIAL, 2021 (USD PER KG)

5.15 AUTOMOTIVE 3D PRINTING MARKET: TECHNOLOGY TRENDS

5.15.1 INTEGRATING 3D PRINTING IN AUTOMOTIVE SERIES PRODUCTION

5.15.2 ADDITIVE MANUFACTURING IN ELECTRIC VEHICLE PRODUCTION

5.16 MARKET SCENARIO

FIGURE 23 MARKET SCENARIO, 2019–2027 (USD MILLION)

5.16.1 REALISTIC SCENARIO

TABLE 13 MARKET (REALISTIC SCENARIO), BY REGION, 2019–2027 (USD MILLION)

5.16.2 LOW IMPACT SCENARIO

TABLE 14 MARKET (LOW IMPACT SCENARIO), BY REGION, 2019–2027 (USD MILLION)

5.16.3 HIGH IMPACT SCENARIO

TABLE 15 MARKET (HIGH IMPACT SCENARIO), BY REGION, 2019–2027 (USD MILLION)

5.17 IMPACT OF CASE (CONNECTED, AUTONOMOUS, SHARED & SERVICE, ELECTRIC) ON AUTOMOTIVE 3D PRINTING MARKET

5.18 INITIATIVES BY OEMS AND TIER-1 PLAYERS

6 CURRENT AND FUTURE APPLICATIONS OF 3D PRINTING IN AUTOMOTIVE INDUSTRY (Page No. - 90)

6.1 INTRODUCTION

6.2 IMPACT OF 3D PRINTING ON AUTOMOTIVE INDUSTRY

FIGURE 24 IMPACT OF 3D PRINTING ON AUTOMOTIVE INDUSTRY

6.3 CURRENT AND FUTURE APPLICATIONS OF 3D PRINTING IN AUTOMOTIVE COMPONENTS

FIGURE 25 3D PRINTING APPLICATIONS IN AUTOMOTIVE COMPONENTS: NOW & BEYOND

6.3.1 CURRENT COMPONENTS

6.3.1.1 Exterior/exterior trim

6.3.1.2 Fluid handling

6.3.1.3 Manufacturing process

6.3.1.4 Exhaust/emissions

6.3.1.5 Electronics

6.3.1.6 Wheels, brakes, tires, and suspensions

6.3.1.7 Interior and seating

6.3.1.8 Engine components

6.3.2 FUTURE COMPONENTS

6.3.2.1 Frame, body, and doors

6.3.2.2 OEM components

6.3.2.3 EV motors and cooling systems

7 AUTOMOTIVE 3D PRINTING MARKET, BY APPLICATION (Page No. - 96)

7.1 INTRODUCTION

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

FIGURE 26 AUTOMOTIVE 3D PRINTING MARKET, BY APPLICATION, 2022 VS 2027

TABLE 16 MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 17 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 PROTOTYPING AND TOOLING

7.2.1 GROWING NUMBER OF ELECTRIC VEHICLES TO DRIVE SEGMENT

TABLE 18 PROTOTYPING AND TOOLING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 19 PROTOTYPING AND TOOLING: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 RESEARCH, DEVELOPMENT, AND INNOVATION

7.3.1 INVESTMENTS IN EV INFRASTRUCTURE TO DRIVE SEGMENT

TABLE 20 RESEARCH, DEVELOPMENT, AND INNOVATION: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 21 RESEARCH, DEVELOPMENT, AND INNOVATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 MANUFACTURING COMPLEX COMPONENTS

7.4.1 NEED TO MAINTAIN MATERIAL AVAILABILITY AND COMPATIBILITY TO DRIVE SEGMENT

TABLE 22 MANUFACTURING COMPLEX COMPONENTS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 23 MANUFACTURING COMPLEX COMPONENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 OTHERS

TABLE 24 OTHER APPLICATIONS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 25 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 AUTOMOTIVE 3D PRINTING MARKET, BY TECHNOLOGY (Page No. - 104)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 27 MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

TABLE 26 MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

TABLE 27 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

8.2 STEREOLITHOGRAPHY (SLA)

8.2.1 RISING USAGE OF PLASTIC COMPONENTS IN VEHICLES TO DRIVE SEGMENT

FIGURE 28 STEREOLITHOGRAPHY: ADVANTAGES VS DISADVANTAGES

TABLE 28 STEREOLITHOGRAPHY: AUTOMOTIVE 3D PRINTING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 29 STEREOLITHOGRAPHY: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SELECTIVE LASER SINTERING (SLS)

8.3.1 COMPATIBILITY WITH ALL TYPES OF MATERIALS TO DRIVE SEGMENT

FIGURE 29 SELECTIVE LASER SINTERING: ADVANTAGES VS DISADVANTAGES

TABLE 30 SELECTIVE LASER SINTERING:MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 31 SELECTIVE LASER SINTERING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 ELECTRON BEAM MELTING (EBM)

8.4.1 NEED FOR DENSE AND VOID-FREE COMPONENTS TO DRIVE SEGMENT

FIGURE 30 ELECTRON BEAM MELTING: ADVANTAGES VS DISADVANTAGES

TABLE 32 ELECTRON BEAM MELTING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 33 ELECTRON BEAM MELTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 FUSED DEPOSITION MODELING (FDM)

8.5.1 COST-EFFICIENCY BENEFITS TO DRIVE SEGMENT

FIGURE 31 FUSED DEPOSITION MODELING: ADVANTAGES VS DISADVANTAGES

TABLE 34 FUSED DEPOSITION MODELING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 35 FUSED DEPOSITION MODELING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 LAMINATED OBJECT MANUFACTURING (LOM)

8.6.1 ABILITY TO OFFER DESIRED DESIGN AND SHAPE OF COMPONENTS TO DRIVE SEGMENT

FIGURE 32 LAMINATED OBJECT MANUFACTURING: ADVANTAGES VS DISADVANTAGES

TABLE 36 LAMINATED OBJECT MANUFACTURING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 LAMINATED OBJECT MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 THREE-DIMENSIONAL INJECT PRINTING

8.7.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE SEGMENT

FIGURE 33 THREE-DIMENSIONAL INJECT PRINTING: ADVANTAGES VS DISADVANTAGES

TABLE 38 THREE-DIMENSIONAL INJECT PRINTING: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 THREE-DIMENSIONAL INJECT PRINTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.8 OTHERS

TABLE 40 OTHER TECHNOLOGIES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 41 OTHER TECHNOLOGIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 AUTOMOTIVE 3D PRINTING MARKET, BY MATERIAL (Page No. - 118)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

TABLE 42 MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 43 MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

9.2 METALS

TABLE 44 METALS: AUTOMOTIVE 3D PRINTING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 45 METALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2.1 STAINLESS STEEL

9.2.1.1 Demand for 3D printing in exterior components to drive segment

9.2.2 TITANIUM

9.2.2.1 Need for materials with high temperature resistance to drive segment

9.2.3 ALUMINUM

9.2.3.1 Demand for lightweight metallic components to drive segment

9.2.4 METAL ALLOYS

9.2.4.1 Demand for high-strength components to drive segment

9.3 PLASTICS

TABLE 46 PLASTICS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 47 PLASTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3.1 ACRYLONITRILE BUTADIENE STYRENE (ABS)

9.3.1.1 Demand for cost-effective components to drive segment

9.3.2 POLYLACTIC ACID (PLA)

9.3.2.1 Demand for surface-finished components to drive segment

9.3.3 NYLON

9.3.3.1 Better heat and chemical resistance properties to drive segment

9.3.4 RESIN & COMPOSITES

9.3.4.1 Unique chemical and physical properties to drive segment

TABLE 48 RESIN AND COMPOSITES: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 RESIN AND COMPOSITES: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 OTHERS

TABLE 50 OTHERS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 51 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 AUTOMOTIVE 3D PRINTING MARKET, BY OFFERING (Page No. - 128)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET, BY OFFERING, 2022 VS. 2027 (USD MILLION)

TABLE 52 MARKET, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 53 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

10.2 HARDWARE

10.2.1 RISING DEMAND FOR R&D, PROTOTYPING, AND TOOLING TO DRIVE SEGMENT

TABLE 54 HARDWARE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 55 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 SOFTWARE

10.3.1 TECHNOLOGICAL ADVANCEMENTS IN AUTOMOTIVE COMPONENT DESIGNS TO DRIVE SEGMENT

TABLE 56 SOFTWARE: MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 57 SOFTWARE: MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 AUTOMOTIVE 3D PRINTING MARKET, BY COMPONENT (Page No. - 133)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 36 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

TABLE 58 MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

TABLE 59 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

11.2 INTERIOR COMPONENTS

11.2.1 RISING DEMAND FOR LIGHTWEIGHT INTERIOR COMPONENTS TO DRIVE SEGMENT

TABLE 60 INTERIOR COMPONENTS: AUTOMOTIVE 3D PRINTING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 61 INTERIOR COMPONENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 EXTERIOR COMPONENTS

11.3.1 EFFICIENCY IN EXTERIOR COMPONENT PRODUCTION WITH 3D PRINTING TO DRIVE SEGMENT

TABLE 62 EXTERIOR COMPONENTS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 63 EXTERIOR COMPONENTS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 AUTOMOTIVE 3D PRINTING MARKET, BY VEHICLE TYPE (Page No. - 138)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 37 MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 64 MARKET, BY VEHICLE TYPE, 2019–2021 (USD MILLION)

TABLE 65 MARKET, BY VEHICLE TYPE, 2022–2027 (USD MILLION)

12.2 ICE VEHICLES

12.2.1 ADVANCEMENT OF 3D PRINTING FROM PROTOTYPES TO CRITICAL COMPONENTS TO DRIVE SEGMENT

TABLE 66 ICE VEHICLES: AUTOMOTIVE 3D PRINTING MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 67 ICE VEHICLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 ELECTRIC VEHICLES

12.3.1 ALLIED DEVELOPMENT OF ELECTRIC VEHICLES USING 3D PRINTING TO DRIVE SEGMENT

TABLE 68 ELECTRIC VEHICLES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 69 ELECTRIC VEHICLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 AUTOMOTIVE 3D PRINTING MARKET, BY REGION (Page No. - 144)

13.1 INTRODUCTION

13.2 RESEARCH METHODOLOGY

13.2.1 ASSUMPTIONS/LIMITATIONS

13.2.2 INDUSTRY INSIGHTS

FIGURE 38 AUTOMOTIVE 3D PRINTING MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 70 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 71 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.3.1 CHINA

13.3.1.1 Increasing popularity of electric vehicles to drive market

TABLE 74 CHINA: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 75 CHINA: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.3.2 JAPAN

13.3.2.1 Adoption of advanced automobile technologies to drive market

TABLE 76 JAPAN: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 77 JAPAN: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.3.3 SOUTH KOREA

13.3.3.1 Developments by domestic manufacturers to drive market

TABLE 78 SOUTH KOREA: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 79 SOUTH KOREA: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.3.4 INDIA

13.3.4.1 Demand for low manufacturing costs to drive market

TABLE 80 INDIA: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 81 INDIA: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.3.5 REST OF ASIA PACIFIC

TABLE 82 REST OF ASIA PACIFIC: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 83 REST OF ASIA PACIFIC: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.4 EUROPE

FIGURE 40 EUROPE: MARKET SNAPSHOT

FIGURE 41 EUROPE: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY COUNTRY, 2022–2027 (UNITS)

13.4.1 GERMANY

13.4.1.1 Increasing demand for premium vehicles to drive market

TABLE 86 GERMANY: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 87 GERMANY: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.4.2 FRANCE

13.4.2.1 Increasing sales of electric vehicles to drive market

TABLE 88 FRANCE: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 89 FRANCE: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.4.3 UK

13.4.3.1 Developments in plastic and metal 3D printing to drive market

TABLE 90 UK: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 91 UK: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.4.4 SPAIN

13.4.4.1 Popularity of luxury vehicles to drive market

TABLE 92 SPAIN: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 93 SPAIN: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.4.5 ITALY

13.4.5.1 Increasing use of plastic components in vehicles to drive market

TABLE 94 ITALY: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 95 ITALY: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.4.6 REST OF EUROPE

TABLE 96 REST OF EUROPE: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 97 REST OF EUROPE: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.5 NORTH AMERICA

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 43 NORTH AMERICA: MARKET, BY COUNTRY, 2022 VS. 2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.5.1 US

13.5.1.1 Increasing number of supply contracts between manufacturers and OEMs to drive market

TABLE 100 US: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 101 US: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.5.2 CANADA

13.5.2.1 Demand for premium and advanced vehicles to drive market

TABLE 102 CANADA: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 103 CANADA: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.5.3 MEXICO

13.5.3.1 Increasing imports from US to drive market

TABLE 104 MEXICO: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 105 MEXICO: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.6 REST OF THE WORLD (ROW)

FIGURE 44 ROW: MARKET, BY COUNTRY, 2022 VS 2027 (USD MILLION)

TABLE 106 ROW: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 107 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.6.1 BRAZIL

13.6.1.1 Trade agreements with key countries to drive market

TABLE 108 BRAZIL: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 109 BRAZIL: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.6.2 RUSSIA

13.6.2.1 Premium vehicle model launches to drive market

TABLE 110 RUSSIA: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 111 RUSSIA: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

13.6.3 OTHERS

TABLE 112 OTHERS: MARKET, BY MATERIAL, 2019–2021 (USD MILLION)

TABLE 113 OTHERS: MARKET, BY MATERIAL, 2022–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 169)

14.1 OVERVIEW

14.2 AUTOMOTIVE 3D PRINTING MARKET SHARE ANALYSIS, 2021

TABLE 114 MARKET SHARE ANALYSIS, 2021

FIGURE 45 MARKET SHARE, 2021

14.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 46 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2019–2021

14.4 COMPANY EVALUATION QUADRANT: AUTOMOTIVE 3D PRINTING SUPPLIERS

14.4.1 STARS

14.4.2 EMERGING LEADERS

14.4.3 PERVASIVE COMPANIES

14.4.4 PARTICIPANTS

TABLE 115 MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 116 MARKET: COMPANY PRODUCT FOOTPRINT, 2021

TABLE 117 MARKET: COMPANY REGION FOOTPRINT, 2021

FIGURE 47 COMPETITIVE EVALUATION MATRIX: AUTOMOTIVE 3D PRINTING SUPPLIERS, 2021

FIGURE 48 DETAILS ON KEY DEVELOPMENTS BY LEADING PLAYERS

14.5 COMPETITIVE SCENARIO

14.5.1 NEW PRODUCT DEVELOPMENTS

TABLE 118 NEW PRODUCT DEVELOPMENTS, 2018–2022

14.5.2 DEALS

TABLE 119 DEALS, 2019–2022

14.5.3 OTHER DEVELOPMENTS, 2019–2022

TABLE 120 OTHER DEVELOPMENTS, 2019–2022

14.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2018–2021

TABLE 121 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND PARTNERSHIPS AS KEY GROWTH STRATEGIES FROM 2019 TO 2022

14.7 COMPETITIVE BENCHMARKING

TABLE 122 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 123 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

15 COMPANY PROFILES (Page No. - 184)

15.1 KEY PLAYERS

15.1.1 STRATASYS

TABLE 124 STRATASYS: BUSINESS OVERVIEW

FIGURE 49 STRATASYS: COMPANY SNAPSHOT

TABLE 125 STRATASYS: PRODUCTS OFFERED

TABLE 126 STRATASYS: DEALS

TABLE 127 STRATASYS: NEW PRODUCT DEVELOPMENTS

15.1.2 3D SYSTEMS

TABLE 128 3D SYSTEMS: BUSINESS OVERVIEW

FIGURE 50 3D SYSTEMS: COMPANY SNAPSHOT

TABLE 129 3D SYSTEMS: PRODUCTS OFFERED

TABLE 130 3D SYSTEMS: DEALS

TABLE 131 3D SYSTEMS: NEW PRODUCT DEVELOPMENTS

15.1.3 EOS

TABLE 132 EOS: BUSINESS OVERVIEW

TABLE 133 EOS: PRODUCTS OFFERED

TABLE 134 EOS: DEALS

TABLE 135 EOS: NEW PRODUCT DEVELOPMENTS

15.1.4 ARCAM AB

TABLE 136 ARCAM AB: BUSINESS OVERVIEW

TABLE 137 ARCAM AB: PRODUCTS OFFERED

TABLE 138 ARCAM AB: DEALS

TABLE 139 ARCAM AB: NEW PRODUCT DEVELOPMENTS

15.1.5 RENISHAW PLC

TABLE 140 RENISHAW PLC: BUSINESS OVERVIEW

FIGURE 51 RENISHAW PLC: COMPANY SNAPSHOT

TABLE 141 RENISHAW PLC: PRODUCTS OFFERED

TABLE 142 RENISHAW PLC: NEW PRODUCT DEVELOPMENTS

TABLE 143 RENISHAW PLC: DEALS

15.1.6 HP INC

TABLE 144 HP INC: BUSINESS OVERVIEW

FIGURE 52 HP INC: COMPANY SNAPSHOT

TABLE 145 HP INC: PRODUCTS OFFERED

TABLE 146 HP INC: NEW PRODUCT DEVELOPMENTS

TABLE 147 HP INC: DEALS

15.1.7 MATERIALISE

TABLE 148 MATERIALISE: BUSINESS OVERVIEW

FIGURE 53 MATERIALISE: COMPANY SNAPSHOT

TABLE 149 MATERIALISE: PRODUCTS OFFERED

TABLE 150 MATERIALISE: DEALS

TABLE 151 MATERIALISE: NEW PRODUCT DEVELOPMENTS

15.1.8 DESKTOP METAL

TABLE 152 DESKTOP METAL: BUSINESS OVERVIEW

FIGURE 54 DESKTOP METAL: COMPANY SNAPSHOT

TABLE 153 DESKTOP METAL: PRODUCTS OFFERED

TABLE 154 DESKTOP METAL: NEW PRODUCT DEVELOPMENTS

TABLE 155 DESKTOP METAL: DEALS

15.1.9 VOXELJET

TABLE 156 VOXELJET: BUSINESS OVERVIEW

FIGURE 55 VOXELJET: COMPANY SNAPSHOT

TABLE 157 VOXELJET: PRODUCTS OFFERED

TABLE 158 VOXELJET: DEALS

TABLE 159 VOXELJET: NEW PRODUCT DEVELOPMENTS

15.1.10 ULTIMAKER

TABLE 160 ULTIMAKER: BUSINESS OVERVIEW

TABLE 161 ULTIMAKER: PRODUCTS OFFERED

TABLE 162 ULTIMAKER: NEW PRODUCT DEVELOPMENTS

15.1.11 CARBON

TABLE 163 CARBON: BUSINESS OVERVIEW

TABLE 164 CARBON: PRODUCTS OFFERED

TABLE 165 CARBON: DEALS

TABLE 166 CARBON: NEW PRODUCT DEVELOPMENTS

15.1.12 FARSOON TECHNOLOGIES

TABLE 167 FARSOON TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 168 FARSOON TECHNOLOGIES: PRODUCTS OFFERED

TABLE 169 FARSOON TECHNOLOGIES: DEALS

TABLE 170 FARSOON TECHNOLOGIES: NEW PRODUCT DEVELOPMENTS

15.1.13 NEXA3D

TABLE 171 NEXA3D: BUSINESS OVERVIEW

TABLE 172 NEXA3D: PRODUCTS OFFERED

15.2 OTHER KEY PLAYERS

15.2.1 EPLUS3D

TABLE 173 EPLUS3D: COMPANY OVERVIEW

15.2.2 PROTOLABS

TABLE 174 PROTOLABS: COMPANY OVERVIEW

15.2.3 SLM SOLUTIONS GROUP AG

TABLE 175 SLM SOLUTIONS GROUP AG: COMPANY OVERVIEW

15.2.4 SINTERIT

TABLE 176 SINTERIT: COMPANY OVERVIEW

*Details on Business overview, Products offered, Recent developments, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 241)

16.1 EUROPE IS EXPECTED TO GROW RAPIDLY IN AUTOMOTIVE 3D PRINTING MARKET

16.2 3D-PRINTED ELECTRIC VEHICLE COMPONENTS TO BE KEY FOCUS AREA

16.3 INCREASED CUSTOMIZATION OPTIONS THROUGH 3D PRINTING TO BE ANOTHER KEY FOCUS AREA

16.4 CONCLUSION

17 APPENDIX (Page No. - 243)

17.1 INSIGHTS FROM INDUSTRY EXPERTS

17.2 DISCUSSION GUIDE

17.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.4 AVAILABLE CUSTOMIZATION

17.4.1 AUTOMOTIVE 3D PRINTING MARKET, BY COMPONENT AND SERVICE

17.4.1.1 Asia Pacific

17.4.1.1.1 China

17.4.1.1.2 India

17.4.1.1.3 Japan

17.4.1.1.4 South Korea

17.4.1.1.5 Rest of Asia Pacific

17.4.1.2 Europe

17.4.1.2.1 Germany

17.4.1.2.2 France

17.4.1.2.3 UK

17.4.1.2.4 Spain

17.4.1.2.5 Italy

17.4.1.2.6 Rest of Europe

17.4.1.3 North America

17.4.1.3.1 US

17.4.1.3.2 Canada

17.4.1.3.3 Mexico

17.4.1.4 RoW

17.4.1.4.1 Brazil

17.4.1.4.2 Russia

17.4.1.4.3 Others

17.4.2 AUTOMOTIVE 3D PRINTING MARKET, BY OFFERING AND SERVICE

17.4.2.1 Asia Pacific

17.4.2.1.1 China

17.4.2.1.2 India

17.4.2.1.3 Japan

17.4.2.1.4 South Korea

17.4.2.1.5 Rest of Asia Pacific

17.4.2.2 Europe

17.4.2.2.1 Germany

17.4.2.2.2 France

17.4.2.2.3 UK

17.4.2.2.4 Spain

17.4.2.2.5 Italy

17.4.2.2.6 Rest of Europe

17.4.2.3 North America

17.4.2.3.1 US

17.4.2.3.2 Canada

17.4.2.3.3 Mexico

17.4.2.4 RoW

17.4.2.4.1 Brazil

17.4.2.4.2 Russia

17.4.2.4.3 Others

17.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

17.5 RELATED REPORTS

17.6 AUTHOR DETAILS

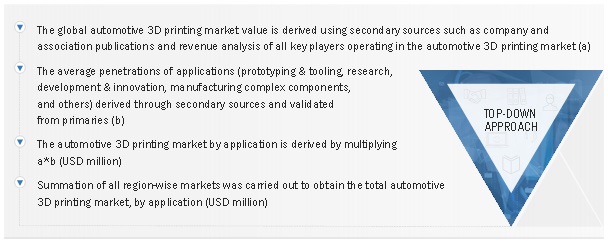

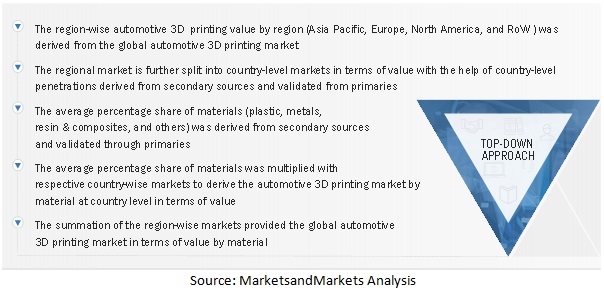

The study involves four main activities to estimate the current size of the automotive 3D printing market.

- Exhaustive secondary research was done to collect information on the market, such as technology, application, material, offering, component, vehicle type and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and data from trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

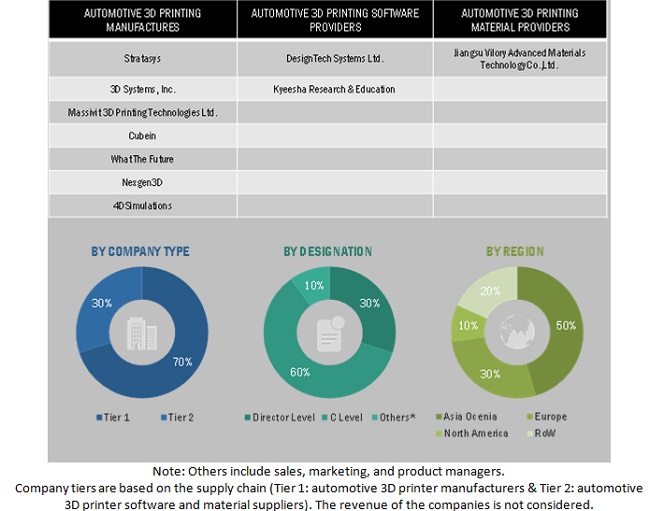

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive 3D printing market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand (3D printer manufacturer) and supply side (Tier-I manufacturers) players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30% and 70%, respectively, of primary interviews have been conducted from both the demand and supply sides. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, administration, and so on, to provide a holistic viewpoint in our reports.

After interacting with industry participants, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the opinions from in-house subject matter experts, has led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the automotive 3D printing market and other dependent submarkets, as mentioned below:

The top-down approach has been used to estimate and validate the size of the global market. The market size has been derived from the overall 3D printing market. The overall 3D printing market penetration for automotive applications has been applied, and then the penetration for the related subsegments has been applied.

Top-Down Approach: Automotive 3D Printing Market, by Application

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach: Automotive 3d Printing Market, by Region & Material

Report Objectives

-

To define, describe, and forecast the size of the automotive 3D printing market in terms of value (USD million) in following segments:

- Application (Prototyping & Tooling, Research, Development & Innovation, Manufacturing Complex Components, and Others)

- Technology (Stereolithography, Selective Laser Sintering, Electron Beam Melting (EBM), Fused Deposition Modeling, Laminated Object Manufacturing, Three Dimensional Inject Printing, and Others)

- Material (Metals - Aluminum, Titanium, Metal Alloys, and Stainless Steel; Plastics - Acrylonitrile Butadiene Styrene (ABS), Nylon, Polylactic Acid (PLA), and Others; Resin & Composites; and Others

- Offering (Hardware & Software)

- Vehicle Type (ICE Vehicles & Electric Vehicles)

- Component (Interior Components & Exterior Components)

- Region (Asia Pacific, Europe, North America, and Rest of the World)

- To understand current and future applications of the automotive 3D printing market

- To provide a detailed analysis regarding the various forces acting in the market (drivers, restraints, opportunities, and challenges)

- To analyze the share of leading players in the automotive 3D printing market and evaluate competitive leadership mapping

- To strategically analyze the key player strategies/right to win, competitive benchmarking, market share analysis, and company revenue analysis

- To analyze the competitive landscape and company profiles of global players operating in the market which includes business overview, products offered, and recent developments

- To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and emerging companies according to the strength of their product portfolio and business strategies

- To analyze key players in the market evolution framework for their respective positioning in the market with respect to each other

- To study the market with Porter’s Five Forces analysis, value chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trend, regulatory analysis, and the COVID-19 impact

- To analyze recent developments, mergers & acquisitions, expansions, and other activities carried out by key industry participants in the market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

-

Automotive 3D Printing Market, by Component & Service

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Russia

- Others

-

Asia Pacific

-

Automotive 3D Printing Market, by Offering & Service

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Russia

- Others

-

Asia Pacific

- Detailed Analysis and Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive 3D Printing Market