Exhaustive secondary research was conducted to collect information on the market, the peer market, and the parent market. The data was validated by industry experts across value chains through primary research. The top-down approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include the organizations in the automotive sector involved with head-up displays; publications from government sources [such as country-level automotive associations and organizations, Organization for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

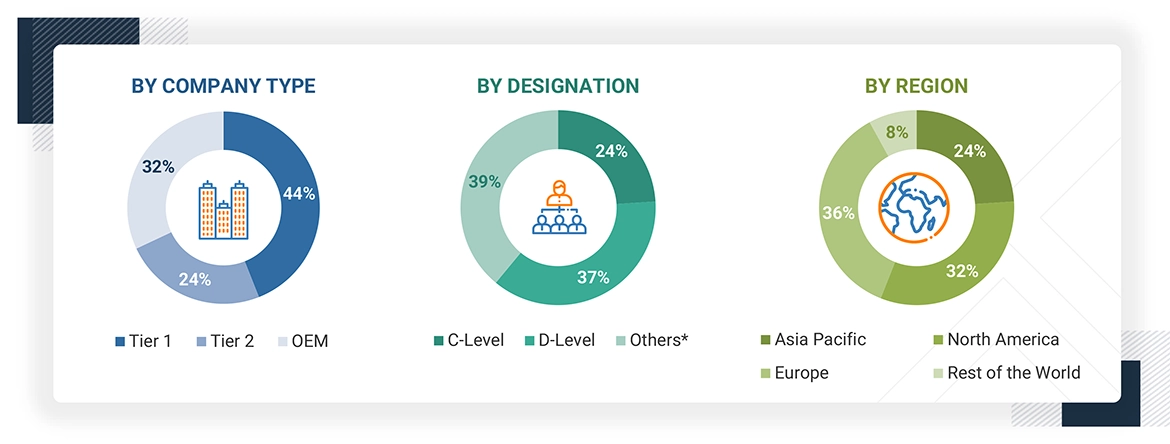

Extensive primary research has been conducted after acquiring an understanding of the global automotive interior market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand (OEMs/vehicle manufacturers) and supply (component manufacturers, module manufacturers, material providers, and system integrators) sides across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 22% of the experts involved in primary interviews have been from the demand side, and 78% have been from the supply side of the industry. Primary data has been collected through questionnaires, emails, and telephonic interviews. Several primary interviews have been conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in the report.

After interacting with industry participants, some brief sessions have been conducted with experienced independent consultants to reinforce the findings from the primary interviews. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of the global automotive interior market. In these approaches, the vehicle production statistics for each vehicle type (passenger vehicles, light commercial vehicles, and heavy commercial vehicles) in a country have been considered.

A detailed market estimation approach has been followed to estimate and validate the volume and value of the automotive interior market and other dependent submarkets, as mentioned below:

-

Key players in the automotive interior market have been identified through secondary research, and their global market share has been determined through primary and secondary research.

-

The research methodology includes the study of the annual and quarterly financial reports & regulatory filings of major market players, as well as interviews with industry experts for detailed market insights.

-

All major penetration rates, percentage shares, splits, and breakdowns for the automotive interior market across different countries and regions have been determined using secondary sources and verified through primary sources.

-

All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

-

The gathered market data has been consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Interior Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters affecting the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for the purpose of this study.

Market Definition

Automotive interiors refer to the interior components of the cabin/body of vehicles, which include various components such as center stack, door panel, seat, instrument cluster, lighting, headliner, dome module, center console, and others.

Stakeholders

-

ADAS Integrators

-

ADAS/Occupant Safety Solution Suppliers

-

Augmented Reality HUD Technology Providers

-

Automobile Organizations/Associations

-

Automotive Center Stack Manufacturers

-

Automotive Cockpit Manufacturers

-

Automotive Component Manufacturers

-

Automotive Display Suppliers

-

Automotive Electronic Hardware Suppliers

-

Automotive Electronic System Integrators

-

Automotive Instrument Cluster Manufacturers

-

Automotive Interior Component Suppliers

-

Automotive Interior System Manufacturers

-

Automotive Seats Manufacturers

-

Automotive Smart Display Panel Manufacturers

-

Automotive SoC and ECU Manufacturers

-

Automotive Upholstery Suppliers

-

Country-specific Automotive Associations

-

European Automobile Manufacturers Association (ACEA)

-

EV and EV Component Manufacturers

-

Government & Research Organizations

-

HUD Technology Providers

-

National Highway Traffic Safety Administration (NHTSA)

-

Raw Material Suppliers for Automotive Interior Manufacturers

-

Raw Material Suppliers for Automotive Interiors

-

Regulatory Bodies

-

Smart Display Technology Providers

-

Software Providers

-

Traders, Distributors, and Suppliers of Automotive Interior Components

-

Vehicle Safety Regulatory Bodies

Report Objectives

-

To define, describe, and project the automotive interior market in terms of volume

(thousand units) and value (USD million)

-

To define, describe, and forecast the market on the basis of component type, material type, passenger car class, electric vehicle (EV) type, level of autonomy, ICE vehicle type, and region

-

To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

-

To segment and forecast the market on the basis of component type: instrument cluster, HUD, center stack, rear seat entertainment, interior lighting (dashboard light, glove box light, reading light, dome light, rear view mirror interior light, engine component light, passenger area light, driver area light, footwell light, and others), door panel, seat (Standard seat; only powered; only heated; powered and heated seat; powered, heated and ventilated seat; powered, heated & memory seat; powered heated, ventilated, & memory seat; and powered, heated, ventilated, massage, and memory seat), dome module, headliner, center console, adhesive & tapes, upholstery, and others

-

To segment and forecast the market on the basis of material type: leather, fabric, vinyl, wood, glass fiber composite, carbon fiber composite, and metal

-

To segment and forecast the market on the basis of passenger car class: mid-segment car, luxury car, and economic car

-

To segment and forecast the market on the basis of electric vehicle type: battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), hybrid electric vehicle (HEV), and plug-in hybrid electric vehicle (PHEV)

-

To segment and forecast the market on the basis of the level of autonomy: non-autonomous cars, semi-autonomous cars, and autonomous cars

-

To segment and forecast the market on the basis of ICE vehicle type: passenger car (PC), light commercial vehicle (LCV), and heavy commercial vehicle (HCV)

-

To forecast the market size, by volume and value, with respect to four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

-

To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

-

To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

-

To analyze the opportunities for stakeholders and details of the competitive landscape for market leaders

-

To study the following with respect to the market:

-

Impact of AI/Gen AI

-

Trend and Disruption Impact

-

Supply Chain Analysis

-

Ecosystem Analysis

-

Technology Analysis

-

Case Study Analysis

-

Patent Analysis

-

Investment Scenario

-

Trade Analysis

-

Regulatory Landscape

-

Key Stakeholder and Buying Criteria

-

Key Conferences and Events

-

Average Selling Price Analysis

-

To strategically profile key players and comprehensively analyze their market share analysis and core competencies

-

To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs.

-

Automotive Interior Market, by Electric Vehicle Type at Country Level

-

Automotive Interior Market, by ICE Vehicle Type at Country Level (for countries not covered in the report)

Company Information

-

Profiling of Additional Market Players (Up to 3)

Dale

Sep, 2021

Who are the major automotive players for interior door panels? specifically Asia and North America.

Amey

Nov, 2019

I am looking specifically for Reports on European Automotive Interior Coatings Market and European Automotive Metal Components Coatings Market. Thank you for circling back..