Fiberglass Market

Fiberglass Market by Glass Type (E-Glass, ECR Glass, S-Glass, Others), by Product Type (Glass Wool, Direct & Assembled Roving, Yarn, Chopped Strands, Milled Fibers), Application (Composites, Insulation), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fiberglass market is projected to reach USD 34.9 billion in 2030 from USD 27.1 billion in 2025, at a CAGR of 5.2% from 2025 to 2030. Fiberglass is a fiber-reinforced plastic wherein the reinforcement material is glass fiber. Properties such as high strength and low weight make fiberglass preferable for use in composite and insulation applications in various end-use industries, such as construction, automotive, and wind energy. There are various types of fiberglass products available in the market, including glass wool, direct & assembled roving, yarn, chopped strands, milled fibers, and multiaxial fabrics. For insulation applications, glass wool fiberglass is used in residential, industrial, and commercial construction.

KEY TAKEAWAYS

-

BY GLASS TYPEThe fiberglass market includes E-glass, ECR-glass, S-glass, and other glasses. E-glass fiber is the most versatile glass fiber, and it can be produced as glass wool, direct-and-assembled roving, chopped strands, yarns, etc. It is also compatible with multiple resin systems, such as polyester, epoxy, vinyl ester, and others.

-

BY PRODUCT TYPEFiberglass is sold in various product types such as glass wool, direct & assembled roving, yarn, chopped strand, and milled fibers.

-

BY APPLICATIONFiberglass is widely used in composites and insulation applications. In composites application fiberglass is used in industries like construction & infrastructure, automotive, wind energy, electronics, and aerospace. In insulation application, fiberglass is used in residential, non-residential, and industrial construction.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 6.3%, driven by strong adoption in the construction & infrastructure, automotive, wind energy, electronics, and aerospace sectors.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as China Jushi Co., Ltd., Owens Corning, Chongqing Polycomp International Corp. (CPIC), Nippon Electric Glass Co., Ltd., and Saint-Gobain. These companies are deploying organic means to grow or leverage partnerships to increase their market presence and overall revenue.

The fiberglass market is poised for strong growth, driven by robust demand across construction, automotive, wind energy, and other key industrial sectors. The demand from automotive and aerospace sectors is increasing as manufacturers are adopting lightweight materials in order to improve fuel efficiency.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of fiberglass suppliers, which, in turn, impacts the revenues of fiberglass manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Extensive use of fiberglass in construction & infrastructure industry

-

Increased use of fiberglass composites in automotive industry

Level

-

Issues associated with glass wool recycling.

-

Lack of standardization in manufacturing technologies of various fiberglass products

Level

-

Increasing number of wind energy capacity installations

-

Increasing demand for composite materials in construction & infrastructure industry in Middle East & Africa

Level

-

Capital-intensive production and complex manufacturing process of fiberglass

-

Competition from alternative materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Extensive use of fiberglass in construction & infrastructure

The building and construction industry in Asia Pacific, North America, Europe, and Middle East & Africa is experiencing significant growth. With the growing demand for high-strength and corrosion-resistant construction products in residential and civil applications, the applications of fiberglass in composites and insulation applications in construction are experiencing tremendous growth. In the construction sector, fiberglass is applied extensively in insulation, cladding, surface coating, and roof covering uses. Due to the inherent characteristics of fiberglass, including its light weight, high strength, corrosion and water resistance, smooth surface finish, and ease in processing when compared to conventional materials, there has been an increasing demand for fiberglass by the residential, commercial, and industrial markets.

Restraint: Issues associated with glass wool recycling

Glass wool is an economic and efficient insulation material. However, glass wool is difficult to recycle, which creates a serious concern for the insulation industry. Glass wool insulation must have proper disposable techniques developed to dispose of glass wool product. The increasingly stringent policies on waste management and environmental legislation are now calling for engineering materials to be recovered and recycled from products such as wind turbines, automobiles, aircrafts which have surpassed their product lifecycle. Therefore, the development of proper recycling technologies for glass wool and other composite materials is becoming important for the sustainable development of the fiberglass industry

Opportunity:Increased number of wind energy capacity installations

Globally, fossil fuels are declining in their ability to sustain the growing energy demand, and effe,ctively, more renewable energy sources need to be deployed. Wind energy is one of the foremost renewable energy sources, which has witnessed a growth in regions such as Europe and Asia Pacific. This in turn has led to the growth of the fiberglass market. Fiberglass composites are utilized in wind turbines to improve blade strength, fatigue resistance, and resistance to corrosion.

Challenge:Competition from alternative materials

Alternative materials pose a considerable threat to the growth of fiberglass market. Carbon fiber, for instance, is a strong and lightweight material whose unique combination of properties is highly suited for more demanding applications in aerospace & defense and marine industry. Light metals, like aluminium or steel, are also low-cost high strength and durability and are used in construction or transportation, industries that have edge in both production and sourcing cost. The emergence of new materials with new formulations or hybrid structures can meet tougher engineering challenges or specific sustainability goals. It is only through innovation and R&D investment that fiberglass producers can continue to stay competitive and relevant.

Fiberglass Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of fiberglass in Boeing 707 for radomes, wing leading, and trailing edge panels | Reduction of overall aircraft weight and improving fuel efficiency |

|

Use of fiberglass in secondary aircraft structures such as fuselage panels, interior linings, and wing components | Corrosion resistance, making fiberglass suitable for harsh environmental conditions faced by aircraft |

|

Fiberglass is extensively used in marine companies for building vessels, hulls, decks, masts, and interior components. | Fiberglass composites resist deterioration from harsh saltwater, moisture, UV radiation, and chemicals, extending vessel life and reducing maintenance |

|

Polser uses fiberglass mainly in the production of GRP (Glass Reinforced Polyester) sheets and panels | High mechanical strength and impact resistance, providing durability and long service life |

|

Rayming PCB and Assembly uses fiberglass primarily in the manufacturing of printed circuit boards (PCBs). | Exceptional electrical insulation properties that prevent electrical leakage and galvanic corrosion. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The fiberglass ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide silica, limestone, soda ash, calcined ammonia, additives, binders, and pigments to fiberglass manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fiberglass Market, by Glass Type

E-glass accounted for the largest market share in terms of value in 2024. It is the most preferred glass type for manufacturing fiberglass owing to its balanced combination of mechanical, electrical, and chemical properties and cost-effectiveness. Compared to higher-performance fibers such as S-glass, E-glass is significantly more affordable, making it suitable for widespread applications.

Fiberglass Market, by Product Type

Based on product type, the fiberglass market is segmented into glass wool, direct & assembled roving, chopped strand, yarn, and milled fibers. The glass wool segment dominated the overall fiberglass market. The growing demand for insulation products in North America and Europe has led to a rise in the consumption of glass wool. The direct & assembled roving segment also held a considerable share in the global fiberglass market, as the demand is fueled by end-use industries like automotive and aerospace

Fiberglass Market, by Application

In the fiberglass market by application, the composite application is expected to dominate the market during the forecast period. The fiberglass market within the composite application is growing rapidly due to the sector’s growing demand for lightweight and high-strength materials. Composites primarily use fiberglass, which offer excellent strength-to-weight ratio. This is crucial in industries like automotive and aerospace, where reducing vehicle weight improves fuel efficiency and lowers emissions. Stringent regulations in regions like Europe are pushing for fuel-efficient and environmentally friendly vehicles boost demand for these lightweight composites.

REGION

Asia Pacific to be fastest-growing region in global fiberglass market during forecast period

The rapid industrial and urban expansion of countries such as China, India, Japan, and Southeast Asia are driving demand for fiberglass in construction, automotive, aerospace, electronics, and renewable energy. Especially construction and automotive illustrate greater boosts in industry development and market growth. New initiatives such as China's "Made in China 2025" and India's "Make in India" as well as smart city programs and renewable energy programs are increasing domestic manufacturing and innovation of fiberglass materials as well government policies that promote sustainable manufacturing and infrastructure developments.

Fiberglass Market: COMPANY EVALUATION MATRIX

China Jushi Co., Ltd. leads with a strong market share and extensive product footprint, driven by its advanced fiberglass products and high-performance materials widely adopted in the aerospace and construction & infrastructure industries. Nippon Electric Glass Co., Ltd. (Emerging Leader) is gaining visibility with its chopped strands, roving, yarns, and tailored solutions for building & construction applications, strengthening its position through innovation and niche product offerings. While China Jushi Co., Ltd. dominates through scale and a diverse portfolio, Nippon Electric Glass Co., Ltd shows significant potential to move toward the leaders’ quadrant as demand for fiberglass continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 26.0 Billion |

| Market Forecast in 2030 (value) | USD 34.9 Billion |

| Growth Rate | CAGR of 5.2% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Glass Type: E-Glass, ECR-Glass, S-Glass, and Other Glasses; By Application: Composites, Insulation; By Product Type: Glass Wool, Direct & Assembled Roving, Yarn, Chopped Strands, and Milled Fibers |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Fiberglass Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Fiberglass Suppliers |

|

|

| Composite Material Manufacturer |

|

|

| Automotive Composite manufacturer |

|

|

| Raw Material Supplier |

|

|

| Defense Contractor |

|

|

RECENT DEVELOPMENTS

- February 2025 : China Jushi launched the construction for the second phase of its Huai'an Carbon-neutral Intelligent Manufacturing Base, featuring a 100,000-ton electronic glass fiber production line and a 500MW supporting facility for wind power generation.

- February 2023 : Saint-Gobain strengthened its presence in the Indian insulation market by acquiring UP Twiga Fiberglass, the largest supplier of glass wool insulation in India. Twiga provides products for thermal and acoustic applications, and the acquisition is aligned with Saint-Gobain's strategy of growing its portfolio and expanding solutions for light and sustainable construction.

- August 2022 : Owens Corning acquired Natural Polymers, LLC. a manufacturer of spray polyurethane foam insulation for building and construction applications, based in Cortland, Illinois.

Table of Contents

Methodology

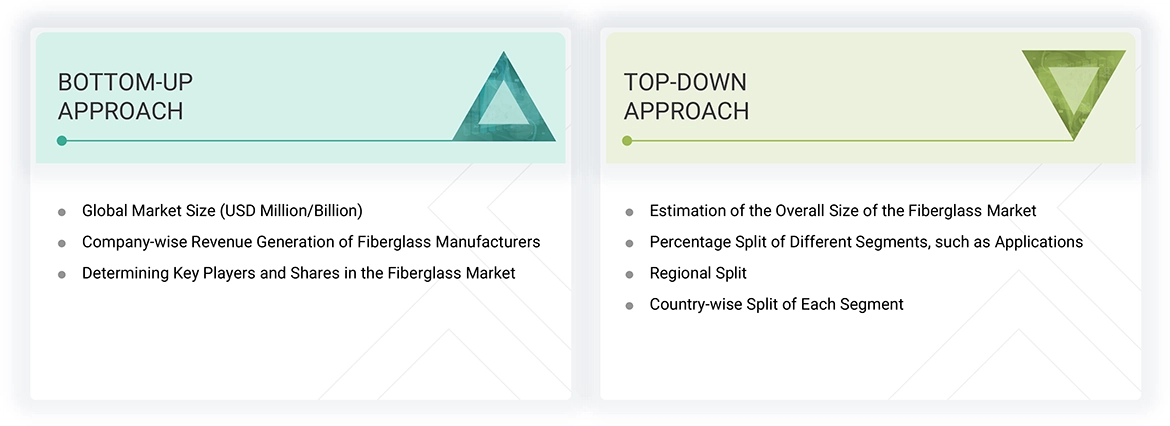

The study involves two main activities to estimate the current market size for the fiberglass industry. Extensive secondary research was conducted to gather information on the market, related markets, and parent markets. The next step was to validate these findings, assumptions, and sizes with industry experts across the supply chain through primary research. Both top-down and bottom-up approaches were used to estimate the entire market size. Afterwards, market segmentation and data triangulation were employed to estimate the sizes of segments and subsegments.

Secondary Research

Secondary sources referenced for this research include financial statements of companies that produce fiberglass and data from various trade, business, and professional associations. Secondary research was used to gather essential information about the industry’s value chain, the total number of key players, market classification, and segmentation based on industry trends down to the regional level. The secondary data was collected and analyzed to determine the overall size of the fiberglass market, which was then validated through responses from primary respondents.

Primary Research

Extensive primary research was conducted after gathering information about the fiberglass market situation through secondary research. Several primary interviews were conducted with market experts from both demand and supply sides across major countries in North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Data was collected through questionnaires, emails, and phone interviews. Supply-side primary sources included industry experts such as chief experience officers (CXOs), vice presidents (VPs), business development and marketing directors, product development and innovation teams, key executives from the fiberglass industry, system integrators, component providers, distributors, and key opinion leaders. These primary interviews provided insights such as market statistics, revenue data from products and services, market breakdowns, size estimates, forecasts, and data triangulation. They also helped in understanding trends related to product type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of customers/end users involved in 3D printing services, were interviewed to gain the buyer’s perspective on suppliers, products, component providers, current fiberglass usage, and future market outlook.

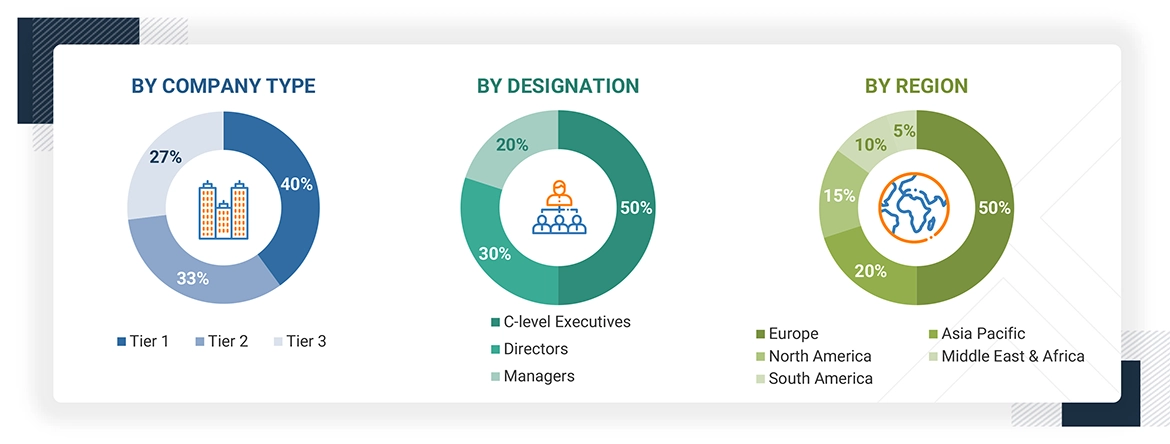

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the fiberglass market includes the following details. The market size was determined from the demand side. The market was expanded based on the demand for fiberglass in different applications at the regional level. Such procurement data provides insight into the demand aspects of the fiberglass industry for each end-use industry. All possible segments of the fiberglass market for each end-use sector were integrated and mapped.

Data Triangulation

After determining the overall size from the market size estimation process described above, the total market was divided into various segments and subsegments. The data triangulation and market breakdown procedures outlined below were applied, where relevant, to complete the market engineering process and obtain precise statistics for different market segments and subsegments. The data was triangulated by examining various demand and supply factors and trends. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Fiberglass is a fiber-reinforced plastic where the reinforcement material is glass fiber. Its high strength and light weight make fiberglass ideal for use in composite materials and insulation across various industries, such as construction, automotive, and wind energy. Different fiberglass products are available in the market, including glass wool, direct and assembled roving, yarn, chopped strands, milled fibers, and multiaxial fabrics. Glass wool fiberglass is used in residential, industrial, and commercial construction for insulation purposes.

Stakeholders

- Fiberglass manufacturers

- Fiberglass Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the fiberglass market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global fiberglass market by source, application, and region.

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the fiberglass market? What key strategies have market players adopted to strengthen their market presence?

Key players include China Jushi Co., Ltd. (China), Owens Corning (US), Saint-Gobain (France), Taishan Fiberglass Inc. (CTG Group, China), and Chongqing Polycomp International Corp. (CPIC, China). These companies focus on product launches, acquisitions, and expansions to strengthen their market position.

What are the drivers and opportunities for the fiberglass market?

Increased government and private sector investment in renewable energy and rising demand for lightweight, fuel-efficient vehicles are key drivers creating opportunities for fiberglass market growth.

Which region is expected to hold the largest market share?

The Asia Pacific region is projected to hold the largest market share due to high demand from automotive, wind energy, aerospace, and construction industries.

What is the projected growth rate of the fiberglass market over the next five years?

The fiberglass market is projected to register a CAGR of 5.2% during the forecast period in terms of value.

How is the fiberglass market aligned for future growth?

The market is experiencing rapid growth due to increasing demand across various industries, indicating strong alignment for future expansion.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fiberglass Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Fiberglass Market

V.Ravichandran

Jul, 2019

Chopped strand mat market and total glass fiber market data.

Vladimir

Nov, 2019

Interested in the glass-fiber mat for the bitumen roofing market .

peter

May, 2020

Hello Sir,would you please offer the information about Market supply and demand(value, volume), including segments and geographies by e-mail?.

User

Nov, 2019

I would like to know about the chopped strand mat and wapping tissue trade market in 2018.

Junko

Feb, 2019

Interested in glassfiber market by type glass and market share by companies of each type.

Drago

Jun, 2020

Fiberglass Insulation and glass fiber reinforcements have nothing in common, other than the history at Owens Corning and Saint-Gobain Vetrotex. Thus, the two industries should be separated. It seems that the report is really about Fiberglass Composites..

Jose

Jan, 2017

Want report for study purpose.

MOHAMED

Nov, 2018

Interested in Fiberglass market with additional information on price level for the coming 5 years, historical info for single & multi-end roving, CSM, WR, and applications in pipes, rebar and other key segments in Middle East, Europe and China.