Bio-lubricants Market by Base Oil (Vegetable oil, Animal fat), Application (Hydraulic oil, metalworking fluids, chainsaw oil, mold release agents, two-cycle engine oils, gear oils, greases), End-use, Region - Global Forecast to 2025

Updated on : January 30, 2023

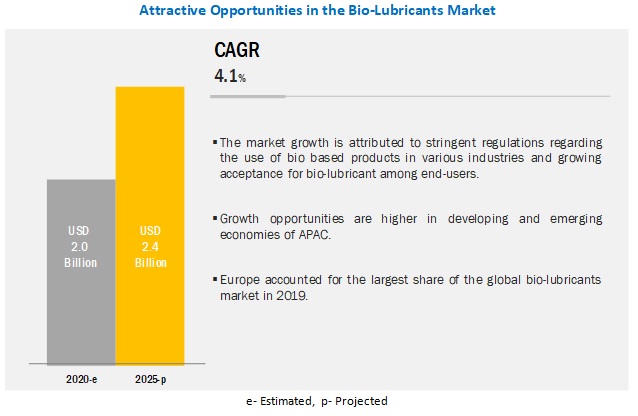

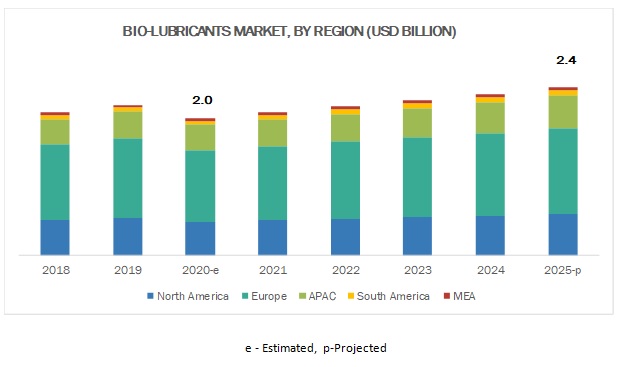

The global bio lubricants market size was valued at USD 2.0 billion in 2020 and is projected to reach USD 2.4 billion by 2025, growing at a cagr 4.1% from 2020 to 2025. The demand for bio-lubricants can be attributed to the growing environmental awareness, adoption of stringent regulations, and increasing acceptance of bio-lubricants in industries.

Vegetable base oil segment projected to lead bio-lubricants market from 2020 to 2025

On the basis of base oil, the vegetable oil segment is projected to be the largest market for bio-lubricants. The dominant market position of the vegetable oil segment can be attributed to its high biodegradability, less toxic, and high lubricity. The growth can also be attributed to the abundant availability of vegetable oil seeds which are used as raw materials.

Industrial segment estimated to be largest end user of bio-lubricants

The industrial segment includes the marine industry and agriculture & construction industry. These two industries are the largest consumers of bio-lubricants. Additionally, various regulations such as the vessel general permit (VGP) in the US and EcoLabel in Europe has made it mandatory to use bio-lubricants or environmentally accepted lubricants (EAL) in shipping vessels, which is driving the market.

Europe estimated to account for highest share of the global bio-lubricants market

The European region is projected to lead the global bio-lubricants market from 2020 to 2025. Stringent regulations and the ongoing transition towards bioeconomy in countries such as Germany, Italy, Nordic countries, Benelux, and France are promoting the use of bio-based chemicals such as bio-lubricants and biofuels in the region.

Bio Lubricants Market Players

Key players such ExxonMobil (US), Royal Dutch Shell (Netherlands), Total S.A (France), Cargill Inc. (US), BP (UK), FUCHS Group (Germany), and Panolin AG (Switzerland) have adopted various strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the bio-lubricants market.

Please visit 360Quadrants to see the vendor listing of Top Lubricants companies

Bio Lubricants Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 2.0 billion |

|

Revenue Forecast in 2025 |

USD 2.4 billion |

|

CAGR |

4.1% |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Base Oil, Application, End-Use, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa |

|

Companies covered |

ExxonMobil (US), Royal Dutch Shell (Netherlands), Total S.A (France), Cargill (US), BP (UK), Emery Oleochemicals (Malaysia), FUCHS Group (Germany), Panolin (Switzerland), Kluber Lubrication (Germany), and Binol Lubricants (Sweden) are the top 10 manufacturers are covered in the bio-lubricants market. |

This research report categorizes the biolubricants market based on base oil, application, end-use industry, and region.

By Base Oil:

- Vegetable oil

- Animal fat

- Others ( synthetic ester)

By Application:

- Hydraulic oil

- Metalworking fluids

- Chainsaw oil

- Mold release agents

- Two-cycle engine oils

- Gear oils

- Greases

- Others (transformer oils, refrigeration fluids, and textile machinery oils)

By End-use Industry:

- Industrial (marine, mining & metallurgy, energy & power, and food & pharmaceutical)

- Commercial Transport

- Consumer Automobile

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In March 2020, Royal Dutch Shell announced the expansion of the lubricant production facility located at Marunda Centre, Indonesia. After the expansion, the plant will be capable of 300-million-liter lubricant production

- In December 2019, FUCHS Group acquired 50% shares of three distributor companies based in Zimbabwe, Zambia, and Mozambique to enhance its presence in the sub-Saharan Africa region.

- In January 2018, ExxonMobil launched Mobil SHC Aware HS (Hydraulic System) Series hydraulic oils, which provides protection in challenging marine operating environments and meet VGP requirements for EAL. This will provide the company with a competitive advantage over others in the bio-lubricants market in the marine application segment.

Key Questions Addressed in the Report:

- What are the global trends in the bio-lubricants market? Would the market witness an increase or decline in demand in the coming years?

- What is the estimated demand for the different types of bio-lubricants?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for bio-lubricants?

- What are the new revenue pockets for suppliers?

- Who are the major players in the biolubricants market globally?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1. Objectives of the Study

1.2. Market Definition

1.3. Market Scope

1.4. Currency

1.5. Package Size

1.6. Limitation

1.7. Stakeholders

1.8. Summary of Change

2 Research Methodology

2.1. Research Data

2.1.1. Secondary Data

2.1.1.1. Key Data From Secondary Sources

2.1.2. Primary Data

2.1.2.1. Key Data From Primary Sources

2.1.2.2. Key Industry Insights

2.1.2.3. Breakdown of Primary Interviews

2.2. Market Size Estimation

2.2.1. Bottom-Up Approach

2.2.2. Top-Down Approach

2.3. Data Triangulation

2.4. Assumptions

3 Executive Summary

4 Market Overview

4.1. Introduction

4.2. Global Market Size Analysis and Forecast

4.3. Forecast Impact Factors

4.3.1. Impact of Covid19 on the industry

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Challenges

4.4.4. Opportunity

4.5. Porter’s Five Forces

4.6. Supply Chain and Value Chain Analysis

4.7. Regulation

4.8. Patent Analysis

4.9. Ecosystem/Market Map

4.10. Average Selling Price Trend

4.11. Cost Structure Analysis

5 Bio-lubricants Market, By Base Oil Type – Forecast till 2025

5.1. Introduction

5.2. Vegetable Oils

5.2.1. Rapeseed

5.2.2. Canola

5.2.3. Sunflower

5.2.4. Palm oil

5.2.5. Others

5.3. Animal Fats

5.4. Others

6 Biolubricants Market, By Application – Forecast till 2025 (Volume and Value)

6.1. Introduction

6.2. Hydraulic Fluids

6.3. Metalworking Fluids

6.4. Chainsaw Oils

6.5. Mold Release Agents

6.6. Two-Cycle Engine Oils

6.7. Gear Oils

6.8. Greases

6.9. Others

7 Biolubricants Market, By End Use – Forecast till 2025 (Volume and Value)

7.1. Introduction

7.2. Industrial

7.2.1. Marine

7.2.2. Foods & pharmaceuticals

7.2.3. Energy & Power

7.2.4. Mining & Metallurgy

7.2.5. Others

7.3. Commercial Transport

7.4. Consumer Automobile

8 Bio-lubricants Market, By Region – Forecast till 2025 (Volume and Value)

8.1. Introduction

8.2. Supply-Demand Scenario

8.3. Average Selling Price Trend (2015-18)

8.4. North America

8.4.1. The US

8.4.2. Canada

8.4.3. Mexico

8.5. Europe

8.5.1. Germany

8.5.2. NORDIC

8.5.3. Italy

8.5.4. BENELUX

8.5.5. Switzerland

8.5.6. Rest of Europe

8.6. Asia Pacific

8.6.1. China

8.6.2. Japan

8.6.3. India

8.6.4. South Korea

8.6.5. Malaysia

8.6.6. Indonesia

8.6.7. Rest of Asia-Pacific

8.7. South America

8.7.1. Brazil

8.7.2. Argentina

8.7.3. Rest of South America

8.8. Middle East & Africa

8.8.1. Egypt

8.8.2. South Africa

8.8.3. Rest of the Middle East & Africa

9 Competitive Landscape

9.1. Overview

9.2. Industry Structure / Market Share* Analysis (Consolidate/ Fragmented, Tier Structure, etc.)

9.3. Expansion

9.4. Merger & Acquisition

9.5. Joint Venture

9.6. Agreement

9.7. Investment

10 Company Profiles

(Business Overview, Financial^, Products & Services, Production capacities, Key Strategy, and Developments)

10.1. Royal Dutch Shell Plc

10.2. Total SA

10.3. Chevron Corporation

10.4. BP Plc

10.5. Albemarle Corporation

10.6. Fuchs Petrolub AG

10.7. Panolin AG

10.8. Klüber Lubrication München Se & Co. Kg

10.9. Emery Oleochemicals

10.10. Binol Lubricants

10.11. Rsc Bio Solutions

10.12. Carl Bechem

10.13. Igol Lubricants

10.14. Biona Jersín S.R.O.

10.15. Vickers Oil

10.16. Kajo Chemie

10.17. Renewable Lubricants

10.18. Polnox Corporation

10.19. Magna Group

10.20. Green Earth Technologies Inc.

10.21. Rowe Mineralolwerk Gmbh

10.22. Balmer Lawrie

10.23. Advonex International

10.24. Mint Biofuels Ltd

Note:

The above list of suppliers is indicative will be updated during the course of research

*best effort basis

^Financial will be available for listed companies

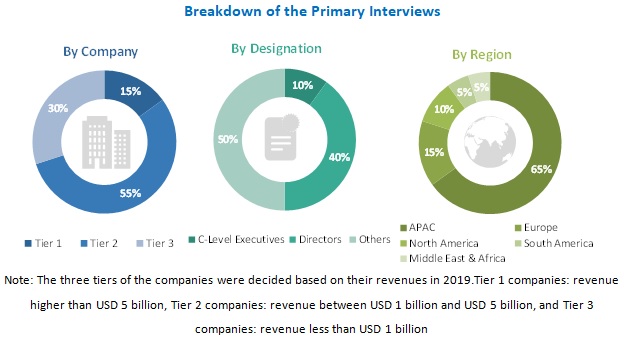

The study involved four major activities for estimating the current size of the global bio-lubricants market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of bio-lubricants through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the bio-lubricants market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Bio-lubricants Market Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the bio-lubricants market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies; trade directories; and databases.

Bio-lubricants Market Primary Research

Various primary sources from both the supply and demand sides of the bio-lubricants market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the bio-lubricants industry. The primary sources from the demand-side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Bio-lubricants Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global bio-lubricants market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Bio-lubricants Market Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the bio-lubricants market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Bio-lubricants Market Report Objectives

- To define, analyze, and project the size of the bio-lubricants market in terms of value and volume based on base oil type, application, end-use, and region

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the bio-lubricants market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Bio-lubricants Market Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the bio-lubricants report:

Bio-lubricants Market Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Bio-lubricants Market Regional Analysis

- Further analysis of the bio-lubricants market for additional countries

Bio-lubricants Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Bio-lubricants Market