Lubricants Market

Lubricants Market by Base Oil Type (Mineral Oil Lubricant, Synthetic Lubricants, Bio-based Lubricants), Product Type (Engine Oil, Turbine Oil, Metalworking Fluid, Hydraulic Oil), End-use Industry (Transportation and Industrial) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

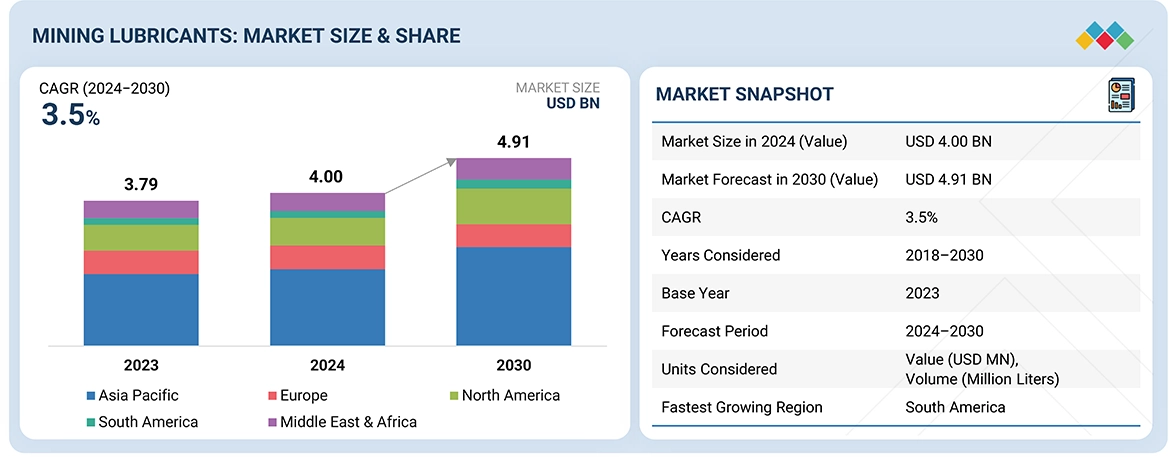

The global mining lubricants market is projected to grow from USD 4.00 billion in 2024 to USD 4.91 billion by 2030, at a CAGR of 3.5% during the forecast period. Mining lubricants are used to minimize the resistance, wear, and temperature in heavy-duty mining equipment, ensuring operational efficiency, equipment longevity, and downtime reduction. Their use results in the smooth functioning of mining equipment in underground and surface mining techniques. These lubricants are categorized into mineral oil-based and synthetic lubricants, where mineral oil-based are cost-effective and commonly used, while synthetic ones have superior performance in extreme conditions. Gear oil & grease, hydraulic oil, engine oil, and transmission oil are their product types, which are essential for functioning the machines used in the mining industry. Mining lubricants are used in multiple end-use industries, including coal mining, iron ore mining, bauxite mining, rare earth mineral mining, precious metals mining, and other end-use industries. The rising demand for higher power-rated mining equipment with larger sump sizes, increasing mining activities, and the shift toward sustainable, eco-friendly lubricants are expected to drive the mining lubricants market.

KEY TAKEAWAYS

-

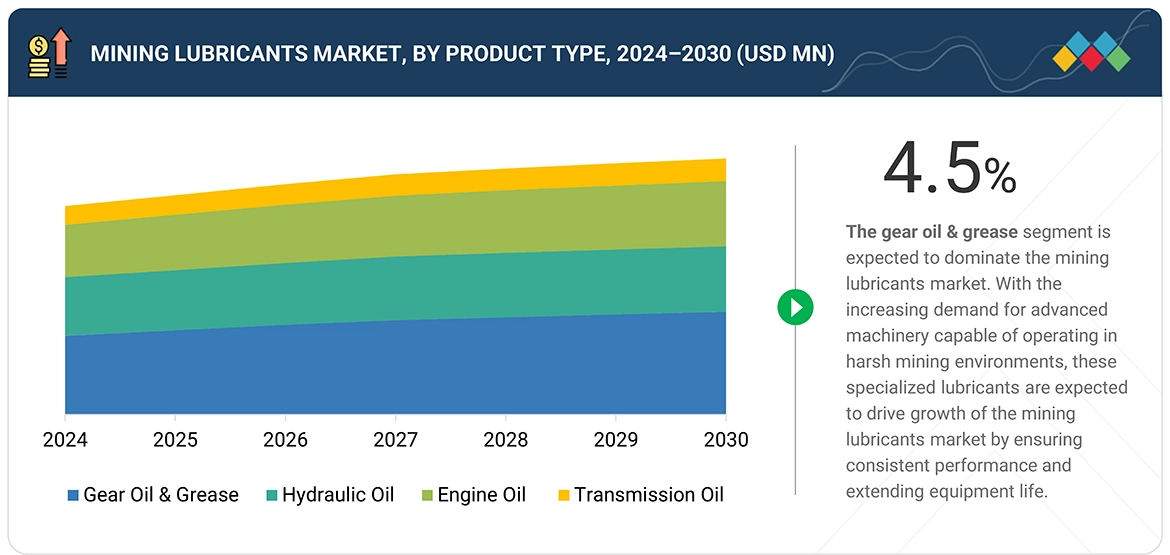

BY PRODUCT TYPEThe mining lubricants market, by product type, has been segmented into engine oil, hydraulic oil, transmission oil, and gear oil & grease. The diverse range of mining lubricants caters to the unique demands of different equipment, ensuring optimal performance and productivity in harsh mining environments.

-

BY MINING TECHNIQUESThe mining lubricants market, by mining techniques, has been segmented into surface mining and underground mining. While underground mining entails reaching mineral resources beneath the surface of the Earth, surface mining entails removing minerals from the Earth’s surface. The need for specialized mining lubricants, coupled with the increasing complexity and depth of underground mining operations, significantly drives the demand for high-performance mining lubricants in the underground mining segment.

-

BY LUBRICANT TYPEThe mining lubricants market, by lubricant type, has been segmented into mineral oil and synthetic lubricants. Synthetic lubricants are advanced lubrication solutions designed to enhance performance in various industrial applications, including mining. Using synthetic lubricants in mining machinery, like gearboxes and hydraulic systems, increases equipment durability, lower maintenance costs, and longer oil change intervals. Their ability to perform well at high and low temperatures further contributes to their effectiveness in maintaining machinery efficiency.

-

BY END-USE INDUSTRYThe mining lubricants market, by end-use industry, has been segmented into coal mining, iron ore mining, bauxite mining, rare earth mineral mining, precious metals mining, and others. The market for mining lubricants is expected to be significantly influenced by the coal mining sector as businesses look for efficient lubrication solutions to increase operating efficiency and reduce downtime. This is due to the growing demand for coal, driven by energy needs and industrial uses.

-

BY REGIONThe mining lubricants market has been segmented into Asia Pacific, Europe, North America, the Middle East & Africa, and South America. The growth of the mining industry, coupled with increasing demand for higher power-rated mining equipment with larger sump size, is expected to drive the mining lubricants market.

-

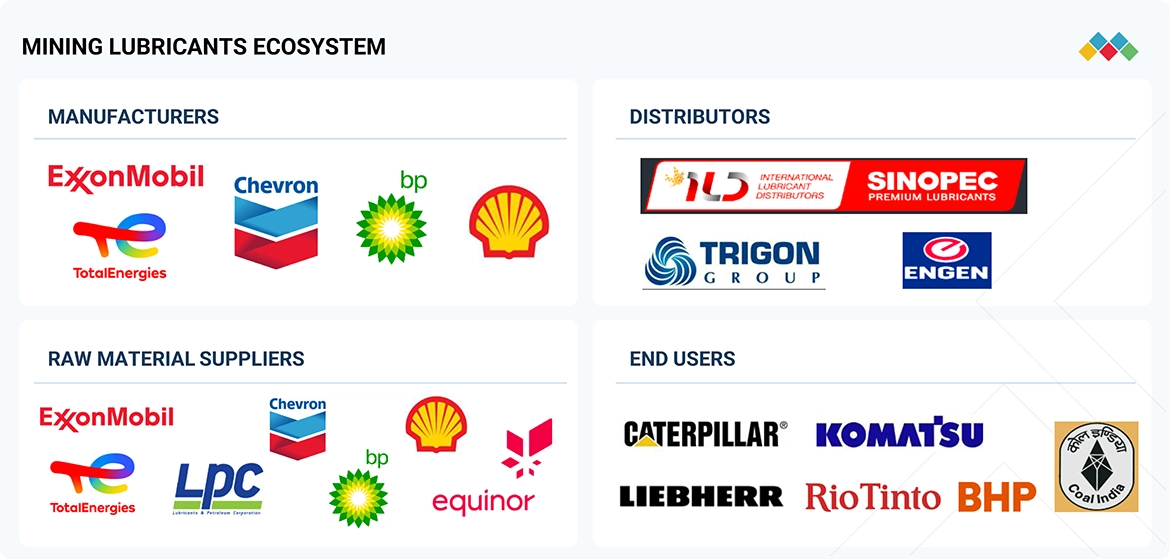

COMPETITIVE LANDSCAPEExxon Mobil Corporation (US), TotalEnergies SE (France), Shell plc (UK), Chevron Corporation (US), BP p.l.c. (UK), Idemitsu Kosan Co., Ltd. (Japan), FUCHS (Germany), Quaker Chemical Corporation (US), LUKOIL (Russia), and Whitmore Manufacturing LLC (US) are some of the leading manufacturers of mining lubricants. They focus on expanding their geographic reach to meet consumer demand. These companies have adopted acquisitions, agreements, and expansions to acquire new projects, strengthen their product & service portfolios, and tap into untapped markets.

Mining lubricants are specialized products designed to enhance the performance and longevity of machinery used in mining operations, which often face extreme conditions. These lubricants are categorized into various product types, including gear oils, hydraulic fluids, engine oils, transmission fluids, and greases. They serve multiple end-use industries such as coal mining, iron ore mining, and bauxite mining. Their applications range from reducing friction and wear in heavy machinery to preventing corrosion and ensuring smooth hydraulic operations. Key functions include improving equipment reliability, minimizing downtime, and boosting operational efficiency, making them essential for both surface and underground mining activities. The growth of this market is driven by the growth of mining industry, increased demand for specialized lubricants for high-performance machinery, increasing demand for higher power-rated mining equipment with larger sump size, and impact of change in US presidency on the mining industry.

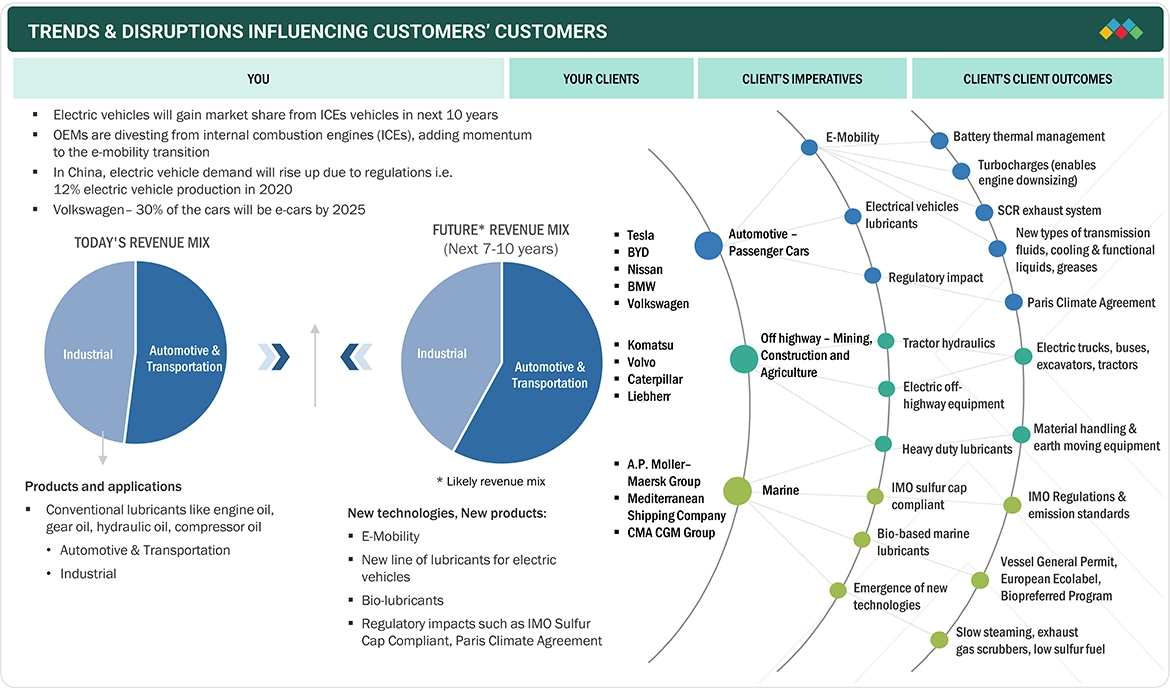

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The mining lubricants market is undergoing rapid expansion, driven by the increased demand for specialized lubricants for high-performance machinery. The growth of end-use industries, such as coal mining, iron ore mining, bauxite mining, rare earth mineral mining, and precious metals mining, leads to the growing demand for mining lubricants. These end-use industries use mining lubricants such as engine, hydraulic, gear, grease, and transmission oil. These lubricants help improve workability, sealing & protection, corrosion prevention, strength, and safety, reducing maintenance cost, time, and friction & wear. These megatrends are expected to drive growth and increase the revenue of the mining lubricants market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding mining industry

-

Increased demand for specialized lubricants for high-performance machinery

Level

-

Volatility in raw material prices

-

High costs of synthetic mining lubricants

Level

-

Supportive government policies related to modernize and boost mining activities

-

Growing demand for bio-based and biodegradable mining lubricants

Level

-

Electrification of mining machinery

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding mining industry, increased demand for specialized lubricants for high-performance machinery, rising demand for higher power-rated mining equipment with larger sump size, and impact of changing US energy policy on mining industry

The expanding mining industry is the major driver for the mining lubricants market. Rising extraction and exploration activities are creating significant demand for specialized mining lubricants to improve the performance and longevity of mining machinery. As demand for coal, iron ore, copper, gold, and rare earth minerals is increasing, so are investments by mining companies in modern machinery that require high-performance lubricants capable of operating under severe conditions, minimizing wear, and improving overall efficiency. Moreover, the rising number of surface and underground mining projects, primarily in Asia Pacific, South America, and Africa, is significantly driving the global demand for mining lubricants. Besides the expanding mining industry, several other factors drive the market’s growth. The formulation of synthetic and bio-based lubricants through advanced technology leads to equipment efficiency while complying with environmental standards. Additionally, the rising demand for larger sump sizes in advanced and high-power-rated mining equipment is also one of the significant drivers of this market. Market expansion continues because business entities in Europe and North America follow environmental regulations requiring the adoption of environmentally friendly biodegradable lubricants. Mining operators are now investing in high-quality lubricants to enhance performance and reduce fuel usage because they need longer maintenance times coupled with minimal equipment downtime. The combination of all of these factors is expected to drive the mining lubricants market.

Restraints: Volatility in raw material prices, and high costs of synthetic mining lubricants

The volatility in raw material prices significantly impacts the market growth of the mining lubricants market. Mining lubricants are mainly composed of base oils and additives sourced from crude oil and other petroleum-based raw materials. These crude oil prices often undergo fluctuations due to various factors, including supply chain disruptions, changing global demands, production cuts by oil-producing nations, and geopolitical tensions. Thus, any changes in crude oil prices directly impact mining lubricants’ prices. This volatility in the prices of mining lubricants often leads to financial uncertainty for the mining companies and lubricants manufacturing companies, and this makes it difficult for them to maintain a long-term procurement strategy and stable pricing strategy. This volatility in raw material prices eventually forces mining lubricant manufacturers to modify their prices often, which impacts demand from cost-sensitive mining operations. Moreover, the high costs of synthetic mining lubricants also significantly restrain the growth of the mining lubricants market. Although synthetic mining lubricants offer enhanced properties compared to mineral-based mining lubricants, like thermal stability, oxidation resistance, and extended drainage intervals, the high costs make buying them difficult for small companies or companies operating on strict budgets. These high costs, clubbed with the changing raw material prices, result in reduced demand for mining lubricants, and thus, this restricts the growth of the mining lubricants market.

Opportunity: Supportive government policies related to modernize and boost mining activities, growing demand for bio-based and biodegradable mining lubricants, and extended drainage intervals of high-performance lubricants

The growing demand for bio-based and biodegradable mining lubricants is acting as a significant opportunity for growth in the mining lubricants market, and it is mainly influenced by the rising levels of environmental awareness and by the stringent regulations related to the emissions and disposal of mining lubricants. In comparison to conventional mineral-based mining lubricants, bio-based and biodegradable mining lubricants often offer better lubricating properties, reduced toxicity, and enhanced biodegradability as these biodegradable mining lubricants are sourced from renewable resources like esters and vegetable oils. This shift from conventional to biodegradable and bio-based mining lubricants is especially important in areas with stringent environmental protection regulations, which, as a result, push mining lubricant manufacturers to invest in green lubricants, and this further acts an opportunity for growth in the mining lubricants market. Apart from this, several other factors act as opportunities for growth in the mining lubricants market, including extended drainage intervals of high-performance lubricants and supportive government policies. Advanced mining lubricants have higher thermal stability and longer lifespans than conventional mining lubricants. Due to this property, there is a reduction in the frequency of mining lubricant changes, which further results in the reduction of equipment downtime as well as maintenance expenses. Mining companies increasingly prefer these lubricants to reduce overall costs and increase operational efficiency, thus driving the mining lubricants market. Moreover, supportive government policies meant to boost mining activities and modernize mining equipment are further boosting the mining lubricants market. Multiple nations are increasing investments in exploratory projects and are formulating policies to boost production. Thus, These government initiatives increase demand for high-quality lubricants that can facilitate effective and sustainable mining activities. Together, these factors act as significant growth opportunities for the mining lubricants market.

Challenge: Electrification of mining machinery

Electrification of mining machinery poses a significant challenge to the growth of the mining lubricants market. This is because the mining sector is gradually moving toward energy-efficient and environmentally friendly solutions. Multiple mining companies are investing in electric and battery-powered mining machinery to reduce their dependence on diesel engines, as diesel engines are the major consumers of mining lubricants. This increasing investment is also a response to the rising concerns related to environmental sustainability and carbon emissions. The electrification of mining machinery poses a challenge to the growth of the mining lubricant market as electric trucks, drills, and loaders use comparatively lesser amounts of mining lubricant product types, including engine, transmission, and hydraulic oils. Moreover, the adoption of electric mining machinery is further accelerated by government bodies worldwide that promote the usage of low-emission mining machinery and formulate stringent emission regulations. Numerous mining corporations have also set zero-emission fleet targets for the coming decades, which further drive the viability of electric mining machinery driven by the advancements in battery technology and charging infrastructure. Not only will the electrification of mining machinery reduce the demand for mining lubricants, but the electric mining machinery is also expected to require specialized lubrication solutions that differ from the conventional ones. For instance, electric mining machinery will require synthetic greases for electrical components and cooling fluids for battery systems. This changing market demand will force the mining lubricant manufacturers to invest in new formulations and compel them to enhance their product offerings, thus decreasing the demand for conventional mining lubricants.

lubricants-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides advanced synthetic gear and engine lubricants for large haul trucks, draglines, and shovels operating under extreme temperatures and loads. | Reduces friction, offering superior thermal/oxidation stability and extended oil drain intervals, leading to fewer oil changes and lower maintenance/labor costs. |

|

Provides specialized engine and hydraulic lubricants formulated to combat high levels of dust, dirt, and water contamination common in earthmoving and quarry operations. | Ensures robust anti-wear properties and corrosion protection, maintaining high machine efficiency and reliability in highly contaminated, harsh environments. |

|

Offers high-quality gear and transmission oils for the specialized gear systems in continuous mining equipment, conveyors, and ultra-class trucks. | Delivers specific characteristics like high shear stability and anti-scuffing protection to maximize power transfer and equipment performance, reducing energy loss. |

|

Provides a full suite of oils (gear, hydraulic, engine) and greases engineered for high load-carrying capacity and performance across a wide temperature range, including arctic climates. | Offers exceptional thermal and oxidation stability, extended drain capabilities, and Extreme Pressure (EP) protection to maximize equipment life in severe service and minimize unscheduled maintenance. |

|

Provides high-performance greases and oil analysis services for heavily loaded plain and anti-friction bearings, especially those subject to shock loading and wet environments. | Superior EP properties provide extra wear protection, while predictive services help anticipate potential failures, reduce maintenance expenditures, and extend oil service intervals. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The mining lubricants market ecosystem consists of raw material suppliers, manufacturers, and end users. Prominent companies in this market include well-established and financially stable manufacturers of mining lubricants. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Exxon Mobil Corporation (US), TotalEnergies SE (France), Shell plc (UK), Chevron Corporation (US), and BP p.l.c. (UK).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Mining Lubricants Market, By Product Type

Gear oil & grease is estimated to be the fastest-growing segment of the global mining lubricants market during the forecast period. This segment’s high growth can be attributed to its significant role in protecting heavy-duty mining machinery from extreme conditions such as heavy loads, dust, and continuous operations encountered while carrying out mining activity. Gear oils and greases are specifically formulated to provide enhanced protection against corrosion, oxidation, and wear, thus guaranteeing the smooth operation of mining equipment bearings, moving components, and gears. Moreover, the segment’s expansion is driven by the growing use of high-load and high-power mining machinery that needs specialized lubrication solutions. Heavy-duty mining machinery, including draglines, haul trucks, loaders, and excavators, rely on gear oils and greases to maintain longevity and operate efficiently. The demand for gear oils and greases that have improved thermal stability and longer-lasting performance is further fueled by the shift toward extended maintenance intervals and larger sump sizes. Additionally, developments in synthetic mining lubricants are further boosting the segment’s demand as it has produced gear oils and greases with increased efficiency, reduced friction, and improved viscosity. The rising emphasis on reducing downtime and lowering maintenance expenses further drives the market.

Mining Lubricants Market, By Lubricant Type

Synthetic lubricants is estimated to be the fastest-growing segment of the global mining lubricants market during the review period, primarily because of their superior performance features compared to conventional mineral-based mining lubricants. Synthetic lubricants are the ideal lubrication solutions for demanding conditions encountered during mining operations as these offer enhanced thermal stability, improved oxidation resistance, higher viscosity index, and better protection against corrosion and wear. These lubricants offer enhanced performance in extreme conditions like heavy loads, continuous operations, and high temperatures. The demand for synthetic mining lubricants is also rising due to the growing demand for effective and long-lasting lubrication solutions required for the efficient functioning of high-performance mining machinery. Synthetic lubricants provide higher operational efficiency and reduce downtime for mining companies as their usage helps reduce maintenance costs, enhance drainage intervals, and improve fuel efficiency. Moreover, as mining companies emphasize enhancing sustainability and decreasing the failure rates of mining machinery, the demand for synthetic lubricants is increasing as synthetic lubricants have less environmental impact and offer longer service life. This demand is further accelerated due to the rising emphasis of mining companies on biodegradable and low-toxicity synthetic mining lubricants due to stringent environmental regulations in various nations. Overall, synthetic lubricants act as a key driver of the mining lubricants market, which is driven by the growing demand for high-performance lubricants in modern mining processes.

REGION

South America is to be the fastest-growing region in global mining lubricants market during forecast period

South America is expected to register the highest CAGR in the mining lubricants market due to the growing investments in exploration activities, rising mining operations, and increasing demand for minerals and metals. Brazil, Chile, and Peru are some of the leading manufacturers of important minerals like iron ore, gold, copper, and lithium, thus driving the demand for high-performance mining lubricants utilized in heavy mining machinery while extracting these metals and minerals. The region’s mining lubricants consumption is increasing due to the growing focus on discovering unexplored mineral sources and developing massive mining projects. The mining lubricants market in South America is also growing due to expanding mining operations to meet the growing global demands for metals and minerals. For instance, Brazil is among the leading exporters of iron ore, and while exporting iron ore to meet global demands, Brazil utilizes high volumes of mining lubricants to maintain equipment efficiency and reduce the downtime of mining machinery. Moreover, the number of mining operations has also increased in the region due to the region’s supportive government policies like tax breaks and policies that help in infrastructure development for mining activities. As these mining operations expand, so does the need for effective lubricating solutions that enhance mining machinery performance and longevity. Furthermore, these rising mining activities also lead to a rise in the usage of mining lubricants as these lubricants help protect the mining machinery from corrosion, oxidation, high temperatures, and wear and tear.

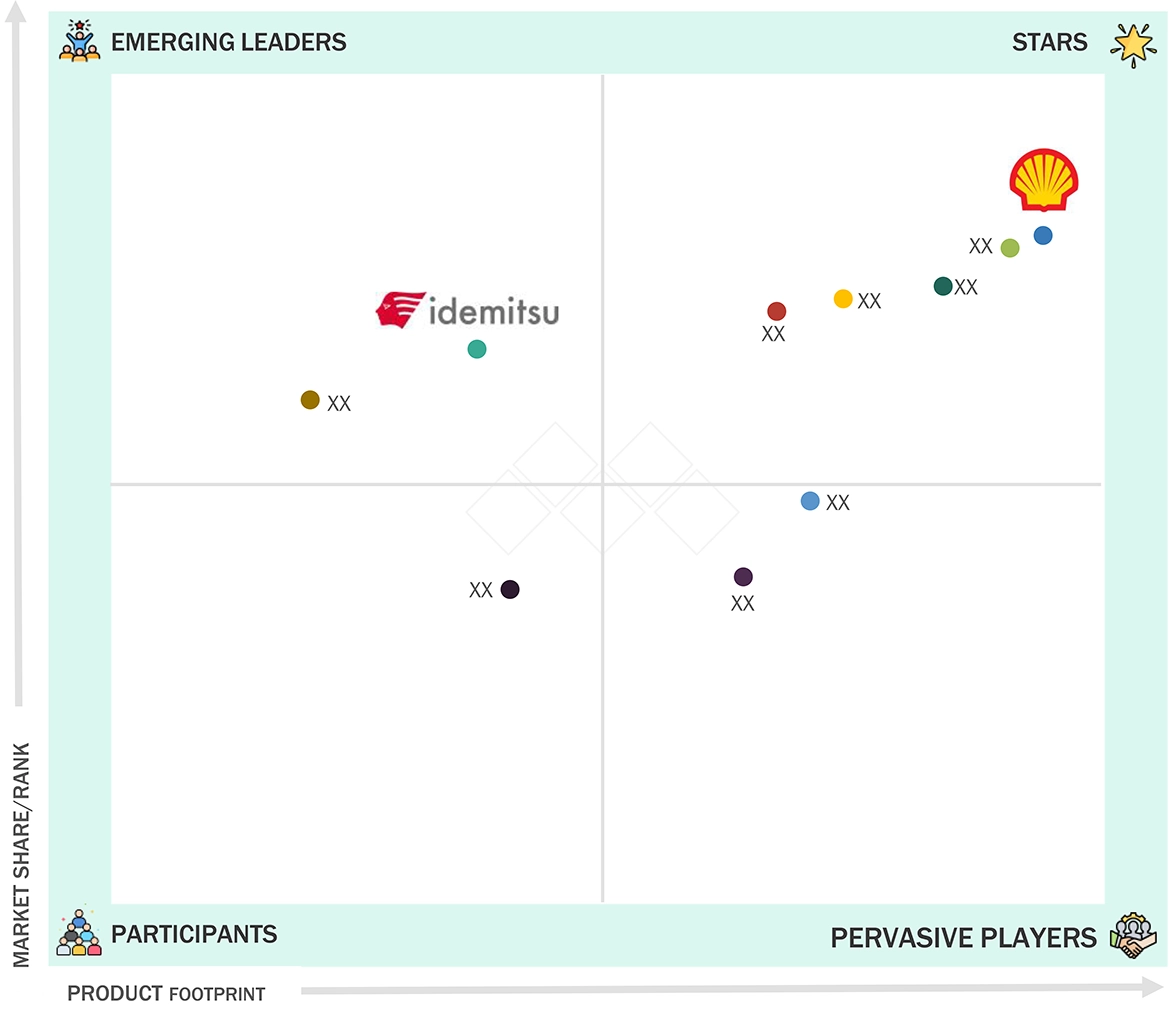

lubricants-market: COMPANY EVALUATION MATRIX

In the mining lubricants market matrix, Shell plc and Idemitsu Kosan Co., Ltd. are some of the leading players in this market. Shell plc stands as a dominant 'Star' in the global lubricants market, leveraging its extensive vertically and horizontally integrated structure, which includes four base oil manufacturing plants, 32 blending plants, and a presence in over 100 countries to supply lubricants for heavy-duty sectors like mining through its Marketing business segment. Shell further solidifies its market leadership through strategic actions, such as the January 2021 joint venture with Whitmore Manufacturing to offer multi-sector expertise, and the December 2022 acquisition of TFH Reliability Group (parent of Allied Reliability Inc.) to combine lubricants with advanced reliability services, ensuring comprehensive solutions for North American clients. In contrast, Idemitsu Kosan Co., Ltd. is positioned as an 'Emerging Player,' actively expanding its Functional Materials segment, which includes industrial lubricants and grease, and boasts a global subsidiary presence across Asia Pacific, Europe, and the Americas. The company has made significant capital investments to boost its global capacity, notably establishing a new company in the Philippines in June 2019 and starting construction on a major new lubricant production facility (120,000 kiloliters/year capacity) in Huizhou, China, in the same month, signaling its strong intent to capture greater share in the industrial and mining lubricant sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.00 BN |

| Market Forecast in 2030 (value) | USD 4.91 BN |

| Growth Rate | CAGR 3.5% from 2024-2030 |

| Years Considered | 2018-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD MN), Volume (Million Liters) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

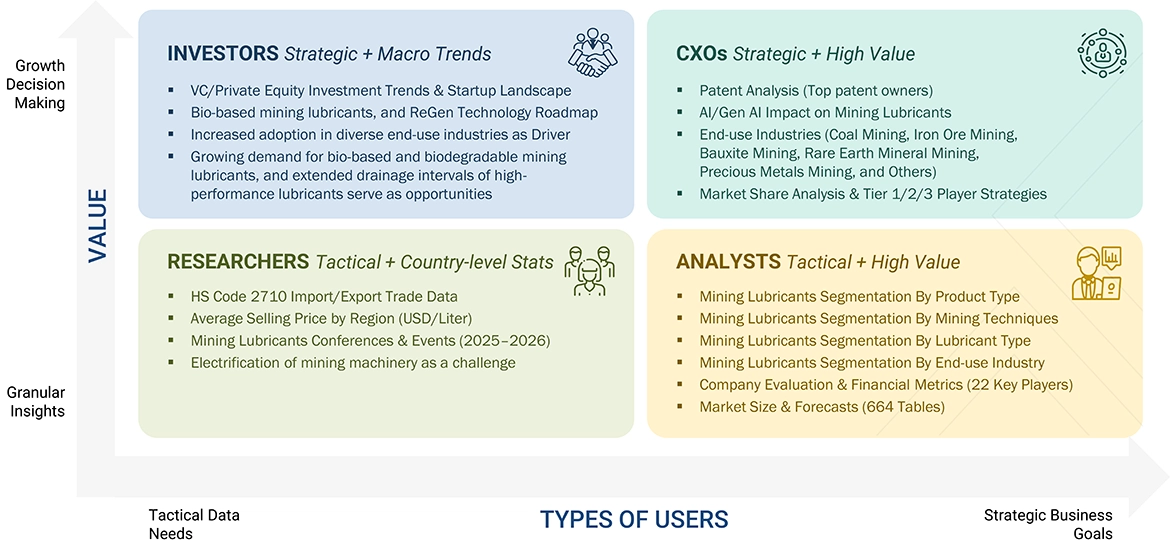

WHAT IS IN IT FOR YOU: lubricants-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Mining Equipment OEMs |

|

|

| Mining Operators |

|

|

| Mining Lubricant Manufacturers |

|

|

| Industrial Lubricant Distributors & Dealers |

|

|

| Mining Services & Maintenance Contractors |

|

|

| Regional Mining Associations / Regulatory Bodies |

|

|

RECENT DEVELOPMENTS

- November 2024 : FUCHS announced the acquisition of STRUB & Co. AG. STRUB & Co. AG develops, produces, and distributes industrial lubricants and specialty products for the Swiss market. With the successful acquisition of STRUB, FUCHS is securing direct market access in Switzerland, combining all Swiss business activities and expanding its presence with a research and production plant.

- May 2024 : Exxon Mobil Corporation announced the acquisition of Pioneer Natural Resources Company. The merger of Exxon Mobil and Pioneer created an Unconventional business with the largest, high-return development potential in the Permian Basin. The combined company’s net acres of more than 1.4 million in the Delaware and Midland basins are an estimated 16 billion barrels of oil equivalent resource. This development will help Exxon Mobil to double its production volume to 1.3 million barrels of oil equivalent per day.

- April 2024 : FUCHS Group signed an agreement to acquire the LUBCON Group, to jointly develop superior specialty lubrication solutions. LUBCON Group has many years of experience and knowledge in creating, producing, marketing, and distributing greases, oils, and pastes.

- December 2022 : Pennzoil-Quaker State Company d/b/a SOPUS Products, a wholly owned subsidiary of Shell USA, Inc. (Shell) that comprises Shell’s US lubricants business, signed an agreement to acquire 100% of TFH Reliability Group, LLC, the parent company of Allied Reliability Inc. The acquisition is anticipated to improve Shell’s presence in the North American market by offering clients complete solutions that combine lubricants with advanced reliability services.

- June 2019 : Idemitsu Kosan Co., Ltd. established a new company, Idemitsu Lubricants Philippines Inc., to expand its lubricant business in the country. It will leverage its relationship with Japanese automotive OEMs, which are present in the Philippines.

Table of Contents

Methodology

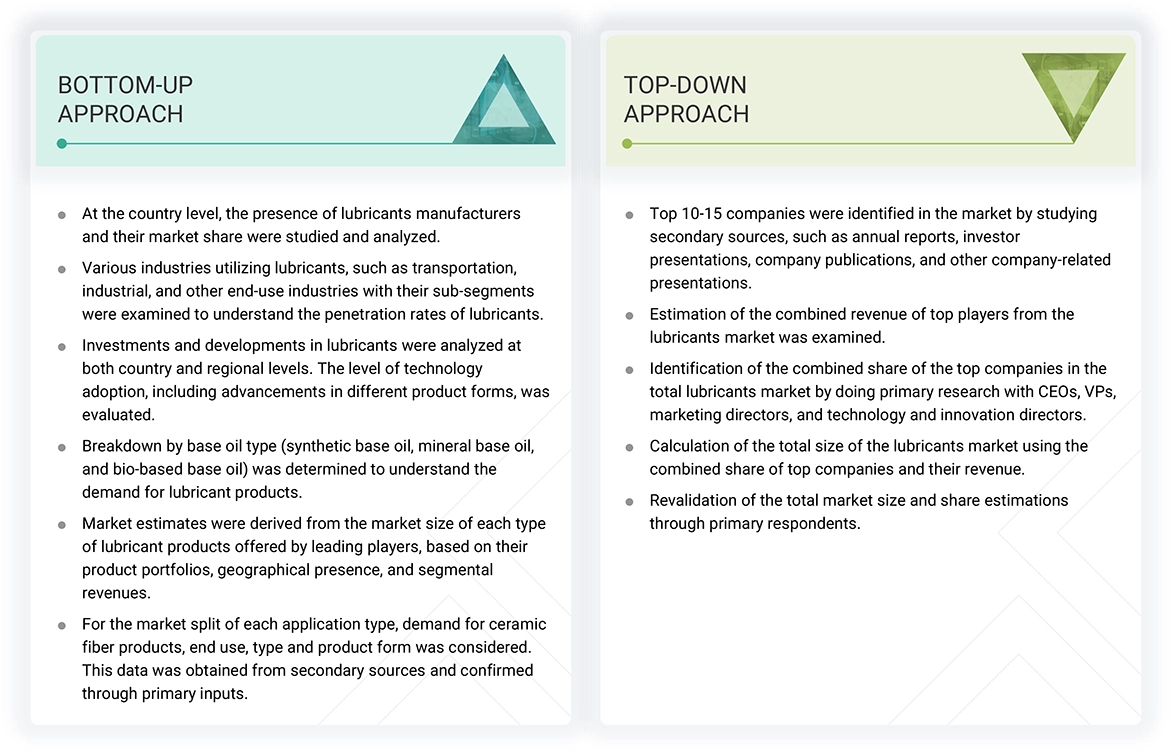

The study involved four major activities in estimating the lubricants market size. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

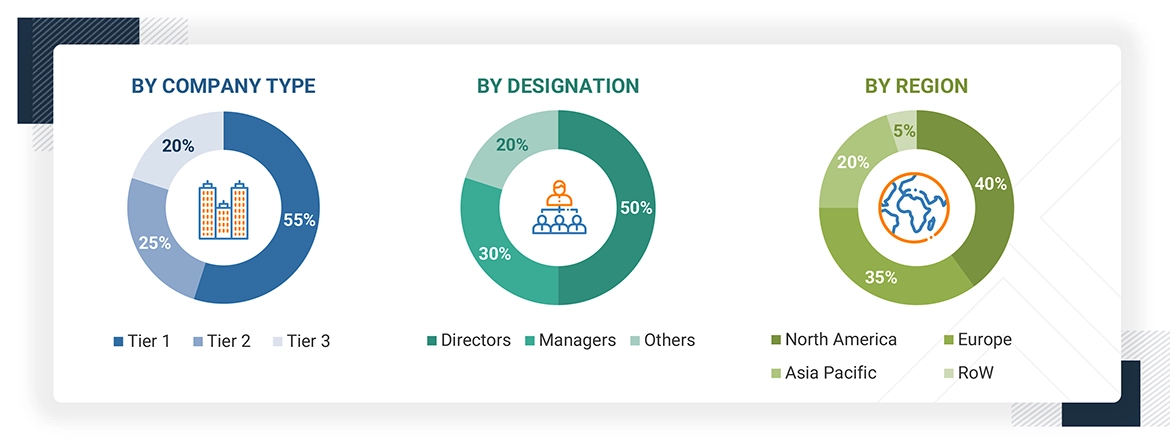

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below.

Primary Research

The lubricants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by engine oil, turbine oil, gear oil, grease, hydraulic oil, compressor oil, metalworking fluid, and others. Advancements in technology and diverse application industries characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown Of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Exxon Mobil Corporation | Senior Manager | |

| Shell plc | Innovation Manager | |

| Indian Oil Corporation Limited | Vice-president | |

| BP p.l.c. | Production Supervisor | |

| Chevron Corporation | Sales Manager | |

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the lubricants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following parameters:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the lubricants industry.

Market Definition

The lubricants market encompasses a range of substances engineered to diminish friction between surfaces, thereby reducing heat generation and facilitating the transmission of forces during movement. These substances also serve to transport foreign particles and regulate surface temperatures. Employed across diverse applications, from industrial machinery and cooking to bioapplications such as artificial joints, medical procedures, and intimate relations, lubricants are pivotal in mitigating friction, wear, heat generation, noise, and vibrations within mechanical systems.

Stakeholders

- Lubricants manufacturers

- Lubricants suppliers

- Raw material suppliers

- Service providers

- Application sector companies

- Government bodies

Report Objectives

- To define, describe, and forecast the lubricants market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by base oil type, product type, end-use industry, and region

- To forecast the size of the market for five main regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To strategically profile key players and comprehensively analyze their growth strategies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Lubricants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Lubricants Market