Agricultural Biologicals Testing Market by Product Type (Biopesticides, Biofertilizers, Biostimulants), Application (Field Support, Analytical, Regulatory), End User, and Region - Global Forecast to 2021

[116 Pages Report] The global agricultural biologicals testing market is projected to grow from USD 686.5 million in 2016 to USD 1,124.7 million by 2021, at a CAGR of 10.4% from 2016 to 2021. Agricultural biologicals testing refers to various types of tests such as efficacy, toxicity, stability, and microbiological analyses that are conducted on biofertilizers, biopesticides, and biostimulants. Agricultural biologicals comprise natural products developed particularly for the purpose of crop production. The market for agricultural biologicals testing includes field support, analytical tests, and tests for regulatory compliance. The base year considered for the study is 2015, and the forecast has been provided for the period between 2016 and 2021.

Market Dynamics

Drivers

- High usage of agricultural biologicals in Europe

- Large investment in product development by agricultural companies

- High organic agricultural production across regions

Restraints

- Lack of regulations in agrarian economies

- High cost of conducting product trials

Opportunities

- Increasing trade of organic fertilizers

- Environmental agencies promoting sustainable agriculture

Challenges

- High level of technical expertise required for field trials

High usage of agricultural biologicals in Europe drives the global agricultural biologicals testing market

The market for agricultural biologicals testing is mainly driven by the increasing usage of biological agricultural inputs in Europe. Stringent regulations imposed in various countries of this region has encouraged consumers to shift from the traditional pesticides to less toxic biological products. Leading manufacturing companies of agrochemicals such as Marrone Bio Innovations Inc. (US) and Monsanto Company (US) are entering the market for biologicals, which has led to an increased awareness about such products among consumers. These developments have encouraged testing companies to offer their services in the agricultural input industry. Manufacturers of biological products are testing their products with different objectives such as field trials,product analysis, and regulatory compliance. Due to these factors, the agricultural biologicals market in Europe is projected to witness a significant growth over the coming years.

The following are the major objectives of the study.

- To define, segment, and project the global market size for agricultural biologicals testing on the basis of product type, application, end user, and region

- To understand the structure of the agricultural biologicals testing market by identifying its subsegments

- To provide detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To project the size of the agricultural biologicals testing market and its submarkets, in terms of value

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze strategic developments such as expansions, mergers, and acquisitions in the agricultural biologicals testing market

- To provide a detailed competitive landscape of this market along with an analysis of the business and corporate strategies adopted by key players

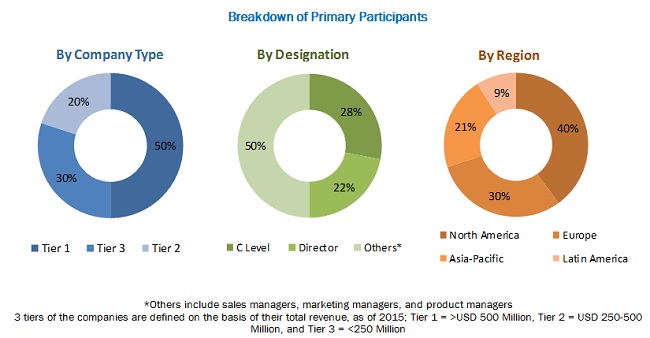

During this research study, major players operating in the agricultural biologicals testing market in various regions were identified and their offerings, regional presence, and distribution channels were analyzed through in-depth discussions. Both, top-down and bottom-up approaches were used to estimate and validate the size of the global agricultural biologicals testing market and various other dependent submarkets. The key players in the market were identified through secondary research and their market share in various regions was determined through primary and secondary research. This entire research methodology included the study of the annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, vice presidents, directors, and marketing executives) for key insights (both quantitative and qualitative) on the agricultural biologicals testing market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the supply chain of the agricultural biologicals testing market include testing companies such as SGS S.A. (Switzerland), Eurofins Scientific SE (Luxembourg), Staphyt SA (France), Laus GmbH (Germany), Bionema Limited (UK), SynTech Research (US), and Anadiag Group (France); government bodies & regulatory associations such as the United States Department of Agriculture (USDA), European Crop Protection Association (ECPA), and end users such as agricultural biological product manufacturers, crop producers, and field scientists.

Major Market Developments

- In June 2016, Eurofins Lancaster Laboratories, part of Eurofins Scientific SE (Luxembourg) expanded its Dungarvan, Ireland campus in the form of development of a new building as well as expansion of its current facility.

- In June 2016, Staphyt S.A. (France) gained possession of all assets of Peracto Pty Ltd. This merger was created to form a group that specializes in agrosciences providing agricultural research & consultation services, particularly in the Asia Pacific region.

- In January 2016, Staphyt S.A. (France) acquired Agro Trial Center Company (Austria) from Kwizda Agro (parent company), to expand its operations in Austria, Czech Republic, and Hungary.

Target Audience

- Manufacturers, importers & exporters, traders, distributors, and suppliers of agricultural biologicals

- Agricultural producers

- Biotechnologists

- Contract research organizations

- Testing equipment suppliers

- International sustainable agriculture organizations

- Government and research organizations

Report Scope

By Product Type

- Biopesticides

- Biofertilizers

- Biostimulants

By Application

- Field support

- Analytical

- Regulatory

By End User Type:

- Biological product manufacturers

- Government agencies

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Critical questions which the report answers

- What are new types of applications which the companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Service Analysis

- Service Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe agricultural biologicals testing market into Sweden, Norway, and Greece

- Further breakdown of the Rest of Asia-Pacific agricultural biologicals testing market into South Korea, North Korea, New Zealand, and Sri Lanka

- Further breakdown of the Rest of the Latin American agricultural biologicals testing market into Paraguay, Uruguay, Chile, and Cuba

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

The global agricultural biologicals testing market is projected to grow from USD 686.5 million in 2016 to USD 1,124.7 million by 2021, at a CAGR of 10.4% from 2016 to 2021. Increasing use of agricultural biologicals in Europe, large investment in product development by agricultural companies, and high organic agricultural production across regions are the key factors driving the growth of this market.

With the rapid growth in the agricultural industry, the demand for sustainable and safe agriculture products has increased. The crop production is projected to increase in parallel with the growing population. However, increasing focus on preserving natural resources such as land and water has encouraged the farmers to adopt sustainable food production techniques such as organic farming. Minimization of the use of conventional pesticides also helps in decreasing the risk associated with soil infertility and hazardous effects on human health.

The agricultural biologicals testing market is segmented on the basis of product type, which is further segmented into biopesticides, biofertilizers, and biostimulants. The biopesticides segment accounted for the largest share in the global agricultural biologicals testing market in 2016. The composition of biopesticides is under clinical trials to examine the application of biopesticides and ensure minimal residue in the final agricultural product being manufactured. In addition, bioassays are conducted in laboratories across regions to ensure efficiency of newly developed biopesticides. To support organic farming and ensure sustainable agricultural production, manufacturers are focusing on developing biopesticides for various types of pests and crops. As the use of chemical pesticides leads to soil degradation, the demand for biopesticide solutions is projected to increase during the forecast period.

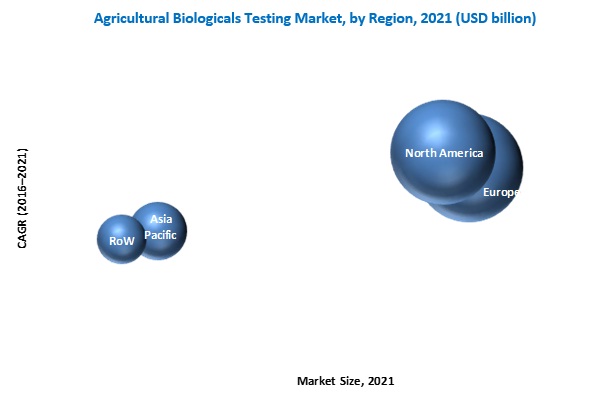

The agricultural biologicals testing market in North America is projected to grow at the highest CAGR during the forecast period. The market growth in North America is attributed to the growth in Canadian and Mexican markets. In addition, early adoption of biostimulants and other biologicals was witnessed in the US. To sustain their lead in the competitive market, key players are focusing on improving their market performance and developing products that comply with the government regulations to shorten the product registration and approval period as compared to the EU. The market growth is further driven due to the increasing awareness regarding the utilization of environment-friendly and cost-efficient products for sustainable agriculture.

The end users of agricultural biologicals testing solutions such as biological product manufacturers and government agencies are projected to drive the market growth

Biological product manufacturers

The primary end-user segment of the agricultural biologicals testing market comprises the manufacturers of biological products. Biopesticide and biofertilizer manufacturers that are focusing on expanding in Europe need to examine the products through tests and submit dossiers for registration, according to the legal requirement of countries. The biological manufacturers segment accounts for a major share due to increasing manufacture of products in the agricultural sector that comply with the government regulations in the Asia Pacific region. In addition, manufacturers use these services to test for efficacy, toxicity, regulatory compliance, as well as the effect on non-target organisms, successive crops, and adjacent crops.

Government agencies

Government agencies involved in the agricultural industry are the major users of agricultural biological product testing services. These agencies utilize these services to set benchmarks for the evaluation of biopesticides, biofertilizers, and biostimulants. The quality and features of the products offered in the market are examined for compliance with the standards and regulations. Moreover, lack of facilities at public universities and state-owned laboratories has led the government agencies to send samples of these products to be tested by private contract research organizations. The services of agricultural biologicals testing companies are availed by government agencies for the preparation of guideline documents as well as research papers.

Critical questions that this report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming applications for agricultural biologicals testing?

Lack of regulations in agrarian economies is a major factor restraining the growth of the market. Despite increasing usage of agricultural biologicals and lack of registration regulations of these products in Asia and Latin America, the scope of growth for testing services remains limited. Due to this, the growth of the market is limited to countries that require dossiers to be submitted prior to the product launch. In addition, the market also includes manufacturers of biologicals that aim to export their products to countries that have stringent regulations. Due to the policy framework of various governments, the market is projected to witness an inhibiting growth over the coming years. However, countries with high production and consumption of agricultural biologics are not bound to stringent regulation regarding the registration of such products. This factor has led the market players to focus on penetrating these markets to their complete potential.

Key players in the market include SGS S.A. (Switzerland), Eurofins Scientific SE (Luxembourg), Staphyt SA (France), Laus GmbH (Germany), Bionema Limited (UK), SynTech Research (US), and Anadiag Group (France). These players are focusing on undertaking expansions, mergers, and acquisitions to grow their presence in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Unit Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitation

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in this Market

4.2 Market For Agricultural Biologicals Testing, By End User

4.3 Agricultural Biologicals Testing Market in the European Region

4.4 U.S. is Projected to Be the Fastest-Growing Market

4.5 Market For Agricultural Biologicals Testing, By Application

4.6 Agricultural Biologicals Testing Market Life Cycle Analysis, By Region, 2016–2021

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Product Type

5.3.2 By Application

5.3.3 By End User

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 High Usage of Agricultural Biologicals in Europe

5.4.1.2 Large Investment in Product Development By Agricultural Companies

5.4.1.3 High Organic Agricultural Production Across Regions

5.4.2 Restraints

5.4.2.1 Lack of Regulations in Agrarian Economies

5.4.2.2 High Cost of Conducting Product Trials

5.4.3 Opportunities

5.4.3.1 Increasing Trade of Organic Fertilizers

5.4.3.2 Environmental Agencies Promoting Sustainable Agriculture

5.4.4 Challenges

5.4.4.1 High Level of Technical Expertise Required for Field Trials

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Upstream Process

6.2.1.1 Research & Development

6.2.1.2 Production

6.2.2 Midstream Process

6.2.2.1 Processing & Transforming

6.2.2.2 Transportation

6.2.3 Downstream Process

6.2.3.1 Final Preparation

6.2.3.2 Distribution

6.3 Regulatory Framework (Biologicals)

6.3.1 U.S.

6.3.2 France

6.3.3 U.K.

6.3.4 China

6.3.5 Brazil

7 Agricultural Biologicals Testing Market, By Product Type (Page No. - 44)

7.1 Introduction

7.2 Biopesticides

7.3 Biofertilizers

7.4 Biostimulants

8 Agricultural Biologicals Testing Market, By Application (Page No. - 50)

8.1 Introduction

8.2 Field Support

8.3 Regulatory

8.4 Analytical

9 Agricultural Biologicals Testing Market, By End User (Page No. - 56)

9.1 Introduction

9.2 Biological Product Manufacturers

9.3 Government Agencies

9.4 Other End Users

10 Agricultural Biologicals Testing Market, By Region (Page No. - 62)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 Rest of Asia-Pacific

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 Africa

10.5.3 Middle East

11 Competitive Landscape (Page No. - 88)

11.1 Overview

11.2 Competitive Situation & Trends

11.2.1 Expansions

11.2.2 Mergers

11.2.3 Acquisitions

12 Company Profiles (Page No. - 92)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 SGS SA

12.3 Eurofins Scientific SE

12.4 Syntech Research

12.5 Staphyt S.A.

12.6 Anadiag Group

12.7 Biotecnologie BT

12.8 RJ Hill Laboratories Ltd

12.9 I2L Research

12.10 Apal Agricultural Laboratory

12.11 Laus GmbH

12.12 Bionema Limited

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 110)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (59 Tables)

Table 1 Agricultural Biologicals Testing Market Size, By Product Type, 2014–2021 ( USD Million)

Table 2 Biopesticides Market Size, By Region, 2014–2021 (USD Million)

Table 3 Biofertilizers Market Size, By Region, 2014–2021 (USD Million)

Table 4 Biostimulants Market Size, By Region, 2014–2021 (USD Million)

Table 5 Agricultural Biologicals Testing Market Size, By Application, 2014-2021 (USD Million)

Table 6 Field Support Market Size, By Region, 2014-2021 (USD Million)

Table 7 Regulatory Market Size, By Region, 2014-2021 (USD Million)

Table 8 Analytical Market Size, By Region, 2014-2021 (USD Million)

Table 9 Agricultural Biologicals Testing Market Size, By End User, 2014–2021 (USD Million)

Table 10 Biological Product Manufacturers Market Size, By Region, 2014–2021 (USD Million)

Table 11 Government Agencies Market Size, By Region, 2014–2021 (USD Million)

Table 12 Other End Users Market Size, By Region, 2014–2021 (USD Million)

Table 13 Agricultural Biologicals Testing Market Size, By Region, 2014–2021 (USD Million)

Table 14 North America: Market Size For Agricultural Biologicals Testing, By Country, 2014–2021 (USD Million)

Table 15 North America: Market Size, By Product Type, 2014–2021 (USD Million)

Table 16 North America: Biopesticides Testing Market Size, By Country, 2014–2021 (USD Million)

Table 17 North America: Biofertilizers Testing Market Size, By Country, 2014–2021 (USD Million)

Table 18 North America: Biostimulants Testing Market Size, By Country, 2014–2021 (USD Million)

Table 19 North America: Market Size For Agricultural Biologicals Testing, By Application, 2014–2021 (USD Million)

Table 20 North America: Market Size, By End User, 2014–2021 (USD Million)

Table 21 U.S.: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 22 Canada: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 23 Mexico: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 24 Europe: Agricultural Biologicals Testing Market Size, By Country, 2014–2021 (USD Million)

Table 25 Europe: Market Size, By Product Type, 2014–2021 (USD Million)

Table 26 Europe: Biopesticides Testing Market Size, By Country, 2014–2021 (USD Million)

Table 27 Europe: Biofertilizers Testing Market Size, By Country, 2014–2021 (USD Million)

Table 28 Europe: Biostimulants Testing Market Size, By Country, 2014–2021 (USD Million)

Table 29 Europe: Market Size For Agricultural Biologicals Testing, By Application, 2014–2021 (USD Million)

Table 30 Europe: Market Size, By End User, 2014–2021 (USD Million)

Table 31 U.K.: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 32 Germany: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 33 France: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 34 Italy: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 35 Rest of Europe: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 36 Asia-Pacific: Agricultural Biologicals Testing Market Size, By Country, 2014–2021 (USD Million)

Table 37 Asia-Pacific: Market Size, By Product Type, 2014–2021 (USD Million)

Table 38 Asia-Pacific: Biopesticides Testing Market Size, By Country, 2014–2021 (USD Million)

Table 39 Asia-Pacific: Biofertilizers Testing Market Size, By Country, 2014–2021 (USD Million)

Table 40 Asia-Pacific: Biostimulants Testing Market Size, By Country, 2014–2021 (USD Million)

Table 41 Asia-Pacific: Market Size For Agricultural Biologicals Testing, By Application, 2014–2021 (USD Million)

Table 42 Asia-Pacific: Market Size, By End User, 2014–2021 (USD Million)

Table 43 China: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 44 India: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 45 Japan: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 46 Rest of Asia-Pacific: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 47 RoW: Agricultural Biologicals Testing Market Size, By Country/Region, 2014–2021 (USD Million)

Table 48 RoW: Market Size, By Product Type, 2014–2021 (USD Million)

Table 49 RoW: Biopesticides Testing Market Size, By Country, 2014–2021 (USD Million)

Table 50 RoW: Biofertilizer Testing Market Size, By Country, 2014–2021 (USD Million)

Table 51 RoW: Biostimulants Testing Market Size, By Country, 2014–2021 (USD Million)

Table 52 RoW: Market Size For Agricultural Biologicals Testing, By Application, 2014–2021 (USD Million)

Table 53 RoW: Market Size, By End User, 2014–2021 (USD Million)

Table 54 Brazil: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 55 Africa: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 56 Middle East: Market Size For Agricultural Biologicals Testing, By Product Type, 2014–2021 (USD Million)

Table 57 Expansions, 2012-2016

Table 58 Mergers, 2012-2016

Table 59 Acquisitions, 2012-2016

List of Figures (48 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 North America is Projected to Be the Fastest-Growing Region for the Agricultural Biologicals Testing Market From 2016 to 2021

Figure 7 Market Size For Agricultural Biologicals Testing, By Product Type, 2016 vs 2021 (USD Million)

Figure 8 Market Growth For Agricultural Biologicals Testing, By Application, 2016-2021

Figure 9 Market Players Preferred Mergers and Acquisitions as Their Key Strategies From 2011 to 2016

Figure 10 High Adoption Rate of Biopesticides Provides Opportunities for the Growth of the Agricultural Biologicals Testing Market

Figure 11 Manufacturers to Utilize Agricultural Biologicals at the Highest Rate Between 2016 & 2021

Figure 12 European Region Was the Largest Market for Testing of Agricultural Biologicals in 2015

Figure 13 U.S. to Be the Fastest-Growing Country-Level Market for Testing of Agricultural Biologicals Between 2016 & 2021

Figure 14 Europe Dominated the Market for Analytical Testing of Agricultural Biologicals in 2015

Figure 15 The Agricultural Biologicals Testing Market in North America is Experiencing High Growth (2016-2021)

Figure 16 Market Segmentation For Agricultural Biologicals Testing, By Product Type

Figure 17 Market, By Application

Figure 18 Market, By End User

Figure 19 Large Investment in Product Development Drives the Agricultural Biologicals Testing Market Growth

Figure 20 Area Under Organic Agricultural Production, By Country, 2012

Figure 21 Export Trade of Organic Fertilizers, 2013–2015

Figure 22 Supply Chain Analysis: Market For Agricultural Biologicals Testing

Figure 23 Biopesticides Segment is Expected to Dominate, 2016-2021 (USD Million)

Figure 24 North American Region Expected to Be the Fastest-Growing, 2016-2021 (USD Million)

Figure 25 Europe to Gain A Large Market Share in the Next Few Years, 2016-2021 (USD Million)

Figure 26 Biostimulants Segment to Grow Rapidly in the North American Region, 2016-2021 (USD Million)

Figure 27 Agricultural Biologicals Testing Market: Field Support, the Largest Segment, 2016 vs 2021 (USD Million)

Figure 28 Field Support Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 29 Regulatory Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 30 Analytical Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 31 Agricultural Biologicals Testing Market: Biological Product Manufacturers to Be the Largest Segment Through 2021 (USD Million)

Figure 32 Biological Product Manufacturers Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 33 Government Agencies Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 34 Other End Users Market Size, By Region, 2016 vs 2021 (USD Million)

Figure 35 Geographic Snapshot (2016–2021): China is Projected to Grow at the Highest Rate and is Emerging as A New Hotspot

Figure 36 Market Snapshot For North American Agricultural Biologicals Testing

Figure 37 Market Snapshot For European Agricultural Biologicals Testing

Figure 38 Market Snapshot For Asia-Pacific Agricultural Biologicals Testing

Figure 39 Key Companies Preferred Strategies Such as Expansions & Acquisitions From 2012 to 2016

Figure 40 Key Players Adopted Acquisitions and Expansions Strategies to Accelerate the Growth of Agricultural Biologicals Testing Market, 2013–2016

Figure 41 Geographic Revenue Mix of Top Two Agricultural Biological Testing Service Providers

Figure 42 SGS SA: Company Snapshot

Figure 43 SGS SA: SWOT Analysis

Figure 44 Eurofins Scientific SE: Company Snapshot

Figure 45 Eurofins Scientific SE: SWOT Analysis

Figure 46 Syntech Research: SWOT Analysis

Figure 47 Staphyt S.A.: SWOT Analysis

Figure 48 Anadiag Group: SWOT Analysis

Growth opportunities and latent adjacency in Agricultural Biologicals Testing Market