Blood Screening Market by Product (Reagent & Kits, Instrument, Software), Technology (NAT, (Real-Time PCR), ELISA (Chemiluminescence Immunoassay), Rapid Test, Western Blot), End User (Blood Bank, Hospital), & Region - Global Forecast to 2028

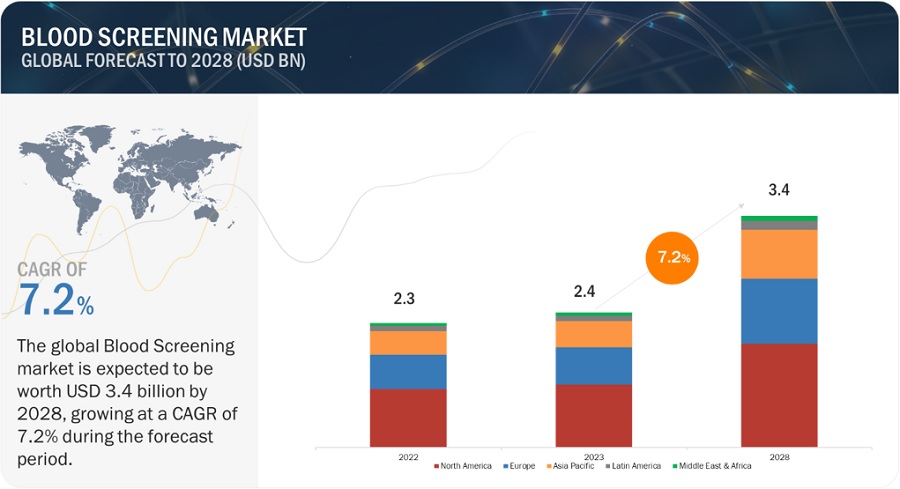

The global blood screening market, valued at US$2.3 billion in 2022, stood at US$2.4 billion in 2023 and is projected to advance at a resilient CAGR of 7.2% from 2023 to 2028, culminating in a forecasted valuation of US$3.4 billion by the end of the period. The need for blood is ever-increasing, forcing the number of blood donations to rise as well throughout the world. Combining this factor along with the growing infectious diseases is the major contributor for the growing blood screening market.

On the other hand, the unfavorable reimbursement scenario and the high cost of instruments and kits may restrain the growth of this market to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Blood screening Market Dynamics

Driver: Increasing number of blood donations worldwide

Advancements in healthcare systems and the availability of and the need for sophisticated surgical procedures, such as cardiovascular & transplant surgery, trauma care, and therapy for cancer and blood diseases, blood transfusions, etc has caused an increase in need for donated blood. On average, globally around 235 million major surgeries are being performed every year, of which 63 million are traumatic surgeries, cancer-related are over 31 million, and 10 million are related to pregnancy complications. Blood transfusion is usually prescribed in cases like complicated childbirths to prepare for childhood congenital maternal blood disorders, acute anemia, and trauma.

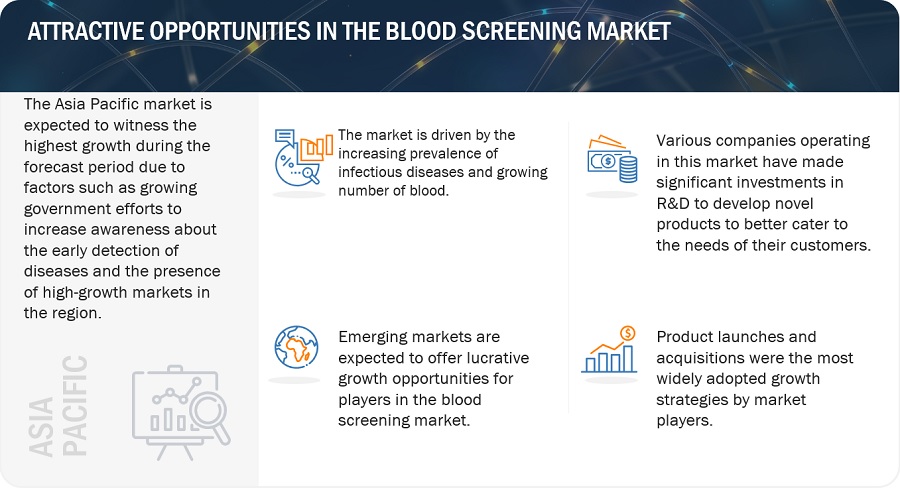

Opportunity: Emerging markets

India, the Middle East and Africa are emerging markets where players in the blood screening industry can benefit from rising disposable incomes and improved healthcare infrastructures. For example, in 2020, India’s healthcare sector was worth about USD 280 billion and is expected to grow to USD 372 billion in 2022 due to increasing income levels, growing awareness of physical well-being and rising prevalence of lifestyle diseases. Currently, ELISA is the most popular technology in India because NAT has relatively low penetration in India. In contrast, in India, NAT is not mandatory. Currently, NAT is used by nearly 120 blood banks in ID-NAT format, while around 40 blood banks use pooling technique. As a result, the Indian government has launched an initiative to educate doctors, hospitals and blood banks on the use of NAT.

Restraint: Alternative technologies

Computerized immunoassays are a one-step answer for single-particle location without requiring washing steps in view of ELISA utilizing a variety of femtoliter-sized wells. In this measure, a biomarker particle is formed with an immunizer covered with attractive microparticle cultivated in a well, enhanced by means of an enzymatic response, and distinguished with fluorescence. These tests have seen huge interest due to the earnest also, always expanding interest for serological Coronavirus counter acting agent tests that are modest, fast, straightforward, profoundly touchy, quantitative, and insignificantly obtrusive. Consequently, a solitary step, sans wash immunoassay for quick and exceptionally delicate quantitative investigation of human serological gG against SARS-CoV-2 has been created, which requires just a solitary bead of serum.

Challenge: High cost of blood screening technologies

With the increasing number of blood donations, awareness of blood verification & safety, and spending on healthcare around the world, more advanced technologies are widely used in high income countries and will be widely adopted in middle and low-income countries within the next 10 years. However, most developing countries, including India and China currently use ELISA. The growth of the market for blood screening for NAT is severely inhibited in the present timeframe. The high cost of advanced tests has led to the increased use of first-generation ELISA, which is older and less effective tests. This test is used in many countries around the world despite the limitations of the test. For example, the global donor supported cost of USD. GeneXpert MB / RIF cartridge is considered to be prohibitively expensive for most low and middle income countries (MIC).

Blood screening Ecosystem/Market Map

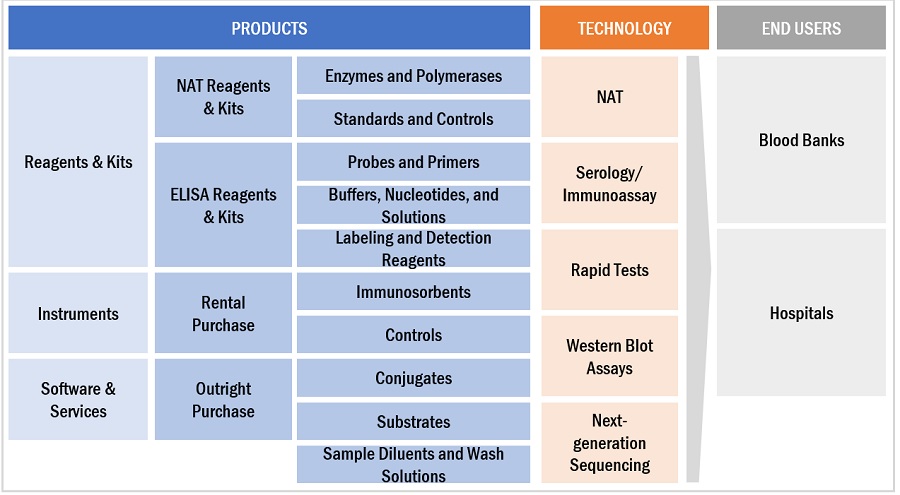

In 2022, reagents & kits segment accounted for the largest share of the blood screening industry, by product & service.

The blood screening market is divided into reagents and kits, tools, and software and services. Reagents and kits made up the biggest chunk of the market in 2022. This is mainly because there's been an increase in blood transfusions, which means more and more people are using reagents and kits.

In 2022, nucleic acid test segment accounted for the largest share in the blood screening industry, by technology.

The blood screening market is segmented into nucleic acid test (NAT), serology/immunoassay, rapid tests, western blot assays, and next-generation sequencing (NGS). The nucleic acid test segment dominated the blood screening market in 2022 due to an increase in adoption of NAT technology, which is more sensitive than other blood screening technologies, and an increase in the number of blood donations.

In 2022, blood banks and hospitals segment accounted for the largest share in the blood screening industry, by end user.

Blood banks and hospitals are the two main segments in the blood screening market, and the blood banks segment had the biggest market share in 2022. This is because more and more people are getting organ transplants.

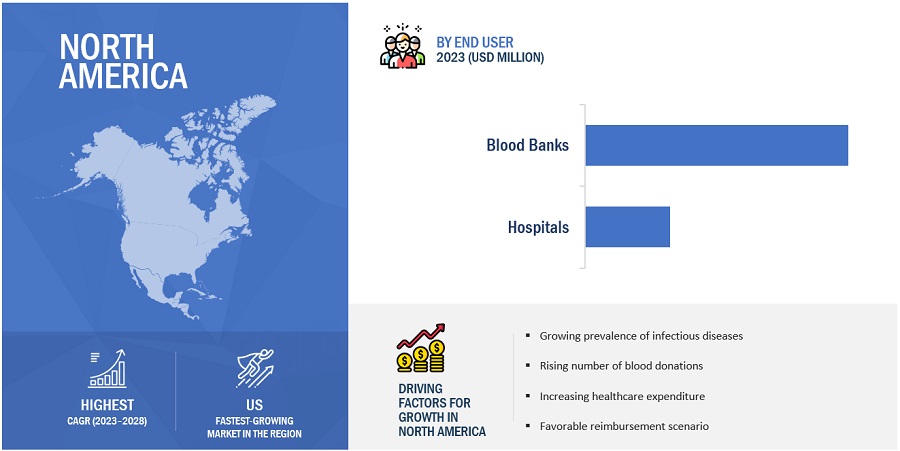

North America is the largest regional market for blood screening industry

There are five main regions in the world where blood screening is available. North America is the biggest one, with a share of the market in 2022. This is due to the rising cost of healthcare, the rise in chronic conditions, and the fact that the US has a really well-developed healthcare system.

To know about the assumptions considered for the study, download the pdf brochure

The major players in this market are F. Hoffmann-La Roche Ltd. (Switzerland), Grifols (Spain), Abbott Laboratories, Inc. (US), Bio-Rad Laboratories, Inc. (US), Danaher (US), bioMérieux (France), Hologic (US), Thermo Fisher Scientific, Inc. (US), Becton, Dickinson and Company (US), DiaSorin (Italy). The market leadership of these players stems from their comprehensive product portfolios and expanding global footprint. These dominant market players possess several advantages, including strong marketing and distribution networks, substantial research and development budgets, and well-established brand recognition.

Scope of the Blood Screening Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$2.4 billion |

|

Estimated Value by 2028 |

$3.4 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.2% |

|

Market Driver |

Increasing number of blood donations worldwide |

|

Market Opportunity |

Emerging markets |

This report categorizes the Blood screening market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

-

Reagents & Kits

-

NAT Reagents & Kits

- Enzymes & Polymerases

- Standards & Controls

- Probes & Primers

- Buffers, Nucleotides, and Solutions

- Labeling & Detection Reagents

-

ELISA Reagents & Kits

- Immunosorbents

- Controls

- Conjugates

- Substrates

- Sample Diluents & Wash Solutions

- Other Reagents & Kits

-

NAT Reagents & Kits

-

Instruments

- Rental Purchase

- Outright Purchase

- Software & Services

By Technology

- Nucleic Acid Test

- Transcription-mediated Amplification

- Real-time PCR

- Serology/Immunoassay

- Chemiluminescent Immunoassays

- Fluorescent Immunoassays

- Colorimetric Immunoassays/ELISA

- Rapid Tests

- Western Blot Assays

- Next-generation Sequencing

By End User

- Blood Banks

- Hospitals

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Blood Screening Industry

- In February 2023, Thermo Fisher Scientific Inc. (US) acquired TIB Molbiol (Germany), to expand its PCR test portfolio with a wide range of assays for infectious diseases.

- In December 2021, Hologic, Inc. (US) launched Panther Trax for high-volume molecular testing.

- In May 2021, Beckmann Coulter (US) launched SARS-CoV-2 IgG.

- In September 2021, Roche Diagnostics (Switzerland) acquired TIB Molbiol Group (Germany). This acquisition will enhance Roche’s broad portfolio of molecular diagnostics solutions with a wide range of assays for infectious diseases, such as identifying SARS-CoV-2 variants.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global blood screening market?

The global blood screening market boasts a total revenue value of $3.4 billion by 2028.

What is the estimated growth rate (CAGR) of the global blood screening market?

The global blood screening market has an estimated compound annual growth rate (CAGR) of 7.2% and a revenue size in the region of $2.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing blood donations- Rising prevalence of infectious diseasesRESTRAINTS- High cost of blood screening technologiesOPPORTUNITIES- Rising technological advancements- High growth potential of emerging economiesCHALLENGES- Usage of low-sensitivity screening tests- Shortage of skilled laboratory technicians

-

5.3 PRICING ANALYSISPRICING MODEL ANALYSISAVERAGE SELLING PRICE TRENDAVERAGE SELLING PRICE OF BLOOD SCREENING PRODUCTS, BY KEY PLAYER

-

5.4 PATENT ANALYSISPATENT ANALYSIS OF NUCLEIC ACID AMPLIFICATION TECHNOLOGIESBLOOD SCREENING MARKET: LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSISBLOOD SCREENING MARKET: ECOSYSTEM ROLE

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- China- Japan- IndiaLATIN AMERICA- BrazilMIDDLE EAST

-

5.10 TRADE ANALYSISTRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS

- 5.13 PESTLE ANALYSIS

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT IN BLOOD SCREENING MARKET

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.16 CASE STUDY ANALYSISCASE STUDY 1: OPTIMIZATION OF HBSAG QUANTITATIVE ELISACASE STUDY 2: CLINICAL EFFICACY OF NAT WITH ELISA

- 6.1 INTRODUCTION

-

6.2 REAGENTS & KITSNAT REAGENTS & KITS- High sensitivity to drive marketELISA REAGENTS & KITS- Ease of use and cost-effectiveness to drive marketOTHER REAGENTS & KITS

-

6.3 INSTRUMENTSRENTAL PURCHASE- Reduced liability with limited financial losses to propel marketOUTRIGHT PURCHASE- Availability of government support to drive market

-

6.4 SOFTWARE & SERVICESRISING DEMAND ACROSS EMERGING ECONOMIES TO SUPPORT MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 NUCLEIC ACID TESTS (NAT)TRANSCRIPTION-MEDIATED AMPLIFICATION (TMA)- High sensitivity to support market growthREAL-TIME POLYMERASE CHAIN REACTION (RT-PCR)- Elimination of contamination risks to propel market

-

7.3 SEROLOGY/IMMUNOASSAYSCHEMILUMINESCENT IMMUNOASSAYS (CLIA)- Ultra-sensitive and automated features to drive marketFLUORESCENT IMMUNOASSAYS (FIA)- Rising demand for safe & stable reagents to propel marketCOLORIMETRIC IMMUNOASSAYS/ELISA (CI/ELISA)- Qualitative and quantitative antigen measurement for blood serum to drive market

-

7.4 RAPID TESTSHIGH EFFICIENCY IN POC DIAGNOSTICS TO PROPEL MARKET

-

7.5 WESTERN BLOT ASSAYSABILITY TO DETECT RETROVIRUS ANTIBODIES TO DRIVE MARKET

-

7.6 NEXT-GENERATION SEQUENCING (NGS)EMERGING TECHNOLOGY FOR HIV TESTING TO SUPPORT MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 BLOOD BANKSRISING INCIDENCE OF CHRONIC DISEASES TO DRIVE MARKET

-

8.3 HOSPITALSINCREASING SURGICAL PROCEDURES TO PROPEL MARKET

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing prevalence of HIV and chronic diseases to drive marketCANADA- Rising volume of surgical procedures to drive market

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- High incidence of cancer to drive marketFRANCE- Growing cases of HIV to propel marketUK- Favorable government support for infectious disease screening to drive marketITALY- Growing number of blood donors to support market growthSPAIN- Rising adoption of NAT technology to propel marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- High burden of infectious diseases to drive marketJAPAN- Growing adoption of advanced blood screening technologies to drive marketINDIA- Increasing road accidents to support market growthAUSTRALIA- Increasing cases of leukemia to drive marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Growing cancer burden to support market growthMEXICO- Rising blood donations to support market growthREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICARISING SURGICAL PROCEDURES DUE TO CHRONIC DISEASES TO FUEL MARKETMIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.1 OVERVIEW

-

10.2 STRATEGIES OF KEY PLAYERSBLOOD SCREENING MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS

-

10.4 MARKET SHARE ANALYSISBLOOD SCREENING MARKET

-

10.5 COMPANY EVALUATION MATRIXLIST OF EVALUATED VENDORSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

10.7 COMPETITIVE BENCHMARKINGPRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

-

10.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.1 KEY PLAYERSF. HOFFMANN-LA ROCHE LTD.- Business overview- Products & services offered- Recent developments- MnM viewsGRIFOLS, S.A.- Business overview- Products & services offered- Recent developments- MnM viewABBOTT LABORATORIES- Business overview- Products & services offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products & services offered- Recent developments- MnM viewDIASORIN- Business overview- Products offered- MnM viewBIOMÉRIEUX- Business overview- Products & services offered- Recent developments- MnM viewBD- Business overview- Products & services offeredDANAHER (BECKMAN COULTER, INC.)- Business overview- Products & services offered- Recent developmentsHOLOGIC, INC.- Business overview- Products & services offered- Recent developmentsSIEMENS HEALTHINEERS AG- Business overview- Products & services offeredTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products & services offered- Recent developments

-

11.2 OTHER PLAYERSORTHO CLINICAL DIAGNOSTICSMERCK KGAAREVVITY (PART OF PERKINELMER INC.)BIO-TECHNEGFETRINITY BIOTECHJ. MITRA & CO. PVT. LTD.MINDRAYMACCURA BIOTECHNOLOGY CO., LTD.IMMUCOR, INC.CELLABSABNOVA CORPORATIONENZO BIOCHEM, INC.TULIP DIAGNOSTICS PVT. LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 INDICATIVE PRICING ANALYSIS FOR BLOOD SCREENING PRODUCTS

- TABLE 2 AVERAGE SELLING PRICE ANALYSIS OF BLOOD SCREENING PRODUCTS

- TABLE 3 AVERAGE SELLING PRICE OF BLOOD SCREENING PRODUCTS

- TABLE 4 BLOOD SCREENING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: CLASSIFICATION OF DEVICES

- TABLE 10 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

- TABLE 11 BLOOD SCREENING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS (2023 −2024)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BLOOD SCREENING PRODUCTS (%)

- TABLE 13 KEY BUYING CRITERIA, BY PRODUCT & SERVICE

- TABLE 14 BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 15 KEY PRODUCTS FOR REAGENTS & KITS

- TABLE 16 BLOOD SCREENING MARKET FOR REAGENTS & KITS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 BLOOD SCREENING MARKET FOR REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 18 KEY PRODUCTS FOR NAT REAGENTS & KITS

- TABLE 19 BLOOD SCREENING MARKET FOR NAT REAGENTS & KITS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 BLOOD SCREENING MARKET FOR NAT REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 21 KEY PRODUCTS FOR ELISA REAGENTS & KITS

- TABLE 22 BLOOD SCREENING MARKET FOR ELISA REAGENTS & KITS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 BLOOD SCREENING MARKET FOR ELISA REAGENTS & KITS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 24 KEY PRODUCTS FOR OTHER REAGENTS & KITS

- TABLE 25 BLOOD SCREENING MARKET FOR OTHER REAGENTS & KITS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 KEY PRODUCTS FOR INSTRUMENTS

- TABLE 27 BLOOD SCREENING MARKET FOR INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 BLOOD SCREENING MARKET FOR INSTRUMENTS, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 29 BLOOD SCREENING MARKET FOR RENTAL PURCHASE INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 BLOOD SCREENING MARKET FOR OUTRIGHT PURCHASE INSTRUMENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 KEY PRODUCTS FOR SOFTWARE & SERVICES

- TABLE 32 BLOOD SCREENING MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 34 KEY PRODUCTS IN NAT MARKET

- TABLE 35 BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 BLOOD SCREENING MARKET FOR TMA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 BLOOD SCREENING MARKET FOR RT-PCR, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 KEY PRODUCTS FOR SEROLOGY/IMMUNOASSAYS

- TABLE 40 BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 42 BLOOD SCREENING MARKET FOR CHEMILUMINESCENT IMMUNOASSAYS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 BLOOD SCREENING MARKET FOR FLUORESCENT IMMUNOASSAYS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 BLOOD SCREENING MARKT FOR COLORIMETRIC IMMUNOASSAYS/ELISA, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 KEY PRODUCTS FOR RAPID TESTS

- TABLE 46 BLOOD SCREENING MARKET FOR RAPID TESTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 KEY PRODUCTS FOR WESTERN BLOT ASSAYS

- TABLE 48 BLOOD SCREENING MARKET FOR WESTERN BLOT ASSAYS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 BLOOD SCREENING MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 51 BLOOD SCREENING MARKET FOR BLOOD BANKS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 BLOOD SCREENING MARKET FOR HOSPITALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 BLOOD SCREENING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: BLOOD SCREENING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 US: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 63 US: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 US: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 65 US: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 66 US: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 US: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 68 US: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 70 CANADA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 CANADA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 72 CANADA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 73 CANADA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 CANADA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 75 CANADA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: BLOOD SCREENING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 81 EUROPE: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 EUROPE: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 83 EUROPE: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 84 GERMANY: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 85 GERMANY: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 GERMANY: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 87 GERMANY: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 88 GERMANY: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 GERMANY: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 90 GERMANY: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 FRANCE: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 92 FRANCE: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 FRANCE: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 94 FRANCE: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 95 FRANCE: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 FRANCE: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 97 FRANCE: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 98 UK: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 99 UK: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 UK: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 101 UK: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 102 UK: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 UK: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 104 UK: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 105 ITALY: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 106 ITALY: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 ITALY: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 108 ITALY: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 109 ITALY: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 ITALY: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 111 ITALY: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 SPAIN: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 113 SPAIN: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 SPAIN: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 115 SPAIN: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 116 SPAIN: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 SPAIN: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 118 SPAIN: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 119 GDP EXPENDITURE ON HEALTHCARE, BY COUNTRY (%)

- TABLE 120 REST OF EUROPE: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 121 REST OF EUROPE: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 124 REST OF EUROPE: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: BLOOD SCREENING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 129 ASIA PACIFIC: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 135 CHINA: KEY MACROINDICATORS

- TABLE 136 CHINA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 137 CHINA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 CHINA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 139 CHINA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 140 CHINA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 CHINA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 142 CHINA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 143 JAPAN: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 144 JAPAN: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 JAPAN: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 146 JAPAN: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 147 JAPAN: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 JAPAN: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 149 JAPAN: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 150 INDIA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 151 INDIA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 INDIA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 153 INDIA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 154 INDIA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 INDIA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 156 INDIA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 157 AUSTRALIA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 158 AUSTRALIA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 AUSTRALIA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 160 AUSTRALIA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 161 AUSTRALIA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 AUSTRALIA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 163 AUSTRALIA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 171 LATIN AMERICA: BLOOD SCREENING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 173 LATIN AMERICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 175 LATIN AMERICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 LATIN AMERICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 179 INCIDENCE OF CANCERS IN BRAZIL, 2020 VS. 2025

- TABLE 180 BRAZIL: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 181 BRAZIL: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 182 BRAZIL: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 183 BRAZIL: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 184 BRAZIL: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 BRAZIL: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 186 BRAZIL: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 187 MEXICO: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 188 MEXICO: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 MEXICO: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 190 MEXICO: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 191 MEXICO: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 MEXICO: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 193 MEXICO: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 REST OF LATIN AMERICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 195 REST OF LATIN AMERICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 REST OF LATIN AMERICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 197 REST OF LATIN AMERICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 198 REST OF LATIN AMERICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: BLOOD SCREENING REAGENTS & KITS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: BLOOD SCREENING INSTRUMENTS MARKET, BY PURCHASE TYPE, 2021–2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET FOR NUCLEIC ACID TESTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET FOR SEROLOGY/IMMUNOASSAYS, BY PLATFORM, 2021–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: BLOOD SCREENING MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 208 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

- TABLE 209 BLOOD SCREENING MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 210 BLOOD SCREENING MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 211 BLOOD SCREENING MARKET: COMPANY PRODUCT & SERVICE FOOTPRINT ANALYSIS

- TABLE 212 BLOOD SCREENING MARKET: COMPANY REGIONAL FOOTPRINT ANALYSIS

- TABLE 213 BLOOD SCREENING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 214 BLOOD SCREENING MARKET: KEY PRODUCT LAUNCHES & APPROVALS (JANUARY 2020−SEPTEMBER 2023)

- TABLE 215 BLOOD SCREENING MARKET: KEY DEALS (JANUARY 2020−SEPTEMBER 2023)

- TABLE 216 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 217 GRIFOLS, S.A.: BUSINESS OVERVIEW

- TABLE 218 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 219 BIO-RAD LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 220 DIASORIN: BUSINESS OVERVIEW

- TABLE 221 BIOMÉRIEUX: BUSINESS OVERVIEW

- TABLE 222 BD: BUSINESS OVERVIEW

- TABLE 223 DANAHER: BUSINESS OVERVIEW

- TABLE 224 HOLOGIC, INC.: BUSINESS OVERVIEW

- TABLE 225 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

- TABLE 226 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- FIGURE 1 BLOOD SCREENING MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

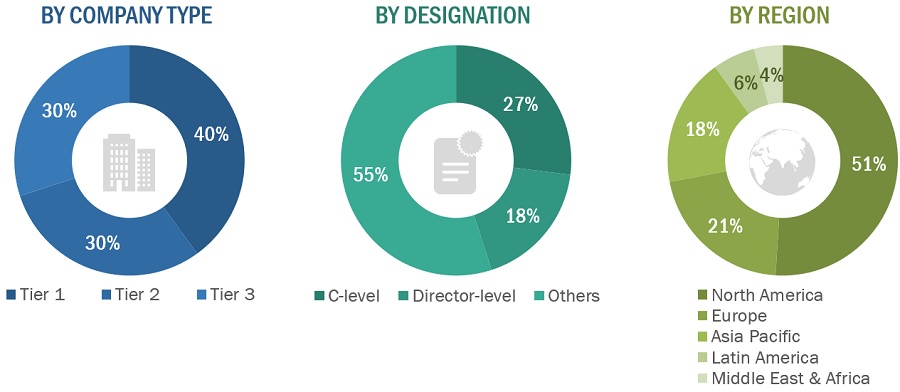

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

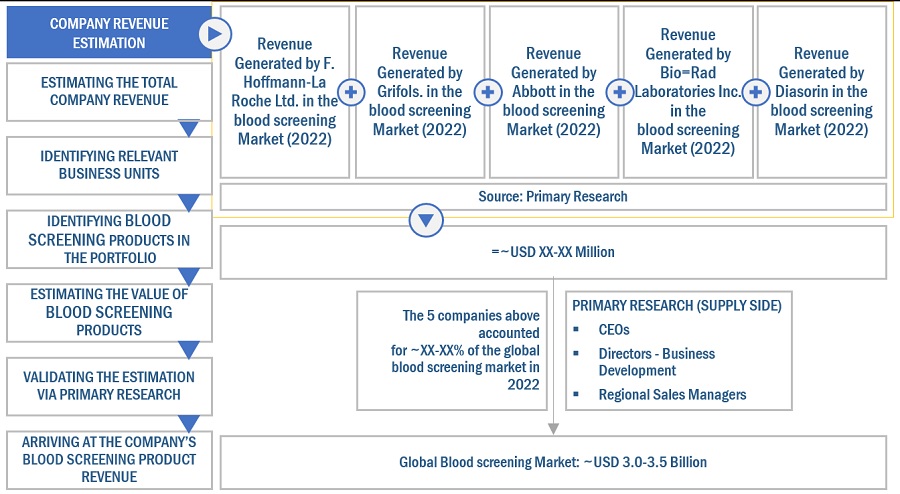

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 6 BLOOD SCREENING MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 BLOOD SCREENING MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 BLOOD SCREENING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BLOOD SCREENING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BLOOD SCREENING MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 INCREASING NUMBER OF BLOOD DONATIONS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 13 REAGENTS & KITS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 NUCLEIC ACID TESTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 BLOOD BANKS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC REGION TO REGISTER HIGHEST GROWTH RATE FROM 2023 TO 2028

- FIGURE 17 BLOOD SCREENING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASE

- FIGURE 19 BLOOD SCREENING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 BLOOD SCREENING MARKET: ECOSYSTEM MAP

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BLOOD SCREENING PRODUCTS

- FIGURE 22 KEY BUYING CRITERIA FOR BLOOD SCREENING PRODUCTS

- FIGURE 23 NORTH AMERICA: BLOOD SCREENING MARKET SNAPSHOT

- FIGURE 24 ASIA PACIFIC: BLOOD SCREENING MARKET SNAPSHOT

- FIGURE 25 REVENUE SHARE ANALYSIS OF LEADING PLAYERS IN BLOOD SCREENING MARKET

- FIGURE 26 MARKET SHARE ANALYSIS BY KEY PLAYER (2022)

- FIGURE 27 BLOOD SCREENING MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 28 BLOOD SCREENING MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 29 BLOOD SCREENING MARKET: PRODUCT AND GEOGRAPHIC FOOTPRINT ANALYSIS

- FIGURE 30 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 31 GRIFOLS S.A.: COMPANY SNAPSHOT (2022)

- FIGURE 32 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- FIGURE 33 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 DIASORIN: COMPANY SNAPSHOT (2022)

- FIGURE 35 BIOMÉRIEUX: COMPANY SNAPSHOT (2022)

- FIGURE 36 BD: COMPANY SNAPSHOT (2022)

- FIGURE 37 DANAHER: COMPANY SNAPSHOT (2022)

- FIGURE 38 HOLOGIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 39 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2022)

- FIGURE 40 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

The objective of the study is analyzing the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies’ developments such as acquisitions, product launches, expansions, agreements and partnerships of the leading players, the competitive landscape of the Blood screening market to analyzes market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess prospects.

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME |

DESIGNATION |

|

Abbott |

Marketing Manager |

|

F. Hoffmann-La Roche Ltd |

Senior Product Manager |

|

Danaher |

Marketing Manager |

Market Size Estimation

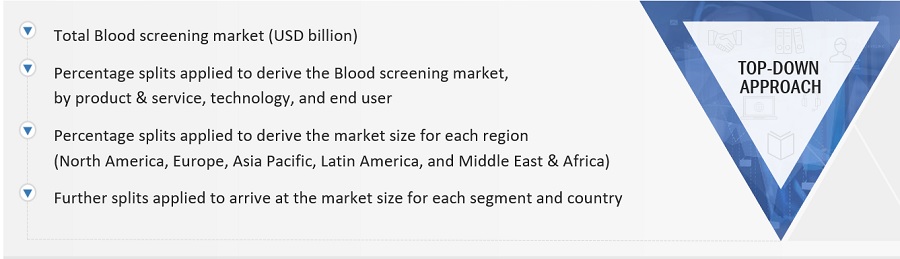

Both top-down and bottom-up approaches were used to estimate and validate the Blood screening market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the Blood screening market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Blood screening Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Blood Screening Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Blood screening is a medical process wherein donated blood is mainly tested for HIV1, HIV2, HBV, HCV, malaria, syphilis, and other infectious diseases. Donated blood is screened for these infectious diseases to reduce the risk of transfusion-transmissible infections (TTIs).

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the global Blood screening market, by products & service, technology, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall Blood screening market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launches & approvals, partnerships, acquisitions, agreements, and other developments

- To benchmark players within the market using the proprietary Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product excellence

Available Customizations

MarketsandMarkets offers the following customizations for this market report

Country Information

- Additional country-level analysis of the Blood screening market

Company profiles

- Additional five company profiles of players operating in the Blood screening market.

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Blood screening market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blood Screening Market

1) We would like to mention that total market size of NAT in Germany (60.8 million in 2015), Europe and US and even others remains the same. However, contribution of RTPCR and TMA will differ. We have done that correction in the report and are sharing the updated report with you in a few minutes. However, we will conduct some further primary interviews to re-validate this data. After re-validation, if any changes/discrepancies found in the further research, we share another version if needed. 2) (NAT) includes overall molecular diagnostics products (Reagents, kits, Instruments (Analysers), Software and Services) used for the blood screening test by all type of end users such as Hospitals and Blood Banks. This number (USD 66.6 million in 2016) is largely sum of TMA and PCR based NAT testing used for blood screening. These tests are being used by blood banks and hospitals. According to WHO report (published in 2016), in 2013, there were around 70 blood centres in Germany. 3) We have identified Ortho Clinical Diagnostics as a leading player. But it will not come in top 5 players. On the basis of our analysis and product offerings we have listed it in top 10 companies (at 6th position).

What are the challenges faced by the key players of the Blood Screening Market?

Which of the segments of Blood Screening Market is expected to hold the major share?

How the technological innovations are boosting the global growth of Blood Screening Market?