Ballistic Composites Market by Fiber Type, Matrix Type (Polymer, Polymer-Ceramic, Metal), Product (Vehicle Armor, Body Armor, Helmet & Face Protection), Platform (Land, Airborne, Marine), Application and Region - Global Forecast to 2027

Updated on : August 28, 2025

Ballistic Composites Market

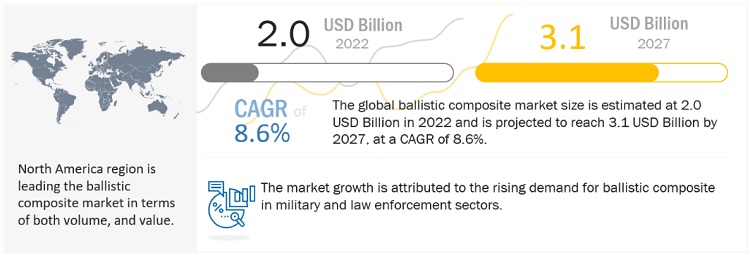

The global ballistic composites market was valued at USD 2.0 billion in 2022 and is projected to reach USD 3.1 billion by 2027, growing at 8.6% cagr from 2022 to 2027. The market is growing because of the rise in the demand from military and law enforcement sector. Although, increase in the demand of ballistic composites material is due to the huge demand for high performance materials.

Attractive Opportunities in the Ballistic Composites Market

To know about the assumptions considered for the study, Request for Free Sample Report

Ballistic Composites Market Dynamics

Drivers: Increasing demand for personnel protection

Increasing crime and terrorist activities are driving the demand for ballistic body and vehicle armor for use by political leaders, businesspeople, bureaucrats, high-profile athletes, entertainment celebrities, and others. As ballistic composite armor is lighter and meets the highest requirements of international standards for safety, there has been a surge in the demand for composite materials in personal protective clothing and transportation. Various companies are focusing on adding composite armor to vehicles designed for civilians in luxury passenger cars by automakers such as Mercedes Benz and Lexus.

Restraints: High costs and extremely stringent standards

High cost of new technology is a major factor restricting the growth of the ballistic composites market. Companies are investing significantly in the development of ballistic composite products and solutions to meet the increasing challenges from new lethal ammunition. However, these new products and solutions are exceptionally expensive, thus, leading to low industry penetration.

Opportunities: Evolution and adoption of new technologies and products

Military research labs are experimenting with the incorporation of multifunctional ballistic materials into protective clothing for soldiers. These materials include conductive properties which are expected to be able to monitor a soldier’s heart rate. These research labs are endeavoring to build antenna communication directly into composite vests which is expected to reduce their weight. Companies are also incorporating nanotechnology to increase the ballistic performance of composite materials.

Challenges: Development of durable ballistic composites as per threats

The biggest challenge in designing ballistic composites is assessing their performance in different combat situations. Manufacturers must develop composite panels and armor that can provide high level of toughness, fracture resistance, and ballistic protection without delamination. For instance, vests must be designed so that they deflect bullets from different types of guns, while armored vehicles should be able to withstand projectiles, roadside bombs, and shells fired from tanks.

In terms of volume, vehicle armor product type has the largest market share in the global ballistic composites market.

The saving in weight for a given level of strength makes the use of composites vital in the vehicle armor product type. Different end-use sectors are focused on reducing weight and increasing the strength of ballistic composites and exploiting more advanced materials. Vehicle armors are equipped with ballistic composites to ensure a high level of protection against ballistic impacts. The US, China, and Germany are the most lucrative markets.

Aramid fiber is the major segment of the market in terms of value and volume.

Owing to its superior attributes, such as strength, flexibility, durability, stability, low weight, and resistance to heat, temperature, and moisture, aramid fiber is used for different applications in the military and homeland securities. It is used for making different products, such as vehicle armor, body armor, helmets and face protection. The demand in for aramid fiber-based ballistic composites is expected to grow due to its lightweight and corrosion resistance properties.

Polymer matrix holds the largest share in ballistic composites in terms of value and volume.

Polymer matrix type dominated the ballistic composites market in the matrix type segment. Polymer matrix ballistic composites have properties like high durability, low weight, high friction, and temperature resistance. However, the most common thermoset resins in ballistic composites are modified phenolics, epoxies, and polyesters, whereas the most common thermoplastic resins are polypropylene (PP), polyphenylene sulfide (PPS), bismaleimide (BMI), and polyurethanes

Military applications accounted for the largest share in terms of value and volume

Based on application, the ballistic composites market has been segmented into military, homeland security, and others (private securities). Military applications hold the largest share in the ballistic composites market. Most casualties occur during military combat due to fragments caused by explosions. Homeland security and military personnel require advanced ballistic protection equipment made from composites like body armor, and other personal protective equipment for protection against ballistic threats during missions. The increase in geopolitical tensions in emerging economies, such as India, China, South Korea, and Pakistan, and the changing battlefield scenarios have increased the growth of the ballistic composites market

To know about the assumptions considered for the study, download the pdf brochure

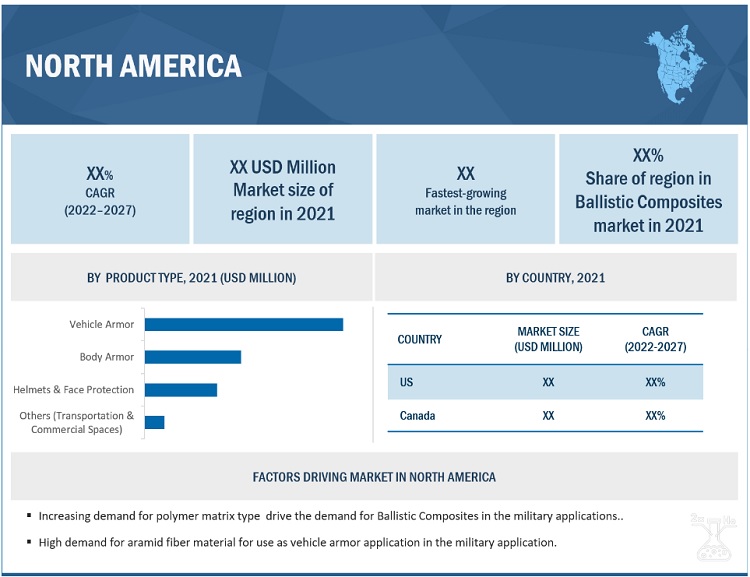

North America held the largest market share in the composites market in 2021.

North America is the major consumer of ballistic composite owing to high demand from US, and other countries. Major product type of ballistic composites in the North America market includes vehicle armor, body armor and helmets among others. Advancements in technology, regulatory policies, and government norms are some of the major factors driving the ballistic composites market in North America.

Ballistic Composites Market Players

The key players in the global ballistic composites market are Honeywell International Inc. (US), BAE Systems plc (UK), Royal Ten Cate N.V. (Netherlands), Koninklijke DSM N.V. (Netherlands), Gurit Holdings (Switzerland), Dupont De Nemours, Inc. (US), Teijin Ltd. (Japan), Morgan Advanced Materials (UK), and Southern States, LLC (US). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the composites industry. The study includes an in-depth competitive analysis of these companies in the composites market, with their company profiles, recent developments, and key market strategies.

Ballistic Composites Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 2.0 Billion |

|

Revenue Forecast in 2027 |

USD 3.1 Billion |

|

CAGR |

8.6% |

|

Years considered for the study |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2020–2027 |

|

Units considered |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments |

Fiber Type, Product type, Platform, Matrix Type, Application and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Honeywell International Inc (US), Koninklijke DSM N.V. (Netherlands), BAE Systems (UK), Royal Ten Cate (Netherlands), Morgan Advanced Materials (UK), DuPont de Nemours Inc. (US), Solvay (Belgium), Gurit (Switzerland), Teijin Limited (Japan), PRF Composites, Gaffco Ballistics (US), M Cube Technologies Inc. (US), FY-Composites Oy (Finland), and MKU Limited (India) |

This research report categorizes the ballistic composites market based on Fiber Type, Product type, Platform, Matrix Type, Application and Region.

By Fiber Type:

- Aramid Fiber

- UHMWPE Fiber

- S-Glass Fiber

- Others

By Product Type:

- Vehicle Armor

- Body Armor

- Helmets & Face Protection

- Others

By Platform

- Land

- Marine

- Airborne

By Matrix Type

- Polymer Matrix

- Polymer-Ceramic Matrix

- Metal Matrix

By Application

- Military

- Homeland Security

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In July 2022, BAE Systems plc has done a contract with US Army for The Defense Supercomputing Resource Center (DSRC) operations, maintenance, and management services, as well as program-wide services for high-performance computer (HPC) customers.

- In January 2022, BAE Systems plc has done a contract with US Navy to handle the command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance (C5ISR) systems for the US Navy.

- In May 2022, Koninklijke DSM N.V., a global purpose-led science-based company announced its agreement to sell its Engineering Materials business to Advent International and LANXESS

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the ballistic composites market?

The growing emerging applications of ballistic composites in various end-use industries

Which is the fastest-growing country-level market for ballistic composites?

China is the fastest-growing ballistic composites market due to high demand

What are the factors contributing to the final price of ballistic composites?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of ballistic composites.

What are the challenges in the ballistic composites market?

Development of low-cost production while maintaining the desired strength ballistic composite is the major challenge in the ballistic composites market.

Which matrix type of ballistic composites holds the largest market share?

Polymer matrix based ballistic composites hold the largest share due to low cost and ease of manufacturing.

How is the ballistic composites market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

Honeywell International Inc. (US), BAE Systems plc (UK), Royal Ten Cate N.V. (Netherlands), Koninklijke DSM N.V. (Netherlands), Gurit Holdings (Switzerland), Dupont De Nemours, Inc. (US), Teijin Ltd. (Japan), Morgan Advanced Materials (UK)

What are the fiber types for ballistic composites?

S-Glass fiber, aramid fiber, UHMWPE fiber are the major types of fibers used for ballistic composites

What are the major applications for ballistic composites?

The major applications for composites are military and homeland security.

What is the biggest restraint in the ballistic composites market?

Volatility in the prices. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 BALLISTIC COMPOSITES: MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 2 BALLISTIC COMPOSITES MARKET: RESEARCH METHODOLOGY

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews: Top ballistic composite manufacturers

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.2 BASE NUMBER CALCULATION

2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

2.2.2 APPROACH 2: DEMAND-SIDE APPROACH

2.3 FORECAST NUMBER CALCULATION

2.3.1 SUPPLY SIDE

2.3.2 DEMAND SIDE

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 5 BALLISTIC COMPOSITES MARKET: DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 6 POLYMER MATRIX TO DRIVE OVERALL BALLISTIC COMPOSITES MARKET

FIGURE 7 VEHICLE ARMOR PRODUCT TYPE TO LEAD BALLISTIC COMPOSITES MARKET

FIGURE 8 ARAMID FIBER TYPE TO LEAD BALLISTIC COMPOSITES MARKET

FIGURE 9 LAND PLATFORM TO DOMINATE BALLISTIC COMPOSITES MARKET

FIGURE 10 MILITARY APPLICATION TO DRIVE OVERALL BALLISTIC COMPOSITES MARKET

FIGURE 11 NORTH AMERICA TO BE LARGEST BALLISTIC COMPOSITES MARKET

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BALLISTIC COMPOSITES MARKET

FIGURE 12 MILITARY AND LAW ENFORCEMENT SECTORS TO DRIVE BALLISTIC COMPOSITES MARKET

4.2 BALLISTIC COMPOSITES MARKET, BY APPLICATION AND REGION, 2021

FIGURE 13 MILITARY WAS LARGEST APPLICATION AND NORTH AMERICA WAS LARGEST REGION

4.3 BALLISTIC COMPOSITES MARKET, BY FIBER TYPE

FIGURE 14 ARAMID FIBER DRIVES BALLISTIC COMPOSITES MARKET

4.4 BALLISTIC COMPOSITES MARKET, BY MATRIX TYPE

FIGURE 15 POLYMER MATRIX TO LEAD BALLISTIC COMPOSITES MARKET

4.5 BALLISTIC COMPOSITES MARKET, BY PRODUCT TYPE

FIGURE 16 VEHICLE ARMOR PRODUCT TYPE TO LEAD BALLISTIC COMPOSITES MARKET

4.6 BALLISTIC COMPOSITES MARKET, BY PLATFORM

FIGURE 17 LAND PLATFORM TO DOMINATE BALLISTIC COMPOSITES MARKET

4.7 BALLISTIC COMPOSITES MARKET, BY COUNTRY

FIGURE 18 CHINA TO BE FASTEST-GROWING MARKET

5 MARKET OVERVIEW (Page No. - 50)

5.1 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BALLISTIC COMPOSITES MARKET

5.1.1 DRIVERS

5.1.1.1 Increasing demand for personnel protection

5.1.1.2 Upgrades in battlefield scenarios

5.1.1.3 Need for lightweight, comfortable, and high-strength materials

5.1.2 RESTRAINTS

5.1.2.1 Failure in providing complete protection

5.1.2.2 High costs and extremely stringent standards

5.1.2.3 Complexity in designing

5.1.3 OPPORTUNITIES

5.1.3.1 R&D and mass production of ballistic fiber

5.1.3.2 High growth in Asia Pacific region

5.1.3.3 Evolution and adoption of new technologies and products

5.1.4 CHALLENGES

5.1.4.1 Development of durable ballistic composites as per threats

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 BALLISTIC COMPOSITES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF BUYERS

5.2.2 BARGAINING POWER OF SUPPLIERS

5.2.3 THREAT OF NEW ENTRANTS

5.2.4 THREAT OF SUBSTITUTES

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 BALLISTIC COMPOSITES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3 SUPPLY CHAIN ANALYSIS

TABLE 2 BALLISTIC COMPOSITES MARKET: SUPPLY CHAIN

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICES OF KEY PLAYERS, BY APPLICATION

FIGURE 21 AVERAGE SELLING PRICE, BY APPLICATION, (KEY PLAYERS) (USD/KG)

5.5 AVERAGE SELLING PRICE

TABLE 3 BALLISTIC COMPOSITES AVERAGE SELLING PRICES, BY REGION

5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-THREE APPLICATIONS

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

5.6.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE PRODUCT TYPES

TABLE 5 KEY BUYING CRITERIA FOR TOP-THREE PRODUCT TYPES

5.7 TECHNOLOGY ANALYSIS

5.8 BALLISTIC COMPOSITES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 6 BALLISTIC COMPOSITES MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.8.1 OPTIMISTIC SCENARIO

5.8.2 PESSIMISTIC SCENARIO

5.8.3 REALISTIC SCENARIO

5.9 KEY CONFERENCES AND EVENTS IN 2022-2023

TABLE 7 BALLISTIC COMPOSITES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.10 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON BALLISTIC COMPOSITES MARKET

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 ECOSYSTEM: BALLISTIC COMPOSITES MARKET

5.12 VALUE CHAIN ANALYSIS: BALLISTIC COMPOSITES MARKET

FIGURE 24 VALUE CHAIN ANALYSIS

5.13 PATENT ANALYSIS

TABLE 12 PATENT ANALYSIS (2019-2022)

6 BALLISTIC COMPOSITES MARKET, BY FIBER TYPE (Page No. - 69)

6.1 INTRODUCTION

FIGURE 25 ARAMID FIBER TYPE LEADS OVERALL BALLISTIC COMPOSITES MARKET

TABLE 13 BALLISTIC COMPOSITES MARKET SIZE, BY FIBER TYPE, 2020–2027 (USD MILLION)

TABLE 14 BALLISTIC COMPOSITES MARKET SIZE, BY FIBER TYPE, 2020–2027 (KILOTON)

6.2 ARAMID FIBER BALLISTIC COMPOSITES

6.2.1 EXTENSIVELY USED IN BODY ARMOR

FIGURE 26 NORTH AMERICA TO LEAD ARAMID FIBER BALLISTIC COMPOSITES MARKET

TABLE 15 ARAMID FIBER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 16 ARAMID FIBER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

6.3 UHMWPE

6.3.1 STRONGEST FIBERS THAT ARE USED IN HELMETS, VESTS, AND PLATES

FIGURE 27 EUROPE TO LEAD UHMWPE BALLISTIC COMPOSITES MARKET

TABLE 17 UHMWPE BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 UHMWPE BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

6.4 S-GLASS

6.4.1 ASIA PACIFIC EXPECTED TO ACCOUNT FOR LARGEST SHARE

FIGURE 28 ASIA PACIFIC LED S-GLASS FIBER BALLISTIC COMPOSITES MARKET

TABLE 19 S-GLASS FIBER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 20 S-GLASS FIBER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

6.5 OTHERS

6.5.1 M5

6.5.2 HYBRID

TABLE 21 OTHER FIBER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 OTHER FIBER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7 BALLISTIC COMPOSITES MARKET, BY MATRIX TYPE (Page No. - 78)

7.1 INTRODUCTION

FIGURE 29 POLYMER MATRIX DOMINATES OVERALL BALLISTIC COMPOSITES MARKET

TABLE 23 BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 24 BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

7.2 POLYMER

7.2.1 EXPECTED TO ACCOUNT FOR LARGEST SHARE OF MARKET

FIGURE 30 NORTH AMERICA TO LEAD POLYMER MATRIX BALLISTIC COMPOSITES MARKET

TABLE 25 POLYMER MATRIX: BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 26 POLYMER MATRIX: BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

7.3 POLYMER-CERAMIC

7.3.1 VEHICLE ARMOR DRIVING DEMAND FOR POLYMER-CERAMIC BALLISTIC COMPOSITES

FIGURE 31 NORTH AMERICA TO LEAD POLYMER-CERAMIC MATRIX BALLISTIC COMPOSITES MARKET

TABLE 27 POLYMER-CERAMIC: MATRIX BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 28 POLYMER-CERAMIC: MATRIX BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

7.4 METAL

7.4.1 NORTH AMERICA EXPECTED TO ACCOUNT FOR MAJOR SHARE

FIGURE 32 NORTH AMERICA LED METAL MATRIX BALLISTIC COMPOSITES MARKET

TABLE 29 METAL MATRIX: BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 30 METAL MATRIX: BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

8 BALLISTIC COMPOSITES MARKET, BY PRODUCT TYPE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 33 VEHICLE ARMOR TO LEAD BALLISTIC COMPOSITES MARKET

TABLE 31 BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 32 BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

8.2 VEHICLE ARMOR

8.2.1 VEHICLE ARMOR MADE FROM BALLISTIC COMPOSITES IS LIGHTWEIGHT

8.2.2 MARINE VEHICLE ARMOR

8.2.3 LAND VEHICLE ARMOR

8.2.4 AIR VEHICLE ARMOR

FIGURE 34 NORTH AMERICA TO LEAD VEHICLE ARMOR MARKET

TABLE 33 VEHICLE ARMOR BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 VEHICLE ARMOR BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.3 BODY ARMOR

8.3.1 ARAMID FIBER FREQUENTLY EMPLOYED IN BODY ARMOR APPLICATIONS

FIGURE 35 ASIA PACIFIC TO LEAD BODY ARMOR MARKET

TABLE 35 BODY ARMOR BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 BODY ARMOR BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.3.2 BODY ARMOR: BY APPLICATION

TABLE 37 BODY ARMOR BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 38 BODY ARMOR BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.3.3 BODY VESTS

8.3.4 SHIELDS

8.3.5 PROTECTIVE UNDERGARMENTS

8.4 HELMETS & FACE PROTECTION

8.4.1 USE OF BALLISTIC COMPOSITES IN HELMETS MAKE THEM LIGHTER

FIGURE 36 ASIA PACIFIC TO LEAD HELMETS & FACE PROTECTION SEGMENT

TABLE 39 HELMETS & FACE PROTECTION BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 40 HELMETS & FACE PROTECTION BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.5 OTHERS

FIGURE 37 ASIA PACIFIC TO LEAD OTHER PRODUCT TYPES SEGMENT

TABLE 41 OTHER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 42 OTHER BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

9 BALLISTIC COMPOSITES MARKET, BY PLATFORM (Page No. - 95)

9.1 INTRODUCTION

TABLE 43 BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 44 BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (KILOTON)

FIGURE 38 LAND PLATFORM DOMINATES OVERALL BALLISTIC COMPOSITES MARKET

9.2 LAND

9.2.1 LAND TO ACCOUNT FOR LARGEST SHARE

TABLE 45 LAND: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION 2020–2027 (USD MILLION)

TABLE 46 LAND: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION 2020–2027 (KILOTON)

9.2.2 UNMANNED ARMORED GROUND VEHICLES

9.2.3 SOLDIERS & SECURITY PERSONNEL

9.2.4 BASE STATION

9.3 MARINE

9.3.1 RISE IN DEMAND FOR MARITIME SECURITY

TABLE 47 MARINE: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION 2020–2027 (USD MILLION)

TABLE 48 MARINE: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

9.3.2 DESTROYERS

9.3.3 FRIGATES

9.3.4 OFFSHORE SUPPORT VESSELS

9.4 AIRBORNE

9.4.1 INTRODUCTION OF UAVS DUE TO CHANGING WAR DYNAMICS

TABLE 49 AIRBORNE: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION 2020–2027 (USD MILLION)

TABLE 50 AIRBORNE BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

9.4.2 FIXED-WING AIRCRAFT

9.4.3 HELICOPTERS

9.4.4 UNMANNED AERIAL VEHICLES (UAVS)

10 BALLISTIC COMPOSITES MARKET, BY APPLICATION (Page No. - 101)

10.1 INTRODUCTION

TABLE 51 BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 52 BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

FIGURE 39 MILITARY APPLICATION DOMINATES OVERALL BALLISTIC COMPOSITES MARKET

10.2 MILITARY

10.2.1 INCREASE IN GEOPOLITICAL TENSIONS IN EMERGING ECONOMIES

TABLE 53 BALLISTIC COMPOSITES MARKET SIZE IN MILITARY, BY REGION, 2020–2027 (USD MILLION)

TABLE 54 BALLISTIC COMPOSITES MARKET SIZE IN MILITARY, BY REGION, 2020–2027 (KILOTON)

10.3 HOMELAND SECURITY

10.3.1 PERSONAL PROTECTIVE EQUIPMENT TO PROVIDE SAFETY DURING MISSIONS

TABLE 55 BALLISTIC COMPOSITES MARKET SIZE IN HOMELAND SECURITY, BY REGION, 2020–2027 (USD MILLION)

TABLE 56 BALLISTIC COMPOSITES MARKET SIZE IN HOMELAND SECURITY, BY REGION, 2020–2027 (KILOTON)

10.4 OTHERS

TABLE 57 BALLISTIC COMPOSITES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 58 BALLISTIC COMPOSITES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (KILOTON)

11 BALLISTIC COMPOSITES MARKET, BY REGION (Page No. - 107)

11.1 INTRODUCTION

FIGURE 40 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 59 BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

TABLE 60 BALLISTIC COMPOSITES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 41 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SNAPSHOT

11.2.1 BY MATRIX TYPE

TABLE 61 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 62 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.2.2 BY PRODUCT TYPE

TABLE 63 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 64 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

11.2.3 BY PLATFORM

TABLE 65 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (KILOTON)

TABLE 66 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (USD MILLION)

11.2.4 BY APPLICATION

TABLE 67 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 68 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.2.5 BY COUNTRY

TABLE 69 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 70 NORTH AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.2.5.1 US

11.2.5.2 High consumption of ballistic composites in military and next-generation aircraft

TABLE 71 US: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 72 US: BALLISTIC COMPOSITES MARKET SIZE, MATRIX TYPE, 2020–2027 (USD MILLION)

11.2.5.3 Canada

11.2.5.3.1 Increasing focus on development of ballistic composites for vehicle armor

TABLE 73 CANADA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 74 CANADA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.3 EUROPE

FIGURE 42 EUROPE: BALLISTIC COMPOSITES MARKET SNAPSHOT

11.3.1 EUROPE: BALLISTIC COMPOSITES MARKET, BY MATRIX TYPE

TABLE 75 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 76 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.3.2 EUROPE: BALLISTIC COMPOSITES MARKET, BY PLATFORM

TABLE 77 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (KILOTON)

TABLE 78 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (USD MILLION)

11.3.3 EUROPE: BALLISTIC COMPOSITES MARKET, BY APPLICATION

TABLE 79 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 80 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.3.4 EUROPE: BALLISTIC COMPOSITES MARKET, BY PRODUCT TYPE

TABLE 81 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 82 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

11.3.5 EUROPE: BALLISTIC COMPOSITES MARKET, BY COUNTRY

TABLE 83 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 84 EUROPE: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.3.5.1 Germany

11.3.5.1.1 Largest supplier of armored vehicles

TABLE 85 GERMANY: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 86 GERMANY: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.3.5.2 France

11.3.5.2.1 Significant ballistic composites market in region

TABLE 87 FRANCE: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 88 FRANCE: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.3.5.3 UK

11.3.5.3.1 Increase in demand for high-performance materials

TABLE 89 UK: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 90 UK: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.3.5.4 Russia

11.3.5.4.1 Increase in military spending in Russia

TABLE 91 RUSSIA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 92 RUSSIA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.3.5.5 Rest of Europe

11.4 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SNAPSHOT

11.4.1 BALLISTIC COMPOSITES MARKET, BY MATRIX TYPE

TABLE 93 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

11.4.2 BALLISTIC COMPOSITES MARKET, BY PLATFORM

TABLE 95 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 96 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (KILOTON)

11.4.3 BALLISTIC COMPOSITES MARKET, BY APPLICATION

TABLE 97 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.4.4 BALLISTIC COMPOSITES MARKET, BY PRODUCT TYPE

TABLE 99 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 100 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE 2020–2027 (KILOTON)

11.4.5 BALLISTIC COMPOSITES MARKET, BY COUNTRY

TABLE 101 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

11.4.5.1 China

11.4.5.1.1 Significant increase in military spending to drive market

TABLE 103 CHINA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

TABLE 104 CHINA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

11.4.5.2 Japan

11.4.5.2.1 Increase in military budgets to counter threats to drive market

TABLE 105 JAPAN: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

TABLE 106 JAPAN: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

11.4.5.3 India

11.4.5.3.1 Most attractive international market for ballistic composite manufacturers

11.4.5.4 Australia

11.4.5.4.1 Defense programs to open new investment avenues

11.4.5.5 Rest of Asia Pacific

11.5 LATIN AMERICA

11.5.1 BALLISTIC COMPOSITES MARKET, BY MATRIX TYPE

TABLE 107 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

TABLE 108 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

11.5.2 BALLISTIC COMPOSITES MARKET, BY PLATFORM

TABLE 109 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (USD MILLION)

TABLE 110 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (KILOTON)

11.5.3 BALLISTIC COMPOSITES MARKET, BY APPLICATION

TABLE 111 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 112 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

11.5.4 BALLISTIC COMPOSITES MARKET, BY PRODUCT TYPE

TABLE 113 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 114 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE 2020–2027 (KILOTON)

11.5.5 BALLISTIC COMPOSITES MARKET, BY COUNTRY

TABLE 115 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 116 LATIN AMERICA: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

11.5.5.1 Brazil

11.5.5.1.1 High demand for ballistic composites in vehicle armor segment

TABLE 117 BRAZIL: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

TABLE 118 BRAZIL: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

11.5.5.2 Mexico

11.5.5.2.1 Increase in demand for ballistic composites due to growing defense sector

11.5.5.3 Rest of Latin America

11.6 MIDDLE EAST & AFRICA

11.6.1 BALLISTIC COMPOSITES MARKET, BY MATRIX TYPE

TABLE 119 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 120 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.6.2 BALLISTIC COMPOSITES MARKET, BY PRODUCT TYPE

TABLE 121 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 122 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

11.6.3 BALLISTIC COMPOSITES MARKET, BY PLATFORM

TABLE 123 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (KILOTON)

TABLE 124 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY PLATFORM, 2020–2027 (USD MILLION)

11.6.4 BALLISTIC COMPOSITES MARKET, BY APPLICATION

TABLE 125 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 126 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

11.6.5 BALLISTIC COMPOSITES MARKET, BY COUNTRY

TABLE 127 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 128 MIDDLE EAST & AFRICA: BALLISTIC COMPOSITES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

11.6.5.1 Israel

11.6.5.1.1 Government initiatives to drive market

TABLE 129 ISRAEL: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (KILOTON)

TABLE 130 ISRAEL: BALLISTIC COMPOSITES MARKET SIZE, BY MATRIX TYPE, 2020–2027 (USD MILLION)

11.6.5.2 Saudi Arabia

11.6.5.3 South Africa

11.6.5.4 Rest of Middle East & Africa

12 COMPETITIVE LANDSCAPE (Page No. - 143)

12.1 INTRODUCTION

12.2 MARKET SHARE ANALYSIS

FIGURE 44 SHARE OF TOP COMPANIES IN BALLISTIC COMPOSITES MARKET

TABLE 131 DEGREE OF COMPETITION: BALLISTIC COMPOSITES MARKET

12.3 MARKET RANKING

FIGURE 45 RANKING OF TOP FIVE PLAYERS

12.4 MARKET EVALUATION FRAMEWORK

TABLE 132 BALLISTIC COMPOSITES MARKET: DEALS, 2018–2022

TABLE 133 BALLISTIC COMPOSITES MARKET: OTHERS, 2018–2022

TABLE 134 BALLISTIC COMPOSITES MARKET: NEW PRODUCT DEVELOPMENTS, 2018–2022

12.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

12.6 COMPANY EVALUATION MATRIX

TABLE 135 COMPANY FOOTPRINT

TABLE 136 COMPANY FIBER TYPE FOOTPRINT

TABLE 137 COMPANY PLATFORM TYPE FOOTPRINT

TABLE 138 COMPANY MATRIX TYPE FOOTPRINT

TABLE 139 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 140 COMPANY REGION FOOTPRINT

12.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 46 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

12.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 47 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS

12.7 COMPANY EVALUATION QUADRANT (TIER 1)

12.7.1 TERMINOLOGY/NOMENCLATURE

12.7.1.1 Stars

12.7.1.2 Pervasive players

12.7.1.3 Participants

12.7.1.4 Emerging leaders

FIGURE 48 BALLISTIC COMPOSITES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

12.7.1.5 Competitive benchmarking of key startups/SMEs

TABLE 141 BALLISTIC COMPOSITES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 142 BALLISTIC COMPOSITES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

12.8 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

12.9 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

12.9.1 PROGRESSIVE COMPANIES

12.9.2 RESPONSIVE COMPANIES

12.9.3 DYNAMIC COMPANIES

12.9.4 STARTING BLOCKS

FIGURE 49 BALLISTIC COMPOSITES MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

13 COMPANY PROFILES (Page No. - 165)

(Business overview, Products/Solutions/Services offered, New product/Technology developments, Deals, MNM view)*

13.1 KEY PLAYERS

13.1.1 HONEYWELL INTERNATIONAL INC.

TABLE 143 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

FIGURE 50 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

13.1.2 BAE SYSTEMS PLC

TABLE 144 BAE SYSTEMS PLC: COMPANY OVERVIEW

FIGURE 51 BAE SYSTEMS PLC: COMPANY SNAPSHOT

13.1.3 ROYAL TEN CATE N.V.

TABLE 145 ROYAL TEN CATE N.V.: COMPANY OVERVIEW

13.1.4 KONINKLIJKE DSM N.V.

TABLE 146 KONINKLIJKE DSM N.V.: COMPANY OVERVIEW

FIGURE 52 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

13.1.5 GURIT

TABLE 147 GURIT: COMPANY OVERVIEW

FIGURE 53 GURIT: COMPANY SNAPSHOT

13.1.6 DUPONT DE NEMOURS, INC.

TABLE 148 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

FIGURE 54 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

13.1.7 TEIJIN LTD.

TABLE 149 TEIJIN LTD.: COMPANY OVERVIEW

FIGURE 55 TEIJIN LTD.: COMPANY SNAPSHOT

13.1.8 MORGAN ADVANCED MATERIALS

TABLE 150 MORGAN ADVANCED MATERIALS: COMPANY OVERVIEW

FIGURE 56 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT

13.1.9 SOUTHERN STATES LLC

TABLE 151 SOUTHERN STATES, LLC: COMPANY OVERVIEW

13.1.10 BARRDAY INC.

TABLE 152 BARRDAY INC.: COMPANY OVERVIEW

13.1.11 PRF COMPOSITE MATERIALS

TABLE 153 PRF COMPOSITE MATERIALS: COMPANY OVERVIEW

13.1.12 GAFFCO BALLISTICS

TABLE 154 GAFFCO BALLISTICS: COMPANY OVERVIEW

13.1.13 M CUBED TECHNOLOGIES, INC.

TABLE 155 M CUBED TECHNOLOGIES, INC.: COMPANY OVERVIEW

13.1.14 FY-COMPOSITES OY

TABLE 156 FY-COMPOSITES OY: COMPANY OVERVIEW

13.1.15 MKU LIMITED

TABLE 157 MKU LIMITED: COMPANY OVERVIEW

13.2 OTHER KEY PLAYERS

13.2.1 INDIAN ARMOUR

13.2.2 POLYONE CORPORATION

13.2.3 COORSTEK, INC.

13.2.4 GMS COMPOSITES

13.2.5 ROCHLING GROUP

13.2.6 PLASAN

13.2.7 3M

13.2.8 RHEINMETALL AG

13.2.9 SOLVAY

13.2.10 ARMORWORKS

*Details on Business overview, Products offered, Recent Developments, Deals, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 213)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involves two major activities in estimating the current size of the ballistic composites market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The ballistic composites market comprises several stakeholders, such as raw material suppliers, manufacturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly military, homeland, and other end-use applications. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

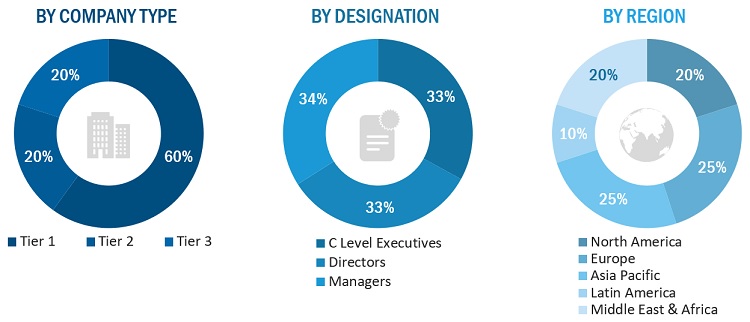

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2021.

Others include sales managers, marketing managers, and product managers.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total ballistic composites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall ballistic composites market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the military, homeland, and other and other end-use applications.

Report Objectives

- To analyze and forecast the global ballistic composites market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on glass type, product type, and application

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC ballistic composites market

- Further breakdown of Rest of European ballistic composites market

- Further breakdown of Rest of North American ballistic composites market

- Further breakdown of Rest of MEA ballistic composites market

- Further breakdown of Rest of Latin American ballistic composites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ballistic Composites Market