Battery Recycling Market by Source (Automotive, Industrial, Consumer & Electronic Appliance), Chemistry (Lead Acid, Lithium-based, Nickel-based, Alkaline), Process (Hydrometallurgy, Pyrometallurgy), Material and Region - Global Forecast to 2030

Updated on : March 11, 2025

Battery Recycling Market

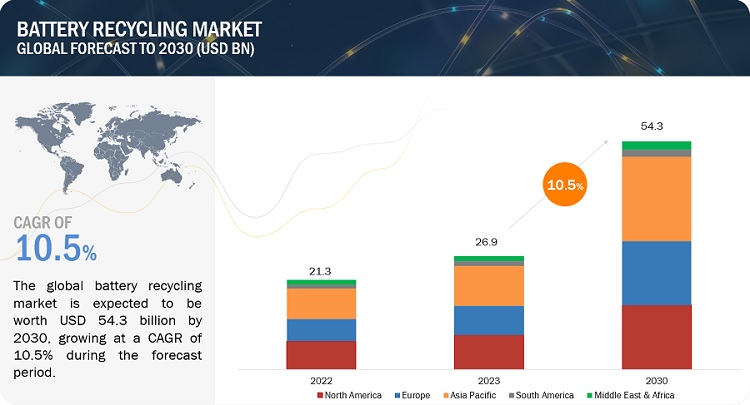

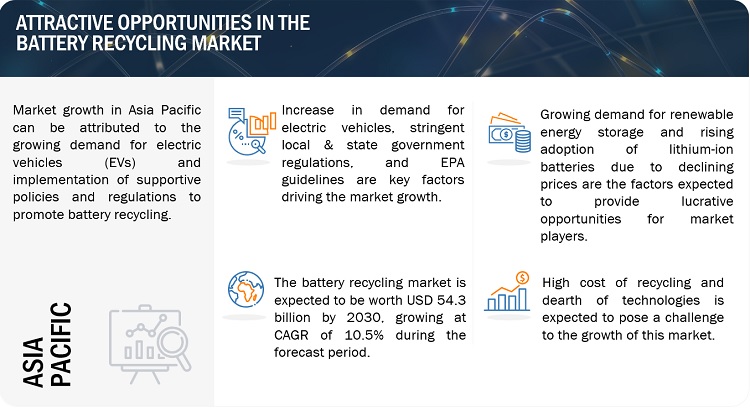

The global battery recycling market was valued at USD 26.9 billion in 2023 and is projected to reach USD 54.3 billion by 2030, growing at 10.5% cagr from 2023 to 2030. The market has observed stable growth throughout the study period and is anticipated to continue with the same trend during the forecast period. Rising investments in the development of electric vehicles, stringent EPA guidelines, and government regulations & initiatives to encourage battery recycling are expected to drive the growth of the market in the upcoming years.

Attractive Opportunities in the Battery Recycling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Battery Recycling Market Dynamics

Driver: Increase in demand for electric vehicles

Shifting consumer preference towards more sustainable and environmentally friendly transportation alternatives is propelling the demand for electric vehicles. Also, the use of electric vehicles is increasing owing to factors such as energy efficiency, and pollution control that are driving up the adoption of batteries. The development of advanced battery technologies, improvements in energy density, charging capabilities, and minimal maintenance requirements are other factors contributing to the growth of electric vehicles. Hence, it is anticipated that the market for battery recycling would continue to expand as a result of the growing use of electric vehicles.

Restraint: Safety issues related to the storage and transportation of spent batteries

Spent batteries contain various hazardous materials including acids and heavy metals such as mercury and lead that can be harmful to human health and the environment. Improper storage or transportation can result in chemical leakage, leading to the release of toxic substances. Owing to these issues, state or federal governments restrict the transportation and storage of spent batteries.

Opportunity: Rising demand for renewable energy storage

The renewable energy sector, including solar and wind power, is witnessing rapid expansion. Most of the renewable energy storage systems utilize batteries such as lithium-ion, lead acid, and sodium-sulfur, to perform essential operations. Therefore, with the rise in renewable energy installations, there is a corresponding need for battery recycling to manage the end-of-life batteries and extract valuable materials for reuse.

Challenge: High cost of recycling and dearth of technologies

High cost of recycling and the dearth of technologies can pose a significant challenge for the battery recycling market. The recycling of batteries involves a number of time-consuming and expensive phases, including collecting, sorting, disassembly, and the extraction of valuable materials including nickel, cobalt, lithium, and rare earth metals. The expense is further increased by the need to ensure safe handling and disposal of hazardous compounds found in batteries. The lack of efficient battery recycling methods is another problem. It is crucial to create scalable and effective procedures which can manage multiple battery types, including different chemistries. Additionally, recycling techniques must advance along with battery technology in order to efficiently recover valuable materials and reduce waste. Thus, investment in R&D for efficient battery recycling technologies is necessary to meet these challenges.

Battery Recycling Market Ecosystem

Prominent companies in this market include well-established, and financially stable recyclers of batteries. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Call2Recycle, Inc. (US), Cirba Solutions (US), Element Resources (US), Umicore (Belgium), Contemporary Amperex Technology Co., Limited (China), and Exide Industries Ltd. (India).

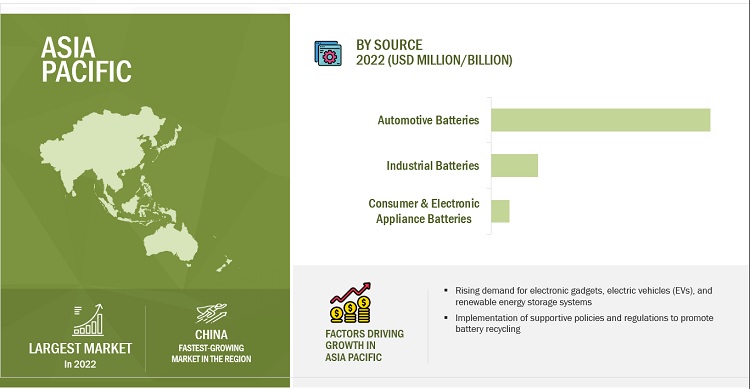

Based on source, the automotive batteries segment is expected to grow at a highest rate during the forecast period.

The automotive batteries segment is estimated to have the largest share of the global battery recycling market in 2023. The global market for automotive battery recycling is significantly being driven by the rising popularity of electric vehicles. The quantity of used batteries that need proper disposal and recycling is increasing along with the growth in EV sales. Rise of EVs demand will result into growth of battery replacement as batteries have a limited lifespan. This will result in large number of spent batteries, creating the need for efficient recycling process. Thus, a sustainable infrastructure for end-of-life battery management and recycling is required as more people switch to electric vehicles, which will further boost the growth of this segment.

Based on chemistry, the lead acid batteries segment is projected to account for the largest share in 2023.

The lead acid batteries segment is estimated to have the largest share of the global battery recycling market in 2023. Lead acid batteries are categorized as hazardous waste as they contain lead and sulfuric acid. Proper management and recycling of lead acid batteries helps control the potential environmental and health risks associated with improper disposal. lead acid batteries have valuable materials, majorly lead and sulfuric acid. Lead can be recycled multile times without loosing its quality. The growth of this segment can be attributed to the rising need for recycling facilities to handle hazardous materials and lower the possibility of pollution and contamination.

Based on region, Asia Pacific region is expected to hold the highest CAGR during the forecast period.

Due to the expanding population, industrialization, urbanization, and rising demand for electronic gadgets, electric vehicles (EVs), and renewable energy storage systems, battery consumption is on the rise in the Asia Pacific region. Asia Pacific is home to some of the largest battery manufacturers in the world. The region manufacturers and consumes huge portion of the world's batteries, especially lithium-ion batteries. Because of this increased battery use, there is a critical need for efficient battery recycling to handle the rising number of used batteries and reduce their negative effects on the environment. The growth is further aided by the implementation of supportive policies and regulations to promote battery recycling.

To know about the assumptions considered for the study, download the pdf brochure

Battery Recycling Market Players

ACCUREC Recycling GmbH (Germany), American Battery Technology Company (US), Aqua Metals, Inc. (US), Call2Recycle, Inc. (US), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), East Penn Manufacturing Company (US), Ecobat (US), Element Resources (US), EnerSys (US), Exide Industries Ltd. (India), Fortum (Finland), GEM Co., Ltd. (China), Glencore (Switzerland), Gopher Resource (US), Gravita India Limited (India), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Raw Materials Company (Canada), RecycLiCo Battery Materials Inc. (Canada), Redwood Materials Inc. (US), Shenzhen Highpower Technology Co., Ltd. (China), Stena Recycling (Sweden), TES (Singapore), Terrapure (Canada), The Doe Run Company (US), The International Metals Reclamation Company (US), and Umicore (Belgium), and others are among the major players leading the market through their innovative offerings, enhanced recycling capacities, and efficient distribution channels.

Read More: Battery Recycling Companies

Battery Recycling Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 26.9 billion |

|

Revenue Forecast in 2030 |

USD 54.3 billion |

|

CAGR |

10.5% |

|

Market Size Available for Years |

2018 to 2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Recycling Process, Processing State, Material, Source, Chemistry, and Region |

|

Geographies Covered |

Europe, Asia Pacific, North America, South America, and the Middle East & Africa |

|

Companies Covered |

The major market players include ACCUREC Recycling GmbH (Germany), American Battery Technology Company (US), Aqua Metals, Inc. (US), Call2Recycle, Inc. (US), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), East Penn Manufacturing Company (US), Ecobat (US), Element Resources (US), EnerSys (US), Exide Industries Ltd. (India), Fortum (Finland), GEM Co., Ltd. (China), Glencore (Switzerland), Gopher Resource (US), Gravita India Limited (India), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Raw Materials Company (Canada), RecycLiCo Battery Materials Inc. (Canada), Redwood Materials Inc. (US), Shenzhen Highpower Technology Co., Ltd. (China), Stena Recycling (Sweden), TES (Singapore), Terrapure (Canada), The Doe Run Company (US), The International Metals Reclamation Company (US), and Umicore (Belgium), and others |

This research report categorizes the battery recycling market based on recycling processes, processing state, material, source, chemistry, and region.

Based on recycling process, the battery recycling market industry has been segmented as follows:

- Hydrometallurgical Process

- Pyrometallurgical Process

- Lead Acid Battery Recycling Process

- Lithium-ion Battery Recycling Process

Based on processing state, the battery recycling market has been segmented as follows:

- Extraction Of Material

- Reuse, Repackaging, & Second Life

- Disposal

Based on material, the battery recycling market industry has been segmented as follows:

- Metals

- Electrolyte

- Plastics

- Other Components

Based on source, the battery recycling market has been segmented as follows:

- Automotive Batteries

- Industrial Batteries

- Consumer & electric appliance Batteries

Based on chemistry, the battery recycling market industry has been segmented as follows:

- Lead Acid Batteries

- Lithium-based Batteries

- Nickel-based Batteries

- Others

Based on the region, the battery recycling market has been segmented as follows:

-

Asia Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- South Korea

- Taiwan

- Thailand

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Italy

- Netherlands

- Spain

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

- Rest of Middle East & Africa

-

South America

- Brazil

- Argentina

- Chile

- Reast of South America

Recent Developments

- In February 2024, Cirba Solutions and EcoPro signed an MoU to improve lithium-ion battery recycling. This collaboration is crucial due to the increasing demand for battery materials and the focus on clean energy production in the US.

- In April 2023, Cirba Solutions signed a Memorandum of Understanding (MoU) with Honda to collect, process, and return recycled battery materials to be used as raw material for Honda’s battery supply chain for application in future EV batteries.

- In February 2023, Contemporary Amperex Technology Co., Limited, Mercedes-Benz, and GEM Co., Ltd. signed a memorandum of understanding for the recycling of cobalt, nickel, manganese, and lithium metals from spent EV batteries of Mercedes-Benz and remanufacture them into battery cathode materials.

Frequently Asked Questions (FAQ):

What is the key driver for the battery recycling market?

Stringent local and state government regulations and EPA guidelines are the major driver for battery recycling market.

Which region is expected to hold the largest market share in the battery recycling market?

The battery recycling market in Asia Pacific is estimated to hold the largest market share. Due to the region's expanding population, industrialization, urbanization, and rising demand for electronic gadgets, electric vehicles (EVs), and renewable energy storage systems, battery consumption is on the rise in the Asia Pacific region.

What is the major source of batteries for recycling?

The automotive segment with an increasing number of electric vehicles is the major source of batteries for recycling.

Who are the major recyclers of batteries?

The key recyclers operating in the market include Call2Recycle, Inc. (US), Cirba Solutions (US), Element Resources (US), Umicore (Belgium), Contemporary Amperex Technology Co., Limited (China), and Exide Industries Ltd. (India).

What is the total CAGR expected to record for the battery recycling market during 2023-2030?

The market is expected to record a CAGR of 10.5% from 2023-2030 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 MARKET DYNAMICSDRIVERS- Increasing demand for electric vehicles- Stringent government regulations and EPA guidelines- Rising demand for recycled products and materials- Increasing awareness of resource conservationRESTRAINTS- Safety issues related to storage and transportation of spent batteriesOPPORTUNITIES- Growing demand for renewable energy storage- Increasing adoption of lithium-ion batteries due to decline in priceCHALLENGES- High cost of recycling and dearth of technologies

- 5.2 VALUE CHAIN ANALYSIS

-

5.3 ECOSYSTEM MAP

-

5.4 PORTER'S FIVE FORCES MODELPORTER'S FIVE FORCES ANALYSIS FOR LEAD ACID BATTERY RECYCLING- Bargaining power of suppliers- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Intensity of competitive rivalryPORTER'S FIVE FORCES ANALYSIS FOR LITHIUM-ION BATTERY RECYCLING- Bargaining power of suppliers- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Intensity of competitive rivalry

-

5.5 TECHNOLOGY ANALYSISINTRODUCTIONTECHNOLOGY- HydrometallurgyPYROMETALLURGYPYROLYSISMECHANICAL THERMODYNAMIC RECYCLINGCOMPARATIVE ANALYSIS

-

5.6 TARIFF AND REGULATORY LANDSCAPENORTH AMERICA BATTERY RECYCLING REGULATIONSEUROPE BATTERY RECYCLING REGULATIONSASIA PACIFIC BATTERY RECYCLING REGULATIONS

-

5.7 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.8 CASE STUDY: ATTERO RECYCLINGKEY HIGHLIGHTS

- 5.9 KEY CONFERENCES AND EVENTS (2023–2024)

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.12 PRICING ANALYSIS OF RAW MATERIALSLITHIUMLEADNICKELCOBALT

- 5.13 TRADE DATA

- 6.1 EXTRACTION OF MATERIAL

- 6.2 REUSE, REPACKAGING, AND SECOND LIFE

- 6.3 DISPOSAL

- 7.1 INTRODUCTION

- 7.2 HYDROMETALLURGY

- 7.3 PYROMETALLURGY

- 7.4 LEAD ACID BATTERY RECYCLING PROCESS

-

7.5 LITHIUM-ION BATTERY RECYCLING PROCESSGROWTH OPPORTUNITIES FOR LITHIUM-ION BATTERY RECYCLING MARKET

- 8.1 INTRODUCTION

- 8.2 METALS

- 8.3 ELECTROLYTES

- 8.4 PLASTICS

- 8.5 OTHER COMPONENTS

- 9.1 INTRODUCTION

-

9.2 LEAD ACIDLOW RECYCLING COSTS AND HIGH RECOVERY RATE TO DRIVE MARKET

-

9.3 NICKEL-BASEDHIGHER POWER DENSITY TO DRIVE SEGMENT GROWTH

-

9.4 LITHIUM-BASEDINCREASING GLOBAL CONSUMPTION TO DRIVE MARKET

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 AUTOMOTIVE BATTERIESHIGH DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET GROWTH

-

10.3 INDUSTRIAL BATTERIESNEED FOR POWER BACKUP IN INDUSTRIAL SECTOR TO SUPPORT MARKET GROWTH

-

10.4 CONSUMER & ELECTRONIC APPLIANCE BATTERIESGROWING USE OF CONSUMER & ELECTRONIC APPLIANCES TO PROPEL MARKET DEMAND

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICIMPACT OF RECESSIONCHINA- Growing electric vehicle market to propel battery recycling in ChinaINDIA- Increasing cleaner energy initiatives to drive marketJAPAN- Growth in battery manufacturing to create demand for recyclingSOUTH KOREA- Substantial growth in automotive sector to positively impact marketINDONESIA- Lead-acid batteries to drive growthMALAYSIA- Requirement of energy storage to increase demand for battery recyclingAUSTRALIA- Supportive government policies to aid market growthTAIWAN- Increasing number of vehicles to support market growthTHAILAND- Electric mobility sector to drive marketREST OF ASIA PACIFIC

-

11.3 NORTH AMERICAIMPACT OF RECESSIONUS- US to lead market in North AmericaCANADA- Battery recycling programs to support marketMEXICO- Government initiatives to fuel demand

-

11.4 EUROPEIMPACT OF RECESSIONGERMANY- Shift toward renewable energy to drive marketUK- Growth of electric vehicles to propel demandFRANCE- Development in battery recycling technologies to fuel market growthITALY- Increasing capacity to recycle batteries and electric vehicles sales to drive marketSPAIN- Growing investments to promote electric vehicle sales to propel marketNETHERLANDS- Growing consumer electronics industry to support market growthREST OF EUROPE

-

11.5 SOUTH AMERICAIMPACT OF RECESSIONBRAZIL- Brazil to lead market in South America during forecast periodARGENTINA- Development of battery recycling facilities to drive marketCHILE- Battery recycling market to register second-highest CAGR in South AmericaREST OF SOUTH AMERICA

-

11.6 MIDDLE EAST & AFRICAIMPACT OF RECESSIONSAUDI ARABIA- Government initiatives toward renewable energy sector to drive demand for battery recyclingUAE- Government support to enhance electric vehicles to drive marketSOUTH AFRICA- Automotive batteries segment to lead marketEGYPT- Focus on electronic waste management to enhance market growthREST OF MIDDLE EAST & AFRICA

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- Call2Recycle, Inc.- Cirba Solutions- Element Resources- Umicore- Contemporary Amperex Technology Co., Limited- Exide Industries Ltd.REVENUE ANALYSIS OF TOP 6 PLAYERS

- 12.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

12.5 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPETITIVE BENCHMARKING

-

12.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.8 RECENT DEVELOPMENTSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 KEY COMPANIESCALL2RECYCLE, INC.- Business overview- Products offered- Recent developments- MnM viewCIRBA SOLUTIONS- Business overview- Products offered- Recent developments- MnM viewELEMENT RESOURCES- Business overview- Products offered- MnM viewUMICORE- Business overview- Products offered- Recent developments- MnM viewCONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED- Business overview- Products offered- Recent developments- MnM viewEXIDE INDUSTRIES LTD.- Business overview- Products offered- Recent developments- MnM viewACCUREC RECYCLING GMBH- Business overview- Products offered- Recent developmentsAMERICAN BATTERY TECHNOLOGY COMPANY- Business overview- Products offered- Recent developmentsAQUA METALS, INC.- Business overview- Products offered- Recent developmentsEAST PENN MANUFACTURING COMPANY- Business overview- Products offeredECOBAT- Business overview- Products offered- Recent developmentsENERSYS- Business overview- Products offeredFORTUM- Business overview- Products offered- Recent developmentsGEM CO., LTD.- Business overview- Products offered- Recent developmentsGLENCORE- Business overview- Products offered- Recent developmentsGOPHER RESOURCE- Business overview- Products offered- Recent developmentsGRAVITA INDIA LTD.- Business overview- Products offered- Recent developmentsLI-CYCLE CORP.- Business overview- Products offered- Recent developmentsNEOMETALS LTD.- Business overview- Products offered- Recent developmentsRAW MATERIALS COMPANY- Business overview- Products offeredRECYCLICO BATTERY MATERIALS INC.- Business overview- Products offered- Recent developmentsREDWOOD MATERIALS INC.- Business overview- Products offered- Recent developmentsSHENZHEN HIGHPOWER TECHNOLOGY CO., LTD.- Business overview- Products offeredSTENA RECYCLING- Business overview- Products offered- Recent developmentsTERRAPURE- Business overview- Products offeredTES- Business overview- Products offered- Recent developmentsTHE DOE RUN COMPANY- Business overview- Products offeredTHE INTERNATIONAL METALS RECLAMATION COMPANY- Business overview- Products offered

-

13.2 OTHER COMPANIESBATREC INDUSTRIEBATTERY RECYCLING MADE EASY (BRME)DUESENFELD GMBHENVIROSTREAM AUSTRALIA PTY LTD.- Recent developmentsEURO DIEUZE INDUSTRIE (E.D.I.)LITHION RECYCLINGMETALEX PRODUCTS LTD.ONTO TECHNOLOGYSITRASASMC RECYCLINGTATA CHEMICALS LIMITED

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 LITHIUM-ION BATTERY RECYCLING MARKETMARKET DEFINITIONMARKET OVERVIEWLITHIUM-ION BATTERY RECYCLING MARKET, BY SOURCE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 BATTERY RECYCLING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 BATTERY RECYCLING MARKET SNAPSHOT: 2023 VS. 2030

- TABLE 3 ECOSYSTEM OF BATTERY RECYCLING MARKET

- TABLE 4 LEAD ACID BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 LITHIUM-ION BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 REGULATIONS AND STANDARDS FOR BATTERIES

- TABLE 7 RECENT PATENTS BY GUANGDONG BRUNP RECYCLING TECHNOLOGY CO., LTD.

- TABLE 8 RECENT PATENTS BY UNIV CENTRAL SOUTH

- TABLE 9 RECENT PATENTS BY AQUA METALS, INC.

- TABLE 10 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 11 BATTERY RECYCLING MARKET: KEY CONFERENCES AND EVENTS (2023–2024)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 14 IMPORT DATA OF BATTERIES, 2021

- TABLE 15 EXPORT DATA OF BATTERIES, 2021

- TABLE 16 COMPARISON OF GENERIC RECYCLING METHODS USED TO RECOVER BATTERY COMPONENTS

- TABLE 17 BATTERY RECYCLING PROCESSES USED BY DIFFERENT COMPANIES

- TABLE 18 OVERALL BATTERY RECYCLING CAPACITIES OF VARIOUS COUNTRIES

- TABLE 19 METALS BY WEIGHT PERCENTAGE IN MOST COMMON BATTERY CHEMISTRIES

- TABLE 20 MAJOR RECOVERABLE METALS FROM VARIOUS BATTERY CHEMISTRIES AFTER RECYCLING

- TABLE 21 BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018–2020 (USD MILLION)

- TABLE 22 BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021–2030 (USD MILLION)

- TABLE 23 LEAD ACID BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 24 LEAD ACID BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 25 NICKEL-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 26 NICKEL-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 27 LITHIUM-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 28 LITHIUM-BASED BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 29 AUTOMOTIVE LITHIUM-BASED: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (UNITS)

- TABLE 30 AUTOMOTIVE LITHIUM-BASED: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (UNITS)

- TABLE 31 OTHERS: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 32 OTHERS: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 33 BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 34 BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 35 AUTOMOTIVE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 36 AUTOMOTIVE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 37 INDUSTRIAL BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 38 INDUSTRIAL BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 39 CONSUMER & ELECTRONIC APPLIANCE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 40 CONSUMER & ELECTRONIC APPLIANCE BATTERIES: BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 41 BATTERY RECYCLING MARKET, BY REGION, 2018–2020 (USD MILLION)

- TABLE 42 BATTERY RECYCLING MARKET, BY REGION, 2021–2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 44 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY COUNTRY, 2021–2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018–2020 (USD MILLION)

- TABLE 46 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021–2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 48 ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 49 CHINA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 50 CHINA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 51 INDIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 52 INDIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 53 JAPAN: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 54 JAPAN: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 55 SOUTH KOREA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 56 SOUTH KOREA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 57 INDONESIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 58 INDONESIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 59 MALAYSIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 60 MALAYSIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 61 AUSTRALIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 62 AUSTRALIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 63 TAIWAN: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 64 TAIWAN: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 65 THAILAND: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 66 THAILAND: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 70 NORTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2021–2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018–2020 (USD MILLION)

- TABLE 72 NORTH AMERICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021–2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 74 NORTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 75 US: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 76 US: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 77 CANADA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 78 CANADA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 79 MEXICO: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 80 MEXICO: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 81 EUROPE: BATTERY RECYCLING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 82 EUROPE: BATTERY RECYCLING MARKET, BY COUNTRY, 2021–2030 (USD MILLION)

- TABLE 83 EUROPE: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018–2020 (USD MILLION)

- TABLE 84 EUROPE: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021–2030 (USD MILLION)

- TABLE 85 EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 86 EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 87 GERMANY: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 88 GERMANY: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 89 UK: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 90 UK: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 91 FRANCE: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 92 FRANCE: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 93 ITALY: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 94 ITALY: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 95 SPAIN: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 96 SPAIN: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 97 NETHERLANDS: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 98 NETHERLANDS: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 100 REST OF EUROPE: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 101 SOUTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 102 SOUTH AMERICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2021–2030 (USD MILLION)

- TABLE 103 SOUTH AMERICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018–2020 (USD MILLION)

- TABLE 104 SOUTH AMERICA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021–2030 (USD MILLION)

- TABLE 105 SOUTH AMERICA BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 106 SOUTH AMERICA BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 107 BRAZIL: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 108 BRAZIL: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 109 ARGENTINA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 110 ARGENTINA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 111 CHILE: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 112 CHILE: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 113 REST OF SOUTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 114 REST OF SOUTH AMERICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY COUNTRY, 2021–2030 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2018–2020 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY CHEMISTRY, 2021–2030 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 121 SAUDI ARABIA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 122 SAUDI ARABIA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 123 UAE: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 124 UAE: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 125 SOUTH AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 126 SOUTH AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 127 EGYPT: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 128 EGYPT: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2018–2020 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: BATTERY RECYCLING MARKET, BY SOURCE, 2021–2030 (USD MILLION)

- TABLE 131 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- TABLE 132 BATTERY RECYCLING MARKET: DEGREE OF COMPETITION

- TABLE 133 BATTERY RECYCLING MARKET: CHEMISTRY FOOTPRINT

- TABLE 134 BATTERY RECYCLING MARKET: RECYCLING PROCESS FOOTPRINT

- TABLE 135 BATTERY RECYCLING MARKET: COMPANY REGION FOOTPRINT

- TABLE 136 BATTERY RECYCLING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 137 BATTERY RECYCLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 138 BATTERY RECYCLING MARKET: PRODUCT LAUNCHES (2019–APRIL 2023)

- TABLE 139 BATTERY RECYCLING MARKET: DEALS (2019–APRIL 2023)

- TABLE 140 BATTERY RECYCLING MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2019–APRIL 2023)

- TABLE 141 CALL2RECYCLE, INC.: COMPANY OVERVIEW

- TABLE 142 CALL2RECYCLE, INC.: PRODUCTS OFFERED

- TABLE 143 CALL2RECYCLE, INC.: DEALS

- TABLE 144 CIRBA SOLUTIONS: COMPANY OVERVIEW

- TABLE 145 CIRBA SOLUTIONS: PRODUCTS OFFERED

- TABLE 146 CIRBA SOLUTIONS: DEALS

- TABLE 147 CIRBA SOLUTIONS: OTHERS

- TABLE 148 ELEMENT RESOURCES: COMPANY OVERVIEW

- TABLE 149 ELEMENT RESOURCES: PRODUCTS OFFERED

- TABLE 150 UMICORE: COMPANY OVERVIEW

- TABLE 151 UMICORE: PRODUCTS OFFERED

- TABLE 152 UMICORE: DEALS

- TABLE 153 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: COMPANY OVERVIEW

- TABLE 154 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: PRODUCTS OFFERED

- TABLE 155 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: DEALS

- TABLE 156 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED: OTHERS

- TABLE 157 EXIDE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 158 EXIDE INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 159 EXIDE INDUSTRIES LTD.: OTHERS

- TABLE 160 ACCUREC RECYCLING GMBH: COMPANY OVERVIEW

- TABLE 161 ACCUREC RECYCLING GMBH: PRODUCTS OFFERED

- TABLE 162 ACCUREC RECYCLING GMBH: OTHERS

- TABLE 163 AMERICAN BATTERY TECHNOLOGY COMPANY: COMPANY OVERVIEW

- TABLE 164 AMERICAN BATTERY TECHNOLOGY COMPANY: PRODUCTS OFFERED

- TABLE 165 AMERICAN BATTERY TECHNOLOGY COMPANY: DEALS

- TABLE 166 AMERICAN BATTERY TECHNOLOGY COMPANY: OTHERS

- TABLE 167 AQUA METALS, INC.: COMPANY OVERVIEW

- TABLE 168 AQUA METALS, INC.: PRODUCTS OFFERED

- TABLE 169 AQUA METALS, INC.: DEALS

- TABLE 170 AQUA METALS, INC.: OTHERS

- TABLE 171 EAST PENN MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 172 EAST PENN MANUFACTURING COMPANY: PRODUCTS OFFERED

- TABLE 173 ECOBAT: COMPANY OVERVIEW

- TABLE 174 ECOBAT: PRODUCTS OFFERED

- TABLE 175 ECOBAT: DEALS

- TABLE 176 ECOBAT: OTHERS

- TABLE 177 ENERSYS: COMPANY OVERVIEW

- TABLE 178 ENERSYS: PRODUCTS OFFERED

- TABLE 179 FORTUM: COMPANY OVERVIEW

- TABLE 180 FORTUM: PRODUCTS OFFERED

- TABLE 181 FORTUM: DEALS

- TABLE 182 FORTUM: OTHERS

- TABLE 183 GEM CO., LTD.: COMPANY OVERVIEW

- TABLE 184 GEM CO., LTD.: PRODUCTS OFFERED

- TABLE 185 GEM CO., LTD.: DEALS

- TABLE 186 GLENCORE: COMPANY OVERVIEW

- TABLE 187 GLENCORE: PRODUCTS OFFERED

- TABLE 188 GLENCORE: DEALS

- TABLE 189 GOPHER RESOURCE: COMPANY OVERVIEW

- TABLE 190 GOPHER RESOURCE: PRODUCTS OFFERED

- TABLE 191 GOPHER RESOURCE: DEALS

- TABLE 192 GRAVITA INDIA LTD.: COMPANY OVERVIEW

- TABLE 193 GRAVITA INDIA LTD.: PRODUCTS OFFERED

- TABLE 194 GRAVITA INDIA LTD.: OTHERS

- TABLE 195 LI-CYCLE CORP.: COMPANY OVERVIEW

- TABLE 196 LI-CYCLE CORP.: PRODUCTS OFFERED

- TABLE 197 LI-CYCLE CORP.: DEALS

- TABLE 198 LI-CYCLE CORP.: OTHERS

- TABLE 199 NEOMETALS LTD.: COMPANY OVERVIEW

- TABLE 200 NEOMETALS LTD.: PRODUCTS OFFERED

- TABLE 201 NEOMETALS LTD.: PRODUCT LAUNCHES

- TABLE 202 NEOMETALS LTD.: DEALS

- TABLE 203 NEOMETALS LTD.: OTHERS

- TABLE 204 RAW MATERIALS COMPANY: COMPANY OVERVIEW

- TABLE 205 RAW MATERIALS COMPANY: PRODUCTS OFFERED

- TABLE 206 RECYCLICO BATTERY MATERIALS INC.: COMPANY OVERVIEW

- TABLE 207 RECYCLICO BATTERY MATERIALS INC.: PRODUCTS OFFERED

- TABLE 208 RECYCLICO BATTERY MATERIALS INC.: PRODUCT LAUNCHES

- TABLE 209 RECYCLICO BATTERY MATERIALS INC.: DEALS

- TABLE 210 REDWOOD MATERIALS INC.: COMPANY OVERVIEW

- TABLE 211 REDWOOD MATERIALS INC.: PRODUCTS OFFERED

- TABLE 212 REDWOOD MATERIALS INC.: DEALS

- TABLE 213 REDWOOD MATERIALS INC.: OTHERS

- TABLE 214 SHENZHEN HIGHPOWER TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 215 SHENZHEN HIGHPOWER TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 216 STENA RECYCLING: COMPANY OVERVIEW

- TABLE 217 STENA RECYCLING: PRODUCTS OFFERED

- TABLE 218 STENA RECYCLING: DEALS

- TABLE 219 STENA RECYCLING: OTHERS

- TABLE 220 TERRAPURE: COMPANY OVERVIEW

- TABLE 221 TERRAPURE: PRODUCTS OFFERED

- TABLE 222 TES: COMPANY OVERVIEW

- TABLE 223 TES: PRODUCTS OFFERED

- TABLE 224 TES: DEALS

- TABLE 225 TES: OTHERS

- TABLE 226 THE DOE RUN COMPANY: COMPANY OVERVIEW

- TABLE 227 THE DOE RUN COMPANY: PRODUCTS OFFERED

- TABLE 228 THE INTERNATIONAL METALS RECLAMATION COMPANY: COMPANY OVERVIEW

- TABLE 229 THE INTERNATIONAL METALS RECLAMATION COMPANY: PRODUCTS OFFERED

- TABLE 230 BATREC INDUSTRIE: COMPANY OVERVIEW

- TABLE 231 BATTERY RECYCLING MADE EASY (BRME): COMPANY OVERVIEW

- TABLE 232 DUESENFELD GMBH: COMPANY OVERVIEW

- TABLE 233 ENVIROSTREAM AUSTRALIA PTY LTD.: COMPANY OVERVIEW

- TABLE 234 ENVIROSTREAM AUSTRALIA PTY LTD.: OTHERS

- TABLE 235 EURO DIEUZE INDUSTRIE (E.D.I.): COMPANY OVERVIEW

- TABLE 236 LITHION RECYCLING: COMPANY OVERVIEW

- TABLE 237 METALEX PRODUCTS LTD.: COMPANY OVERVIEW

- TABLE 238 ONTO TECHNOLOGY: COMPANY OVERVIEW

- TABLE 239 SITRASA: COMPANY OVERVIEW

- TABLE 240 SMC RECYCLING: COMPANY OVERVIEW

- TABLE 241 TATA CHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 242 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 243 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2021–2031 (USD MILLION)

- TABLE 244 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2017–2020 (UNITS)

- TABLE 245 AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY REGION, 2021–2031 (UNITS)

- TABLE 246 NON-AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY SOURCE, 2017–2020 (USD MILLION)

- TABLE 247 NON-AUTOMOTIVE: LITHIUM-ION BATTERY RECYCLING MARKET, BY SOURCE, 2021–2031 (USD MILLION)

- FIGURE 1 BATTERY RECYCLING MARKET SEGMENTATION

- FIGURE 2 BATTERY RECYCLING MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED FOR ASSESSING DEMAND FOR BATTERY RECYCLING

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 BATTERY RECYCLING MARKET: DATA TRIANGULATION

- FIGURE 7 AUTOMOTIVE BATTERIES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 EUROPE TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 HIGH OUTPUT OF SPENT BATTERIES FROM ELECTRIC VEHICLES TO DRIVE BATTERY RECYCLING MARKET

- FIGURE 10 ASIA PACIFIC SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 AUTOMOTIVE BATTERIES TO REGISTER HIGHEST CAGR FROM 2023 TO 2030

- FIGURE 12 LITHIUM-BASED SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BATTERY RECYCLING MARKET

- FIGURE 14 VALUE CHAIN ANALYSIS OF BATTERY RECYCLING MARKET

- FIGURE 15 ECOSYSTEM MAP OF BATTERY RECYCLING MARKET

- FIGURE 16 LEAD ACID BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 LITHIUM-ION BATTERY RECYCLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 19 PUBLICATION TRENDS – LAST 10 YEARS

- FIGURE 20 LEGAL STATUS OF PATENTS

- FIGURE 21 TOP JURISDICTION, BY DOCUMENT

- FIGURE 22 TOP 10 PATENT APPLICANTS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING LITHIUM-ION BATTERY ECOSYSTEM

- FIGURE 26 PRICE OF LITHIUM CARBONATE, JANUARY 2019 TO APRIL 2023

- FIGURE 27 PRICE OF LEAD, JANUARY 2019 TO APRIL 2023

- FIGURE 28 PRICE OF NICKEL, JANUARY 2019 TO APRIL 2023

- FIGURE 29 PRICE OF COBALT, JANUARY 2019 TO APRIL 2023

- FIGURE 30 LITHIUM-BASED SEGMENT TO LEAD BATTERY RECYCLING MARKET DURING FORECAST PERIOD

- FIGURE 31 AUTOMOTIVE BATTERIES SEGMENT TO DOMINATE BATTERY RECYCLING MARKET DURING FORECAST PERIOD

- FIGURE 32 BATTERY RECYCLING MARKET, BY REGION (USD MILLION)

- FIGURE 33 ASIA PACIFIC BATTERY RECYCLING MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA BATTERY RECYCLING MARKET SNAPSHOT

- FIGURE 35 EUROPE BATTERY RECYCLING MARKET SNAPSHOT

- FIGURE 36 RANKING OF TOP SIX PLAYERS IN BATTERY RECYCLING MARKET, 2022

- FIGURE 37 BATTERY RECYCLING MARKET SHARE ANALYSIS

- FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES (2018–2022)

- FIGURE 39 BATTERY RECYCLING MARKET: COMPANY FOOTPRINT

- FIGURE 40 COMPANY EVALUATION QUADRANT: BATTERY RECYCLING MARKET (TIER 1 COMPANIES)

- FIGURE 41 STARTUP/SM EVALUATION QUADRANT: BATTERY RECYCLING MARKET

- FIGURE 42 UMICORE: COMPANY SNAPSHOT

- FIGURE 43 EXIDE INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 44 AQUA METALS, INC.: COMPANY SNAPSHOT

- FIGURE 45 ENERSYS: COMPANY SNAPSHOT

- FIGURE 46 FORTUM: COMPANY SNAPSHOT

- FIGURE 47 GLENCORE: COMPANY SNAPSHOT

- FIGURE 48 GRAVITA INDIA LTD.: COMPANY SNAPSHOT

- FIGURE 49 LI-CYCLE CORP.: COMPANY SNAPSHOT

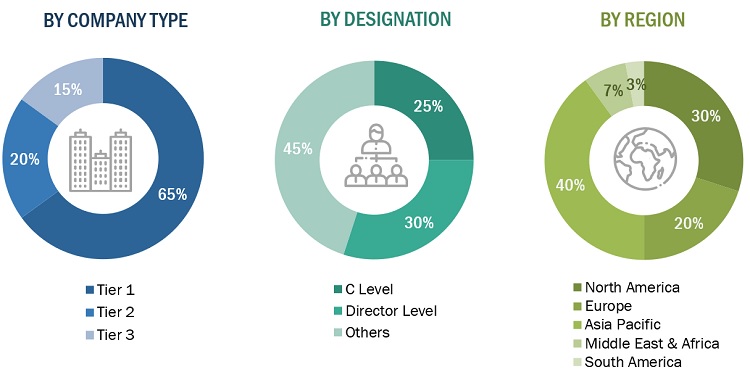

The study involved four major activities in estimating the current market size of battery recycling. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of battery recycling through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The battery recycling market comprises several stakeholders, such as such as battery suppliers, processors, recycling companies, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the battery recycling industry. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom- up approaches were used to estimate and validate the total size of the battery recycling industry. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the battery recycling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Battery Recycling Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Battery Recycling Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive and non-automotive sources.

Market definition

Battery recycling refers to the process of collecting and reprocessing used batteries to recover valuable materials and reduce environmental impact. It involves the safe and responsible disposal of batteries, followed by the extraction and recycling of materials such as precious metals (e.g., lead, lithium, copper, nickel, cobalt) and other components (e.g., plastic, acid) that can be reused or repurposed. Battery recycling helps conserve natural resources, minimize pollution, and prevent hazardous substances from entering the environment.

Key Stakeholders

- Governments and research organizations

- Battery manufacturers

- Electric vehicle manufacturers

- Mining companies

- Oil companies expanding into alternative energy

- Recycling associations and Industrial bodies

- Battery recycling manufacturers/traders

Report Objectives:

- To analyze and forecast the market size of battery recycling in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global battery recycling market on the basis of source, chemistry, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as new technology launches, joint ventures, partnerships, contracts, collaborations, acquisitions, agreements, investments, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the battery recycling market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Battery Recycling Market