Biostimulants Market

Biostimulants Market by Active Ingredients (Humic Substances, Seaweed Extracts, Amino Acids, Minerals & Vitamins), Crop Type, Mode of Application (Foliar treatment, Soil treatment, Seed treatment), Form, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The biostimulants market is projected to expand from USD 4.46 billion in 2025 to USD 7.84 billion by 2030, at a CAGR of 11.9% during the forecast period. Biostimulants play a significant role in modern agriculture by enhancing crop productivity and quality, thereby meeting the rising demand for food. With the global population anticipated to reach 10 billion by 2050, crop production needs to increase dramatically; hence, biostimulants have become essential to ensure sustainable food production.

KEY TAKEAWAYS

- Europe dominated the biostimulants market, accounting for a 40.5% share in 2024.

- By active ingredient, the microbial amendment segment is expected to register the highest CAGR of 13.0%.

- By form, the liquid segment is projected to grow at the fastest rate from 2025 to 2030.

- By mode of application, the seed treatment segment is expected to grow at the fastest rate during the forecast period.

- By crop type, the fruits & vegetables segment is expected to dominate the market, growing at the highest CAGR of 12.3%.

- Syngenta Group, Corteva, UPL, and Sumitomo Chemical Co., Ltd. are recognized as the star players in the biostimulants market, due to their emphasis on innovation, extensive industry coverage, and strong operational and financial capabilities.

- Cascadia Seaweed, Aminocore, AlgaEnergy, and Kelpak have distinguished themselves among startups and SMEs due to their strong product portfolios and business strategies.

The biostimulants market is driven by the growing demand for sustainable agricultural practices that aim to enhance crop productivity while minimizing environmental impact. Increasing concerns over soil degradation, climate change, and the harmful effects of chemical fertilizers and pesticides have accelerated the adoption of biostimulants as eco-friendly alternatives. Additionally, rising consumer preference for organic and residue-free agricultural products, advancements in microbial and seaweed-based biostimulant formulations, and expanding applications across various crops, including herbaceous field crops, are fueling market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of biostimulant manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising sustainable agriculture

-

Growth in organic food consumption

Level

-

Commercialization of low-quality biostimulant products

-

High product and R&D costs

Level

-

Technological advancements

-

Customized crop-specific formulations

Level

-

Lack of standardized regulations

-

Limited distribution in developing regions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising sustainable agriculture

Sustainable agriculture is significantly influencing the biostimulants industry as farmers increasingly adopt environmentally friendly methods to enhance crop yields without harming the ecosystem. Biostimulants can improve nutrient absorption, enhance stress resilience, and promote soil health. As a result, they are becoming key contributors to plant development and play a crucial role in reducing the reliance on chemical fertilizers. Change is also driven by increasing consumer desire for organic and sustainably cultivated food, prompting farmers to incorporate biostimulants in their farming activities. Government policies favoring sustainable practices are also driving the market.

Restraint: Commercialization of low-quality biostimulant products

The commercialization of low-quality biostimulant products is a growing issue in the biostimulants market. As demand for biostimulants increases due to the trend toward sustainable agriculture and organic farming, many untested or poorly developed products have entered the market. Low-quality products are often inconsistent, ineffective, and lack scientific support, leading to unreliable outcomes for farmers. The use of substandard products undermines consumer trust because farmers are bound to experience erratic crop performance. Moreover, the propagation of such products undermines the integrity of genuine, research-based biostimulants, thereby affecting their demand and adoption.

Opportunity: Technological advancements

Advancements in technology play a central role in the growth of the biostimulants market as they allow manufacturers to introduce innovative products for plant growth promotion, resilience improvement, and sustainable agriculture. Valagro, Sea6 Energy, UPL, and Acadian Plant Health are among the companies investing in advanced technologies to expand their range of biostimulant products. Valagro utilizes its proprietary GeoPower technology to extract natural active ingredients from raw materials (vegetables), enabling the production of effective crop nutrient products. Sea6 Energy employs TARMA and SPURT technologies to extract sea plants, which are used as plant growth promoters, such as its product AgroGain. UPL introduced a new line of biostimulants based on GoActiv Technology in Australia to address crop physiological pain points and abiotic stresses in numerous crops. Such advances not only boost the performance of biostimulants but also drive the market by providing novel solutions that address the changing demands of contemporary agriculture.

Challenge: Lack of standardized regulations

The inconsistency of regulations confuses farmers, lowering the adoption rate of biostimulants and slowing the growth of the market. In Europe, the European Biostimulants Industry Council (EBIC) points to uncertainty regarding whether biostimulants are plant protection or plant nutrition products, resulting in differing interpretations. For instance, France categorizes biostimulants as additives, whereas Germany sells them as plant straighteners or growth promoters. While the European Biostimulants Industry Consortium (EBIC) has prepared a directive to unify rules, the process of registration is still onerous since biostimulant products are required to meet different standards by different EU nations. Even in the US, each state has its own regulatory framework for fertilizers, plant or soil amendments, and biostimulants, often with incompatible norms. This lack of harmonization complicates navigation through the registration process at the state level by manufacturers.

biostimulants market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Adopts microbial biostimulants to improve cocoa and coffee resilience in Africa and Latin America | Improve soil health, stimulate root development, and enhance stress tolerance |

|

Integrates biostimulant-based nutrient programs to enhance soybean and corn productivity | Improve nutrient uptake and stimulate root development |

|

Uses soil-enhancing biostimulants for oil palm and sugarcane plantations | Improve soil health and nutrient uptake |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Some of the prominent companies in this market include well-established and financially sound manufacturers of biostimulants. These companies have been operational in the market for more than a decade and have diversified portfolios, the latest technologies, and excellent global sales and marketing networks. Some of the prominent companies in this market include UPL (India), FMC Corporation (US), Sumitomo Chemical Co., Ltd. (Japan), Syngenta Group (Switzerland), and Corteva (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biostimulants Market, By Active Ingredient

The active ingredients segment comprises humic substances, seaweed extracts, amino acids, microbial amendments, minerals & vitamins, and other active ingredients. Seaweed extracts hold the largest share in the active ingredient segment of the biostimulants market. Seaweed extracts contain a rich array of organic compounds, including plant hormones, vitamins, and minerals, contributing to their efficacy as biostimulants. These substances play a vital role in enhancing plant growth, nutrient uptake, stress tolerance, and overall crop quality. The presence of trace levels of inorganic nutrient elements in seaweed extracts further augments their beneficial effects on plant health. Furthermore, seaweed extracts have gained prominence due to their versatility in application methods.

Biostimulants Market, By Form

Liquid biostimulants hold the largest share in the form segment of the biostimulants market, as they are convenient for farmers as they dissolve easily and can be applied through irrigation or foliar spraying, ensuring uniform coverage of crops. Plants absorb liquid formulations rapidly, leading to quicker responses and benefits compared to dry forms, thus enhancing nutrient and bioactive compound utilization efficiently. The flexibility of liquid biostimulants in application methods, such as fertigation or foliar spraying, allows farmers to adjust to different needs and growth stages.

Biostimulants Market, By Mode of Application

The mode of application segment comprises of foliar treatment, soil treatment, and seed treatment. Foliar treatment holds the largest share in the biostimulants market, as it facilitates the direct absorption of biostimulants through the leaves, thereby circumventing the need for soil application. This promotes swift uptake and utilization, ensuring rapid plant responses and benefits. Moreover, it allows precise delivery of nutrients and bioactive compounds to particular plant areas, enhancing their efficient utilization and supporting essential physiological processes crucial for plant growth and development.

Biostimulants Market, By Crop Type

The crop type segment includes cereals & grains, oilseeds & pulses, fruits & vegetables, flowers & ornamentals, and other crop types. Fruits & vegetables hold a major share in the crop type segment. Biostimulants enhance the efficiency of nutrient absorption in plants, improving their uptake of essential nutrients from the soil. This is especially crucial for fruits and vegetables, which rely on adequate nutrients for optimal growth. Moreover, biostimulants assist plants in coping with environmental stressors like drought, salinity, and temperature fluctuations, which are common challenges faced by crops. By bolstering resilience, biostimulants mitigate yield losses in fruits and vegetables.

REGION

Asia Pacific to be fastest-growing region in global biostimulants market during forecast period

The Asia Pacific is the fastest-growing region in the biostimulants market, propelled by several key factors. The rising demand for sustainable and eco-friendly farming practices is encouraging farmers to adopt biostimulants to enhance crop yield while reducing chemical inputs. Additionally, supportive government policies and initiatives promoting organic agriculture and soil health are accelerating adoption across the region. Technological advancements in biostimulant formulations and application methods are further improving efficacy, making these products more accessible and effective for diverse crops. Together, these factors are driving rapid market growth and positioning the Asia Pacific as a leading hub for biostimulant adoption.

biostimulants market: COMPANY EVALUATION MATRIX

In the biostimulants market matrix, Syngenta (Star) leads the market with its comprehensive portfolio of plant health solutions, including seaweed extracts, microbial biostimulants, and nutrient-enhancing products that enable growers to improve crop resilience, yield, and sustainability outcomes. FMC (Emerging Leader), meanwhile, is emerging as a strong player by expanding its range of biostimulant solutions, focusing on innovative formulations, precision application technologies, and environmental sustainability, positioning itself as a key innovator in modern crop management practices.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 4.46 Billion |

| Market Forecast in 2030 (Value) | USD 7.84 Billion |

| Growth Rate | CAGR of 11.9% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (KT) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: biostimulants market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Biostimulants Manufacturers |

|

|

| Asia-Pacific Biostimulants Innovators |

|

|

| Seaweed Extract Biostimulants Suppliers |

|

|

RECENT DEVELOPMENTS

- January 2025 : Haifa Group launched its 18th international subsidiary in India, further expanding its global presence.

- October 2024 : Acadian Seaplants Limited and BASF have formed a strategic partnership to develop innovative agricultural solutions, providing climate-resilient products that enhance crop yield and quality. Under this collaboration, BASF will integrate Acadian’s advanced biostimulant technology into its comprehensive chemistry and biological portfolio, expanding its sustainable crop solutions.

- October 2024 : Elicit Plant and BASF France – Agro Division partnered for the 2024-2025 campaign to advance the development of the biostimulants EliSun-a and EliGrain-a, targeting the sunflower and cereal markets in France.

- April 2024 : PI Industries acquired Plant Health Care (PHC), a company specializing in peptide- and protein-based biocontrol and biostimulant products.

- March 2024 : FMC Corporation announced a collaboration in Canada with Novonesis, formerly Novozymes A/S, a leader in plant biosolutions. This agreement is part of FMC’s strategic plan to expand its biologicals platform in key markets.

Table of Contents

Methodology

The study involved two major approaches in estimating the current size of the biostimulants market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

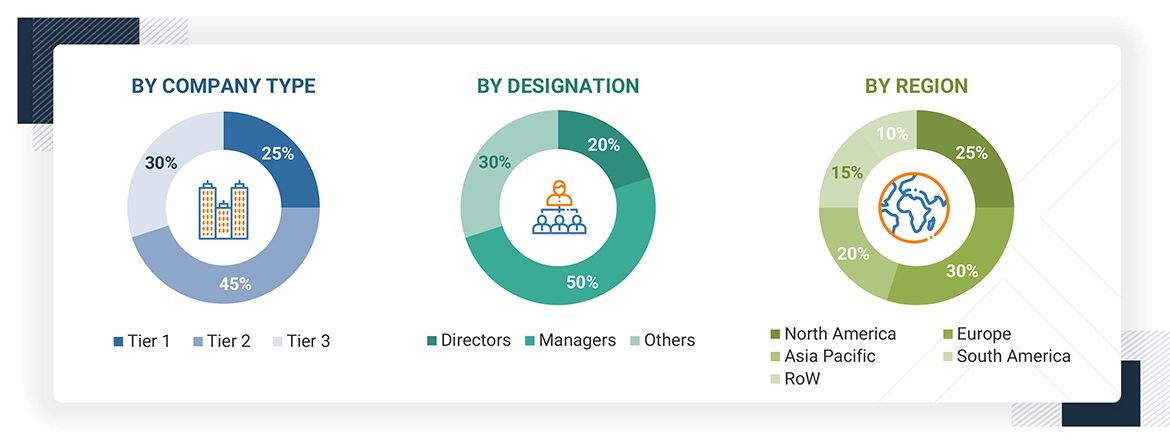

Primary Research

Extensive primary research was conducted after obtaining information regarding the biostimulants market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to biostimulants' active ingredients, form, crop type, mode of application, and region. Stakeholders from the demand side, such as research institutions and universities, agrochemical distributors and retailers, and food processing companies, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of biostimulants and the outlook of their business, which will affect the overall market.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

UPL (India) |

General Manager |

|

Acadian Plant Health (Canada) |

Sales Manager |

|

Syngenta Group (Switzerland) |

Manager |

|

Sumitomo Chemical Co., Ltd. (Japan) |

Sales Manager |

|

PI Industries (India) |

Marketing Manager |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the biostimulants market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Biostimulants Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall biostimulants market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the European Biostimulants Industry Council (EBIC), “Plant biostimulants contain substance(s) and/or microorganisms whose function, when applied to plants or the rhizosphere, is to stimulate natural processes to enhance/benefit nutrient uptake, nutrient efficiency, tolerance to abiotic stress, and crop quality.”

According to the Agriculture and Horticulture Development Board (AHDB), a plant biostimulant contains substances and/or microorganisms that stimulate natural processes. The effect will be independent of its nutrient content and will improve one or more of the following characteristics of the plant or the plant rhizosphere:

- Nutrient-use efficiency

- Tolerance to environmental stress

- Quality traits

- Availability of nutrients in the soil or rhizosphere

Stakeholders

- Manufacturers, dealers, and suppliers of biostimulants

- Government bodies and research organizations

- Intermediate suppliers, such as retailers, wholesalers, and distributors

- Agriculture and Horticulture Development Board (AHDB)

- European Biostimulants Industry Council (EBIC)

- Biological Products Industry Alliance (BPIA)

- Regulatory bodies and institutions

- Canadian Food Inspection Agency (CFIA)

- US Food and Drug Administration (FDA)

- US Environmental Protection Agency (US EPA)

Report Objectives

- To determine and project the size of the biostimulants market with respect to the active ingredient, form, mode of application, crop type, and regions in terms of value over five years, ranging from 2025 to 2030.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the biostimulants market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe biostimulants market into key countries.

- Further breakdown of the Rest of Asia Pacific biostimulants market into key countries.

- Further breakdown of the Rest of South America biostimulants market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the biostimulants market?

The biostimulants market is estimated to be USD 4.56 billion in 2025 and is projected to reach USD 8.02 billion by 2030, registering a CAGR of 11.9% during the forecast period.

Which are the key players in the market, and how intense is the competition?

UPL (India), FMC Corporation (US), Sumitomo Chemical Co., Ltd. (Japan), Syngenta Group (Switzerland), and Corteva (US) are some of the key market players.

The market for biostimulants is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the biostimulants market?

Europe leads the biostimulants market, driven by its focus on sustainable agriculture, organic farming, and friendly policies like the EU's Farm to Fork strategy. Higher application rates in countries like Spain, Italy, and France, especially on high-value crops like fruits, vegetables, and vineyards, further drive the market.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the biostimulants market?

Population growth & food demand, government subsidies & policies, changes in climatic conditions, and a rise in sustainable agriculture are driving the biostimulants market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biostimulants Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Biostimulants Market