Grant Management Software Market by Component, Function (Document Management, Performance and Outcomes Measurement, and Application Tracking), Platform, Deployment Type, Organization Size, End User, and Region - Global Forecast to 2024

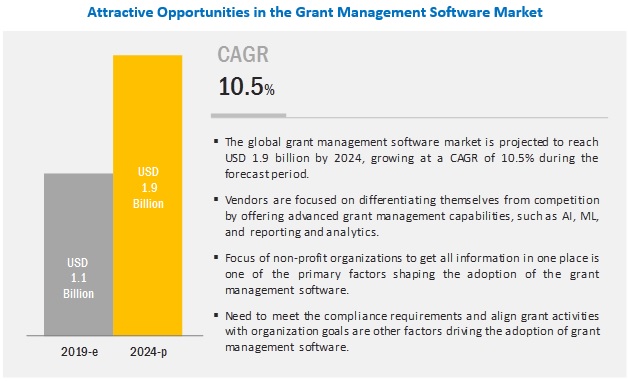

[146 Pages Report] The global Grant Management Software Market size is projected to reach USD 1.9 billion by 2024, at a CAGR of 10.5% during the forecast period. Growing need among enterprises to improve the grant process and acceleration of grant application review is expected to drive the growth of the grant management software market across various end users globally.

By component type, the solution segment is expected to hold the largest market size during the forecast period

The grant management software empowers organizations with a centralized platform to efficiently manage their grant processes. The growing focus of organizations to automate and enhance their grant processes is expected to drive the demand for grant management software in the global market. The grant management software provides grant management professionals with efficient tools to effectively engage with potential grantmakers and grantseekers. Organizations across end-users are adopting the grant management solution, as it helps to manage charitable channels and data effectively.

The cloud deployment typeis expected to grow at a higher CAGR during the forecast period

Organizations nowadays are looking forward to having their solution deployed on the cloud, as cloud deployment offers various advantages, such as scalability, flexibility in capacity, enhanced collaboration, and cost-efficiency. Implementation of cloud-based grant management software facilitates SMEs and large enterprises to focus on their core competencies, rather than IT processes. With the help of the cloud-based grant management solution and services, organizations can avoid costs related to software, storage, and technical staff. The cloud-based grant management software offers a centralized way to integrate the system and its components with web and mobile applications and helps organizations to fast track grant-making processes.

Large Enterprises is expected to have the largest market size during the forecast period

The need to address grants is driving the adoption of grant management software and services among SMEs, as well as large enterprises. This process is usually complicated and time-consuming, which demands an enhanced grant management software to overcome these challenges. Among different organization size, the large enterprises segment is expected to account for a higher market share in the grant management software market, due to the affordability and acceptance for emerging technologies Moreover, large enterprises generate a massive amount of data daily, which needs to be narrowed down to relevant information during a legal case and is a time-consuming process if done manually, thereby leading to the growing adoption of the grant management software in this segment.

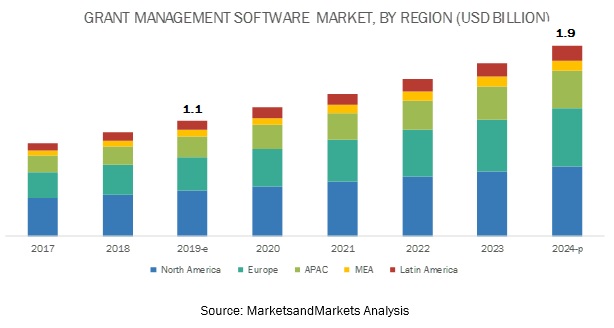

North America is expected to account for the largest market size during the forecast period

North America is an early adopter of grant management solutions, as it is more concerned about grants projects and follows standardized regulations as compared to the other regions. The huge amount of data generated in the North American organizations is because of the rapid adoption of new technologies, which is in turn leading to the growing adoption of grant management solutions to maintain and manage such data for on-demand availability. Grant management software is designed to help the brand reach high-potential prospects, review grant applications, and manage the grant lifecycle. The presence of major players in the region also supports the demand and awareness regarding the benefits achieved by the adoption of a grant management solution.

Key Market Players

The major grant management software vendors include WizeHive (US), Submittable (US), Oracle (US), Workday (US), Salesforce (US), eCivis (US), Benevity (Canada), SmarterSelect (US), Foundant Technologies (US), Blackbaud (US), Sage (England), SurveyMonkey(Canada), Fluxx (US), Award Force (Australia), Evalto (Spain), Fluent Technology (UK), HTC Global Services (US), ZoomGrants (US), CyberGrants (US) and Altum (US).

HTC Global Services (US), one of the leading providers of IT and Business Process Services (BPS) to global customers, was founded in 1990 and is headquartered in Michigan, US. In the grant management market space, HTC Global Services offers Electronic Grants Administration and Management System (EGrAMS) solution. EGrAMS is a web-based, easily configurable, and scalable end-to-end grant management solution. It is widely adopted by nonprofit organizations to streamline, automate, and simplify grants administration and management processes. HTC Global Services caters its services to different industries such as media and publishing, universities and libraries, higher education, government, automotive and manufacturing, hospitality and retail, telecom, healthcare payer and provider services, and BFSI.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components (solution and Services), Functions, Platform, Deployment Type, Organization Size, End Users, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

It includes 20 major vendors, namely, WizeHive (US), Submittable (US), Oracle (US), Workday (US), Salesforce (US), eCivis (US), Benevity (Canada), SmarterSelect (US), Foundant Technologies (US), Blackbaud (US), Sage (England), SurveyMonkey(Canada), Fluxx (US), Award Force (Australia), Evalto (Spain), Fluent Technology (UK), HTC Global Services (US), ZoomGrants (US), CyberGrants (US) and Altum (US). |

This research report categorizes the grant management software market to forecast revenues and analyze trends in each of the following submarkets:

Based on Components, the grant management software market has been segmented as follows:

- Component

- Solution

- Services

- Implementation and Integration

- Training and Education

- Support and Maintenance

Based on Functions, the market has been segmented as follows:

- Performance and Outcomes

- Document Management

- Reporting

- Application Tracking

- Collaboration

- Grant discovery

- Others (compliance management and proposal creation)

Based on Platform, the grant management software market has been segmented as follows:

- Web

- Mobile

- IOS

- Android

- Windows

Based on Deployment types, the market has been segmented as follows:

- On-premises

- Cloud

Based on Organization size, the grant management software market has been segmented as follows:

- SMEs

- Large enterprises

Based on End-users, the market has been segmented as follows:

- Government

- Healthcare and Human Services

- Educational Institutes

- Corporations

- International and National Organization

- Philanthropic Organizations

- Others (Political Organizations and Environmental Entities and Associations.)

Based on Regions, the grant management software market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- APAC

- China

- Japan

- Australia

- Singapore

- Rest of APAC

- MEA

- Saudi Arabia

- United Arab Emirates (UAE)

- South Africa

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In September 2019, Workday enhanced the capabilities of its grants management software for offering a better experience to the users. The new skills added to the software are enhanced reporting with the new Principle Investigator (PI) portal, greater visibility into sub-awards; real time data reporting; and processing of cost transfers and Personnel Accounting Adjustments (PAAs) within Workday by eliminating the need of additional forms.

- In February 2019, Blackbaud launched Peer-to-Peer Fundraising Solution in the US at no subscription cost. Blackbaud Peer-to-Peer Fundraising solution is powered by JustGiving, delivers an unparalleled opportunity for organizations operating for social good. The new solution allows customers to make a direct connection between their fundraising campaigns and supporters through virtual events, giving days, Livestream fundraising, and more. The solution is mainly designed to help organizations in raising more funds, sharing passion, and growing impact by providing unrivaled reach.

- In December 2018, eCivis partnered with Questica, a leading provider of budgeting, performance, transparency, and engagement solutions to the public sector. This partnership has enabled both the companies to offer their customers a consolidated and integrated approach for budgeting, grants management, and cost allocation, for better analysis and helping customers to drive greater organizational and community impact.

- In April 2018, WizeHive partnered with eCivis, part of GTY, a leading public sector Software-as-a-Service (SaaS) company. The partnership is intended to centralize and streamline the application intake, evaluation, and grant award process across the entire state of Arizona.

Key Questions Addressed by the Report

- How is the adoption trend of grant management software across major economies?

- What are the challenges faced by grant management software vendors in the global market?

- The report provides insights on the global grant management software market concerning different end users.

- What are various developments happened in the global market?

Frequently Asked Questions (FAQ):

What is grant management software?

Grants are a critical funding source for many organizations, supporting a variety of programs and research. Adequate management of grant is important to enhance the social impact. As defined by Submittable, grant management basically consists of administrative tasks needed to manage grant funding, reporting, and program implementation. The grant management lifecycle consists of 3 phases: pre-award, award, and post award. An effective grant management software empowers organizations to manage the entire lifecycle of grant processes. Major functionalities of the grant management software offered by the vendors operating in this market space include performance and outcomes measurement, document management, reporting, application tracking, collaboration, grant discovery, and others (compliance management and proposal creation).

What are the top companies providing grant management software solution and services?

The top grant management software vendors are listed below:

- Blackbuad

- Salesforce

- Oracle

- Workday

- WizeHive

- Submittable

- Sage

- eCivis

- CyberGrants

- HTC Global Services

- SurveyMonkey

- Benevity

- SmarterSelect

- Fluxx

- Award Force

- Evalato

- Fluent Technology

- ZoomGrants

- Altum

- Foundant

What are the top end users adopting grant management software?

The following are major end users adopting grant management software; government, international and national organizations, healthcare and human services, educational institutions, corporations, and philanthropic organizations.

What are various functions of grant management software?

There are six major functions offered by grant management software namely, document management, performance and outcomes measurement, application tracking, grant discovery, collaboration, and reporting.

What are various trends in grant management software market?

The below are current market trends impacting grant management software market;

Driver:

- Increased demand for automating grant processes

- Accessibility to vital information anytime, anywhere or any device

Opportunities:

- Integration of AI-enabled tools with grant management solutions

- Increasing engagement of customers through social media platform

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

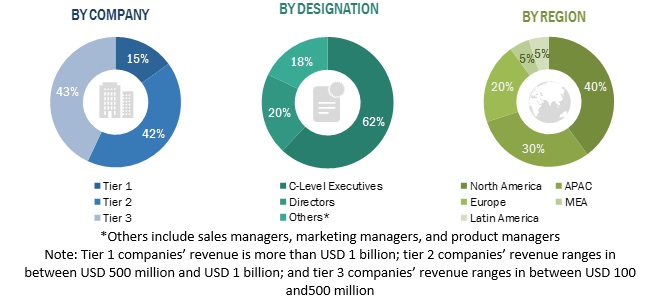

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Grant Management Software Market

4.2 Market By Platform (2019 vs 2024)

4.3 Market By Function (2019 vs 2024)

4.4 Market By Organization Size (2019 vs 2024)

4.5 Market By End User (2019 vs 2024)

4.6 Market Investment Scenario

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Demand for Automating Grant Processes

5.2.1.2 Accessibility to Vital Information Anytime, Anywhere, on Any Device

5.2.2 Restraints

5.2.2.1 Lack of A Universal Standard Procedure

5.2.3 Opportunities

5.2.3.1 Integration of AI-Enabled Tools With Grant Management Solutions

5.2.4 Challenges

5.2.4.1 Integration Between Federal, State, and Local Grant Systems

5.2.4.2 Integration of Grant Management Solutions With Existing Communication Systems

6 Grant Management Software Market By Component (Page No. - 39)

6.1 Introduction

6.2 Solution

6.2.1 Need to Automate Grant Processes to Drive the Demand for Grant Management Solution

6.3 Services

6.3.1 Implementation and Integration

6.3.1.1 Simplified Implementation, Ease of Maintenance, and Maximum Return on Investment to Drive the Demand for Grant Management

6.3.2 Training and Education

6.3.2.1 Increasing Shift Toward Digital Grant Applications to Drive the Demand for Training and Education Services in the Market

6.3.3 Support and Maintenance

6.3.3.1 Growing Demand for On-Time Assistance By Customers to Spur the Demand for Support and Maintenance Services

7 Grant Management Software Market By Function (Page No. - 44)

7.1 Introduction

7.2 Performance and Outcomes Measurement

7.2.1 Growing Need to Measure the Success of Grant Applications Among Enterprises to Drive the Growth of Performance and Outcomes Measurement Function

7.3 Document Management

7.3.1 Increasing Need to Arrange and Sort Documents for Effective Management of Grant Applications to Drive the Adoption of Document Management Function

7.4 Reporting

7.4.1 Increasing Focus of Organizations to Make Data-Driven Decisions to Drive the Adoption of Reporting Function

7.5 Application Tracking

7.5.1 Need to Keep Track of the Received Funds to Drive the Adoption of Application Tracking Function

7.6 Collaboration

7.6.1 Growing Need to Keep the Team Members Updated to Drive the Adoption of Collaboration Function

7.7 Grant Discovery

7.7.1 Need to Identify Relevant Grant Prospects in Minimum Time to Drive the Adoption of Grant Discovery Function

7.8 Others

8 Grant Management Software Market By Platform (Page No. - 51)

8.1 Introduction

8.2 Web

8.2.1 Freedom to Access Applications Over Any Browser to Drive the Adoption of Web-Based Grant Management Solution

8.3 Mobile

8.3.1 Proliferation of Mobile Devices to Fuel the Growth of Mobile-Based Grant Management Solution

9 Grant Management Software Market By Deployment Type (Page No. - 55)

9.1 Introduction

9.2 On-Premises

9.2.1 Concern for the Security of Data Among Enterprises to Drive the Adoption of On-Premises Grant Management

9.3 Cloud

9.3.1 On-Demand Availability of Enhanced and Organized Storage to Drive the Adoption of Cloud-Based Grant Management Solution

10 Market By Organization Size (Page No. - 59)

10.1 Introduction

10.2 Large Enterprises

10.2.1 Growing Need to Deal With the Huge Amount of Data on A Daily Basis to Drive the Adoption of Grant Management Solutions Among Large Enterprises

10.3 Small and Medium-Sized Enterprises

10.3.1 Scalability, Flexibility, and Cost Effectiveness are Major Drivers for the Adoption of Grant Management Solutions in Small and Medium-Sized Enterprises

11 Grant Management Software Market By End User (Page No. - 63)

11.1 Introduction

11.2 Government

11.2.1 Need to Streamline Grant Processes to Drive the Adoption of Grant Management Solution Among Government Organizations

11.3 Healthcare and Human Services

11.3.1 Need to Manage Entire Grant Management Lifecycle to Drive the Adoption of Grant Management Solution Among Healthcare and Human Service Organizations

11.4 Educational Institutions

11.4.1 Need to Manage Complex Post-Award Reporting to Drive the Adoption of Grant Management Solution Among Educational Institutes

11.5 Corporations

11.5.1 Need to Streamline Workflow, Payments, and Reporting to Drive the Adoption of Grant Management Solutions and Services Among Corporations

11.6 International and National Organizations

11.6.1 Need to Meet the Compliance Requirement to Drive the Adoption of Grant Management Solutions Among International and National Organizations

11.7 Philanthropic Organizations

11.7.1 Need to Plan Fund Strategies to Drive the Adoption of Grant Management Solutions Among Philanthropic Organizations

11.8 Others

12 Grant Management Software Market By Region (Page No. - 70)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.1.1 Increasing Investment By Organizations in Advanced Technologies, Such as Analytics and AI, to Drive the Adoption of Grant Solution

12.2.2 Canada

12.2.2.1 Need to Align With Information Governance to Drive the Adoption of Grant Management Solution in Canada

12.3 Europe

12.3.1 United Kingdom

12.3.1.1 Increasing Adoption of Predictive Coding Among End Users in the UK to Drive the Adoption of Grant Management Solution

12.3.2 Germany

12.3.2.1 Increasing Use of Grant Management Solution for Grant Discovery Practices in Germany

12.3.3 France

12.3.3.1 Need to Meet the Grant Compliance to Lead to the Adoption of Grant Management Solution in France

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 China

12.4.1.1 Globalization of Businesses to Drive the Adoption of Grant Management Solution in China

12.4.2 Japan

12.4.2.1 Benefits of Cost Effectiveness and Data Management to Drive the Overall Market of Grant Management Software in Japan

12.4.3 Australia

12.4.3.1 Increasing Focus of Enterprises to Review Grant Documents Efficiently Encouraging the Deployment of Grant Management Solution in Australia

12.4.4 Singapore

12.4.4.1 Increasing Demand of Grant Management Services From Financial Organizations Operating in the Country to Drive the Adoption of Grant Management Solution in Singapore

12.4.5 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Saudi Arabia

12.5.1.1 Increasing Investment By Oil Giants in Advanced Technologies to Drive the Grant Management Software Market in Saudi Arabia

12.5.2 United Arab Emirates

12.5.2.1 Ned for Reducing Manual Administrative Tasks to Encourage the Adoption of Grant Management Solution in the UAE

12.5.3 South Africa

12.5.3.1 Growing Demand for the Availability of Data Anywhere and Anytime to Drive the Adoption of Grant Management Solution in South Africa

12.5.4 Rest of Middle East and Africa

12.6 Latin America

12.6.1 Brazil

12.6.1.1 Increasing Investments By Government to Drive the Adoption of Grant Management Solution in Brazil

12.6.2 Mexico

12.6.2.1 Increasing Focus of Enterprises to Protect Information to Drive the Adoption of Grant Management Solution in Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 106)

13.1 Introduction

13.2 Competitive Scenario

13.2.1 New Product Launches/Product Enhancements

13.2.2 Partnerships

13.2.3 Acquisitions

14 Company Profiles (Page No. - 110)

14.1 Introduction

14.2 Blackbaud

(Business Overview, Solutions and Services Offered, Recent Developments, and MnM View)*

14.3 Salesforce

14.4 Oracle

14.5 Workday

14.6 Wizehive

14.7 Submittable

14.8 Sage

14.9 Ecivis

14.10 Cybergrants

14.11 HTC Global Services

14.12 Surveymonkey

14.13 Benevity

14.14 Smarterselect

14.15 Fluxx

14.16 Award Force

14.17 Evalto

14.18 Fluent Technology

14.19 Zoomgrants

14.20 Altum

14.21 Foundant

*Details on Business Overview, Solutions and Services Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 137)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Available Customizations

15.4 Author Details

List of Tables (105 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Grant Management Software Market Size, By Component, 20172024 (USD Million)

Table 4 Solution: Market Size By Region, 20172024 (USD Million)

Table 5 Services: Market Size By Region, 20172024 (USD Million)

Table 6 Market Size, By Function, 20172024 (USD Million)

Table 7 Performance and Outcomes Measurement: Market Size By Region, 20172024 (USD Million)

Table 8 Document Management: Market Size By Region, 20172024 (USD Million)

Table 9 Reporting: Market Size By Region, 20172024 (USD Million)

Table 10 Applicant Tracking: Market Size By Region, 20172024 (USD Million)

Table 11 Collaboration: Market Size By Region, 20172024 (USD Million)

Table 12 Grant Discovery: Market Size By Region, 20172024 (USD Million)

Table 13 Other Functions: Market Size By Region, 20172024 (USD Million)

Table 14 Grant Management Software Market Size, By Platform, 20172024 (USD Million)

Table 15 Web: Market Size By Region, 20172024 (USD Million)

Table 16 Mobile: Market Size By Region, 20172024 (USD Million)

Table 17 Market Size By Deployment Type, 20172024 (USD Million)

Table 18 On-Premises: Market Size By Region, 20172024 (USD Million)

Table 19 Cloud: Market Size By Region, 20172024 (USD Million)

Table 20 Market Size, By Organization Size, 20172024 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 20172024 (USD Million)

Table 22 Small and Medium-Sized Enterprises: Market Size By Region, 20172024 (USD Million)

Table 23 Grant Management Software Market Size, By End User, 20172024 (USD Million)

Table 24 Government: Market Size By Region, 20172024 (USD Million)

Table 25 Healthcare and Human Services: Market Size By Region, 20172024 (USD Million)

Table 26 Educational Institutions: Market Size By Region, 20172024 (USD Million)

Table 27 Corporations: Market Size By Region, 20172024 (USD Million)

Table 28 International and National Organizations: Market Size By Region, 20172024 (USD Million)

Table 29 Philanthropic Organizations: Market Size By Region, 20172024 (USD Million)

Table 30 Other End Users: Market Size By Region, 20172024 (USD Million)

Table 31 Grant Management Software Market Size, By Region, 20172024 (USD Million)

Table 32 North America: Market Size By Component, 20172024 (USD Million)

Table 33 North America: Market Size By Function, 20172024 (USD Million)

Table 34 North America: Market Size By Platform, 20172024 (USD Million)

Table 35 North America: Market Size By Deployment Type, 20172024 (USD Million)

Table 36 North America: Market Size By Organization Size, 20172024 (USD Million)

Table 37 North America: Market Size By End User, 20172024 (USD Million)

Table 38 North America: Market Size By Country, 20172024 (USD Million)

Table 39 United States: Market Size, By Component, 20172024 (USD Million)

Table 40 Unites States: Market Size By Organization Size, 20172024 (USD Million)

Table 41 Canada: Market Size By Component, 20172024 (USD Million)

Table 42 Canada: Market Size By Organization Size, 20172024 (USD Million)

Table 43 Europe: Grant Management Software Market Size, By Component, 20172024 (USD Million)

Table 44 Europe: Market Size By Function, 20172024 (USD Million)

Table 45 Europe: Market Size By Platform, 20172024 (USD Million)

Table 46 Europe: Market Size By Deployment Type, 20172024 (USD Million)

Table 47 Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 48 Europe: Market Size By End User, 20172024 (USD Million)

Table 49 Europe: Market Size By Country, 20172024 (USD Million)

Table 50 United Kingdom: Market Size, By Component, 20172024 (USD Million)

Table 51 United Kingdom: Market Size By Organization Size, 20172024 (USD Million)

Table 52 Germany: Market Size By Component, 20172024 (USD Million)

Table 53 Germany: Market Size By Organization Size, 20172024 (USD Million)

Table 54 France: Market Size By Component, 20172024 (USD Million)

Table 55 France: Market Size By Organization Size, 20172024 (USD Million)

Table 56 Rest of Europe: Market Size By Component, 20172024 (USD Million)

Table 57 Rest of Europe: Market Size By Organization Size, 20172024 (USD Million)

Table 58 Asia Pacific: Grant Management Software Market Size, By Component, 20172024 (USD Million)

Table 59 Asia Pacific: Market Size By Function, 20172024 (USD Million)

Table 60 Asia Pacific: Market Size By Platform, 20172024 (USD Million)

Table 61 Asia Pacific: Market Size By Deployment Type, 20172024 (USD Million)

Table 62 Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 63 Asia Pacific: Market Size By End User, 20172024 (USD Million)

Table 64 Asia Pacific: Market Size By Country, 20172024 (USD Million)

Table 65 China: Market Size, By Component, 20172024 (USD Million)

Table 66 China: Market Size By Organization Size, 20172024 (USD Million)

Table 67 Japan: Market Size By Component, 20172024 (USD Million)

Table 68 Japan: Market Size By Organization Size, 20172024 (USD Million)

Table 69 Australia: Grant Management Software Market Size, By Component, 20172024 (USD Million)

Table 70 Australia: Market Size By Organization Size, 20172024 (USD Million)

Table 71 Singapore: Market Size By Component, 20172024 (USD Million)

Table 72 Singapore: Market Size By Organization Size, 20172024 (USD Million)

Table 73 Rest of Asia Pacific: Market Size By Component, 20172024 (USD Million)

Table 74 Rest of Asia Pacific: Market Size By Organization Size, 20172024 (USD Million)

Table 75 Middle East and Africa: Market Size, By Component, 20172024 (USD Million)

Table 76 Middle East and Africa: Market Size By Function, 20172024 (USD Million)

Table 77 Middle East and Africa: Market Size By Platform, 20172024 (USD Million)

Table 78 Middle East and Africa: Market Size By Deployment Type, 20172024 (USD Million)

Table 79 Middle East and Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 80 Middle East and Africa: Market Size By End User, 20172024 (USD Million)

Table 81 Middle East and Africa: Market Size By Country, 20172024 (USD Million)

Table 82 Saudi Arabia: Grant Management Software Market Size, By Component, 20172024 (USD Million)

Table 83 Saudi Arabia: Market Size By Organization Size, 20172024 (USD Million)

Table 84 United Arab Emirates: Market Size By Component, 20172024 (USD Million)

Table 85 United Arab Emirates: Market Size By Organization Size, 20172024 (USD Million)

Table 86 South Africa: Market Size By Component, 20172024 (USD Million)

Table 87 South Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 88 Rest of Middle East and Africa: Market Size By Component, 20172024 (USD Million)

Table 89 Rest of Middle East and Africa: Market Size By Organization Size, 20172024 (USD Million)

Table 90 Latin America: Market Size, By Component, 20172024 (USD Million)

Table 91 Latin America: Market Size By Function, 20172024 (USD Million)

Table 92 Latin America: Market Size By Platform, 20172024 (USD Million)

Table 93 Latin America: Market Size By Deployment Type, 20172024 (USD Million)

Table 94 Latin America: Market Size By Organization Size, 20172024 (USD Million)

Table 95 Latin America: Market Size By End User, 20172024 (USD Million)

Table 96 Latin America: Market Size By Country, 20172024 (USD Million)

Table 97 Brazil: Grant Management Software Market Size, By Component, 20172024 (USD Million)

Table 98 Brazil: Market Size By Organization Size, 20172024 (USD Million)

Table 99 Mexico: Market Size By Component, 20172024 (USD Million)

Table 100 Mexico: Market Size By Organization Size, 20172024 (USD Million)

Table 101 Rest of Latin America: Market Size By Component, 20172024 (USD Million)

Table 102 Rest of Latin America: Market Size By Organization Size, 20172024 (USD Million)

Table 103 New Product Launches/Product Enhancements, 2019

Table 104 Partnerships, 2018

Table 105 Acquisitions, 20172019

List of Figures (31 Figures)

Figure 1 Global Grant Management Software Market: Research Design

Figure 2 Grant Management Market Estimation Methodology and Key Assumptions Method 1: Based on No of Companies Revenue

Figure 3 Market Sizing Methodology: Approach 2: End User Level Bottom Up

Figure 4 Market Snapshot 20172024

Figure 5 Market Segments With the Highest Growth Rates During the Forecast Period

Figure 6 Document Management Segment to Hold the Largest Market Size Among Functions During the Forecast Period

Figure 7 Large Enterprises Segment to Hold A Larger Market Size During the Forecast Period

Figure 8 North America to Account for the Highest Market Share in 2019

Figure 9 Need to Meet the Compliance Requirement and End-To-End Management of Grant Processes to Drive the Adoption of Grant Management Software Market

Figure 10 Web Segment to Account for A Higher Market Share During the Forecast Period

Figure 11 Document Management Segment to Account for the Highest Market Share During the Forecast Period

Figure 12 Large Enterprises Segment to Account for A Higher Market Share During the Forecast Period

Figure 13 Government Segment to have the Highest Market Share Among End Users During the Forecast Period

Figure 14 Asia Pacific to Emerge as the Best Market for Investments in the Next 5 Years

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Grant Management Software Market

Figure 16 Services Segment to Grow at A Higher Rate During the Forecast Period

Figure 17 Application Tracking Segment to Grow at the Highest Rate During the Forecast Period

Figure 18 Mobile Segment to Grow at A Higher Rate During the Forecast Period

Figure 19 Cloud Segment to Grow at A Higher Rate During the Forecast Period

Figure 20 Small and Medium-Sized Enterprises Segment to Grow at A Higher Rate During the Forecast Period

Figure 21 Educational Institutions Segment to Grow at the Highest Rate During the Forecast Period

Figure 22 Asia Pacific to Grow at the Highest Rate During the Forecast Period

Figure 23 North America: Market Snapshot

Figure 24 Asia Pacific: Market Snapshot

Figure 25 Key Developments By Leading Players in the Market During 20172019

Figure 26 Geographic Revenue Mix of the Leading Players in the Grant Management Software Market

Figure 27 Blackbaud: Company Snapshot

Figure 28 Salesforce: Company Snapshot

Figure 29 Oracle: Company Snapshot

Figure 30 Workday: Company Snapshot

Figure 31 Sage: Company Snapshot

The study involved four major activities in estimating the current market size for the grant management software market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the grant management software market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The grant management software market comprises several stakeholders, such as grant management software vendors, cloud solution providers, cloud service brokers, system integrators, consulting service providers, managed service providers, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the grant management software market consists of enterprises from different end-users, such as government, healthcare, and human services, educational institutes, corporations, international and national organizations, philanthropic organizations, and others (political organizations, and environmental entities and associations). The supply side includes grant management software providers, offering grant management software and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Grant Management Software Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the grant management software market. These methods were also used extensively to determine the extent of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the grant management software market by component (solution and services), function, platform, deployment type, organization size, end-user, and region

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size of the market segments for five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile the key players of the market and comprehensively analyze their market size and core competencies2 in the market

- To track and analyze competitive developments, such as new product launches; acquisitions; and partnerships, and agreements, in the global grant management software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the European grant management software market into countries

- Further breakup of the APAC market into countries

- Further breakup of the MEA market into countries

- Further breakup of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Grant Management Software Market