Award Management Software Market by Component, Function (Entry Management, Judging Management, Reporting and Analytics, and Application Tracking), Platform, Deployment Type, Organization Size, End User, and Region - Global Forecast to 2025

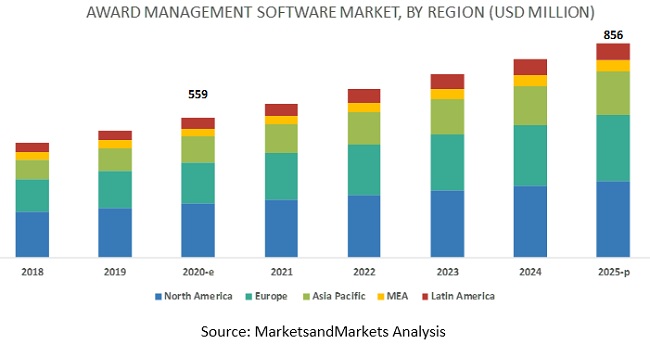

The global Award Management Software Market size was valued at $559 million in 2020 and is projected to reach $856 million by 2025, at a CAGR of 8.9%. The growing need among enterprises to improve the award process and acceleration of award application review is expected to drive the growth of the award management software market across various end users globally.

To know about the assumptions considered for the study, download the pdf brochure

By component, the solution segment to hold a larger market size during the forecast period

The award management software empowers organizations with a centralized platform to efficiently manage their award processes. The growing focus of organizations to automate and enhance their award processes is expected to drive the demand for award management software in the global market. The award management software provides award management professionals with efficient tools to effectively engage with the reviewer, applicant, sponsors and award organizers. Organizations across end users are adopting the award management solution, as it helps to manage data effectively.

Cloud deployment type to grow at a higher CAGR during the forecast period

Organizations nowadays are looking forward to having their solution deployed on the cloud, as cloud deployment offers various advantages, such as scalability, flexibility in capacity, enhanced collaboration, and cost-efficiency. Implementation of cloud-based award management software facilitates SMEs and large enterprises to focus on their core competencies, rather than Information Technology (IT) processes. With the help of the cloud-based award management solution and services, organizations can avoid costs related to software, storage, and technical staff. The cloud-based award management software offers a centralized way to integrate the system and its components with web and mobile applications and helps organizations to fast track award-making processes.

Large enterprises segment to have a larger market size during the forecast period

The need to manage award processes efficiently is driving the adoption of award management software and services among Small and Medium-sized Enterprises (SMEs), as well as large enterprises. This process is usually time-consuming, which demands an enhanced award management software to overcome the challenge. Among different organization size, the large enterprises segment is expected to account for a higher market share in the award management software market, due to the affordability and acceptance for emerging technologies Moreover, large enterprises generate a massive amount of data daily, which needs to be narrowed down to relevant information during a legal case and is a time-consuming process if done manually, thereby leading to the growing adoption of the award management software in this segment.

To know about the assumptions considered for the study, download the pdf brochure

North America to account for the largest market size during the forecast period

North America is an early adopter of award management solutions, as it is more concerned about awards, projects, and follows standardized regulations as compared to the other regions. The huge amount of data generated in the North American organizations is because of the rapid adoption of new technologies, which is in turn leading to the growing adoption of award management solutions to maintain and manage such data for on-demand availability. Award management software is designed to help brands reach high-potential prospects, review award applications, and manage the award lifecycle. The presence of major players in the region also supports the demand and awareness regarding the benefits achieved by the adoption of an award management solution.

Award Management Software Companies

The major award management software vendors include Blackbaud (US), WizeHive (US), Submittable (US), Evalato (Spain), Award Force (Australia), SmarterSelect (US), Reviewr (US), Eventsforce (UK), Currinda (Australia), AwardStage (UK), AcclaimWorks (England), Judgify (Singapore), Untap Compete (Egypt), OpenWater (US), omniCONTESTS (US), eAwards (Philippines), alpha awards (Austria), Omnipress (US), Submit.com (Ireland) and RhythmQ (Canada).

Submittable, one of the leading providers of award management software to global customers, was founded in 2010 and is headquartered in Montana, US. Submittable empowers thousands of organizations globally for collecting and reviewing any content through its easy-to-use platform. The flagship platform, Submittable, is an all-in-one cloud-based platform supporting varied enterprise applications. The solution portfolio of the company includes awards and nominations, conferences, grants, publishing, contests, corporate giving, scholarships and fellowships, Human Resources (HR) and operations, events and festivals, residencies, auditions and talent, peer review, exhibitions, and admissions. Submittable, the awards and nominations solution, offered by the company simplifies the award management process for different organizations, including foundation, corporates, government, non-profit, and universities.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2020 |

US $559 Million |

|

Market size Value in 2025 |

US $856 Million |

|

Market Growth Rate |

8.9% CAGR |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component (solution and Services), Function, Platform, Deployment Type, Organization Size, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

List of Companies in Award Management Software |

It includes 20 major vendors, Blackbaud (US), WizeHive (US), Submittable (US), Evalato (Spain), Award Force (Australia), SmarterSelect (US), Reviewr (US), Eventsforce (UK), Currinda (Australia), AwardStage (UK), AcclaimWorks (England), Judgify (Singapore), Untap Compete (Egypt), OpenWater (US), omniCONTESTS (US), eAwards (Philippines), alpha awards (Austria), Omnipress (US), Submit.com (Ireland) and RhythmQ (Canada). |

This research report categorizes the market to forecast revenues and analyze trends in each of the following submarkets:

Based on components, the award management software market has been segmented as follows:

-

Component

- Solution

- Services

- Implementation and Integration

- Consulting and Training

- Support and Maintenance

Based on functions, the award management software market has been segmented as follows:

- Entry Management

- Judging Management

- Reporting and Analytics

- Application Tracking

- Others (social media management and voting management)

Based on Platform, the award management software market has been segmented as follows:

- Web

- Mobile

- IOS

- Android

- Windows

Based on deployment types, the award management software market has been segmented as follows:

- On-premises

- Cloud

Based on organization size, the award management software market has been segmented as follows:

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Based on end users, the award management software market has been segmented as follows:

- Government

- Educational Institutes

- Corporations

- Industry Associations

- Philanthropic Organizations

- Others (Political Organizations and Environmental Entities)

Based on regions, the award management software market has been segmented as follows:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia

- Singapore

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2018, Blackbaud inaugurated its new headquarters at Daniel Island in South Carolina. The newly inaugurated headquarters is considered to fulfill varied purposes, such as an innovation center, a high-tech meeting space where customers, partners, community leaders, and influencers across the social economy can convene to turn action into impact.

- In April 2018, Blackbaud entered into an agreement with a higher educational institution to streamline the scholarship process. The University of Nevada implemented a cloud-based solution from Blackbaud to streamline the scholarship and award management process, improve campus-wide collaboration, strengthen relationships with alumni and supporters, and advance fundraising and marketing activities.

- In April 2018, WizeHive partnered with eCivis, part of GTY, a leading public sector Software-as-a-Service (SaaS) company. The partnership between WizeHive and eCivis intended to centralize and streamline the application intake, evaluation, and grant award process across the entire state of Arizona.

Key questions addressed by the report

- How is the adoption trend of award management software across major economies?

- What are the challenges faced by award management software vendors in the global market?

- The report provides insights on the global market concerning different end user.

- What are various developments happened in the global award management software market?

Frequently Asked Questions (FAQ):

How big is the global Award Management Software Market?

What is Award Management Software?

What is the estimated growth rate (CAGR) of the global Award Management Software Market?

Who are the major vendors in the Award Management Software Market?

What are the major revenue pockets in the global Award Management Software Market currently?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 MARKET DEFINITION

1.1.1 INCLUSIONS AND EXCLUSIONS

1.2 MARKET SCOPE

1.2.1 MARKET SEGMENTATION

1.2.2 REGIONS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY CONSIDERED

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 29)

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE MARKET

4.2 AWARD MANAGEMENT SOFTWARE MARKET, BY PLATFORM (2020 VS. 2025)

4.3 MARKET, BY FUNCTION (2020 VS. 2025)

4.4 MARKET, BY ORGANIZATION SIZE (2020 VS. 2025)

4.5 MARKET, BY END USER (2020 VS. 2025)

4.6 MARKET INVESTMENT SCENARIO

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Need for automating award management processes

5.2.1.2 One-tap accessibility to vital information

5.2.2 RESTRAINTS

5.2.2.1 Obligations for addressing governance and compliance requirements

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of AI-enabled tools with award management solution

5.2.4 CHALLENGES

5.2.4.1 Meeting requirements of data security and privacy concerns

5.2.4.2 Unification of award management solution with existing communication systems

5.3 USE CASES

5.3.1 USE CASE 1: EASE IN DATA EXPORT OF PARTICIPANTS OF THE AWARD PROGRAM

5.3.2 USE CASE 2: FASTER EVALUATION AND LAUNCH OF THE CONTEST

5.3.3 USE CASE 3: MANAGEMENT OF AWARD PROCESS FOR 11 DIFFERENT CATEGORIES IN SPORTS

6 IMPACT OF COVID-19 ON THE AWARD MANAGEMENT SOFTWARE MARKET (Page No. - 41)

7 AWARD MANAGEMENT SOFTWARE MARKET, BY COMPONENT (Page No. - 42)

7.1 INTRODUCTION

7.2 SOLUTION

7.2.1 SOLUTION: MARKET DRIVERS

7.3 SERVICES

7.3.1 SERVICES: MARKET DRIVERS

7.3.2 IMPLEMENTATION AND INTEGRATION

7.3.3 CONSULTING AND TRAINING

7.3.4 SUPPORT AND MAINTENANCE

8 AWARD MANAGEMENT SOFTWARE MARKET, BY FUNCTION (Page No. - 47)

8.1 INTRODUCTION

8.2 ENTRY MANAGEMENT

8.2.1 ENTRY MANAGEMENT: MARKET DRIVERS

8.3 JUDGING MANAGEMENT

8.3.1 JUDGING MANAGEMENT: MARKET DRIVERS

8.4 REPORTING AND ANALYTICS

8.4.1 REPORTING AND ANALYTICS: MARKET DRIVERS

8.5 APPLICATION TRACKING

8.5.1 APPLICATION TRACKING: MARKET DRIVERS

8.6 OTHERS

9 AWARD MANAGEMENT SOFTWARE MARKET, BY PLATFORM (Page No. - 54)

9.1 INTRODUCTION

9.2 WEB

9.2.1 WEB: MARKET DRIVERS

9.3 MOBILE

9.3.1 MOBILE: MARKET DRIVERS

9.3.2 IPHONE OPERATING SYSTEM

9.3.3 ANDROID

9.3.4 WINDOWS

10 AWARD MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT TYPE (Page No. - 59)

10.1 INTRODUCTION

10.2 ON-PREMISES

10.2.1 ON-PREMISES: MARKET DRIVERS

10.3 CLOUD

10.3.1 CLOUD: MARKET DRIVERS

11 AWARD MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE (Page No. - 63)

11.1 INTRODUCTION

11.2 LARGE ENTERPRISES

11.2.1 LARGE ENTERPRISES: MARKET DRIVERS

11.3 SMALL AND MEDIUM-SIZED ENTERPRISES

11.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

12 AWARD MANAGEMENT SOFTWARE MARKET, BY END USER (Page No. - 67)

12.1 INTRODUCTION

12.2 GOVERNMENTS

12.2.1 GOVERNMENTS: MARKET DRIVERS

12.3 EDUCATIONAL INSTITUTIONS

12.3.1 EDUCATIONAL INSTITUTIONS: MARKET DRIVERS

12.4 CORPORATIONS

12.4.1 CORPORATIONS: MARKET DRIVERS

12.5 INDUSTRY ASSOCIATIONS

12.5.1 INDUSTRY ASSOCIATIONS: MARKET DRIVERS

12.6 PHILANTHROPIC ORGANIZATIONS

12.6.1 PHILANTHROPIC ORGANIZATIONS: MARKET DRIVERS

12.7 OTHERS

13 AWARD MANAGEMENT SOFTWARE MARKET, BY REGION (Page No. - 75)

13.1 INTRODUCTION

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: MARKET DRIVERS

13.2.2 UNITED STATES

13.2.3 CANADA

13.3 EUROPE

13.3.1 EUROPE: MARKET DRIVERS

13.3.2 UNITED KINGDOM

13.3.3 GERMANY

13.3.4 FRANCE

13.3.5 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: MARKET DRIVERS

13.4.2 CHINA

13.4.3 JAPAN

13.4.4 AUSTRALIA

13.4.5 SINGAPORE

13.4.6 REST OF ASIA PACIFIC

13.5 MIDDLE EAST AND AFRICA

13.5.1 MIDDLE EAST AND AFRICA: AWARD MANAGEMENT SOFTWARE MARKET DRIVERS

13.5.2 KINGDOM OF SAUDI ARABIA

13.5.3 UNITED ARAB EMIRATES

13.5.4 SOUTH AFRICA

13.5.5 REST OF MIDDLE EAST AND AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: MARKET DRIVERS

13.6.2 BRAZIL

13.6.3 MEXICO

13.6.4 REST OF LATIN AMERICA

14 COMPANY PROFILES (Page No. - 115)

14.1 INTRODUCTION

(Business Overview, Products & Services, Key Insights, )*

14.2 BLACKBAUD

14.3 WIZEHIVE

14.4 SUBMITTABLE

14.5 EVALATO

14.6 AWARD FORCE

14.7 SMARTERSELECT

14.8 REVIEWR

14.9 EVENTSFORCE

14.10 CURRINDA

14.11 AWARDSTAGE

14.12 ACCLAIMWORKS

14.13 JUDGIFY

14.14 UNTAP COMPETE

14.15 OPENWATER

14.16 OMNICONTESTS

14.17 EAWARDS

14.18 ALPHA AWARDS

14.19 OMNIPRESS

14.20 SUBMIT.COM

14.21 RHYTHMQ

*Details on Business Overview, Products & Services, Key Insights, might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 139)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

LIST OF TABLES (105 TABLES)

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

TABLE 2 FACTOR ANALYSIS

TABLE 3 AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 4 SOLUTION: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 5 SERVICES: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 6 AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY FUNCTION, 2018–2025 (USD THOUSAND)

TABLE 7 ENTRY MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 8 JUDGING MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 9 REPORTING AND ANALYTICS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 10 APPLICATION TRACKING: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 11 OTHERS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 12 AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY PLATFORM, 2018–2025 (USD THOUSAND)

TABLE 13 WEB: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 14 MOBILE: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 15 AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 16 ON-PREMISES: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 17 CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 18 AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 19 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 20 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 21 AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

TABLE 22 GOVERNMENTS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 23 EDUCATIONAL INSTITUTIONS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 24 CORPORATIONS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 25 INDUSTRY ASSOCIATIONS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 26 PHILANTHROPIC ORGANIZATIONS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 27 OTHERS: MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 28 AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 2018–2025 (USD THOUSAND)

TABLE 29 NORTH AMERICA: AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY FUNCTION, 2018–2025 (USD THOUSAND)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY PLATFORM, 2018–2025 (USD THOUSAND)

TABLE 32 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 33 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 34 NORTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 36 UNITED STATES: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 37 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 38 UNITES STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 39 CANADA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 40 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 41 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 42 EUROPE: AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 43 EUROPE: MARKET SIZE, BY FUNCTION, 2018–2025 (USD THOUSAND)

TABLE 44 EUROPE: MARKET SIZE, BY PLATFORM, 2018–2025 (USD THOUSAND)

TABLE 45 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 46 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 47 EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

TABLE 48 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 49 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 50 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 51 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 52 GERMANY: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 53 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 54 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 55 FRANCE: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 56 FRANCE: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 57 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 58 ASIA PACIFIC: AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY FUNCTION, 2018–2025 (USD THOUSAND)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY PLATFORM, 2018–2025 (USD THOUSAND)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

TABLE 64 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 65 CHINA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 66 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 67 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 68 JAPAN: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 69 JAPAN: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 70 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 71 AUSTRALIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 72 AUSTRALIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 73 AUSTRALIA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 74 SINGAPORE: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 75 SINGAPORE: MARKET SIZE, BY DEPLOYMENT TYPE SIZE, 2018–2025 (USD THOUSAND)

TABLE 76 SINGAPORE: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 77 MIDDLE EAST AND AFRICA: AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA: MARKET SIZE, BY FUNCTION, 2018–2025 (USD THOUSAND)

TABLE 79 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PLATFORM, 2018–2025 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 84 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 85 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 86 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 87 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 88 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 89 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 90 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 91 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 92 SOUTH AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 93 LATIN AMERICA: AWARD MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 94 LATIN AMERICA: MARKET SIZE, BY FUNCTION, 2018–2025 (USD THOUSAND)

TABLE 95 LATIN AMERICA: MARKET SIZE, BY PLATFORM, 2018–2025 (USD THOUSAND)

TABLE 96 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 97 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 98 LATIN AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD THOUSAND)

TABLE 99 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 100 BRAZIL: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 101 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 102 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

TABLE 103 MEXICO: MARKET SIZE, BY COMPONENT, 2018–2025 (USD THOUSAND)

TABLE 104 MEXICO: MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2025 (USD THOUSAND)

TABLE 105 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2018–2025 (USD THOUSAND)

LIST OF FIGURES (26 FIGURES)

FIGURE 1 RESEARCH DESIGN

FIGURE 2 TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) – REVENUE OF PRODUCT/SOLUTION/SERVICE OF THE MARKET

FIGURE 4 AWARD MANAGEMENT SOFTWARE MARKET SIZING METHODOLOGY: APPROACH 2 (BOTTOM-UP) – END USER LEVEL

FIGURE 5 AWARD MANAGEMENT SOFTWARE MARKET SNAPSHOT, 2018–2025

FIGURE 6 AWARD MANAGEMENT SOFTWARE MARKET SEGMENTS WITH THE HIGHEST GROWTH RATES DURING THE FORECAST PERIOD

FIGURE 7 ENTRY MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE, AMONG FUNCTIONS, DURING THE FORECAST PERIOD

FIGURE 8 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 9 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2020

FIGURE 10 NEED TO AUTOMATE AWARD PROGRAMS AND END-TO-END MANAGEMENT OF AWARD PROCESSES TO DRIVE THE ADOPTION OF THE AWARD MANAGEMENT SOFTWARE MARKET

FIGURE 11 WEB SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 12 ENTRY MANAGEMENT SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 13 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 14 CORPORATIONS SEGMENT TO HAVE THE LARGEST MARKET SHARE, AMONG END USERS, IN 2020

FIGURE 15 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AWARD MANAGEMENT SOFTWARE MARKET

FIGURE 17 SERVICES SEGMENT TO GROW AT A HIGHER RATE DURING THE FORECAST PERIOD

FIGURE 18 APPLICATION TRACKING SEGMENT TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

FIGURE 19 MOBILE SEGMENT TO GROW AT A HIGHER RATE DURING THE FORECAST PERIOD

FIGURE 20 CLOUD SEGMENT TO GROW AT A HIGHER RATE DURING THE FORECAST PERIOD

FIGURE 21 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER RATE DURING THE FORECAST PERIOD

FIGURE 22 EDUCATIONAL INSTITUTIONS SEGMENT TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

FIGURE 23 ASIA PACIFIC TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 26 BLACKBAUD: COMPANY SNAPSHOT

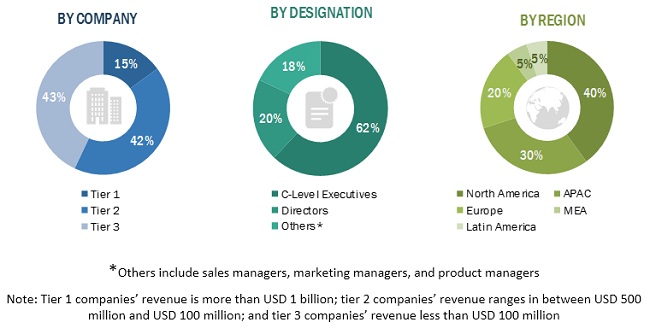

The study involved four major activities in estimating the current market size for the award management software market. An exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the award management software market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies; trade directories; and databases.

Primary Research

The award management software market comprises several stakeholders, such as award management software vendors, cloud solution providers, cloud service brokers, system integrators, consulting service providers, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the award management software market consists of enterprises from different end users, such as government, educational institutes, corporations, industry associations, philanthropic organizations, and others (political organizations, and environmental entities). The supply side includes award management software providers, offering award management software and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the award management software market. These methods were also used extensively to determine the extent of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the award management software market by component (solution and services), function, platform, deployment type, organization size, end user, and region

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size of the market segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players of the market and comprehensively analyze their market size and core competencies in the market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the European award management software market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin American market into countries

Company information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Award Management Software Market