Cellular IoT Market Size, Share & Industry Growth Analysis Report by Component (Hardware, Software, and Services), Technology (2G, 3G, 4G, LTE-M, NB-LTE-M, NB-IoT, and 5G), Application, Vertical and Geography(North America, Europe, APAC, South America & MEA) - Global Growth Driver and Industry Forecast to 2027

Updated on : Oct 23, 2024

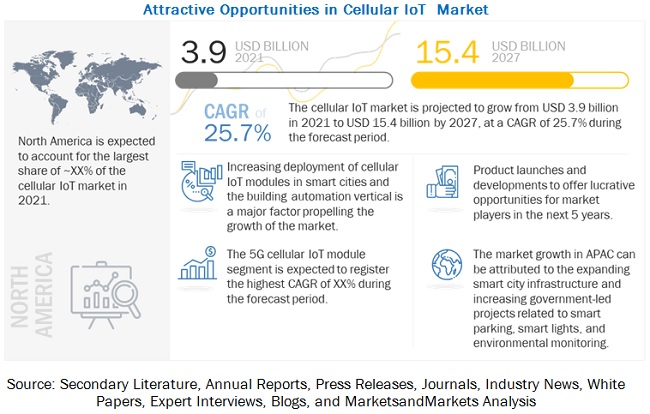

The global cellular IoT market size was valued at USD 3.9 billion in 2021. it is projected to reach USD 15.4 billion by 2027, growing at a compound annual growth rate (CAGR) of 25.7% during the forecast period.

The key factors fueling the growth of the market include the increasing deployment of cellular IoT modules in smart city infrastructure and building automation verticals, and growing demand for cellular IoT in agricultural automation and environmental monitoring. Additionally, increasing application of cellular IoT modules in medical wearables, and Increasing applications for cellular IoT modules in vehicle telematics and fleet management is expected to create a growth opportunity for the cellular IoT industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Cellular IoT Market

The outbreak of the COVID-19 pandemic has significantly impacted the market. Various regions are still affected, and governments have been responding to this pandemic in their ways.

As the COVID-19 pandemic continues to persist in North America and developing countries of Asia, the manufacturing and government sectors are facing immense challenges. The growth of the US automotive industry, which is one the largest in the world, has declined since the Q3 of 2020. Various automobile companies have downsized their manufacturing activities across the region.

Besides, the extreme scarcity of cellular IoT modules and chipsets for automobiles is expected to hamper the growth of the automotive industry for few years. Mexico is a major beneficiary of the automotive industry in North America. Since the manufacturing of automobiles has been reduced significantly, the Mexican automotive industry is also witnessing a tremendous loss.

Lockdowns and travel restrictions have constrained the availability of workforce in manufacturing units in Europe, especially in the UK, Ireland, Scotland, and Finland. This has resulted in complete closedown of some of the manufacturing units in the region due to decreased demand and less availability of workforce; hence, the cellular IoT market in Europe is set to witness some losses until the end of 2021 till all the lockdown measures are withdrawn completely.

Likewise, the production activities in the manufacturing sector in this region have declined significantly, owing to which the demand for various cellular IoT products and solutions has also reduced.

Asia Pacific is hardly hit due to the COVID-19 pandemic among all the regions. The semiconductor manufacturing industry in APAC accounts for ~70% of the total semiconductor manufacturing.

China, being the hub of semiconductor manufacturing, has witnessed high losses in this sector in FY2020 due to the COVID-19 pandemic. Production of electronics and medical devices was suspended in some containment areas because of the rampant spread of COVID-19.

India has been experiencing relapsing waves of the pandemic, which is disrupting supply chains. Periodic lockdowns and movement restrictions as of Q2 of 2021 are causing massive losses in the manufacturing sector. Japan and South Korea are still suffering moderately from the after-effects of the pandemic resulting in a lack of production activities in the manufacturing sector.

Cellular IoT Market Segment Overview

The hardware segment is projected to account for the largest share of the market by 2027

Hardware components such cellular IoT modules and chipsets form the basis of the entire cellular IoT ecosystem.

The increasing deployment of cellular IoT modules in wearables and connected healthcare devices as well as smartcity infrastructure, and building automation projects is expected to fuel the growth of the hardware segment during by 2027

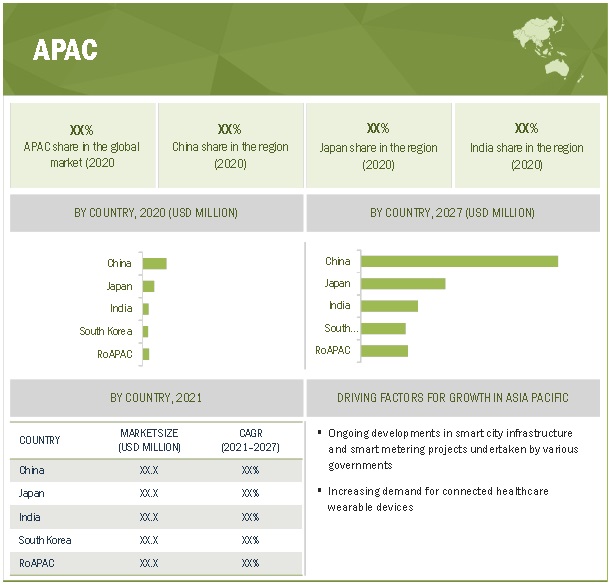

APAC region is expected to grow at the highest CAGR from 2021 to 2027

China, Japan, India, and South Korea are the major countries contributing to the growth of the cellular IoT market in APAC. Rapid deployment of smart city projects and increased demand for connected health wearable devices during the COVID-19 pandemic are driving the growth of the regional market.

To know about the assumptions considered for the study, download the pdf brochure

Top Cellular IoT Companies - Key Market Players

The cellular IoT players have implemented various types of organic as well as inorganic growth strategies, such as new product launches, and acquisitions to strengthen their offerings in the market. The major cellular IoT companies are

- Quectel (China),

- Thales Group (France),

- Fibocom Wireless (China),

- Telit Communications (UK),

- u-blox Holding (Switzerland),

- Sierra Wireless(US),

- Qualcomm (US),

- Mediatek (Taiwan),

- UNISOC Tec

The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Years considered |

2018–2027 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2027 |

|

Forecast units |

Volume (million units), Value (USD million/billion) |

|

Segments covered |

Component, Technology, Application, Vertical |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Quectel (China), Thales Group (France), Fibocom Wireless (China), Telit Communications (UK), u-blox Holding (Switzerland), Sierra Wireless(US), Qualcomm (US), Mediatek (Taiwan), UNISOC Technologies (China), Altair Semiconductor (Israel), Intel (US), Nordic Semiconductor (Norway), Murata Manufacturing (Japan), Sequans Communication (France), Analog Devices (US), Qorvo (US), AT&T (US), GosuncnWelink Corporation (China), HiSilicon Technologies (China), MeiG Smart Technology (China), Neoway Technology (China), Sercomm Corporation (Taiwan), Skyworks (US), Xiamen CHEERZING IoT Technology (China), Commsolid (Goodix Technology (Germany) |

Cellular IoT Market Dynamics

Driver: Increasing deployment of cellular IoT modules in smart city infrastructure and building automation verticals

Smart city infrastructure and building automation are the major verticals deploying cellular IoT modules. As of 2020, almost ~30% of the revenue of the market was generated from these verticals.

Emerging cellular IoT technologies such as NB-LTE-M, NB-IoT, and 5G are offering an affordable and power-efficient way to connect battery-operated devices to the internet. From smart street lighting to smart parking, these technologies can help in connecting devices more efficiently than the existing 2G and 3G technologies.

Some of the major applications of cellular IoT in smart cities are in streetlights, traffic sensing and control devices, infrastructure monitoring devices, waste management devices, and parking management devices. Governments worldwide are particularly focusing on modern infrastructure reforms, and many pilot projects are being set up to achieve this goal. Besides, the governments in North America and Eastern Europe are incentivizing such projects and forging public–private partnerships (PPPs).

Restraint: Susceptibility to cyberattacks

Cellular IoT modules and devices work on a connectivity ecosystem. Although they help in simplifying various applications across key verticals, they are prone to cyberattacks.

With the increasing number of IoT devices on cellular networks, cybercriminals are leveraging both cellular and IoT vulnerabilities to launch cyberattacks more effectively than ever before.

Most of the cellular IoT devices are dependent on cloud networks for proper functioning. This makes cloud-based security a critical part of cellular IoT security policy as insecure cloud infrastructure can lead to data theft or device hijacking.

For instance, a surveillance or delivery drone, which is a cloud-dependent IoT device, is capable of processing information such as navigation instructions and image data on its own, but it may transmit captured videos or logs to a cloud-based server. If the device is compromised, it may risk other devices or the entire network if the breach is not immediately contained.

Examples of some of the common cyber-attacks related to cellular IoT devices are battery drain attacks, data channel rerouting attacks, and Denial of Service (DoS) attacks.

Opportunity: Increasing applications for cellular IoT modules in vehicle telematics and fleet management

Vehicle telematics to enhance performance and connectivity, which maximizes an organization’s assets, is one of the key emerging use cases for cellular IoT.

According to MarketsandMarkets’ analysis, the telematics solutions market is projected to reach USD 62.6 billion by 2025 from USD 29.9 billion in 2020 at a CAGR of 15.9%. Apart from highway vehicles, the trend of implementing telematics solutions in off-highway vehicles is expected to present high growth opportunities for cellular IoT solution providers.

When it comes to off-highway vehicles, such as cranes and excavators, time is considered to be a critical aspect with a limited number of technicians. This necessitates the need for implementing IoT and telematics solutions to monitor both equipment and on-road assets. Therefore, telematics solution providers are implementing cellular IoT modules in their product offerings, which makes it easy for off-highway vehicle OEMs and fleet managers to collect and analyze data to identify heavy equipment usage trends and field-based problems.

Challenge: Development of common protocols and standards across IoT platform

Presently, in the technical market scenario, IoT does not seem to provide a promising architectural solution or a universal standard to solve the interoperability issue. Thus, there is an urgent requirement for making universal standards for cellular IoT to eliminate the interoperability issues.

Any universal standard seeking to encompass such diverse IoT applications would have to be scalable. To achieve this, enterprises, organizations, and developers are required to make efforts to develop a universal standard comprising all diverse IoT applications, devices, platforms, and software, which seems to be difficult to achieve in the next few years.

The requirement for devices would vary depending on their applications, for instance, low power sensors are required for security cameras and streaming video signals. The complexity of developing a unified set of standards is high in the case of IoT; thus, organizations that set standards for wired and wireless IoT connectivity should come together to implement effective solutions.

Cellular IoT Market Categorization

In this report, the overall market has been segmented based on component, technology, application, vertical and region.

By Component:

- Hardware

- Software

- Services

Technology:

- 2G

- 3G

- 4G

- LTE-M

- NB-LTE-M

- NB-IoT

- 5G

By Application:

- Alarms & Detectors

- Smart Appliances

- Smart Metering

- Smart Parking

- Smart Street Light

- Surveillance & Monitoring

- Trackers

- Wearable Devices

- Others (Connected Healthcare devices and environmental monitoring devices)

By Vertical:

- Agriculture

- Automotive & Transportation

- Building Automation

- Consumer Electronics

- Energy & Utilities

- Healthcare

- Industrial/ Manufacturing

- Retail

- Smart Cities

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Recent Developments in Cellular IoT Industry

- In April 2021, Sierra Wireless has launched its HL7845 Module. The module features support for 450 MHz wireless spectrum and is designed to meet the IoT connectivity needs of utilities in Europe.

- In March 2021, Fibocom has launched next-generation 5G NR modules compliant with 3GPP R16 standard during Mobile World Congress Shanghai (MWC-S21). The launch includes FM150 and FG160 5G module series 5G module series of sub-6 GHz frequency range as well as the FM160W and FG160W series of mmWave range.

- In February 2021, Quectel launched the second-generation RG520-F and RG520-N 5G IoT modules that are compliant with 3GPP Release 16 standards. These modules support the following bands: sub-6GHz, Time Division Duplex (TDD), Frequency Division Duplex (FDD), and Carrier Aggregation (CA).

- In February 2021, Fibocom has collaborated with Deutsche Telekom, the world’s leading integrated telecommunications company, and Redtea, a pioneering connectivity solutions provider, to deliver best-in-class commercial-ready nuSIM IoT modules.

- In January 2021, Quectel introduced RM500Q-AE, RM502Q-AE, and RM505Q-AE, a new set of 5G modules to accelerate the deployment of IoT devices. Its features include support to global 5G frequency bands, multi-gigabit data rates, multi-constellation GNSS capabilities, USB 3.0/3.1, PCIe 3.0, and eSIM interfaces.

Frequently Asked Questions (FAQ):

Who are the top 5 players in the cellular IoT market?

The major vendors operating in the industry market include Quectel, Thales Group, Fibocom Wireless, Telit Communications, and u-blox Holding

What are their major strategies to strengthen their market presence?

The major strategies adopted by these players are contract, acquisitions, product launches, and developments.

Which major countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and rest of European countries.

Which major countries are considered in the APAC region?

The report includes an analysis of the China, Japan, India, South Korea and rest of APAC countries.

Does this report include the impact of COVID-19 on the cellular IoT market?

Yes, the report includes the impact of COVID-19 on the cellular IoT market. It illustrates the post- COVID-19 market scenario. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF STUDY

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CELLULAR IOT MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 CELLULAR IOT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Methodology for arriving at market size using bottom-up approach

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Methodology for capturing market size using top-down approach

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (DEMAND SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES OF MARKET SIZE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

TABLE 2 CELLULAR IOT MARKET, BY COMPONENT, 2018–2020 (USD BILLION)

TABLE 3 MARKET, BY COMPONENT, 2021–2027 (USD BILLION)

FIGURE 7 IMPACT OF COVID-19 ON MARKET

3.2 POST-COVID-19 SCENARIO

TABLE 4 POST-COVID-19 SCENARIO: CELLULAR IOT, 2021–2027 (USD BILLION)

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 5 OPTIMISTIC SCENARIO (POST-COVID-19): CELLULAR IOT MARKET, 2021–2027 (USD BILLION)

3.4 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 6 PESSIMISTIC SCENARIO (POST-COVID-19): CELLULAR IOT, 2021–2027 (USD BILLION)

FIGURE 8 HARDWARE SEGMENT TO LEAD MARKET FROM 2021 TO 2027

FIGURE 9 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 10 INCREASING DEPLOYMENT OF CELLULAR IOT MODULES IN SMART CITIES AND BUILDING AUTOMATION VERTICALS TO FUEL GROWTH OF MARKET FROM 2021 TO 2027

4.2 CELLULAR IOT MARKET, BY TECHNOLOGY

FIGURE 11 4G CELLULAR IOT MODULE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2021 TO 2027

4.3 MARKET, BY TECHNOLOGY AND REGION

FIGURE 12 4G MODULE SEGMENT AND NORTH AMERICA TO HOLD LARGEST SHARES OF MARKET IN 2021

4.4 CELLULAR IOT MARKET, BY COUNTRY

FIGURE 13 MARKET IN INDIA TO REGISTER HIGHEST CAGR FROM 2021 TO 2027

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 MARKET DYNAMICS: CELLULAR IOT MARKET, 2020

5.2.1 DRIVERS

5.2.1.1 Increasing deployment of cellular IoT modules in smart city infrastructure and building automation verticals

5.2.1.2 Growing demand for cellular IoT in agricultural automation and environmental monitoring

FIGURE 15 MARKET: IMPACT ANALYSIS OF DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS

5.2.2.1 Susceptibility to cyberattacks

5.2.2.2 Difficulties in management and maintenance of cellular IoT deployments

FIGURE 16 MARKET: IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing application of cellular IoT modules in medical wearables

5.2.3.1.1 USE CASE - MAYO CLINIC

5.2.3.2 Increasing applications for cellular IoT modules in vehicle telematics and fleet management

5.2.3.2.1 USE CASE - ONSTAR CORPORATION

5.2.4 CHALLENGES

5.2.4.1 Development of common protocols and standards across IoT platform

5.3 VALUE CHAIN ANALYSIS

FIGURE 17 CELLULAR IOT MARKET: VALUE CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 ECOSYSTEM ANALYSIS

TABLE 8 ECOSYSTEM: CELLULAR IOT

5.6 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

5.7 CASE STUDY ANALYSIS

5.7.1 USE CASE - ZHEJIANG MOBILE & HUAWEI

5.7.2 USE CASE - TUYA SMART

5.7.3 USE CASE – TATA POWER DELHI

5.8 TECHNOLOGY ANALYSIS

5.8.1 CLOUD COMPUTING

5.8.2 5G

5.8.3 MQTT PROTOCOL

5.9 PRICING ANALYSIS

FIGURE 18 ASP OF CELLULAR IOT MODULES, 2018–2021 (USD)

TABLE 9 AVERAGE SELLING PRICE (ASP) TREND OF CELLULAR IOT MODULES BY TOP COMPANIES

5.10 TRADE ANALYSIS

5.10.1 IMPORT AND EXPORT SCENARIO

FIGURE 19 IMPORT DATA, BY COUNTRY, 2016−2020 (USD MILLION)

FIGURE 20 EXPORT DATA, BY COUNTRY, 2016−2020 (USD MILLION)

5.11 PATENT ANALYSIS

TABLE 10 LIST OF PATENTS

5.12 REGULATORY LANDSCAPE

5.12.1 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

5.12.2 REGISTRATION, EVALUATION, AUTHORIZATION, AND RESTRICTION OF CHEMICALS (REACH)

6 CELLULAR IOT MARKET, BY COMPONENT (Page No. - 75)

6.1 INTRODUCTION

FIGURE 21 MARKET, BY COMPONENT

FIGURE 22 SOFTWARE SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 11 MARKET, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 INCREASING DEPLOYMENT OF CELLULAR IOT MODULES IN VARIOUS APPLICATIONS TO BOOST MARKET GROWTH

6.2.2 BASEBAND PROCESSOR

6.2.3 RF TRANSCEIVER

6.2.4 RF FRONT END

6.2.5 POWER MANAGEMENT UNIT

TABLE 13 MARKET FOR HARDWARE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 14 MARKET FOR HARDWARE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 15 MARKET FOR HARDWARE, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 16 MARKET FOR HARDWARE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 17 MARKET FOR HARDWARE, BY REGION, 2018–2020 (USD MILLION)

TABLE 18 MARKET FOR HARDWARE, BY REGION, 2021–2027 (USD MILLION)

6.3 SOFTWARE

6.3.1 EASE IN REMOTE MONITORING OF CELLULAR IOT DEVICES TO FUEL GROWTH OF SOFTWARE SEGMENT

6.3.2 PROTOTYPING PLATFORM

6.3.3 SOFTWARE DEVELOPMENT KIT

TABLE 19 CELLULAR IOT MARKET FOR SOFTWARE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 20 MARKET FOR SOFTWARE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 21 MARKET FOR SOFTWARE, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 22 MARKET FOR SOFTWARE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 23 MARKET FOR SOFTWARE, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 MARKET FOR SOFTWARE, BY REGION, 2021–2027 (USD MILLION)

6.4 SERVICES

6.4.1 GROWING NEED FOR ANTENNA DESIGN SERVICES TO CALIBRATE IOT DEVICES IN SPECIFIC APPLICATIONS TO BOOST MARKET GROWTH

TABLE 25 MARKET FOR SERVICES, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 26 MARKET FOR SERVICES, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 27 MARKET FOR SERVICES, BY VERTICAL 2018–2020 (USD MILLION)

TABLE 28 MARKET FOR SERVICES, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 29 MARKET FOR SERVICES, BY REGION, 2018–2020 (USD MILLION)

TABLE 30 MARKET FOR SERVICES, BY REGION, 2021–2027 (USD MILLION)

7 CELLULAR IOT MARKET, BY TECHNOLOGY (Page No. - 88)

7.1 INTRODUCTION

FIGURE 23 EVOLUTION OF CELLULAR IOT TECHNOLOGY

FIGURE 24 MARKET, BY TECHNOLOGY

FIGURE 25 5G CELLULAR IOT MODULES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 31 CELLULAR IOT MODULE SHIPMENTS, 2018–2020 (MILLION UNITS)

TABLE 32 CELLULAR IOT MODULE SHIPMENTS, 2021–2027 (MILLION UNITS)

TABLE 33 CELLULAR IOT MODULE MARKET, 2018–2020 (USD MILLION)

TABLE 34 CELLULAR IOT MODULE MARKET, 2021–2027 (USD MILLION)

7.2 2G

7.2.1 HIGH DEMAND FOR 2G IOT MODULES IN STATIC ASSET MANAGEMENT APPLICATIONS TO BOOST MARKET GROWTH

7.3 3G

7.3.1 INCREASING DEMAND FOR 3G IOT MODULES IN EASTERN EUROPE AND SOUTH-EAST ASIA FOR SMART PARKING AND SMART STREET LIGHT APPLICATIONS TO FUEL MARKET GROWTH

7.4 4G

7.4.1 INCREASING DEMAND FOR 4G IOT MODULES IN SMART MANUFACTURING APPLICATIONS TO DRIVE MARKET GROWTH

7.4.2 USE CASE - CORINTECH AND TELIT COMMUNICATIONS

7.5 LTE-M

7.5.1 GROWING DEMAND FOR LTE-M MODULES IN UTILITY METERS AND ENERGY MANAGEMENT APPLICATIONS TO FUEL MARKET GROWTH

7.5.2 USE CASE - KDDI JAPAN

7.6 NB-LTE-M

7.6.1 INCREASING DEMAND FOR NBLTE-M MODULES IN APPLICATIONS REQUIRING VARIABLE CELLULAR SPECTRUM TO PROPEL MARKET GROWTH

TABLE 35 NB-LTE-M: RECENT DEVELOPMENTS

7.7 NB-IOT

7.7.1 INCREASING DEMAND FOR NB-IOT MODULES IN SMAR METERING AND AGRICULTURAL AUTOMATION APPLICATIONS TO DRIVE MARKET GROWTH

7.7.2 USE CASE - TATA POWER DELHI

7.7.3 USE CASE - CHINA MOBILE AND STATE GRID CORPORATION OF CHINA (CEPRI)

7.8 5G

7.8.1 RISING DEMAND FOR 5G IOT MODULES IN SMART BUILDINGS FOR SECURITY AND SURVEILLANCE TO DRIVE MARKET GROWTH

TABLE 36 5G: RECENT DEVELOPMENTS

8 CELLULAR IOT MARKET, BY APPLICATION (Page No. - 98)

8.1 INTRODUCTION

FIGURE 26 MARKET, BY APPLICATION

FIGURE 27 WEARABLE DEVICES SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 37 MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 38 MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

8.2 ALARMS & DETECTORS

8.2.1 GROWING DEMAND FOR ALARMS AND DETECTORS IN SMART BUILDINGS TO FUEL MARKET GROWTH

8.2.2 USE CASE - ZHEJIANG MOBILE & HUAWEI

TABLE 39 CELLULAR IOT MARKET FOR ALARMS & DETECTORS, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 40 MARKET FOR ALARMS & DETECTORS, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 41 MARKET FOR ALARMS & DETECTORS, BY REGION, 2018–2020 (USD MILLION)

TABLE 42 MARKET FOR ALARMS & DETECTORS, BY REGION, 2021–2027 (USD MILLION)

8.3 SMART APPLIANCES

8.3.1 GROWING DEMAND FOR SMART HOME AUTOMATION TO BOOST GROWTH OF SMART APPLIANCES SEGMENT

8.3.2 USE CASE - TUYA SMART

TABLE 43 MARKET FOR SMART APPLIANCES, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 44 MARKET FOR SMART APPLIANCES, BY COMPONENT 2021–2027 (USD MILLION)

TABLE 45 MARKET FOR SMART APPLIANCES, BY REGION 2018–2020 (USD MILLION)

TABLE 46 MARKET FOR SMART APPLIANCES, BY REGION 2021–2027 (USD MILLION)

8.4 SMART METERING

8.4.1 EASE IN ELECTRICITY BILLING AND AUTOMATIC RECORD LOGGING OF DAILY CONSUMPTION TO BOOST DEMAND FOR SMART METERING

8.4.2 USE CASE - TATA POWER DELHI

8.4.3 USE CASE - CHINA MOBILE AND STATE GRID CORPORATION OF CHINA (CEPRI)

TABLE 47 CELLULAR IOT MARKET FOR SMART METERING, BY COMPONENT 2018–2020 (USD MILLION)

TABLE 48 MARKET FOR SMART METERING, BY COMPONENT 2021–2027 (USD MILLION)

TABLE 49 MARKET FOR SMART METERING, BY REGION 2018–2020 (USD MILLION)

TABLE 50 MARKET FOR SMART METERING, BY REGION 2021–2027 (USD MILLION)

8.5 SMART PARKING

8.5.1 COMBINATION OF SMART PARKING TECHNOLOGIES WITH IOT TO DRIVE MARKET GROWTH

FIGURE 28 WORKING MECHANISM: SMART PARKING SYSTEMS

8.5.2 USE CASE - CHINA MOBILE AND DT MOBILE

TABLE 51 MARKET FOR SMART PARKING, BY COMPONENT 2018–2020 (USD MILLION)

TABLE 52 MARKET FOR SMART PARKING, BY COMPONENT 2021–2027 (USD MILLION)

TABLE 53 MARKET FOR SMART PARKING, BY REGION 2018–2020 (USD MILLION)

TABLE 54 MARKET FOR SMART PARKING, BY REGION 2021–2027 (USD MILLION)

8.6 SMART STREET LIGHTS

8.6.1 NEED TO REDUCE WASTAGE OF ELECTRICITY TO FUEL DEMAND FOR CELLULAR IOT IN SMART STREET LIGHTS SEGMENT

FIGURE 29 WORKING MECHANISM: SMART LIGHTING

8.6.2 USE CASE - DEUTSCHE TELEKOM AND ELEKTRIZITÄTS- UND GASVERSORGUNG GMBH

TABLE 55 CELLULAR IOT MARKET FOR SMART STREET LIGHTS, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 56 MARKET FOR SMART STREET LIGHTS, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 57 MARKET FOR SMART STREET LIGHTS, BY REGION, 2018–2020 (USD MILLION)

TABLE 58 MARKET FOR SMART STREET LIGHTS, BY REGION, 2021–2027 (USD MILLION)

8.7 SURVEILLANCE & MONITORING

8.7.1 INCREASING DEMAND FOR SURVEILLANCE CAMERAS IN SMART BUILDINGS TO BOOST MARKET GROWTH

TABLE 59 MARKET FOR SURVEILLANCE & MONITORING, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 60 MARKET FOR SURVEILLANCE & MONITORING, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 61 MARKET FOR SURVEILLANCE & MONITORING, BY REGION, 2018–2020 (USD MILLION)

TABLE 62 MARKET FOR SURVEILLANCE & MONITORING, BY REGION, 2021–2027 (USD MILLION)

8.8 TRACKERS

8.8.1 GROWING DEMAND FOR TRACKERS FOR ASSET MANAGEMENT IN RETAIL SECTOR TO BOOST MARKET GROWTH

FIGURE 30 CHALLENGES: ASSET TRACKING

TABLE 63 CELLULAR IOT MARKET FOR TRACKERS, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 64 MARKET FOR TRACKERS, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 65 MARKET FOR TRACKERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 66 MARKET FOR TRACKERS, BY REGION, 2021–2027 (USD MILLION)

8.9 WEARABLE DEVICES

8.9.1 GROWING POPULARITY OF WEARABLE DEVICES TO FUEL DEMAND FOR CELLULAR IOT TECHNOLOGIES

TABLE 67 MARKET FOR WEARABLE DEVICES, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 68 MARKET FOR WEARABLE DEVICES, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 69 MARKET FOR WEARABLE DEVICES, BY REGION, 2018–2020 (USD MILLION)

TABLE 70 MARKET FOR WEARABLE DEVICES, BY REGION, 2021–2027 (USD MILLION)

8.10 OTHER APPLICATIONS (CONNECTED HEALTHCARE DEVICES AND ENVIRONMENTAL MONITORING DEVICES)

FIGURE 31 ENVIRONMENTAL MONITORING VALUE CHAIN

TABLE 71 MARKET FOR OTHER APPLICATIONS, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 72 MARKET FOR OTHERS, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 73 MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2020 (USD MILLION)

TABLE 74 MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

9 CELLULAR IOT MARKET, BY VERTICAL (Page No. - 121)

9.1 INTRODUCTION

FIGURE 32 MARKET SEGMENTATION, BY VERTICAL

TABLE 75 MARKET, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 76 MARKET, BY VERTICAL, 2021–2027 (USD MILLION)

FIGURE 33 HEALTHCARE VERTICAL TO GROW AT HIGHEST RATE IN MARKET DURING FORECAST PERIOD

9.2 AGRICULTURE

9.2.1 GROWING REQUIREMENT FOR FOOD IS INCREASING DEMAND FOR CELLULAR IOT SOLUTIONS IN AGRICULTURE VERTICAL TO ACHIEVE HIGH YIELD

TABLE 77 MARKET FOR AGRICULTURE VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 78 MARKET FOR AGRICULTURE VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 79 MARKET FOR AGRICULTURE VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 80 MARKET FOR AGRICULTURE VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.3 AUTOMOTIVE & TRANSPORTATION

9.3.1 INCREASING DEMAND FOR CELLULAR IOT MODULES IN TELEMATICS AND FLEET AUTOMATION TO BOOST MARKET GROWTH

TABLE 81 MARKET FOR AUTOMOTIVE & TRANSPORTATION VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 82 MARKET FOR AUTOMOTIVE & TRANSPORTATION VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 83 MARKET FOR AUTOMOTIVE & TRANSPORTATION VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 84 MARKET FOR AUTOMOTIVE & TRANSPORTATION VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.4 CONSUMER ELECTRONICS

9.4.1 INCREASING DEMAND FOR CELLULAR IOT IN SMART HOME APPLIANCES TO DRIVE MARKET GROWTH

TABLE 85 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 86 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 87 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 88 MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.5 BUILDING AUTOMATION

9.5.1 INCREASING GOVERNMENT-LED GREEN BUILDING PROJECTS TO FUEL GROWTH OF BUILDING AUTOMATION SEGMENT

9.5.2 CASE STUDY - BEHRTECH

TABLE 89 CELLULAR IOT MARKET FOR BUILDING AUTOMATION VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 90 MARKET FOR BUILDING AUTOMATION VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 91 MARKET FOR BUILDING AUTOMATION VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 92 MARKET FOR BUILDING AUTOMATION VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.6 ENERGY & UTILITY

9.6.1 SMART METERING AND SMART GRID PROJECTS TO BOOST DEMAND FOR CELLULAR IOT

TABLE 93 MARKET FOR ENERGY & UTILITY VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 94 MARKET FOR ENERGY & UTILITY VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 95 MARKET FOR ENERGY & UTILITY VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 96 MARKET FOR ENERGY & UTILITY VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.7 HEALTHCARE

9.7.1 INCREASING DEMAND FOR MEDICAL WEARABLES TO BOOST MARKET GROWTH

TABLE 97 CELLULAR IOT MARKET FOR HEALTHCARE VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 98 MARKET FOR HEALTHCARE VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 99 MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 100 MARKET FOR HEALTHCARE VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.8 INDUSTRIAL/MANUFACTURING

9.8.1 INCREASING APPLICATIONS OF CELLULAR IOT MODULES IN SMART FACTORY AUTOMATION TO DRIVE MARKET GROWTH

TABLE 101 MARKET FOR INDUSTRIAL/MANUFACTURING VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 102 MARKET FOR INDUSTRIAL/MANUFACTURING VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 103 MARKET FOR INDUSTRIAL/MANUFACTURING VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 104 MARKET FOR INDUSTRIAL/MANUFACTURING VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.9 RETAIL

9.9.1 INCREASING DEMAND FOR CELLULAR IOT MODULES FOR ASSET TRACKING TO BOOST MARKET GROWTH

TABLE 105 MARKET FOR RETAIL VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 106 MARKET FOR RETAIL VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 107 MARKET FOR RETAIL VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 108 MARKET FOR RETAIL VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.10 SMART CITIES

9.10.1 RAPID INCREASE IN NUMBER OF PUBLIC SECTOR PROJECTS TO FUEL GROWTH OF CELLULAR IOT MARKET FOR SMART CITIES

TABLE 109 MARKET FOR SMART CITIES VERTICAL, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 110 MARKET FOR SMART CITIES VERTICAL, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 111 MARKET FOR SMART CITIES VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 112 MARKET FOR SMART CITIES VERTICAL, BY REGION, 2021–2027 (USD MILLION)

9.11 OTHERS

9.11.1 USE CASE - US MILITARY AND VERIZON

TABLE 113 MARKET FOR OTHERS, BY COMPONENT, 2018–2020 (USD MILLION)

TABLE 114 MARKET FOR OTHERS, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 115 MARKET FOR OTHERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 116 MARKET FOR OTHERS, BY REGION, 2021–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 142)

10.1 INTRODUCTION

FIGURE 34 CELLULAR IOT MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 118 MARKET, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: SNAPSHOT OF MARKET

10.2.1 US

10.2.1.1 Government projects for development of smart city infrastructure to propel demand for cellular IoT solutions

10.2.2 CANADA

10.2.2.1 Increasing environmental monitoring projects to fuel demand for cellular IoT modules

10.2.3 MEXICO

10.2.3.1 Increasing requirement for vehicle telematics and fleet management to fuel demand for cellular IoT solutions

TABLE 120 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

10.3 EUROPE

FIGURE 36 EUROPE: SNAPSHOT OF MARKET

10.3.1 GERMANY

10.3.1.1 Increasing deployment of 5G infrastructure to boost demand for cellular IoT

10.3.2 UK

10.3.2.1 Increasing demand for cellular connectivity in manufacturing sector to drive market growth

10.3.3 FRANCE

10.3.3.1 Increasing government support for smart city projects to boost demand for cellular IoT

10.3.4 REST OF EUROPE

TABLE 121 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 122 MARKET IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

10.4 APAC

FIGURE 37 APAC: SNAPSHOT OF MARKET

10.4.1 CHINA

10.4.1.1 Increasing infrastructure projects for smart parking lots to boost demand for cellular IoT

10.4.2 JAPAN

10.4.2.1 Expanding 5G connectivity to boost demand for cellular IoT devices

10.4.3 INDIA

10.4.3.1 Government projects supporting high production of semiconductor devices to propel growth of market

10.4.4 SOUTH KOREA

10.4.4.1 Increasing demand for trackers and wearable devices to propel demand for cellar IoT solutions

10.4.5 REST OF APAC

TABLE 124 CELLULAR IOT MARKET IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

10.5 ROW

FIGURE 38 ROW: SNAPSHOT OF MARKET

10.5.1 SOUTH AMERICA

10.5.1.1 Growing 4G and 5G connectivity to boost demand for cellular solutions

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Rapid deployment of smart city grids to fuel growth of market

TABLE 126 MARKET IN ROW, BY REGION, 2021–2027 (USD MILLION)

10.6 IMPACT OF COVID-19 ON REGIONS

11 COMPETITIVE LANDSCAPE (Page No. - 159)

11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2 OVERVIEW

11.3 TOP 5 COMPANY ANALYSIS

FIGURE 39 MARKET SHARE FOR CELLULAR IOT MODULE SHIPMENTS OF TOP 5 COMPANIES, IN TERMS OF VOLUME (2018)

FIGURE 40 MARKET SHARE FOR CELLULAR IOT MODULE SHIPMENTS OF TOP 5 COMPANIES, IN TERMS OF VOLUME (2019)

FIGURE 41 MARKET SHARE FOR CELLULAR IOT MODULE SHIPMENTS OF TOP 5 COMPANIES, IN TERMS OF VOLUME (2020)

11.4 MARKET SHARE ANALYSIS (2020)

TABLE 127 CELLULAR IOT MARKET: MARKET SHARE ANALYSIS

11.5 COMPANY EVALUATION QUADRANT, 2020

11.5.1 STAR

11.5.2 PERVASIVE

11.5.3 EMERGING LEADER

11.5.4 PARTICIPANT

FIGURE 42 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

11.6 SMALL AND MEDIUM ENTERPRISE (SME) EVALUATION QUADRANT, 2020

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 43 CELLULAR IOT MARKET (GLOBAL), SME EVALUATION QUADRANT, 2020

TABLE 128 MARKET: COMPANY FOOTPRINT

TABLE 129 COMPANY VERTICAL FOOTPRINT

TABLE 130 COMPANY REGION FOOTPRINT

11.7 COMPETITIVE SCENARIO

TABLE 131 MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, MARCH 2020−APRIL 2021

TABLE 132 MARKET: DEALS, MARCH 2020−MARCH 2021

12 COMPANY PROFILES (Page No. - 171)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 QUECTEL

TABLE 133 QUECTEL: BUSINESS OVERVIEW

FIGURE 44 QUECTEL: COMPANY SNAPSHOT

12.1.2 THALES GROUP

TABLE 134 THALES GROUP: BUSINESS OVERVIEW

FIGURE 45 THALES GROUP: COMPANY SNAPSHOT

12.1.3 FIBOCOM WIRELESS

TABLE 135 FIBOCOM WIRELESS: BUSINESS OVERVIEW

FIGURE 46 FIBOCOM WIRELESS: COMPANY SNAPSHOT

12.1.4 TELIT COMMUNICATIONS

TABLE 136 TELIT COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 47 TELIT COMMUNICATIONS: COMPANY SNAPSHOT

12.1.5 U-BLOX HOLDING

TABLE 137 U-BLOX HOLDING: BUSINESS OVERVIEW

FIGURE 48 U-BLOX: COMPANY SNAPSHOT

12.1.6 SIERRA WIRELESS

TABLE 138 SIERRA WIRELESS: BUSINESS OVERVIEW

FIGURE 49 SIERRA WIRELESS: COMPANY SNAPSHOT

12.1.7 QUALCOMM

TABLE 139 QUALCOMM: BUSINESS OVERVIEW

FIGURE 50 QUALCOMM: COMPANY SNAPSHOT

12.1.8 MEDIATEK

TABLE 140 MEDIATEK: BUSINESS OVERVIEW

FIGURE 51 MEDIATEK: COMPANY SNAPSHOT

12.1.9 UNISOC TECHNOLOGIES

TABLE 141 UNISOC TECHNOLOGIES: BUSINESS OVERVIEW

12.1.10 ALTAIR SEMICONDUCTOR

TABLE 142 ALTAIR SEMICONDUCTOR: BUSINESS OVERVIEW

12.1.11 INTEL

TABLE 143 INTEL: BUSINESS OVERVIEW

FIGURE 52 INTEL: COMPANY SNAPSHOT

12.1.12 NORDIC SEMICONDUCTOR

TABLE 144 NORDIC SEMICONDUCTOR: BUSINESS OVERVIEW

FIGURE 53 NORDIC SEMICONDUCTOR: COMPANY SNAPSHOT

12.1.13 MURATA MANUFACTURING

TABLE 145 MURATA MANUFACTURING: BUSINESS OVERVIEW

FIGURE 54 MURATA MANUFACTURING: COMPANY SNAPSHOT

12.1.14 SEQUANS COMMUNICATION

TABLE 146 SEQUANS COMMUNICATION: BUSINESS OVERVIEW

FIGURE 55 SEQUANS COMMUNICATION: COMPANY SNAPSHOT

12.1.15 ANALOG DEVICES

TABLE 147 ANALOG DEVICES: BUSINESS OVERVIEW

FIGURE 56 ANALOG DEVICES: COMPANY SNAPSHOT

12.1.16 QORVO

TABLE 148 QORVO: BUSINESS OVERVIEW

FIGURE 57 QORVO: COMPANY SNAPSHOT

12.1.17 AT&T

TABLE 149 AT&T: BUSINESS OVERVIEW

FIGURE 58 AT&T: COMPANY SNAPSHOT

12.1.18 GOSUNCNWELINK CORPORATION

TABLE 150 GOSUNCNWELINK CORPORATION: BUSINESS OVERVIEW

12.2 OTHER KEY PLAYERS

12.2.1 HISILICON TECHNOLOGIES

12.2.2 MEIG SMART TECHNOLOGY

12.2.3 NEOWAY TECHNOLOGY

12.2.4 SERCOMM CORPORATION

12.2.5 SKYWORKS

12.2.6 XIAMEN CHEERZING IOT TECHNOLOGY

12.2.7 COMMSOLID (GOODIX TECHNOLOGY)

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 226)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

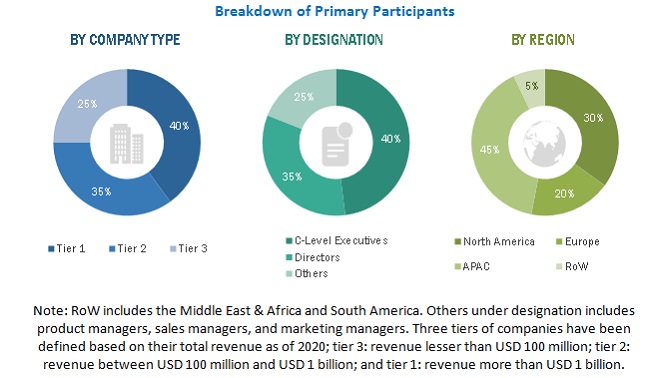

The study involves four major activities for estimating the size of the cellular IoT market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Top-down and bottom-up approaches have been used to estimate and validate the size of the cellular IoT market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for the key insights.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as the Global System for Mobile Communications Association (GSMA), Multidisciplinary Digital Publishing Institute (MDPI), The Mobile Association, Institute of Electrical and Electronics Engineers (IEEE), and IoT M2M Council have been used to identify and collect information for an extensive technical and commercial study of the cellular IoT market.

Primary Research

In the primary research process, primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as assess prospects. Key players in the cellular IoT market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as chief executive officers (CEOs), directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The Cellular IoT market consists of various technologies such as 2G, 3G, 4G, LTE-M, NB-LTE, NB-IoT, and 5G. Cellular IoT products and solutions have major applications such as alarms & detectors, smart appliances, smart metering, smart parking, smart streetlights, surveillance & monitoring, trackers, wearable devices, and others across key verticals such as agriculture, automotive & transportation, building automation, consumer electronics, energy & utility, healthcare, industrial/manufacturing, retail, and smart cities.

Top-down and bottom-up approaches have been used to estimate and validate the size of the cellular IoT market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for the key insights.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches

Study Objectives:

- To define and forecast the cellular IoT market based on component, technology, application, vertical, and region in terms of volume and value

- To describe and forecast the cellular IoT market based on four key regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the cellular IoT market

- To provide a detailed impact of the COVID-19 pandemic on the cellular IoT market, its segments, and the market players

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the cellular IoT ecosystem

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, and provide a detailed competitive landscape

- To analyze competitive developments, such as product launches and developments, acquisitions, collaborations, agreements, and partnerships, in the cellular IoT market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cellular IoT Market