Europe Biodegradable Polymers Market for Extrusion Coating, By Type (PLA, Starch, PBS, PHA), Substrate (Paper & Paperboard, Cellulose Films), Application (Rigid Packaging, Flexible Packaging, Liquid Packaging) Country - Forecast to 2024

Updated on : September 01, 2023

Europe Biodegradable Polymers Market

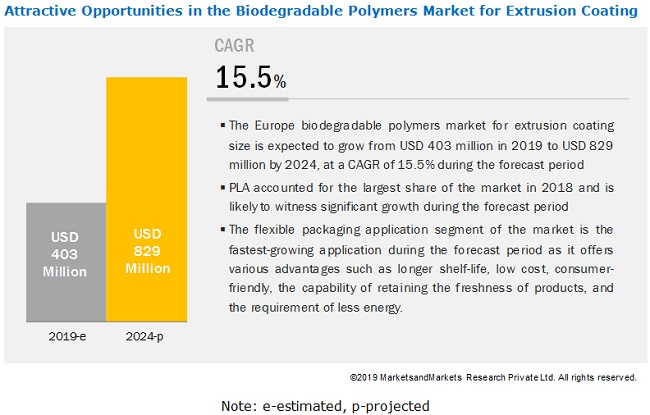

The European biodegradable polymers market for extrusion coating is estimated to grow from USD 403 million in 2019 to reach USD 829 million by 2024, at a CAGR of 15.5% during the forecast period. The europe biodegradable polymers market for extrusion coating is driven mainly by its growing demand in various packaging applications and stringent environmental regulations against the use of non-biodegradable polymers.

The flexible packaging application is expected to be the fastest-growing application of the biodegradable polymers market for extrusion coating during the forecast period.

The flexible packaging segment of the Europe biodegradable polymers market for extrusion coating is the fastest-growing application. It is used in various industrial and consumer products. Many brands are shifting from rigid packaging to flexible packaging as it offers various advantages, such as longer shelf-life, low cost, consumer-friendliness, the capability of retaining the freshness of products, requirement of less energy, eco-friendliness, and others. In Europe, the demand for flexible packaging is expected to be driven by the food industry, specifically bakery and cereals segments of the industry.

The paper & paperboard segment is expected to be the largest contributor to the biodegradable polymers market for extrusion coating during the forecast period.

Among the different substrates available in the Europe biodegradable polymers market for extrusion coating, paper & paperboard is the fastest-growing segment. PLA, PBS, and other biodegradable resins are used to extrude craft papers that are used in applications such as wrapping, grocery bags, sacks, and specialty packaging. Paper & paperboard is lightweight, recyclable, low-cost, and has an added advantage of improving the visual appearance of a product. The market in this segment is expected to grow in the coming years due to the increasing demand from the packaging industry.

The PLA segment is expected to be the largest contributor to the biodegradable polymers market for extrusion coating during the forecast period.

Among the different types of biodegradable polymers for extrusion coating available, the PLA segment is the fastest-growing type. PLA can be safely used for the packaging of hot soup, coffee, and other hot beverages. It is often blended with starch to increase its biodegradability and reduce its cost. The key applications of PLA used for extrusion coating are dairy containers, disposable tableware, agricultural mulch films, milk & juice cartons, and planter boxes. PLA is being adopted rapidly as it is easily available and economical to manufacture as compared with other biodegradable polymers.

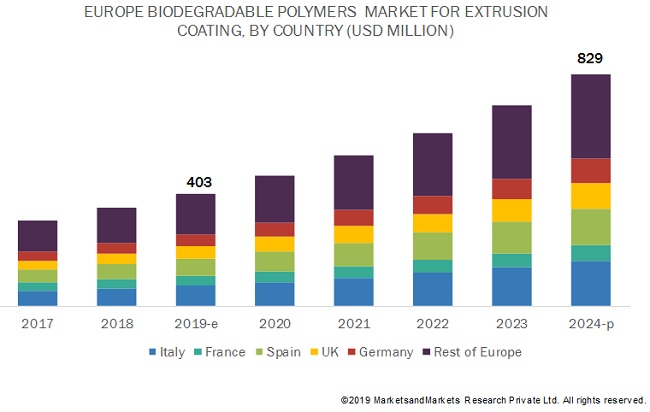

Italy is expected to account for the largest market share during the forecast period.

Italy is projected to be the fastest-growing country for Europe biodegradable polymers market for extrusion coating and is expected to offer significant growth opportunities to the overall market during the forecast period. The demand in the country is driven by the use of flexible packaging for various products, such as biscuits, snacks, noodles, and pasta, among others. In addition, Italy also provided expansion opportunities for the major players in the market. Bio-On (Italy) has started a new biodegradable and bioplastic production facility at Castel San Pietro Terme, Bologna (Italy). The new plant has been established to produce 100% natural and biodegradable special PHA bioplastics to be used in niche applications.

NatureWorks LLC (US), BASF SE (Germany), Total Corbion (Netherlands), Mitsubishi Chemical Holdings Corporation (Japan), Biotech (Germany), Novamont S.P.A. (Italy), Biome Bioplastics (UK), Toray Industries (Japan), Bio-On (Italy), and Plantic Technologies (Australia) are the leading biodegradable polymer manufacturers for extrusion coating.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2024 |

|

Units considered |

Value (USD million ) and Volume (Kiloton) |

|

Segments covered |

Type, Substrate, Application, and Region |

|

Geographies covered |

Europe |

|

Companies covered |

NatureWorks LLC (US), BASF SE (Germany), Total Corbion PLA (Netherlands), Mitsubishi Chemical Holdings Corporation (Japan), Biotech (Germany), Novamont S.P.A. (Italy), Biome Bioplastics (UK), Toray Industries (Japan), Bio-On (Italy), and Plantic Technologies (Australia) |

This research report categorizes the Europe biodegradable polymers market for extrusion coating based on type, substrate, application, and region.

By Type:

- PLA

- Starch

- PBS

- PHA

- Others

By Substrate:

- Paper & Paperboard

- Cellulose Films

- Others

By Application:

- Rigid Packaging

- Flexible Packaging

- Liquid Packaging

- Others

By Country:

- Italy

- France

- Spain

- UK

- Germany

- Others

Key Questions Addressed by the Report

- Which are the future revenue pockets in the biodegradable polymers market for extrusion coating?

- Which key developments are expected to have a high impact on the European market?

- Which products/technologies are expected to overpower the existing technologies?

- How is the regulatory scenario further expected to impact the European biodegradable polymers market for extrusion coating?

- What will be the future product mix in the biodegradable polymers market for extrusion coating?

- What are the prime strategies of leaders in the European market?

Frequently Asked Questions (FAQ):

What are the factors driving the European biodegradable plastics for extrusion coating?

Increasing use of biodegradable polymers in food packaging, increasing demand for compostable bags, and shift in consumer preference to eco-friendly products are the major factors driving the demand in the market.

What is the major restraint for European biodegradable plastics for extrusion coating?

The major restraint to the growth of the european biodegradable polymers market in extrusion coating is high cost of biodegradable polymers as compared to others polymers. Generally, the production cost of biodegradable polymers is 20-80% higher than that of conventional polymers.

What was the market size of European biodegradable plastics for extrusion coating in 2018 and how is it estimated to grow?

The market size for european biodegradable polymers market in extrusion coating was 350.21 million in 2018. It is projected to reach USD 828.54 million by 2024.

Which are the top players which exist in the market?

Natureworks LLC (US), BASF SE (Germany), Total Corbion PLA (The Netherlands), Mitsubishi Chemical Holdings Corporation (Japan), Biome Bioplastics (UK), Biotec (Germany), Toray Industries (Japan), Novamont S.P.A. (Italy), Plantic Technologies (Australia), and Bio-On S.p.A. (Italy) are major players in the market.

Which are the major application areas of European biodegradable plastics for extrusion coating market? Which application led the market and why?

The most common application of biodegradable polymer used for extrusion coating includes packaging. The packaging application is further divided into flexible, liquid, and commercial packaging.

Rigid packaging is the largest application of biodegradable polymers used for extrusion coating. Flexible packaging is the second-largest application due to its use in cigarettes, biscuits, confectioneries, baked food items, noodles, and snack items.

Which are the different type of European biodegradable plastics for extrusion coating market?

The biodegradable polymers market for extrusion coating can be segmented on the basis of type into PLA (polylactic acid), starch, PBS (polybutylene succinate), PHA, and others.

Which region leads the market?

Europe is a major market for biodegradable polymers used in extrusion coating. Italy, Germany, France, Spain, and the UK are the major countries in the European biodegradable polymers market for extrusion coating. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Supply Side Analysis

2.2.2 Forecast

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the Europe Biodegradable Polymers Market for Extrusion Coating

4.2 Biodegradable Polymers Market for Extrusion Coating, By Type

4.3 Europe Biodegradable Polymers Market for Extrusion Coating, By Substrate and Country, 2018

4.4 Biodegradable Polymers Market for Extrusion Coating, By Application

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use in Food Packaging and Compostable Bags

5.2.1.2 Shift in Consumer Preference to Eco-Friendly Products

5.2.2 Restraints

5.2.2.1 High Cost of Biodegradable Polymers as Compared to Other Polymers

5.2.3 Opportunities

5.2.3.1 Emerging Applications of Biodegradable Polymers for Extrusion Coating

5.2.3.2 Growing Market in the Developing Countries

5.2.4 Challenges

5.2.4.1 Performance Issues Related to Biodegradable Polymers

5.3 Biodegradable Polymers Market: Pricing Analysis

5.3.1 Introduction

5.3.2 PLA (Polylactic Acid)

5.3.3 Starch

5.3.4 PBS (Polybutylene Succinate)

5.3.5 PHA (Polyhydroxyalkanoates)

5.3.6 Others

6 Europe Biodegradable Polymers Market for Extrusion Coating, By Type (Page No. - 33)

6.1 Introduction

6.2 PLA (Polylactic Acid)

6.2.1 The Largest Use of PLA is in the Packaging Industry

6.3 Starch

6.3.1 Starch Blends Offer Tensile Strength and Elongation, and These Properties are Boosting Their Demand

6.4 PBS (Polybutylene Succinate)

6.4.1 The Excellent Processability Capacity of PBS is Driving the Demand in the Market

6.5 PHA (Polyhydroxyalkanoates)

6.5.1 The Market in This Segment is Projected to Grow Rapidly as It Fully Complies With Bio-Based, Biodegradable, Compostable, Or Biocompatible Requirements

6.6 Others

7 Europe Biodegradable Polymers Market for Extrusion Coating, By Substrate (Page No. - 37)

7.1 Introduction

7.2 Paper & Paperboard

7.2.1 Craft Paper, Bleached Paper, and Glassine Paper are Used in Extrusion Coating

7.3 Cellulose Films

7.3.1 Low Permeability to Greases, Air, Bacteria, and Oils are Driving the Demand for Cellulose Films as A Substrate for Extrusion Coating of Biodegradable Polymers

7.4 Others

8 Europe Biodegradable Polymers Market for Extrusion Coating, By Application (Page No. - 41)

8.1 Introduction

8.2 Rigid Packaging

8.2.1 The Medical Industry is the Largest Consumer of Rigid Packaging

8.3 Flexible Packaging

8.3.1 The Food & Beverage Industry is Expected to Drive the Market in This Segment

8.4 Liquid Packaging

8.4.1 Dairy Food Products, Seasoning, Dressings, Sauces, and Beer & Soft Drinks Segments are Propelling the Demand for Liquid Packaging

8.5 Others

9 Europe Biodegradable Polymers Market for Extrusion Coating, By Region (Europe) (Page No. - 45)

9.1 Introduction

9.2 Italy

9.2.1 The Reviving Economy is Favorable for the Market in the Country

9.3 France

9.3.1 Government Initiatives are Encouraging the Use of Bio-Based and Biodegradable Polymers in the Country

9.4 Spain

9.4.1 The Market is Gaining Traction in the Country With the Growth of the Packaging Industry

9.5 UK

9.5.1 Stringent Regulations Regarding the Use of Non-Biodegradable Polymers are Driving the Market

9.6 Germany

9.6.1 Flexible Packaging Application is Expected to Drive the Market for Biodegradable Polymers Used in Extrusion Coating

9.7 Rest of Europe

10 Competitive Landscape (Page No. - 58)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Expansion

10.3.2 Merger & Acquisition

10.3.3 Joint Venture

10.3.4 New Product Launch

11 Company Profiles (Page No. - 63)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competitors, Right to Win and MnM View)*

11.1 Natureworks LLC

11.2 BASF SE

11.3 Total Corbion PLA

11.4 Mitsubishi Chemical Holdings Corporation

11.5 Biome Bioplastics

11.6 Biotec

11.7 Toray Industries

11.8 Novamont S.P.A.

11.9 Plantic Technologies LTD.

11.10 Bio-On S.P.A.

11.11 Additional Company Profiles

11.11.1 Succinity GmbH

11.11.2 Perstorp

11.11.3 The Mondi Group

11.11.4 Synbra Technology Bv

11.11.5 Bio-Fed

11.11.6 Futerro

11.11.7 Aquapak Hydropolymers LTD.

11.11.8 Clondalkin

11.11.9 Galactic S.A.

11.11.10 Kompuestos

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competitors, Right to Win and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 88)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (37 Tables)

Table 1 Biodegradable Polymers for Extrusion Coating: Pricing Analysis, By Type

Table 2 Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (Kiloton)

Table 3 Europe Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (USD Million)

Table 4 Biodegradable Polymers Market Size for Extrusion Coating, By Substrate, 2017–2024 (Kiloton)

Table 5 Europe Biodegradable Polymers Market Size for Extrusion Coating, By Substrate, 2017–2024 (USD Million)

Table 6 Biodegradable Polymers Market Size for Extrusion Coating, By Application, 2017–2024 (Kiloton)

Table 7 Europe Biodegradable Polymers Market Size for Extrusion Coating, By Application, 2017–2024 (USD Million)

Table 8 Europe: Biodegradable Polymers Market Size for Extrusion Coating, By Country, 2017–2024 (Kiloton)

Table 9 Europe: Biodegradable Polymer Market Size for Extrusion Coating, By Country, 2017–2024 (USD Million)

Table 10 Italy: Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (Kiloton)

Table 11 Italy: Biodegradable Polymer Market Size for Extrusion Coating, By Type, 2017–2024 (USD Million)

Table 12 Italy: Market Size for Extrusion Coating, By Application, 2017–2024 (Kiloton)

Table 13 Italy: Market Size for Extrusion Coating, By Application, 2017–2024 (USD Million)

Table 14 France: Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (Kiloton)

Table 15 France: Biodegradable Polymer Market Size for Extrusion Coating, By Type, 2017–2024 (USD Million)

Table 16 France: Market Size for Extrusion Coating, By Application, 2017–2024 (Kiloton)

Table 17 France: Market Size for Extrusion Coating, By Application, 2017–2024 (USD Million)

Table 18 Spain: Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (Kiloton)

Table 19 Spain: Biodegradable Polymer Market Size for Extrusion Coating, By Type, 2017–2024 (USD Million)

Table 20 Spain: Market Size for Extrusion Coating, By Application, 2017–2024 (Kiloton)

Table 21 Spain: Market Size for Extrusion Coating, By Application, 2017–2024 (USD Million)

Table 22 UK: Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (Kiloton)

Table 23 UK: Biodegradable Polymer Market Size for Extrusion Coating, By Type, 2017–2024 (USD Million)

Table 24 UK: Market Size for Extrusion Coating, By Application, 2017–2024 (Kiloton)

Table 25 UK: Market Size for Extrusion Coating, By Application, 2017–2024 (USD Million)

Table 26 Germany: Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (Kiloton)

Table 27 Germany: Biodegradable Polymer Market Size for Extrusion Coating, By Type, 2017–2024 (USD Million)

Table 28 Germany: Market Size for Extrusion Coating, By Application, 2017–2024 (Kiloton)

Table 29 Germany: Market Size for Extrusion Coating, By Application, 2017–2024 (USD Million)

Table 30 Rest of Europe: Biodegradable Polymers Market Size for Extrusion Coating, By Type, 2017–2024 (Kiloton)

Table 31 Rest of Europe: Biodegradable Polymer Market Size for Extrusion Coating, By Type, 2017–2024 (USD Million)

Table 32 Rest of Europe: Market Size for Extrusion Coating, By Application, 2017–2024 (Kiloton)

Table 33 Rest of Europe: Market Size for Extrusion Coating, By Application, 2017–2024 (USD Million)

Table 34 Expansion, 2013–2019

Table 35 Merger & Acquisition, 2013–2019

Table 36 Joint Venture, 2013–2019

Table 37 New Product Launch, 2013–2019

List of Figures (28 Figures)

Figure 1 Europe Biodegradable Polymers Market for Extrusion Coating: Segmentation

Figure 2 Europe Biodegradable Polymers Market for Extrusion Coating: Research Design

Figure 3 Market Number Estimation

Figure 4 Europe Biodegradable Polymers Market for Extrusion Coating: Data Triangulation

Figure 5 PLA to Be the Largest Biodegradable Polymer for Extrusion Coating

Figure 6 Paper & Paperboard to Be the Largest Substrate Used for Extrusion Coating of Biodegradable Polymers Between 2019 and 2024

Figure 7 Rigid Packaging to Be the Largest Application of Biodegradable Polymers Used for Extrusion Coating Between 2019 and 2024

Figure 8 Italy to Register the Highest CAGR in the European Market

Figure 9 Packaging Applications to Drive the Demand for Biodegradable Polymers in Extrusion Coating Between 2019 and 2024

Figure 10 PLA to Be the Largest Segment of the Market

Figure 11 Paper & Paperboard and Italy Accounted for the Largest Shares

Figure 12 Rigid Packaging to Be the Largest Application Segment of the Market

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Biodegradable Polymers Market for Extrusion Coating

Figure 14 PLA to Be the Largest Segment of the Market

Figure 15 Paper & Paperboard to Be the Largest Segment of the Market

Figure 16 Flexible Packaging to Be the Fastest-Growing Application Segment

Figure 17 Europe: Snapshot for Biodegradable Polymers Market for Extrusion Coating

Figure 18 Companies Primarily Adopted New Product Launch as the Key Growth Strategy Between 2013 and 2019

Figure 19 Biodegradable Polymers Market for Extrusion Coating, 2018

Figure 20 Natureworks LLC: SWOT Analysis

Figure 21 BASF SE: Company Snapshot

Figure 22 BASF SE: SWOT Analysis

Figure 23 Total Corbion PLA: SWOT Analysis

Figure 24 Mitsubishi Chemical Holdings Corporation: Company Snapshot

Figure 25 Mitsubishi Chemical Holdings Corporation: SWOT Analysis

Figure 26 Biome Bioplastics: Company Snapshot

Figure 27 Biome Bioplastics: SWOT Analysis

Figure 28 Toray Industries: Company Snapshot

The study involved four major activities in estimating the current size of the European biodegradable polymers market for extrusion coating. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg Business Week, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

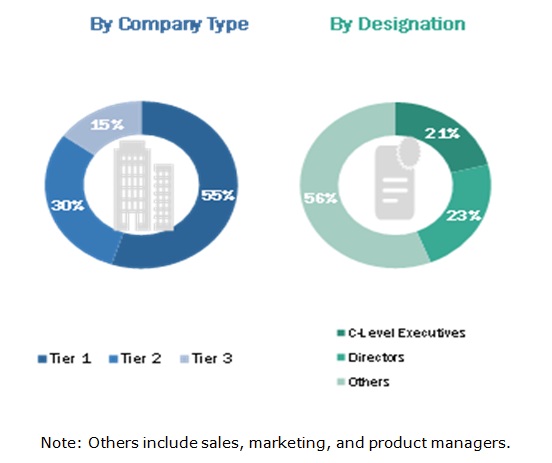

The biodegradable polymers market for extrusion coating comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side is characterized by the developments in the market. The supply side is characterized by market consolidation activities undertaken by the manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the biodegradable polymers market for extrusion coating in Europe. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the European biodegradable polymers market size for extrusion coating in terms of volume and value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key market players, along with extensive interviews of leaders, such as directors and marketing executives

Data Triangulation

After arriving at the European market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the biodegradable polymers market for extrusion coating.

Report Objectives

- To define, describe, and forecast the market size of the European biodegradable polymers market for extrusion coating in Europe, in terms of value and volume

- To identify and analyze the key drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define and segment the market size by type, substrate, and application

- To forecast the size of the European biodegradable polymers market for extrusion coating on the basis of countries in Europe

- To analyze the market opportunities and competitive landscape of the stakeholders and market leaders

- To analyze recent market developments and competitive strategies, such as expansion, acquisition, new product launch, agreement & joint venture, and partnership

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of country-level by type and end-use Industry

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Europe Biodegradable Polymers Market