Colorants Market by Type (Dyes, Pigments, Masterbatches, Color Concentrates), End-Use Industry (Packaging, Building & Construction, Automotive, Textiles, Paper & Printing), Region (North America, Asia-Pacific, Europe) - Global Forecast to 2022

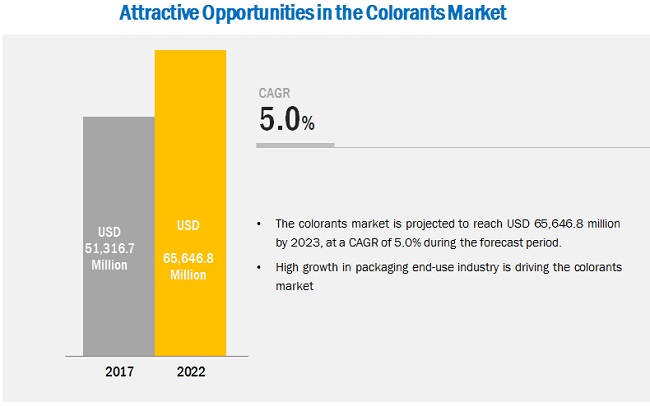

[167 Pages Report] The colorants market was valued at USD 47.45 billion in 2016 and is projected to reach USD 65.65 billion by 2022, at a CAGR of 5.0% from 2017 to 2022. The high demand for colorants in the plastics and paints & coatings applications is driving the colorants market across the globe.

Market Dynamics

Drivers

- Increasing applications of colorants in emerging economies

- Growing demand for plastics

- Rise in demand for paints & coatings

- Growing importance of aesthetics in packaging

Restraints

- Environmental regulations

Opportunities

- Technological advancements

Challenges

- Recycling of plastics

- Overcapacity of dyestuffs

Increasing applications of colorants in emerging economies

Rapid industrialization in emerging economies such as Asia-Pacific and South America is expected to provide huge opportunities for the colorants market. China, India, South Korea, Indonesia, Thailand, Taiwan, Mexico, Brazil, and Argentina have been witnessing rapid growth in key manufacturing sectors. Automotive, packaging, chemicals, building & construction, and textiles industries have grown significantly over the years. The growth of the manufacturing industry in Malaysia, Vietnam, Colombia, and Chile is further expected to fuel the market growth in these regions. The government policies in these regions are supporting the growth of industries. In addition, low labor costs, skilled workforce, availability of raw materials, and increasing urbanization has enabled domestic and foreign companies to establish their facilities in these regions. This favorable industrial scenario would increase consumption of dyes, pigments, color concentrates, and masterbatches. The growth in paints & coatings application will boost the consumption of pigments. Moreover, high growth rate of around 8% of the plastics industry is projected to increase the consumption of color concentrates and masterbatches in these regions. The textile end-use industry is growing with the increasing use of fabric in diverse applications. According to the World Trade Statistical Review, 2016 by the World Trade Organization (WTO), the global market size of textiles was USD 291 billion in 2015 and the global apparel exports were of USD 445 billion in 2015. In the global scenario of the textiles industry, Asian countries and especially India plays a crucial role. Moreover, India exports most of its apparel to Europe and North America, and China is the largest exporter of apparel with a contribution of USD 288 billion. This has propelled the demand for pigment in fabric printing and for dyes in textiles which is 65% of the total demand for dyes.

Objectives of the Study

- To define, describe, and forecast the colorants market on the basis of type, end-use industry and region

- To analyze and forecast the size of the colorants market in terms of volume and value

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the colorants market size with respect to five main regions, namely, North America, Europe, Asia-Pacific, the Middle East & Africa, and South America

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches, regional expansions, and R&D in the colorants market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Years considered for this report

- 2016 Base Year

- 2017 Estimated Year

- 2022 Projected Year

Research Methodology

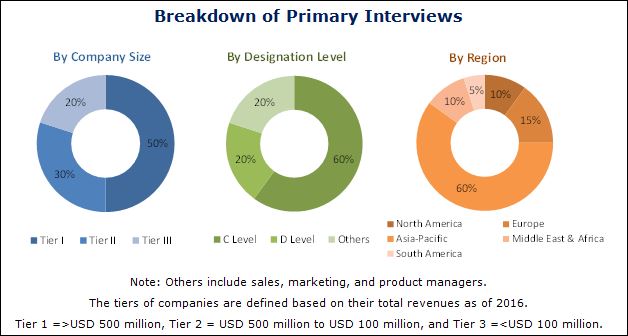

This study estimates the size of the colorants market for 2017 and projects its growth by 2022. It provides a detailed qualitative and quantitative analysis of the colorants market. Secondary sources, such as Hoovers, Bloomberg Business Week, and Factiva, among others have been used to identify and collect information useful for this extensive, commercial study of the colorants market. Primary sources such as experts from related industries and suppliers of colorants have been interviewed to obtain and verify critical information and assess future prospects of the colorants market.

To know about the assumptions considered for the study, download the pdf brochure

The key players profiled in the report include, Clariant AG (Switzerland), BASF SE (Germany), DIC Corporation (Japan), Huntsman Corporation (U.S.), E. I. du Pont de Nemours & Company (U.S.), Cabot Corporation (U.S.), LANXESS AG (Germany), PolyOne Corporation (U.S.), and Sun Chemical Corporation (U.S.).

Target Audience

- Manufacturers of Colorants

- Chemical Suppliers

- Traders, Distributors, and Suppliers of Colorants

- Raw Material Suppliers

- Government and Research Organizations

- Industry Associations

This study answers several questions for stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments. It also provides a competitive landscape of the colorants market.

Scope of the Report:

The colorants market has been segmented as follows:

Colorants Market, by Form:

- Pigments

- Dyes

- Masterbatches

- Color Concentrates

Colorants Market, by End-Use Industry

- Packaging

- Building & Construction

- Automotive

- Textiles

- Paper & Printing

- Others

Colorants Market, by Region

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

The market has further been analyzed for the key countries in each of these regions.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for this report:

Product Analysis

- A product matrix that provides a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the rest of Asia-Pacific colorants market into Australia and New Zealand

The colorants market is projected to reach USD 65.65 billion by 2022, at a CAGR of 5.0% from 2017 to 2022. The colorants market has witnessed high growth in the recent years, and this growth is projected to continue in the near future, owing to the increase in demand for colorants in various end-use industries, such as packaging, building & construction, and automotive, among others and in applications such as plastics and paints & coatings. The growing demand for plastics in various industries is also a driver for the growth of the colorants market.

On the basis of type, the colorants market has been segmented into pigments, dyes, masterbatches and color concentrates. The pigments segment leads the colorants market. The growth of this segment of the market can be attributed to the increasing use of pigments in the paints & coatings application in the automotive and building & construction industries. The market for masterbatches is projected to grow at the highest CAGR during the forecast period due to the growing plastics industry.

On the basis of end-use industry, the colorants market has been classified into packaging, textiles, paper & printing, building & construction, automotive, and others. The packaging end-use industry is leading the colorants market and is projected to grow at the highest CAGR during the forecast period. The growth of the packaging end-use industry in the colorants market is due to the increased demand for colorants for coloring plastics used for lightweight packaging. Moreover, increasing use of colorants to color packaging materials such as plastics, paper, metal, fabric, and so on has also propelled growth in this industry.

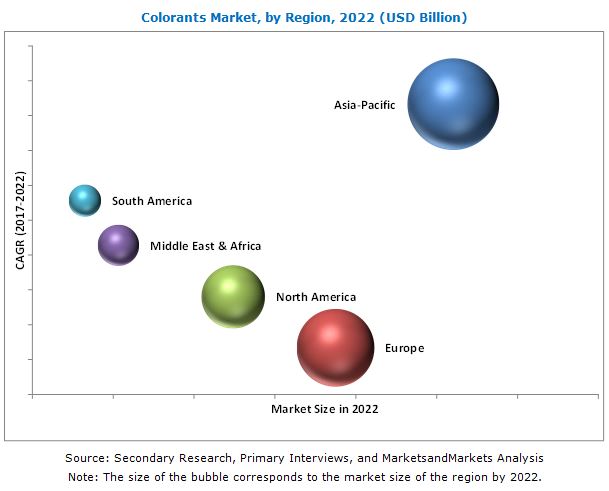

Based on region, the colorants market has been segmented into Asia-Pacific, North America, Europe, the Middle East & Africa, and South America. The Asia-Pacific colorants market is projected to grow at the highest CAGR during the forecast period, owing to the increasing demand for colorants in packaging medical, pharmaceutical, and food & beverages products.

Packaging

Packaging protects goods during distribution, transportation, storage, and use. The aesthetic appeal of a package is extremely important to attract the consumer. Color helps in distinguishing product and establish brand identity. Hence, colorants play an important role in making packaging attractive.

The packaging end-use industry uses different materials such as plastics, metal, and fabrics. Different types of colorants are used depending on the types of materials that must be colored. Dyes are used in inks to print on various packaging materials such as paper, cardboard plastics, and metal. They are also used to manufacture packaging printing colors for paperboard containers, bags, sacks, flexible packaging, boxes, and tubes. Pigments are helpful in giving effects to various packaging products. There are various pigments of food and non-food grades which are used in packaging depending on the applications. For instance, for packaging of food products, cosmetics, medical & pharmaceutical food grade pigments are preferred while non-food grade pigments are preferred in sports equipment, packaging of electronic goods, and other applications. Color concentrates are widely used in plastic packaging for food, cosmetic, and consumer products. Color concentrates and masterbatches with different dosing ratios give a variety of color shades. These color shades make packaging colorful and enhance the consumer appeal of the goods. Colorants are widely used in rigid and flexible packaging applications such as food packaging, bottles, PET, oil, pharmaceutical, and chemical in various forms such as caps, bottles, trays, bags, and pouches.

Textiles

The textile industry has a high consumption of colorants. Applications of colorant types such as dyes and pigments in the textile end-use industry are also undergoing changes to meet the rapidly changing demand from the fashion industry. For instance, disperse polyesters mainly consume dyes. Similarly, color concentrates are used in coloring plastic material used in carpets, curtains, cushion covers, disposable medical garments such as masks, gloves, and other breathable fabrics. Cotton fabrics are more in demand during the summers, which increases the demand for vat, reactive, and direct dyes. Moreover, growing demand for environmentally friendly products propel the sales of dyes for textile applications. Colorants are used in textiles for two reasons mainly, to color the fabric entirely and to print the desired pattern on fabric or textile materials.

Automotive

The automotive end-use industry requires high color control and advanced technologies to produce colorants suitable for outdoor applications where the automotive is subjected to UV exposure. Various types of colorants are used in different applications in the automotive end-use industry. Water soluble and oil soluble dyes are widely used in various automotive applications such as automotive fabric, components, window washer fluid, industrial engine cleaners, soaps for car washes, and for coolants. High-performance pigment dispersions are used in various automotive applications such as exterior finishes, interior stylings, and functional coatings. Similarly, the metal effect and pearlescent pigments are used in giving an elegant appearance to the automotive. Color concentrates find use in lighting systems, cooling system, engine covers, electrical & electronic sensors, front-end modules, air-intakes, batteries, and so on in the interior of automotive where plastic is used. Similarly, exterior parts of the automotive such as wheel trim, rub strips, grills, sealing systems, as well as large parts such as fenders, bumpers, spoilers, and so on use color concentrates. Color masterbatches are used in door panels, headliners, floor coverings, seat upholstery, side view mirrors, running boards, interior & exterior trim, and so on.

The key restraining factors for the colorants market are environmental regulations and volatility in raw material prices. This is expected to trigger innovations in the colorants market, as manufacturers of colorants are expected to take initiatives to manufacture colorants that are compliant with regulations. Moreover, companies such as, Clariant AG (Switzerland), BASF SE (Germany), DIC Corporation (Japan), Huntsman Corporation (U.S.), E. I. du Pont de Nemours & Company (U.S.), Cabot Corporation (U.S.), LANXESS AG (Germany), PolyOne Corporation (U.S.), and Sun Chemical Corporation (U.S.) are investing in R&D activities to launch new products and strengthen their positions in the colorants market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Research Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Significant Opportunities in the Colorants Market

4.2 Colorants Market, By End-Use Industry

4.3 Asia-Pacific Colorants Market, By End-Use Industry and Country

4.4 Colorants Market, By Region

4.5 Colorants Market, By Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Impact Analysis

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Applications of Colorants in Emerging Economies.

5.3.1.2 Growing Demand for Plastics

5.3.1.3 Rise in Demand for Paints & Coatings

5.3.1.4 Growing Importance of Aesthetics in Packaging

5.3.2 Restraints

5.3.2.1 Environmental Regulations

5.3.3 Opportunities

5.3.3.1 Technological Advancements

5.3.4 Challenges

5.3.4.1 Recycling of Plastics

5.3.4.2 Overcapacity of Dyestuffs

5.3.4.3 Volatility in Raw Material Prices

5.4 Porters Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Suppliers

5.4.4 Bargaining Power of Buyers

5.4.5 Intensity of Competitive Rivalry

6 Macroeconomic Indicators (Page No. - 45)

6.1 Introduction

6.2 Trends and Forecast of GDP Major Economies

6.3 Textile Industry

6.4 Automotive Industry

6.5 Trends in Construction Industry

6.5.1 Trends in Construction Industry in North America

6.5.2 Trends in Construction Industry in Europe

6.5.3 Trends and Forecast of Construction Industry in Asia-Pacific

7 Colorants Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Pigments

7.2.1 Organic Pigments

7.2.1.1 Azo Pigments

7.2.1.2 Polycyclic Pigments

7.2.1.3 Anthraquinone Pigments

7.2.1.4 Dioxazine Pigments

7.2.1.5 Triarylcarbonium Pigments

7.2.1.6 Quinophthalone Pigments

7.2.2 Inorganic Pigments

7.2.2.1 Colored

7.2.2.1.1 Complex Inorganic Colored Pigments (CICP)

7.2.2.1.2 Metal Oxides

7.2.2.1.3 Metal Salts

7.2.2.1.4 Others

7.2.2.2 White

7.2.2.2.1 Opaque Pigments

7.2.2.2.2 Non-Opaque Pigments

7.3 Dyes

7.3.1 By Type

7.3.1.1 Natural Dyes

7.3.1.1.1 Natural Dyes From Plants

7.3.1.1.2 Natural Dyes From Animals

7.3.1.1.3 Natural Dyes From Minerals

7.3.1.2 Synthetic Dyes

7.3.2 By Nature

7.3.2.1 Acid

7.3.2.2 Basic

7.3.3 By Lake

7.3.3.1 Basic

7.3.3.2 Fat Soluble

7.3.3.3 Metal Complex

7.3.4 By Chemistry

7.3.4.1 Direct Dyes

7.3.4.2 Mordant Dyes

7.3.4.3 Disperse Dyes

7.3.4.4 Reactive Dyes

7.3.4.5 Acid Dyes

7.3.4.6 Direct Dyes

7.3.4.7 Vat Dyes

7.3.4.8 Azoic Dyes

7.3.4.9 Sulphur Dyes

7.3.4.10 Others

7.4 Color Concentrates

7.4.1 Solid Color Concentrates

7.4.2 Liquid Color Concentrates

7.5 Masterbatches

7.5.1 White

7.5.2 Black

7.5.3 Color

8 Colorants Market, By End-Use Industry (Page No. - 62)

8.1 Introduction

8.2 Packaging

8.2.1 Food & Beverage Packaging

8.2.2 Healthcare & Pharmaceutical Packaging

8.2.3 Consumer Goods Packaging

8.3 Paper & Printing

8.3.1 Paper

8.3.2 Printing & Inks

8.4 Textiles

8.4.1 Fabric Coloring

8.4.2 Printed Fabric

8.4.3 Leather

8.5 Building & Construction

8.5.1 Paints & Coatings

8.5.1.1 Plastics

8.5.1.1 Others

8.6 Automotive

8.6.1 Paints & Coatings

8.6.2 Plastics

8.6.3 Textiles

8.7 Others

8.7.1 Consumer Goods

8.7.2 Others

9 Colorants Market, By Region (Page No. - 69)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 Australia

9.2.5 South Korea

9.2.6 Thailand

9.2.7 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 U.K.

9.4.3 Italy

9.4.4 France

9.4.5 Spain

9.4.6 Russia

9.4.7 Rest of Europe

9.5 Middle-East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 Egypt

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 113)

10.1 Overview

10.2 Vanguards

10.3 Dynamic

10.4 Innovators

10.5 Emerging

10.6 Competitive Benchmarking

10.6.1 Product Offerings

10.6.2 Business Strategy

10.7 Market Share Analysis

10.7.1 BASF SE

10.7.2 Clariant

10.7.3 Huntsman Corporation

10.7.4 E. I. Du Pont De Nemours and Company

10.7.5 DIC Corporation

11 Company Profile (Page No. - 119)

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 BASF SE

11.2 Clariant

11.3 E. I. Du Pont De Nemours and Company

11.4 Huntsman Corporation

11.5 DIC Corporation

11.6 Cabot Corporation

11.7 Dystar

11.8 Lanxess

11.9 Polyone Corporation

11.10 Sun Chemical Corporation

11.11 Others

11.11.1 A. Schulman, Inc.

11.11.2 Ampacet Corporation

11.11.3 Archroma

11.11.4 Atul Ltd.

11.11.5 Chromatech Incorporated

11.11.6 Ferro Corporation

11.11.7 Flint Group

11.11.8 Heubach Color

11.11.9 Holland Colours

11.11.10 Greenville Colorants, LLC

11.11.11 Solvay

11.11.12 Sudarshan Chemical Industries Limited

11.11.13 The Chemours Company

11.11.14 Kronos Worldwide, Inc.

11.11.15 The DOW Chemical Company

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 160)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (90 Tables)

Table 1 Regulations in Colorants Market

Table 2 Trends and Forecast of GDP Growth Rates From 2016 to 2021

Table 3 Motor Vehicle Production

Table 4 Contribution of Construction Industry to GDP in North America, USD Billion

Table 5 Contribution of Construction Industry to GDP in Europe, USD Billion

Table 6 Contribution of Construction Industry to GDP in Asia-Pacific, USD Billion

Table 7 Colorants Market Size, By Type, 20152022 (Kiloton)

Table 8 Global Colorants Market Size, By Type, 20152022 (USD Million)

Table 9 Colorants Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 10 Global Colorants Market Size, By End-Use Industry, 20152022 (USD Million)

Table 11 Global Colorants Market Size, By Region, 20152022 (Kiloton)

Table 12 Global Colorants Market Size, By Region, 20152022 (USD Million)

Table 13 Asia-Pacific: Colorants Market Size, By Country, 20152022 (Kiloton)

Table 14 Asia-Pacific: Colorants Market Size, By Country, 20152022 (USD Million)

Table 15 Asia-Pacific: Colorants Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 16 Asia-Pacific: Colorants Market Size, By End-Use Industry, 20152022 (USD Million)

Table 17 Asia-Pacific: Colorants Market Size, By Type, 20152022 (Kiloton)

Table 18 Asia-Pacific: Colorants Market Size, By Type, 20152022 (USD Million)

Table 19 China: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 20 China: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 21 India: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 22 India: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 23 Japan: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 24 Japan: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 25 Australia: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 26 Australia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 27 South Korea: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 28 South Korea: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 29 Thailand: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 30 Thailand: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 31 Rest of Asia-Pacific: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 32 Rest of Asia-Pacific: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 33 North America: By Market Size, By Country, 20152022 (Kiloton)

Table 34 North America: By Market Size, By Country, 20152022 (USD Million)

Table 35 North America: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 36 North America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 37 North America: By Market Size, By Type, 20152022 (Kiloton)

Table 38 North America: By Market Size, By Type, 20152022 (USD Million)

Table 39 U.S.: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 40 U.S.: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 41 Canada: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 42 Canada: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 43 Mexico: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 44 Mexico: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 45 Europe: By Market Size, By Country, 20152022 (Kiloton)

Table 46 Europe: By Market Size, By Country, 20152022 (USD Million)

Table 47 Europe: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 48 Europe: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 49 Europe By Market Size, By Type, 20152022 (Kiloton)

Table 50 Europe By Market Size, By Type, 20152022 (USD Million)

Table 51 Germany: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 52 Germany: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 53 U.K.: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 54 U.K.: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 55 Italy: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 56 Italy: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 57 France: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 58 France: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 59 Spain: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 60 Spain: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 61 Russia: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 62 Russia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 63 Rest of Europe: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 64 Rest of Europe: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 65 Middle East & Africa: By Market Size, By Country, 20152022 (Kiloton)

Table 66 Middle East & Africa: By Market Size, By Country, 20152022 (USD Million)

Table 67 Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 68 Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 69 Middle East & Africa: By Market Size, By Type, 20152022 (Kiloton)

Table 70 Middle East & Africa: By Market Size, By Type, 20152022 (USD Million)

Table 71 Saudi Arabia: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 72 Saudi Arabia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 73 UAE.: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 74 UAE.: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 75 Egypt: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 76 Egypt: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 77 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 78 Rest of Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 79 South America: By Market Size, By Country, 20152022 (Kiloton)

Table 80 South America: By Market Size, By Country, 20152022 (USD Million)

Table 81 South America: By Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 82 South America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 83 South America: By Market Size, By Type, 20152022 (Kiloton)

Table 84 South America: By Market Size, By Type, 20152022 (USD Million)

Table 85 Brazil: Colorants Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 86 Brazil: Colorants Market Size, By End-Use Industry, 20152022 (USD Million)

Table 87 Argentina: Colorants Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 88 Argentina: Colorants Market Size, By End-Use Industry, 20152022 (USD Million)

Table 89 Rest of South America: Colorants Market Size, By End-Use Industry, 20152022 (Kiloton)

Table 90 Rest of South America: Colorants Market Size, By End-Use Industry, 20152022 (USD Million)

List of Figures (42 Figures)

Figure 1 Colorants Market: Market Segmentation

Figure 2 Colorants Market: Research Methodology

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Colorants: Data Triangulation

Figure 6 Pigments to Dominate Colorants Market Between 2017 and 2022

Figure 7 Packaging End-Use Industry to Dominate the Colorants Market Between 2017 and 2022

Figure 8 Asia-Pacific Was the Largest Colorants Market in 2016

Figure 9 China to Be the Largest Colorants Market Between 2017 and 2022

Figure 10 Emerging Economies to Offer Lucrative Growth Potential for Market Players Between 2017 and 2022

Figure 11 Packaging to Be the Fastest-Growing End-Use Industry for Colorants Market, 2017-2022

Figure 12 China to Dominate the Asia-Pacific Colorants Market

Figure 13 Asia-Pacific is the Largest Colorants Market

Figure 14 Pigments to Account for the Largest Market Share, in Terms of Value

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the Colorants Market

Figure 16 Porters Five Forces Analysis

Figure 17 World Textile Trade Data, 20052014

Figure 18 Pigments to Dominate the Colorants Market

Figure 19 Classification of Pigments

Figure 20 Market Shares of Pigments in Kilotons in 2016

Figure 21 Classification of Dyes

Figure 22 Market Shares of Dyes in Kiloton, 2016

Figure 23 Market Shares of Color Concentrates in Kiloton, 2016

Figure 24 Market Shares of Masterbatches in Kiloton, 2016

Figure 25 Packaging End-Use Industry to Dominate the Colorants Market

Figure 26 India to Register the Fastest-Growth in Colorants Market

Figure 27 Asia-Pacific is the Largest Market for Colorants

Figure 28 China Dominates Asia-Pacific Colorants Market

Figure 29 Presence of Key Colorant Players Driving the Market

Figure 30 Germany Dominates Colorants Market in Europe

Figure 31 Plastic Industry Driving the Colorants Market in Middle East & Africa

Figure 32 Packaging End-Use Industry to Drive Colorants Market

Figure 33 Dive Chart

Figure 34 Colorants Market Share Analysis, 2016

Figure 35 BASF SE: Company Snapshot

Figure 36 Clariant: Company Snapshot

Figure 37 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 38 Huntsman Corporation: Company Snapshot

Figure 39 DIC Corporation: Company Snapshot

Figure 40 Cabot Corporation: Company Snapshot

Figure 41 Lanxess: Company Snapshot

Figure 42 Polyone Corporation: Company Snapshot

Growth opportunities and latent adjacency in Colorants Market