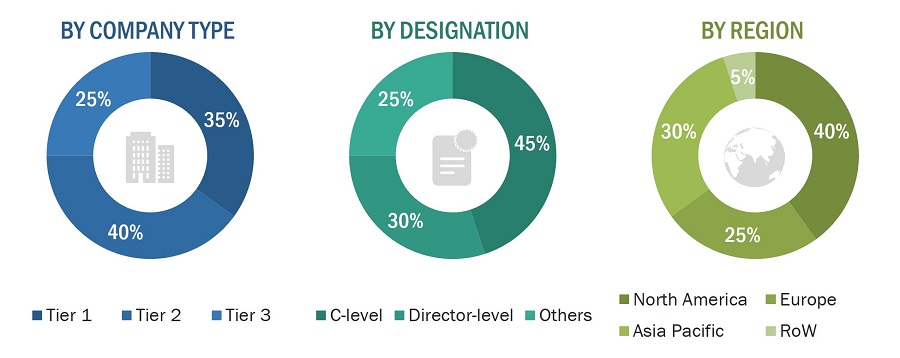

The research study involved the extensive use of secondary sources, directories, and databases (annual reports or presentations of companies, industry association publications, directories, technical handbooks, World Economic Outlook (WEO), trade websites, Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the Digital Signal Processor market size . Primary sources mainly comprise several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, system providers, technology developers, alliances, and standards and certification organizations related to various phases of this industry’s value chain.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from key companies and organizations operating in the Digital Signal Processor market across four major regions: North America, Europe, Asia Pacific, and RoW (South America, Africa, Middle East). Primary data has been collected through questionnaires, e-mails, and telephonic interviews. Approximately 40% and 60% of primary interviews have been conducted from the demand and supply sides, respectively.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used along with several data triangulation methods to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

In this approach, important players, such Analog Devices, Inc. (US), Microchip Technology Inc. (US), Texas Instruments Incorporated (US), NXP Semiconductors (Netherlands), and Marvell (US), have been identified. After confirming these companies through primary interviews with industry experts, their total revenue has been estimated by referring to annual reports, SEC filings, and paid databases. Revenues of these companies pertaining to the business units (Bus) that offer Digital Signal Processor have been identified through similar sources. Industry experts have reconfirmed these revenues through primary interviews.

Digital Signal Processor Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the Digital Signal Processor market from the revenues of key players and their share in the market.

Digital Signal Processor Market: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share has been estimated to verify the revenue shares used earlier in the supply-side approach. The overall parent market size and individual market size were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

Data Triangulation

After arriving at the overall Industry size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the Digital Signal Processor market share has been validated using both top-down and bottom-up approaches.

Market Definition

A digital signal processor (DSP) is an integrated circuit (IC), or IP core designed for efficient digital signal processing. It converts analog signals to digital, processes them using algorithms for tasks like filtering and compression, and outputs digital or converted analog signals. DSPs excel in real-time signal handling, performing complex math operations swiftly and power-efficiently. They find applications in audio processing, video processing, image processing, speech processing & recognition, radar systems, communication systems, and others. DSPs are programmable and often used to offload advanced tasks from CPUs, sometimes paired with specialized hardware for enhanced power efficiency and performance.

Key Stakeholders

-

Digital Signal Processor products and solutions providers

-

Electronic design automation (EDA) and design tool vendors

-

Wafer manufacturers

-

Government bodies, venture capitalists, and private equity firms

-

Integrated device manufacturers (IDMs)

-

Owners of intellectual property related to DSP

-

DSP technology platform developers

-

Digital Signal Processor consulting companies

-

Digital Signal Processor related associations, organizations, forums, and alliances

-

Government and corporate offices

-

Venture capitalists, private equity firms, and start-up companies

-

Distributors and traders

-

Research organizations

-

Semiconductor Foundry Service Provider

Report Objectives

-

To define, describe, and forecast the global Digital Signal Processor market share , in terms of value, based on Type, Category, Core, Configuration, IC Design, Application, End-User Industry, and geography

-

To describe and forecast the global Digital Signal Processor market size, by Type, in terms of volume

-

To forecast the market size, in terms of value, for various segments, with respect to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

-

To provide detailed information regarding the major factors influencing the growth of the Digital Signal Processor market share (drivers, restraints, opportunities, and industry-specific challenges)

-

To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s Five Forces analysis, and regulations pertaining to the market.

-

To offer a comprehensive overview of the value chain of Digital Signal Processor market ecosystem

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total Industry

-

To analyze opportunities for the market stakeholders by identifying high-growth segments of the Digital Signal Processor market share

-

To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders

-

To analyze competitive developments such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches and developments in the Digital Signal Processor market

-

To evaluate the impact of the recession on the Digital Signal Processor Industry

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Digital Signal Processor Market