Carbon Capture and Sequestration Market by Service type (Capture (Pre-Combustion, Post-Combustion, & Oxy-Fuel), Transport, and Sequestration), by Application (EOR, Industrial, and Agricultural), and by Region - Global Trends and Forecast to 2021

[140 Pages report] The size of the global carbon capture & sequestration market is estimated to be USD 4.25 Billion in 2016, and is projected to grow at a CAGR of 13.6% from 2016 to 2021, to reach USD 8.05 Billion by 2021. Market growth is driven by factors such as the growing demand for power & CO2-EOR techniques and rising environmental concerns worldwide.

The years considered for the study are as follows:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

2015 has been considered as the base year for company profiles in the report. Wherever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, analyze, and forecast the global carbon capture & sequestration market based on application, service, and region

- To provide detailed information on major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the carbon capture & sequestration market with respect to individual growth trends and future prospects

- To identify the major stakeholders in the carbon capture & sequestration market and draw a competitive landscape for market leaders

- To project the market size of the carbon capture & sequestration market and its segments in key regions, namely, North America, Africa, Asia-Pacific, South America, Europe, and the Middle East

- To analyze market opportunities for stakeholders by identifying high-growth segments of the carbon capture & sequestration market

- To track and analyze recent developments such as expansions, new product launches, mergers & acquisitions, and contracts & agreements in the global carbon capture & sequestration market

Research Methodology

- Analysis of key operational and upcoming carbon capture and sequestration projects across the globe, along with capacity

- Analysis of carbon emission levels in each sector, in every country for the past 3 years

- Analysis of operation and upcoming coal-fired and natural gas-fired power plants across various countries

- Major regions have been identified along with countries contributing to the maximum share

- Secondary has been conducted to find out investments in R&D and emission control across countries

- Revenue of top companies (regional/global) and industry trends along with top-down, bottom-up, and MnM KNOW have been used to estimate the market size

- The overall market size has been finalized by triangulating the supply-side data, which include product development, supply chain, and annual generator sales across the globe.

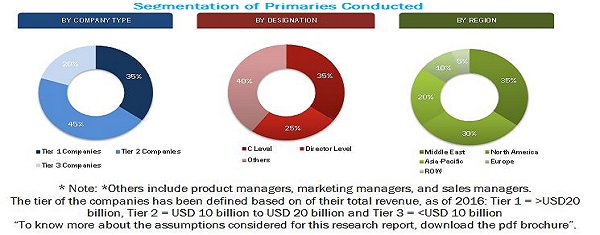

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below provides a breakdown of primaries conducted during the research study, based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

Target Audience:

- Carbon capture service providers

- Carbon transport service providers

- Carbon storage service providers

- Power producers by coal

- Chemical and other industries

- Iron and steel sector

- Environmental associations

- Offshore production platform manufacturing companies

- Government and research organizations

- Investment banks

Scope of the Report:

- By Service

- Capture

- By Capture Techniques

- Pre-combustion

- Post-combustion

- Oxy-fuel

- By Capture Techniques

- Transport

- Sequestration

- Capture

- By Application

- EOR Process

- Industrial

- Agricultural

- Others (Healthcare and pressurized containers)

- By Region

- North America

- Asia-Pacific

- South America

- Europe

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for this report:

- Detailed analysis and profiling of additional market players (Up to 5).

- Further breakdown of regional markets

- Detailed country analysis

The global carbon capture & sequestration market is projected to reach USD 8.05 billion by 2021, at a CAGR of 13.6% from 2016 to 2021. This growth can be attributed to rising environmental concerns across the world and increasing demand for CO2-EOR techniques.

The report segments the carbon capture & sequestration market based on services into capture, transport, and sequestration. The capture segment recorded the largest market size in 2015. This segment has further been segmented into pre-combustion, post-combustion, and oxy-fuel. Pre-combustion segment held the largest market size in 2015, given an increase in the number of pre-combustion projects.

The carbon capture & sequestration market has also been classified based on application into EOR process, industrial, agricultural, and others. The demand for EOR process is expected to increase during the forecast period, due to its usage in a wide range of applications in the oil & gas industry.

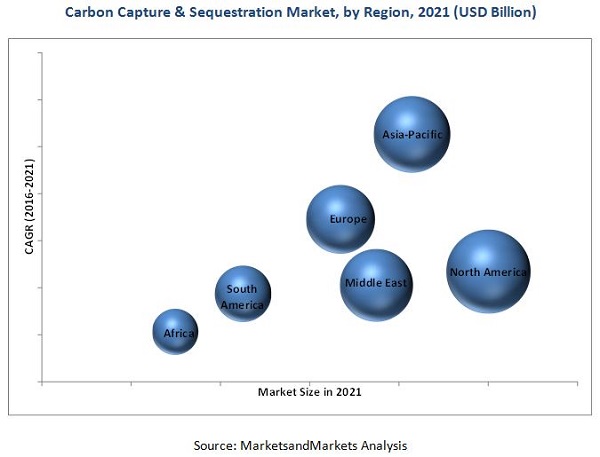

North America held the largest market share, followed by Asia-Pacific and the Middle East. In 2015, the U.S. dominated the North American carbon capture & sequestration market. This can be attributed to government support, followed by presence of more coal- and gas-fired power plants. Meanwhile, the market is estimated to grow the fastest in Asia-Pacific, owing to more number of coal-fired power plants. The figure given below indicates the market size of various regions by 2021, with their respective CAGRs.

The successful deployment of carbon capture and sequestration technologies is dependent on comprehensive policy support; carbon capture and sequestration lacks policy incentives. Moreover, it is costly to install and its operating cost is high. These factors are restraining the growth of the carbon capture & sequestration market.

Some of the leading players in the carbon capture & sequestration market include Fluor Corporation (U.S.), Linde AG (Germany), Shell CANSOLV (USA), Siemens (Germany), and Mitsubishi Heavy Industries (Japan), among others. Contracts & agreements was the most commonly adopted strategy by the top players in the market, followed by expansions and other developments.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.3.1 Key Data From Primary Sources

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

3.1 Introduction

3.1.1 Historical Backdrop

3.2 Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 30)

4.1 EOR Process Segment is Estimated to Dominate the Carbon Capture & Sequestration Market During the Forecast Period

4.2 U.S. and Canada are the Hotspots in North America for Large Scale Carbon Capture Deployment

4.3 North America Was the Largest Market for Carbon Capture & Sequestration in 2015

4.4 Carbon Capture & Sequestration Market, By EOR Process Application

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Regulations & Policies

5.3 Methods to Enhance Carbon Capture & Sequestration Adoption

5.4 Carbon Capture & Sequestration: Market Segmentation

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Growing Environmental Concerns

5.5.1.2 Increasing Demand for Co2-EOR Techniques

5.5.2 Restraints

5.5.2.1 Limited Adequate Policies

5.5.2.2 High Cost of Carbon Capture & Sequestration

5.5.3 Opportunities

5.5.3.1 Second-Generation Capturing Techniques Enabling Economic Operations

5.5.3.2 Capturing Unburnable Carbon Reducing Emissions Further By 1%5%

5.5.4 Challenges

5.5.4.1 Uncertain Paybacks

5.5.4.2 Safety Concerns at Storage Sites

5.6 Supply Chain Analysis

5.7 Porters Five Forces Analysis

5.7.1 Threat of New Entrants

5.7.2 Threat of Substitutes

5.8 Bargaining Power of Suppliers

5.8.1 Bargaining Power of Buyers

5.8.2 Intensity of Competitive Rivalry

6 Carbon Capture & Sequestration Market, By Application (Page No. - 46)

6.1 Introduction

6.2 EOR Process

6.3 Industrial

6.4 Agricultural

6.5 Others

7 Carbon Capture & Sequestration Market, By Service (Page No. - 53)

7.1 Introduction

7.2 Capture

7.2.1 Pre-Combustion Capture

7.2.2 Post-Combustion Capture

7.2.3 Oxy-Fuel Combustion

7.2.4 Others

7.3 Transportation

7.4 Storage

8 Carbon Capture & Sequestration Market, By Region (Page No. - 62)

8.1 Introduction

8.2 North America

8.2.1 By Country

8.2.1.1 U.S.

8.2.1.2 Canada

8.3 Europe

8.3.1 By Country

8.3.1.1 France

8.3.1.2 Netherlands

8.3.1.3 U.K.

8.3.1.4 Norway

8.4 Asia-Pacific

8.4.1 By Country

8.4.1.1 Australia

8.4.1.2 China

8.4.1.3 South Korea

8.4.2 Middle East & Africa

8.4.2.1 Saudi Arabia

8.4.2.2 UAE

8.4.3 South America

8.4.3.1 Brazil

9 Competitive Landscape (Page No. - 92)

9.1 Overview

9.2 Development Share Analysis, Till July 2016

9.3 Competitive Situation & Trends

9.4 Contracts & Agreements

9.5 Expansions

9.6 New Product Developments

9.7 Mergers & Acquisitions

10 Company Profiles (Page No. - 99)

(Overview, Products and Services, Financials, Strategy & Development)*

10.1 Introduction

10.2 Aker Solutions

10.3 Fluor Corporation

10.4 Hitachi, Ltd.

10.5 Linde AG

10.6 Mitsubishi Heavy Industries, Ltd.

10.7 Exxonmobil Corporation

10.8 General Electric

10.9 Halliburton

10.10 Honeywell International Inc.

10.11 Schlumberger Limited

10.12 Shell Global

10.13 Siemens AG

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 132)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Introducing RT : Real-Time Market Intelligence

11.6 Related Reports

List of Tables (65 Tables)

Table 1 Emission Targets in Key Countries By 2020

Table 2 Major Projects Targeting Co2-EOR Techniques, 20122020

Table 3 Carbon Capture & Sequestration Market Size, By Application, 20142021 (USD Million)

Table 4 EOR Process: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 5 Industrial: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 6 Agricultural: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 7 Others: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 8 Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 9 Capture: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 10 Pre-Combustion Capture: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 11 Post-Combustion Capture: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 12 Oxy-Fuel Combustion: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 13 Others: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 14 Transportation: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 15 Storage: Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 16 Carbon Capture & Sequestration Market Size, By Region, 20142021 (USD Million)

Table 17 Post-Combustion: Carbon Capture & Sequestration Market Size, By Top Countries, 20142021 (USD Million)

Table 18 Pre-Combustion: Carbon Capture & Sequestration Market Size, By Top Countries, 20142021 (USD Million)

Table 19 Oxy-Fuel Combustion: Carbon Capture & Sequestration Market Size, By Top Countries, 20142021 (USD Million)

Table 20 Other: Carbon Capture & Sequestration Market Size, By Top Countries, 20142021 (USD Million)

Table 21 Top Countries: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 22 North America: Carbon Capture & Sequestration Market Size, By Country, 20142021 (USD Million)

Table 23 North America: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 24 North America: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 25 North America: Carbon Capture & Sequestration Market Size, By Application, 20142021 (USD Million)

Table 26 U.S.: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 27 U.S.: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 28 Canada: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 29 Canada: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 30 Europe: Carbon Capture & Sequestration Market Size, By Country, 20142021 (USD Million)

Table 31 Europe: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 32 Europe: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 33 Europe: Carbon Capture & Sequestration Market Size, By Application, 20142021 (USD Million)

Table 34 France: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 35 France: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 36 The Netherlands: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 37 The Netherlands: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 38 U.K.: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 39 U.K.: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 40 Norway: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 41 Norway: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 42 Asia-Pacific: Carbon Capture & Sequestration Market Size, By Country, 20142021 (USD Million)

Table 43 Asia-Pacific: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 44 Asia-Pacific: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 45 Asia-Pacific: Carbon Capture & Sequestration Market Size, By Application, 20142021 (USD Million)

Table 46 Australia: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 47 Australia: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 48 China: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 49 China: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 50 South Korea: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 51 South Korea: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 52 Middle East & Africa: Carbon Capture & Sequestration Market Size, By Country, 20142021 (USD Million)

Table 53 Middle East & Africa: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 54 Middle East & Africa: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 55 Middle East & Africa: Carbon Capture & Sequestration Market Size, By Application, 20142021 (USD Million)

Table 56 Saudi Arabia: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 57 Saudi Arabia: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 58 UAE: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 59 UAE: Carbon Capture & Sequestration Market Size, By Capturing Technique, 20142021 (USD Million)

Table 60 South America: Carbon Capture & Sequestration Market Size, By Application, 20142021 (USD Million)

Table 61 Brazil: Carbon Capture & Sequestration Market Size, By Service, 20142021 (USD Million)

Table 62 Contracts & Agreements, 20132016

Table 63 Expansions, 20132015

Table 64 New Product Developments, 2016

Table 65 Mergers & Acquisitions, 2016

List of Figures (49 Figures)

Figure 1 Carbon Capture & Sequestration Market Segmentation

Figure 2 Carbon Capture & Sequestration Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 North America Dominated the Carbon Capture & Sequestration Market in 2015

Figure 7 EOR Process Segment is Expected to Occupy the Largest Market Share (Value) During the Forecast Period

Figure 8 Carbon Capture & Sequestration Market Size, By Service, 2016 & 2021 (USD Million)

Figure 9 North America is Expected to Generate the Highest Demand for EOR Process From 2016 to 2021

Figure 10 Attractive Market Opportunities in the Carbon Capture & Sequestration Market

Figure 11 EOR Process Segment is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 12 U.S. Capture & Sequestration Market Held the Largest Share in 2015

Figure 13 Carbon Capture & Sequestration Market Regional Snapshot

Figure 14 The North American EOR Process Market is Expected to Account for the Largest Share During the Forecast Period

Figure 15 Carbon Capture & Sequestration Market Segmentation: By Service, Application, & Region

Figure 16 Market Dynamics for Carbon Capture & Sequestration Market

Figure 17 Risks of Geological Storage

Figure 18 Carbon Capture & Sequestration Market: Supply Chain

Figure 19 Porters Five Forces Analysis: Carbon Capture & Sequestration Market

Figure 20 Carbon Capture & Sequestration Market Share (Value), By Application, 2015

Figure 21 EOR Process Segment is Expected to Dominate the Market During the Forecast Period

Figure 22 Carbon Capture & Sequestration Market Share (Value), By Service, 2015

Figure 23 Capture Segment is Expected to Dominate the Carbon Capture & Sequestration Market During the Forecast Period

Figure 24 Regional Snapshot: North America to Be the Fastest Growing Market, for Carbon Capture & Sequestration Market (20162021)

Figure 25 Carbon Capture & Sequestration Market Share (Value), By Region, 2015

Figure 26 North America & Asia-Pacific to Dominate the Carbon Capture & Sequestration Market During the Forecast Period

Figure 27 North America: Regional Snapshot

Figure 28 Asia-Pacific: Regional Snapshot

Figure 29 Companies Adopted Contracts & Agreements as the Key Growth Strategy, 20132016

Figure 30 Fluor Corporation Accounted for the Largest Development Share in the Carbon Capture & Sequestration Market in 2015

Figure 31 Market Evaluation Framework

Figure 32 Battle for Market Share: Contracts & Agreements Was the Key Strategy, 20132016

Figure 33 Aker Solutions: Company Snapshot

Figure 34 Aker Solutions: SWOT Analysis

Figure 35 Fluor Corporation: Company Snapshot

Figure 36 Fluor Corporation: SWOT Analysis

Figure 37 Hitachi, Ltd.: Company Snapshot

Figure 38 Hitachi, Ltd.: SWOT Analysis

Figure 39 Linde AG: Company Snapshot

Figure 40 Linde AG: SWOT Analysis

Figure 41 Mitsubishi Heavy Industries, Ltd.: Company Snapshot

Figure 42 Mitsubishi Heavy Industries, Ltd.: SWOT Analysis

Figure 43 Exxonmobil Corporation: Company Snapshot

Figure 44 General Electric: Company Snapshot

Figure 45 Halliburton: Company Snapshot

Figure 46 Honeywell International Inc.: Company Snapshot

Figure 47 Schlumberger Limited: Company Snapshot

Figure 48 Shell Global: Company Snapshot

Figure 49 Siemens AG: Company Snapshot

Growth opportunities and latent adjacency in Carbon Capture and Sequestration Market