Solid State Radar Market by Dimension (2D, 3D, 4D), Frequency Band (S-band, X-band, L-band), Waveform (Doppler, FMCW), Application (Navigation, Weather Monitoring), Industry and Region

Updated on : April 04, 2023

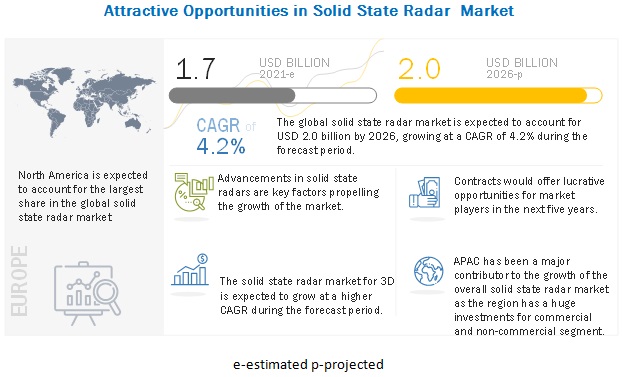

Global solid state radar market report share is projected to reach USD 2.0 billion by 2026; at a CAGR of 4.2% during the forecast period.

The key factors fueling the growth of the market include advancements in solid state radar technologies, development of phased-array solid state radar, and increased demand for advanced weather monitoring radar. Additionally, the growing investments across the defense sector in the APAC is expected to create an opportunity for the market.

To know about the assumptions considered for the study download the pdf brochure

COVID-19 impact on the solid state radar market

In 2020, COVID-19 had a negative effect on the solid state radar industry, resulting in decreased revenues generated from them. As a result, a drop was witnessed in the growth trend of the market during the first half of 2020. This trend is expected to discontinue in the latter half of the year as the demand is expected to increase due to the growing concern for solid state radar.

The COVID-19 pandemic has substantially impacted the value chain of the market. The US, China, South Korea, and Japan, which have been adversely affected by the pandemic, account for a significant share of the global solid state radar. Commercial and non-commercial industry witnessed a low demand, which is expected to continue for the short term due to the global slowdown and declining purchasing power.

Market Dynamics

Driver: Advancement in solid state radar technologies

Latest technologies, such as software-defined radars and digital components are being extensively used in the solid state radar market. The use of Digital Signal Processors (DSP), Ultrafast Analog-to-Digital (A-D) and Digital-to-Analog (D-A) converters, fast Commercial Off-the-Shelf (COTS) microprocessors, and high-speed digital networking has enabled new age radars to provide high output to power ratio and maintain a relatively small form factor. The development of active electronically-scanned arrays has made the development of 3D radars possible, which, in turn, is driving the market for solid state radars. The development of solid state electronics, such as Gallium Nitride (GaN) and Gallium Arsenide, have led to the emergence of a new generation of Advanced Electronically Scanned Array (AESA) radars. These radars have higher target detection capabilities and the ability to track multiple targets at the same time. They also have a longer range and multi-function capabilities compared to the previous vacuum-tube-based radars. These capabilities have led to their large-scale adoption, and the obsolete TWT and klystron-based radars are being replaced by these new systems. Various countries, such as India, Russia, and China, are developing new AESA radars for aerial, naval, and land-based platforms.

Restraint: High manufacturing cost

Solid state radars are used across various applications, such as surveillance, weather detection, and traffic control. The manufacturing of radars requires significant R&D funding, which consequently increases the manufacturing cost. Furthermore, high costs are involved in incorporating these radars in the various defense systems of a nation. The radars have to be integrated with different fire control systems, command and control systems, missiles, and anti-aircraft gun systems. Significant investments are required to launch and maintain these systems. Thus, high development costs as well as the time required to manufacture and deploy these systems may restrain the growth of the solid state radar market.

Opportunity: The rise in adoption of unmanned aerial vehicles

Unmanned Aerial Vehicles (UAVs) are primarily used in the military domain. They can also be used in the civilian domain as remote sensing tools. Various countries, such as China, Russia, and Israel are developing UAVs for intelligence gathering, surveillance, and reconnaissance missions. New generation UAVs are being used for various combat missions, including attacks on hostile ground targets. Combat UAVs, such as the Predator and the Heron, have been developed by the US and Israel, respectively. These UAVs use various synthetic aperture radars for airborne mapping. The increasing adoption of lightweight combat UAVs equipped with solid state radars is expected to create an opportunity for the solid state radars market.

Challenge: Susceptibility to new jamming techniques

Radar jamming involves the deliberate emission of radio frequency signals that interfere with the operations of a radar. Jamming can be done with the help of two main techniques, namely, noise technique and repeater technique. Solid state radars are susceptible to a jamming technique depending on their range, size, and nature. New electronic radar jamming techniques use interfering signals to block the receiver with highly concentrated energy signals, thereby effectively blocking the signal from reaching the airborne radar and stopping it from functioning effectively. The susceptibility of solid state radars to novel jamming techniques may challenge the growth of the market in the near future.

The 3D segment to hold the largest size of solid state radar market by 2026

The 3D solid state radars are used in applications, such as surveillance, navigation, and weather monitoring. These 3D radars can provide high target location accuracy along and fully automatic operation modes, which has resulted in an increased demand for these radars in the military.

The non-commercial to account for the largest size of the solid state radar market in 2021.

The solid state radars are used by police forces, border security forces, coastal & maritime patrol officers, and search & rescue operatives. These radars are also used to detect targets and determine their position, course, and speed over a long-range. Solid state radars facilitate intelligence gathering, surveillance, and reconnaissance. Thus, all these factors are expected to drive the growth of solid state radar market for this segment.

To know about the assumptions considered for the study, download the pdf brochure

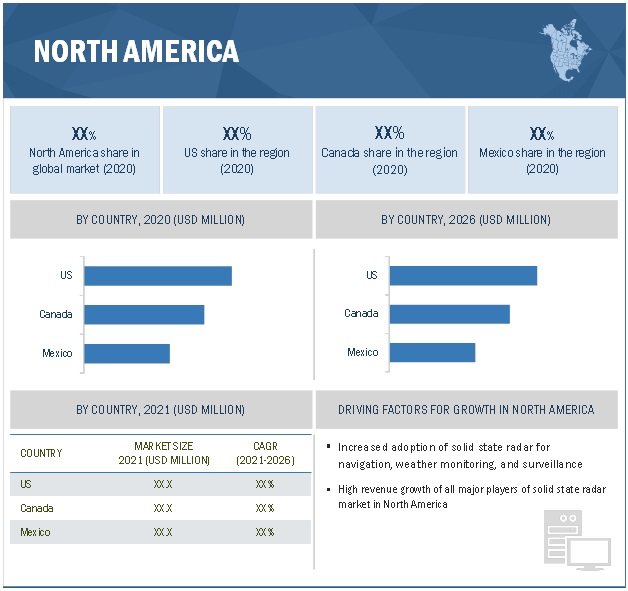

North America in solid state radar market is projected to be the largest market from 2021 to 2026

The increased adoption of solid state radars in the navigation, border security, surveillance, and traffic management applications is the major reason for the growing demand for radars in the commercial as well as non-commercial industries. The demand for solid state radars is expected to increase with the growing investments across the defense sector in the region.

Key Market Players

The solid state radar companies have implemented various types of organic as well as inorganic growth strategies, such as new product launches, and acquisitions to strengthen their offerings in the market. The major players in the solid state radar market are Lockheed Martins (US), Raytheon Technologies (US), Honeywell (US), Thales Group (France), Leonardo (Italy), Elbit Systems (Israel), Garmin (US), Indra (Spain), Wartsila (Finland), and Teledyne Flir (US), Furuno (Japan), Terma (Denmark), Aselsan (Turkey), Tokyo Keiki (Japan), Simrad (Norway), EWR Radar Systems (US), Blighter Surveillance Systems (UK), GEM Elettronica (Italy), Gamic, Hensoldt (Germany), Reutak Radar Systems (South Africa), Japan Radio (Japan), Easat (UK), Lowrance (US), ICS Technologies (Italy).

The study includes an in-depth competitive analysis of these key players in the solid state radars market with their company profiles, recent developments, and key market strategies.

Scope of the Report:

|

Report Attributes |

Details |

|

Market Size Value in 2021 |

USD 1.7 Billion |

| Revenue Forecast in 2026 | USD 2.0 Billion |

| Growth Rate | 4.2% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | North America |

| Largest Market Share Segment | 3D Segment |

| Highest CAGR Segment | S-band Segment |

| Largest Application Market Share | Commercial and non-commercial Application |

In this report, the overall solid state radar market has been segmented based on frequency band, dimension, waveform, application industry, and region.

Solid State Radar Market By Frequency Band:

- S-Band

- X-Band

- L-Band

- C-Band

- Ka-Band

- Ku-Band

Solid State Radar Market By Dimension:

- 2D

- 3D

- 4D

Solid State Radar Market By Waveform:

- Doppler

- Frequency Modulated Continuous Wave (FMCW)

Solid State Radar Market By Application:

- Airspace Monitoring & Surveillance

- Weather Monitoring

- Collision Warning

- Navigation

- Airport Perimeter Security

Solid State Radar Market By Industry:

- Commercial

- Non-commercial

Solid State Radar Market By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Recent Developments

- In March 2021, Honeywell will provide its RDR-7000 Weather Radar and the -036 Enhanced Ground Proximity Warning System (EGPWS) upgrade to Leonardo’s AW139

- In January 2020, Lockheed Martins partnered with the governments of the US, Spain, Canada, and Japan. The company’s solid state radar technology will provide a front-line defense to these nations with the help of its cutting-edge air and missile defense capabilities

- In January 2020, Leonardo signed a contract with the Indonesian company PT Len Industri (Persero) to provide a RAT 31 DL/M radar system for the Indonesian Air Force (IAF).

- In September 2019, Raytheon won a contract from the US Air Force to upgrade solid state radar modules designed to support missile defense, space surveillance, and satellite warning operations at a military station located in England

- In September 2020, Garmin launched the GMR Fantom 254/256 open-array radars that deliver 250W of pulse compression power

Frequently Asked Questions (FAQ):

Who are the top 5 players in the solid state radar market?

The major vendors operating in the solid state radar market include Lockheed Martins, Raytheon Technologies, Honeywell, Thales Group, and Leonardo

What are their major strategies to strengthen their market presence?

The major strategies adopted by these players are contract, product launches, and partnership.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries.

What are the major applications of solid state radar?

The major applications of solid state radar are commercial and non-commercial.

Does this report include the impact of COVID-19 on the solid state radar market?

Yes, the report includes the impact of COVID-19 on the solid state radar market. It illustrates the post- COVID-19 market scenario. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SNAPSHOT

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 SOLID STATE RADAR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.1.4 MARKET SIZE ESTIMATION

2.1.5 BOTTOM-UP APPROACH

2.1.5.1 Approach for arriving at market size using bottom-up analysis

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.1.6 TOP-DOWN APPROACH

2.1.6.1 Approach for arriving at market size using top-down analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 MARKET: SUPPLY-SIDE APPROACH

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.3 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

2.4 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 7 COVID-19 IMPACT ANALYSIS ON THE SOLID STATE RADAR MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 X BAND WAS THE LARGEST SEGMENT OF THE MARKET IN 2020

FIGURE 9 THE 3D SEGMENT ACCOUNTED FOR A LARGER SHARE THAN THE 2D SEGMENT IN 2020

FIGURE 10 AIRSPACE MONITORING AND CONTROL WAS THE LARGEST SEGMENT OF THE MARKET IN 2020

FIGURE 11 THE NON-COMMERCIAL INDUSTRY SEGMENT IS EXPECTED TO REGISTER A HIGHER GROWTH THAN THE COMMERCIAL SEGMENT DURING THE FORECAST PERIOD

FIGURE 12 MARKET TO WITNESS HIGHEST GROWTH IN APAC DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SOLID STATE RADAR MARKET

FIGURE 13 INCREASING DEMAND FROM THE COMMERCIAL SEGMENT IS DRIVING THE DEMAND FOR SOLID STATE RADARS

4.2 MARKET, BY FREQUENCY BAND

FIGURE 14 X-BAND IS EXPECTED TO BE THE LARGEST SEGMENT OF THE MARKET FROM 2021 TO 2026

4.3 MARKET, BY DIMENSION

FIGURE 15 3D SOLID STATE RADAR WAS A LARGER SEGMENT THAN THE 2D SOLID STATE RADAR SEGMENT OF THE MARKET IN 2020

4.4 MARKET, BY APPLICATION

FIGURE 16 AIRSPACE MONITORING AND SURVEILLANCE WAS THE LARGEST SEGMENT OF THE MARKET IN 2020

4.5 MARKET, BY INDUSTRY AND REGION

FIGURE 17 NON-COMMERCIAL AND NORTH AMERICA ACCOUNTED FOR A MAJOR SHARE OF THE MARKET IN 2020

4.6 MARKET, BY GEOGRAPHY

FIGURE 18 THE US HELD THE LARGEST SHARE OF THE MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 SOLID STATE RADAR MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Advancements in solid state radar technologies

5.2.1.2 Development of phased-array solid state radar

5.2.1.3 Increased demand for advanced weather monitoring radar

FIGURE 20 DRIVERS OF MARKET AND THEIR IMPACTS

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing cost

FIGURE 21 RESTRAINTS FOR MARKET AND THEIR IMPACTS

5.2.3 OPPORTUNITIES

5.2.3.1 The rise in the adoption of unmanned aerial vehicles

5.2.3.2 Increased research & development for advanced solid state radars

FIGURE 22 OPPORTUNITIES FOR MARKET AND THEIR IMPACTS

5.2.4 CHALLENGES

5.2.4.1 Stringent policies on cross-border trading

5.2.4.2 Susceptibility to new jamming techniques

FIGURE 23 CHALLENGES FOR MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MARKET

5.4 ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

FIGURE 25 MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 26 REVENUE SHIFT & NEW REVENUE POCKETS FOR SOLID STATE RADAR MANUFACTURERS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 PORTER’S 5 FORCES IMPACT ON THE RKET

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.6.1 THREAT FROM NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 DEGREE OF COMPETITION

5.7 CASE STUDY

5.7.1 LRDR INDUSTRIAL CONTROL SYSTEM (ICS) CYBERSECURITY & RISK MANAGEMENT FRAMEWORK (RMF SOLUTIONS)

5.7.2 LOCKHEED USES SOLID STATE RADAR INTEGRATION SITE TO DEMO LONG RANGE DISCRIMINATION RADAR

5.8 TECHNOLOGY TRENDS

5.8.1 LIDAR TECHNOLOGY

5.8.2 3D & 4D RADAR

5.8.3 SOFTWARE-DEFINED RADAR

5.8.4 INVERSE SYNTHETIC APERTURE RADAR (ISAR)

5.9 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE OF SOLID-STATE RADAR IN 2020 (USD)

5.10 TRADE ANALYSIS

FIGURE 28 IMPORT DATA OF RADAR APPARATUS, BY COUNTRY, 2017–2020 (USD MILLION)

FIGURE 29 EXPORT DATA OF RADAR APPARATUS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 5 EXPORT OF RADAR APPARATUS, BY REGION, 2017–2020 (USD BILLION)

5.11 PATENT ANALYSIS

FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN THE LAST 10 YEARS

FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2020

TABLE 6 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

5.11.1 LIST OF MAJOR PATENTS

TABLE 7 INNOVATIONS & PATENT REGISTRATIONS, 2016–2020

5.12 REGULATORY LANDSCAPE

TABLE 8 REGULATIONS AND STANDARDS FOR SOLID STATE RADAR

6 SOLID STATE RADAR MARKET, BY COMPONENT (Page No. - 71)

6.1 INTRODUCTION

FIGURE 32 MARKET, BY COMPONENT

FIGURE 33 TRANSMITTER IS EXPECTED TO BE THE LARGEST SEGMENT OF THE MARKET IN 2021

6.2 TRANSMITTERS

6.3 ANTENNAS

6.4 POWER AMPLIFIERS

7 SOLID STATE RADAR MARKET, BY FREQUENCY BAND (Page No. - 73)

7.1 INTRODUCTION

FIGURE 34 MARKET, BY FREQUENCY BAND

FIGURE 35 X-BAND IS EXPECTED TO BE THE LARGEST SEGMENT OF THE MARKET IN 2021

TABLE 9 MARKET, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 10 MARKET, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

7.2 S-BAND

7.2.1 THE S-BAND MARKET IS EXPECTED TO WITNESS THE HIGHEST GROWTH FROM 2021 TO 2026

TABLE 11 S-BAND MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 12 S-BAND MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

7.3 X-BAND

7.3.1 X-BAND IS EXPECTED TO BE THE LARGEST SEGMENT OF THE MARKET IN 2021

TABLE 13 X-BAND MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 14 X-BAND MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

7.4 L-BAND

7.4.1 L-BAND SOLID STATE RADARS ARE WIDELY USED FOR ASSET TRACKING

TABLE 15 L-BAND MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 16 L-BAND MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

7.5 C-BAND

7.5.1 C-BAND SOLID STATE RADARS ARE USED FOR LONG-RANGE SURVEILLANCE

TABLE 17 C-BAND MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 18 C-BAND MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

7.6 KA-BAND

7.6.1 THE HIGH-POWER SIGNALS OF KA-BAND RADARS PROVIDE IMPROVED ACCURACY

TABLE 19 KA-BAND MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 20 KA-BAND RADAR MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

7.7 KU-BAND

7.7.1 KU-BAND OFFERS WIDE BEAM COVERAGE AND HIGHER THROUGHPUT IN COMPARISON WITH LOWER BANDS

TABLE 21 KU-BAND RADAR MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 22 KU-BAND RADAR MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

8 SOLID STATE RADAR MARKET, BY DIMENSION (Page No. - 81)

8.1 INTRODUCTION

FIGURE 36 MARKET, BY DIMENSION

FIGURE 37 THE 3D SEGMENT IS EXPECTED TO BE LARGER THAN THE 2D SEGMENT OF THE MARKET IN 2021

TABLE 23 MARKET, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 24 MARKET, BY DIMENSION, 2021–2026 (USD MILLION)

8.2 2D

8.2.1 INCREASING USE OF FOR TRAFFIC MANAGEMENT IS EXPECTED TO BOOST THE MARKET GROWTH OF 2D RADARS

TABLE 25 2D RADAR MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 26 2D RADAR MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.3 3D

8.3.1 HIGHER TARGET DETECTION ACCURACY THAN 2D RADARS IS PROJECTED TO DRIVE THE 3D RADAR MARKET

TABLE 27 3D RADAR MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 28 3D RADAR MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.4 4D

8.4.1 4D SOLID STATE RADARS TO OFFER SUPERIOR AERIAL AND SURFACE OBJECT DETECTION

9 SOLID STATE RADAR MARKET, BY WAVEFORM (Page No. - 86)

9.1 INTRODUCTION

FIGURE 38 MARKET, BY WAVEFORM

FIGURE 39 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW) IS EXPECTED TO BE LARGER THAN THE DOPPLER SEGMENT OF THE MRKET IN 2021

TABLE 29 MARKET, WAVEFORM, 2017–2020 (USD MILLION)

TABLE 30 MARKET, WAVEFORM, 2021–2026 (USD MILLION)

9.2 DOPPLER

9.2.1 ACCURATE AND PRECISE WEATHER PREDICTION CAPABILITIES ARE EXPECTED TO DRIVE THE MARKET

TABLE 31 DOPPLER RADAR MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 32 DOPPLER MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

9.3 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW)

9.3.1 FMCW HOLD LARGEST SIZE OF GLOBAL MARKET IN 2021

TABLE 33 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW) MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 34 FREQUENCY MODULATED CONTINUOUS WAVE (FMCW) MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

10 SOLID STATE RADAR MARKET, BY APPLICATION (Page No. - 91)

10.1 INTRODUCTION

FIGURE 40 MARKET, BY APPLICATION

FIGURE 41 AIRSPACE MONITORING & SURVEILLANCE IS EXPECTED TO BE THE LARGEST SEGMENT OF THE MARKET IN 2021

TABLE 35 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 36 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 AIRSPACE MONITORING & SURVEILLANCE

10.2.1 NEED FOR SECURITY FOR CRITICAL INFRASTRUCTURES EXPECTED TO BOOST THE MARKET GROWTH

TABLE 37 MARKET FOR AIRSPACE MONITORING & SURVEILLANCE, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR AIRSPACE MONITORING & SURVEILLANCE, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 39 MARKET FOR AIRSPACE MONITORING & SURVEILLANCE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR AIRSPACE MONITORING & SURVEILLANCE, BY INDUSTRY, 2021–2026 (USD MILLION)

10.3 WEATHER MONITORING

10.3.1 THE NEED FOR SOLID STATE RADARS FOR ACCURATE WEATHER FORECASTS DRIVES THE MARKET

TABLE 41 MARKET FOR WEATHER MONITORING, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR WEATHER MONITORING, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 43 MARKET FOR WEATHER MONITORING, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR WEATHER MONITORING, BY INDUSTRY, 2021–2026 (USD MILLION)

10.4 COLLISION WARNING

10.4.1 TECHNOLOGICAL ADVANCEMENTS ARE EXPECTED TO DRIVE THE MARKET

TABLE 45 MARKET FOR COLLISION WARNING, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR COLLISION WARNING, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR COLLISION WARNING, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR COLLISION WARNING, BY INDUSTRY, 2021–2026 (USD MILLION)

10.5 NAVIGATION

10.5.1 THE NEED FOR PRECISE NAVIGATION TO DRIVE THE MARKET

TABLE 49 MARKET FOR NAVIGATION, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 50 MARKET FOR NAVIGATION, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 51 MARKET FOR NAVIGATION, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR NAVIGATION, BY INDUSTRY, 2021–2026 (USD MILLION)

10.6 AIRPORT PERIMETER SECURITY

10.6.1 SOLID STATE RADARS PROVIDE CRITICAL INFORMATION FOR EFFICIENT OPERATIONS AT AIRPORTS

TABLE 53 MARKET FOR AIRPORT PERIMETER SECURITY, BY DIMENSION, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR AIRPORT PERIMETER SECURITY, BY DIMENSION, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR AIRPORT PERIMETER SECURITY, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR AIRPORT PERIMETER SECURITY, BY INDUSTRY, 2021–2026 (USD MILLION)

11 SOLID STATE RADAR MARKET, BY INDUSTRY (Page No. - 101)

11.1 INTRODUCTION

FIGURE 42 MARKET, BY INDUSTRY

FIGURE 43 NON-COMMERCIAL IS EXPECTED TO BE A LARGER THAN THE COMMERCIAL SEGMENT OF THE MARKET IN 2021

TABLE 57 MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 58 MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

11.2 COMMERCIAL

11.2.1 SHIPPING

11.2.1.1 Solid state radars help enhance situational awareness and safety of shipping vessels

11.2.2 AEROSPACE

11.2.2.1 Solid state radars facilitate the smooth functioning of airports

11.2.3 CRITICAL INFRASTRUCTURE

11.2.3.1 Solid state radars help in avoiding the incapacitation or destruction of critical infrastructures

TABLE 59 MARKET FOR THE COMMERCIAL INDUSTRY, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 60 MARKET FOR THE COMMERCIAL INDUSTRY, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 61 MARKET FOR THE COMMERCIAL INDUSTRY, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR THE COMMERCIAL INDUSTRY, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR THE COMMERCIAL INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR THE COMMERCIAL INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR THE COMMERCIAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR THE COMMERCIAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

11.3 NON-COMMERCIAL

11.3.1 DEFENSE

11.3.1.1 X-Band to capture the largest share of solid state radar in the defense sector during the forecast period

TABLE 67 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY FREQUENCY BAND, 2017–2020 (USD MILLION)

TABLE 68 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY FREQUENCY BAND, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY WAVEFORM, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY WAVEFORM, 2021–2026 (USD MILLION)

TABLE 71 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 73 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR THE NON-COMMERCIAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

12 SOLID STATE RADAR MARKET, BY GEOGRAPHY (Page No. - 111)

12.1 INTRODUCTION

FIGURE 44 THE MARKET IN CHINA IS EXPECTED TO GROW AT THE HIGHEST THE CAGR FROM 2021 TO 2026

FIGURE 45 NORTH AMERICA IS EXPECTED TO BE THE LARGEST MARKET FOR SOLID STATE RADARS IN 2021

TABLE 75 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 46 NORTH AMERICA: RADAR MARKET SNAPSHOT

TABLE 77 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 78 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 79 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 80 MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Increasing support from the government for the development of airport infrastructure to encourage market growth

12.2.2 CANADA

12.2.2.1 Upcoming investments in advanced radar technologies to boost the market in the country

12.2.3 MEXICO

12.2.3.1 Rising awareness about climate changes to fuel the demand for weather radars in the country

12.3 ASIA PACIFIC

FIGURE 47 APAC: MARKET SNAPSHOT

TABLE 81 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 82 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 83 MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 84 MARKET IN APAC, BY INDUSTRY, 2021–2026 (USD MILLION)

12.3.1 CHINA

12.3.1.1 Increasing surveillance capabilities are expected to boost the market in coming years

12.3.2 JAPAN

12.3.2.1 Increased focus on the country’s security is expected to fuel the growth of the market in the coming years

12.3.3 SOUTH KOREA

12.3.3.1 Initiatives and investments by the country to boost the market for solid state radars during the forecast period

12.3.4 REST OF APAC

12.4 EUROPE

FIGURE 48 EUROPE: RADAR MARKET SNAPSHOT

TABLE 85 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD MILLION)

12.4.1 GERMANY

12.4.1.1 Rising investments in the R&D and manufacturing of solid state radars to boost the market

12.4.2 UK

12.4.2.1 Government initiatives expected to boost the market for solid state radars during the forecast period

12.4.3 FRANCE

12.4.3.1 The government’s support to the aviation industry is expected to boost the market for solid state radars

12.4.4 ITALY

12.4.4.1 The presence of major players in the electronics sector is expected to create growth opportunities for the market

12.4.5 REST OF EUROPE

12.5 REST OF THE WORLD

FIGURE 49 ROW: RADAR MARKET SNAPSHOT

TABLE 89 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 90 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 91 MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 92 MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD MILLION)

12.5.1 SOUTH AMERICA

12.5.1.1 Growing investments in the defense sector are expected to increase the demand for solid state radars

12.5.2 MIDDLE EAST & AFRICA

12.5.2.1 The market in the Middle East is expected to grow at a significant rate

13 COMPETITIVE LANDSCAPE (Page No. - 126)

13.1 OVERVIEW

13.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 50 TOP PLAYERS DOMINATING THE MARKET IN 5 YEARS

13.3 MARKET EVALUATION FRAMEWORK

TABLE 93 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS OF MARKET

13.4 MARKET SHARE ANALYSIS, 2020

TABLE 94 SOLID STATE RADARS MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION MATRIX

13.5.1 STAR

13.5.2 EMERGING LEADER

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 51 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

13.6 STARTUP/SME EVALUATION MATRIX

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 52 STARTUP/SME EVALUATION MATRIX

TABLE 95 COMPANY APPLICATION FOOTPRINT

TABLE 96 COMPANY REGION FOOTPRINT

TABLE 97 COMPANY FOOTPRINT

13.7 COMPETITIVE SITUATIONS AND TRENDS

13.7.1 PRODUCT LAUNCHES

TABLE 98 MARKET: PRODUCT LAUNCHES, MAY 2019–2021

13.7.2 DEALS

TABLE 99 SOLID STATE RADR MARKET: DEALS, JANUARY 2020

13.7.3 OTHERS

TABLE 100 SOLID STATE RADR MARKET: OTHERS, SEPTEMBER 2018–MARCH 2021

14 COMPANY PROFILES (Page No. - 139)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 LOCKHEED MARTINS

TABLE 101 LOCKHEED MARTINS: BUSINESS OVERVIEW

FIGURE 53 LOCKHEED MARTINS: COMPANY SNAPSHOT

14.2.2 RAYTHEON TECHNOLOGIES

TABLE 102 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 54 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

14.2.3 HONEYWELL

TABLE 103 HONEYWELL: BUSINESS OVERVIEW

FIGURE 55 HONEYWELL: COMPANY SNAPSHOT

14.2.4 THALES GROUP

TABLE 104 THALES GROUP: BUSINESS OVERVIEW

FIGURE 56 THALES GROUP: COMPANY SNAPSHOT

14.2.5 LEONARDO

TABLE 105 LEONARDO: BUSINESS OVERVIEW

FIGURE 57 LEONARDO: COMPANY SNAPSHOT

14.2.6 ELBIT SYSTEMS

TABLE 106 ELBIT SYSTEMS: BUSINESS OVERVIEW

FIGURE 58 ELBIT SYSTEM: COMPANY SNAPSHOT

14.2.7 GARMIN

TABLE 107 GARMIN: BUSINESS OVERVIEW

FIGURE 59 GARMIN: COMPANY SNAPSHOT

14.2.8 INDRA

TABLE 108 INDRA: BUSINESS OVERVIEW

FIGURE 60 INDRA: COMPANY SNAPSHOT

14.2.9 WARTSILA

TABLE 109 WARTSILA: BUSINESS OVERVIEW

FIGURE 61 WARTSILA: COMPANY SNAPSHOT

14.2.10 TELEDYNE FLIR

TABLE 110 TELEDYNE FLIR: BUSINESS OVERVIEW

FIGURE 62 TELEDYNE FLIR: COMPANY SNAPSHOT

14.3 OTHER PLAYERS

14.3.1 FURUNO

14.3.2 TERMA

14.3.3 ASELSAN

14.3.4 TOKYO KEIKI

14.3.5 SIMRAD

14.3.6 EWR RADAR SYSTEMS

14.3.7 BLIGHTER SURVEILLANCE SYSTEMS

14.3.8 GEM ELETTRONICA

14.3.9 GAMIC

14.3.10 HENSOLDT

14.3.11 REUTEK RADAR SYSTEMS

14.3.12 JAPAN RADIO

14.3.13 EASAT

14.3.14 LOWRANCE

14.3.15 ICS TECHNOLOGIES

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKET (Page No. - 172)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 LIDAR MARKET

15.3.1 DEFINITION

15.3.2 MARKET OVERVIEW

15.3.3 LIDAR MARKET, BY APPLICATION

TABLE 111 LIDAR MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

15.4 CORRIDOR MAPPING

TABLE 112 LIDAR MARKET FOR CORRIDOR MAPPING APPLICATION, BY INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 113 LIDAR MARKET FOR CORRIDOR MAPPING APPLICATION, BY SUB-APPLICATION, 2017–2025 (USD MILLION)

15.5 ENGINEERING

15.5.1 LIDAR-BASED SURVEY HELPS IN EXTRACTING DATA RELATED TO ELEVATION OF GROUND

TABLE 114 LIDAR MARKET FOR ENGINEERING APPLICATION, BY INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 115 LIDAR MARKET FOR ENGINEERING APPLICATION, BY GROUND-BASED INSTALLATION TYPE, 2017–2025 (USD MILLION)

15.6 ENVIRONMENT

TABLE 116 LIDAR MARKET FOR ENVIRONMENT APPLICATION, BY INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 117 LIDAR MARKET FOR ENVIRONMENT APPLICATION, BY AIRBORNE INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 118 LIDAR MARKET FOR ENVIRONMENT APPLICATION, BY GROUND-BASED INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 119 LIDAR MARKET FOR ENVIRONMENT APPLICATION, BY SUB-APPLICATION, 2017–2025 (USD MILLION)

15.7 ADAS & DRIVERLESS CARS

15.7.1 LIDAR CAN PROVIDE HIGH ACCURACY IN OBJECT DETECTION AND RECOGNITION FOR ADAS & DRIVERLESS CARS

15.8 EXPLORATION

TABLE 120 LIDAR MARKET FOR EXPLORATION APPLICATION, BY INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 121 LIDAR MARKET FOR EXPLORATION APPLICATION, BY GROUND-BASED INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 122 LIDAR MARKET FOR EXPLORATION APPLICATION, BY SUB-APPLICATION, 2017–2025 (USD MILLION)

15.9 URBAN PLANNING

15.9.1 LIDAR HELPS OBTAIN DIGITAL MODELS OF CITIES AND DIGITAL SURFACE MODELS OF EARTH SURFACES

TABLE 123 LIDAR MARKET FOR URBAN PLANNING APPLICATION, BY INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 124 LIDAR MARKET FOR URBAN PLANNING APPLICATION, BY AIRBORNE INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 125 LIDAR MARKET FOR URBAN PLANNING APPLICATION, BY SUB-APPLICATION, 2017–2025 (USD MILLION)

15.10 CARTOGRAPHY

15.10.1 LIDAR HAS BEEN ADOPTED FOR CARTOGRAPHY, OWING TO THE USE OF NAVIGATION AND POSITION SYSTEMS

15.11 METEOROLOGY

15.11.1 LIDAR CAN PROVIDE ACCURATE DATA OF ATMOSPHERIC STRUCTURES

TABLE 126 LIDAR MARKET FOR METEOROLOGY APPLICATION, BY GROUND-BASED INSTALLATION TYPE, 2017–2025 (USD MILLION)

15.12 OTHER APPLICATIONS

TABLE 127 LIDAR MARKET FOR OTHER APPLICATIONS, BY INSTALLATION TYPE, 2017–2025 (USD MILLION)

TABLE 128 LIDAR MARKET FOR OTHER APPLICATIONS, BY AIRBORNE INSTALLATION TYPE, 2017–2025 (USD MILLION)

15.12.1 LIDAR MARKET, BY REGION

15.12.1.1 Introduction

TABLE 129 LIDAR MARKET, BY REGION, 2017–2025 (USD MILLION)

15.12.1.2 North America

TABLE 130 LIDAR MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

15.12.1.3 Europe

TABLE 131 LIDAR MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

15.12.1.4 Asia Pacific

TABLE 132 LIDAR MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

15.12.1.5 Rest of the world

TABLE 133 LIDAR MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

16 APPENDIX (Page No. - 184)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

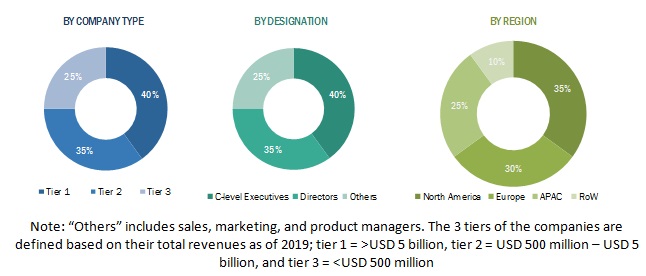

The study involves four major activities for estimating the size of the solid state radar market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the solid state radar market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as the National Defense Industrial Association (US), Association of American State Geologists, and National Association of Manufacturers have been used to identify and collect information for an extensive technical and commercial study of the solid state radar market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the solid state radar market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the solid state radar market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the solid state radar market, in terms of value, segmented by frequency band, dimension, waveform, application, and industry

- To forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the COVID-19 impact on the solid state radar market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the market

- To provide a detailed overview of the value chain of the solid state radar ecosystem

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailed competitive landscape for the market leaders

- To analyze the major growth strategies implemented by the key market player, such as product launch.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solid State Radar Market